Evening Star Newspaper, March 9, 1933, Page 4

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

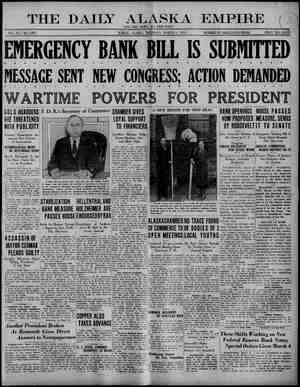

CURB ON PRIVATE BANKERS IS URGED Aldrich of Chase National Also Would Divorce Deposit and Investment Accounts. By the Associated Press. NEW YORK, March 9.—Wide-eyed Wall Street looked toward Washington todsy and pondered the legislative chances of Winthrop W. Aldrich’s plan | to change the set-up in the financial | heart of the Western World. 1 Aldrich, who is head of the Chase Na- | tional Bank, the largest in the world, | and is brother-in-law to John D. Rocke- feller, jr., proposed last night the most | drastic program of banking reform that | has ever emanated from Wall Street. Not only would it divorce deposit and investment banking completely, but it would go far beyond even the Glass bill, which hitherto has met much disfavor | in Wall Street. One effect would be to curb severely the activities and power of leading private banking firms, notably J. P. Morgan & Co. Denied Directorships. It would forbid private bankers to take | deposits or to be directors of banks of deposit. Members of the Morgan firm | are directors of some of the largest commercial banks of the country and hold important deposits, foreign and do- mestic. There was a feeling in some parts of Wall Street today that Congress would give close consideration to the Aldrich proposals. They adopted the spirit of the Glass bill, which advocates the separation of banks and security afliates and extended it further. The program. designed to rid com- mercial banking of any “spirit of spec- ulation,” astonished many in Wall| Street. It involves the inciusion of all commercial banks i the Federal Re- serve System. Power Would Be Reduced. ‘The New York Times pointed out the suggested program would curb the power of the large private investment banking firms in three respects: Pirst, by depriving these firms of the right to accept deposits, it would make it necessary for the private banks to ob- tain credit from the commercial banks in financing thelr security flotation. Second, by doing away with the se-| curity affiliates of the commercial banks, the proposed regulations would take from the private banks outlets for the syndicating of their securities which have in the past been of great impor- tance. Third, by removing all private bank- ers from their positions as directors of the commercial banks, the changes would greatly reduce the prestige, in- fluence and “inside information” avail- able to partners of investment houses &t present. Separated From Affiliate. Aldrich, & comparative newcomer to the banking firm, made his proposals in connection with an announcement that the Chase National Bank would divorce its security afiliate, the Ohase Securi- ties Corporation. Similar steps are be- ing taken by the National City Bank. The Aldrich plan would necessitate further changes by his own bank. For for gm‘?"‘mmnm.mu the largest numbers of any bank. Blatemont Bormed. AMirich fsmsed the following state- the aoction of tion between commercial banking and investment almost inevitably leads to abuses. “For some time the Chase Na- tional Bank has giving _serious consideration to the question of sever- ing its connection between itself and its security affiliate. The matter was dis- cussed at the last meeting of the di- rectors and s subcommittee has been appointed by the Executive Committee 10 report as soon as ible upon ways and means of brln‘m. about this re- sult. “I am entirely in sympathy with the divorcing by law of security afflliates from commercial banks. I do not think, however, that the Glass bill goes suffici- ently far in separating the business of commercial banking from that of deal- ing in securities.” Additional Proposals. ‘The Glass banking bill would enforce the separation of banks and their se- curity affiliates over a period of years. The additional regulations suggested by Aldrich were: “1. No corporation or partnership should be permitted to take depsits un- less such corporation or partnership is | subjected to the same regulations and required to publish the same statements as are commercial banks. “2. No corporation or partnership dealing in securities should be per- mitted to take deposits even under Tegulation. “3. No officer or director, nor any member of any partnership dealing in securities, should be permitted to be an officer or director of any commercial bank or bank taking deposits, and no officer or director of any commercial bank or banks taking deposits should be permitted to be an officer or director of any corporation or a partner in any | partnership engaged in the business of dealing