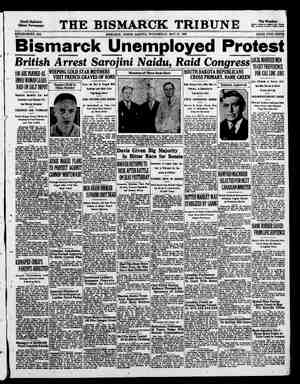

Evening Star Newspaper, May 21, 1930, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

F INANCIAL. THE EVENING STAR, WASHINGTON, D. C, WEDNESDAY, MAY 21, 1930. FINANCIAL. *%¥% A_15 w——__-_———_—_#—_—____—_—_—____—__—_.—___—__—_—_#w UTILIMES FEATURE | NEW YORK CURB MARKET Most Issues Move Within Narrow Range, With Trad- ing Cautious. BY JOHN A. CRONE. Special Dispatch to The Star. NEW YORK, May 21.—Public utili- ties, oils and a miscellaneous list of securities, especially trading corpora- tions, insurance companies. and food manufacturers, recevied the most at- tention in today's dull curb market. Electric Bond & Share moved within & point range in early trading and the fluctuations of United Light & Power A ‘were equally narrow. American Super- power eased slightly. . Natural gas shares, if National Fuel Gas be excepted, also lagged. Ameri: can Natural Gas inclined toward higher -levels. Cities Service, after opening up % at 35%, reacted to 34% and then recovered to 35 on a greatly Teduced turnover. ‘The manner in which the market favorable news developments was best illustrated by the movement of Insurance Company of North Amer- fca. This company plans to increase its capital from $10,000,000. to $15,000,000. The growing number of insurance shares listed on the curb was inc today by the admission of West Coast Life Insurance Co. Alabama Great Southern common and preferred were each up a point on their initial sales and Pennroad Cor- poration was fractionally higher. Pacific Coast Biscuit common and preferred, which is being acquired by National Biscuit, led the food stocks as they rose to new peak prices. on a sale of 100 shares rose 2% points. Mead Johnson, through its gain of 214 points, attained a new high level for the year. —o. CHICAGO DAIRY MARKET 'AGO, 21 () .—Butter— Rge“l!ficl. lb’;‘"{lb‘i barely steady, prices unchanged. 4 Receipts, 13, D ean e eira frets, 321 firsts, 211,822 graded current firsts, 20a21; ordinary firsts, 19a19%; storage packed firsts, 23%; storage packed extras, 241, BONDS ON THE CUI MARKET. 55 ] 55| EEn by 2 i i § FEs ] B R AT BT e ooEEEREZ E 3E33e55es! SRR = 22! L 388 uuSve-85, 0000, T 4 i IR PR ~0% o 993, bk W 2 s3g822u8e 82:328287883258 Pt 213 s2a228s S HeReeeS 3. g.é_..g}. ey 5 o ottt 2 B B i By ! FIEEE % Allison Drug St (A). Allison Drug St (B). Am C P&L(B)(10%) Am Com I'(A) b10%. Am Cwlith P(B)10% Am Co'with Pwr war 14 70 1 5 Am For Pwr(war).. 12 Am Gas & Eles (31). 9 Am Gas&Elec pf(6). 1 Am Invest Ing (B).. 3 Am Laund Mach(4). 268 Am Lt&Trac 10 Am Superpwr pf (6). A.n Super 15t pf (6). Asso Elec nd (30¢). Asso Gas & Elec. G&E (A) 12 G&E (A)dbrts 15 Gas&Elctfs(3) 1 I 1 Atlantic Secur Corp. Atlas Util Corp. . Atlas Utilities(ws Auto Music A(fL. Aviation Corp of Am Aviation Credit. .... Aviation Securities. Axton-F Tob A (3.20 Bania Corp. Bickford's.I! Blus Ridge Corp. 1 Bourjols. Bow Biltmore P Brasil Trac & Lt «2) 2% Brit CelaneSe ret. 32% Bulovacv pf (3%). ¥ Burco, ue... 3% Bwana M Kubwa, 2 Cable & Wire A rets.. lg :0% Chathm Phoe Al n-v. 10 Chem Nat Asson-v. 12 26% Cities gnvlunlu) 120 11% Col Oil & Gas v. 24 - Columbia Pic ($1%). 42% Colum Pic v.t.c. $1%. % Comstock Tunnel 4 234 Com'with Edison(8) 10 3% Com’with & Sou war. . 4b 3% Consol Royal 28 Cooper Bessemert2 5 Copeland Prod.ine A 10% Cord Corp..... 25% Corp Secur, Chicag: 71 Cor & Rey pf (A)(6) 45 Cosden Oil. 9% Coty,So Ano 18% Crocl 40% Cumbe) 31 Cueno Press (234),.. 2% Curtiss Airports vic, 1% Curtiss Wright war. i 1 Dres(SR)MfR A 3%. 38% Dresser (SR) B (2). 