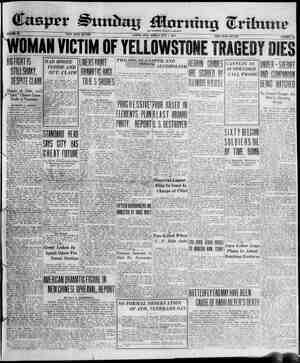

Evening Star Newspaper, July 1, 1923, Page 31

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

* FACEFOURISSUES| Read]ustment in Bulldmfl . Trades Overshadows Many |1zt 5 a1 . 274 Other uueshons. L 3188 31y 324 98% 141 5 2% AL a9 8 " MINE 'WAGES UNSETTLED o 19% 1201 Stagnant * Market f"" u“d A“t" 0% 1o May Curtail Output.of New. G 130" Machines, 5 three monthe the 421 carnival as! 1;:_’;: 58')4 Por more than beare have held high stocks have fled to new low levels for the year. Why have values dropped an average of eighteen polats In fourteen weeks? Is-trouble around the corner? Is Wall street gambling right on a day~ of industrial read- Justment soon to come? Ofclal Washington, or, rather; so much of it as remains here in the xweltering days of summer, has asked itself these questions lately with srowing concern. Until the past ten daye it has not glimpsed the future through the glasses of the Wall street | traders. Today it has such a glimpse. It sees no longer in declining values the work of professional traders put 1th practiced shears to fleece what- ever lambs might come into the mar- et. Instead, it seems possible that the decline may be based upon sub- | 52 stantial economic reasons. e Looking Ahead Eight Mong {1755 Wall street looks from six to elght | 108y ‘9 Tionths ahead and generally foretells | ggig the tides of prosperity by that mugln 1124% of time. " If there is any justifica- | p; Tion for belteving tyall atreet is right in Ita present bear state of mind, the | 3 country will know what the trouble | is_from three to five months hence | ~—long after the real leaders of the | 40% market will have got out. .The knowledge of coming events twhich determines the way of tas market ared by perhaps less than 100 | big fellows on the | inside of the indust: 1 and financlal circle that spells good times or_bad for the nation. The rest of Wall but follows these street doesn't know, leaders. And at this time, when the tide of prosperity is making a new high line on American shores, Wall street | may have sepsed four things whead that have signaled it to trim its salls. Government officials here are begin- ning to wonder ihether -the four take form about as follows: i Bullding Issue Looms Large. 1. Readjustment in the building | trades, lately grown to lead almost{ 21l other industries in magnitude of | operations. At the present rate, our building trades are operating on the | basis of approximately $50,000,000,000 & year. This Is more than double the normal volume of business. ~ 9 138% 12 % 20% fi?: 8% — 8 — 88 7 10 4 4 240 5 2 8 8 8 1 10 B 50e B 6 1% 7 4 10 , Atlantic 8 Jixpress. A&v:‘mflvnl Am Agricultire Am Agriculture Chem pt. Americip Beet sm American Boschl meto. American Can.. ... Anerican Can'pf, . American Car & Foundry. Chain class A American Chicle. . 2 Am Hide & Leather pt American Ice American Linseed. . TS Linseed p! Ametioar Locomotive Am Locomotive (new American Metal, . American Radlator. Anmterican Sipolting & Ref. Am Smeit & Refining pf. American Snuff. American Steel Foundr: Ametican Sugar Refining. A)n Sugar Refining pf Am Sumgtra Tobacco Am Telephone & Teleg. . American Tobaceo. Am Tobacen Class B Am Water Works & A W W & Elee par pt. Am W W & Elee 1st pf. Amer(®n Woolen. . Ameriesn Woolen pf. Am Writing Paper pf. American Zinc Lead & S... American3dinc L & Spf... Anaconda Copper. Ann Arbor pf. Arnold Constable & Co. Asso DFy Goods. Aseociated OIl. " 