The Nonpartisan Leader Newspaper, August 17, 1916, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

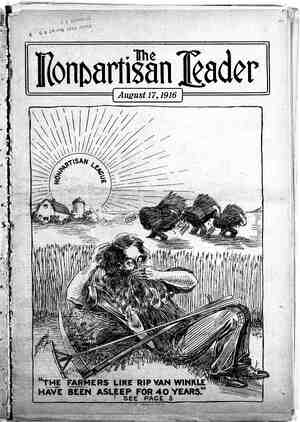

i 1 i ! bk N ities and only a small part to the state at large. LOCAL COMMUNITIES GET MOST OF TAX REVENUES Total taxes paid on iron ore for the last year, reported in the last tax com- mission report, amounted to $6,258,291. Of this the state at large benefitted by only $1,291,081. This was the amount that went to the state treasury under the state tax levy. The rest of the tax, $4,967,210, about four-fifths of it, went to local school, county, town and city governments in the counties where the ore is mined. This same year the railroads paid a Potal tax of $5,775,513 in Minnesota, all of which went to the state government ‘for the benefit of all the people of the state. The mining industry paid a total tax of $6,258,291, only $1,291,081 of ‘which went to the state government for 4he benefit of all the people of the state. dn other words, the people of the state as a whole share equally in the railroad taxes; but they get only about one-fifth of the tax from the state’s greatest natural resource, the iron deposits. EFFORTS TO CHANGE SYSTEM COMBATTED BY STEEL TRUST This system of taxing the ore deposits has many evils, some of which Minne- sota has attempted to correct by legis- lation, but most of which have been allowed to exist because efforts at reform have met vigorous opposition of the steel trust and other powerful influences. The tax commission -seems perfectly satisfied with' the present unfair and _unscientific plan of taxation of the min- ing industry, which is cheating the people at large out of the benefit they should get from this asset nature has given the state. The tax commission has never recommended a change and its members and secretary do not make any attempt to conceal their aversion to plans aimed at reforming present abuses. The chief eftorts at reform have con- sisted in bills introduced in the legisla- ture to levy a tonnage tax against the ore mined in addition to the present taxes, to go to the state for the benefit of all the people of all the state. Others have suggested various plans; among them a tonnage tax on production in lieu of all other taxes that would go partly to the state and partly to the local districts, but on a basis of division that would give the people at large a fairer share of the ore taxes and yet give the - local communities sufficient for all pur- poses of local government. FARMS TAXED HEAVILY, IRON MINES LIGHTLY The chief abuse of the present plan, aaside from the fact that it makes this natural resource an asset of the local mining communities in four counties in- stead of an asset of the state at large, is the fact it results in the owners of the yast ore deposits paying a less rate of taxation than owners of agricultural or city real estate, and less than the rate paid by any other industry in the state: This comes about as follows: The local mining communities, by reason of the tremendous wealth stored in the ground and valued for taxation in those districts, are the richest districts. of the state. Their valuations for tax- ation purposes are immense and it en- ables them, through a tax rate smaller than in any other communities ‘of the tate, to realize a tax revenue that sup- orts the local governments in princely ptyle, making possible school,- municipal and other expenditures on a reckless and dazzling scale, out of all proportion to the needs of the districts and their population. 4 Thus the taxing district of Hibbing, in the heart of the mining district, enjoys 2 valuation on iron ore of $79,912,660 against which to levy a-tax. Total tax- es, local, county and state, in this taxing district for the year reported in the pub- lished report of the tax commission smounted to only 19.8 mills, and it ;ais- 7 “my contention * of 00000000000000000000 ed a revenue in the Hibbing taxing dis- trict of $1,180,311 for Jocal and county governments exclusive of state tax, a revenue that a community of many tixes this size would be proud of. MINE TAXES PAY FOR LAVISH TOWN EXPENDITURES Another instance is the town of Stuntz in St. Louis county, rich almost beyond imagination in tax reveune be- cause of the ore deposits. This town for the last year reported by the tax com- mission paid a total tax of only 15.2 mills for all purposes, county, school, town and state. Yet this brought a total revenue of $579,478 from iron ore alone. In the mining districts as a whole the mines pay 95 per cent of all taxes. In some districts they pay 98 per cent or more. The tax levy for the mining districts as a whole for the last year reported by the tax commission averaged omly 24.39 mills. Therefore mining property, for local, county and state purposes, paid only 24.39 mills. The average tax in the state that year was 83.4 mills and in some counties it was as high as 43 mills,’ which was the rate in Polk county, an agricultural district. Hennepin county, _in which is Minneapolis, paid a total rate of 42 mills that year. mines got off for 24.39 mills. The. 1913 legislature attempted in a measure to correct this abuse. It pass- ed a bill providing that iron ore should be assessed at 50 per cent of its true and full value, while household furni- ture should be assessed at only 25 per cent of its value; live stock, goods and merchandise, machinery and agricultural Yet the land at only 33% per cent of its true value, and stocks and bonds and city real estate at 40 per cent of its true value. ACT OF LEGISLATURE FAILS TO ACCOMPLISH PURPOSE This law was effective January 1, 1914. - Heretofore property was supposed to be assessed at its full and true value, but it never was.- The tax commission re- adjusted the valuations after the new law was passed, with the result that the total valuation in the state for taxation purposes was raised between 9 and 10 per cent. Real estate was increased 10.8 per cent; personal property was de- creased 2% per cent and the valuation of ore deposits was increased 5 per cent. - Hence this law did not under the ad- ministration of the tax commission, pro- portionally increase the tax on ore, as "it: was evidently. intended to do.” - Ore still pays a substantially less tax than other - property, though. valued at a greater per cent of its true value for taxation purposes. It pays a less tax be- cause the state has never assumed the policy that it is a state-wide asset, a gift of nature to all the people, but has let it be exploited as a local asset in four counties, where, the taxation values be- ing so high, it has not been subject to as great a rate as agricultural land, city real estate and many other kinds of property in other counties. = The steel trust has got off easy. HOW TAXES COMPARE ON SAME PROPERTY VALUE Taking into consideration the differ- ent per cent of true values at which dif- ferent classes of property are now sup- The Northmen of America (Editorial in Minot Messenger.) GOGIN SAYS:—During my recent Wisconsin visit I found not only the far- mers but labor union men and even pro- minent business or {own men were deep- ly interested in what the North Dakota farmers have already doile in a political way, and like all the rest of the North- west the people of Wisconsin will - be close and interested observers of the. le- gislative and administrative acts of our. North Dakota forces of state govern- ment when the farmers’ party has assu- med the reins of government in . this state. o WA et Rl SR This keen interest on:the part of the general. public and more especially. of students of political economy “and: cur- rant politics_ is, . for me .at least, the strongest evidence that the conditions of the times are demanding—and the Ame=. rican people are ready to comply with that demand—that the American farmer be reinstated. in his inherent rights to political equity, that is, to represent him- self in_governmental affairs, both state and national. -And incidentally. it proves : some _years ago that the time was not only ripe for such political reinstatement of the farmer, but the national economic drift urgently ‘de- manded the steadying and corrective in- . fluence of the actual farmer or tiller of the ‘soil in_governmental affairs as pro~ per and adequate parts and portions of our forces of government. One of the worst things that could .....................O....0..........0.................0.. MUST ORGANIZE TO WIN : : President Townley of the Nonpartisan Leag{xe frankly says: If it had not been for the fees contributed by the farmers to the organization and the little old “Fords” to help carry the messages to Garcia, the recent campaign could not have succeeded. He is right. Any movement, political or secular, worth striving for demands organization before the program can be considered worked out.—LISBON FREE PRESS. $00000000000000000000¢ oo‘oj_.o.o‘o'oq(ogo’oopop'ooooiiq . PAGE EIGHT happen to any man, people or nation is to become affiliated with what we com- monly call “the big head” and our Amer- ican nation has long been badly affect- ed by that ailment, but Europe and _even Mexico is offering lessons for teach- ing us how ‘ill-conditioned a disease it is. - One of the evil effects of that nation- al disease has been the debasing of our American farmer to such.an extefit that even our President has said, “We will ‘take eduéation right down to the farmer.” If there was not a screw very much loose in somebody’s upper story no _such " unstatesmanlike thing or insult -would- ever-have been uttered, and our chief executive would have naturally ta- ken counsel with the farmer instead of emphasizing the tendency. to treat him’ as though he was but a' ward of the government, -jyst as the Indian was be- fore Standing Bear, by his eloquence, re- deemed him and made of him a man— governmentally. 