in securities. “4. The boards of directors of com- mercial banks should be limited in num- ber by statute, so as to be sufficiently ! small as to enable the members to be actually cognizant of the affairs of thetr | banks and in a position really to dis- charge their responsibility to stockhold- ers, depositors and the business com- munity.” ‘Would Eliminate Speculation, “The spirit of speculation should be eradicated from the management of commercial banks,” Aldrich's statement | continued, “and commercial banks should not be permitted to underwrite securities, except securities of the United States Government and of States, Ter- ritories, municipalities and certain other public bodies in the United States. “The Federal Reserve System was | founded for the purpose of serving the governmental and commercial life of the country. I think that all commer- cial banks should be members of the system and that their management rould be actuated solely by the desire to carry out such purposes in a sound | and conservative manner. In my opin- ion, not until the reforms above men- tioned have been put into effect will this result be obtained.” FORD ACCOUNTANT DIES Executive Had Been With Motor, Car Company 20 Years. DETROIT, March 9 (#) —William E. Carnegie, 54. chief accountant for the Ford Motor Co., died here Kuurdly. He had been an auditor for the Ford com- ny for more than 20 years, coming re from the Peter Kine Co. of Buffalo, N. Y. Carnegie played an important part in the development of South American rubber and Brazil lumber production for the company. He was engaged in shap- ing an extensive program along these lines at the time of his death. —_— 8licing wood into boards at the rate ©f 12,000 an hour is the accomplish- meénd of & new revolving knife. which % no sawdust in its trail. The Woards are 2 inch by 36 inches long. The extraordinary special session of Congress called by President Roosevelt to deal with the banking crisis as it opened today. PREPARE T0 ISSUE SCRIP INMARYLAND Assembly Ready to Enact Law After Urging Issuance | of Emergency Currency. By a Staff Correspondent of The Star. ANNAPOLIS, Md., March 9.—Having passed & resolution calling on the Fed- eral Government to broaden the base of bank assets, which will secure the issuance of additional currency, the General Assembly todsy was prepared | 10 enact legislution suthorizng an emergency corporation to issue scrip in | the State, if necessary. i ‘The resolution was passed under a | suspension of the rules Jast night upon | recommendation of Gov. Ritchie, who! had conferred yesterday morning with President Roosevelt on the national banking situation. Urges Emergency Currency. | It states that the Assembly “believes | the sound investments of any bank | should be included in its proper assets, even though such investments are not considered liquid under the require- | ments of the Federal Reserve act.” | “The fundamental principle of in- cluding all of the sound assets of any bank as the basis of securing the is- suance of additional currency or other circulating medium should be applied in the 1ssuance of emergency currency 1o relieve the existing national currency shortage,” and delivery made to all banks slike, the resolution says. Although advised that the Treasury Department has prohibited the issuance of scrip by a new corporation in New York, members of the General Assem- bly were perfecting plans to establish & scrip system in Maryland today. They sald, however, the plans are subject to revision to conform to the wishes of the national administration. Lee Explains State Program. E. Brooke Lee, legislative liaison officer of the Governor, explained the State administration views as {ollows: “We'll develop a State-wide clearing bouse if the corporation plan of issuing | scrip is banned. We hope to have the necessary legislation introduced this afternoon or tonight. We want to have our plan ready for operation 1f Washington says go ahead, and if it | doesn'’t, our plans can be shelved. Maj. Lee accompanied Gov. Ritchie on his call at the White House and later on Secretary of the Treasury Woodin. Upon returning here, Maj. Lee ex- plained developments in the banking situation both in Washington and Baltimore and the prposed legislation | concerning scrip before a joint meet- | ing of the Senate Finance Committee and the House Ways and Means Com- mittee. Gov. Ritchie extended Maryland's | own bank holiday to include today, ain postponing the time when John J. Ghingher, State bank commissioner, may permit restricted cash withdrawals from the State’s banking institutions under the emergency bank act. | erisis arose | master National ‘This picture taken