118% 111 13% I & W I pf Atlantic Refinin Atlas Tach. . Austin Nichols. . Auto Knit Hosier: Baldwin Locomotive: Raltimore & Ohfo. . Baltimore & Ohjo pf . Barnsdall, Class A, ...... Barnsdall, Class B, Beechnut Packing Bethlehem Steel. . Bethlehem Steel pf new. Bethichem Steel 8% pf. British Empire Steel 2d pt. Brooklyn Edison Electric. Brooklyn Unlon Gas...... Brown Shoe. ..... Burns Bros. . Burns Bros Class B. . Butte Copper & Zinc. Butte & Superiof. Butterick Company’ California Packing. California Petroim (; Californta Petroleum pf. . Callahan Zinc & Lead Calumet & Arizéna. Canadian Paelfic. . Central Leather Co. 4. 30% 82% 20% lfll‘i 13“ 168% 1581 2% 208 58% 53 965 92 138 130 5 3z 1 101 100h 20% ", 1590 110w 1 140% 144 140% ST 84 102 90 1313 1% 5435 135 1% 41% 42 L T T 7 A T I O ) L R Y s T 5 B 1 TSRS 8 IR S 18 0 NS LR 5 A | 513 1013 46 1833 42% 9% 46t 728 20 21% 117% 24% 484 815 1688, 116 6 24% 48 2 1 stern ll% E:. = ..w:n pf ctts. W 1% 2 l’.n Rubber& Tire: 3 815 LehighValley ml Lounnu % orvnml uB fscutt... 'wnnc:rrheh 5t Pl. .. 2 7 Mack Trucl pf. 57% —— Macy. (R H) & Company 268 —— Msgma Copper... 21" —— MNallinson & Co. 43% — Manati Sugar. 42 4 Manhattan Ele: 38}, —— Manhattan Ell\'ltfld. ig“ 240 Manhattan Blavt!ed 3 1 6 iarketSt Railway prpf.. 4 Marland 01l & Refining. . . 3 M;r}‘l‘ml’nrr) Maxwejl Motor, Class 4. Maxwell Motor, Class B May Department Stores MeXican Beaboard Mexican Seaboard ctfs. Miami Copper. Middle States Oil, Minnespolis'® St Lne: Mo Kan & Texas new. ot 1o OF - S [ Nuttong] Biscuft National Cloak & Suit. Nat Department Stor 6 Nat Enamel & Stampg. ... Natlonal Lead. . Nevada Con Copper, New Orleans, Tex & Me: Neéw Ya! Afr Brake. X:' Y Air Brake class A 8 ll o 84 26% 14! New York Ontario & W lol‘fi Norfolk &Western. 4 North Americat North American pf. Northern Pacific Nova Scotia S & Pan-Am P Trans Class B.. Penna Coal & Coke. .. Pennsylvania Rallroa: — Penn Seaboard Steel Peopls as, Chjcag Pere Marquette. Philadelphia Comipany. Philip Morris & Co. Phillips Petroleum....... Phoenix Hostery .. {08 L N 5 PELLET e f*;?”““ & 5332382 @ ! i l volnld\ mm mn Argehtine 78 1927 103% 93 Belgium 7%s 1943 98% 931 Belglum 6s.1925. 1083 91° Belglum ts P Bordeaux -6s i Brazil 53 1941. % Canada iw 1926 Canada §%s 19 Cavada l- Jll. Chile Chils 8s nze Chile 85 1941 Chinese Govt Ry 5s 1951. openfiagen 53t 1944 echoslovakis 33'1951. nmari $a 1945 Denmarlc 6e 1942 Duteh Fast Indies Gs 1947. Dutch’ East Indies Gs 1962. Framerican Ind Dev Tifs 1942 French Govt 8s 1943 ¥rench Govt T%s 1941. Holland-American 3 £ 8s 1947. 3 Japa: Japaneso 451931.... o Lyons 6s 1834. JMarseilles 6s 1 10 80% 969 wo-xx 10044 10050 98 97-24 B'I-l! 19 . Low, 80%% 96% 101% 1 100% 06% 100 9% : z! e ] mo's i | lD 7% 00‘. 100'2100W 01% 101% ! 102‘1‘) ’u!. 95%% 90% 9% 9% . 100%: . 110% Queensiand 7Ts 1841, Queensland Gs 1847, Rio de Janeiro 3s 194C. Sao Paitlo, State of, 65 1936, . Seine, Dept of, 7s. 7. : Sweden 651989 Swiss Confed s t 88 United Kingdom 81;s ,,-, 102% United Kingdom 6ibs DUSTRIAL o Amer Agri Chemical T3%s 1941 86% Anver qmel\ & Ref 1st b= 1947. mo», Amer Sugar Refining 6s 183 s Amer Tel & Tel cl tr 03 1946 Amer Tel'& Tel cl-tr 4= 1926 Armour & Co 435 1939 Atlantic Refining deb 65 19, 5% Bell Te] (Pa) ref s 1848..... Eethleffern Steel p m 53 1936 Bethlehem Steel = £ 65 1948 Brooklyn Edison 7s D 1940 Cegtral Leather 58 1 Cerro de Pasco 851831 hile Copper 68 1962 ‘one Coal (Md) 1st ref % Cuba Cane Sug ov deb 8 wu: Du Pont de Nem 7%s 193 Duquesne Light 7i&s 1926. Empire Fuel & Gas Ths 19. General Blectric deb bg 1952 Goodrich (B F) 6148 194 14 Goodyear Tire 8s 1931 4 Goodyear Tire 85 1941 Humble Ol & Ref & Indiana Steel §s 1952 % Inter Mar Marine 6s 1941. 