Evening Star Newspaper, May 18, 1930, Page 69

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

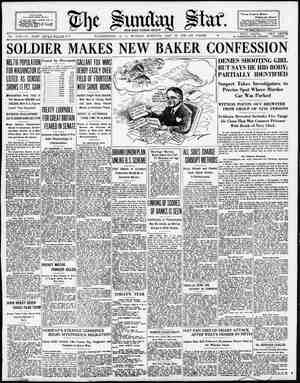

News of Markets Pages 1 to 4 Part 6—12 Pages FINANCIAL AND CLASSIFIED he Sunday Star WASHINGTON, D. C, THOMPSON 10 OPEN BUSINESS INCREASE ASSOCIATED STOCK EXCHANGE MEETING Washingtonian Is Head of Or- ganization Comprising 15 Trading Agencies. BROKERAGE PROBLEMS WILL BE THRESHED OUT Burton Named Vice President of Mechanics’ Bank—New Stock Listed. BY EDWARD C. STONE. Members of 15 stock exchanges out- side of New York and Chicago will n the fourth annual convention of Associated Stock Exchanges, of which Eugene E. Thompson of this city is president, tomorrow forenoon ®t Minneapolis, Methods of stock exchange trading, more information for the public, in- vestment trusts, advantages of list ing securities and inter-exchange busi- ness will be among the important topics up for discussion. Loans and call money markets and the guarantee of signatures will also draw their share of_attention. President George T. Piper, jr., of the Minneapolis-St. Paul Exchange, wil greet the delegates and Mr. Thompso: will then make hhud:ulnhetdot associated exchanges. The first b nted will tel.lu to methogl ehln,e ling, made by cl.l.ude !'. th ollom by the report of the vision of con- ltlhlthm and by-hwl, by Willlam M. Laudermann, and the report on inter- P business, by Chairman E. B. Another address at the morning ses- m'fl!bedeuveredWHllhA.o'Dnn assistant business manager of the Ne' York 'nmel, on “Letting the Public Know.” be followed by a talk on "n:mhnent Trusts” by Ray Vance, author of “Investment Policies That Pay.” Highlights on Second Day. fgnal to ments” will be discussed by Prancis T. Christy of New York, author of “The fer of Stock.” ‘hanges” and Stal h; P;m; mu mwmma for . R. Jones of the Wutem Union will talk in - Excl l"furmon on “Stock forum dllm-hnvnflworthe ofinupu. vlomlymeuunnadvfll follow. Late in the afternoon the election of is due. ‘The present members of the associa- tion are the at_Baltimore, edlm- fi“ Orle ew _Orleans, lebwth. ‘Washington. W-hln‘wnlhellxdumm one of first to join the association, The association has the protec: . About 200 ites St tits ‘week's convention. Burton Elected Bank Official. Clarence F. Burton has been elected ‘'vice president and cashier of the Wash- Mechanics Savings Bank and lnumzhlldutluon.lumlltv.he bank’s new office just being completed the m.mm of the District Bankers’ Association at Asheville, N. C. Incidentally, he is a member of the EUGENE E. THOMPSON Of this city, president of the Associated Stock Exchanges, who opens the fourth annual convention tomorrow at Min- neapolis. He also represents the Wash- ington Stock Exchange at the meeting. Retail Store Sales Show Small Loss In Recent Months “Group Incentives” Plan of Merchandising Gains Favor With Employers. BY J. C. ROYLE. ‘The average life of the new ntl-\l store is short, according to Stephen I. Miller, manager of the National As- sociation of Credit Men. Every time one such store goes under it repre- sents an economic loss-to the com- munity, and the total of such losses in the last 10 years, he says, has been ,000,000. . Faulty ammum is given as the cause for most of these ess dis- asters. The pubuc is beln¢ over mer- other dis- - plt‘:hd wlt.:"mmpetmor‘; hlt its %dflm of costs. ‘nu difference the volume of re- tail sales between times of prosperity and depression is small. rtment store sales in April were sufficient to bring total sales for March and April almost up to the level for those months TR R e y. irop was hli’ about During the uu ll was estimated wul sales at the low point of business g EEEEE'*E i BB 8 1 e E! the than | models for the succeeding year. Finance | to_an even greater e second-quarter returns A the low-priced lines 'hu:h run in the $600 class ce!umbu Country Club and the Racquet dollars. " New llnk Stock Is Listed. has- listed, for beginning tomorrow, 20,000 $10 W 'llue. of the $200,000 the Prince atock Georges &Tflutco ‘The bank is located Hyattsville, Md,, and is & combina- | o of two financial