immediately after the House of Representatives was called to order, shows the mem- tjon to reduce the quantity of gold in { bership bowed in prayer before taking up their legislative task. —Assoclated Press Photo. THREE PAYDAYS Steps Taken to Aid Marines on Duty Here. To ease the banking situation for ‘about 100 Marines on duty at headquar- ters in the Navy Department, officials decided there will be three paydays this month instead of two. Maj. Gen. Ben H. Fuller, commandant of the corps, signed an order author- iging the paymaster to disburse funds for the enlisted men tomorrow, March 20 and March 30. Officials explained that s0 many demands have been made for extra vouchers since the fiscal at the three paydays were decided upon. NATIONAL SUPPORT BIVEN ROOSEVELT Governors, Churchmen, Labor and Others Urge National Confidence. ‘The Governors' proclamations issued yesterday, urging unity on the part of the people and prompt action of Con- gress in support of the President, wdfe made in response to a proposal made to the Governors' couference March 6. This proposal came {rom & non-par- tisan committee representative of relig- ion, labor, agriculture, business and other elements of population, ‘The committee initiating the Gover- nors’ proclamations included Rear Ad- miral Richard E. Byrd, retired, cpafr- man: Willlam Green, president Amer- ican Federation of Labor; Louis Taber, Grange; O'Neal. president American Farm Bu- reau Federation; Cardinal Mundelein, Rabbl Stephen S. Wise, Dr. Harry Em- | erson Fosdick, H. 1. Harriman, presi- dent United States Chamber of Com- | merce; Alfred E. Smith, Newton D. Ba- ker, Daniel “Villard, Dr. Nicholas Mur- ray Butler. and Walter Lippmann. Church Leaders Active. Leaders of church orgsnizations have taken steps to have each Governor's proclamation read from the pulpits throughout each State next Sunday. Gov. Lehman called upon the people of New York State “and each and every elected and appointed public official thereof. as well s public officials of the pclitical subdivisions thereof, to render | whole-hearted and unflinching co-oper- ation to the President of the United | States in his efforts to bring about a return of economic, banking and finan- clal stability.” Gov. Pinchot of Pennsylvania urged “all men and women of good will throughout this State, without regard to politics, partisanship or any other consideration except the common good, to give their loyal support to the Presi- dent of the United States in his patri- otic and promising effort to lead the | Nation out of the morass of doubt and fear in which it has been struggling and | from which, under his leadership, it | already has begun to emerge.” Faith Rededicated. [d Proclaiming the day as one of “re- Edward_A. | THINKS GOLD SHOULD BE TURNED INTO TRERSURY |, Ermar e i g . |lina of their falth and confidence in | Mrs. Robert H. Dunlap Exchanges 'our present leader” Gov. Blackwood | | urged his fellow citizens to “revive their | $25 for Greenbacks as an | spirit of unselfish patriotism, so as to | be able to discard politics and group | and sectional interests in s pur of co-operation with our President.” “We have assurance” he continued, “that this spirit animates our whole people and that there is throughout the Na- tion a spontaneous uprising of confi- dence and hope.” “The situation demands of each and | every one of us the fullest measure of co-operation with our President in his_stupendous task of restoring our economic balance, our happiness and prfipemy," said Gov. Horner of Illi- nols, Example. 758 K street, | . 1t H. Dunlap, 1 Mrs Robe 1d should thinks Americans who have gol turn it in to the Treasury and get paper currency for it. and has put her belief into an example for other Americans. | Yesterday she took a $20 and a $5 | gold piece to the Treasury and ex- ‘ changed them for greenbacks. | Expiaining her action, she said today, | “I remember that in England in 1931 everybody turned in all their gold, even | their wedding rings. Then I remem- | bered these coins that I received at| Christmas, so I thought I might be able | to set an example. We are as patriotic | lish.” uN‘l’r‘:. El;‘smap is the widow of Gen. Robert H. Dunlap of the Marine Corps, who was killed in a landslide in France about & year ago. | | JUST LEARN OF HOLIDAY | Snowbound Villagers Renew Cnn-i tact With Outside World. DINKEY CREEK, Calif, March' 9/ () —The bank holiday was fresh news | key Creek yesterday. | O ey the inauguration of Franklin D. Roosevelt and the death of Mayor Anton J. Cermak of Chicago from an assassin’s, bullet. Six thousand feet above sea level i n Attacks Suspicion. “It is & serious fact” Gov. Miriam A. Ferguson's