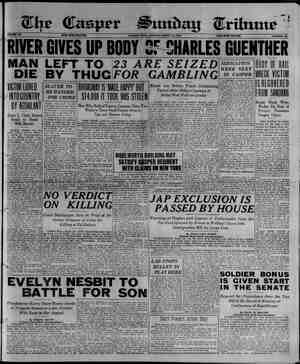

Casper Daily Tribune Newspaper, April 13, 1924, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

PAGE NINE. BABSON DISCUSSES _ COMMODITY TREND Major Industries and ‘Their Present Activities Form Basis of Forecasts Showing Imme/ diate Prospects in Country. BABSON PARK, Fla., April 12— Commodity prices, unsettled or some time, have finally dropped :o a new low for two years - In light of this fact, Roger W. Babson’s stati- ment made today on the probabli future trend of prices is of unusual int “The recent declines have been in strict accordance with the long swing trend of commodity prices,” says Mr. Babson, “and it is probable that over a period of years this gen- eral décline will continue. Whether further ‘recessions can be expected immediately or not depends very largely upon industrial activity. “Commodity prices at present are bound up with the bullding situation, the automobile and the textile indus- tries. ‘What is to happen to the building industry before the end of 1924 cannot be told at this time, but it seems to be holding its own very well at present. There has been a falling off in certain lines of build- ing, to be sure, but home construc- tion is continuing at a fair rate. This is largely due to the fact that the automobile is enabling people to move from congested centers to the suburbs and the country. Such ‘mi- gration’ can be depended upon to continue for some years to come. ‘The good wages that mechanics and others are getting also helps to {n- crease home building. Statistics on lumber sales now available show a 3 per cent decrease in shipments as compared with the same period of last year. As against this decline we find production so far shows an increase of 8 per cent. This slight decline in shipping together with in- creased production explains the re- cent softness in the price of certain grades of lumber. Cement is still in a sound position owing to continued activity in road building. Most other building materials are still steady in price, but there is a great dif- ference of opinion as to how long quotations will remain at their pres- ent level. “The production of automobiles is still at high tide and is now run- ning at about 30 per cent above the spring of 1928, Needless to say this is a very high figure for this season of the year. Distributing costs mean- time are br apn and immediate sales are slowing up. has been Anterpreced in different ways by different manufacturers. Some companies have increased the price of their cars, others have re- duced prices on certain models. Cer- tain manufacturers. have obviated the necessity of reducing prices by bringing out an entirely new model. “Most of tle tire manufacturers are feeling distinctly better for the time being. One company, at least, in Akron has announced that they will not take on any more dealers for the next three months because thelr factories have all the orders that they can handles The total tire production is running over 4,000,000 per month and 1924 output should exceed that of 1923. Of course the great question in this field today is that of the future of the balloon tire. Investors in tire securities should watch this development very care- fully, If the public stampedes for balloon tires it means that this type will rise in price while the old high pressure tire will decline during the next year or two. ; “So long as automobile production holds up the sted] business should continue to be prosperous as the two are now linked very closely, The unfilled orders of a steel corporation are about five million tons at the Everyman’s Investment Present or an increase of two hun- @red thousand tons over the first of | Cerro the year. On the other hand at this time iast year amounted to over seven million tons. The steel business is good at the present time and distinctly better than a few months azo, but it is at @ rather critical point anda few more | Go; or a feweless crders will materially affect the price during the next three months, “Coal markets show little activity. Non-union mines are dolng