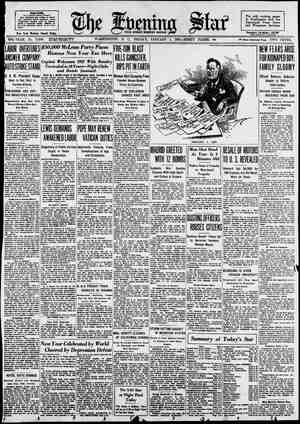

Evening Star Newspaper, January 1, 1937, Page 18

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

A—18 * FINANCIAL. THE EVENING -STAR, WASHINGTON, D. MARKETS SIMILAR C., Curb Stocks in 1936 MUR";AGE mANS FRIDAY, JANUARY 1, 1937. FINANCIAL. Transactions in N. Y. (Continued From Seventeenth Page.) Bonds on New York Stock Exchange in 1936 (Continued From Sixteenth Page.) Year's sales 1334000 Me: ! : 1 fil‘ Ie’l ::I l‘;‘ ‘d “ :mn ana owvidends ollar: Net Hieh. Low. Last. change. Stocks and dlvldcnfll ' (in dollars. B 1y ] IN'1935 AND 135 Lows of Both Years Set in Spring, While Highs Came in November. BY GEORGE T. HUGHES. S1ecial Dispatch to The Star NEW YORK, January 1.—When we compare the bull markets of 1935 and 1935, we find a striking similarity in the patierns made by the move- ments of the general stock averages. That similarity is more notable if we confine our comparisons to the in- dustrial stock average, which has been free from the special influences which at times have affected the railroad and utility groups. Looking at the industrial average alone, we find that not only is there | conformance in the main swings dur- ing the two years, but the extent of the gains from the start of each year to its high point is also very nearly comparable. | Reviewing brisfly the movements of the Dow-Jones industrial average, we | find that the high point in 1935 was | reached on November 19, while this| year's high point was touched on No- | vember 17. In both cases, what is| known as the “closing high” is used. Both years saw trading reactions which set the approximate lows of the | vear in the early Spring, the main | intermediate downtrend in 1935 reach- ing its lower limit in March, while that of 1936 occurred in April. Price gains show an even more striking conformance, for, if we meas- | ure the gains in each year from Jan- uvary levels to the November highs, we discover that the industrial aver- | age added slightly more than 42 points in 1935, while the 1936 bull market has scored an advance of only a frac- tion less than 42 points. Gain Slows Down. In percentages, of course, the 1936 * price gains in the industrial group will figure out as somewhat less than the gains of 1935, for the start was from a higher base. Moreover, if we | compare the upward swings from the | Spring lows to the November highs of each year, it is found that 1935 has the edge, with a rise of nearly 52| points, against this year's Spring-to- | Autumn rise of a little more than 41 points. | To that extent, therefore, it may be said that the major upward move- | ment is slowing down. Some slowing | down is naturally to be expected, in | view of the fact that the current bull | market, the foundations of which are | set in the rock-bottom low levels of | mid-1932, has in the last two years | scored an unusually rapid advance | without an old-fashioned ‘“healthy” | reaction. From January, 1935. to the high | point of last month, the industrial stock average has risen about 75 per cent. And it is to be remembered that | the level of January, 1935, was some- thing more than two and one-half | times the average price of the indus- | triz] zroup at the depression low point | in 1932. At this year's high the indus- | trial average stood at nearly four and | one-half times the low of four years ngo. Rails and Utilities Lag. | That indicates a rather impressive | improvement in quoted values in the | industrial sections, where corpora- | tions have not been hindered in their | efforts to recoup earning power. | Inters Fow s 87 ull Inters P Svc Bs '56 D 93 Inters P Svc 4%2s '58 _ ) Ia-Neb L&P b3 '57 Jacksonv Gas 5s 42 106,000 Jamaica Wat b 55, 2304000 Jer Cen P&L 4 Pow Ky 0l ihs aub Ky Util bas '55F Ky Util bs '691 "~ Ky Uil 5s 'UIH i Lone Star G bst, 43 Long 1sl Lk s ‘4b-__ 1 Lou P&l b: Manitoba P Bhi "BIA meLord R G5 ‘44 = McCallum Hos 