proclamation to the peo- ple of Texas said, “that we as a people have suffered ourselves to lose faith, not only in the Government, but in each other. If we can but overcome the silent whisper of suspicion and the fear of the future, it will be easier to surmount our material difficulties.” Mrs. Ferguson appeéaled to all “red-blooded Texans” to begin proclaiming their faith in the Government. Gov. Buck of Delaware asked for & spirit of co-operation with the Presi- dent and called upon “our representa- tives in the national Congress to give concerted support to such medsures as | will vest in the President such powers as will enable him to supply imme- | diately such remedies as will guaran-| tee economic stability, restore con-| MONEY EXPANSION * ALREADY POSSBLE $3,000,000,000 in New Cur- rency Could Be Issued Under Present Laws. By the Associated Press. Banks of the country can issue $3.- 000,000,000 in new currency without the shifting of a single comma in present | laws. This realization emerged forcibly yes- terday from a profusion of talk about banks, money and scrip, and more espe- | cially from President Roosevelt's belief | that general resort to scrip will prove | unnecessary. Authority for most of the huge ex- pansion in cash has existed for more than a year, has been used by the banks | t & limited extent and can be used further when members of the Federal | Reserve system and national banks choose. It was given in amendment 1o the Federal Reserve act and in the Borah rider to the home loan bank law, amending the national banking act. U. 8. Securities Allowed. Originally, Federal Reserve notes had to be secured by u 40 per cent gold minimum and 60 per cent in eligible commercial paper. The Glass-Steagall resolution permitted the substitution of | Governent obligations for commercial paper, which the depression made scarce. When the resolution was enacted member Reserve banks had $2,920,000- 000 in currency outstanding. In the Treasury and with the Federal Reserve agency to secure this currency was $2.- 060,000,000 in gold, or more than 70 per cent of its value. was & $1,000,000,000 backing in com- mercial paper. | #pproximately a year, outstanding Fed- | eral Reserve notes totaled $3,865,000,000 | and were secured by $2,180,000,000 in | | 8old, or more than 55 per cent of their | value, $1,032.000.000 in commercial pa- | Per and $662,000,000 in Government | bonds. Then besides, the Reserve member | banks had $220,000,000 in gold which could have been used to secure more currency, making an aggrega 1 | $2,400,000,000 in gold. i | . _This meant that u.coo.ooolgw as the 40 | mum ' gold security and putting u | $3,600,000,000 for the 60 pg- cent, res | quired in commercial paper and Gov- | ernment bonds, member banks could issue an aggregate of $6,000,000,000 in ' currency, or more than $2.000,000,000 in excess of outstanding notes. Added Expansion Possible. Aside from this huge figure, national | banks still could do some expanding of their own. They have authority to cir- | culate nationul bank notes up to the total value of their capital stock. Formerly, for every bank note cir- culated, the national banks had to put up at the Treasury a like amount of | 2 per cent Government obligations— consols or Panama Canal bonds. On this basis they had issued $666,000.000 in bank notes out of $1,600,000,000 in total capital stock. They still could have issued $934,000000 in national bank notes, but were limited by the scarcity of 2 per cent oblightions. Then last July the Borah provision extended the circulating privileges to Government bonds bearing up to 33 per cent interest. In less than a year national banks increased their note circulation $156,000,000. But that leaves more than three- quarters of a billion in capital stock, of which they still can take advantage to issue more currency whenever they want. by using this per cent mini- — POSTAL CHARGES CUT Penalties for Storage of Delivery Letters and Packages Suspended. If you don’t have the money to ac- cept collect on delivery letters and packages sent by mail, you won't have to pay any storage on them for a while. This is one contribution made by the Post Office rtment to its patrons during the banking emergency. Orders to make no demurrage charges were sent out by Postmaster General Farley, effective “until further notice.” Ordinarily a charge of 5 cents a day for each letter and package is made after 15 days, the total not to exceed 65 cents. ASKS SILVER FOR GOLD the Glass-Stegall | Then also there | the Sierra National Forrest, Dinkey fidence and relieve unemployment.” Creek dug itself out of snow-bound iso- | 1ation yesterday. Having plenty of food i and fuel and no access to money, the INDIANS PAY IN GOLD folks will just stick to the family | hearths. DEBT HOLIDAY TABLED LITTLE ROCK, Ark., March 9 (#). —By a vote of 18 to 9 the Arkansas Senate last night tabled a House bill providing & 90-day moratorium on all debts, public and private. - There was no debate on the motion to table, which killed the bill. It would take fromr courts the right to enforce collection of debts during period, haste to &OMIM at learn Quickly Respond to Help “Uncle Sam Out of Trouble.” GALLUP, N. Mex., March 9 (#.