institutions which recently brought together, J. Enos resident. P is the first listing on the local exchange since the Nortolk & Wash- ington Steamboat rights were plued on At & meeting of the directors of the Investment Corporation of North Amer- l;‘llulfi‘l:‘hét !vverm‘ in the Union Trust director to fill % ey ca = , | rent, too, that e Co. | American 'Iun The Investment Corpora f the more successful mvu and is managed largely men. Willlam M. Ja reury of Agriculture, is chairman of the board, and other directors include Rolfe E. Bol]ln‘, president of the Mer- chants’ Bank & Trust Go.; William J. l-uck consulting economist, and Roland R-Lnnold of Sharp & Dohme, Balti- tion s one Heard in Financial District. ted | up; oats uncl d to Y cen! .g‘ hange Ya 26, publ! uumy business in this country, exclucive of steam rail- ' roads, by mm uun 3,000,000 investors, ! to the lic utility survey made by !onhfl(h & Co.,, xn:‘. b Gt Tioreos T puak eas credit manager of manu- facturers and wholesalers. “If credit granters continue to set weak and inefficient retallers, they slowly diminish the buying power o( the country f.hrml‘h waste and in- creased cost,” he said. GRAIN MARKET Reports of Cold Weather Cause Late Advance in Market. CHICAGO, May 17 ~—Uneasiness regarding unseasonable cold weather led to late advance in wheat values today, notwithstanding early declines. Sleet and snow prevailed in some parts of Nebraska and frosts were reported in States Northwest. llflmlwl ‘were cur- m irchases of North lay totaled 1,000~ bushel higher than :\l:m.lt 4,000,000 bushel day’s finish. in the h-ut three Bet«huh witnessed in wheat values at times today were in some quarters a8 & natural sequence coming after advances on four successive days. Some of the selling here that ac- companied price declines was ascribed to forelgn sources. Bearish effects re- sulted from reports that State officials and farmer's organizations Northwest are already sending out warnings to growers wsupll’e to hold 1930 grain on farms ible, s0 as to avert congestion at unmn-.l mm:eu t closed nervous, %-% cents a highe rthan ye-terdnya finish. | Unj carncmual/.unuoflm" cents down, unchanged to a rise of 1S SEEN IN LARGER BANK CHECK TOTAL Department of Commerce Reports Gain for Week Ended May 10. LOANS AND DISCOUNTS GREATER THAN YEAR AGO Conditions Abroad Are Declared Quiet, With Canadian Situation Somewhat Improved. By the Associated Press. ‘With check payments used as a barometer, the Department of Com- merce finds the volume of business for the week ended Mly 10 w be 13 per cent greater than during the previous week. By the same icator a gain of 1 per cent was shown over the corresponding period of last year. ‘Wholesale prices showed a :llghl de- cline from the preceding week and were more than 7 per cent below the level of a year ago. Composite iron and steel prices registered a slight de- cline from the preceding week, and were 8 per cent lower than a year ago. loans and discounts at the end of the week, while showing a slight decline lrom the previous period, were more than 3 per cent above a ar ago. Prices for stocks showed a gn from the preceding week and were 11 per cent below the same week of 1929. Business in Argentina during the riod continued to be dull, with slight- {”lm pessimism, owing to the peso uchnn recovery and continuance of Tains which are Tavorable fo the agri- cultural and live stock industries of the country. Canada’s business conditions were improved generally, although tariff re- adjustments have disturbed importa- tions, and the unno\lnoement of a gen- an um e - tario provincial government ‘has passed legislation setting aside $2,000,000 for loans to farmers to buy electrical ap- plhnoel and ent. Brufl remuned chnn(ed. although there is still optimism concerning the early unpmvemu:c of conditions. Coffee shipments have light and the prices for futures wukened consid- erably _after last week's rise. Official trade figures for 1929 show imports de- clined 4,000,000 pounds and exports 2,600,000 pounds. AUTOMOBILE SALES IN UPWARD TREND Seasonal Advance Is Expected to Continue Until End of, This Month. Special Dispatch to The Star. DETROIT, May 17.