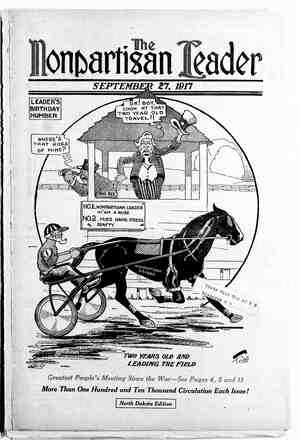

The Nonpartisan Leader Newspaper, September 27, 1917, Page 12

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

The above picture was taken at a Nonpartisan league picnic at Brush Lake, N. D., which is about two miles north of Mercer, in MeLcan county. Mercer is the home town of James Rice, who was a representative from MeLean county, N. D, to The other two representatives R. L. Fraser was in- the North Dakota legislature. were Walter Maxwell and R. L. Fraser. vited over to take charge of the meeting as chairman. It is about 40 miles from Garrison, where he lives. Frazier, Langer and Thomason were present and gave excel- lent talks. Thomason explained the objects and purposes of Governor the League in a clear cut statement and was well received. He got hearty applause at the end of his talk. Mr. Langer follow- ed Thomason and he gave a very convineing talk in regard to the enforcement of law and what he had already accomplished along this line in North Dakota, especially at Minot. Governgr Frazier closed the meeting. He held the audience throughout his talk. He told how he had been conscripted to serve the state and the same method would be followed by the League in the future; that those seeking public office would not re. ceive very kindly treatment at the hands of the League; that The Farmers’ Regime in Action Nonpartisan League Men in Office in North Dakota Fix 1917 State Taxes—First Answer to “What Have They Done?” HE fixing of taxes in North Dakota has always been a scandal. For one thing, the {2 state tax commission for many years has been in pos- session of facts and figures showing that railroads were grossly under- assessed. They paid less taxes per mile in North Dakota than any other state through which they passed. At the same time freight rates in North Dakota were greatly in excess of rates in adjoining states. The tax commis- sion knew what the railroads were making in North Dakota and what taxes they should pay. It employed experts to find out. Nevertheles: cessive state boards of equal sidetracked the tax commi fig- ures and laughed at efforts to make the railroads pay their fair s| The state continually n revenue. It could not r Tate, becausc that is stitution. So ecach y 2 property valuations to get the ecxtra Tevenue needed. But it never, raised railroad valuations to what they ought ar it raised the to be, to get this added revenue, It al- ways raised agricultural land, city property and other items. It was easier to do that because the railroads kept plenty of slick and plausible law- yers and t xperts” at Bismarck, Who made friends of the poll in office and showed them quite plainly that all property should stand sub- stantial except railroads. SOME HISTORY OF N. D. TAXATION The amount of property escaping taxation also has always been a scan- dal in North Dakota. Private car lines, like the Pullman company, escaped taxes. Leased sites on railrond rights of way were ignored by taxing officials. But the politicians had to have more money to run the state, to meet their ever increasing cxpenditures. So in 1915 in desperation the politicians add- ed dogs, fences, poultry and other items of personal property of farmers and city householders to the tax list. And all the while the big fellows were Betting off! The 1915 tax equalization—so-called —was the most astonishing thing ever put over on a long suffering people. The politicians in office found they had to have 20 per cent more money than they had the year before to run the governmient on. Instead of going out and getting this extra 20 per cent from property of big corporations that had been escaping taxation, and getting it from the notoriously - underassessed railroads, what do you suppose these politicians did? They increased the tax on farm lands 28 per cent, while increasing railroads only 24 per cent. The raised valuations got about $3,000,- 000 more in revenue for the state and all its subdivisions, and of this farm lands paid 67 per cent and all other property only 33 per cent! And they added to the tax lists the dogs, poultry THIS ARTICLE AND SOME OTHERS The farmers’ admi ration in charge of the government of North Dakota has been in office less than nine months. This is a short time in which to accomplish the reforms the farmers were pledged to carry out. It will take several years. The politicians had held sway at Bismarck, the state capital, for 30 years.when the farmers’ regime was ushered in. The farmers have been in charge but nine months. Nevertheless, the oppos n is asking the question, “What have you done”? That is a fair question and the farmers’ administration does not dodge if Nine months is a short time, but' wonders have been accomplished—a substantial start has been made in the great work of restoring the government to the people. The Leader pro- poses in the accompanying article, and