63 '41. semph_P&L 5s 48 Meiro Ed 4s '71. Midland Val 55 "33 Mid St. Pet 6las "46A_ Milw G Lt 425 ' Minn P&L 4 Minn P&L 5s 896,000 2.545.000 Miss Riv P 5s Mo P & Li 5lus '35 Mo Pub Svc as Mont-Dak_F 5%z '3 Munson SS 625 #7 ctis. Nassau & Suffolk 5s 4 Nat P&L 6s A Nat P&L 5s Nat Pub S bs Nebr Pw 65 A Nebr Pw_4’2s "Si_ Neisner Bro fs Nevada Cal E 53 222 22227 & Lt & G 4%.3 '80 G & E blas '€ Niaw Fail P 65 %50 L& P Bl 156 Nor Con Ut 8'>s z “ e Nor Slate P alss '40 Norwest El fs '45 Nor'west Pow 65 " CenP &L4's Pen Cen P L 55 en TR Penn Wat&P s '40 Pen W&P 4'2¢ 'AR Peo Gas L&C 45 81 b £ N fit s " ‘p - Pub Sv N TIl_5s Pub S N T Pub S N 1l 4'3s 'ROE - 175 Pub S N 1l 4las 'S1F- 1665 000 796.000 £4.000 San 202, o' bonth cax ow b o Iny 5Yas Stand P&L 6s ‘57 Starrett Corp ‘5_1 '80. Femo ELP 5 Teon Fub 8 Vll’l Pub § 65 Virg P S b‘n ’M A Wash Ry & Bl h ol Wash Wat P 58 West 61 Weat Tex UI. 6! ‘57 A W Up G&E 5'as '55 A ‘Wheeling El 55 '41 Wis Min L&P bs '4 Bu Alre Pr 7's Bu Alre Pr 7s 'A% ;!I 000 Cauce Vol 48 160,00 Cent Bk Ger 6s 57 A 180000 Cent Bk Ger fis '52 A 531,000 1 . 0 Cubn Tab e 44 Danish Con Alas "Ul Danish Con 58 Danzie Port Al Den M~ Bk s Ercole M El 6 Farmer Net Me 7 n R M B! FInsCah Gl W 7 Ger € Mun 73 a3 Hamburx Il ] Hamburg Fl 515 over 8t A15 il Lrotts Pras s "4n t Sup Pw fx "A3 A Lima Peru Y (a8 d M&S 7 Rio de .Yln N,a N Ruhr Gas 8%s '53A Ruhr Husng li’z.\ '58 Russisn fi’/u 19 - Russ 8155 N C 'ID Russ 574s 1821 Russ Blas ctf 1921 Sakon Pub W as 't Stinnes 43 '40 2d stp Stinnes 4x 36 3tp_ Stinies 45 ‘46 sto 14.000 Stinnes 43 '48 1.24R1000 Terni Elec @' 28.000 Tietz (L) 7'2s '486. 591.000 Un E1 Sve s 'ML 113000 Un Ind 6las ‘41 158 000 Un Ind s '43 44.000 Vamma Wat P 5'ax Wise Pol 4e00 4 8 *63_22 k Bs ‘Al 0 Santa Pe Are 41 ‘45 st s 1067 2100 8% 1o o pr1 107 108% 107t 1 EERE Ertt £ S PPt Ty SHRREI i1 uh 24 Ya 100% porery BE L33 S e HIT BILLION TOTAL Building Assdciations Handle 56 Pct. More Business Than in 1935. (By Cambridge Associates.) For the first time since 1929 the total of mortgage loan disbursements by savings, building and loan asso- ciations will reach a billion dollars in 1936. A steadily increasing volume of | new home construction loans month by month, a similarly steady upward trend in volume of loans made for the purchase of existing homes and a good-sized volume of moderniza- tion, repair and refinancing loans have been made by the building and | loan associations this year. The 1936 total of new loans is about 56 per cent ahead of the 1935 total, which was $641,000,000, according to the figures of the United States Build- ing and Loan League. It is remarked, however, that the last three months | of 1935 saw the real beginning of the | loan pick-up, and thus the course of | recovery has run for about 15 months | altogether in this business. A larger percentage of the associations are participating in lending activities cur- rently than during any time since | the depression began, and while no | figures on the subject are available, it is probable that there has been at | least a 50 per cent gain in the num- | ber of institutions actuallv making loans, as compared with the end of 1935, i Showing developing financial | strength, reserves of the nvmu.“ building and loan associations eon- | stituted 10.45 per cent of total assets, as compared with 9.28 per cent at the corresponding period of the previous year, according to the latest statistics. | The total amount of real estate owned increased by only $110.271.000 during 1935, as compared with nearly twice | that much in 1934. Reports for 1936 | indicate that by the end of the year | the associations will be disposing of | their real estate at & more rapid pace than they are taking it in. so that | the depression phase in delinquencies is apparently at an end. At the beginning of 1936 there were 10,534 associations with 7.049.567 members and total assets of $5,888.