Evening Star Newspaper, June 29, 1933, Page 2

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

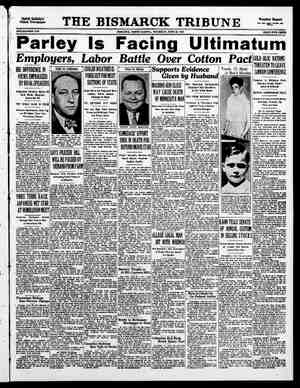

.. through them. TA KAHN HITS CAPITAL CANS TR LA Says Sale of Stocks at End of Year Is “Sort of An- nual Custom.” i (Continued_From First Page) saying the stock was sold | lar market prices. arch, 1931, he added, his daugh- ter arrived from abroad and they dis- cussed her affairs. . THE EVENING STAR, WASHINGTON, D. C., THURSDAY, JUNE 29, 1933 Oldest Operator Feted IS HONOR GUEST AT C. & P. CO. LUNCHEON. | Spanish Prince and Bride: ALFONSO'S SON WEDS COMMONER. It was decided..in consultation with | he said, to turn over all her securities to him and close a trust set up for her previously. t of stock d. on Marsh 30, dated December 31, 15.3. b counsel suggested the canc the close of the year In April, 1 was made. 1931, the st 30 days allowed ‘I was in Efwope,” protest was filed by They cont actually reacquired until March, three months later.” he said. my attorney Fecora took up~the guestioning after finished reading his statemen n fingered a pencil while & nd had difficul Hard to Remember, “Did yor personal pss cause the sale * Pecora- aske difficult " Kehn said. 1 recollect my daughter was formed of it and that the moneéy was furnished by her to me.” “Were time?” s “I'm afraid T couldn't tell you.” “Were they made through a broker?” | “Again, I couldnt say that with any definiteness. They were either through a b “Wer to be made n was.” tie sales made through the | nge?” necessarily. I couldn't positively whether this t through the after three year ar transaction > or curb market.” ‘Went Through His Office. Then, prompted fI. Kahn d now informed they did not g0 | national recovery law is to get more | thelr the exchange but through my out that the transac- by transfer of credits s ere ex- 1 hie couldn’t recall whether the sale with his daugh ransaction. but he was t with her when wrope and “she ap- prior certain I she retu proved™” “Was the price consistent with mar-. ket aquotations?” Pecora asked. “I'm quite certain it was.” Kahn again consulted his attoiney, M. T. Moore, and added: ; “I'm informed by my mentor it-was. Doesn’t Remember Market. Questioned further by Pecora, Kahn said he not remember whether there was a falllng market when he sold the stock to his daughter. “Hav 1 ever before or- since” sold to your daughter or other tembers of your family at the end of a tax year?” Pecora asked. “Yes, either I, or one of those acting s agent for me.” > discusses ed from Eu “Did you do it every year for a period | of years? “1 am not certain how frequemt an occurrence it was. “Did you on each occasion re-acquire ¢ any means the securities or like “To the best of my knowledge never within 30 days and rarely at all, but I can't recall” Do you have any one else making | decisions for you regarding the pur- chase or sale of securities?” “I ha my chiidren and wife and several peo- ple have the power of attorney for me. Sell Without Consulting. “Is it customary for persons other than yourself to sell without consuiting Yes, frequently.” W you?* Moore whispered Into Kahn's ear and Pecora asked that it be noted in the Tecord, but the attorney said he was not_advising the witness. Kahn said his wife was authorized to sell his stock without consulting him. “Do you want the committee to be- Yieve she is as well qualified as you?” Pecora_asked. “No,” Kahn replied, “but I don’t think she makes such decisions with- out competent advice.” Pecora asked if he had directed the sales to his daughter, but Kahn said he could not remember. He said he could not recall whether s in the country at the Take Stock Losses. “Do vou know whether she was con- sulted?” Pecora asked again, “She had several pecpl power of attorney for her “The same people as you had? Yes.” “In alt instan “I shoud think Kahn agreed with Pecora that each December there are “substantial sales of securiti or bear raids, to take Josses for income deduction purposes. “It's an annual custom, isn't it?” Pe- cora asked. “T Delieve it is,” Kahn replied. «“Why did you pick out the year 1930 to make the sale?” “To determine what T owed the Gov- here with ernment, to determine my losses and my | income.” “Did you take a tax loss?” “That is an ugly connotation. T sup- pose this tax loss provision will be abolished when you are through with this hearing.” i “I hope so,” Pecora said. Ought to Be Abolished. Kahn then volunteered that anv law which is “apt to irritate public senti- ment and cause resentment ought to be abolished.” j ‘He told Senator Steiwer, Republican of Orcgon, the capital gains and loss provision _should be ~abolished —or amended because it allowed the Gov- ernment to “speculate en making money or losing money” through in- come taxes. Under the capital gains clause, tax- payers are permitted to deduct losses in ‘securities, but also must report gains Kahn said many market operators didn't take profits in 1929 because of the gains tax and this helped arti- ficially to inflate the market and bring on the “crash.” “It's & bad thing” he added, “from the point of view of making it easier to inflate and stop the natural flow of credit.” Favors Rich Paying Share. Kahn asserted any changes in the's Jaw which would make the rich people ay their just share of taxes would be Be]plul. Chairman Fletcher said “some modi- fications” in the law already had been made, but Kahn said more complete remedies were nceded. Any artificial operation, Kahn said, s “bound to have an effect on the mar- ket and ought to be restricted.” Such opesmbors, e sheuld be 1 “and a wded the securities were not 