6% Dubilier Cond & Rad Duquesne Gas (new), Durant Motor: .1 EastButte. 2% Eastn G&b Asso. 18% Kastn Sta Pwr B(1). 7 Eastn Util Inv (A).. 13 Educational Pic pf.. 18% Eisler Eelectriet13%) 80's E| Bond & Sh (b8) 103% EIl Bond & Sh of (6). 22% Elec Pwr Asso A (1) 2814 Eler Pwr & L op war 9934 El P&L 2 pf(A) Kvans Wallow Lead. Fabrics Fininshing.. 1 Fandango Corp. . 32 Federal Screw (3)... 2% Financial Inv, N Y.., 18 Flintkote (A) (13%). 100 Florida P&Lt pf (7). 13% Fokker Afreraft.... 16 Foote Br Gr M (1.20) 28 Ford Motor, CantA). 6% FordMot France 30c. 10% Ford Mor.Ltd. 37 3%e. Whi r.... 6 24% nd P L(118) 100s 56% 4 Received by Private Wire Direct to The Star Office perpwr Italian Super war. Jonas & Naumburg KanC PS (A) pf (4 Kirby Petroleum Klein (D E) Co (1 Kolster-Br (Am 8h). Lily Tulip Cup 1%... Loew's. Ine (war). Lone Star Gas, n (1). Long Isld Ltpt (7).. Louisiana Lan & Ex. 3 1% 20% 13% 2w 304 17% % 3% 55% 344 112% 107% 5 3 TR . ~neBuanenmund - am ta Ut (1%).. Mid Wst Util(b8%). Mid Wst Util B war. Mid Roylty ev pf(3). Min Corp of C (25¢).. Mo Kan P L (b10%). MissKPLv.tc.. Mock Judson Voe(2). Mountain&Gulf (8¢c). Mount Prod(1.60). Natl Baking Co. Natl Bond & Sh Natl Investors Natl Pwr&Lt pt Natl Pwr & Lt pt (1) 500 Natl Pub §v A(1.60) Natl Rub Mach (2) Natl Steel x-war(2). Natl Sugar, NJ (2).. 49 % 20 Neet, Ine, cv A(1.60). Nelsner Bros pf (7). Nelson (Herman)(2) Nevada Cal Elec. . . . 580: New Eng Pwr pf (6). Newmont Min (34) Newport Co (2).. N Y&Hon Ros(t1%). N Y Rio&Bu Atre Niag Hud Pwr(new). Niag Hud Pwr.A war % Niag Hud Pwr B war Niag Shars Md(40c). Niles-Bement-P 123 Nipiasing (30¢)..... Noranda Mines (3) No Am Aviat A wai North Am Cement. Nor Am L&P (b8%) . Nor Cent Tex(60c). . Ohlo Copper.......d Ohio Oil (4)..vvsr.s Qutboard Motor (B). Overseas Secur (1).. Pac Coast Biscult (1) Pac Coast Bis pt 3.60 Pac G&EI 18t pf 1%. Pac Pub Sve (1.30) Pac Western Oll. Pandem Oil.. Pantepec Oil. Param't Cab(b§%) Fennroad Corp. Petrol Corp (1% 4 Petrol Corp war. Philip Morris, Inc. Pilot Ra T(A)(1.20 Pitney B P.n (20¢ Polymet Mfg (31)... Power Securities pf.. Prince & Whitely 1., Prince & Whit pf(3) Pub Util Hold Pub Utll Hold wa Puget § P&Lt pt (6). Rainbow Lu Prod A. Rainbow Lu Prod B.. Reliance Intl (A). Be @ 2 R e BT T L L L Tt 16% 16% 0% 0% kel 5% 9% 'Y 12% 13% ™ » 2 4 57 11% 10% Richmond Radiato Rich Rad cum pf Field.Inc. Rossia Intl Corp. St Anthony Gold. St Regls Paper (1).. St Regis Pap pf (7). 160s Salt Creek Prod (2).. % Seg Lock & H (50¢). Seiberling Rubber. .. Sel Ind allot cfs 5% . Shenandoah Corp Sheaan Coro pf (a3). Silica Gel Ctf: South Coast. .. South Penn Ol (12% SoCal Ed pf C (1%). So Pipe Line (12). Southland Roy (1) S W Gas Utilitl Sowst Bell Tel p Spanish & Gen K dard Motors. ... Stand 011, Ind (2%). Stand Of1 Ky. (1.60), Stand Pub Serv (A).. Stein Cosmet! % Stutz Motor Car. ... ¢ Sullivan Mach (4). 4 Sunrav Ofl 14vc) Superieater (13%).. Swift & Co new Swift Inter: Swiss-Am El bf (6). Syrac Wash M B (1) Technicolor. Inc. Texon Ol & Land Thatcher Sec Corp “Thermoid Co pf (7 % Transamer (11.60) ‘Cran Con Afr Tran 4 Trans Lux D L Tri-Cont Corp + war) Ulen&Co.......... UnieMeider K Corp 12% 30 15% 97 108% 1074 30 30 65% 62 104% 103 23% 34 MODIFICATION SEEN IN BRANCH BANKING A. B. A. Committee Finds Views of Bankers Changing on Disputed Question. Special Dispatch to The Stai NEW YORK, May 21.