— Gold came out of hiding yesterday when news of the banking holiday penetrated the Black Mountains, wildest and most | inaccessible region of the Navajo res- ervation. N A trader reported that the Indians, paying in gold, cleaned him out of his :t:ck of g:g:e;::a j{l& receipf of e news, dians sent & messenger “if Uncle Sam is in 1“SmArt Man” to Beat U. 8. Going Off Standard. SACRAMENTO, Calif, March 9 (®). —Five thousand dollars in gold was brought out of hiding to & bank here yesterda; 5 Joseph H. Stephens, president of the Merchants’ National Bank, said a mal "HURSDAY 'SOUND CURRENCY' HELD PRIMARY AIM Question of “Will There Be Inflation?” Partly Answered in Negative. M BY MARK SULLIVAN. All the steps taken by President Roosevelt in anticipation of the meet- | ing of Congress today, and all the ac- tions done about banking, point to-! ward maintaining strictly what con- servatives call “sound currency.” There might be & temporary increase in the amount of paper currency. It is to be borne in mind, however, that the more than four billlons of gold now held by the Treasury and the Federal Reserve System, and the energetic | steps to keep this gold and acquire more, make it possible to increase the amount of paper currency by some | three billion dollars and still remain | within the Jegal requirement of $40 in |gold for each $100 of paper. { All the evidence in Washington re- | flects » state of mind on the part of the administration which aims toward preserving sound cuwirency. They admit with a smile, what every one must ad- mit, that the country is for the moment ! about half way off the gold standard. | The inference, however, from every a | tion and utterance, and from the ma: | ner of the men most concerned, is that I they intend in due course to get back | fully on the gold standard. To say the |same thing another way, there is no | faintest evidence of intention to inflate the currency with paper or silver. There is no present evidence of inten- | |the standard dollar, though it should | be added there are persons who predict | this must come. Some Exists Already. ‘The sum of all this would seem to | | constitute an answer, 30 far as an I answer can be made on present appear- ances, to the question “Will there be | | inflation?” It must be borne in mind, | however, that inflation is to some ex- ! tent an intangible thing. It is, in part, & matter of fact and in part a matter of public psychology based on fact Persons ask “Will there be inflation |as if infiation came about only through | Congress on & given date enacting “we | hereby inflate.” Inflation does not | ordinarily happen that way. There is | a more common way. That way has already happened in the United States | and the fact is that at this moment | some inflation exists. Inflation properly understood always | | arises from one cause, the fact of Ii | government spending more than it takes | !in. After a government has done that | for some time it usually yields to the | temptation to print fiat “currency in | | order to meet ils deficit. That is the | | direct type of inflation understood by everybody. We have not done that, and every-; body understands that under no cir- | cumstances would we be willing to do | | that. We have pald our deficits not by printing dollar bills, but by printing | Government, bonds, which have been | sold to the public. Printing and issuing | -V bond for a thousand dollars can be, | as respects inflation, much the same as i printing a thousand one-dollar bills, | The difference is mainly one of time. When I Government last week LmuedE many thousand dollar bonds, each of | | those bonds was and is convertible into | dollar bills in 91 days. Baruch’s Views Quoted. As it was put by Bernard M. Baruch, testifying before a Senate committee, “I can see no fundamental difference between what we have done and the | proposal to issue Federal Reserve notes and other currency to pay for our def- icits which our inflationists now pro- | pose The inescapable fact is that the Gov- emment has issued so many bonds that a large part of the public, especially the financial part of it, came to doubt whether under