1931, after three years to in- § necessaty | the sales made all at one i | t should take effect as of the | Kahn continued, in<| ternal revenue agents “raised the point™ k had been reacquired within and therefore no loss could be HE Prince of the Asturias, eldest son of the ex-King of Spain, and his bride, the former Senorita Edelmira Ignacia Adriana Sampedro, daughter of a rich Cuban merchant, shown leaving the Sacred Heart Church at Ouchy, near Lausanne, Switzerland, after the religious ceremony. —A. P. Photo. AIMS OF RECOVERY ACT sold roker or through my office.” e they listed on the exchange:at but I don't think Manhntwn-l ¢ & member of his ! People So They Editor’s note: series of articles prepared by s of the Associated Press 1o e: simple terms the important laws enacted at the lgst session of Congress in Presi- wdent Rooserell's recovery program. a rs n This is the first of taf write tain | . The first task or objective under the money into the hands of the people, 30 they may buy more goods, so stores and ! factories will hire millions of the un- | employed to meet the demand. |« To do this, the law makes possible a | cut in the number of hours now worked First Objective Is to Get More Money Into Hands of Can Buy Goods to Provide Jobs. eliminate “sweatshop” competition. This agreement is submitted to Hugh 8. Johnson, the administrator, who calls for a public hearing st which minori- ties within the intiustry, representatives of labor and representatives of the buy- ing public may suggest changes to meet The law permits employes the right | to organize any:way they choose, and their employers are forbidden to inter- fere. Johnson is afded tn considering the agreements by three boards: One of by men with jobs. Others then will |industrialists, cne of labor experts and have to be hired to do part of the work. | the third representing consumers. Each At the same time the rate of pay is to inust advise from the viewpoint it rep- be increased so that, working less time, | resents. | men will still make a living wage or| When they agree upon terms of the | better and be able to spend enough to code. it is up to Johnson. When he help business make jobs for yet more | approves, it passes to President Roose- men. | velt, who has reserved final say on all | The law lets all businesses in the sgreements. Once the codes are pro- same llne get together and voluntarily |mulgated they have the force of law, ugree to do this. The procedure for ac- | so all plants within the specified in- PRIESTLY BANKERS SEENDUETO PROBE Conservatives and Liberals Would Make Public’s Money Safe. BY MARK SULLIVAN. The investigation of Kuhn, Loeb & Co., and its senior partner, Otto Kahn, 1s less dramatic than that of J. P. Mor- gan & Co, attracts a smaller audience, and is not accompanied by the same tenseness. Nevertheless, the keeping up of the mvutgman into this and other private banking houses has a large purpose, which may emerge in the nex: session of Congress. ‘The early purpose of the whole in- vestigation was to get information on | which to base legislation to regulate sal of securities and to reform banking in general. These objectives have been | accomplished in the passage of the | securfties act and the Glass-Steagall | banking bill, both now laws. This ac- | complishment, however, is only partial. | The securities bill may be regarded as complete. Much more, however, will be done about banking. As to the future objectives there are two views. Some of President Roose- velt's advisers, of the type embraced in the so-called “brain trust,” would go very far indeed. They not only would regulate the issue of securities in the sense of protecting the purchaser, as the present bill does. They would look upon the whole matter of capital invest- ments from a public and social point of view. As part of their theory of a planned soclety, they would not permit Ilnf' corporation to borrow money and enlarge its plant at will. ‘Would Pass On Expansion. They would have & public regulatory body pass on the question of whether an increase in producing capacity in the par- ticular fleld of industry is necessary or desirable, They would not permit, for example, a steel manufacturer to en- large his plant until the Government should decide that larger output of steel is desirable. They would have the Gov- ernment allocate capital investment for increasing production only in areas where it is judged that increfse is de- sirable from the public point of view. This extreme theory about capital and banking, while held by some now in important itions, is not likely to be attempted in practice. For the fore- seeable future it can be ignored. There is, however, another and more practical school of thought which se- riously and earnestly hopes to express itself in early legisiation. Those who hold this other view hold it as complete believers in the present social system and with no thought of fundamental change. Their objective is to restore the word “banker” and the business of “banking” to the function of safeguard- iIng money and nothing else. They| would ele/ate bankers into a kind of priesthood whose sole trust and func tion would be caring for the publi money and keeping it safe. To this| end. they would, in the priestly analogy, | require the banker to foreswear all pel interests other than the safe- keeping of money, ‘Would Diverce Banks. Concretely, they would require that 2 banker, certainly an official of & na- | tlonal or other public bank, should not TEXTILE PARLEY CONSIDERS COSTS Drops Its Study of Dispute Between Employers and Labor on Wages. (Continued From_First Page) | insistence on confining remarks