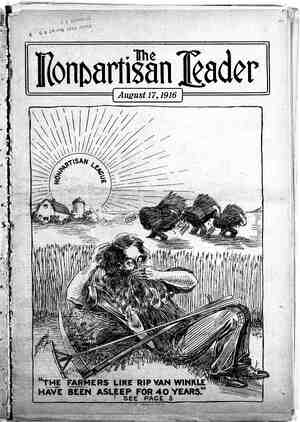

The Nonpartisan Leader Newspaper, August 17, 1916, Page 7

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

< A partial view of the Hull-Rust mine, @t Minnesota’s rich deposits. The surface J \HE state of Minnesota producey two-thirds of the iron ore mined in the United States. |, It is hard to realize the magni- tude of this great Minnesota industry. The figures concerning it run high in the millions and billions and the mind is confused in studying it. The iron deposits of Minnesota are a mighty resource. It is estimated that considerably over two billion dollars must be spent in' Minnesota to mine and transport to the state’s borders the iron ore deposits NOW ACTUALLY SUR- VEYED AND KNOWN TO EXIST. This money will go mostly for labor. This is taking into consideration the high grade ore only. When it is exhaus- ted furnaces undoubtedly will be con- structed to handle lower grades of ore, for which there will then be a market. Untold billions of tons, only partially surveyed and discovered, of this lower grade ore exist in Minnesota. BILLION AND A HALF TONS ARE ACTUALLY SURVEYED All the railroads of Minnesota—and ‘here many transcontinental lines con- verge and have their extensive terminals —do not pay as much in taxes in all of Minnesota as the iron industry does in four counties. v .y There- is actually surveyed, available for mining, a billion and a half tons of merchantable- ore in the iron ranges of . Minnesota. At the present rate of pro- duction this will last over 60 years. The state tax commission’s latest published estimate of the value of the UNMINED ore known to exist is over $540,000,000, as it exists in the ground. Its value at the furnaces would be many tiems that. All this wealth is in four counties in the Lake Superior region. The known merchantable ore deposit, it is estimated, will pay the state govern- ment, under the present taxing and royalty system, $108,315,000 in revenue before it is exhausted. This is the state tax, exclusive of the taxes paid by the ore deposits to local school, county and town treasuries, but it includes the royalty the state is getting from state- owned ore lands leased to operators. LAVISH GIFTS OF NATURE " NOT AN ASSET OF PEOPLE These figures give some idea of the extent and value of the Minnesota iron deposits as ‘at present discovered and surveyed. . They do not indicate the untold wealth believed to exist and await- ing discovery. £ Few states contain a natural resource, ' a pure ‘gift of nature, as extensive and valuable as this underlying the Lake Superior region of Minnesota. But these vast ore deposits under present ownership and the present system of taxation are not a Minnesota resource—that is, not an assét of the - whole people of the state, except in a- limited way. - : . Minnesota - has ~never. assumed the position that nature put this great wealth within her borders for the benefit of all the people of the state. Under the present system of taxation the ore deposits practically are an asset only of the -local communities in which they are located. - ; The ore depoli\m jpay less taxes than i largest iron mine in the wold, located in the Lake Superior district at Hibbing. This is typical of the methods used in gettin covering over the deposits is scraped off and the ore scooped out, A Huge Resource in Minnesota That Does Little to Lighten the Public’s Load deposits. : other property of the state and the tax is levied on an unscientific system that has driven the control of the mines out of the hands of independent owners and into the hands of the steel trust and the Great Northern railroad intere~ SEVENTY PER CENT IS OWNED BY STEEL TRUST Today 70 per cent of the hn..... ore bodies are owned by the United States Steel corporation through the Oliver Iron Mining company, and 20 per cent are owned by the Great Northern and Hill railroad interests. This leaves only 10 per cent—a tenth—of the mining industry in independent hands, and even this small independent centrol is rapidly ‘passing. It is only a question of time when the steel trust will own or control the entire iron resources of the state, if present conditions continue, except deposits in state-owned lands, which are consider- gble. g But even a large part of the state- owned ore lands are being exploited by .....0...‘...0.!............,'..................0........ The immense deposits of iron ore in the state of Minnesota are often spoken of as “a magnificent state resource.” They are a magnificent resource, surely, but whose? The accompanying article shows how under the present system of state taxation the tax- payer’s burdens are lightened but little by this fabulous deposit of nature’s own wealth under the soil of northeastern Minnesota. To combat the forces of corporation influence and make the great possessions of the steel trust pay an equitable share of the general tax burdens of the state is one of the big problems before Minnesota voters. It is a problem that also contains great interest for all states, North Dakota among them, which have substantial mining O...'............O...........................0.0........ _ The' state capitol at St.’ Paul, one of the most beautiful and imposing capitols in the United States, but one where ideas, especially in : farmers’ legislation, have not had a very warm .........Q...O...‘.............'.......Q................. ........0...O.....C.....O.......0......0.‘.....0....'.... private interests without proper return to the state. Minnesota has done in the case of the iron industry exactly the opposite of what it has done in the case of the rail- roads, the next largest industry of the state. Most other states allow local communities, such as school districts, counties, - cities and towns, to benefit - from railroad taxation in proportion to the mileage of the railroads in such local political subdivisions. ¢ MINNESOTA MAKES RAILROADS HELP ALL EQUALLY But Minnesota has declared it as pub- lic policy that the railroads are a state asset—that they were built for the bene- fit of all the people of the state, not only of the communities through which they pass. Minnesota has said that because a community has several lines of rail- road it is not entitled to more taxes than a community that has one or no railread. The state therefore levies a gross revenue tax against the railroads and all this tax goes to the state government, progressive PAGE SEVEN & without tunnels or shafts, making its mining very economicals it F i in lieu of all other taxes that under other systems are divided up among local political divisions according to raile road mileage in such communities. Thig makes the railroads truly a state asset Every taxpayer in the state benefitg equally from the railroad taxes. In the case of the iron ore deposits, however, such a policy has not been declared. Minnesota has never said that the iron resources are a state- wide asset, to be taxed for the bene- fit of all the people. This vast wealth, lying close to the surface and easily mined, upon .which the iron and steel industry of the United States, and in a lesser degree of the world, is dependent, is taxed chiefly for the benefit of the little commun- ities where it is mined, making them probably the richest communities in the warld, from the standpoint of tax revenue. With such tremendous valuations for taxation purposes these communities need to levy only a small tax, in comparison with the rest of the state, and therefore the mining industry is getting off easier than any other industry or any other kind of land owned in the state, when it comes to taxes. There are three iron ranges in Minne- sota. The Mesabi and Vermilion ranges, the oldest and the "richest in explored ore, stretch through St. Louis, Itasea and Lake counties in northeast Minne= sota. Two of these counties, Lake and St. Louis, border on Lake Superior, and Itasca adjoins them on the west. These ranges are the iron treasure house of North America. The third and newly discovered range is in Crow Wing county, southwest of the other two ranges, and is known as the Cuyuna district. HUGE TREASURE ALREADY TAKEN FROM GROUND The total shipments since mining started on these ranges to January 1, 1914, were as follows: Vermilion, 34,829,073 tons; ~Mesabi, 313,105,968 tons; Cuyuna, 1,185,563 tons. The sur- “veyed, unmined deposits in these dis- tricts are as follows, according to the last published report of the tax commissions In St. Louis county, 1,237,390,282 tons; in Itasca county, 168,566,170 tons; in Lake county, 443,162 tons; in Crow Wing ecounty, 70,857,865 tons. This gives some idea of the comparative extent and importance of the various iron districts. The iron deposits of Minnesota are taxed at present on the.ad valorem plan. That is, the state tax commission places a value on the various surveyed deposits and the deposits pay taxes like other. property on this valuation. The school districts, counties, cities and towns in the iron districts levy taxes against the valuation of the ore deposits, and of course the state tax levy also is:levied .against them. So the rate of taxation the ore deposits pay.is the sum of the school, county and city or town tax levies in the mining - districts, plus the state tax. levy. Under this plan, ‘of course, the great bulk of the taxes paid by the ore deposits goes to the local commun= — ~3