present conditions the Government would pay them in gold when due. Along with this arose doubt | whether the Government would be able | to redm its dollar bills in gold. That | this doubt existed there can be no ques- | tion. This doubt is a state of mind | Which is in itself inflation. There can It now is. Presently, unless it changes or is checked, it will express itself in a disposition to sell dollars. Selling dol- lars merely exchanging dollars into goods. That accounts for the rise in prices of goods, which is an early state of inflation. Termed Financial Prophet. ‘The axiom running through all this is that, whenever a government con- tinues for a sufficient time to spend more than it takes in the result is inflation. Our own Government reached that point some weeks ago.' It was on February 13, the day before the Michigan bank closing, that Mr.| Baruch told the Senate Committee that “I fear we have gone to the limits of prudence already in this method of; Federal financing * * *” Events since | that day have proved Mr. Baruch a prophet. | ‘Those who now seek the answer about | whether inflation will go on or be ar-| rested will find the answer solely in' what Congress does or fails to do to! bring Governmént expenses below Gov- ernment income. Congress has failed to do that for three years continu- ously. That failure has brought in-| flation. When Congress brings expendi- tures below income we shall know that | inflation is arrested and averted. ‘The answer will come, not when Congress legislates about banking but | when it legislates about reducing ex- penditures and otherwise keeping ex- penditures below receipts. Whether Congress will legislate on this point| during its session the latter part of this week remains to be seen. does not it will act presumably when it meets again some two weeks from now. MORE BRITISH SHIPS BOUGHT BY JAPANESE Two English and Two Canadian Vessels Bring Total Purchases to Nine Since Jehol Drive. By the Associated Press. LONDON, March 9.—Japan bought two British lnflm' l:: fi:na"a‘d,hn sh‘;;: sterday, bring nine the number fi vesu{. it has purchased -since the outbreak of hostilities in Jehol vince. ‘The ships purchased yesterday were the Peninsular and Oriental Line’s 6,000-ton Padua, the Glen Line's Glen- shane of 6,498 tons, the 5.497-ton Cana. dian Inventor, and the 5,384-ton Can dian Mariner. ‘The two Canadian ships will be used i scrapped for the metal they contain. Japan -paid about $36,015 each for the two British craft. The price of the Canadian vessels was not revealed. SEA HERO PROMOTED for trading and the others will be: ARCH Ohio Studying Plan To Pérmit Trading In Bank Passhooks By the Associsted Press. OLE' It calls for publication of pass- book quotations in newspapers in & manner similar to the quota- tions on stocks and bonds. Meanwhile, Cleveland banke: ‘were called to discuss the & means of enabling need of immediate funds to sell ,000,000 tempot in banks of this district. ization to supervise passbooks may be were under oonsideration by bankers in & number of other large Ohlo citles. CZAR DEA SPREADS 10 WALL STRE Would Adjust Delicate For- eign Exchange Operations During Emergency. By the Associated Press. NEW YORK, March 9—The “czar” ides is spreading to—of all places— Wall Street. Long ago base ball decided to get itself & czar in the person of Kenesaw Mountain Landis. The movies have one in Will Hays, whose sway is mighty in many cinema matters. Now the Street that is known the globe over as the main lane of the big money world is hearing talk of a dic- tator. He would be a referee to adjust the delicate operations of foreign exchange transactions during the present emer- gency. Many men of the financial com- munity believe Wall Street is prepared to_accept him. The word “czar” is not officially used. Bankers shy from it in this connection. It is believed, however, that a central office to pass on foreign exchange oper- ations would necessarily involve the granting of wide powers. The proposal was under wide discus- sion yesterday. It was pointed out that a program of this character would be in line with measures adopted during the World War. At that time Fred I. Kent. vice president of the Bankers' Trust Co., was lent by his institution to function as a foreign exchange ‘‘czar.” ‘The project has not got so far as naming any specific individual. It is understood, however, that headquarters for any such designee would probably be in the Federal Reserve Bank of New York and that the bank might conceiv- ably take over the direction of such functions. MARTINEZ RECOGNIZED |Salvadorean Regime Gets Approval of Uruguay Government. SAN SALVADOR, March 9 (4 —The government