to the code. ‘With that the witness expressed fear that the minimum wages provided might become actually the maximum wages for the industry, and said re- duction in hours and creation of mini- mum wages might result in such pro- hibitive prices that an actual hardship would be worked upon labor. “The basic law of supply and demand can't be eliminated by legislation,” he sald, noting there was no assurance that I an arbitrary schedule of hours would absorb idle labor. | Already the differences are sharply drawn by the cotton textile mlnuhn-] turers on one side and labor, headed | Willlam Green, American Federluonl chieftain, on the other. A protest against exclusion from pro- visions of the code of cleaners and out- side employes was made by John B. Davis, executive secretary of the Negro Industrial League. He said the great proportion of col- ored workers in cotton mills came with- in the excluded groups and asserted it was as_important to textile manufac- turers themselves as to the colored per- sons to lift the purchasing power of colored families in the South. Asks Equal Treatment. He submitted reports by private in- vestigators which, he said, showed that in the South colored workers worked longer hours and received lower wages than did white workers on the same jobs and he recommended that the code be revised to permit application of the minimum wage to colored and white laborers. Davis also asked that & provision be inserted in the code that it was the policy of the administration in re- employment of labor that no discrimi- nation be shown between raclal groups. “If the purchasing power of colored families is raised,” he said, “it will do much to take up the slack in trade re- sulting from loss of export trade to American manufacturers.” Miss Maud Younger, chairman of the Congresisonal Committee of the Na- tional Woman's Party, urged equal standards for men and women in all regulations. “We do not take any position as to other phases of this code nor as to whether improved working conditions should come about through legislation or other agencies,” she said, “but what- ever the agency, we urge that all regu- lations regarding paid employment shall, as in the textile code, apply alike to all persons and that this standard of equality of opportunity for men and wonien be cbserved by the industry re- covery administration.” Miss Mason objected that “exemp- tion from this code of learners for a period of six weeks and of cleaners Remon, reneral manager of the which is other retired emp..yes were honor guests -elebrating a half century of telephone service. ERNARD NEVIUS (left), Washington’s first telephone operator, is shown above inspecting the new-fangled dial phone, quite different from the cumbersome equipment he handled 50 years ago. ‘With him is John A. Chesapeake & Potomc Telephone Co., Nevius- an of the company at a luncheon yesterday. -—Star Staff Photo. LONDON SEES ROOSEVEL complishing the objective is: A representative group of one in-| | dustry drafts a code of fair competi- | tion. Since enactment of the Sherman | anti-trust law, in 1890, companies in {the same line have been prevented from | getting together, but the national re- | covery allows it for two years. | dustries must abide by their terms. If any firm refuses to act under its industry’s code, the President can com- vel. it to do so by requiring the whole industry to take out licenses. closing down the plant which does not qualify for one by accepting the code. It any industry refuses to adopt be a director on the boards of other and outside employes from the mini- corporations and not even hold stock | mum wage provisions seriously weak- in other corporations. They would di- ens the scope and effectiveness of the vorce bank officials from temptation to cotton textile code and is in conflict serve outside interests as completely as | with the intent of the act as explained a judge refrains from having a private by the President. interest in a matter upon which he “Permission to pay less than the passes judicially. Some would extend minimum wage to any group of workers this regulation to the so-called private opens the door to evasion of the code banks, typified by the Morgan and |by unscrupulous employers and would the power of attorney for vithout previous consultation with The code, for the present, is only code, the Government may frame one to set the minitnum wage that the In- |and order it enforced. dustry may pay and fix the maximum | Whiie increasing wages and jobs is hours that any employe shall work. 'the emergency phase of the law, later with, possibly, provisions forbldding the codes may be expanded to outlaw sellipg below cost of production, to'unfair competition. | “prevented from damaging the mlm’ll’personll legal firm, Straock & Stroock, | flow of credit and prices.” and his daughter's firm, Parsons, Par- | He sald he believed the buying and | sons & McIlvane. | selling of securities in the ordinary| “The protest against the Internal course of business is a “proper function Revenue agent's ruling. (holding Kahn of the public,” but that any artificlal owed a tax of $16.000) was not signed activity 1s an improper function. by me. It was signed while I was in Cites Bank of England. Eurpe “I certainly had no intention of doing Kahn suggested the time might come | anything that could be to the detriment | when Congress would place all banks | of ‘the Government.” | under “some suthority analagous to the | _ Pecora said the fleld agent. N | Bank of England.” Shields, made his report April 28, 1933, Pecora_then took the witness back | Which he pointed out was only two | to what he previously had described as | monthis ago. and sought to assess a tax |8 “manis in 1929 for buying up every- | of $16.000 or more on the theory it was body else’s property.” | ! . | " “What were the elements that en- 'So I am informed this morning, {tered into that mania?