The Nonpartisan Leader Newspaper, October 17, 1921, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

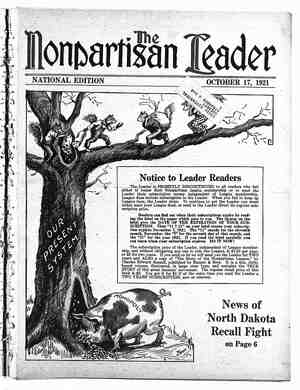

Causes of Monopolies Are Explained A Further Discussion of the Tax Question by Author of the Exposure - of Federal Reserve System—Sixth and Last Article - BY JOHN LORD John Lord is the pen name of a student of financial, political and economic questions, who until recently was financial editor of a large eastern daily paper. . N MY last article I dealt with the sub- ject of the high cost of living and the part which rent plays in adding to costs. My subject this week is monop- olies and trusts. When an industry reaches the stage of monopoly, it is able to do two things: 1. Restrict production to the point of demand for the product. 2, It is able to fix prices and it does fix prices, recognizing only one law—what the traffic will bear. For example, take the railroads. The railroad system is now a monopoly made so by the govern- ment. There is no competition between 'railroads in rates. Prices on passengers and freight are fixed by a governmental bureau, the interstate commerce commission. Another governmental bureau regu- lates the price of labor. Railroad ratés have been increased to such an extent that traffic has been de- stroyed where long hauls are involved. This is now recognized and steps are being taken to reduce rates on some things so that trade in those articles between the states will be revived. Monopolies ark governed by the same rule. Prices could be made so high by the monopolies, especially when protected by tariff laws, that trade would re- cede or stop. Monopolies, therefore, seek to fix a price. which will exactly empty the pockets of the people. It is, therefore, not kindness or generosity which restrains a monopoly from boosting its prices to the sky, but a careful estimate of how much may be gouged out of the people without stopping busi- ness. I need to make no further argument along this line. MONOPOLIES DO ROB THE PEOPLE. They do charge more for goods than would be charged under conditions where fair and unrestrict- ed competition exists. How may we deal with this system of monopoly ? Congress has been legislating against trusts and monopolies for 30 years. Has a single monopoly been legislated out of existence? NOT ONE. Anti- trust laws are not worth the paper on which the statutes are printed. But congress pos- sesses the power to break the back of every monopoly speedily and effective- ly. This power is the power to tax. A great English economist once said: “The power to tax is the power to destroy.” POWER TO TAX ALSO IS POWER TO CREATE The power to tax is also the power to create. About 1870 congress creat- ed a great monopoly by using the tax- ing power. This was the act creating the national banks whereby these banks were given the privilege of is- suing paper money. As a matter of fact, the federal reserve system, which is a bigger monopoly, grew out of the national banking aect which was adopted about 50 years ago. Prior to the adoption of the national banking act, state banks were empowered by the states to issue money and they did issue paper money of all kinds and de- scriptions, much of it worthless. In order to get rid of this nuisance, con- gress had resort to its power to tax. Congress levied a tax of 10 per cent on the issue of state bank currency. After the adoption of this law, not a single dollar of state bank currency has béen issued. Congress thus abol- ished a nuisance by use of the taxing power and by the same means created a monopoly. But how shall we tax mohopolies in order to abolish them? Shall we tax - the plants of the trusts, their machin- ery, capital, etc? No. Congress could not discriminate by means of .a tax be- tween monopolies and independent enterprises—a tax that would so dis- criminate would be called “discrimi- natory” by the courts, and set aside. But congress may tax land values, and by taxing land values, every trust would soon be broken and competition restored. On what does a monopoly rest? Does it rest on capital, on machinery, on labor? No, capital, ma- chinery and labor may not &e monopolized—each _and all of these factors may be duplicated or re- produced. . But there is one thing which may not be dupli- cated or reproduced. This one thing is land. The supply of land is always the same. And all monop- olies exist as such because they own land—land which is used and much more land which is held: out of use. : The steel trust is the steel trust because it holds title to most of the valuable land containing iron ore. The steel trust has ore reserves far beyond its capacity to use. The steel trust is not using these ore reserves and it won’t permit anybody else to use them. ; The anthracite coal trust is a trust because it holds title to vast areas of coal land, only a part of which are used. Just the other