- 710,326. The decrease in assets dur- | ing the year was $561714.063, ac- counted for in part by what is termed “artificial defiation”: that is, through the change in the accounting set up of a large number of institutions by which loans were placed on the direct reduction basis as each monthly pay- | ment is made by the borrower in- | stead of continuing at their face value until the borrower has accumulated share payments equal to the amount { of his loan. [ The safety percentage of associa- | tion assets for the year 1935 was 99.73 per cent, as compared with 99.74 per cent the previous year, but the total liabilities of the associations which clased last vear were less in amount than in any year since the first com- | pilation of such data was made In 1930. /OUTLOOK CHEERS | ‘ AVIATION FIRMS Bonds. 00 Chile M lnu Bk 0 ‘03 ot e B Colomb_#s '] Oct Colom Mt Bk ;s '48 Copenhag 63 ‘52 Copenhaz 4'us '53 Cnnenh-lp'l'el Bs “ o Cuba Bs (1904) 44 Cuba 53 (1914) '49A Cuba 4%2s Crecho s Crecho 8s Denmark 6s ' Denmark 5'2s Brionia. Rep Piat 78 ‘46 Finland #s '4 Fran 1 Dev 7’ Frankfort u',s 54'1 mm 7.000 Ger C Aur Bk 7 R75.000 Ger C Ag Bk 6z "3R8 Apr Ger C Aer_Bk_6s '80 Jul Ge 3 Ger C 3 R Gov 5.8 '6#5 unstpd Gov 75 ‘49 Good Hnne Gt Con E! 44 Gt Con rlP Jab 6%s 50 Greek s Greek %s '61 pt pd Greek s 'FR Greek Hs ° Haiti s '57 Hamburg St fs 46 Harven Min 6s unv Heidelhz < Helsingfors ' #15s ‘filr Hungary 7%s 44 Hung I. Mt 7 0 Hung L ML Hung Mun Jugosiav Bk 7s Kars 65 '43 = Kars 6s 43 ct m or Karstadt 6« '43 81000 Kars s '43 et R14.000 Kreuger 99.000 Leip7ie stg 7 714.000 Lombard E) {000 Low Aus Prov 71 40.000 1 Aus HE P 6158 44 R45000 Nedelin Mun 6ips 3 2,000 Met Wl('r1 Blas 1Il A EFFFo W 00 Minas Ger 5SS TS T BEEETSsTEeEEts 200t bt st X8 KOK.000 406,000 Panama uee Queensld Rheinelbe .497.000 710,000 384000 925.000 39,000 000 386.000 109.000 Siemen & Slemen & Silesia El Minas Ger 6 e 8% 3% Montecat’ M&A 73 37 Montevideo 7s 52 Norway #; Norway 63 ‘4 Orient Dev 5 Oslo City 4%2s '55 Qslo G&E Wk b * anama 5Y: Panama £s b3, "6 Par-Orl RR 5% Paulista Ry 73 Pernambuco 7s ) Peru s '59 Peru st 65 '60 Peru Znd tlx WOI Eorend ‘&s 50" Poland 75 '47 Poland #s 40 Rheincitin’ 2 RReln-Runr w'e Rhine Westoh 73 ‘50 225550 s 33332832 =y 222553 ISR 3 B FESTI 3 3191300% 106 22 D3] SEEFSREITEL 6 X BH0ET S20e 2Rieceicitas Ed Hal Hal 6% 51 o%s 46 Slietia Prov 13 Silesia Ld Assn P Trondhiem Blzs '57 ‘Tyrol Hy EIP 7%s ‘Tsrol HyEl P Ujigawa EI P 7 Un St Wk 6%s Un St Wk Wk £ Un St as Uruguay s '4f Uruguay 65 ° 108,000 Wurttemb £57.000 Yokohama e !1 .; "5 NEW HIGHS REACHED BY AUTO |NDUSTRY‘ \ln the United States of 24. "50000 | motor ca and 4.020,000 motor | trucks. representing 71 per cent of | the world's automobiles. users of these vehicles paid mul taxes of $1.400,000000. which | Three-and-a-Half Billion Dofllar Alfred Reeves, A. M. A. vice president. | Business in 1936 Reported by Manufacturers’ Group. By the Associated Press. DETROIT. Januarv 1.—The au- tomobile industry did a three and a half billion dollar business in 1936, the Automobile Manufacturers’ ciation reported. New records were set by registration Asso- | estimated to represent 14 per cent of | | all taxes from all sources collected by | Federal, State and local government. Factory sales in the United States and Canada for 1936, including those | of the Ford Motor Co., which is not an A. M. A. member. were estimated to total 3,767.000 passenger cars and, 798,000 motor trucks, an increase of \ 11 per cent over the preceding vear. The wholesale value of these cars and trucks was placed at $2448,925.