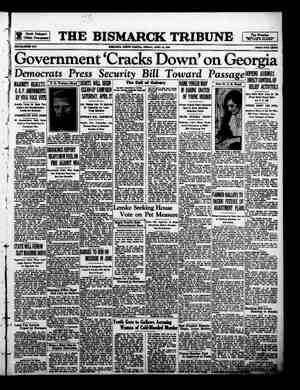

Evening Star Newspaper, April 19, 1935, Page 4

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

A_4 ok - __THE EVENING STAR, WASHINGTON, D. C, : FRIDAY, 'APRIL 19, 1935. - of the League was paralleled by the language he employed in a statement accompenying a bill proposing to shut off private loans to European nations. New Cruiser A BIG SHIP FOR A SMALL BORAH DENOUNCES D.C. TAX ADEQUATE, RICHARDS SHOWS Per Capita City Burden Exceeds That of Many Cities Compared. (Continued From First Page.) Louis, Baltimore, Indianapolis, Pitts- burgh, Houston, Tex.; Buffalo, Cin- cinnati, Newark, Rochester, - Louis- ville, Portland, Oreg.; Denver, Prov- idence, R. I.; Richmond, Va.; Nash- ville, Tenn.; Des Moines, Iowa, and Reading, Pa. They were selected as examples of cities having populations ranging gradually from 100,000 up to the largest. While Mr. Richards included, for comparative purposes, both State taxes and debt service, he deyoted & portion of his report to discussing the effect of city indebtedness on tax levies, showing that in 1930 the debts of 50 cities amounted to nedrly $5,- 000,000,000, or more than 12 per cent of the total of their property assess- ments. He argued that debt service should be eliminated from the com- parison of city tax burdens, although the elimination was not made in the| lack of necessary statistical informa- tion. Debt Charge Is High. He cited one specific example, De- troit, where 24.2 cents out of the city tax dollar went for payment of inter- est and principal on its debt. This figure was larger than any other single unit cost, including that for public schools—23.5 cents. 1t would appear, he said, that at least 10 per cent would be added to the taxpayer's burden in the District if similar conditions existed here in regard to debts and payment of in- terest and the sinking fund. “It is evident that many cities, if they wish to do so, can avoid debt by a policy of ‘pay as you go,’” Mr. Richards asserted. “Such a policy would save interest on the money to be borrowed, although for a short period it would increase the tax rate. “It is well known procedure of many cities to reduce their debts by a sinking fund and then to borrow additional money to a point beyond any previous amount of indebtedness. At least it seems fair and equitable in comparing local taxation with taxes elsewhere to make a deduction of any tax due to any debt burden. It is not fair to add to the District | tax burden because of the debt in- terest elsewhere, since the District (by direction of Congress) has been required to adopt a policy of ‘pay as you go.’ This policy either has pro- duced all needed special improve- ments or else there is & lack of cer- tain improvements.” The Treasury experts eliminated taxes due to debt payments. If this deduction, which Mr. Richards was unable to make on account of the lack of the necessary figures, were made in his comparisons, the result ;;nuld be even more favorable to The decided contrast between the District and a list of other cities in the relation of assessments to prop- erty values is revealed clearly in other tabulations by Mr. Richards, based on city reports of 1928. Three Years Covered. ‘Where other cities had failed to show proof that their assessments were near to true market value, Richards submitted reports on a factual check made on assessments in nine large sections of the District (representative of Washington's total taxable area), revealing that they were but slightly below sales. This survey covered sales and assessments in the Years 1932, 1933 and 1934. Eight hundred sales in all were checked against assessments. Even after making allowance for default sales, not regarded as true tests of value, Mr. Richards found his assess- ments totaled $12,181,801, whereas the sales amounted to $12,329,558, or & difference of only $147,757. In the downtown business area there were 15 sales listed in the three- year study, the total price being $3,- 614,571 as against asessments amount- ing to $4,224,232, showing they were 110 per cent of sales. In an area between K street and Florida avenue, between Sixteenth street and Rock Creek Park, there were 111 sales amounting to $2,514,633 as compared with assessments totaling $2,571,227, showing assessments were 102 per cent of sales. Sales of 116 properties in the area between Florida avenue and Spring road, Eighteenth street and Georgia avenue showed assessments were at almost 100 per cent. The sales totaled $1,188,217 as against $1,193,422 for assessments. Private sales in the area between Seventeenth and Twenty-third, F and K street amounted to $445950 as compared with assessments of $431,- 904, showing the latter were 96 per cent of sale prices. Default sales in the same area amounted to $747,750 as against asessments of $904,816 against these properties, showing as- sessments were 121 per cent of sales. 