—The seasonal upward trend in automobile sales chain throughout the country is continuing, = according to reports made to factories in_the Michigan manufacturing area. Officials it will continue until the end of this month, when the peak will be reached. ‘With June will come the period when the makers, following the sales trend that usually begins to set in at that time of year, taper off operations pend- ing introduction n! pr!-ul‘:on c- cording to present indications, the let- down, when it comes, is likely to reflect the curtailed operations for the me- dium priced and high priced output xtent thln now. fraining from predlct as to what may show. For and below it, the -hmu is certain to record still greater gains in volume than were mlde in the first three months. With general business of any quick up- , ivisions of the various plants are calling for schedules that virtually maintain openunu at the levels of recent weeks. That the sales figures since the first of the year are not as favorable as they may seem is indicated in a com- pllation_of State registrations reeenfly made. It showed the first for all makes all l rresponding lods five years, but it was 16 per cent below last year’s top, which ran to 838,095. With April Tegistrations not available yet, but certain to show a ad- vance, which has been enrrled along into May, it is considered that the industry is more than holding its own against the depression. (conmnn, 1030.) CURB LIST IS QUIET IN LIGHT TURNOVER Utilities Move in Narrow Range. Most Changes Are Small. BY JOHN L. COOLEY. Associated Press mflnfl:ll'hwflg;b st NEW YORK, May 17.—The Todag." ON shar rade Titte ‘mn;::: ay. shares to the cut in crude prices. Utllities moved within generally narrow limits. United Light & Power “A” was again a feature, squeezing to & new high for the year.' The buying in this stock i3 attributed to Electric Bond & interests and it is being mentioned in connection with a merger with Am can Light & 'rruunn ‘The latter stock was qulet. selling off about half a point. ted Light reacted '“":J from the ‘The regular_mont the | National City d it ‘was mwu%flm points. collapse HAMILTON WILL ADD STRENGTH TO BOARD OF BETHESDA BANK D. C. Educator, Attorney and Financier Has Had Wide and Varied Career. Is Active in Club and Social Life of Capital—Heads Law Faculty. ‘The week's banking news included announcement of the election of Attor- ney George E. Hamilton as director in the Bank of Bethesda. Mr. Hamil- ton had had an unusually interesting career. A native of Charles County, Md,, he attended school in Washington and was graduated from the literary department of Georgetown University in 1872. He received his law degree from the same institution and in 1922, was accorded the honorary degree of doctor of jurisprudence. For many years he has been dean of the George- town Law School faculty, as well as a regent of the university. Mr., Hamilton began the practice of law In Wi n in 1876, and has been very active in lagal work since that time. He is chairman of the board and general counsel of the Capital Trac- tion Co.; vice president, general coun- sel and trust officer of the Union Trust Co., and general counsel of the Wash- GEORGE E. HAMILTON. as counsel for the Bnltlmore & Ohio and other railway He is a member of the cosmosclb Chevy Chase Club and Columbia His- torical Society and trustee of the Cor- coran Art Gallery. His home on the Rockville pike is one of the show places in_that region, ‘The Bank of Bethesds, in which he now becomes a director, is a thriving inat&utlon. ‘The president is George P. ington Terminal Co. He has often acted ' Sac! Business News Retrospect Although Signs of Re- covery Can Be Seen, Trade Has Shown But Little Progress Since the Stock Market Break. BY I A. FLEMING. ‘There can he no question but what the reeovery in general ess and of trading in securities is very slow and dl.unppol.nun‘ in the mat- ter of the holding of improvements made, other than temporarily. Nor are there exceptions of importance to the rule. Perhaps real estate