a fair business but many of the union mines are running on part time or at a loss. Unless production is cur- tailed or consumption increased, prices cannot very well go higher. The settlement of the wage question in the bituminous fields should ell- minate all possibility of a strike this spring. It should also tend to sta- bilize the market. “Crude oil production fs making a small gain and the entire oil situa- tion looks better than it has for sometime. The shrewd investors in oll securities are now banking on a great increase in the use of fuel oll. “When it comes to thé discussion of the commodities connected with wearing apparel statistics do not present such an optimistic condition. Production of textiles, shoes and other forms of clothing is declining owing to the falling off of the de- mand for these goods. This develop- ment is resultng in considerable un- employment in the textile, leather and other centers. The cotton in- dustry is operating at about 60 per cent capacity. Whether this slack- ening is due to weather conditions or to the new habits of life brought in by the automobile is a debated ques- tion, Probably both are responsible for causing pedple to buy fewer clothes and to wear out fewer pairs of shoes. When people are paying for an automobile on the installment plan they must economize on some- thing else. Moreover the more they ride the less they walk. In any event shoes are suffering. In January 1924 production of 26,400,000 pairs falls considerably below the figure 30,740,000;made in January © 1923. The ‘hide and leather market suffer correspondingly. Statistics on the men’s and boys’ clothing show that business {s falling off. Production is falling off. Production of woolen suits this year is running about 20 per cent below the figure of last year. All of these statistics are now available in the it of Com- merce in Washington and will be- come more and more valuable as they are studied in connection with these Industries. Altho the Depart- ment of Justice has apparently tried to discourage publication of such fig- ures I am convinced that Secretary Hoover, who favors their publica- tion, will win out. It may be to the advantage of special interests and to speculators to have the court sus- tain Ex-Secretary Daugherty's opin- fon, but the collection and publica- tion of these figures are distinctly to the benefit of the average business man. If we are over eating or under eating have some other physical tll the sooner we know about it the better and the same principle applies to general business. “General activity as reflected by the Babsonchart,” concluded Mn Babson, “is running at 6 per cent below normal as compared with 2 per cent above normal on January Ist, 1924 and 18 per cent above nor- mal a year ago. The recent drop is due exceptionally large failure fig- ureéss.”” By GEORGE T. HUGHES. Copyright, 1924, by Consolidated Press mn Third Article. risk your future credit. Yes, I know that a Lond Issue, if feasible, would be the cheapest way for you to ob- tain capital, but it wouldn’t be A Bond Issue that never reached| wholly fair to my customers to let the publfe and why it became @ com-| them take even a/ slight ris! mon stock issue. and it wouldn't be fair to your business to i friend, one of the] tle it up in a loan that might make see ae capable men I/ future loans difficult. dssue stocks. ever knew asked me to introduce him to an investment banker. He had built up a profitable manufactur- ing business that was growing #0 rapidly he wished to issue $200,000 in bonds to care for new business. I was present when my friend laid be- fore the investment banker a com: plete report of his business. We all three knew it was the whole truth and nothing but the truth. “Excellent,” said the investment banker, “but I would not touch It. It is a common stock proposition. Your security would make the bonds safe if you had no misfortunes or severey depressions, but it isn’t sufficient to ansure absolutely full payment of the bonds should you fail. I don't think you will fail. A man could afford to take the folr