100 Properties Checked. In the area east of North Capitol street to the Anacostia River and north of Florida avenue to the Dis- trict line assessments amounted to 77 per cent of sales, as shown in disposi- tion of 100 properties for $615,819. As- sessments against these were $479,775. In the area north of Albemarle street from Rock Creek Park to Wis- consin avenue there were 102 sales totaling $1,059,260 as against assess- ments of $917,339, showing an 86 per cent relationship. In the area north of Spring road and east of Sixteenth street to the District line the percentage was found to be 82 per cent, with 153 sales total- ing $1,343894, as compared with assessments of $1,104,133. In the Northeast and Southeast sec- ttons, combined for study, there were 176 sales amounting to $1,547,214, as against assessments totaling $1,259,- 769, showing an 81 per cent relation- ship. The progress made in development of the Federal character of the Dis- trict of Columbia has taken a heavy toll in taxable properties here, Mr. Richards showed in another section of his calculations. The present value of Federal property in the District, which is tax exempt, he placed at more than a half billion dollars, or $556,148,606, to be exact. This is about half the total assessed value of taxed property here. Tax Exemptions Cited. The District Government tax-ex- empt property was valued by the as- sessor at $58,893,324. In this con- clusion the assessor placed the value of the buildings of the District at $40,000,000. The old assessment rec- ords show their value at but $17,979,- 317, but Mr. Richards explains that figure was cost price based on & low period of construction and that the $40,000,000 total is approximately present-day reconstruction cost less depreciation allowance. |valued at $96,137,951 in the tax-| mm;onwmul'ammmmt tax-exempt property there are . tions, churches, hospitals, pri- vate schools and other institutions 4 “Give Us Food,” Copyright, A. P. Wirephoto. Part of a throng of 10,000 hungry Chinese bringing rice bowls to the I F at Yangsin, China, where the commission doles out two spoonsful of rice a day to each registered applicant. An average of 20 deaths a day are reported from starvation in Southern Hupeh Province. D. C. Assessor’s Comparison of Tax Burdens (Figures Based on Recent Inquiry by Mr. Richards.) Population. 500,000 1,950,961 1,568,662 821.960 804,874 364,161 669,817 292,352 573,076 451,160 442,337 328,132 307,745 301,815 287,861 252,981 182,929 153,866 142,559 111,171 City. . Washington, D. C . Philadelphia, Pa . Detroit, Mich . St. Louis, Mo . Baltimore, Md. . Indianapolis, Ind. . Pittsburgh, Pa. . Houston, Tex . Buffalo, N. Y...... . Cincinnati, Ohio. . Newark, N. J.. . Rochester, N. ¥ . Louisville, Ky. . . Portland, Oreg. . Denver, Colo.. 16. Providence, R. I. . Richmond, Va. . Nashville, Tenn . Des Moines, Iowa . Reading, Pa.... 1, 1 assessment. $1,132,827,649 3,071,877,946 City rate. $1.50 175 2465 1.74 245 230 2.67 3.06 2.54 1.78 2.147 2.294 2.20 3.16 1575 245 220 220 1.869 Total Total rate. $1.50 2675 3.02 2.74 267 3.13 346 4.76 3.18 2.14 3.65 2924 288 492 3.375 2.45 220 3.18 3.32 2.60 ,799.166,300 902,224,540 836,122,837 401,560,730 ,180,808,660 262,229,432 969,222,560 943,531,550 711,317,521 633,827,915 285,692,660 242,860,890 236,778,450 411,696,200 230,474,800 131,441 477 134,926,690 170,279,082 City levy. $17,022,414.00 53,757,864.06 44,349,449.30 15,698,707.00 20,485,009.51 9,235,896.79 31,527,591.22 8,024.220.62 24,618,253.02 16,794,861.59 15,271,987.18 14,540,012.37 6,285,238.52 7,674,404.12 3,729,260.59 10,086.556,90 ~5,070,445.60 2,891,712.49 2,521,779.84 3,575,860.72 City per capita. $34.04 27.55 28.27 19.10 25.45 25.36 47.07 27.45 42,96 37.23 34.53 4431 20.42 2543 12.96 39.87 2772 18.79 17.69 3217 Total per Total levy capita, $17,022,414.00 82,172,735.06 54,334,822 26 24,720,952 .40 22,324 479.75 12,568,850.85 40,855,979.64 12,482,120.96 30,82 20,191,575 25,963,089.52 18,533,128.23 8,227,948.61 11,948,755.79 7,991,272.69 10,086,556.90 5,070,445.60 4,179,838.97 4.479,566.11 4,427,256.13 Totals . as debt service. ...10,508,419 $14,688,467.889 The figures in the last column contain, for In such comparisons, it is equitable to deduct both these items. statistical data necessary for such deductions. . The cities included in the comparative study were selected, Mr. Richards explained, to include cities in the different population groups. Mr. Richards sent questionnaires to officials of 28 cities. Replies were received from 20. $313,161,527.44 cities other than Washington, State and county taxes, as well $418,405,066.06 $29.81 Mr. Richards did not have the | exempt column. | All of these facts, Mr. Richards ex- plained, should be considered in studies of the tax burden of the Dis- trict. Washington, he emphasized, is in a class by itself when it comes to tax exemption. A similar study presented to Con- gress in 1929 showed the ratio of tax-exempt property to taxable prop- erty in the National Capital to be 54.09 per cent. The average for 13| other large cities of the country was found at that time to be 17.35 per cent. The tax-exempt Federal holdings here then were valued at some $320,- 000,000. If such a sum.had been added to the assessed valuation, applying the theory that the United States was taxed, the District ratio of exempt to taxable property would have dropped to 19.74 per cent, leaving Washington still above the average for the other cities in the study. Mr. Richards stressed the point that more than $700,000,000 of property is exempt from taxation, with the value of Federal holdings amounting to about half the value of the taxed property and about 30 percent of the entire real estate wealth of the District. It is evident that the District resi- dents alone could not carry the burden if they were to pay all the District costs, in the face of the enormous tax exemption, he stated in a separate memorandum to the city heads. “The District of Columbia is not a manufacturing city and probably should not become such, for the ac- tivities of the Government supply the principal sources of revenue. and make unnecessary large mercantile establish- ments or manufacturing plants. “The District has no voice in its municipal affairs except through methods of petition, and its financial set-up has no counterpart in any other city. “We have a municipality national in character and national in control. Every property owner in the District | pays whatever Congress directs, and every dollar so paid goes into the Treasury of the United States and can be removed only by authority of an act of Congress.” N s 91-YEAR-OLD COED DIES LOS ANGELES, April 19 (#)—Mrs. Adolphine Kaufman, 91, who was known at the University of Southern California as the oldest coed in the United States, died yesterday of a hip injury received in a fall as she was matriculating there last February 20. Mrs, Kaufman, a widow, won her master’s degree last June and had started work on a doctor of philosophy 1 degree. i Easter Bunnies and Ducklings Give the children living gifts this Easter. These cute little white Pekin Ducklings are only 25¢ eaen 2 tor 49¢ Bunnies — white and assorted colors. 75¢ 9%0c S1.0 ATHERTON'S PET SHOPS MzglGoorz y s:i.fiNA‘vv;nuo FIVE BOUND OVER INHOLD-UP PROBE $100,000 Bond Required for Two Awaiting Grand Jury Action. Two of seven men linked by police to numerous hold-ups of liquor and other business establishments here during recent months were held for | action of the grand jury at $100,000 bond each by Judge Ralph Given in Police Court today, while three of | the others were held under $50,000 bond each. Those receiving the heaviest bonds were John M. Williams and George S. Kulik, who were charged in two robberies. Receiving the lesser bonds were Joseph Markovich, George I. Pulley and Joseph H. Givham. Two women were taken during the round-up of the gang, arrested in raids on two rooming houses, but are not accused of participating in the Tobberies. The raids followed informa- tion gained by Lieut. Oscar J. Let- terman of the fourth precinct. All of the men, police said, were identified as having participated in numerous hold-ups, but those ar- raigned today were only charged in one or two instances, the others to be presented to the grand jury. All of the men pleaded not guilty to the charges. Williams, Kulik, Pulley and Givham were arraigned today on charges of robbing Robert Epstein, liquor store, 1338 North Capitol street, of $162 Phone NOrth 3609 J. EDW. CHAPMAN 37 N St. NW, JOHNNY'S COMING This Is the Time for Home-Repairing Houses are