day the Anthra- cite Coal company of Pennsylvania advanced the price of coal at the mines 10 cents a ton. In the same column of the same paper which reported this advance, was another item of financial news, stat- ing that the Cambria Steel company had reduced the price of labor to 30 cents per hour. The monop- olized industry puts up its price. Labor which is not a monopoly had its price reduced and on the same day. The timber trust is the timber trust because it * holds title to practically all the land containing timber, only a part of which timber land is used. And so with all the trusts. The basis of every trust is found in land monopoly. . Destroy land monopoly and the trust will go 'at once. How may we destroy land monopoly? We may destroy land monopoly easily and quickly by taxation. Tax, not land, but the value of land, the value of all land whether used or unused. Tax it hard enough and no one will hold land in excess of what may be profitably used. TaX land values high enough and the coal trust will let go of all its coal l : CAN IT PULL HIM OUT? l w © . . PAGE BIGHT _head tax (poll tax). —Drawn ;'xhressly.for:t_l@ Leader by W. C. Morris. reserves, except that part needed for a reasonable number of years. When the coal trust lets go of its extra holdings of coal lands, other organizations of capital will enter the field of coal production and thus re-establish competition. The great trusts and ‘monopolies are able to hold land out of use because their land is not taxed on its real value. The An thracite Coal company, for example, pays no fed- eral taxes on its land values. This trust pays a very nominal tax to the state of Pennsylvania. The coal land is taxed on the same basis as farm land, that -is to say, only the surface of the ground is staken into consideration and no attention paid to the coal in the ground. Being thus aided by the gov- ernment, the Anthracite Coal’ company may and does hold out of use vast bodies of coal land while charging exorbitant prices for the coal which it mines. HOW FARMERS WOULD BENEFIT BY CURBING THE MONOPOLIES I repeat that every trust is a trust because the foundation of a“trust lies in the holding of land, both in use and out of use. The holding of this land out of use is fostered by the government through its neglect to tax land values. Business is taxed, buildings are taxed, incomes are taxed, but land values are not taxed. The gov- ernment taxes us on what we eat, drink and' wear. We are taxed on the things we make and the things we use. We are taxed in some states even on dish- Jpans and washboards. In other statées we have a Governments tax everything that is loose—everything that man creates by his industry and energy. But for some strange reason the federal government does not tax land values, and practically speaking, neither do the states. Every foolish assessor deals generously with an idle lot or an idle piece of land on the theory that ‘the idle land or the idle lot does not earn anything, and therefore should not be taxed. Now, the fact that the idle land or the idle lot does not earn any- thing is one of the precise reasons why the idle land or the idle lot should be taxed. Tax the value of the idle lot or the idle land hard enough and the idle land or the idle lot will get busy. Of course if neither has any value, then there is nothing to tax because it the. land value. By neglecting to tax "land values, the federal government and the states are directly aiding and promoting the development of a land- lord class. These governments are di- olies and trusts. - 3 2 Do you wonder why land values go up or stay up while other values come down? Do you wonder why 97 per. live in houses which they do not own? Why nearly half the farmers in the United States are tenants? Why the trusts and monopolies * are slowly crowding out competition? Why 65,- 000,000 of our people are rack-rented every year? Why about 60 per cent of all new wealth goes to owners of land values, while only about 30 per " cent goes to the account of wages and 10 per cent to capital account? You find the reason in the fact that we tax the products of labor and we tax the products of capital, but we wholly neglect and absolutely refuse to tax land values. B Farmers probably have more to gain from taxation of land values than " any other class; and when they finally come to see this fact, a new era will begin. Real estate boards and monop- olists, the only people who will ‘lose: by land ‘value taxation, always seek to scare the farmers about land value taxation. The monopolists- hire lick- spittle editors of farm papers to tell == their readers that a tax on land values =G ored - means that the farmers would have to pay all the taxes. The facts are, that a tax-on land values would fall rectly aiding in the creation of monop- - cent of the people of New York City” is mever land that should be taxed, but