The Nonpartisan Leader Newspaper, October 4, 1920, Page 10

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

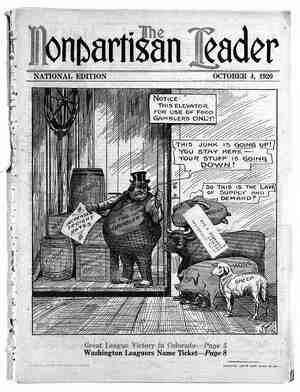

i ~ manufacturers lose. _itors demand cash. What Is Cause of “Hard Times” Talk? WASHINGTON CORRESPONDENC o Deflation 22 Painful Coming Congress Will Have to Face Severe Financial Problems Washington Bureau, . Nonpartisan Leader. 7]RICES are to be pulled down by the painful process known as deflation. Word has gone forth from the treas- ury department and through the big New York banks to the whole financial world that the time has arrived to call in_the speculative loans and to refuse to loan any money on speculative projects. : ; One of the biggest clothing manufacturers in the country has agreed with retailers handling his prod- uct that he will “take a loss” of from $12 to $30 on all suits of men’s clothes which they ordered early in the season. Otherwise, he is quite aware, a large part of his orders will be canceled and he will have the goods left on his hands. And he finds that he can not borrow money; he must collect it. Woolen manufacturers reveal the fact that hundreds of thousands of bolts of woolen cloth, manufactured for the export trade at high prices, have been stranded in their warehouses. The cus- tomers in Latin-American countries and in Europe refuse to pay the prices. Now . the woolen. mills are closing down. Fifteen thousand work- ers were discharged recently in the city of Lawrence, Mass., alone. Silk manufacturers in Pater- son, N. J., and other centers are in a like situation. Dealers ordered right and left, gam- bling on a big market. The de- mand for silks 'and woolens failed to meet their hopes and the merchants canceled the or- ders. Meanwhile the manu- facturers had gambled on the filling of these orders. The Many of < the dealers also lose, where they have paid in part or in full for stocks too great for the retail demand. Now their cred- Interest rates are going steadily up- ward. Sacrifice sales are in order and manufacturers are closing their plants to wait un- til they can be sure of a cash payment for what they may — produce. One of the big rubber plants of New England dismissed nearly 4,000 employes. It had stored a vast supply of auto- mobile tires and must sell them for cash before it could pay wages. The banks were reduc- ‘ ing their loans to concerns in the rubber industry. But food prices are staying up. Every one must buy food, regardless of whether the normal supply of woolens, silk and automobiles is to be considered extravagant or not. Food production has been more expensive to the farmer this year than ever before. Implements, fertilizer, employed labor, upkeep of . horses—every item has been more costly than last year or the years before that. Food prices are not coming down with prices of the less immediate necessaries of life, MEAT PRODUCTION LESSENING; FARMERS CAN’T MAKE PROFITS Meat production is falling off. At 69 markets— the principal stockyards cities of the country—gov- ernment reports show that in the first six months of 1920 there were 2,500,000 less animals slaugh- tered than in the corresponding six months of 1919. If this rate of decrease should continue—and it is likely to, because of the shrinkage of credits to cat- tlemen—the meat production this year will be near- ly a billion pounds less than last year, or a decrease of nearly 5 per cent. While the government could keep retail meat prices at a reasonable level by re- stricting exports; as is done in Queensland, Austra- lia, the chances are all in favor of the big meat packers boosting the prices of meat to the general publie, this profiteering move to be accompanied by a clever press campaign which will seek to make townspeople believe that the farmers are to blame. Along with food, the people must have shelter, whether they are employed or not. Rents must be such that families can withstand the cold of the coming winter. There is a shortage of housing throughout the United States, due to the falling off of construction during and since the war. Cost of building materials has been almost prohibitive since the profiteers’ seized control under guise of “war efficiency.” Lumber was slaughtered in 1917 and 1918 at five times the normal rate of .consumption. . Lumber supply for the future will be greatly re- stricted and prices will be higher. This means less building and higher rents for buildings now in use or yet to be erected. = ¥ ; CAMPAIGN OF MORTGAGE FORECLOSURES TO BE EXPECTED Banks are refusing to make loans for building im- provements in the District of Columbia. They are demanding early payment of loans already made on real estate. Men who have speculated on a quick turnover of investments in houses are in a pinch. Buyers can not borrow money with which to com- plete a purchase. “Reduce credits” means the fore- closure of mortgages and a repetition—perhaps