3 8 In one of my public addresses of the past two years I cited the beneficial in- fluence which the Northmen of Europe had exerted upon the building of that European civilization which ‘we knew be- fore the breaking out there-of the pres- ent cataclysm of international anarchy and I cited reasons for expecting the people of North Dakota to be or:to be- come the Northmen of the United States. Am I not already justified in believing that they are soon”to fulfil that predic- tion along political and economical lines ? or 990000000000000000008000 The farmer pays a higher rate on the land whose stubborn soil he must force into production than the steel trust does on its tremendously rich possessions of ore deposits in Min- nesota. An antiquated system of taxation is to blame. ‘ / sota . to get the needed reforms. posed to be assessed in Minnesota, comparisons can be made of the tax paid by iron ore and other kinds of property. For every $1000 of true and full value of iron ore a tax of $12.19 is paid. This would be the rate for the ore as a whole. Some vast deposits, like those around Hibbing and Stuntz, pay a tax of only $7.60 to $7.90 per $1000 of full gre value. Now in Hennepin county, where Minneapolis is located, the average tax: rate is 42 mills, so that for every $1000 of full value of city real estate a tax of $16.80 is paid, against an average tax of $12.19 for every $1000 of true velue of ore. That shows how little a tax ore pays in comparison with city realty. Agricultural land pays taxes on a valu- ation in theory of only 331 per cent of true value, while ore is supposed to pay on 50 per cent of true value. Yet even with this difference in valuation ore gets -the best of it. The average tax rate in Polk county is 43 mills, in Clay county 37.6 mills and in Marshall county 41.7 mills. These are agricultural counties. On $1000 true value of agricultural land Polk county farmers have to pay under the average county rate, $14.33, Clay county farmers $12.50 and Marshall county farmers $13.89. Yet the ore deposits, for every $1000 of true value, .get off for a tax of $12.19. Some great ore deposits only pay $7.60 per $1000 of true value. : ; These figures are based on the average tax rates figured from the tax commis- sion’s last published report, the latest published figures available for com- parison. : POOR MEN CAN'T HOLD BODIES OF IRON ORE But these are not all the evils of the present unscientific method of taxing ore deposits. Under the present system the ore bodies have been gradually forced into the hands of the steel trust and ‘Great Northern railroad interest hands. Because all known ore bodies in the ground are taxed it becomes impossible ‘for any owner to hold ore land unless he has capital to mine it. ‘ As soon as an ore body is discovered .it “begins to pay taxes.. ‘If the owner has not the capital to develop and oper- “ate it he must sell, for the tax on the ore in the ground is too great to allow ‘him to hold the land. ‘He couldn’t meet ‘the tax, perhaps not even the first year. His_only hope of any. realization at all on his-ore holding is to sell out as soon as_possible. 'He ‘must sell. The “steel trust offers him a ridiculously low price for his holdings “and he’ must take it. “There is no ‘alternative; * - . Millions of dollars have been lost by independent_interests in -the mine fields because of this system of taxation, STUDY: AND. WORK: SRR Rt NEEDE_D ‘TO-SOLVE PROBLEM Of course a tonnage:tax on ore pro- duction would solve this latter abuse and perhaps some other abuses, It could be made sufficiently high so that ore would pay something nearer the same rate in proportion to value that other property in the state pays, and: it would work to 8top -the passing. of the .reémaining" ore nhow in-indepéendent hands to the: steel trust for 4 song. An independent owner could. hold ‘his-ore’in the ‘ground till'he has capital to mine it or till he'could sell atg fair price, for he would pay'no taxes 4l he started to mine; © 0 There is no doubt that the present tax- ation plan is bad. It is unjust to the people of the - 'state, The solution undoul::e;:dly will be some sort of a ton- nage on ore production. How bi this tax should be and just what sort ogf. a tax it should be in detail are prob- lems that Minnesota should figure out, and undoubtedly it will be fizured out scientifically as soon as there is sufficient organized public demand, but not before. . The steel trust is satisfied, the tax.com- mission is satisfied and past legislatures have been satisfied with the present sit- uation. It ‘will therefore take' lots of study and work by the people of: Minae- o