several others that will follow, to tell what the farmers’ adm istration has done. and interesting series of articles. The first is presented herewith. It will be an important Read this, and watch for the rest—THE EDITOR. and fences of farmers, which had never been taxed before. Then the Nonpartisan league was organized, with its platform for fair and square taxation, and the League swept the primaries of 1916, nominat- ing its every candidate and defeating the office holders at Bismarck. The state officials were through politically. They were in the discard. But they did not retire from office till January, when the farmer officials took office, and in the meantime they got another whack at the taxes. The board of equalization of 1916 went down the line and reduced all kinds of taxes. They lopped $30,000,000 off the state's tax valuations, They did it to decrease the state revenue for 1917, so that the farmer officials this year would be up against it for money to run the gov- ernment, and so the retiring officials could claim they reduced taxes before leaving office. The reduction, conced- ing it was reasonable to reduce taxes at that time, was not done fairly or scientifically, The already grossly un- derassessed railroads had their valua- tion reduced from $56,960,000 to $51,- 340,000, It was a dirty trick to put the farmer officials up against a depleted treasury in 1917, and to let the political gang lay claim to having reduced taxes. RAILROAD TAXES PUT ON FAIR BASIS Such is the history of tax making in North Dakota the last two years before the farmers put their men into office. And now the 1917 taxes have been fix- ed—fixed by the farmers’ representa- tives. The present board of equaliza- tion consists of Governor Lynn J. Frazier, Attorney General Langer, Commissioner of Agriculture Hagan and State Auditor Kositzky, all elected by the farmers through the Nonparti- san league, and State Treasurer John Steen, the sole remaining office holder of the old regime at Bismarck. What did these farmers do? Well, it's quite an interesting story. To start with, the tax com- mission, which had carefully gath- ered data about the railroads and had been ignored by the board of equalization all these years, was called in and some attention was paid to the real facts about rail- road valuations. The railroad of- ficials were given a fair hearing. Then the board jumped the rail- TOTAL ASSESSED VALUATION NORTH DAKOTA 1915 Farm 1ands ......... Farm improvements Town and city lots .... Personal property Railroads ... Telegraph property . Telephone property . Express companies Street railways .. Pullman cars ....... -$213,137,140 eee 14,276,001 13,877,116 Improvements on lots 21,23: 63,071,681 56,960,772 415,483 1,329,206 533,430 72,741 32,692 1916 1917 (Nonpartisan League Board) $202,961,578 13,486,613 18,630,675 21,290,443 69,339,458 70,762,452 761,782 1,400,000 757,403 80,015 157,304 $193,470,548 18,642,217 12,079,767 3 20,058,708 61,545,651 51,340,643 417,035 1,367,172 469,023 72,741 32,602 Total assessed valuation.....$384,938,700 $354,496,097 $894,627,923 Note: The assessment may vary a few thousand dollars but not materially from that indicated, as at the time the figures were obtained the item of telephone property was only estiiated, and a few other slight varia~ tions were expected. PAGE TWELVE road valuations up nearer to what they should have been all theso years. Railroad valuations were increased by the farmers from $56,960,000 in 1915 and $51,340,000 in 1916, to $70,762,000. This is an increase, over what the politi left railroads at last year, of over 33 per cent. The notoriously outrageous “equali- zation” of the politicians in 1915 had left farm lands valued for taxation at $213,137,000. The dishonest reduction, made to hamper the incoming farmers' administration, left farm lands in 1916 valued at $193,470,000. The farmers equalized farm lands this year at $202,961,000, a decrease of over 4 per cent from the 1915 valuations, and an increase of less than 5 per cent over the dishonest last assessment of the politicians. Railroad taxes increased 33 per cent and farm lands only 5 Der cent, as was done by the farmers, comes near to making the assessment fair to both classes of property, accord- ing to the expert data of the tax com- mission that the politicians have re- fused to listen to all these years. COUNTY EQUALIZATION WAS CORRECTED For the first time in the history of the state the Pullman car company was forced this year by the farmers to toe the mark with a majority of its property. It has been slipping along for a number of vears paying on a valuation of only $32,000, and the Non- partisan league officials raised it to $157,000. 