and build- ing operations are at their lowest. President Hoover sensed the advent of the depression in building operations very early and his personal efforts were responsible for furnishing employment to many, but it is not humanly pos- sible to force the activity in one over- supplied industry any more than it is in another and it lnoh! lodly as if the supply exceeded the d d in almost every line of endnvor. Likewise retail trade is slow, merch- ants are bu; frequently and 1n very small amounts, being encouraged in byldukewukemvm&eotm rice recessions, which manufacturers, an effort to stimulate trade, are will- lns:o make. prusion on farms, in city lots, the disposition on the part of the usual buyers of mottcml to choose some other security and the growing indif- ference on the part of the makers of mortgages and deeds of trust to meet their obll.n::h:: promptly all tend to living s g down and the movies and theaters are about the | Gt only interests that are working at full there is much unemployment— but the shows are cheap if patronized | Pre early in the day. Caused General Surprise. Business reports for the first quarter of the current year indicated severe de- creases in the earnings of corporations, with the exception of food and steel, with some few other industries, notably | Ot! the automotive, where the wisdom of | pj actor in | the manufacturers in not forcing busi- ness has left the trade much healthier, ":‘I";fl' light, with n“f:dm‘nmed d of raf cars of to & desirable extent ‘There was a general idea that T conditions were bound to unpmve after e the slump last Fall. Very many ex- pected It in the security mlrke!., but while there have been days when the strength there appeared founded and some da actions reached nearly 8,000,000 shares, traders did not show confidence, ut were speedily in and out, small profits were gratefully nabbeu when they lingered long enough to permit, the payment to Uncle Sam of a part of the grdoflc in income taxes never being con- m:l.ll ?m‘h';‘l a habit of de’:l“‘m"- 80 ere were radi of a betterment there might be m.flf vance, but one must indeed be an this | than for small specialty concerns. crease pression. B'-Iulfla indicate that the cost of | Bet comin that o4 FIRMS REVEAL GAIN IN EARNINGS Corporationé Go Trend in First Quarter and Move Forward. Special Dispatch to The Star. NEW YORK, May 17.—Although ag- gregate net profit of companies which have thus far reported earnings for the first quarter of 1930 showed a decline of 16.1 per cent, & long list of cor- porations have demonstrated their re- sistance to the downward trend in business by reporting earnings in ex- cess of those of the first quarter of 1929, A list of 54 companies in this favorable mliunn has been compiled by Charles D. Robbins & Co., mmberl of the New York Stock Exchang “The earning power demonstrated by these companies is not accidental,” says ;he m.o&ms firm. "l: relul;l elfla?r rom ement or a favorable economic nm, or both. This acid SniTount Tof peeat corporations’ domg significant for greaf ns doing & national mf' international bull.nelu n food companies, the benefit of cheap commodity 1is obvious and highly imj A partial list of t.heu ‘successful com- panies is as follows: Earnings per share on_common Alr Reduction, !ne Allis-Chalmers American Chicl American Metal G ARER pc R Bangor & A k ot it ol o Sortls BuTiiehine Diamond Matcn C: eeport, General American” General Electric Co. Geners General Retiway Hershey chocolate Houston Oil BeRsRERaIIRE IRl EaREEERTINERIS; PR % E;;;;; 90008, pa Evicts Wrong Family. DETROIT, May 17 (N.ANA)— Constable Arthur Terry got an order 0 evict household goods from a resi- dence in Detroit. So he rolled up his sleeves and went to work. He tossed furniture and antiques out of the win- dows, tore up bedding and even put }:a, unl'z:ry out. Then he went down optimist to find encouragement in the | 7S news of the day. Local Mortgage Situation Bad. Foreclosures are very general in '.he local mortgage field and the dis tion on the part of the makers of trusts is to ignore interest rates. Even foreclosure