- 000. Accessories, service equipment and replacements of parts and tires brought the total value of production for the industry to $3,626,612,000. Safest Frontier Co]d. “It is m regrettable fact that after millenniums of civilizing work the safest frontier is one behind which no lives,” declared Herr Sandler, Swedish foreign minister, at a peace meeting at Norrkoeping. “The north- ern states have the North Pole at their backs, and that is safe, because nobody lives there.” one But | the expediture of over a million dol- | | the rails and utilities have | | | culties under which speculative opera- | PT moved by fits and sta the outlook | :‘:‘:m“ n"r:d no‘wl‘dlvs conducted. It NEw U URN DUE for those two groups, while SNOWINE | ma' be that the general price-carn- | Improvement. never becoming S0 inoq ratio remains as reasonable as | clearly optimistic as to win wide in- ;"o becagse the price-boosting pro- | vestment favor for their shares. | ctivi t 1i | The effect of their backwardness | pLonics Of SPeculative cliques have | upon the general level of equity| sng stiff margin regulations, which values, however, has not been so great may become even stiffer in the fu- 83 might be supposed, for, of the ., . have left no place for the weak total market value of all stocks listed | , 000\ hte 56 often in the past the prey | on the New York Stock Exchange, the | o¢ ..spake-out” maneuvers. Partly as rails and public utilities combined ac- | "o 10 of high margin requirements | count for something less than 25 per | and partly because of the pressure uf‘ cent. | funds seeking investment, the notable | Recovery Accelerated. rise in quoted values of listed stocks | Essentially, there has been a broad | on the New York Stock Exchange has similarity also between 1936 and 1935 | heen financed largely on a cash basis. | when we turn to what the market| Brokers' loans used to fluctuate in follower calls “outside developments.’ | correspondence with changes in stock | A well sustained and accelerating | values, but, says the December bulle- | business recovery which has spread | tin of the New York Stock Exchange, out encouragingly into heavy industry, | “the value of listed shares has now | with railway equipment manufactur- | risen to levels similar to those that ers the latest to feel the release of prevailed in the latter part of 1928, deferred demands, has this year, at|but brokers’ loans are less than one- last, been the prime mover, provid- | sixth of what they were then. More- | ing the increasing employment at ris- | over, there has been no net increase ! IN GLASS INDUSTRY| | Pittsburgh Plate President Re- rett. ports 25 Per Cent Rise for 1936, | Forecasts 10 to 15 in 1937, \ tpeciai Dispatch to The Star. NEW YORK, January 1.—The| steady and definite upswing in the | | automobile industry, furniture indun-n try and in building activity through- | out the country has resulted in a |25 per cent increase in the business ' of the Pittsburgh Plate Glass Co. | for the current year, according to H. S. Wherrett, president of the com- pany. A year Ago. sensing the increased | the company laid | | extensive plans for aggressive action. | Distributing warehouses were increased | in number end a promotional cam- paign was put into effect involving | Jars in advertising in magazines, news- papers and a national radio hook-up. “Our predictions of last year have been amply justified,” said Mr. Wher- “The long-awaited upswing ln business, and particularly the bufldm( | field, has definitely arrived. This next | United Aircraft Corp., said in a year- year should see an even greater in- crease in building activity and mod- | ernization which can no longer be | ing year.” postponed. We have good reason to | believe that, unless labor troubles in- | terfere. the increase in our business | during 1937 will be at least 10 to 15 per cent over that of 1936.” Thieves Restore Gem Loot. In a bulky envelope eonulmnu jewelry valued at $500 the police of ! Reading, England, to whom the gems had been mailed, found a note stating that the men who had robbed the homes of H. Golderdown and W. J. Stevens wished to make restitution. ing wages, the profits and the divi- | in these loans since the middle of dends which go around and