3 But the good work of the farmers’ equalization board does not all appear in total figures of its equalization. It not only had to go up against the big corporations, but it had to go up against county boards of equalization in 52 counties, Every one of the fights had been fought out before the county boards, the arguments for special favors heard (and in some instances listened to), and the state board had to equalize these. In some countics, where officials still in power have been bitterest against the Nonpartisan league, the county boards had sent in assessments so low that the state would have been getting but a small amount of the taxes to which it was entitled from all sources in those counties, To let these lowered county assess- ments stand, would have been to levy an extra burden on those counties that had rendered a more mearly full ac- count of their tax resources. ANOTHER YEAR TO CLEAN UP JOB And ot the least important work of the farmers at Bismarck has been the elimination of the old unfair and un- sclentific tax schedule for personal property. The old “chicken and dog” schedule has been repealed and in its Place a schedule adopted that will get (Continued on page 20) o i 'with more force should be called Brush lake. the League would pick out the men it thought would serve the state honestly and efficiently. rupted during his. talk on account of rain but it seemed to make no difference. He resumed his talk as soon as rain stopped an ever. He was right at home. As soon as he started talking, he took off his coat. Both the governor and his wife met many of the people at this pienic. Brush Lake is a beautiful spot—two lakes joined together and with fine groves of trees around. It seems funny that the lake It:should be called Timber lake Governor Frazier was inter- or Tree lake. However, it may be like the constitution of North Dakota. At the time it was named probably it was ‘‘brush,’” but now trees are all around the lake. constitution, and the lake called Timber lake. The picture seems to show about 500, but there must have been about as many more, as there were some out to the ball game when the picture was taken, and many down amongst the trees. The Red Cross furnished meals. Walter Maxwell, a League representative, sat on the platform during the program. It should have a new BY R. L. F., WHO ATTENDED. "New N. D. Grades at Wor Farmers’ Law Gives Chance to Get Mill Test on Grade Samples---First Car Passes as No. 1 Through State’s Grain Department---What It Means HE first carload of wheat ever inspected in North Dakota under North Dakota grades; was No, 1 Northern Spring weighing 59 pounds to thé measured bushel comprising Marquis and Bluestem; was sold by the Genoa Equity Co-Operative Elevator company of Norwich, N. D, H. M. Hendrickson, manager; and was shipped to the Equity Co-Operative - Exchange at Superior, Wisconsin, September 6. Thus it completely passed over the state of Minnesota, which has for so many years controlled the grading ‘of spring wheat, and went direct from North Dakota, with a North Dakota grading certificate, into the state of ‘Wisconsin. The little slip of paper showing this grade, is in a sense an epoch-malking document. Inspection was made by J. A. McGovern, chief deputy grain inspector of the state of North Dakota, himself a former co-operative elevator manager, and under a law passed by farmer legislators, against the stubborn opposition of old gang politicians at Bismarck. It is a bit of evidence to the eve of what the farmers have be- gun to do for themselves in the way of marketing their crops, since they came into power in North Dakota. INSPECTION SAMPLES TO BE MILLED True this grain was graded accord- ing to the federal grades, for North Dalkota adopted federal grades, and Mr. McGovern is licensed by the United States government to inspect grain for interstate shipment and for export. But this historic carload of grain got ‘more than the government was willing 1o give it, more than Minnesota grades ever gave it, and it got that more be- cause of the North Dakota law. The sample sent from this carload for inspection weighed five pounds, enough to give a fair and represent- ative grading and a sample for milling. Less than five pounds is no good for grading purposes (a fact which farm- ers cught to keep in mind whenever they send grain to Fargo for North Dakota inspection). After this grain was graded, the sample Was put through the experimental mill, and its flour value and baking value deter- mined, This is the only state-owned flour mill in the United States, it is Delieved, and the story it has been tell- ing for the last nine years, of the rob- bery of farmers by grain sharks has Deen the biggest factor in awakening farmers to a sense of thelr rights and one of the biggest factors, no doubt, in preventing a lower maximum price than that fixed by the price fixing commission—namely $2.20 for No. 1 at_Chicago. . 