more comfortable and livable when they look bright and clean. Springtime is the right time to give this matter your attention. Barker materials are always the best and lowest in price. Free and easy parking always! We will gladly recommend reliable car- penters to do your work. ‘MONEY- for improvements is n rdance with ng Act. e ———————— LUMBER and MILLWORK *<SINCE 86S - 649 N. Y. Ave. N.W. NA. 1348 April 5. Williams, Kulik and Marko- | vich were charged with robbing Sam- uel C. Sutton, Cameo furniture store, 600 Fourth street southwest, of $98 April 8, More than $2,000 and a | quantity of liquor was obtained by | the gang during the robbery wave, i police said. Coal Mines to Be Aided. China will raise nearly $8,000,000 to finance coal-mining enterprises. Famine Victims Cry B".l. TU PUREHASE FARMS INDORSED Group Backs Bankhead Measure to Aid Tenants. The Bankhead-Jones bill to finance tenants in the purchase of farm lands ‘was unanimously indorsed by the Na- tional Committee on Small Farm Ownership shortly before the commit- tee adjourned its meeting at noon to press for Senate action on the bill later today. A score of leading farm experts, editors of agricultural journals, social workers and educators composing the committee, heard an address this morning by Senator Bankhead of Ala- bama, one of the sponsors of the bill, who predicted it would pass the Sen- ate today. The far-reaching provisions of the measure, expected to affect 2,000,000 farm tenant families during a long program of rehabilitation, were dis- cussed by committee members meet- ing at the Brookings Institution. Dr. Edwin R. Embree, president of the committee, and Dr. W. W. Alexander, director of the Commission on In- terracial Co-operation, presided at the sessions this morning. Diversification Aid Seen. Opinions were expressed that the bill would reduce overproduction of “money” crops, such as cotton and wheat, and promote diversification or | subsistence farming. It was said that | landlords bring pressure on their ten- | ‘The roving farm tenant, who moves at least every few years, leaving be- hind a farm from which he has ex- hausted every possible resource, was described as one of the greatest evils| of agriculture in the United States. | “No greater problem confronts our | rural community than the persistent growth of farm tenancy,” said Frank ‘Tannenbaum of the research depart: ment, Brookings Institution, who es- timated there were at least 2,000,000 tenant families in the United States Peril Seen in Tendency, “Nearly one-half of all our farm- ers are now tilling land owned by others,” Tannenbaum continued, “and if the present tendency toward con- | verting the indtependent farmer into a dependent and propertyless tenant continues then we must abandon hope of achieving a stable and pro- gresive rural civilization.” Other speakers this morning in- cluded Secretary of Agriculture Wal- lace, Kirk Rankin, editor of the| Southern Agriculturist, and M. W.| Thatcher of the Farmers’ Educational and Co-operative Union of America. DECEIVED BY CUBS MONTELLO, Wis., April 19 (#).— John Schwark thought he would be | $40 richer today. Instead he was| | liable for game law violation. | Schwark found what he thought were seven wolf cubs in a woods den and carried them home. When four | of the cubs died he applied to the county clerk for beunties of $10 each. i Game Warden Dan Trainor dis- | covered they were fox pelts. Because | the fox season closed March 1, pos- session of & fox either dead or alive constitutes violation of the game laws. Schwark was released with a warn- ing and the other three cubs were confiscated. Novel Ice Cream Moulds for COLONIAL’'S— EASTER ICE CREAM CAKE Made of delicious Cocoanut Bisque with French Va- nilla—topped with whipped cream. Orders received up to § SMALL SIZE LARGE SIZE Assorted Individual Moulds Special, $1.75 Doz. 2 Doz. or More, $1.50 Doz. Center Moulds, $1.20 Doz. French Vanilla center with shell of Cocoanut Bisque— Large Egg Vanilla with Chocolate shell and decorated with whipped cream. Serves 8 to 10 persons, $1.25 . Special Price April 17th through April 28th $1.00 $1.50 Persons e Persons p- m. delivered same day. COLONIAL ICE CREAM COMPANY Makers of Colonial and Wadrex Ice Cream For Your Nearest Dealer Call ATlantic 6000 LOCALLY OWNED AND OPERATED A A ants to concentrate on “money” crops. | |- NATION. An impressive and odd view of the new Dutch cruiser, the Ruyter, as it appears at the yards, in Rot- terdam, where it is now nearing completion to become the latest addition to Holland's navy. —Wide World Photos. PROHIBITION GAIN SEEN | | Blake Reports Sentiment After! Swing Through New York. | NEW YORK, April 19 (#).