- Pecora uk;d,‘xlhfl sald. “What were the elements that did | not?” Kahn replied, adding: “The nrst{ 2 ""‘o‘;"';:"u:" :’h:‘:': o thing was we thought we were bigger | Pecora pointed out a pancy than we actually are; that ;‘e cuglkét Shields’ report that the sale was made | to be the money center of the world. | 1 th K i Eahn's atates | the ‘industrial center, and the greatest| ' "t"::‘ ::t;ee:h::u[h et exporting and loaning country. “There was nothing at that time we| “I do not know who made the error, }dldn'm believe was practicable in this| whether it was the agent or my at- We cannot be & great €X-|,, .y put I'm inclined to believe my country. | porting nation without being to some : | extent an imporling and loaning | sttorney,” Kahn said. - | nation.® “All my .'.’{"’z’“ ;md "‘f flm'fly: bgofi | | were opened to inspection of the fiel | Many Bad Bonds. | agent,” he added. pes Senator Costigan, Democrat, of Colo- | Pecora asked again if any cash en- | rado, recalled testimony that “many bad | tered into the stock sale. “Kahn said | bonds” were offered to the public at | While none actually was transferred it | the time. was & book transfer of credit and 95 | Kahn sald many bonds were offered | Per cent of all cash transactions are which should not have been, but which | carried out in that way. then were believed to be sound. | Suggests Probe. “At that time there was hardly & person in America. We were nu'; After the morning session Pecorn t away.” { suggested to newspaper men that other 3 ‘dw‘;:edyuu Clmt'itm( l‘r;v:‘stmmu in i'ovnnmenul agencles might investigate ad bonds?” Costigan asked. | the resson why an Internal Revenue e e nvlted e US| Bureau official first held an income tax to subscribe to bonds we did not be- lieve to be good,” Kahn replied. \reduclng stock sale by Otto H. Kahn Referring to s statement by Costigan | was a “wash sale” and then reported it | in a previous hearing about concentra- | was “an ordinary transaction on the |tion of wealth in & few hands, Kahn | Exchange.” | quoted an economist as saying in 1926 | Pecora's statement was made, after | that was erroneous. | he produced evidence that N. C. Shields | More than 87 per cent of the Na- jsubmitted a memorandum to the In- i tion's income that year, he quoted the | ternal Revenue Bureau two months |sw !ecnnamm as saying, went to those with {annual incomes of $5,000 or less. Transactions With Daughter. Next, Pecora drew Kahn back to his stock transactions with his daughter. “You owned other shares of these same stocks, why didn't you sell them all to her?” he asked. “I assume she did not have sufficient money to pay for it all.” “Did she exercise her independent judgment on the question of buying the stock?” “She exercised her independent judg- ment as soon as the malter was brought to her knowledge. She was perfectly free to say I don’t want that.” “But she had already bought it,” Pe- cora sald. “But if she said she didn't want them the securities would have been taken back. But it's a most remote possi- bility she would say that.” Assigned Back in March, Pecora pressed for an answer as to whether she exercised her independent dgment, but Kahn said he could not ‘member. Kahn said the stocks were assigned back to him in March at the advice of her English solicitor. “What consideration did you pay?” “None.” “It was transferred as a gift?” “There was no consideration, but the original trust was transferred and re- ranged. “I recall that the stock was used to set up a trust for her bemefit.” Kahn said he did not know why the agree- ment was dated back to December, but it was done on the advice of counsel under bellef no one was concerned other than himself and his daughter. Arranged by Counsel Kahn said detalls of the stock action in 1930 were seranged. ns- Mg his. ago holding Kahn's sales constituted |"nn ordinary transaction” on the Ex- change. | Shields previously had reported in 11931 that the sale by which Kahn | claimed & deduction of $117,000 was a “wash sale,” but was overruled by su- | periors. | " In the first report Shields held the ! transaction was a “wash sale” because | the stock was reacquired from Kahn's daughter in less than 30 days. Sold Stock Direct. Pecors said in the second report only | two months ago, Shields reported Kahn ‘had no direct transactions with his ! dsughter. Kahn testified he sold the stock direct to his daughter, and that the mistake was made either by his attorneys or | Shields. | Asked if the Department of Justice would be requested to look into the mat- ter, Pecora said he did not know, but suggested other agencies of the Govern- ment could inquire into it better than | the committee. | Just before the recess Pecora asked Kahn how Shields made the erroneous | statement in his memorandum of two months ago that the sale was an ordinary stock transaction, calling at- tention to Kahn’s earlier statement to the contrary. Kahn said the error either was made sagent or his own counsel and clined to believe my counsel was | correct.” Ignorant on Income Tax. Kahn unhesitatingly told the investi- gators.yesterday he had paid no income tax during the past three years, but m the hope “there will be a different picture for 1933.” | Questioned® by Pecora, he confessed an “abysmal ignorance” on income tax affairs, and said he did not remember selling some - stocks- -on - December 1930, at the “I'm in 