business risk in buy- ing your stock because the prob ability of excellent dividends would pay for the risks. There is every indication that you will contique to pay excellent dividends. But a bond buyer could not assume the same risk for the lower yield of bonds. ‘ 1 have three economic weak- reases,” the investment banker said indicating the report. “Labor troubles could cripple you. Your pa- tents are exceedingly valuable. Sup- pose other patentable devites are de- Yeloped that make yours’ obsolete. Your patents would be worthless as security for your bonds. “That's on the bond buyer's side. Tt wouldn't be fair to your busines ‘0 bond you so heavily. It would In your business they are an excel- lent buy.” ‘This investment banker handled only bonds. TI took my friend to en investment banker who handled both stocks and bonds. A stock issue was sold quickly to well-to-do-business men who knew the investment bank- ing house and who recognized the stock as an excellent purchase, My friend, like a great many other gvod business men, up to that time had known virtually nothing of cor- porate finance, which is the proper arranging of stock or bond issues of an enterprise so that the enterprise will have the best opportunity for safety or profit. That is one example of how sound securities are made, It is a careful, scientific, procedure. It ia wholly different from the. make believe stocks and bonds that glib erool offer the inexperienced with Promises of impossible returns, (Mr. Hughes’ fourth article will appear in the Tribune Monday after noon.) ——— Utah Loses Rig. Complete destruction by fire of the derrick over well No, 2-A on the Lost Soldier lease of the Utah Oi! Refining company, is reported from Rawlins. The well is a good pro- ducer making between 250 and 360 barrels of ofl daily. The origin of the blaze is unknown. Several weeks ago fire consumed the new cook house on the Utah lease, unfilled — orders | Che: : he Casper Sunday Cribune ° eo Stocks = Grain = Livestock : STOCK PRICES GIVEN |GRAIN PRICES RALLY SETBACK IN WEEK| AT CLOSE OF WEEK and Rails Are Only Issues to Show Any] «CAC: Amt, sous grain prices averaged lower during Marked Resistance to Selling Pressure; eo e 4 Today's range of grain and pro- vision prices follows: Open High Low Close American T. and T. American Woolen the week, due largely to Hquidating sales in corn, the close today was ae eee = $e H Ind z firm at rlightly higher quotations 01% 1.02% 1.01% 1.02% in Locomotiv; wnat 238) Bears jammer on the strength of reports that Ger- 03% 1.04 1.03% 1.03% Baltimore and ‘Ohio nae oe isa ustrial Shares. many would accept the Dawes plan. 04% 1.05 1.04% 1.04% Steel .----------— 49%) Upturns took place in both wheat RSE, Soxeeen 146 [{ NEW YORK, April 12—wVeatmose Unite States Steel corporation, far 3 pike Sateaed pebcoge oc tag cad ie air pt. developed in today’s brief sessfon of |ther curtailment in the automobile) +, ¢144, while May corn closed at 18% 78% 78% stock exchange, boought about | !Sdustry and a decline in commodity | 7,3* 0a. heavy selling of Studebaker | Pres, wor” Be chief undermining | Corn selling during the week was A8% 4TH 46% 47 : outstanding in the case of dealers 43% 44 43% 44 hich reached a new low level for|common fell off from sales above having contracts f deliveries. 40 40 40 0% © year, and the clostag was unset-| par last week to a new low for the| win prommecie for a coco a | Seep tf AO AO 40H d with total sales fpr the session | year of 96. babs: Es or possib! - " i z timated at 400,000 shares. Sev-|° Ole ‘continued steady in compari.|Y82ce 19 prices fading the near ap. 10.95. 10.92 10.95 eral of tha motor issues broke|son with a majorite or the lier the | proach of the opening of lake nav. Way 1145 11.17 ti improved statistical ‘position of” the igation had little or no effect. The Steel ~....-------. Cuba Cane Sugar pfd. ----- 58% | Preferred and American Sugar pre-| industry being apalyzed favorably | Sov "hen, Cg Teport, on | wheat aa Famous Players Lasky ----. 67 ferred also received setbacks. by traders for the advance. peor Rey btee artemis ey uy 10.12 General Asphalt ---..