The Nonpartisan Leader Newspaper, October 17, 1921, Page 7

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

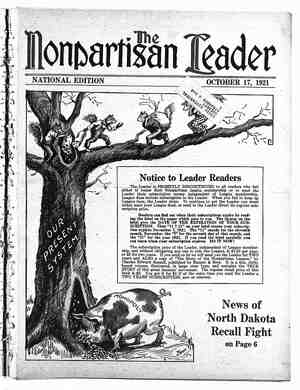

.Bank of North Dakota, every -one of his banks would be closed today, and he would be a ruined © man, The I. V. A. has been assailing the Bank of North Dakota because of the “unsafe” ratio of its loans compared with its resources. Disregarding entirely the fact that the Bank of North Dakota has behind it all the resources of the state, and considering only its $2,000,000 capital, its liabili- ties are four times that capital. On the other hand, the Merchants’ National bank of Fargo has liabili- ties 20 times as great as its capital stock, and the First National bank 16 times. The bank issue isn’t working out very happily for the I. V. A. The I. V. A. has initiated seven measures, the net effect of which will be to delay and hamper the in- dustrial program. Two of these measures, they pretend, will enable them to complete and operate the Grand Forks mill and elevator, for even the I. V. A: doesn’t dare openly oppose that project. But Datus C. Smith, a prominent farmer, a_con- servative in polities, has closely analyzed the 1. V. . # \ A. measures and makes the definite charge that they are so drawn as probably to make impossible the completion by the state of the mill and elevator, and in any event to make impossible their opera- tion by the state. And there has been no refuta- tion by the I. V. A. of Mr. Smith’s specific charges. It is claimed, on the other hand, that prominent I. V. A.s have entered into an agreement with the grain trade in the Twin Cities to sell or lease the mill and elevator. The I. V. A. measures confer specific authority on the industrial commission to do this. The I. V. A. has stirred up a hornet’s nest among some of its own members by submitting two elec- tion laws, the effect of which would be to prevent party tickets in state gnd county elections, and to change the date of congressional primaries te the third Tuesday in March. Old line politicians of both national parties are opposed to the non-party election law, and the March primary law is a direct slap at the farmers, since the worst blizzard in the history of the state occurred in March, 1920, and it is openly charged that the reason for the changing . of the congressional primary to March is to dis- franchise the farmers. It is not so much around the officials whose recall is sought, therefore, that the fight in North Dakota rages, as about these initiated measures. There are many who believe the I. V. A, has all along felt it hopeless to recall the League officials, and that their only purpose in holding the election was to secure the adoption of some one or two or three of their initiated measures. The I. V. A. had some success in the last election with initiated measures, and hopes to repeat on October 28. But one of the initiated measures adopted last year has been the cause of great damage to the Bank of North Da- kota, and thereby. to all private banks in the small towns, and there is evidence that farmers have considerably more suspicion of pretended ‘“helpful” legislation than last year. The Nonpartisan league is devoting most of its attention to a campaign to get voters to “vote no on all initiated measures.” It is these initiated measures that are the real bone of contention. The Infamy of the Federal Reserve Act - Lindbergh, Who Fought This Wall Street Measure While He Wasa Congress- : man, Tells Readers of the Leader About Passage of the Bill BY CHARLES A. LINDBERGH Mr. Lindbergh was a member of congress for Minnesota at the time the federal reserve a¢ct was adop For this reason his comment on thé John Lord articles in the Leader is of great value. Mr. Lindbergh was the candidate of the farmers for governor in Minnesota in 1918. He lives at Little Falls. HE articles in the Leader by John Lord on the federal reserve system must impress readers at a time when they know that the people and the gov- of dollars by virtue of the federal re- serve act. What else could be expected, when con- gress, almost unanimously, voted to turn over to a group of big financiers the money and credit of the country— to the same group which had just be- fore been proven in congress to be financial pirates? * 2 The important parts of the federal reserve act were framed by that group of financial pirates in 1906. Paul M. ° Warburg, a member of the first fed- eral reserve board, so testified in 1914 on the hearing in the senate for the confirmation of his appointment. Af- ‘ter Wall street approved the bill, it put on the 1907 panic, ‘to make the people sick of the old banking system, which