—Modification of the attitude of bankers on-the long- disputed branch banking question is forecast in a review and report cov- ering group, chain and branch bank- ing developments prepared by the Eco- nomic Policy Commission of the Amer- ican Bankers' Association and made public here today by the chairman, R. S. Hecht, president Hibernia Bank and Trust Co., New Orleans, La. The re- port, however, after referring to the proposal of Controller of the Currency J. W. Poole that national banks be given branch banking powers within the trade areas surrounding their places of operation, expresses the opin- jon that “we do not believe that so- called ‘trade-area’ branch . banking is likely to gain the support of any large percentage of the banking fraternity.” “The Economic Policy Commission feels that the most important develo] ment that has affected American bank- ing in recent years involves the rapid growth of muitiple banking organiza- tions in the form of group, chain and branch banking systems,” the report says. “We present this report as an unprejudiced ecenomic study and have 30 theories or policies to urge at this me.” Rapid Changes in Banking. Rapid changes in the banking 'orldl along the lines of failures, voluntary liquidations, amalgamations and new | organizations have caused substantial changes in respect both to group and chain banking as well as to individual unit banking during the past six months, the report declares. | “A great many larger group organiza- | tions have taken in not only many ad- | ditional unit banks, but also & number of smaller bank groups as a& whole,” the report says. “There have also been numerous consolidations between strong bank groups. Furthermore, many in- stances. have come to our attention where consolidations of groups have been followed by consolidations within the group of banks that duplicated or oversupplied facilities jn given local- ities. These have been factors tend- ing toward stronger, more compact banking, whether from the angle of individual unit banking or from that of group or chain organizations. “They have also tended to increase the volume of banking rescurces now held §n group and chain systems at & faster rate than the increase in the number of systems or of member banks. Our files now contain information re- garding 269 group or chain systems, | comprising 1922 member banks and $15,285,000,000 in aggregate resources. | There are only six States and the Dis- | trict of Columbia where we do not find any group organizations. “We have been in touch with the managers of many important groups. Aside from the obvious economies of centralized operation and control, a number of these organization heads very frankly tell us that they do not feel that the system has been in opera- tion and tested long enough tp justify them 4n_making positive or sweeping statements as to jts advantages or dis- advantages as Compared with unit banking in the larger economic view- point. Advantages Are Noted. . “The banking and currency commit- | tee of the House, which is conducting an investigation into banking develop- | ments, has called a number of operating heads' of some of the great group systems. These men declared that they found, under certain conditions, definite operafing and economic advantage in both group and branch banking over | independent unit banking. Some | thought group banking was only a transitional stage, that branch banking | was preferable and if it were permitted | on an extensive enough scale they would change their groups over to branch systems. Others held that group bank- ing was preferable as being more fle: ible and maintaining greater local inde- | pendence and contact. “Some held that the ideal plan was a | combination of the two, with group| bank units for localities strong enough to support complete banking institutions | and with branch offices extending fur- ther out into the smaller places requir- ing banking services but not large enough to support complete banks. | Several of these who advocated multiple banking declared that nevertheless they believed there would always be room for vigorous independent unit bank com- petitors. . “The. comptroller of the currency recommended that national banks be | | given branch banking powers within ‘trade areas.’ His theory is that this | would strengthen the national banks, extend the benefits of city banking to country districts ‘and allow national | banks to adapt themselves to modern - STOCK AND BOND AVERAGES By the Assoe! From Yesterday's Two years ago g0, weekly iated Press. 30 Edition. VARIOUS STOCKS CLASSIFIED IN LATEST EXCHANGE SURVEY Periodical Changes Noted in Bulletin—Thirty-Five Divisions Are Listed. BY CHARLES F. SPEARE. Special Dispatch to The Star. NEW YORK, May 21.—The second of the monthly bulletins issued by the New York Stock Exchange, whose object “is to make' more readily and con- veniently available to all interested par- ties economic statistics which relate to security markets,” has been published. It contains a mass of information val- uable to those who follow movements in stocks and in bonds and are interested in the month-to-month changes in par- ticular groups of issues. There are about 35 major classifica- tions of the common and preferrcd stocks listed in the stock exchange bul- letin. Subdivisions of these main groups divide the listings into more than 50 different kinds of companies. For in- stance, under the main group of finance stocks are included those of banks and trust companies, investment trusts, in- surance companies and holding com- panies.- The chemical industry group is separated into the stocks of the heavy and light chemical manufacturing companies, those of the fertilizer, glass and drug and cosmetic producers. The food industry is split up into the stocks of companies distributing milk and milk products, flour, cereals, bread, sugar. mineral waters, groceries, canning, con- fections and fruit. Division of Groups. Amusements are subdivided into those of the radio, piano, motion picture and theater companies. Chain stores and restaurants, department stores, mail order houses and miscellaneous dis- tributors appear in the retail and mer- chandising list. Under the ratlroad in- dusty division are the stocks of rail- roads, railroad holding and investment companies and railroad equipment man- ufacturers. The public utility group in- cludes gas and electric operating and holding companies, communications companies, which would embrace Amer- ican Telephone & Telegraph, Interna- tional Telephone & Radio; also trac- tions, omnibus, exprass and water and heating utility companies. With these sharp divisions between different types of stocks, it is possible, from month to month, by comparing the market values, to obtain a very definite idea of where the weak or the sirong spos In the invstment or specu- AMERICANS INVEST HEAVILY IN ITALY $350,000,000 Capital Represented in Issues Sold to United States Public. BY WILLIAM H. STONEM’AN. Special Dispatch to The Star. ROME, Italy, May 21.