-.----- 36 New low records were ung up by| Marked resistance to selling pres-|weahen cate ee ended to ‘| General Electric ----------- 210 | numerous issues during the week,| sure was also exhibited by the rail | So.’ oats. 30:38 Genera tors a Trew, aig | Prices_crumbling with only tempo-| issues, Western Pacific and Texas — Sie Roe Pid. ----——— ed rary rallies in industrials, ‘motors|& Pacific touching new highs for the Glass Tuutiration’ Copper LLL 24% | 824 steels. No immediate effect | year. PITTSBURGH—A syndicate head- International Harvester ---. 8544 }°f the Dawes report was in evidence} The ready absorption of $45,000,(¢4 by W. A. James of Pittsburgh} COLUMBIA, Mo.—r‘ue grass seed Int. Mer. Marine ptd 29% | With the exception of slight im-|000 worth of New York State bonds| Will erect a $2,000,000 glass factory| ts, becoming one of the most profit- Kelly Springfield Tire 14 |Provement in forelgn exchange] was the outstanding feature of the|®t Durant City, east of Kane, Pa.,|able crops of this region. Over Kennecott Copper -~~. 3% _|rates. bond market and tended to stabilize | t0_employ 600 men. Maxws Moto: Middle States Ol! ~. New York Central Pacific Oil ---------. Pan American Petroleum Producers and Refiners Pure Sil _----+------ — Republic Iron and Stee’ Sears Roebuck Sinclair Con OD -.. Southern Pacific Southern Railway Standarc) Oil of N. J. Studebaker Corporation Texas Co. Tobacco Prod A Trancontinental Oil Union Pacific —-. U. &. Ind. Alcohol -. United, States Rubber United States Steel ---. ‘Westinghouse Electric Willys Overland Co'orado Fuel and Iron-.-.-- B. aw National Lead ~ — of 3,733 feet, on the northeast quar | be abandoned. The depth of this| ae At sitegn h quarter of sectior |sand was originally estimated at| 16-77. The ‘ota. was entered a | 3.500 to 4,000 feet, and the additional Standard Oil Stocks 3,845 feet and carried oll as did th | depth is. difficult to account for, un? e Lakota at 3.868; the well was drill | !ess the hole was drilled through the 6 to a depth of 2,936 feet and wa: | «xis of the structure into the steeper ANM0 --—pnncnenence-—- 16 16% | still in the Lakota. It is reporte | dips on the west side of the fold, or Buckeye -------—-- 68 , 69~ | that n 24 hour bailing test brough | unless there was faulting not observ- Continental’ ----------- 43 45 | up 575 barrels cf oll similar in qua! | «4 at the surface. 180 | tty to the Rock River crude. Ther Four other wells were abandoned $7 _ 6844} is no gax pressure and the wel! doe: | ‘or different causes; one drilled to 187 139 | not figw. The axis of the structurr | , depth of 1,800 feet and encounter- 94% §5 |has a northeast southwest strike | > some gas at 1,500 feet. The crude 22 33 —| but the length and width of the pr: | 2 situation In 1923 did not en- 1 77 duotive arex haye not been dete: | courage further testing of a field 96 98 | mined. where the oil is at such a depth as Ohio Oil -—---------- (4% 65% James Lake. this latest test indicates. It was be- Prairie Oi! ~--.-.----- $33 235 This structure 18 located in towr |‘ieved that the Muddy sand was Prairie Pipe ---------. 103 105 {ship 18, range 75 and township 1 | vithin a short distance, probably e Solar Ref. -.---------- 201 264 range 75, about three or four mile | ‘00 feet, from the bottom of the last Sou. Pipe ------------- 94 95 | east cf James Lake, and about 1 | vell. It 4s unfortunate that this 8. O, Kan. ...----.-. 41% 42%] mi'es northwest of Laramie. Top. well could not have been deepened to 4 8. O. Ky. ——-———----- 107% 108% | graphically the area presents a gen’ | he Dakota and Lakota formations. 238 240 | ly rolling surface which consists o | \ new test will undoubtedly be drii- 40% 40% | alluvium and terrace Geposite. Th | “4 when market conditions make it . 307 ©2308 | Steele shale outcrops in a few place: | dvisable, 62% 62% ]and the Mesaverde formation 1 Rock River Anticline 146 148 | Prominent to the north and north | nis is a to: a 60 60%] west. The axis of the structuré aiag aces age hey Grass Creek light Grass Creek, heavy -—-—-2---- ‘Torchlight Greybull Elk Basin --—— -— 1.95 Rock Creek --------—--—---—- L70 Balt Creek --------------oo-= 1.60 Big Muddy --.