of Uruguay yesterday recognized the regime of President Maximiliano Martinez. Gen. Martinez took office in Decem- ber, 1931, after a military coup which sent. President Arturo Araujo fieeing IHI:, exile. = year ago the State Department in Washington refused to receive a special emissary seeking recognition for the Martinez government, on ground that it had not been consti- tutionally reorganized. Herndon Fire Auxiliary to Par- ticipate in Vaudeville Show. Special Dispatch to The Star. HERNDON. Va. March 9 —The; Ladies’ Auxiliary of the Herngdon Vol- | unteer Fire Department has made ! plans for the auxiliary’s contribution ! to the vaudeville entertainment to be | presented jointly with the Herndon | Chapter, Order of Eastern Star, the ' Floris Community League, and the Herndon Volunteer Fire 'Department the latter part of. this month. 1 Mrs. Theda North Filly reported a | contribution tosthe fire department of | a stretcher and a first-aid kit, secured | with proceeds from the Auxiliary “Card Club” of the Fire Department. Missionary Group ieetl. HERNDON, Va., March 9 (Special) — The Woman's Missionary Society of the Wolfe Memorial Methodist Episcopal Church South, met with Mrs. B. F. McGuire Tuesday afterncon. Mrs. Magnus T. Wilkins read a paper on the duties of a deaconess in the church and missionary field. Mrs. D, N. Brown also spoke. —_— Legislators Invited to Ball. ANNAPOLIS, Md., March 9 (#).— Members of the Maryland House and Senate yesterday received their invita- tions to the Biennial General Assembly ball to be held March 16 at St. John's College. This affair usually climaxes thelmclll calendar of the legislative session. 1 | Starts Friday! The Hecht Co.’s 37th Anniversary Turn to pages B-6 and Ex-Master of American Merchant Sails as Leviathan Officer. n came into the bank and emptied & sack of gold coins on the counter, asking that it be exchanged for silver. ac- commodating him, Stephens asked where he got the gold. “Well,” the man said, “I knew this was ewuu.: !e?; ll;:‘oll“:re':oout el Er:‘:t:" x'-:: :&w v ihat the United NEW YORK, March 9 {#).—Giles C. Steadman, master of the American Merchant when it rescued the crew of the f Exeter Ci A lathan l.:l,t ight Lev] nf as ‘The 7 and read the amas- ing news . . . also see to- day’s other evening papers for more infor- ! mation HULL WOULD AID FOREIGN ENVOYS LOS ANGELES REQUESTS POWER TO ISSUE: §CRIP Nearly $50,000,000 Worth Print- ed—Preparation of Regulations Holds Up Pay Checks. | By the Associated Press. Urges Banks to Permit With-| drawals for Current Expenses. Secretary of State Hull has urged the Treasury Department, take initial steps with a view to per- | mitting foreign representatves in the United States to withdraw sufficient | funds from the banks in Washington and elsewhere throughout the country 10 cover current expenses. Confers With Woodin, - ry Hull took the matter up| at the request of | thorised by the Treasury. foreign diplomats in Washington, to| house | local Secreta. last night with Secretary of the Treas- | ury Woodin upon being advised that| many of the embassies and legations are temporarily embarrassed as & re- sult of the bank holiday. He suggested to Secretary Woodin that the regulations under which the banks are operating be made sufficiently broad 50 as to provide funds for foreign ! consuls in various parts of the country. Undersecretary of State Phillips, in commenting op the situation, said the i diplomats sought no special favor or treatment in view of the situation, and that the statutes governing diplomatic immunity do not require the Treasury to make any special provision for with- drawal of diplomatic funds deposited in banks. He characterized Secretary Hull's petition as more of an accom- modation or a courtesy. Held Large Amount. Every country represented in Wash- has consular offices in the larger cities of the country. No idea was given as to the general ‘amount of diplomatic !funds tied up in American banks by the bank hodliday, but it is, neverthe- less, a considerable amount. ‘The request made of Secretary Woodin respecting the withdrawal of funds as necessary, Mr. Phillips ex- plained, does not extend to any banks that closed before the legal bank holi- dlly‘.'u proclaimed by President Roose- vel — BODY OF CERMAK LIES IN STATE IN CITY HALL| i Chicago Continues Today to Pay| Homage—Rites to Be Held Friday in Stadium. By the Associated Press. CHICAGO, March 9.