threats indicate a state of affairs that lessens one's desire to bother with them. It does not help the situation that so many prominent buildings and h-grade apartment are covered by trusts that are being offered for sale at s much below the face of “-t?e mo! rvest time on very m truau issued for cost of the bufld.ln‘fi covered—iniquitously through taking out buudinl permits for much greater face value than the builders had any idea of putting into the structure cov- ered even skimping in l,uny essentlals f construction for grafting purposes. Cereals and Cotton. Overproduction in corn, wheat and cotton, larger acreage phnun( and smaller consumption are having their natural effect on supply and demand. Diversity of production is the salva- tion of this country. Automobiles, radios and the thousand and one elec- tric appliances with numerous other im- provements in old-line manufactures have broadened the scope of industry, else conditions today would indeed be more serious than they are. Also the wisdom nf the retafler in meeting the installment trade w".h open arms is to be commended, for at .h“d-nme there is a chance to keep National CI‘] M of gmfit Roberts, has ”m;fiu “The but only one fea- ture of it, although one which has con- tributed substantially to the general confusion and demoralization which m«mm’-mmfifi of the bogm, bub while the ‘WORLD COPPER OUTPUT. NEW YORK, May 17 m—wma output of copper in 143793 short tons, 148,005 short tons in March, the Amer- Icln Bureau of nl:gm Statistics re- ‘The monthly average for the nm “four months of t.hc yelr was 46,441 tons, compared to ol 178,034 for '.he ‘entire ym 1'2!. Electrical Equipment Business. NEW YORK, May 17 (#)—Electrical equlpmznt business throughout _the country in the pm week proceeded on & somewhat restricted basis, Electrical World b§§f€° Few advance orders ed and the demand, was chlafly for current needs. Although improvement was noted in some sec- :m:e the total volum Teflected little Iatter gave rellef from a tigh credit situation which was th‘i"um‘ Fhock ?a““.i‘."u”m’u"fi'n."&’fi““ = luence. disturbed a good m: inflated and more or less -runcm situations, with the result that instead of giving an im- mediate stimulus to the chief effect of this time has world-wide accumulation of idle flmd& “It was sald at first that the lndm- trial daprusum was not likely to for the reason .that eommod!cy prleumnocbemlnflnudmdm— modity stocks were not large, thus ren- Against| 79 | that_have been steadily SUNDAY MORNING, MAY 18, 1930. Classified Ads Pages S to 12 unvic|VOLUME OF STOCK DURATION OF TRADE TRADING CUT DOWN 10 SMALL FIGURES Market Placed in Technically Sounder Position During Last Week. DECLINES IN COMMODITY PRICES APPEAR CHECKED Action of Copper Producers in Ad- vancing Quotations Called Good Strategy. BY CHARLES F. SPEARE. Special Dispatch to The Star. NEW YORK, May 17.—For several days the stock market has been at dead center. New high prices a small list of shares are balanced new low prices for the year in others. There is resistance to luch conserva- tive speculative movements for a rise and opposition to professional efforts to bring about further liquidation. ‘The effect of this is to destroy in- itiative and to intimidate the public. In volume the market has dropped down to the smallest proportions since February. It is & market, however, in which considerable amount of confidence may now be assumed. It has cancelled the excess values of March and April A.nd nimfly it is sounder than it has been since the early part of the Winter. Sentiment toward it is passively bullish. Dividend Record Scanned. ‘There is still necessity for careful se- lection of common stocks, for the ef- fects of six months of mta illness have nnz yet rmhfi:i"mzlr prflpermm hnve m the carrying on regular dividends out of '.he earnings | g)) of 1928 and 1929, in anticipation of an early recovery. is significant that while between December and the end of March the number of hvonbu div- idends declared greatly exceeded those that were reduced or passed, in April, for the first time, dgaenu exceeded | py, increases. So