-----------—— 1.50 Mule Creek 1.10 1.95 Sunburst --------------------- 1 Two Rivers. the recoverable production would ap- Hamilton Dome ------------. 1.40/ The Two Rivers anticline, lyinr | -roximate 20,000 barrels per acre, or Ferris < ~---------------~--- 1.65 | sbout five or six miles east of the 1.95 cd 110 70 Pilot Butte ~.------------. Lander OIL SECURITIES By Wilson Cranmer & Co. Bid Asked | wtratigraphically than the Jamon | 20rtheast of the town of Rock River, Big Indian -------- .06 08 | Take field. The Ohio Of! company | 2°! @ narrow anticline trending Blacksotne 8. C. ~~ 30 33 abandoned !ts test on section 23-18 northeast and southwest, and having Boston Wyo. ------ 1.00 112 | 74, after getting water in the Wal) a closure three or four miles in Buck Creek -—- 3 20 | Creek at 1,215 to 1,265 fect, the|\ensth. The surface rocks: here be- * * eahy~ Tain ood 20 long to the Chugwater formation. orl cae Hi to Sole eed fn fl pe nrgr Drive out today, about ten miles east Golutise hae ae AS |-rhis etructure apparently’ aid not | ther parts.of the basin, the Muddy . Cone. Roy, —-——--=- 127 129 | have sufficlant cipe to trap the ofl.| ind Dakota. are eroded away. from on the Yellowstone Highway. Sales- Date peso ose "a0 a3 why Saasnis bye In the | #88 being also removed. Conse. a 5 uently the oil, if a *, . Kinney Goa isan | yattimettney pete aotentass (ee | Subntty the’ ol fav tn thle etrac men on the ground all day. Lance: Creak rit 42] range 76 and tho northeastern part | which corresponds to the Dmber ag Mtn. an . a trap 38.00 of township 17, range 77. It wes | in the Casper formation which is be. pedihrersrdic= Dem cozy | tested by the Matador Petroleum} ieved to represent the Atnsden and Aine agg le Saat ‘07% | company and proven to be a failure.|Tensteep of the central and north Wont. Expiora —..- 3.60 ¥ A few barrels production was found western parts of Wyoming. ‘They West. States -... 20 Y Off and Gas .... 08 M. 8. Phone ~.---~105.00 Cement Securities -156.00 Amal Sugar Com - Holly Sugar Com. .. 33.50 Holly Sugar Pref. ~~ 88.00 Utah Idaho Sugar .. 3.70 NEW YORK CURB CLOSING Bid Asked] Ship 18, range 78, about 12 miles i Mountain Producers . 17,87 18.00 | southeast of the Rock Creek field and ro phar: band ies four to five Glenrock OU ‘32 .88] about 80 miles northwest of Lara-| Muthwen une Tt pllnges to the Balt Creck Prd 22.75 23.00) mie, It isa small natural basin] Southwest and is open to the north: Salt Creek Conn 8.50 9.00 | practically surrounded by low hills) “AMt Tocks from the Cretaceous New York Ol 10.00 11.00} to the north, past and south, and] WR to the Pennsylvanian being qx-| @ e Mutual 11.12 11.26 “why Atcln. How | Posed on its cre no trap for of M 4 the foothills of the Medicine Bow } 8. ©. Ind. . 59.87 60.00 range to the west. . The floor of the| Cele Present. It was tested in 1910 8. O. Indiani 60.00 60.12 . f or 1911 and found to be barre . € > ildi “4 pane Doin ent oe basin ts neart c used ie barren sapecp hewn ed (Conclude Tornorrow) 343 P. & R. Building. Phone 1761 > Maple Sugar er creek. The exposures in the sur- MONTPELIER, Vt is estl-| rounding hills show the Mesaverde Potatoes mated that the maple sugar produc-|aandstones and light colored shales} LAWRENCE, Kans.—The potato BY ALBERT B. BARTLETT. (State Geologist of Wyoming) INSTALLMENT NO. 2. Rex Lake. The Ohio Ol company commence? Ming this structure July 13, 192: and oil was discovered October 7 1923, in the Muddy sand, at a dept! bears nearly north and south. Th Cactus Petroleum company drille on the southeast quarter of sectior 32-18-76, getting a small showing o oll in a hard thin sand at 1 bu with water in the Muddy and D: kota, and the hole was. abandone The dips were probably too slight t afford an accumu'ation of oil. Wes of James Lake the Western Petro’ eum company suspended operation: inCefinitely at a depth of 3,000 feet The Western Holding company 0% St. Louls drilled on the northeas’ quarter of section 