lrfl"nd in a spiral of rising economic well- being. ‘Total dividend payments this year will reach the highest level 1930, but that part of such payments which represents tax-forced distribu- tions unfortunately tends to enlarge the picture of actual earning power to false proportions. Second only to business recovery as & market influence, and some observers would probably put it first, has been the continuance of a plethora of money seeking employment. The United States Treasury, which sold in 1935 medium-term bonds bearing in- terest at from 3 per cent down to 23 per cent, this year made similar flota- tions at from 2% per cent down to 2!, per cent, with yields on comparable maturities in the listed market down to 2% per cent. A utility company, which priced a refunding issue to yield 3.17 per cent in April of this year, has this month floated addi- tional bonds of the same maturity to yield but 2.995 per cent. Setbacks From Abroad. Looking back over the course of stock prices in 1936, it must be re- garded as significant that such set- backs as have occurred in the market have been mainly due to “outside” infiliences which have had only an indirect relationship either to recov- ery or the going return on money. In April the markets were unsettled by fears which followed Hitler's Rhinish gesture. In August it was the Spanish situation that worried the markets into & decline, and in Sep- tember there was concern over the possible repercussions of devaluation of the French franc, but the tripartite “gentlemen’s agreement” set mone- tary fears at rest and the market surged ahead again. Toward the year end the London market’s fears of a grave constitutional crisis, along with Tenewed alarm over the Spanish in- ‘volvements, were depressing. But so far, with each recurring setback, the market has come to realize that, while it hesitated, business improvement continued to move forward. Corporation earnings have more than kept pace with the rise in quoted values. The price-earnings ratio of the average stock is now no higher than it was 19 months ago. Roughly, prevailing prices are about 18 times earnings and, back in April, 1935, they were over 20 times earnings. Yearly surveys of the stock market in retrospect are no longer complete without some reference to the diffi- since | 1934, despite the fact that the value of shares listed on the exchange has doubled.” Trading Volume Moderate. By reason of the high-margin dam- | per. stock trading volume has been { moderate this year, by comparison | either with pre-depression standards | or the flare-up in the Summer of 1933. Because of the quasi-investment na- ture of the market, sober judgment | of values present and prospective has | had a larger play than usual, with the | result of high selectivity in move- | ments as between different groups n( stocks and issues within those groups. On a basis of percentage gains in | group price indices, the groups which | have fared best in 1936 are the farm implement, rubber and tire, cotton textile. metal, explosive, mail order, railroad equipment and department stores. | Among the groups which have ap- preciated less than the average for | 48 different classifications are pe- | troleum, sugar producing and refining, aviation transport and manufactur- | ing. automobile equipment, building | supply, food canning, office equipment, public utility, cigar, baking, radio and cigarettes. Groups to show declines in the index were distillery, meat packing, wool, snuff, alcohol and cottonseed ofl. | Some of the backward groups in 1936 were out in front in 1935, while others are lagging, not because re- covery has passed them by, but rather for the reason that benefits are slow in filtering through to them. In this category, the investor who investigates first and makes sure of his ground may find some of the op- | portunities for 1937. | (Copyright. 