The Nonpartisan Leader Newspaper, November 29, 1920, Page 6

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

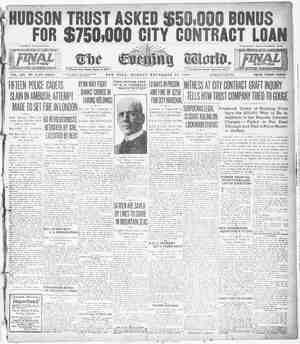

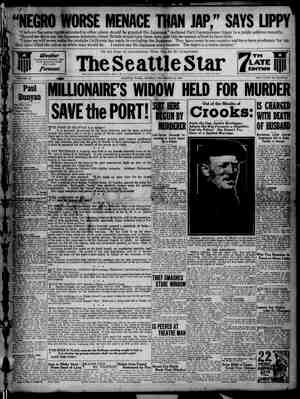

Let’s Study Up a Little on Banking How the Country Bank Controls the Farmer, How the City Bank Controls the Country Bank, and Who Controls the City Bank BY E. B. FUSSELL VERY banker in the Northwest is in- terested in farming. You don’t have to prove this. It is like the case of General Ben Butler, famous military leader-and politician. A friend once 7 asked Butler who was the smartest man in Massachusetts. “I am,” Butler replied. “But how are we going to prove it ?” the friend persisted. “We don’t have to prove it,” said Butler, “I'll ad- mit it.” So we don’t have to prove that all bankers are interested in farming. They will admit it. Now if bankers are interested in farming, which they admit they are, why shouldn’t farmers be in- terested in banking ? * This article is written to show a few reasons why they should be. Raising a crop is just half of a farmer’s job. It means hard work and often gives him a backache. But the other half of the job, just as important, is to dispose of the crop at a profit. That requires hard work, too, and may give the farmer a head- ache along with his backache. There is not much chance for an argument as to which half of the farmer’s work is most important. If he didn’t raise the crop he wouldn’t have anything to sell.” On the other hand, if the farmer can’t sell his crop at a profit, he might just as well not have raised it. When a farmer is raising’ his crop he does the work by himself. When he has it ready to sell he gets plenty of help and advice. Then it is that the banker admits his interest in farming. And to un- derstand why the banker is interested in farming, _ at this point, it is up to the farmer to become a little interested in banking. ; The bank with which the farmer generally has his: direct dealing is a small institution, probably with a capital of around $25,000 and ‘deposits of four or five times that amount... The local merchants and the elevator proprietor deposit their spare money - with the bank; so does the farmer if he happens t: have any. - ‘What becomes of this money after it is deposited ? Some of it is loaned out in the wvicinity. The merchants may require small lines of credit so that they can pay cash and take a discount on their goods, the elevator man may need a little help to carry the line of coal and other supplies he has laid in, a few farmers may be given long time loans on mortgages. : But during the larger part of the year the coun- try banks have more money than they can use locally. There is a more constant, all-the-year- around demand for money in the cities, where in- dustrial plants keep busy regardl&ss of whether it . . is planting, growing or harvesting weather, THE COUNTRY BANK CONTROLS THE PROSPERITY OF THE FARMER The lecal bank is too small to be able to afford to keep an agent in the Twin Cities or whatever may be the commercial center of the district. So it sends its surplus funds to some large bank in the commercial center. The small bank becomes a “cor- respondent” of the large bank and the large bank becomes a ‘“depositary” for the small bank. The large bank takes care of the funds sent it by the correspondent banks, dividing the earnings with the small bank. It takes care of transfers of money, by check and draft, which the small bank may have to make, and it sends the small bank collections and other business in its own neighborhood. This happens during the larger part of the year, when money is more plentiful in the farming dis- tricts than in the cities. During three months or so in the summer and fall of each year the condition is reversed. When harvesting begins farmers' must have money to buy twine and pay their harvesting crews. In every country town there is a greater de- mand for money than can be supplied through the - local banks. The result is that the country banks call upon: the depositary banks in the large cities for help. The large banks, as a part of the written or unwritten agreement with the small banks that have become correspondents, withdraw what funds they can from city use and apportion this money to the various country banks in proportion to their needs and in proportion-to the business that the - “SQUEEZE THE FARMER” - FIRST NATIONAL BANK ¢ CAPITAL $ 5,000.000 SURPLUS 8§ 5,000,000 # M. PRINCE ,Chairman of the Exocutive Committes fe T JAFFRAY, Presdent A A CRANE, VicePrest J S POMEROY, VicoPrest FRED SPAFFORD, Vice Prest H.A WILLOUGH BY, VicePrest. MINNEAPOLIS, MINN. _ o e F an 8 use 'Yu’x‘qm‘ : ! 8mog S thg . : on o0 n (] *hat Govep Hn g 1t u!u" th : . S e Uur frg 5 ° 80, the : oray () 8 8a 8 a b’ror CEPS n ng o (] RIVQH ’ t 4 couht}', h S st a . ; ! P’ much ak Toe) : 0 Ccop, ; tos torns . 