—Approximate- ly $350,000,000 of American capital is now invested in Italy, it is revealed by | statistics just published by the Banca Commerciale Italiana. This sum in- cludes bond issues made in the United States on behalf of the Italian govern- ment, municipalities and industries to the amount of $330,682,000, as well as various issues of stock of Italian com- panies which are represented by “Amer- ican shares” listed on the New York $tock Exchange and_“depositary re- ceipts” on the New York Curh. The amount of the latter is not available, though it is known to exceed $5,000,000: The $100,000,000 Morgan loan of 1925, of which $93,000,000 is now outstand- regional economic developments evi- denced in the spread of group and | chain benking in some sections of the country through what might be desig- | com- ing; $30,000,000 loans to the Milan and Rome communes, and various larger loans to public utilities lead the list. ‘The Pirelli Rubber Co., the Fiat and the Isotta-Fraschina Works each is in All Croups Are lative situation exists. This is further brought out in the series of 24 charts showing the trend of market values in these groups in 1929 and up to the pres- ent date. In this respect the complla- tions of the New York Stock Exchange Bulletin are more . comprehensive and instructive than those available in the different popular financial services. On May 1 the total number of com- mon shares listed on the New York Stock Exchange was 1,088,621,347. This represented the stocks of 863 separate companies in the United States and abroad. The total market value of these shares on May 1 was $66,669,793,607, with the average price $61.24. The total number of preferred shares listed ‘was 110,682,081, with a market value of $8,634,814,605, and an average price of $78.01 a share. Bond Statistics. In the compilation of bonds the same general division into groups and sub- groups has besn carried out in the bulletin. The par value of listed bonds is given. This, on May 1, amounted to $49,678,901,677. The market value was $48,066,265,312, or a shrinkage during April of $225,000,000, compared with one of $852,000,000 in common stocks, but an appreciation of $81,000,000 in pre~ ferred stocks. Most of the latter oc- curred in the public utility s-nior shares, which have made more of a response to cheap money in the last few weeks than have bonds. Another interesting fact developed by the figures in the bulletin is that the | total par value of all foreign govern- ment bonds listed on the exchange is $16,803,459,757, while the total market value of these issues is $16,293.234,367. This does not mean, however, that the diff:rence between the two amounts represents a shrinkage, for a great many—in fact, the majority—of foreign issues were sold at a discount and are still on a discount basis. On the other hand, the par value of all United States Federal and municipal bonds listed is just short of $13,000,000,000, and their mark:t value about $320,000,000 greater | than par value. Next to United States Government and foreign issues, the largest proportion of l'sted bonds is that | of the railroad industry, which repre- | i;xtla'l‘ approximately 20 per cent of the i g (Copyright. 1930.) Missouri-Kansas-Texa! NEW YORK, May 21 (Special) —It is understood that the plan of the Mis- souri-Kansas-Texas_directors is to de- | clare a quarterly dividend of $1 & share | ion the common stock, payable within the current half year. This will give | the common $3 a share for the calendar | CHICAGO STOCK MARKET By the Associated Press. CHICAGO, May 21—Following is the complete official list of transactions in stock on the Chicago Stock Ex- o SeBENLEE! kG gugsuuBENSELsy, SENEY Py 3 160 Cent Ill Pub Serv pf 3f cant 0l geturiis; 7 700 Cent Pub Serv A 1 Cent & So Wi es! et & 82 Wevt's 1 pi 103 28 Chain Belt 43 BE Sy & R my Bt 141 n Ry P 1000 Chicago Corp. i 700 Chicago Corp pi 100 Chicago Investos Chi No Sh & Mil 120 Chi Rwys serles 500 ities Serv rts. 58 IE T o8 855 52R8UES: o 3 1t N FETIE TR OTEE 2 cozey & EE oy sesguas, susd, » FESERE T sussussyeroges: SBI2RS! Lal 45 Great X o0 Greas Lakes Dredee. 