The Nonpartisan Leader Newspaper, October 17, 1921, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

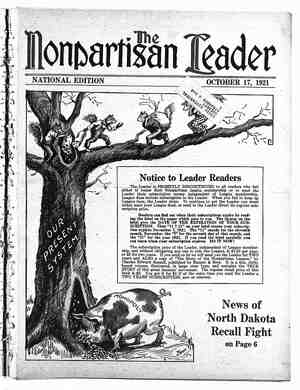

also the most potent. Leaguers feel that Mr, Turner is a man of whom they could be more sure of than any- body else who has been mentioned to be the head of the legislative refer- ence library, and his appointment will mean much to the future of Wisconsin. The recent appointment by Gover- nor Blaine of C. B. Ballard of Apple- ton as state treasury agent has been gratifying to Leaguers throughout the state. Mr. Ballard has served two terms as member of assembly from the first district of Outagamie county. He has represented his town on the Outagamie county board for 25 years. He has been one of the League organ- izers. ® 17 MINNESOTA { BY EDITOR MINNESOTA LEADER EETINGS being held in Min- nesota by farmers to pro- test against the impending imprisonment of A. C. Townley, president of the National Nonpartisan league, are attracting thousands of persons, said George D. Brewer upon his return to Minneapolis after addressing several of the huge audiences. So thoroughly are the farmers aroused against the injustice done to Mr. Townley that everywhere, Mr. Brewer said, former opponents of the League are joining the movement to demonstrate that the people are out of sympathy with a court decision which sends to jail a man who dared to voice the belief that wealth should be conscripted to pay for war expenses. This fact was particularly demonstrated at. Worthington. Mr. Brewer spoke to an audience of between 3,000 and 4,000. “Farmers applauded every " A LEAGUER'S HOG HOUSE _ ~ Edwin Kampfe of Gothenburg, Neb., sends the Leader this picture of his hog house. Mr. Kampfe finds it pays to erect substantial buildings on approved ‘lines to take care of his hogs. He adds at the bottom of his letter: “Farmers are willing to slop hogs if they could see a little profit. I am sure a Leaguer.” Mr. Kampfe would be glad to explain to Leader readers the plan ‘ of this barn, and the cost, if they will write to him. reference to the injustice done to Mr. Townley. XLast year he spoke at the same place. Spurred on by a representative of a flour mill in Minneapolis, rowdies in last year’s audience threw rotten eggs at him. There was no chance at’ the latest meeting for rowdies to repeat this stunt. The townspeople as well as farmers were so much in sympathy . with the speaker that a rowdy would not have dared to show his hand or head. Another evidence of the way the in- justice done to Mr. Townley is re- acting upon his persecutors, the polit- .. ical gang of the state, is the fact that business men, Mr. Brewer said, are beginning to understand the farmers’ movement better than ever before. Women are prominent at all of the meetings, distributing advertising and boosting. They declare they will dou- ble the League’s membership while Mr. Townley is in jail. i In his speeches Mr. Brewer is em- phasizing the fact that the prosecu- tion of Mr. Townley has cost the tax- payers of Jackson county, where.the trial was held, $25,000. At no time was it possible for the taxpayers, forced into this expenditure for polit- ical purposes, to collect more than $200 if Townley were convicted. That is the maximum fine for a - misdemeanor which was the nature of the charge against him. Of course, conviction carried an ad- ditional 90-day sentence, but that put nothing in ~the taxpayers’ treasury to offset the heavy costs. North Dakota Bond Boycott Is Broken State Bank Sells Real Estate Bonds—Financial Crisis Passed—Great Boost Given Farmers’ Campaign to Defend State Officers From Recall BY R. M. McCLINTOCK Mr, McClintock is editor of the Fargo Daily Courier-News GREAT boost has been given to the farmers’ campaign to defeat the recall proposed by the I. V., A, The Bank of North Dakota has made two im- portant announcements. First, the state bank is now in a position to pay all its obligations, and cash all checks drawn upon it. This means that the financial crisis brought about by the closing of some 40 private banks in the state during the last year, which tied up a large part of the state bank’s funds, has been passed. Second, the state bank has sold, incone lump, another $1,500,000 worth of the state real estate bonds, which complete the sale of the entire part of the real estate bonds offered by the state at this time. : The breaking of the bond boycott engineered by the big- financial interests of the East, is perhaps the most important of the two announcements. Spitzer, Rorick & Co., old-established and well- known bond dealers of Toledo, have purchased in one lump $1,500,000 of the state real estate bonds, at par. The bonds carry 53 per cent inter- est. This sale, added to the previously announced heavy sales of the bonds in small amounts to in- dividuals and farmer and labor organizations all over the country, disposes of all the real estate bonds recently offered by the state bank. The real estate bonds were provided by the farmers’ legis- lature to make loans to farmers on first mortgages, and are secured by farm mortgages as well as the - faith and credit of the state. Since large bond buying houses are now willing to take North Dakota bonds in large blocks, as evi- denced by