30, and to. aloss of $117,000 . B AV Kuhn, Loeb firms.” They would require | the ‘Mogan partners to relinquish me’ three or four score of dictatorships in corporations which they now iold. Whether to extend this kind of regula- | tion to private bankers is precisely the | question for declding which the present | investigation is being carried on. | The principle underlying it all is that | banking should be & priestly and judi- | cial function. The further principle is | that banking is one business and that the issue and sale of securities is an- | other business, not only different but | directly inconsistent with the first. Mr. | Morgan, in his testimony, described | himself as & “merchant of securities.” | Those who have immediate regulatory legislation in mind would say that is a perfectly respectable business but that it must be divorced from the business of accepting deposits. They would say that persuading the public to buy se- curities for the sake of the profit made on the sale, entails a state of mind in- | consistent with a mind forused solely on keeping the public's money abso- i lutely safe. This latter is no fantastic view held | by theorists or radicals. It conforms to the spirit of the legal words “trust” and “trustee” still sacred in spite of recent misuse of them. This view is | held by some of the most orthodoxly | conservative men in Congress; and it is certain legislation will be attempted to confine bankers to the function here described. (Copyright, 1933.) . VETERANS DEMAND REMOVAL OF HINES D. A. V. Also Wants J. C. 0'Rob- erts, Assistant Administrator, Discharged. By the Assoclated Press. CINCINNATI, June 29.—Aroused &t reduction of disability allowances, dis- abled American veterans of the World War today demanded “immediate re- moval” of Gen. Frank T. Hines as di- rector general of the Veterans' Bureau. ‘The resolution adopted at the organ- ization’s annual convention also de- manded the removal of J. C. O'Roberts, Hines’ assistant in the bureau. Hines appeared before the convention yesterday, pledging the co-operation of his sdminigfration with the veterans, and receiving their demands for restor- ation of the sums cut from their dis- ability allowances by the economy act adopted by Congress March 20. Representative Byron Harlan of Day- ton, Ohio, was booed lustily today when he attempted to explain to the conven- tion the provisions of the economy act. — DOUBLE TAXATION PROBE MAPPED BY SENATORS Subcommittee -to Study Overlap- ping of Federal and State Levies. A Senate subcommittee headed Senator King, Democrat, of Utah, ap- { pointed to find out how much double taxation - occurs between Federal and State revenue laws as now written, will confer this afternoon to chart a course of dure. As a preliminary step, Chairman King has requested Governors to supply the subcommittee with coples of State tax laws and other material that would be helpful in learning to what extent there is duplication in the levying of taxes in certain directions. Gasoline, for ex- ample, is now taxed both by the Fed- eral Government and by the various States. The subcommittee also is ex- pected to study what should be the prnicipal sources of Federal revenue what extent nuisance taxes could i | the minimum wage generally applicable make the whole enforcement of the code difficult, uncertain and complex.” She protested the minimum wages proposed as “too low” and said they “would merely result in removing the cotton textile industry from the regu- lation of the anti-trust laws without providing that increased purchasing power which it is the purpose of the industrial recovery act to insure.” Miss Mason insisted particularly that the textile d all other codes be ap~ plied to white-collar workers. She as- serted that automobile manufacturers in Detroit were discussing the exclusion of this type of worker and quoted Pres- ident Roosevelt's statement applying the plan for higher wages. Consideration also should be given in the various codes, Miss Mason sald, o obtaining workmen's compensation legislation in States which have none. ‘The representative of the Ccnsumers’ League proposed elimination of night work except where it is necessary in continuous processing, and suggested “substantially higher wages” for the night shift in those cases. In response to s question from Allen, Miss Mason sald she was unable to give & definite answer as to whether making to all employes would lead to the em- ployment almost entirely of white workers in the South in preference to Negroes. Referring to the proposed $1 differential in the minimum wage be- tween the North and the South, Miss Mason said that some slight differenti seemed justifiable. 4 In place of George Harriss of Char- lotte, N.C., who was the temporary ap- pointee, B, E. Geer of Greenville, 8. C., has been appointed to the committee named by Johnson to investigate the “stretch-out” system in the mills under which each man_is required to tend a number of machines. Geer was expected to arrive late to- day and the committee will meet to- morrow. Other members are Robert W. Bruere of New York, former head of the Bureau of Industrial Research, and George L. Berry, president of the Print- ing Pressmen’s Union. Higher Minimum Urged. President Green of the American Federation of Labor took the stand late yesterday and said the proposed $11 & week minimum in the North and $10 in the South was “not a bare sub- sistence wage.” He added that if prices returned to the 1926 level the wage should be $17.48 & week, and suggested fixing the minimum at between $14 and $16. Green was questioned by Johnson with regard to the number of addi- tional