—Citizens of Chi- cago today continued to do homage and pay respects at the biler of their as- sassinated mayor, Anton J. Cermak. Surging crowds greeted the body on ! its arrival yesterday from Miami, Fla., and throughout the day and evening ad- | mirers of the late Democratic leader | passed through the residence at the rate of 2,000 an hour. ‘Today's program called for removal of the body to the City Hall, which for so | many years was the stage of Cermak's career. There for another day it was | scheduled to rest upon a catafalque| draped in purple and black velvet that | other thousands might view it. | The three-day observance was to! reach its height Priday in the huge Chi- cago Stadium, where ministers of three faiths and Gov. Henry Horner will eulogize the man. | Col. C. B. Hodges already has arrived | in the city as the personal representa- | tive of the President and the National | Government. Mayors of other cities, in- _t{:.dmr[fl P;lnlr( c)e-xuulek of Jersey City, | close friend of Cermak, ar illund P ‘Tomorrow night Democrats said the; | planned to pause for a few hours in their mourning to meet with Gov. Hor- Der to discuss the task of filling the | mayor’s chair. Pinal decision, one re- Ml?:d."wld bet}eft to the Democratic council in an effort to preserve th unity of the party. 5 5 URGES DICTATOR POWER |Nevada G. 0. P. Governor Issues i | ? | | i 1 | | | Proclamation to Congress. CARSON CITY, Nev.. March 9 (@), —F. B. Balzar, 'Nevada's Republican Governor, yesterday issued a procla- mation calling upon Congress to give the President “full and unlimited su- thority and power to deal with the present crisis.” |said. “to the end that fear and un- certainty may be driven from the minds of our people.” CUT-PRICE Service-Specials To Keep Force of 40 Men on the Job In order not to “lay off” men during Bank Holiday we offer these 2 NO-PROFIT speci to provide a volume of work for our shop. "\ Valve & Carbon SPECIAL (FORDS ONLY) Regular Price, $5.50 i3 95 PARTS EXTRA Friday and Satur -~ Only No. 2 $2.91 Value for Five Quarts Pure ia Oll—Re, FREE! FREE! FREE! “Jig-Saw Puzzle” Given With Every Purehase MOTOR (@) COMPANY 2N. Y. Ave. NW.' | Such power should be delegated, he | LOS8 ANGELES, Calif., March 9.—The clearing house here sent a telegram to Washington yesterday asking special suthority to begin issuing scrip imme- diately. Nearly $50,000,000 in scrip has been printed and is read for use. Los Angeles banks still have not started cashing pay roll checks as su- A clearing statement said that before pay u;"be u‘:hed. preparation of lons is “necessary to pre- vent mflnmu for hoarding,"” p-nu that “such regulations are now be: prepared.” o PASTOR'S RITES SET Services for Rev. W. E. Glanville to Be at New Market Tomorrow. Spectal Dispatch to The Star, MOUNT AIRY, Md, March Funeral services for Rev. W. E. Glan- ville, Ph. D., 65, rector of Linganore parich, Protestant Episccpal Church, New Market, with charges at New Mar- ket, Mount Alry and Poplar Springs, will be conducted at Grace Church, New Market, tomorrow morning at 11 o'clock by Right Rev. Edward Helfenstein, Bishop of Maryland. Interment will be made in a Baltimore cemetery. Stresses Character Building. SILVER BPRING, Md, March 9 (Special) —Dr. E. W. Broome, superin- tendent of public schools of the county, in an address before the Parent-Teacher Association of the Woodside School, stressed the need of character building rather than the development of skill in education. Mrs. Walter Crossan’s room won the attendance prize for the lower graaes and Mrs. Grace Zeller's room won the prize in the higher grades. Romney Schools to_(I]Ole. ROMNEY, W. Va., March 9 (Special). —Elementary schools in Romney dis- trict will be closed tomorrow, except the eighth grades, because of lack of funds. it was announced today. The school ordinarily would run & month longer. Temporary provision is being made for the excepted eighth-graders to permit them to continue to prepare for the elementary tests at the conclusion of the school year. T is human nature to g’ive least tl’mught to the things with which we are most familiar. Consequently people don’t think about the sugar they use. But sugar is the one essential food to which you should give most serious attention. Sugar is made from a variety of things. It is made in many eountries—made un- der widely different sanitary conditions. lse There is a way In which you can be certain that the su- gar you and your family use is pure, clean, wholesome sugar. B Jug””’ Then you will know that thesugaryouuseis made from sugar cane Then you will know it is made under the most modern, sanitary conditions Then you will know that it is 100% Pure Cane Sugar.Madein theU.S.A. and guaranteed by 4 The Nefional Sugar Reftking Cev of N.1. Ditference In Sugar — Pure cane sugar, as refined in this country, has established & « definite standard of quality by which America’s sugar values are measured and judged.