far this month they have been at about & balance. The reduc- tion in the rate on American Loco- motive Co. common stock was one of the long deferred acts of a board of di- rectors that had reluctantly reached the decision that it could no longer pay dividends out of surplus. ‘The other side of the situation is that a pronounced improvement hn appeared in some industries with a bef ter trend visible in others. Quite thz incident in trade af- g‘u e:‘:u:g then to 12%; cents. At T abroad felt that the time had come for them to replenish depleud lu]:r of metal. Their buying has lown surplus stocks at a rate never before 1058 lppromhsd in 8o short a time. metal at 13 cents, however, flrfler little profits for the average producer. is not yet reasonable w try to measure the probable effect onihe perad o i cons Siption | st monf of consumption and interval before metal pflou can be returned w a level where present dividends may be fully covered. Resistance Point in Commodities. In the iron and steel trade a slow sag in the volume of production from the high figure of last Winter is taking place; also further price concessions. The best opinion however is that an u-npmvement is pending. The same feeling exists toward other commodities marked down and have contributed to the present low average of the year in the commodity index, now ne‘rly eight points lower than 12 months ago. ‘Various commodities that have hen The conspicuously weak for a long time are reaching a point of resistance. The advance in the price of copper was not only good strategy, so far as the metal market was concerned, but it madeconsumers of other raw products conaider the advisabllity of bullding up their supplies while they had the mar- ketc- with them. il loadings of railroads also s ted that business is on the mend. res for the first week of May nwwed a decided increase over those in April and were the largest for any week this year. They were, how- ever, 10 per cent under the total for same period in 1929; even less than the sam - | those in 1928. Roads Maintain Dividends. For those who may be the decline in railroad and have been ing the substi- tution of public utility or industrial stocks for railroad shares, it might be well to look back over the records of dividends declared on the stocks of a majority of the leading carriers during such really trying times as 1908 and period directly 'r:um the re- turn: of the carrier lvate owner- ship in 1920 with the almost immediate verage | gequal of the severest strike within the memory of this generation. mnry have Tvne through the murepemdotnm a quarter of a century with an uninterrupted dividend record. Of the few that were compelled to reduce their rates, a majority have subsequently advanced them to a higher level than the original. ‘There has NEW YORK BANK STOCKS NEW YORK, May 17 (Special).— Dullness trading in bank stocks L P‘d' with the result that unnecessary a protracted process | of o:%mmmmwmm able ‘markets. fmve notwhsvehnn-.lmethunn fl-ofll ed. h on the a cline o! prices has been uh severe as in 1920-21, and it is true '.h-t s a rule merchandise stocks and man- inventories were not ex- cessive, it has been suddenly realized t | that the production of most of the im- portant raw ma is overdeveloped, hh‘thll ices for such _commodil nufi@a muuam.-nam M been seriously affected thereby.” and crude prod- 138% uvuaL I “’mm-.u B ol Yol B 0, o, Naonay, 883 oflp‘;:' ;rvgl‘:? 611;%. u %, and Publ.h'. Wt up 4. The flo:';&,‘ Inunhte, 53; Bank of 133; ; Con Th SR re consumers here and | sin CLARENCE F. BURTON, has been elected vice president and cashier of the Washington Mechanics’ Savings Bank. He will join the staff on June 1 at the bank’s new branch office, 3401 Connecticut avenue. - BONDS MARK TIME . INWEEK'S TRADING Cheap Money Has Thus Far Failed to Stimulate In- terest in Market. Special Dispatch to The Star. NEW YO May 17—Bonds con- tinue to m’:’k&flne. not much different fro; high. ary domestic issues, followed by an ab- sence of demand and a reaction back ‘The rages stand where they were in the rediscount n&u forms of dmwed to the