employes the textile industry could absorb. “My thought is we can't do this all in one bite,” Johnson sald. “We can’t put too many on the first in- dustry, with others to comg, Are con- ditions such in the textlle industry that 210,000 workers can be absorbed at one time?” = Green contended that to absorb more than 12,000,000 persons he sald now were unemployed an industry would have to take on some new labor not formerly employed in that business. Johnson asked about the proposed reduction in machine working hours. QGreen said that if & mill wanted to work 24 hours a day on & labor basis of a five-day. week and a six-hour day_“let them do_ it.” “But we know they can't,” Johnson remarked. “I wouldn't be opposed to a machine hour limit if your lnvrfinnum show it by | i needed,” Green said. Johnson said the Industrial Adminis- tration would have to see to it that minimum wages do not become a maxi- mum and agreed with Green that “graduations normally existing in labor must be maintained.” Joln PFrey, secretary and treasurer of the metal trades department of the American Federation of Labor, pre- sented statistics which he said sup- ported his contention that 40 hours a week and $10 as a weekly wage was altogether too long and too low for the textlle industry. Work Hours Argued. ‘The last speaker of the dny was Sid- ney Hillman, presiden$ of the Amaiga- mated_Clothing Workers, wbo pesticu 1 YIELDING ON STABILIZATION‘ Consensus Holds Price Rise Has Gone| Far Enough and That U. S. Will Soon Peg Dollar. By Cable to The Star. ment of President Roosevelt's policy PARLEY MENAGES U. 5. HOME POLICY | Repercussions to Gold Crisis May Be Adverse to Price Boosting. | | { | By the Associated Press. LONDON, June 29.—The United States faced a serious dilemma today in the effort to save its domestic policy from collision with the foreign situation. While still hesitating to stabilize the doliar in view of the severe reaction on American markets resulting from the stabilization trial balloon s fort- night ago, the Americans were warned that a further drop in the dollar would dislodge other currencies from gold, { which might also have adverse reper- cussions at home. “ It was pointed out that a fall of the continental countries from gold would be likely to bring a quick rise of the {dollar in terms of otner currencies,/and { there has been a tendency for markets to decline when the dollar rises. Dollar stabilization has also brought selling into the markets by speculators feeling that it was a signal that de- | preciation had reached its limit. Care Held Essential. Important Americans expressed th~ view that under the circumstances th~ effort to prevent foreign developments from Interfering with the American in- ternal program had reached the point where careful handling was essential. Some American sources had hoped |that a moderate degree of stabilization tcould be achieved early in the con= ference without any fanfare of publicity, |but it was found impossible to act quietly in the glare of s great world | conference. Repeated rumors have been heard in London financial quarters that the chief central banks had reached a gentle- man’s agreement to prevent erratic | fluctuations in exchange, but the recent sumps in the dollar showed no such agreement had taken effect. While the American representatives have made it clear from the first that stabilization was their ultimate objec- tive, the question of the time to take such a step has remained undecided. The American official view from As- sistant Secretary of State Raymond Moley is that most of the recovery in | prices at home has been based on & ! fundamental business recovery rather LONDON, England, June 29—Lon- ! would be in danger of a setback which | ;01" 0n fear of inflation. In this con- don newspapers today appear to believe that President Roosevelt is becoming so alarmed over the swift rise of prices and the swift fall of the dollay that he may change his mind in the near future about stabilization. An editorial in the London Times ys: “The prevailing opinion in American circles here appears to be that the | American commodity price index has| now reached a satisfactory level, that | stock market activities may become un- duly feverish and that President Roose- velt may be willing to consider gentle pressure on the national foot-brake.” | ‘Telegraph: “There is a strong belief | that, with the fall of the dollar and higher commodity prices, President Roosevelt may decide sooner than ex- pected. to open negotiations for cur- rency stabilization.” Up to Prof. Moley. ‘This same newspaper’s correspondent adds: “I gather that President Roosevelt is prepared to accept tke advice of Prof. | Raymond Moley (Assistant Secretary of | State, just arrived at the London Con- | ference) as to whether or not there should be temporary stabilization. Ac- | cording to my information, the ques- | tion will be decided one way or the | other during the week or 10 days Prof. Moley will remain in London.” ; Express: “The gold-standard coun- tries are saying in effect to Great Britain and the United States, “If you | do not get back on gold, we must come off” They also refuse to move in the matter of tariffs and quotas unless there | is first stabilization in the exchanges.” Morning Post: “A speculative rise be- vond the level which can be eventually justified and sustained by actual fulfill- | might easily degenerate into a landslide. The situation certainly appears delicate. “France and the gold bloc suspect the Americans of looking with equanim- ity at the possibility of Holland and tlen Switzerland being forced off gold, followed inevitably by France