4 Inter Paper 65 B 1947 2 Telly-Springfield §s 1931, Lackawanna Steel 58 1950. ; Liggett & Myers 0s 1951. Manati Sugar 8 f 738 1942 Atiavale Steel os 1936. New York Edison 1st 634 New York Tel 6a 1941 Pacific Gas & Elec 55 1942 offic Tel & Tel s 1952. . 2; Philadelphia Co ref 6s 194 4 Public-Service o5 n..fl Stinclair Ofl 7s 1837 b ! AND )ll!rzu ANEOT 76% 107% 101 9 8678 . 105% . 115 113% 90 101% 96% os 83 9674 8815 99 107% . 985, 106%% 918 1002, . 100% . 1024 1L 104% 93 101 102% 100% 110% 1761 106% 101 87 105% 115% 113% s 103% 901 901 102 8854 98% 109 98% % 107% e, 100% 100%; 102% 105% 931¢ 101! 98¢ 100 1003 1 ll“a | 9"» | sfi;l 928, 2% 80% 823 7i 9% i 54% ! 341 100% ! ok | % | 93% q . BREAK N STOOKS 1| PARTLY EXPLANED New Securities, Ford Boom ~and Railroad. Fears-Are Among Bear Factors. WAGES ALSO ALArimuG., Grerht and General Business De~ clared Sound—Merchants Are Not Overstocked. BY GEORGE P. HUGHES. Special Dispateh to'The Star. ORK, June 20.—The week in - Wall streef has been one of alternate fear and hope. bat mostly fear. This {15 2 normal condition of a speculative jmarket. This week, however, the al- ternations in mood have been more rapld and violent than in monthse The immediate cause of ,the dire jforeboding was the spectaclé of sharply declining prices afforded by the stoclk market on Wednesday and the first half of Thursday. The specu- - lative community was greatly im- jpressed by the fact that the “aver- | ages” had broken through the pre- vious low established last November It Immediately began to look about or the cause and, more important still, to attempt to make up its mind what it was that the market was now - discounting.” Now as to these latter matters there 'was; no universally accepted opinion. All sorts® of cxplanations Wwere offered and none of them wgs™ entirely convincing. Factors ing Decline. A great deal of attention was paid ! to the advice given to its clients by a well known statistical service tu the effect- that the market was i for at least a year of declining prices. + j The fact that this same professional adviser considerably opinfon later in alter the effect. Then, 100, the views of a certain professional speculator whose mas- ket “experiences have been the puhr modified - his the week did noir 4 {Jeet of constderable literary embei- lishment. which views werée sald to Le very pessimistic as to thé future , | Of Security prices, #dded to the gloom., eeriousl { outpouring of new 86 963 | 1085, 96% | { manship. i It may ‘serve a useful purpose to { set down some obstacles to continued | prosperity which were. more. or lesx discussed while prices werc. nost rapidly. One of real one (o the Wall found in the vast securities, man; of which are still undigested. These securities cover a wide range. as to quality from bonds of real in- vestment rmerit to common Stocks of nly” speculative value. Bond dealers and traders were especially bitter over modern methods of bond sales- Methods Called Mistake. The conservative view is that iy is a mistake to apply the same methoy to the distrfbution of investmel o8, | £ecurities that are used in the sale of automoblies. In the rush to marke ew - offerings, seasoned securities ve been neglected. Sometimes, too. the - offering price