1936. by the North Ameriap Newspaper Alliance. Inc.) U. S. COTTON EXPORTS TO ITALY DWINDLE; By the Assoclated Press. A decline in Italian purchases of American cotton this season, coin pared with last, was forecast by the Division of Foreign Crops and Mar~ kets of the Agriculture Department. It said this was indicated by the high price of American cotton and large quantities of similar cotton avaiable at lower cost from India, South America and other sources. Italian imports of cotton from this country for the 1935-36 season were estimated at 425,000 bales, compared wtih 455,000 bales the previous sea- son. ’ No Approval Bureau. The appearance of thin publicity is evidence that "Before You Invest==Investigate members of the publie for the serviee it zenders. THE BETTER BUSINESS BUREAU OF WASHINGTON, D. C,, 534 Evening Star Building, Washington, D. C. Membership i D. L. Brown, United Aircraft Chief, Points to Conquering of Pacific During Last Year. By the Associated Press EAST HARTFORD, Conn.. Jan- | uary 1.—D. L. Brown, president of | end statement that 1936 leaves the | | aircraft industry “full of eptimism | and with bright prospects for the com- | “It appears that the aircraft indus- | | try is definitely out of the depression,” | | he said. “The Pacific Ocean hax been con- | quered by the airplane, and during | 1937, if well-laid plans come to frui- | tion, pioneering flights will be made | across the Atlantic. * * * } i “Our domestic airlines have also | made great strides forward during the | past year. The time from coast to | coast has been reduced. and larger | | and more comfortable ships are being | put into operation.* No Emblems The Better Business Bureau does not approve any person or business . . . nor does it issue any seals or emblems for the identification of members. the Better Business Bureau is an expression of willingness to participate in this organization’s efforts to promote Truth in Ad- vertising and Honesty in Business . . . such mem- bership does not carry with it approval or en- dorsement, for recommendations are not within the province or policy of the Better Business Our members are not permitted to allude to their Bureau membership, lest such allusion be an inference of approval furnished with any insignia to use on their stationery or in their advertising. Any repre- sentation to the contrary should be your instant warning to . .. . . neither are they NC. Member Federal Reserve System AMERICAN SECURITY AND TRUST COMPANY WASHINGTON, D. C. Condensed Statement of Condition Cash on Hand an and Other Banks as of December 31, 1936 RESOURCES d Due from Federal Reserve U. 8. Government Obligations, Direct or Fully Guaranteed ..... . State and Municipal Bonds ..... Stock in Federal Other Securities Joans and Discounts ..................... Accrued Interest Banking Houses, and Other Real Estate Owned ............... Obher ReSOUPCAN| . oovcciosinsssroisaissonvobinesosne Reserve Bank ...... Receivable .. Vaults, Furniture and Fixtures = 301,250.34 . $14,846,498.92 . 25,444,259.61 . .S 346 681.52 204,000.00 3,048,947.65 3,599,629.17 13,314,598.53 3,023,219.32 60,583.02 Total RESOUICES +ovvvvrrerernsnsnenensssss. $60,590,038.91 Deposits LITABILITIES Reserve for Interest, Taxes, Bxpenseate. . e avs s ee s e s ... $52,130,373.24 321,319.60 Capital Stock «...ovvvnvnenennnn .. $3,400,000.00 Surplus; .. ....:. Undivided Profits Reserve for Contmgencxes Total Capital Funds ........... e 3,400,000.00 1,060,172.30 278,173.77 Total Liabilities «eovvevesvenceeness . 8,138,346.07 . $60,590,038.91 FIVE CONVENIENT BANKING OFFICES Main Office: IFTEENTE STREET AND PENNSYLVANIA AVE. CENTRAL BRANCH %th and Massachusetes Ave., N. W. NORTHEAST RRANCE Eighth and H Sereets, N. E. NORTHWEST UTHWEST RRANCH chenth and’E Sereets, S. W, »raNcH 1140 Fifteenth Strect, N. Wa Member Federal Deposit Insurance Corporation Capital, Surplus, Undivided Profits and Reserves $8,138,346.07,