mut level in years. Dealers in investment securities con- tinue to have faith in the ultimate re- sponse by bonds to cheap money. There is everything in favor of their th worl out, but it may take um. le, conditions dlswunge those re urryinz nsold issues. Obvi- ously, the steady innow of new issues lnw a market mn had not been cleared up of tbe March and April offerings when rediscount rates were reduced has a depressin; ng efect and hoids back sues that normally would react more prompt- ly to better bond market surroundings. Reparations Loans, ‘The theory that the reparations loans w:re causing the ation does not ld good, in view domuuc corporations municipal issues, and also the ecnmm able sum of short and long term for- eign bonds that have come into-sight | g ce German loan was first con- sidered. The effort to hold back new financing in order to make a place for the reparations loans either has not been successful or never had been in-|jeq te'nde¢ weeks the total of new bond: noteu and stocks has been run- ning at an average of su.'.ooonoo, It includes loans of large individual size, which are more mpomlhlu for the high totals than the number of moderate- who n of the le-nm government 5l2s, which was brought out on Monday at 90 and has since sold at a good premium. In contrast is the Brazilian coffee loan, which is at a dis- count of 134 per cent in London. Distributers of bonds find that they can sell almost any short-term issue at ylelds approximating 4 per cent for one and two year maturities, but that the longer dated bonds hang fire. The change in the bond market will come when corporations and institutions be- gin to show as much of a desire to take up the long maturities as they have displayed toward the ones. question of price nltunny enters sues. They are somewhat affected by y are somewhat acected bp gestion exists. The experience of pur- chasers of this type of issue has not ether ummwry in the last ith the closing out of syndicates nnd u:e establishment of & free market prices have reacted to the extent of taking nwly nearly all of t.ha du.lm pmflfi the business. \ too il h oompa.rod' ow“l%hboll:g: l 8] ol gr-lna of the same type in Mkfl. It is another situation '.hlt will have to be im| ‘before the investment list shows a great deal of vigor. Municipal Borrowing. Municipalities are able now to bor- row on a better basis than for many months, which is an aid to development of general business chroulhout the The 1 Department forward to re?nnd.\n: of zhe 1% per cent certificate due June 15. There are now quoted on less than a 2 per cent basis, with less than a month to run, whereas the Government just a year ago was paying the highest price for money and giving an additional in- centive to purchasers in the form of income tax immunity. It should be able in June to redeem its hl(h~ooupon notes in the most favorable basis g}i similar situation. The 'l‘rmury so0ld _this woek on a 254 bank t basis, which is & new low nwrd of interest for plEr of this kind. (Copyright, 1 BAY STATE OFFICIAL LAUDS BANK MERGERS|? ‘The bank consolidation movement In lhlluhuuul. Roy A Hovey, ts banking commissioner, said in 'Al- ufyl.n‘ before the House currency committee, has slowed dovm m recent months. He contended there has been no disadvantage to either deposi- tors or borrowers as a result of con- centration of banking capital by rious methods emplo; utual savings Questioned banks of New mllnd. ll.ld these in- Stitutions are found in some 17 States, but mut.