245 ~Grunow ... 33% 100 Harc-Carter .. 31ia 150 Houdallle-Hers| a4 450 Houdaille-Hershey B. 183 llinojs “Brick. . 20t 20 Ya 3 Ut In pf 2nd Ser Fireman. 'S a3 100 McGraw Elec 400 Mercin & Mrs ALl 100 Midcontinent Laund, 13000 Mid West Util n..... S8R 858! SEFE¥ L BRSNS BaR LIS EISREBRE! =33 250223220 8583005 S, 1071 107 3410 114 6431 914 ey ilazeage P b com Print & Pub pr | year. The dividends will reflect what | has been earned previous to 1930 rather | the large investment trusts holds about | 94,000 shares of “Katy” common, and | income from the stock as soon as pos- | sible. o FOREIGN EXCHANGES. (Quotations furnished by W. B. Hibbs & Co.) 7 Nominal sold Selling o ). toda 19.3424¢ <ps. drac e Madrid, peseta 19 217 Vvienna! schilling ."[l Budapest. pengo. i Prague, crown (n zloty. en, crof os Stoci has been anxious, naturally, to obtain | 1as than in the last few months. One of | 29} 10" =' ) . 105'% 108 44 9TV Y ? . 98 %.000 POTATO MARKET. CHICAGO, May 21 (United States Department of Agriculture) —Potatoes— Receipts, 90 cars new, 20 old; on track, 167 new, 98 old; total United States shipmenis, 881; old steady; trading just fair; Wisconsin sacked round whites, 285a3.00; Idaho sacked russets, 3.70a 3.90; new, firm; trading good; Alabama, Louisiana sacked Bliss Triumphs, 3.50a 3.75; mostly 3.60a3.65; Texas sacked Bliss Triumphs, 3.50a3.65. SILVER QUOTATIONS. NEW YORK, May 21 (#).—Bar sil- ver, 40%. Stock sales toda: 'BONDS 33000 Insull. 85 *40. v 2000 Sou Nat Gas 1000 Unit Am Util Bond sales today, Pearl street, New York, is one of the oldest thoroughfares on this continent. nated as economic trade areas, prising scmeotimes several States. Gov. Young’s Views. | shown to have a large amount of Amer- {ican capital. The latest loan is that | of $10,000,000 to the Pledmont Hydro- Union Ol Asso (32). Up Nat Gas, Can 1.60 Union Tobaceo. . 24 Fox Theater Cl (A 76 Franklin Mfg of (7). 5 2232822338255888%% 337 ,'S1ys (40 06 s A '49 101 40 wi. (1 G o 2ega2e EdEE e HEH 8 Elwe G FEEFE T T PP R TR o 8 Wes Union Tel 5t 3 Westvac Chi Slos ' FOREIGN BONDS. M Bk 75 47 n 81%2 Air 0 2 Bogot 1 wi 9511 r 2 Hamburg Elec 7 1 Hanover City 15 '3 8 Syd A{’ 5! l iney 1 United &I Ber 75 /66 '56 xw 85 5 " W'z ~With warrsnts. xw—Without warrants. n-New. wi—When issued. sl e Nearly 3,000 motor cycles were im- ported into’ Japan last year. 2% 2% General Baking 24% Gen Baking pf (3) 51 Gen Capital Corp. 10% Gen E, Ltd rcts(50e) 95 Gen Mot pf new w.l.., Gen W W&E(A) (3), Glen Alden Coal 11% Globs Underwriters. ¥ Golden Center. . & Goldfield Consol 34 Goldman Sachi 2% Gold Seal Elec now. . 1% Goth Knitback Mach 20 Gram'ph'nerets3.91. 2204 Gr A &P T n-v (5) 115% Gr A &P Tea pf (7 90 Grief & Br ptX (7).. 27% Guenther Law (2. 131% Gulf Oll of Pa(1%). 11% Hecla Mining (1). 19% Houston O1t of Tex n ¥% Hudson Bay M&S.. 37w Hydro Elec See (2).. 10 Hygrade Food Prod. 22% Imp Oil, Can, n(50¢). 35 Ind 'Terr dllu U1l (A) 35 1nd Terr Lllu Ol (B) 17 Ind #in etfs(b10% ). 60 Indus Finev pf (7). 2 S4 Insull Ut IDVIDE% ). 0. No Am (13). ance Sect1.40). 2% Intercont Pow A 12). 4 Intercontinent Pet n 4% Int Holdg&lInv 10c.. 17% intl Petroleum (1).. 32% Intl Superpwr(31)... 6% Internatl Util (B)... 