on I THE DIFFERENCE : l THE OTHER & DOES UNCLE SAM ONE DOES ALL HE (AN FOR UNCLE SAM. a very great scale—of the terrible experiences of smalb investors, farmers and householders in the years 1893-96 and 1907. Thus far the stock market has held steady, with only a general tendency downward in such barome- ters as U. S. Steel, which has dipped below 90. So long as the reduction process goes smoothly, and no considerable number of business firme are driven to the wall, the stock market will probably hold up. But .when the cancellation of orders for goods and the withdrawal of bank credit has resulted in clos- ing the leading plants in a wide range of industries, and when the unemployed become a disturbing factor because they can not pay rent or feed their families, then the “market” will drop. A renewed demand from financial interests allied with the export trade for resumption of trade with Russia, to relieve the crowded warehouses along the Atlantic coast, but with a national campaign on no immediate action alongthis line is-to be expected. The dire predictions of Wall street financiers, made early last spring, have long delayed their com- ing true. But they do look more nearly justified to- day than ever before. Add this financial outlook to the railroad chaos created by the Esch-Cummins law and we have 2 real problem to be faced by our tory congress when it meets in December. PAGE TEN &2 —Drawn expressly for the Leader by W. C. Morris. Mine Owners Conceal Profits, Says Expert What Does Coal Cost? Experimental Mines Proposed to Determine_ Fair Price to Consumer Washington Bureau, ] Nonpartisan Leader., XPERIMENTAL government-operated mines in both the anthracite and the bituminous coal fields have been pro- posed to the president’s anthracite coal commission by Thomas Kennedy, president of District No. 7, United Mine Workers of America. ! - Kennedy, who is one of the big liberal leaders among the coal miners, said that he was merely put- . ting forward officially the Ferry plan, so-called, which was drafted by the miners and was suggested at the anthracite miners’ conference some months ago by Neal Ferry, who is now the miners’ own member of the three-party commission. The an- thracite miners approved this plan, and it has be- come as much a part of their immediate program as the Plumb plan for government ownership and democratic operation of railroads has become the immediate program of the 16 railroad labor organ- izations. 2 In the anthracite controversy the anthracite min- : ing companies were shown to be merely the cover agents or stool pigeons of the anthracite railroads, which were in turn owned, through interlocking stockholders, by a small group of capitalists dominated by J. P. Morgan & Co. and the Na- tional City bank crowd in Wall street. Seven coal-carrying railroads form the anthracite trust, and they all take orders from Morgan. RAILROADS CONCEAL PROFITS OF MINES W. Jett Lauck, the famous industrial economist, had pre- sented figures showing that the profits of the anthracite coal business were covered up and their selling agencies. The lawyers for the companies fought bitterly to exclude all of this evidence from the record. Lauck argued that until the ac- tual profits of these railroads and their selling concerns were made known by an exhibit of their books, the facts as to the profits of anthracite coal pro- + duction could not be proved and hence the commission could not know whether an increase in the retail price of anthracite would be necessary when a wage increase was granted the miners. As a final means of prying loose the facts as to the profits in the coal industry Kennedy brought -forward the proposal approved by the anthracite miners—the Ferry plan. | 1 “The time has come,” he said, “when the public must know the exact truth about the basic facts of mining—management, equipment, costs and profits —if we are to hope for stability in the industry and a square deal for the mine workers and the consum- ers of coal. After 30 years of ‘investigations’ the government itself does not know the first thing about mining—the cost of getting out one ton of o - fearss coal. ‘Mr. Ferry showed us that the official figures varied from $1.12% to $7.80 a ton, and he gave in detail the basis .of his own calculations as' a prac- tical miner that the miner gets 69 cents for each ton he mines. When this coal sells at $12.75 a ton, or even as high as $14.50, both miners and consum- ers justly become suspicious of the whole industry, and accordingly he suggested that the government should take over four anthracite mines and one coal washery in order that a practical experiment can be g:onducted to ascertain the exact costs of pro- ducing .and marketing a ton of coal in small, medi- um and large veins. : “I add to that the suggestion that a like experi- (Continued on page 18) . [ in the profits of these railroads _