has been a bove the market, in which case, of 101% | course, the syndicate was the princi- Wages are at the highest peak ! those trades have ever Lnown and the trend is still higher. The back- wash already has set in, according 1o reports gathered by government | and private Investigators, in post- —— Central Leather Copt #12 Central Rallroad of N J Century Ribbon ‘Mills Cerro de Pasco Copper. Chandler Motor. . Chesapeake & Ohlo. Plerce-Arrow. Plerce-Arrow pf. Pierce-Arrow prior pf.. Plerce Of1 Pitteburgh Coal. South Porto Rica Sugar = 1194\ penement of ambitious projects and in a growing rebellion on the part of the home builder. Prices are re- garded generally as too Rhigh, even Dy_the highest men In the industry. The possibility of a buyers' strike, now thet- the country {s catching up Wwith its most urgent buflding re- quirements, looms up as a factor that may exert its tremendous effect upon the nation's prosperity with the coming of fall. i Shippers Complain Over Rates. c.. Readjustment of freight rates. At the ‘present time when nearly everything else in the country's work-a-day 1life has accomplished much of its post-war price deflation, railroad Tates stand generally at 90 per cent of their highest levels. Shippers of all classes of commodities ipe complaining, with the €armers in the van. At tho same time the transporta- | tion system of the country, as a whole, Is earning money at a rate fixed by the Interstate Commerce Commission as a fair return. The commission is undertaking a survey of conditions as a preliminary . to making up ity mind about reopening the question of freight rates. Ap- parently Wall street belle: that the question will be reopened and that there is prospect ahead for a period of uncertainty with respect to this subject, even.if the present rates are upheld. A well founded bellef by market leaders that freight rates probably would be reduced in the fall un. | doubtedly would drive rall stocks|jgy” down, in price, and they might carry g, the rest of the market with them. 4 Mine Wage Comtreversy. | 3. Readjustment of wages In the‘ 0oal industry. There has been no such readjustment since 1920; anthra- } cite and bituminous miners are earn- | ing today the highest rates of pay cver enjoyed. Notwithstanding, there {s talk of a demand for higher wages on the part of the anthracite workers, and another major indus- trial conflict looms us an unsettling tactor. There is little doubt that the present state of the Wall straet markets reflects this fear to some extent. 218 4. Possible readjustment of the au- | 108% tomoblle industry. Production dur- | 193 ing the current year has been at|._— breakneck speed. 1If the rate set thus far is a fair index, the country Wil produce more than’ 3,000,000 au- l tomobiles this year. Used Car Market Stagmant. Meantime the market for used cars ig as siagnant as the market for new cars is active. The condition i3 re- sarded as decidedly unhealthful, and mafly observers fear a sharp curtail- meno operations when the present 100 seasonal demand is over next fall.. . These are the prime fears of Wall Street, as oficials here are glimpsing them. No-attempt 1! made as yet to | say whether any or'all of these fear are justified. They may be appari- tons or they inay bo real; omelals here don't know. But officlals are studying the sftua- tion in each of these four fields and some minor ones with lncreksln' at- tenton, (Cooyright, 1923.) COTTON PRICES DECLIN‘E‘ Crop “Figures Fail to Arouse' Sat- urday Market. NEW YORK, June 30.