the resent sale to the Toledo house, the state will soon be able to dispose of all the bonds it wants to carry out all parts of the farmer pro- gram. i It will be remembered that after so many private banks failed in North Dakota, the Bank of North Dakota had to stop payment on part of the checks drawn against it. The state bank had hundreds of thousands of dollars in cash tied up in the closed private banks, and for a time was up against it for ready money, although the soundness of the bank was never questioned. Now that the state bank can meet all its obligations, and, by the sale of the \ Seri e e e e e bonds, is established on a firm, permament basis, the attacks of the I. V. A. on the bank have had the ground cut out from under them. This has of course given great impetus to the farmers’ recall defense campaign. The farmers now have a better chance than ever to win October 28, the date of the election. : The fight in North Dakota is ostensibly a fight for and against the recall of Governor Lynn J. Frazier, Attorney General William Lemke and Commissioner John N. Hagan of the department of agriculture and labor, the three Nonpartisan league ~ officials who constitute the North Dakota_industrial commission. But the issue is in reality far bigger than one of personalities. The real issue is not whether the Nonpartisan league officials shall remain in office; it is whether the farmers shall be permitted to carry forward their program for a better marketing system. g The issue, then, simply is this: Shall the state industrial system be scrapped, or shall it be given a fair trial? "The I. V. A., of course, is for serap- ‘ping the system; the Nonpartisan league for giv- ing it a fair chance. L V. A. CLAIMS TO BE FOR NONPARTISAN LEAGUE PROGRAM Unfortunately, however, the issue is not as plain to the voter as this statement of it. The I. V. A. is dding everything in its power to muddy the waters. It doesn’t want a fight for and against the industrial program. It knows such a fight would result in its overwhelming defeat. So it tries to claim that it is merely for strengthening the pro- gram; to make it work, where the farmers’ officials ‘have failed to do so. But on one issue there is a straightforward fight. The I. V. A. admits it will, if elected, close the Bank of North Dakota. It has been trying to get votes by claiming that the Bank of North Da- kota is responsible for the state’s financial troubles. They have tried to place upon the bank all the blame for the necessity of registering for future prayment some checks of public treasurers upon public funds in the Bank of North Dakota. As a matter of fact this necessity of postponing some payments was forced upon the Bank of North Dakota by its failure to secure funds redeposited in private banks, some of which were closed and PAGE, SIX . others of which were open but in bad shape. The Bank of North Dakota had the option ef demand- ing the closing of these private banks, for failure to pay money due, or of postponing payment of some demands upon the Bank of North Dakota. For the sake of the depositors and stockholders in. - these small banks—as much the victims of Wall . street deflation as the farmers themselves—the" Bank of North Dakota chose the latter course. / But the issue of the registered checks is mow purely academic. The Bank of North Dakota’s an- nouncement of its readiness to pay off all registered checks, and all other obligations, came on Septem- ber 27. In spite of the vicious opposition of the L V. A, and in spite of the boycott by Wall street interests, the Bank of North Dakota had been enabled to sell such a block of bonds, in addition to borrowing $500,000 in the East, that it was able to get back upon an absolutely cash basis. So the I. V. A. campaign against the Bank of North Dakota has been badly punctured. Other developments have been still more embarrassing to the I. V. A. “They have claimed the Nonpartisan league should be defeated, and the I. V. A. initiated measures adopted, in order that the credit of the state might be helped. But in the very face of the L. V. A. election the Bank of North Dakota is able to bring new money into the state. And this is in startling contrast to the action of private banks. The Fargo national banks, which are the center of the opposition to the League program, have within the past year contracted their loans over $1,000,000 —in other words, have contracted the state’s credit to that extent. And other banks in the state, pur- suing the same policy, have sent from the state mil- lions of dollars badly needed here. The Bank of North Dakota stands forth as the only institution bringing money into the state. Another embarrassing incident for the I. V. A. was the exposure of the fact that W. F. Hanks, president of the North Dakota Bankers’ associa- tion, and sponsor of the bankers’ resolution adopted last summer calling for the closing of the Bank of North Dakota as insolvent, because of the registra- tion of certain checks, had gone on record in writ- ing as admitting that each and every one of his half dozen country banks was unable to meet the demands of the Bank of North Dakota. If the same treatment had been accorded his banks that was demanded by him and his fellow bankers for the -