\y in New England and New of the features of sat system curities can be purchased by such banks, the witness said. Under the Massachusetts law, trust REACTION REMAINS DOUBTFUL MATTER Hoover Committee Works Out Chart Showing Former Movements of Industry. END OF PRESENT CYCLE MAY COME IN NOVEMBER But Exact Forecasts Are Impossi- ble Because of Many Factors Involved. BY JOHN F. SINCLAIR. Special Dispatch to The Star. NEW YORK, May 17—How long will the present trade reaction last? President Hoover’s committee on eco~ nomic changes recently worked out & chart showing the duration of all in- flation and deflation movements since the war. The first inflationary movement lasted from May, 1919, to January, 1920, & period of nine months. A deprunum followed, which lasted from February, 1920, to September, 1921, 20 monlbl. The second cycle showed business expansion from October, 1921, to May, 1923, 20 months. Then the drop move- ment, from June, 1923, until July, 1924, came—14 months. ‘The third cycle showed an running from August, ll24 w Ombe'r 1926, 27 months, while the d depression which occurred from November, 1936, to_December, 1927, lasted 14 months, The fourth {‘;;1’“’ would not end until May, Timing such movements is far from scientific and exact—yet. Price Lining. Upon such does ch..nxe in retail merchandising huel depend—at the moment. % Price lining may be defined as the concentration and offering of mer- chandise at specific demand-price levels. It means a more lerlmu attempt to parallel stock with the price level of customers. A New York executive, finding that 81 per cent of his sales in his ‘hand-ba department were for items selling ‘ only 45 per cent of his entire mc\: only $45 per cent of his entire stock were in such items. "lnut.herm ummt'nm- vested in stock o ‘104 ‘whereas cnly 19 per cent of hl.u les were of bags at 't price or over,” he said. Seehu the slowing up of business not due to mwdz condif lt all, but ly to conditions within his own organization, he set co ‘work, reorn.n his ent on the billl his stock with the current price- lining conditions. Result—sales took jump! What is true of handbags, is true many other lines. No better time study the price-lining than right now. Future Meat Markets. Picture the coming meat market— beautiful vllnln and llnl show cases, instead of the old meat ax and lilnd. with rugs on the floor of saw- dun and meat sold in neat, attractive PR kind of & meat store Is already operating in certain sections of the larger cities, byt it has not spread out very far yet in the country. “Fresh meat, scientifically cut at the packing plant,” says the author of this a in to new venture in business, “is imme- in trade-marked, cello- under & new system of grading recently !nhvaueod Refrig- erated motor trucks make daily deliv- eries to retail stores where the meats are sold from %ovemment-l “But the cost—is it more or less than undzr t.he old system?” he was asked. con-umer—l or 3 Denhl less pound tha: uu ‘l'ld! W he replied. cause under the new system more cuts per quarter ‘are red; the trim- mings form a valuable by-] product w ume packer instead of retail waste; middleman and jobber pmm.l eliminated entirely, u the prodt 8o unmuched by hand from plcnr 'n consumer nnw;h but, one intermediate step—the retall store.” New Russian Railway. ‘The Turkish Railway, buflb by the Soviet government under the mncun of a former Chicago anarchist, Central Asla with its 1,700 mfln road, is open for business, three mnth.l ahead of schedule. 000,000 & year. That's real news to the Ameflun cotton planter. But this is not -u The wheat farm- ers, too, will be interested. For this section of the country, through which the nllxoad is passing, is a wheat im- rting ter. lmwlth this road in eomylefiod ‘wheat imports may be supplied from the cene tral part of Blbfl'll which, on account of remote * dtistane the seacoast and the freight cm involved, have never been & factor in the world ex- ‘market. ‘Then Russia can send the wheat that she formerly sent into Turkestan into the world market, now already vmuyglud. (Copyright, 1930, by North American News- paper Alliance.) SEES BETTEIi BUSINESS IN WESTERN STATES Special Dispatch to The Star. wold secrtasy ‘of BAfeway Biores, T secref 1C., umtmeduolmenmmy(or the mfl (our monthl of the curnm g est 'm 1.m 'Inf “Sales for this riod were $73, g‘o 37; $64,545,13 r’ for "&‘ same period . “un a eomi parative basis—a gain of T cen A business was somewhat p‘ it better than this. Due to an average deulm of about 9 per cent in commodity prices, it was necessary to sell more units of mer- chandise this last year in or- than el der to obtain a similar volume of dollar sales is evidence of & increase in unit sales vol- &