—~Further pri- vate crop figures falled to inspire any additional interest In the cotton mar- : 25. 12 ket today and trading was generally | —— —— quiet. The bulk of the business {n | &6 . 91 evidence was.attributed to e ng- 17% up of accounts for over the week end % and in preparation for tl govern- ment's crop report on l(on?ly ‘This included scattering Hguidation; which sent the price of October eonu‘uu oft to.24.55, and that month closed at 24.76, with the general market closi| steady at net.declimes of 11 ‘to 21 points. NEW ORLEANS, June ‘30:—Cotton mture- closed steady at net declines of % 30 points. Close: -July a7 “137 *October)-23.98223.91; De- mbfl' 25.47a28.48; .'h.nu-;'y $3.388 : March, 23.31423.25: apot_quiet, | ggy B pamteowers ‘middling; s ———— n the Jamps of the vestal thought to have been the miperal ot orecy Taen B every e mf’"fivmad Blaes. . 27% 12% N% 613 21% 19% 274 10%- 116% 97% T 443 3 21 83 94% ;s Chesapeake & Ohlo pf [ 4 1 7 1 8 4 6 6 % 4% 5 87% 8 34 7 87% 43 64y 6 +10 e 50% 6 443 — H’K BSKZ s“_—_ 4% — Chicago & East Illinois. .. Chi & East Ilinots pf. .... Chicago & Great Western. Chicago & Gt Western pf. . Chi, Milwaukee & St Paul. Chi, Milwaukee & St P pf.. Chicago & Northwestern. . Chicage Pneumatic Tool.. Colorado Southern. Columbia Gas & Elec Columbia Gas (new) Columbia Carbon. Consolldated Cigar. Consoljdated Gaa new Consolidated Textlle. . Continental Can. Continental Motorg. Corn Products Ref. ... Cosden Company . Crucible Steel. .. 2 Cuban-American Sugar. Cuban-American Sugarpf. Cuba Cane Sugar. Cuba Cane Sugar pf Cuyamel Fruit. Davison Chemic: Detroit Edison Dome Mines. Du Pont de Nemours Du Pont de Nem 6% déb Eastman Kodak. Erie Rallrpad. Erie Railroad 1s Trie Ratlroad 24 pr. Famous PlayersiLaskey. . Famous Phy-l—nloy pt.. Federal Mfn & Smelt Fifth Avenué Buj Tisher Body. er Body Ohto.p. Rubbers ...... Flelishmann Company. Foundation Company. Fr Texas. Seneral American; Tank. .. General Asphal General Aiph-n L. ‘General Cigar. Goodyear T & R 3% pt. . Granby Consolidated. I Great Northern Qre gtfs. Greene' mnu Cépbam Guantanamo 8t Quiz, Mobile & &) Ste Ty 1161 11134 1 00% 05" 1301 1ot 37% 3341 3 119% 106 84 8 1047 1014 87% 53% 83 80% 81 usu 171% rn 12% 81% sm 26 BEhg & eEgg b sZgyingepanenzyagy b b b B b4 [T RN LR TR e N TR o T 2 P P W R [ER NN 7% 1u s3¥sangenss 58 S Pittsburgh & W Vnrlinl: Postum Cereal Pressad Steel Car. Producers & Reflners. Public Service new. Rallway D! ~— Rapid Transit w i. 2% —— Rapid Traneit ptw | !l‘!u Gonsolidited aner. ead! Reynolds Tobacco, B, Royal P N reshs. St Louis-San Francisco. S Louis-San Frad pf. Louls Southwestern. g:lalli! Southwestern Shattuck Arizona. = 92%cShall Trad & ’rrannert . " 1 Slsell Unipn OIl. ol Stramons Co.. ~— Simms Petroleum. 2 Sinclair Con Ofl. —— ‘Slasa-hefficld 5ti & Tran. 6 Southern Pacific uth Porto Rice Sugar. 24! outiiern Rajlwas 63% 5 Southern Rallway pt. 12 — Spicer Manufacturing 49% 2 Standard Oll of Californi Standard Oll of NoJ. ... el Standard Ol of N J pf. 85 Steel & Tube pf. .. 81 ' +4% Sterling Product: 15% 8% Stewart Warner Speed. 7 Stromberg Carb bm: 24 — supcrlor med. 8 1 Tennessee Cop & Chem.. 413% 3 TexasCompany.. Go¥% 6 Texas Gulf Sulphur 18 —— Texas & Pactfic. . sal — Tide Water Oil. 33% 3 Timken Roller Bear 47% —— Tobacco Products. 7% 7 Toheacco ProdncucuuA. 50 4 Toledo StL & Westn pf ctfs 5 - Transcontinentsl Ofi.. 68. 