1t 1s this milling and baking test that the North Dakota grading system gives to wheat. Under the new federal grades this is not provided, but there 18 no law to prevent the saniples being milled and the data tiled for future reference. It will now be possible to know the exact relation between the federal grades, and the actual milling and bread-making value of grain, Every sample sent for inspection large enough to mill, will be milled, and the data_compiled on a certificate that will be filed with the duplicate of the official grading certificate. Taking flour value into account was a feature of the North Dakota grain grading act, and was provided for -on appeals from local inspection to the state inspectors at headuarters. FLOUR VALUE FOR GOVERNMENT APPEALS But if there are appeals from the state inspection, under the federal law such appeals go to the secretary of agriculture, and it is then up to his department to say whether the grade given by the licensed government in- spector was the correct on or not, For instance, take this first carload: when this arrives at Superior, if the inspec- tors there do not give it a grade of No. 1 Northern Spring, as it was given in North Dakota, there will be an appeal. There may be an appeal anyway, for the miller who buys this grain_may want to have it graded down to No. 3 or No. 4 If the miller appeals, the Genoa co-operative elevator will send to Fargo, and ask that the milling and baking data on the carload inspected on North Dakota certificate No. 1 be forwarded to Washington for Secretary Houston’s experts to look at. In, Inspection This data will show how big a per- centage of flour the wheat actually produced when milled; how large and light a loaf of bread it actually made; how white that loaf of bread actually was. It will show how coarse or fine the bread was when sliced, and it will show how much bran, shorts, and screenings it vielded as by-products. These facts will all be determined by methods as scientific, careful and im- partial as it is possible for them to be —the same methods and the same standards that all the large mills in the country use when they test out wheat and offer a price for it. The owners of this wheat can put right into the hands of the arbiters at Washing- ton everything that can ever be known about this wheat, without delay, with- out quibble, without possibility of manipulation. And with this data at hand, the TUnited States umpires can say in a jiffy just what the wheat ought to have, and the owner and the buyer can learn at once where they stand. With the stamp of North Dakota inspection, and North Dakota milling and baking, there will be nothing further to be said. It will be as safely and correct- 1y graded and analyzed as the hams and bacon that come from government inspected packing plants. That is the beauty of this North Dakota system, and a feature for which President Ladd of the North Dakota Agricultural col- lege (now chief inspector of grain un- (ORIGINAL) der the North Dakota law) is respon- sible. MAY POINT THE WAY TO GENUINE GRADES Every sample of grain that goes to Fargo for inspection will be handled this same way, and when 100 or 1000 samples have been milled and baked, it will be possible to tell how the gov- ernment grades stack up along side of facts. Perhaps this data will be pub- lished in bulletins, as former data has been. When enough samples have been tested it will be possible for the North Dakota farmers—and the farmers of all other states as well—to ask that wheat grading be based upon the de- termined flour and baking values, as it is all based in actual trade now before a pound of it is ground into flour. It will no longer be possible for the organized millers and Chamber of Commerce traders to cry boo, and raise a clamor when the milling values of wheat are mentioned. It may even be possible to do away with some of the arbitrary standards now used in the federal grades, such as test weight per bushel, or the percentages of so-called inseparable weed seed that is actually separable, and base grain grades on commercial values. Dr. Ladd has long maintained that it is possible to form grades that are based on actual value instead of on the (Continued on page 20) GRAIN INSPECTION CERTIFICATE NORTH DAKOTA STATE GRAIN INSPECTION DEPARTMEN, grade the_kind of grain covered by ¢ Agricultural College, N. D./X 1 HEREBY CERTIFY fhat I hold a license under the United States Grain Standards Act to inspect and certificate; that on the above date I inspected and graded the follow- ing lot or parcel of grain; and that the grade thereof, according to the official grain standards of the United States, is thal, stated below: E. F. LADD, f..onsee Car Initials.. Chief Grain Inspector of North Dakot Agricultural College, North Dakota 3. A. McGOVERN, Chiet Deputy Tnspector of Gratn Agricoltural’ College, North Dakota This is a facsimile of the first grain inspection certificate issued for a carload of grain under Ncrth Dakota inspection, the Inspector being also licensed by the federal government. PAGE THIRTEEN