was also a Wall street system, ~ but not so much in Wall street’s favor as the new system now is. Next, but under cover, Wall street started the so-called “citizen’s leagues,” with units in all states, to have the people demand financial legislation. Wall street, always adroit, was particular - that the demand should be for “some” bill, leaving it to congress to say what. People from 2ll states innocently peti- tioned congress to pass “some” bill, without naming what. . Wall street was “Johnny-on-the- spot,” with its bill drafted in 1906, and congress incorporated its impor- tant features in the new law. g Don’t cuss Wall street! The people know Wall street to be for Wall street only, so why should it have been left to Wall street to frame the bill? WAS ON COMMITTEE WHICH HANDLED BILL The law shows on its face that it is a Wall street law. Any one knowing human nature, and having some knowledge of -politics, would know that it is Wafl street’s law. I happened to be a member of - the house banking and currency committee when the bill was be- fore it. I' filed the only report « that was mgde against the bill. -I \ ernment have been robbed of billions . Neither the farfners or campaign and, ele also led the opposition to it in the house, and put pesitive evidence before every member that it was Wall street’s bill, There were 435 members, and only six votes were against the bill. It went to the senate and fared the same there, Senator La Follette being its strongest opponent. Of course, there was no doubt as to what Wall street would do with that law. I therefore-kept up the fight, in the hope that the public might take notice of a dangerous law. I filled the records of congress with it; filed articles of impeachment against the five active members of the federal re- reserve board, showing what they were leading to, .HERE COMES THOSE INSANE, .~ Viciouvs " AGITATORS, agaiN! X SPECIAL A/~ SN o PAGE SEVEN [ WON’T LEAVE HIM ALONE _ I —Drawn' expressly for the Leader by John M. the people 'of North Dakota in general wanted a recall on this year, which was not a regular election year. The people wanted to rest from politics and the farmers had work to do. But the L V. As politicians forced the issue. Bear shows how the farmers feel about it. and published two books setting forth the facts. But most of the press spit ridicule on me without showing the facts. f PAYMENTS WERE PUT OVER UNTIL AFTER THE WAR After six years of systematic praising of the law by the big press, we have Wall street’s steal of ap- proximately $12,000,000,000 from the farmers, wage workers and dependent business interests. The stealing, however, is not over. It is merely in progress. Though the people have already lost billions, congress is doing nothing to end the whole- sale thieving. In war, no new work except for war took place that could possibly be left till after the war was over. New bonds to renew old bonds that came due in war time were mostly left to be renewed when war ended. Everything not required for war that could possi- bly be left till war ended, should be left over, was the policy adopted. The policy that had been adopted to enormously increase the improved roads was made to wait. When war was over, there were re- quirements for more new construction work than ever; there were more old bonds to be renewed than ever; enormously greater new issues of bonds and other paper indebtedness had to be put on the market. The federal reserve board allowed the inflation to go on till the estimates on these things were made. Then when the bonds would have to be put / on the market, the federal reserve banks were required to cut down the loans, and increase the interest rates. By that act, the new bonds were forced to run with a much higher in- terest rate. These bonds—billions of dollars there are of them—run all the way from 5 to 50 years, and, on the in- crease in interest alone that is a steal of billions of dollars that this and. the next generation is mortgaged to pay. Even all that has been printed about it doe¥ not tell half the injustice that has been done under cover of the fed- eral reserve act. When the people are as much as they can. One thing is to be said in favor of the federal reserve board. It is open and above Board. Its acts are frankly *explained. It told the péople in ad- vance when deflation would be applied. — The members are undoubtedly honest Bder. in‘the belief that it was the best thing to do. But those who have been rob- bed do not think so. 3 _Where, oh where are those loyal . (Continued on page 15) . B L————————SMEES AR L S L LR s SR robbed, the robbers cover their tracks - R S SRR # e ————— T T S R S P (38