4 TwinCity Rapig 7 136 10 ‘Underwood Ty ted Railway Jnvest 26% —— United Rwy Invest pf. 64% 380 United RetailStores. 8 Hoffman Machfe. u.slnaunm;l Alcpho Cl\- 8 United StatesR 7. UBR&ImppL.. §epgiianiaey VLR (EERER N AR IR N NN NN Va-Carolina Chenrs £ 7s 1947... ¥ 746 '37 war. Western Union Tel 6348 1936 Wilson'& Co dst 63 2941 Wilson & Co cv t%! 1981. AILROA! 4 Atchison ‘en 8 2995 “Atlantic Coast Line lst s 19, Balto & Ohlo pr In 8148 192 Balto & Ohlo gold 4s 1945. Balto+& Ohlo 6s 1829.. Balto & Ohlo cv 4148 1933, Balto & Ohio zef Gs 199; B&OPItsLE & W Va B &.0 Southwn dlv 333s 18: Brooklyn Rap Tran 7s 1921 Canadian Northern 6%:s 194 Canadian Pactfic deb 4s Central Pacific 4s 1949 Chesapeake & Ohfo cv CHesapeaks & Ohjo cv 432 1950. Chesapeake & Ohlo gn 43s 1992 Chicagb & Alton 3s 194 2 Chicago & Alton 33:s 1930. Ch1B & Quincy 1st ref 5s 19 Chi & Eastern 1l gen 58 1951. 2 Chi Great Western 4s 1959 Chi Bf & St Paul ref 4%s 2014, 5 Chi M & St Paul ov be 2014 Chi M & St Paul cv 4 Chi M & St Paul'gen 418 1959 4 Chicago Rallways b5 192 Chi R T & Pacific ref 4s 1931 Chi Union Station 414s 1984, Chi & Western Ind con 48 19 C CC &St Lref 63 A 1929, 4 Cleveland Term 63%s 1972, Colorado & Southern 4328 1935.. Cuba R R bs 1952. Delaware & Hudxo! + Den & Rio Grande con 4= 1936 Great Northern gen 7s 1936. Great Northern gen 548 1952. .. Hudson & Manhattan ret 5s 1957 Hudson & Manhattan adj.6s 1951 IMinols Central 5%s 1934 Inter. Rapld Transit 53 1966. Inter Rapid Transit cv 7s 1932. 35% Inter & Great Nor adj 6s 1952 i *78% Kan C Ft'Scott & M 4s 1936, . 65 Kansas City Southern 3s 1950. i ss Kansas City Southern s 195 % Lake Shore 4s, 1928 v 0% Lake Shore 45 193 100% Lehigh Valley 6s_1928. 874 Louls & Nash unified 4s 19: . ~ Laufs & Nash'lst ref 5%s 200%. 91" Market St Ry.con s 1924. . 9% 81% Mil Elec Ry & Lt 1st ref bs 101% stpbssufl-llsu 4 72% Mo Kan & Tex 1st 45 1990 5 74% Mo Kan & Tex pr In s A 1962.. 45% Mo Kan & Tex adi 55 1067. ... 90% Missouri Pacific 65 1949. 51% Missouri Pacific gen 4s 1 76 N'O Tex & Mex inc 5s.1985. 2 101% New York Central deb 65 1935 ‘(:v York:Cent deb 4s 1934.... 8% 68 N Y‘lnfitl"{acvdel‘y;-}u:. . N Y: West oston 43%s . “M ’“ Vorfolk & :’nnem con ':-‘nn.. Norfolk & Western cv “"‘ wm o:herh Pacific:2s 1947. 81 slu Northern Pacific 4s 1987, 108% 108%-Northern Pacific ref imp 6s 2047 100 © 2% Northern Pacific ret |mn §8 2047 104% 99% Ore Short Line atd bs 1 90% Ore Bhort Line r:t LR 97. . ‘Western :lt is'184s.] Ase - R&Gds llli 'prln 4s A 1.50 # sseyeeeten qppeseregeeeg i gierenaly S -3¢ Ss3dsspyagesesy #8255 ; FEREIRGRES 35 - + snszege Eeage FHI S? ! 112% 108% 9 . 103 4% 6% 52%" 98% Sol‘A 112% 1081 9 109‘/1 ts.w 86 85% 49 1084 112 107% 98% "1% 100% 59 108% 2% TA% 495 80% 51% 75 m 104;. 108% 92% New York Cent ref imp 5a 2018. 85% | 801 ! 62 | 109 96 ! 95% | ssuI 95% | 7 | wotm 89! 1125 781 8 | 87 86% | 834 | 52% | i ame 48 it T, 631 | 68 810 T4 764 | 883 i 711! 100% ! 0 over i gives pal sufferer. It ia an open secret-in investmen: - clicles that g certain foreign govorn ment issue, fot a recent offering, was hrought out so far above the market that it 48 still undistributed.-+All this | ties up a lot of money and so has a very marked effect on pricas. Wall street also is greatly” disturbed the political - outlook.