and Bel- gium, as a prelude to the simultaneous devaluation of currencies. Sees Action Now Necessary. “There is a feeling among a section of the American delegation that thers would be unfortunate repercussions in America itself were the four countries still on gold to be forced off. This con- viction, coupled with an uneasy feeling that the present rise in the commodity and stock markets is too precipitate to be healthy. has led to a more favorable | nection it is emphasized that no mone- tary inflation of any sort has actually | been made effective. Nevertheless, the | psychological effect of the knowledge | that the administration has infiationary | powers has been a factor in the rise in tae markets. Disagree on Devaluation. ‘The question now arises whether the administration may use certain of its inflationary powers to solidify the posi- tion attained in the recovery, particu- |larly whether the dollar should be de- valued in terms of gold to the level to which it already has fallen in the | international markets. | Economists and experts have shown | wide disagreement on this point. Sev- | attitude toward the idea of temporary | eral feel that gold devaluation may not stabilization.” News-Chronicle: “There are grow- | ultimately be necessary. Others urge the advantages of a revaluation which ing fears m New York that the arti- | would greatly increase the effective ficial price boom in the United States may get out of hand. Meanwhile the countries whose stability is threatened by the prevailing atmosphere of un- certainty and speculation are warning both the Bank of England and the British government in the plainest terms that, unless suitable measures are taken with Great " Britain, they may be forced to abandon the gold standard. A widespread currency col- lapse would kill all hopes of British trade recovery.” Gen. Jan Christian Smuts, South African delegate, is quoted as saying that the success of the conference rests with Great Britaln and the United States. “There is no use dealing with tariffs or other trade impediments as long as the exchanges are allowed to fluctuate,” he says. (Copyright. 1933.) | larly stressed the importance of any work hours agreed or in the textile industry as influencing the work weeks of other industries drawing up codes. “Put up a 40-hour week here and other industries will bargain for it,”| Hillman said. Johnson was quick to comment on this argument. He asked Hillman if he favored the same work week for all industries. Hillman said he did not. | “Just because one industry has one| number of hours, it does not apply to Johnson stated. “I want to dis-| abuse the mind of anybody who has that | idea. There is no precedent in this. | If any announcement to that effect is | necessary from this administration it will be made.” Hillman said he did not think the 40-hour work week would meet the | purpose of the industrial recovery act to give employment on a decent stand- | ard of living. “On a 40-hour basfs, so far as the | clothing industry is concerned, you may | look for no re-employment,” Hillman | said. "It would require a 27-hour week to re-employ our workers. But I am not recommending 27 hours because I realize you can't do everything over night. “Employers are ready to discuss less than 40 hours, but they say no industry can do it by itself, and I believe the tex- tile industry should encourage others to come forward with shorter hours.” After the day's hearing, Johnson an- nounced the appointment of Walter C. Teagle of the Standard Oil Co. of New Jersey as chairman of his industrial advisory board. He chose also three | new members to this board: John B. Elliott, Jameson Petroleum | Co. of Los Angeles, Calif.; Henry H. Heimann of the National Association of Credit Men, New York City, and David C. Coker, president of the Cokers Pedigreed Seed Co. of Hartsville, 8. C. COURT RECOGNIZES NINE WENDEL HEIRS | Fifth-Degree Relatives Agree With | Executors, Receiving About $2,000,000 Apiece. By the Associated Press. NEW YORK, June 20.—Surrogate James A. Foley today signed an order settling the estate of Ella V. von E. Wendel, multi-millionaire spinster, and approved an agreement between the executors and nine persons, who were mnot mentioned in her will, but were Iater recognized as fifth-degree relatives. The nine persons were all that re- mained of the more than 2,000 who sought in Surrogate’s Court to establish relationship to the eccentric spinster. The nine recognized heirs, it was said, received more than $2,000,000 from the estate to drop their claims. ‘The nine are Ross Dew Stansbury, Vicksburg, Miss.; Grace Barney Mc- Quarrie, Oakland, Calif.; Leha Barney Butler, Barney Barney, all of Seattle, Wash.; Barney Bush, Alameda, Calif.. Hattie Barney Simmons, Spokane, Wash., and the estate of Laurs Oral Alameds, Calif, 1 AUSTRALIA YIELDS INSTAND ON WHEAT Bruce Expresses Hope of Convincing States of Need for Acreage Reduction. By the Associated Press. LONDON. June 29.