1% Internatl Utll (war). 40% interst Eqev pfi3)., 12 frving Air Ch(1.60). 6 Irving Air Chute war & 9% United Corp (war) Unitt bry Docks Utd Founders(bz.35) United Gas Co...... | 2 United Gax Co (new) United G Cnited Gas pt (7). Cnited Gas Corp ctts Utd L1 & Pwr At U1d Lt & Pwr pt(6 US Da.ry (B)... U S Flee Pwr iwar). 70 U 8 Finishing pf(7). 1008 U8 Kol (B) (1), ... U S&1ntl Sec 15t (5). U S Linesof (1).... U 8 & Overseas war. U 8 Radiator (2).... U S Radiator ctfs(2) U S Shares in 4 United Stores. Ut Verds kxt Utah Apex (50¢).... i Uty Pwr&Lial), ity & Ina Gtility Kaquitie racuum O1) (144 )., van Camp Packing. . van Camp Pke pf. .. Vick Financial Corp. 120 46% iy ot enSeunmxxhean ton Engine (4). . “Y"Oll & Gas. ... RIGHTS. Expire Cities Service. ...Juneé 16 Ciev K1 11} ..-lrun- s upont DeX .June — % 1% i Mo Kan Pi| June2s 42 1% l’\: :t /{:t vidend rates in doilars based on last quarterly or semi- men -dividend. YPartly extra. iPlus extra in st 1n cash of SLOCK. b Payabie in Stock. d Payable In Breferred Hiock 66% ™ " 31 1% 1 820 203 20 20% NEW YORK BANK STOCKS NEW YORK, May 21 (Special).—The brisk bidding in Corn Exchange stock, which followed a proposed inc: of r an e consequent offer of righi 15 aiacrive. o the s shares at $1i share to the extent of 231; pe. cent of present holdings, lifted tradi in bank stocks and trust sharei out ,t')% the lethargy that characterized it at the opening today. Over on the Produce Exchange Corn Exchange rights opened at 22 bid, 2¢ offergd, and subsequently in the over- the-counter market they were 241; to 26. as the oulstanding shares averaged & 7-point advance. Holders of record R June 12 have the privilege to subscribe 0 142,175 shares, and the balance of 2,825 shares will be auctioned publicly. Chase National at 168%z was off 13 National City, 197%, ff 1; Equitable, 133%, off %; Guaranty, 769, off 1; Bank of Americs, 134, up 32; Bankers, 163, off %; Bank of United States, 643, o:r ,; Chemical, 78%. up Y4} Continental, 36%, Up %: Manhai- tan, 135, off '3 ‘)unu!umrm. 13475, up 15: Publie, 141%2, up 'z The following were unchanged: Broskiyn Trust, 816; Central Hanover, 380 Chat- ham-Phenix, 138'2; Commercial, 523; Empire? 90; First National, 5.875; Irv- ing, 6015, and New York Trust, 295, INVESTMENT TRUSTS NEW YORK, May 21 .—Over-the- counter market: & Ly A “Big. Asked Aftisiatea Inv Inc.. Do. new unit; 0 Am, (ns Stocks 5 19% Brifish Type Invest new 4 181 Chain & Gen Eaqulties 6'2% pf. 80 Diversified Trustee Shares A Frid B. 31 28 35 3% 6 n: 105 Granger Trade... Incorp Eauities ... . Mohawk Invest com Power & Light Sec Trus Union Financial A.. Super Corp of Am Ti 193 “Gov. Young of the Federal Reserve | Board appeared to be in general agree- | * | ment with the comptroller. As to mul-| tiple banking, he said that there were | 24,645 banks and 3,547 branches, a total | 192 banking offices: 'that in this ,'6.353 offices were either branches or bank members of groups. or both, | leaving 21,839 banking institutions that | might be definitely termed independent | unit banks, having no branches and in no way connected with group affilia- | tions. He said all the banks had total | loans and investments of $58.500,000,000, | of which the group and branch systems | held $30,000,000,000, or more than half. | While he expressed himself as in favor | of ‘trade-area’ brahch banking, he was | opposed to Nation-wide branch banking | at present. However, he said that ul- timately if bankers became trained ‘and experienced in the larger technique of ‘trade-area’ would in time evolve