3-17-76 in 192/ to a depth of 3,050 feet, without get ting protluction, James Lake structure, is apparent!: & parallel structure, as it has a nearly north and south axis. It is ‘ocated in the southwest portion of township 18, range 74, and the northwest portion of 17-74. The Steele shale is exposed alomg the north bank of the Laramie river, which crorses the anticline in a westerly aud ‘northwesterly direc- tion. is area is somewhat lower in the Mowry shale at a depth of 3,400 feet, but the Muddy sand was found to be water bearing and like- ‘wine the Dakota. ‘This sma!! produc- tion in the Mowry chale was not considered sufficient to justify mak ing a well of it. Cooper Cove Cooper Cove ts located tn the southwest part of township 18 range 77 and the southeast corner of town- tion of Vermont will yield farmers|and the dark shales of the Steele about $3,000,000 this year. About formation. No detailed study of the 500,000 trees have been tapped and| structure was made, but it is be each ri verageagabout 1% pounds af | lieved to be on the same general fold with the Rock Creek structure. Reduction in unfilled orders of the prices. Geological Data and Oil In Laramie-Medicine Bow District Are Reviewed Development has been going on for some time in this area byt as yet no wells have reached the oil producing | sand. The Utah Oil and Refining company of Salt Lake City is operat-| Ing, and the fifth well, on the SW% of section 20 18-77, was lost at a/ depth of 4,575 feet, having failed to} reach the Muddy sand, and had to he major axis bearing nearly north ind south, the productive area hav- ng a length of about 3% miles, and \ width of probably not over a mile. The Umits of the field bave been {nirly well outlined by drilling,, in be northeastern part of township 19-78 and southeastern part of town-! hip 20-78, an area of probably 1,100 | ‘eres. There are about 50 producing vells in the field, the production in “ebruary 1924 being approximately 1,00 barrels. Production comes from hree sands, first and second\muddy, lepths 2,570 to 2,600 feet, anti 2.670 to 2,695 feet, and the Dakota 2,725 to 2,775 feet, the Dakota belrg the big pay. It has been estimated that “0,000,000 barrels for the field. The Qhio Oll ‘company holds all the pro- lucing acreage. The Prairie Dog Ol! and Gas com- “any of Norton, Kansas, is now dril- ng in the 8% of section 12 town- *hip 19-78, and has reached a depth “f 2,400 feet, on a test for an ex- tension of the field to the southeast. McGill Anticline ‘This structiire les about 12 miles have not been found to be oll bearing in any part of the Laramie basin as yet. This anticline continues to the fouthwest to the Rock River oil fleld, and has been drilled near the town of Rock River without showing Production, but jt is reported that further tests are planned in 10924, Gillespie Anticline This structure is parallel to the acreage in the Kaw valley will be lens this yoar than for a long period but due to selected seed and careful cultivation, growers expect the yield to be up to or aboye normal, 300,000 bushels were harvested in All Markets the section last year and this prob- ably will be topped this season. a Automobiles ST. PAUL—Plans for the largest motor bus terminal In this country will permit the simultaneous loading and unloading of 13 busses. Tho terminal, contracts for which will be opened May 15 will have an area of 22,400 square feet and serve nine affiliated motor bus companies. > mio A mao Summer and Christmas were tho names of complainant and defend- ant in a recent court case in Lon- don. OIL ROYALTIES | Bi Nigbe wenet | Colorade iy attracting tion. .. Royalty ling at very reasonabW: but strong di a using sharp advancds We will handle your busing sas to your entire sagisfacy on comply with all legal re- Better writ N Bank, Warden, . THOMAS & Co, Harris, Co}o FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE FREE Have You Investigated ? MEADOWLAND Be Given away FREE! Meadowland Irrigated Tracts Will Make You Independent Look For the Big Sign Meadowland Irrigated Tracts FREE FREE FREE FREE FREE. FREE