7 ag po‘filbl () rol1eq 1n 1y, s o8t Posgy 4y . thoy 4 Y "e0ogny o Pelp, why o : an ze i ch ; : 80 % e ; L4 o £ ~Zhat b ,, t °F they,, , Eoneth o oy Produgy, ;%\'«l& vy, ? Todyg, ® loty,,, : o : 8 : Thig Tarets %0 fupy, 2y das mog4 2 Whe v 8] L] oy, Ll D0ttapn, ~=2 the 8ymony in norgban @ent » 8nd ‘athN 0f Joa. . P J LEEMAN.VicePrest. SUMNER T. MoKNIGHT Vice Pre sé GEO A.LYON, VicePrest S ~ G BYAM, VicaPrest € E BLACKLEY. vicePrest F.A. CHAMBERLAIN, Chatrman of the Boerd of Directors STANLEY H. BEZOIER, Cashier J G MACLEAN, AsstCashier W A MEACHAM, Asst Cashier C B8.BROMBACH, Asst Cashier K M MORRISON, A33t.Canhins ’. 8 &l ¢ 5 1An country bank has thrown the city bank during the preceding year. : It can be seen what a hold the large city bank has over the small country bank, But for their city con- nections few country banks would be able to operate profitably. They would be unable to dispose of their surplus money during the time when they have more funds than they need, and would be unable to get outside money during the time when they need more than they have. The fact is that the city bank has the same hold upon the country bank that the country bank has over the individual borrower. And every farmer knows the kind of 2 hold the country bank has over the individual borrower. : S By collecting its loans, as soon as a crop is har- vested, a country bank can force a farmer to sell his crop at the lowest point on the market. The coun- try bank often does this. The country banker thus has it within his power, in numberless cases, to de- termine whether the farmer makes a profit or a loss. Under natural conditions the country banker should always want to see the farmer make a profit. The prosperity of the country banker, in the long run, depends upon the prosperity of the community. A few country bankers are short-sighted enough to want to “skin” the community of its profits during @ few years, and then move somewhere else. A ma- jority undoubtedly would like to see the community prosper, for self-interest, if for no other reason. But just as the country bank controls the farmer and his prosperity, so that city bank controls the country bank and its prosperity. But for the city bank, which takes care of the surplus funds of the country and supplies additional funds when the country bank ‘must have them, the majority of coun- try bankers would have to go out of business: CITY BANK CONTROLS COUNTRY BANK; WHO CONTROLS CITY BANK? The country banker many times, when he calls in a farmer and tells him he must close out a loan, does so merely because he is acting under orders from the city bank, which demands the return of money with the implied threat that if it is not produced the country bank will be closed out.- So the country banker has no choice: but' to close down on the _ farmer. ‘ Now if the country bank controls the farmer and _ the city bank-controls the country bank, who con- trols the city bank? ‘Who is it that is anxious that country loans be closed out immediately after harvest, when the farmer must sell on a falling market and at a loss? Not the country banker, who wants to see his own community prosper. Every city bank is controlled by a board of di- rectors. These directors not only determine the general policies of the bank’s business, such as what classes. of Ioans shall be made and when they shall be called in, but they also elect the president, vice president, cashier and other officers of the bank, who handle the details of deciding just what country banks shall get these loans and for how long. Why should the directors of the city bank want to see the farmer ruined by being forced to sell his wheat and other crops at a loss, when the market is at its lowest point? There certainly could be no gain to the city bank by hurting the business of the country bank unless— Here is the big point—UNLESS the directors of the city bank happened to be engaged in some other business that made it necessary or desirable for them to be able to buy wheat at the cheapest possi- ble point. Rhoan o . Suppose we study the make up of the boards of directors of -some of the big Minneapolis banks that act as depositaries for dozens of small country banks in North Dakota, South Dakota, Minnesota and Wisconsin. : Let us take, first of all, the First National bank of Minneapolis.. This is one of the large institutions of - the Twin Cities, with a capital and surplus of $10,- 000,000 and deposits of many times that amount.’ Most of these deposits come from the small country “banks, which have drained the money out of the Dakotas, the country districts of Minnesota and ‘Wisconsin. A rcproduction of part of the First National bank’s letter to country banks, urging them to collect loans from farmers so the money could be used by grain speculators on the Minneapolis Chamber of Commerce,. PAGE SIX The First National bank of Minneapolis has been one of the foremost institutions to urge count.y bankers to close out their loans to farmers and to