Nation-wide branch banking under control of rela- tively few banks, but he did not believe this would mean monopoly or lack of competition. He favored branch over group banking, which, he said, how- ever, represented an economic develop- ment along ‘trade-area’ lines and would spread unless checked. He did not ad- vocate a check unless something else were substituted, and he thought ‘trade- area’ branch banking would serve this purpose. “The inquiry is now in the s gathering information as to the issues. Branch and unit bankers are now being heard. The indications are that the issue as to,branch banking will not be joined for some time., It ‘would, therefore, seem best to wait be- fore attempting to formulate anything in the name of the American Bankers' Association along the line of a broad policy. “It is the intention of the economic policy commission to continue to de- velop its own studies in these ques- tions, to ‘watch carefully every move that is made and every bit of informa- tion that may develop in this connec- tion and keep itself prepared to give the association an unbiased and ac- curate statement of the facts of the case whenever that is desired. “In the meantime we do not hesitate to venture the opinion that the asso- ciation in the not distant future will have to modify the position it has taken in the branch banking problem, al- though we do not believe that so-called “trade-area’ branch banking is likely to gain the support of any large percentage of the banking fraternity.” banking he thought it |} Electric Co., which was financed by the Chase National Bank and Blair & Co. (Copyright, 1930.) NEW YORK COTTON NEW YORK, May 21 (Special).— Strength in the old crop months served to offset in great measure ideal weath- |er in the cotton belt and prices held within a narrow range on the cotton market today. As trading in May will cease at noon Friday, demand for near months left May and July with an advance of about 5 points, as compared with a loss of an equal amount on distant deiiv- eries. Trading was light throughout. Spots were advanced 10 points to 16 50. Cotton range: . Close. 16.26 3 e CHICAGO, May 21 (#)—Despite transient setbacks owing to increased offerings from the Southwest at times, the wheat market here averaged higher today. Some of the buying that accom- panied advances in price was credited to the influence of traders who were active in expressing themselves as “bull- ish on the United States” and in con- |l tending that declines in commodity prices are unjustified by the actual| economic outlook. Taken as a whole, ' the sggregate of trading was light, and the market easily influenced. i Wheat closed firm, ¥4 to 7 cent a bushel higher than yesterday’s finish. Corn closed % off to 1 up, oats, 33 to | 14 advance, and provisions varying from 12 decline to a rise of 5. May (no trading uly ... Beptember December and nearby Maryland and Home Apartment MORTGAGE LOAN 1321 Connecticut Ave. 5% = Apply First Mortgage Loans On improved Real Estate in the District of Columbia Virginia for 3, 5 er 10 year terms on your RANpALL H. FIAGNER & COMPANY CORRESPONDENT NEW YORK LIFE INSURANCE COMPANY Decatur 3600 Organized 1879 JOHN JOY EDSON, President teereresenee..$5,723,083.61 S vest. uitable -operative Bldg. Assn 50th YEAR COMPLETED WALTER S. PRATT, Jr, Secretary Surplus & Profits......$1,755,911.57 Subscription for the 99th Issue of Stock Being Receiyed Save Systematically! ane, conservative in- ing eventually makes a nice little estate. Come in and let us explain! 915 F ST. N.W.