—Public | sentiment is swinging back towa: prohibition, Edward E. Blake, chaf man of the National Prohibition Com- mittee, said yesterday after a trip through New York State where he has been organizing the forces opposed to liquor traffic. He will leave for Chica- go today to continue his campaign. LEAGUEQF NATIONS Terms Body “Spineless Tool of a Few. Euro- pean Nations.” By the Associsted Press. Senator Borah, Republican, of Idaho, irreconcilable foe of the League of Nations since its inception, yester- day took the floor in thie Senate to denounce the League as the “spine- less tool of a few European nations,” and introduced a bill designed to keep American money from financing Eu- ropean wars. Borah, senior Republican member of the Foreign Relations Committee, declared “this institution should no longer pretend to be an independent body seeking by independent methods to advance the cause of peace. “Nothing in the history of this in- stitution better illustrates that it is not an independent body for peace, but & spineless tool in the hands of a few nations to do what those na- tions elect.” Lewis Hits Defaulters. Borah's attack echoed through the chamber at the conclusion of a speech | by Senator Lewis of Illinois, Demo- cratic whip, criticizing members of | the League for demanding that Ger- | many live up to her treaty obligations | while they continue to disregard “ob- | ligations they have contracted wm:‘ the United States.” President Roosevelt, meanwhile, laid a restraining hand on the Senate munitions investigators to avoid em- barrassing Great Britain. It was the second time within a week that the President had, in effect, tempered the course of the committee headed by Senator Nye, Republican, of North Dakota. Called to While House. Acting after Sir Ronald Lindsay, British Ambessador, had made in- fo.mal representations against the committee’s search through the record of J. P. Morgan & Co., the crown's fiscal agent during the World War, President Roosevelt called to the White House three members of the committee and Secretary Hull. The Senators were Nye, Clark, Democrat, of Missouri, and Pope, Democrat, of Idaho. It was indicated the President frankly cautioned the Senators about making use of its investigation of any wartime correspondence between the British government and the big banking house that might cause embarrassment. The committee decided to continue the arrangement already made where- by any “questionable” correspondence will be discussed with the State De- partment before being employed in the inquiry, ———— Jobless Deplore Act. Unemployed of Britain are protest- ing against the new unemployment act. Harness—Saddlery—Trunks— Luggage—Repairing of All Leather Goods The bitterness of Borah’s criticism G.W.King, Jr.,511 11thSt.N.W. GARDEN SPECIALS FOR SATURDAY ONLY HIGH-GRADE ROSES No. 1 Field FRUIT TREES FLOW Peaches. Pears. Plums, Apples, Cherries tor $1.65 59¢, 3 35¢ 3 for SHRUI PANSIES Giant Variety Doz. to Basket basket 49¢ ERING BS each $1.00 :ole;? 25 Ibs, $1.00; 100 ibs. @ MAKE YOUR SPRING M e, 25 lbs. $1.00; 100 bs.. $2.5 Manure, 25 lbs, SL. 00 . 50c: 10 Ibs. 83c: i 50 lbs.. $2.50; 100 1L, 65¢; for fed plants. SEDGE PEAT, 100 lbs., MOSS, large .35, IMPORTED PEA bushel bale. $2.50. BALDERSO 626 INDIANA AVE. N.W. LAWN NOW Balderson's Famous Wasl Lawn_Seed is best; 1 Ibs.. $1 0 1bs.. e per Ib. Washington Shady Lawn Seed is best for shady nooks; 1 Ib.. 40c; 5 Ibs. $1.35: 10 Ibs. $3.25i 50 1bs_or over. 30c per ib. Extending Thru to 617 C St. N.W. The House of Service and Quality PHONES NAT. 9791-9792 FREE DELIVERIES PAYAS-YOU-RIDE on Bailey's Budget Basis WORLD FAMOUS U. 3. ROYALS of Tempered Rubber BATTERY 4.95 — PHILCO Triple TEMPERED RUBBER is an exclusive feature of U. S. Tires. And the famous cog- wheel tread and Safety Bonded cord body insure the strongest construction and safest non- skid traction found in any tire. AUTO RADIO Latest 1935 Model * NO 42 Music wherever any Bailey store, {18 ROYALS FREE INSTALLATION 95 MONEY DOWN ou go! Newest design with many worth-while improvements. Fits on steering wheel or on instrument panel. Stop in and hear one today at Big Stores ® 14th & P Streets N.W. ® 14th & Columbia Rd. N.W. ©® 9th & H Streets N.E. ® 7th & Penn. Ave. S.E. ® 2250 Sherman Ave. N. BUY ON BAILEY'S BUDGET BASIS A