—Australian op- position to the American program of wheat acreage reduction, with the view of raising the price of the world's prin- cipal staple commodity, manifested what American quarters termed “a definite softening” today. Stanley M. Bruce at a meeting of the representatives of the United States, Canada and Argentina, called especial- ly at his request, made it clear that he and the Australian government g1rant the necessity of acreage reduc- tion, He also expressed the belief that the Australian states, in which the power of co-operating with the project rests, may be brought around to a similar vle:v providing certain conditions are met. The central Australian government intends threshing the matter out fur- ther with the states at a meeting Sat- urday (Friday afternoon London time), and the attitude that Australia is to adopt here should be known more definitely then. Asks for Statistics. In order that the central government may have all the facts at its disposal when this meeting is held, Mr. Bruce asked the other wheat delegates to prepare a table of statistics and to present their positions, so that he may cable to Canberra tonight. As outlined by Mr. Bruce, the attitude of the central government now is that of seeking from the states & grant of power to negotiate a restriction agree- ment providing its conditions are met. ‘While three states already have definitely said no, in two of those three there has been some moderation in at- titude in the last two days, and there is some hope that all three may be brought around to the agreement. ‘The Australian conditions are highly technical and very complex. One of them in particular sets certain produc- tion figures as the basis for calculating 15 per cent restriction, and the Amer- icans are fearful that acceptance of these figures might leave Australia with virtually the same production as she has now. Plan Not Revealed. Mr. Bruce is understood to have told the conferees that while he feared he may have given an impresison of un- reasonableness in the previous discus- sion as to the necessity of bringing Eu- ropean countries into the agreement, he had not intended to do 0. It is not exactly clear just how the Australians wish the European coun- tries to be approached—whether they will insist upon the import quota prin- ciple or how much they are to be ed to restrict their production. These two questi ions were to be gone into more deeply ¢ & meeting late this afternoon. = | e i supply of monetary metal and should | have the lifting effect upon the w price level that discoveries of | new gold deposits have had in the pas:. | Even among those who favor gold re- | valuation, however, there is considerable | disagreement as to whether it could be | undertaken at this time or whether it | should be done later after the proper | relationships of the currencies have been found by experience. | There is a strong feeling among som@ | of the Economic Conference leaders, ‘mcludm[ Americans, that it is fortue | bate that financial experts and finance | ministers of the great world powers | should be gathered in London at this critical time to deal with the situation. But_other delegates, particularly the | French—and some Americans as well— feel that the conference has been called |at a bad time and should reassemble after currency probiems have been clar- | ified. Each Out On a Limb. For the moment the situation is so complex that each of the big powers of the conference finds itself out on & limb, and all of them are struggling to get back to the trunk. The Americans must decide on the consequences to themselves if they stabilize or do not stabilize; the French must decide whether to try to stick t@ a rigid gold standard program or fole low the American reflationary programs the British .are struggling vainly to keep to the middle of the road, with the knowledge that they must take more definite action to preserve the current stabilization of the pound with the French franc or to hook the pound to the dollar. ‘The British situation is particularly confusing. The drop of the dollar, they | fear, will hurt their foreign trade by | bringing Amekican goods into more severe price competition in world mare kets. But if the British discontinue supw port of the gold standard countries, the franc and other gold monies might des preciate in terms of the pound, and British trade thus would lose the ad- | vantage on the continent of the drop |in the pound in the terms of those | currencies since the pound was pushed | from gold. The gold standard countries are feary ful that their position will become une tenable if the dollar and pound bfi | decline, but they face grave politi | consequences at home if they permit { devaluation ! their own currencies bee cause of the fears of their people cone cerning inflation. {300 DUE TO LEAVE COMMERCE POSTS AS YEAR CLOSEY (Continued From First Page. | | | newly created agencies would escapd the pay cut, which developed in & rule ing a few days ago by Controller Gene eral McCarl, with regard to the rail cos ordinator's force, became an actuality today when McCarl held that employes of the Home Owners’ Loan Corporation likewise should be exempted. McCarl repeated his rail co-ordinator ruling that the salaries, not being subject to the' classification act, had no basis againet which cuts could be levied, as they were atill to be fixed on the day the agency came into operation, which m] ’:éur the 15 per cent cut had been applied. McCarl said also that under the law, the officials could fix the leave allows ances {or these workers, and 8lso their travel pay, which elsewhere is $5 a day. Excluded From Ruling. At the same time, however, the cons | troller general ruled that the Federal Home Loan Bank-Boarl workers must take the cut, inasmuch.as their rates of pay had been fixed prior to the new economy act. Another decision held that leave credit earned in 1932 by Government Printing Office employes, and to be taken now, must have 15 per cent lop« ped off. ‘The scale of furloughs to be adopted in the Post Office Department is ex« pected to be settled in the next few dags. In the current year, this force, right at bedrock, was exempt from ade ministrative furlough, but Postmastef General Farley has decreed it for n:: year, inasmuch as ml workers to get at least nine - 1