+ has * noted with interest the prominence of Henry Ford in the poll takén by well known weekly of the presidential @ references of .its readers. Ford Boom Causes Worry. Now Wall street respects .Heni: | Ford, but does not lpve him. While it dqes not belleve Eat he will be jelther nominated or elected President, it is impressed with .the testimony that this favor shown to. Mr. Ford a feeling of unrest almost country-wide, an unrest which. might asily be translated into radical action in the next.Congress. Report: from the middle west agricultural wection are especially disturbine. t may well have been the fear that the Femer would domand. and. ohtat a reduction in railway rates that led to the selling of railroad stocks this week. It is not intended here.io say that this concern js justified. .There is no doubt, however, that ‘it exists. The labor situation also is nat pleasing to those who are accustomed to buy stoeks with the idea of sell- ing them to somteone else, later on a higher price. There is too much Talsing of Wages and too much talk of more raising of wages. little the railroads arc ssary to increase the compensation of their _employes The case of the bricklayers, is notor- ous. Now there is added worry over a_ possible anthracite ccal strike | Here and there, there is an optimist 10 59 8 36% 74% | 65% | “E i 104 ! 215 | B86%s | 95% B9 39% | 874 urn.' | 105‘% | 95% | 3{ment _of & new low record by 80%[ | ! { 7% | 91 1% that points out that high wages in- crease the purchasing power of the Wage earner. but for the most pa the Wall street view is that increas- jed wages mean decreased profits to the_eorporations, the stock of Which | is dealt in on the exchanges. Bright Side of Picture. Now _for the other side. No one pretends ghat there is any credit rain . or -likely to be one. No one serts that there are any unduly swollen ipventories. No one claims that merchents are overstocked with geods. And the Federal Reserve Board, hien ought to Kknow, says that the’ general business and finan- clal conditlon is entirely sound and that prosperity is distinctly threatened.with collapse. Tirobably nine-tenths of the coun- try's business men _agree with the Federal -Reserve Board, provided they are not under the spell, as are Wall _street speculators, of the little machiné that prints prices in stocks and bonds. » (Copyrizht, 1923.) STEEL AT NEW LOW. Common Drops to 895-8 Durin: Brief faturday Session. NEW YORE, June 30.Prices of 4 large number’ of standard industriul and raflroad stocks dropped to new low levels for the vear in today's brief but active session of the stock market. One of the most interesting devel opments of the day was the enlbllls’h he United States Steel common at $9% Several previous attempts had been made to breal Steel through 0 but without’ success until today. The stock rallied later to 90, where good support has been offered on all pre- vious occasions. Several railroad shares’ also estab- lished new minimum priees, includ- ing Pennsylvanis, Lehigh Valley, New , Haven and Ann Arbor preferred. Ca~ nadian Pacific broke more than foul not fluctuating % 5.’1"" to 143% and Southern Pacific timore and Ohio, Chesapedke and hio, St. Paul, common and preferred, ?nd Unlon Pacific registered net losses of one point or more. i ———— WEEKLY BANK-REPORT. NEW YORK, June 30.—The weck- Iy clearing house statement showed increases of $114,070,000 in loan. glscounts and invextmonte: 31317000 cash in own Vo $13,128,006. lhe reserve of. mlmb-r mku in uw federal reserve \Ank lnd llb 454,000 in net demand di Time de- Vosits decrearsd by 358,000, Asare to reserve . .totaled ' $§524,605,000 fe-'Mn cYCass romvo of §13, ”5‘1"0 an increase of §¢846.170 overa w. ago: