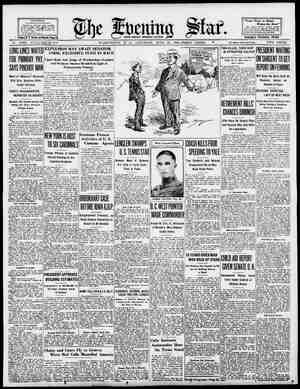

Evening Star Newspaper, June 12, 1926, Page 29

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

THE EVENING STAR, WXSHINGTON, D. C, SATURDAY, JUNE 12, 1926. ¢ FINANC IAL. » 29 *——_—WM NEW YORK CURB MARKET PRGES OF TURKEYS SLOWLY INCREAE Buyers Out Early Today at Center Market, But Trad- ing Is Not Brisk. Turkey prices. much lower than usual the past few weeks, are grad- ually increasing. With increased prices has come a decreased demand, although, it is stated, the demand in- variably ' decreuses as the weather gets warmer. There was a time when very few sales of turkeys were made during the Swnmer months. Live turkeys, quoted several day 'ago at 25 cents, were 35 cents todu Dressed stock was quoted at 35 and 28 cents. Prices are expectei tu fur- ther advance in the near future. Only slight changes in other poultry products were reported during the week. No declines in meat prices were in evidence this week. Pork products were decidedly higher; no decreases in lamb or veal were reported, and | beef prices remained at practically ! one figure. ! Butter Market Firmer. i Storing of butter by packers re sulted in making the market on dairy products a trifle stronger. Prices ad vanced in some of the big butter cen ters, but the local market was not af- fected, dealers reported Light supplies of watermelons met a light demand, but the market con- tinued steady. with practically no change in prices. Many sales are being made direct to retailers. prices ranging from $1.50 to §2 | Cantaloupes of various sizes and quality are being received in quanti- | tles in excess of the demand. Most | of them are Salmon Tints from the Imperial Valley i . prices ranging from § Homegrown awberries are sup- plying the market. The season for the berries is far advanced. dealers report, and the rruit is expected to become scarce in a few days. Prices asked. quality and condition con- sidered, ranged from $3 to $7 a crate of 32 quart boxes. North and south Carolina blackberries are com- | ing in liberal quantities, muhmg_ al weak market. Prices this morning | ranged from $3.50 to $4.50. 1 Plenty of Tomatoes. | Florida and Texas growers are send- ing liberal supplies of tomatoes. A moderate demand and steady market | is reported. Poorest quality sold as low as 75 cents. Fancy counts sold as high as $4. Liberal supplies of string beans of exceptionally good quality from the arolinas weakened the market and brought down prices. Bushel hampers “are selling at from $1.50 to $3.50, and some of the shipments were received .tn such poor condition that they were not accepted. Growers in the Norfolk, Va., sec- tion and South Carolina are furnish- ing the local market such large quan- 1ities of cucumbers that prices have dropped and the market weakened. A moderate demand for light ship- ments of corn from Texas is reported. Much of the corn is in splendid condi- tlon, dealers report, while some is not worth buying. It is in moderate de- mand at $2.50 and $2.75 a bushel ham r. ”Buyers were out early this morning getting_supplies for their week end trade. Buying was not exceptionally brisk, however, retallers realizing that large numbers of patrons will be out of the city for the week end rest period. Market Prices Today. Butter—Fancy, one-pound prints, 46a47; tub, 45a46. Eggs—Fresh, selected, 31a32: hen nery, 33a34; current receipts, 30a3l. Poultry, allve—Turkeys, 33; Spring broilers, 40a45; Plymouth Rock broil- ers, 13 to 2 pounds, 48; smaller, 40a 43; white Leghorns, 35a38; fowls, 32 * roosters, 20; ducks, young, 20; old, keats, ung, 70a80; old, 35ad0. Dressed—Turkeys, 35a38; broilers, 50a §6; keats, youns, 90a1.00; old, 40a50. Live stock—Calves, choice, 1213; medium, 10a11; thin, 6a’ and medium, 13%; light, choice, 15; iambs, 17. Meats—Beef, 17a18; lamb, 34a37: veal, 20a22; dressed pork, heavy, 19: pork loins, 35a36: Western, 30a32; hams, 36; shoulders. 24a25: fresh hams, 33a33; fresh shoulders Fruit and Vegetable Review. Today's market report of fruits and vegetables (compiled by the Market News Service Bureau of Agricultural , Bconomics), says: Cantaloupes—Supplies moderate; de- mand moderate, market steady; Cal fornia, Imperial Valley, Salmon Tints, Received by Private Wire BY WILLIAM H. HEFFERNAN. NEW YORK, June 12.—The curb market closed this week with the up- ward movement still in progress, but with demand still confined to special- tles. One of the outstanding strong Spots was Auburn Auto. Buying here was In direct response to the declara- tion of a quarterly dividend of $1, thereby placing the stock on an an- nual $4 basis as against the previous $3. According to the president of the company, second quarter earnings ex- ceeded those of the first three months, total earnings of the first half year exceeding $8. At 591, Auburn Auto E 5 points above the Friday final period. Continental-Tobacco was in domundl on reports that plans for a merger _ NEW_YORK, June 12—Following is an official list of bonds and stocks traded in on the New York Curb Market today, with the volume of sales and prices up to and including the close of the market: Sales in INDU! 8 hundreds OSCRIARY. <ow. | clom. outh. . . 108 108 outh pid 113 1123 1 k Bar vte 11% oAb $orGem 1388 133 1% Am & i i 4m Gar & Bl 3% 4 i as SOSEESE823.0m2 008 2E805..8 7 Consol Continen 1 T 2 Bl Ronafeh Bad El B&Sh n Corp i a3cacsiod s FESS FEIFN S SIS, FESE F FSSE S FEL 2ot D cDi02-1D ¥ gl IR B IREREE $EE FESEE S5PE o coz e e Mid pr Ties Mohawk V new ohawk Hud Pw Municipal _Serv atl Elec Pow A at P 1 Lo li!lrloln e & , Bratt & Lamp'¢ 80 % Broct & Gamble 1 1 fit; B X0 31 ARG B few § 1 alot ... B T B R R B e DO DR B SR 00 B BO DS 095 DDA h DB - LRGDE b HoAS A D) Fes it b e ooy 312431309808 risusisas! LT = o = o corrcan Py SINIPESES - o~ 3 N BRI AD DD O DD B - B ez Oras ny n nk Gld M Lt rst Thour G M . oidan Cen M. oldfeid Con ecla Mine . ay Cop_Cor . S e Fi S - SSmaSiser i on S Sui bt ke o e .. o a3 2GS i s S W F S im, Tonopah Ext. Tri Bullion Unt Verde Ext. Ttah Apex. 1 Wenden Coppe: 1 ~ B ) wniaSes e Direct to The Star Office with the Phillip Morris Co. had been completed. These, howéver, have yet 10 be approved by directors and stock- holders. Profit-taking came into the market for Glen Alden Coal shares, carrying the price down more than a point when it sold just above 162. At this figure the price was taking into ac- count the semi-annual $5 dividend which recently was deducted from the selling price. Public utilities continued to be fea- tured by United Gas and Improve- ment and Northern States Power class A, both of which were up a point or so. Tropical oils moved fractionally higher, but others of the group did comparatively little. The close was fairly active with buying operations still in progress. ales in INDEPENDEXT OIL STOCKS hundreds. 0o~ e 19 Am Con Oilfd. . i Columbla 3 Creols Synd... . § Crown Cent Pet 2 Euclid Oil Co. 1 Gibson Oil Cor.. 3 Leonard Oil. 7 Lion Qi1 Am Maracaibo. k Nut Gas.... g i row 1 Gulf Oil of Pa... 8 Mex Pu ount Prod. atiaBion PISPEEEES PRPEE Sales in units, 10 Borne Scrymser 100 Chesebr'gh Mfg.. 1000 Continent Oil n.. 00 Cres 3 SR S csaizas ERERSIRAEL! ST BONDS 1Allied Pk Bs.... 7 16 Am Gas & EI 5. 1011 20Am Pw & Lt 6s. 90T, 8 Am P & L 0s nw 100 W 6y 9475 Cudahy 5ls 19 Det City 6 1 Det Ed 7a 2! 60 Duke R 3232 10 Kresge Fair 12 Keith, BF 61 2 Laclede Gas 5% 38 Lehizh Pow 68 A Sean3555Soselootnos0cxs B s PR S PARL I P SRS o PRELEE 8 Leipzie 2onh, B IR PSNTR PEESSTES R nSa3ER e RRRERBS 82T ™ Iy SeE R Aok F S ey xeDSrmmnoeroToroRseOTETS EEEENERSE R IRRRSIBIZEEE = & standards 36s d 458, mostly stand- ard 36s, 3.00a3.50: Jumbo 27s, 36s and | 45s, 3.25a3.75: mostly 3.50, soft over- ripe: all sizes, 2.00a3.00. Lettuce—Western supplies light; too few sales to establish market; home- gown 2 dozen crates Big Boston type, st, 1.26a1.50; poor quality, leafy, low as 50. Onions—Supplies moderate; demand light, market steady; Texas, standard crates Yellow Bermudas, United States, No. 1, 1.75a2.00; some ordinary quality and condition, 1.60; California, standard crates Yellow Bermudas, United States, No. 1, few sales, 2.25. Peaches—Supplies light; demand limited, market steady: North Caro- lina 6s, Mayflowers, ordinary quality and condition, 3.00; Georgia, 6s, Uneedas, medium size, 3.50a4.00; few large slze, 4.50. Potatoes—OId stock; supplies light; demand light, market dull; Michigan, 960-1b. sacks Russet Rurals, U. 8. No. 1, 6.26a5.60. New stock, sup- plies moderate; demand moderate, market steady; South Carolina, cloth- top stave harrels, Cobblers, U. 8. No. 1, 56.50a6.00; few ordinary condition low as 5.00; No. 3, 1.50a2.00. Homegrown Strawberries. Strawberrles —Homegrowns supply- Ing the market; demand good, market steady: homegrown, 32-qt. crates large varieties, 5.00a7.00, mostly 5.00a6.00: few higher; small varieties, 4.00u4.50. Tomatoes—Supplies light; demand moderate, market firm; Florida, 6s, ripes and turning wrapped, fancy count, 3.60a4.50; best mostly 4.00; choice count, 2.50a3.00; few high as 3.50: 216s and crooks, 1.50a2.00; poor- er, all sizes, 50a1.00 Jower, ‘Watermelons—Supplies light; de- snand light, market steady; sales di- rect to retailers; Florida, Tom Wat- wons, 26a28 Ib. average, 1.25a1.50; 30- 84 1b. average, 1.756a2.00. Cabbage—Supplies liberal: demand moderate, market steady; homegrown, barrels, pointed type and round type, 2.00a2.25. Asparagus—Supplies moderate; de- mand moderate, ‘market steady; Dela- ‘ware, crates, per dozen bunches, small size, mostly 2.50; few low as 1.80; me- dium size, 3.00a3.50; large size, 4.00a 4.50; few best, 5.00. upplies light; demand mod- erate, market slightly stronger; home- wn, barrels, large-pod varieties, 0029.00 per barrel. String Beans Firm. String beans—Supplies liberal; de- mand good, early market firm; later wmarket is slightly weaker on heavier ; South Carolina, bushel ham- ers, green, fair ?ua.my and condition, .00; North Carolina, bushel hampers, green, 2.50a3.00; very few sales North Carolina flat stringless, bushel ham- pers, 4.00; 6-peck hampers, 5.00. Squash—Supplies moderate; demand moderate, market steady; South Caro- Nne and Wi lm.mpefl.' BY STUART P. WEST. Bpecia! Dispatch to The Star. NEW YORK, June 12.—The striking episodes of the past week in the financial situation have been active buyin{ movements in parts of the stoc 4 market which have ht about numerous 5:3'-":« the year, the continued de. pression in French, and Italian paper currencl of cotton to new low levels. The change in the stock market position has been noted in these dis- patches for several weeks. ‘With the exception of the latter half of 1920 end the first of 1921, no more ex- tensive decline has occurred in such a short space of time than took place between the middle of January and the first of May. The decline in- volved a wholesale transfer from the accounts of the ovlrlgoeuhflv. into hands that were capable of holding them. The market thereupon resum the ul drift which been in- terrupted in Midwinter. lative campaign for t! newed, but along selective lines. Special Status of U. 8. Steel. A difference has to be noted be- tween the remarkable advance in United States Stesl common and the comparatively moderate gains in the independent steel shares. This points to the conclusion, which other clrcum- stances support, that United States Steel has been going up for reasons which do not tgply to other members of the group. It has been bought on the idea that before long there is to be a distribution of assets in some form, quite likely in that of a stock divi- high reo- jend, K Other steel stocks have been affect- ed only sympathetically. This is be- cause, while steel reports have been better, they have not yet suggested the two essentials for a period of gen- profitable prices, the other the reap- earance of forward buying. The situation is very such the same in the motor sections. General Motors has been moving forward rapidly, while other stocks in the same class have been slow to participate. The explanation appears to lie in the pros- pect that holders of General Motors are in for more special distribution. Also the company is in a peculiarly favorable position, as instanced by its plan for extending production sched- ules. Equipments Also Showing. Industrial specialties do not count s0 much. They can go up and down over a wide range on nothing but speculative causes. The strength of the railway equipments has been It fits in with the reports s m 3 eral expansion in the steel industry, one being re-establishment of inore the |} ed | & month or so of nol |ACTIVE BUYING CARRIES SOME STOCKS TO NEW HIGH LEVELS half of the vear. Wall Street has been too often disappointed in similar predictions to have too much faith in them now. But the equipment shares are closely held, are in small supply n the market and can be easily mow ed, especlally where there is a short lng:lst to work upon. 'way stocks have been strong, not because of anything new in th:{l‘ situation, but because of the anticipa- tion that the Autumn will bring a record traffic volume. This expec- tation has been supported by the Gov- ernment report on Winter wheat showing an increase of more than 36 per cent in the indication as com. pared with a year ago. And against this the Spring wheat condition is low. On the first of June, it stood at 78.5 per cent, as compared with 87.1 last year. But this s chiefly due to the backward season, and the de. ficlency might easily be overcome by weather. srewing Wheat Prices Down. The wheat market evi this view. It is down wnfimfi;k:: the weelk. The notion that very low gl;ces will discourage production and themselves bring about a read- Justment of the crops has certainly not been borne out in the case of cot- ton. Here prices well below the 17- cent level are under what are com- Guction ‘cont Gxcopt I sharimetPR on e n the vuyr;d mnaunltleo. P r rat time since the tion of the Government war m there is to be no new Governmerit financing, colncident with the quar- terly tax collections. This has been interpreted as a proof that the Treas- ury balance is still on the right side. Still it may also mean that the mar ket is being prepared, as it was in 1922, for much more important Gov- ernment financing later. This finane ing quite possibly would be connected with the prospects of the Third Lib- erty loan, maturing in 1928, French Position Unchanged. The French position has not been essentially changed by any of. the ‘week’'s developments. All sorts ‘of recommendations’ have been made with the object of sustaining the franc, «yet the selling continues. suggestion that imports be restricted able until the terms of the debt set- tlement are actually approved, and this seems some distance off. Even if there were to be new Amer- icam loans it is doubtful if these would prove more than a stop-gap, so long as the balancing of the Fregc! budget through the only xumalng up GENERAL BUSINES SITUATION 15 600D Steel Industry Holding Its Own—Some Money Is Reaching Retailers. BY J. C. ROYLE. Special Dispat:h to The Star. NEW YORK, June 12.—The reser- voirs of purchasing capital in the United States are gradually filling up, but so far only small streams have begun to trickle over the spillwa into retall trade. The harvest fa on r of the agricul- s growing, but the he flood today in going to pay oif debts and clear old obligations. - None the less, the mer- chants of the country have benefited appreciably in the last week from an additional flow of money. Thi= is speclally noticeable in the und Southwest. In the Spring States the Government crop < dil nothing to dispel pes- regentment over the farm tinance situation, which is usually supposed to find expression in refusal to buy manufactured articles. The steel industry is holdng its own. aided by construction activity reflected in the letting of actual con- tr s for big work culling for ex- penditure of between $75,000,000 and $80,000,000 during the week. Lumber prices huve been remarkably steady in the face of rises in production, slight decreases in new business and con- siderable stocks accumulated at cér- tain Southern distributing points. Used Car Situation. The used car situation is the dom- inant fuctor for the moment in the automobile field, and it is now defl nitely determined that many large manufacturers are looking to foreign rather than domestic business to bolster up sales figures for the fu- ture. Tt is notable, however, that the company which made the latest price cut had the most active April and May sales in its history, approximat- ing 33,600 cars each month. The introduction of one of the new ‘‘bug" models next week will be closely .watched as indicating the general trend of public demand during the main portion wheat remainder of the year. Cotton textiles are exceedingly dull, with mills preparing to stretch vaca- tion periods over a longer space than usual until orders catch up. The raw wool market has shown improvement both at home and abroad and many keen judges believe prices are on the rebound. Silk manufacturers are con- ducting operations on a sharply re- duced scale. This does not apply to makers of fullfashioned silk hosiery, who are well engaged. Rayon opera- tions have been sufficiently heavy to absorb American production of raw material. Lake shipments have done their share to spur coal production, but the fuel situation is still in a most unsat- isfactory state, with many mining mergers in negotiation. The oil out- look {s bright, and pipe for oil and gas well use stands out as the most active product in the steel market. Furniture Trade Checked. ‘There has been a fairly well marked check to activity in the furniture trade, and the response to Fall open- ings of rugs and carpets has been slightly less active than in the last two years. This is uttributed largely to the change in character of new construction, which has involved larger building for industrial pur- poses. - Consumption of news print paper has been at extremely high levels, and while low contract prices have tended to reduce paper company profits, the volume of business this month prob- bably will exceed that of any June of history. Kraft papers have done ex- cellently. This is true also of composi- tions composed of sugar cane fiber. The manufacture of cellulose for films and other purposes from rice hulls, & waste product of rice mills, now I8 planned on a big scale. Strength in London has stiffened both copper and zinc prices, and lead buying has been active at present levels. i i MARYLAND CANNERS WARNED ABOUT LAWS Cases of Adulteration and Failure to Meet Sanitary Rules Will Be Prosecuted. Bpecial Dispatoh to The Star BALTIMORE, June 12.—Warning that the Maryland canning industry may be injured unless a high stand- ard is maintained, the State depart- ment of health has {ssued bulletins to Maryland canners calling atten- tion to requirements prescribed for the manufacture of canned goods. Canners were warned that viola- tions of the requirements will resuit in prosecutions of all violators by the State. Cases of adulteration of ma- terials and fallure to meet sanitary requirements have been reported by State inspectors, according to health officials. A. L. Sullivan, commissioner of food and drugs, declared that im- provement of the quality of Mary- land canned products is necessary to insure Maryland produced goods holding a favorable market. Importation of Itallan canned to- matoes and improvement of canning industry operations in other States have made it necessary to improve the Maryland products, if the volu of the Maryland canning industry is to be maintatned, it was said. “The demand for canned zoods is practically limited to first quality products,” Mr. Sullivan declared. He eaid there is litle market for prod- ucts of inferior quality and that therefore canners must sacrifice quantity production to output of first quality goods. Notice was called to regulations “prohibiting adulteration of canned tomatoes with water, skin and core juice, pulp and other substances” and to sale of decomposed, moldy, worm- infected or otherwise unwholesome fruits and vegetable: Your Banker, Knows. When in doubt about a security eonsult your banker. It is equally as much his interest as your to nr%t"m your savings. You trust him with your deposits—why not trust him with your investment problems? CHECK TRADING. ROME, June 12 (#).—With the lira again slipping downward, the govern- ment has instituted & new measure of control. Revoking its recent de- cree_limiting exchange operations to the Rome and Milan stock exchanges, it has ordered the restriction of ex- change trading to banks having an invested capital of 100,000,000 lire. TODD SHIPYARDS PROFIT. NEW YORK, June 12 (#).—Todd Shipyards Corporation reports profit of $715,608 for the year ended March 31, after interest and depreciation, but before Federal taxes, equal to $3.40 & share, against $226,5685, or $1.07 & the yeax belera, |WEATHER HAS PLAYED HAVOC WITH RETAIL TRADE THIS YEAR Babson Finds Spring Goods Have Moved owly—Advises Diversification of Stock to Roger SI BY ROGER W. BABSON. BABSON PARK, Mass., June 1 Undoubtedly one factor in the decline of general business in the last few months has been due to the abnormal weather conditions. The four great- est factors in trade are: (1) Necessary food, shelter and clothing; (2) specu- lation and the desire for profit; (3) style and the instinct of imitation; (4) weather conditions. Weather con: ditions are not only a factor in de- termining what people buy, but also @ great factor in determining when people buy. Trade in the North not only demands a Spring season, but it demands that the Spring season comes on schedule. If the season is late, this is almost as harmful as if the season dld not come at all. Therefore. it fs safe to say that the actlon of the Babsonchart in dropping from 15 per cent January 1 to 8 per cent at the present time Iis largely due to the abnormal weather condi tions. Merchants are no Summer weather, carrying heavy lines of Spring goods. Many stores are endeavoring to solve the prob with radical mark-down sales while some merchants are going into bank- ruptey. Owing to the fact that stores are heavily stocked with merchandise which they have been unable to move owing to weather conditions, they now have no money with which to buy a normal amount of Fall govds. Hence, wholesalers and jobbers are handicapped in _ getting business which in turn affects mills and fac- torles. This wenther condition, added to the short skirt, bobbed hair and various other radical style changes. have played havec with many lines of business. approaching The Farming Situation. “The farmers are especially upset. Ever since the war the wheat-raising section of this country has been com plaining. For a short time last year there was an increase in prices which gave a ray of hope, but this was found to be of only temporary benefit. Those who have been following the discus- sions at Washington must realize that the farmer has real problems, even though a solution of these problems is wot in sight. The farmer would not complain if the prices of his products rose and fell with the prices of the la- bor and supplies which he must buy. To have the price of what he has to sell go down and the price of what he buys go up is a situation which he can stand only o long. This is the condi tion which he faces today. The Gov- ernment farm product index nwmnber last Summer was 163 compared with of 8 points In favor of the farmer. In January this year the farm number was 152 compared with a fig ure for all commodities of 156 or 4 points against the farmer. Now the situation shows a farm index number of 145 compared with a general index number of 15, farmer. Of course, the situation may change at any time in favor of the . but the trend today s very un- tory. ever, the farmers’ courage was good the first of April, and they en- tered the Spring season with hope and determination. The constant back wardness of the season, however, wus very discouraging. The farmer was late in his plowing, late in his plant- {ng, and his crops wre late today. The prophecies floating about that we are to have a cold Summer with early frosts naturally disturb him further and make him wonder where he is coming out. Of course, all these prophecies may be wrong. With sat- isfactory Summer weather crops catch up very quickly, and 1926 mayv be the best year that the farmers have had since the war. The present uncer- tainty, however, has retarded pur- chasing on the part of the farme Thus business has been harmed weather conditions in the farming sec- tions in the same way—although from an entirely different reason—as it has been harmed by weather conditions in the industrial sections. A Cold Summer Ahead? “The forecasts of a cold Spring and Summer are based on the theory that the temperatures of currents change with the variations in the COMMODITY NEWS WIRED STAR FROM ENTIRE COUNTRY PITTSBURGH, June 12.—Small ewards are general in the concrete bar market. Truscon Steel, Jones & Laughlin and other mills report good numbers of contracts. Foundry iron is weak, with considerable tonnages placed at $18 for base grades. MONROE.—The Palmer interests of Chicago have brought in a gas well producing 42,000,000 cubic feet of gas & day. This is accepted as indicatin, that this field still has many years of production ahead of it. PORTLAND.—Sales of wool in cen- tral Oregon have been increasing in volume, with prices around 28 to 30 cents a pound. Negotiations indicate that Eastern mills are actively in the market. BOSTON.—Town officials of Sudbury state that Henry Ford plans a tory and an industrial village on the banks of Wask Brook, near Sudbury, provided he can get the necessary land. May deliveries of Dodge cars and Gra- ham trucks in Boston exceeded all vious records for those models. ATMNTA.—!}AIH;Q ‘“fi!‘?‘“th l}elor- have greatly benefited growing !‘o’;ncno crops, while the breaking of the drought in the mnorthern section and in South Carolina has improved cotton conditions. BOSTON.—Bankers in close touch with the textile industry in New Eng- land after a survey sald today that there was still no indication that cot- ton goods production had been ad- justed to demand, despite the curtail- nent of the last six weeks. e DIVIDEND INCREASED. NEW YORK, June 12 (P).—Stock of the Auburn Motor Co. yesterday was placed on an increased annual dividend basis of §4 a share, with a quarterly disbursement of $1 a share, which formely had been 75 cents. A stock dividend of 10 per cent also was authorized, payable 5 per cent on August 1 and 5 per cent November 1. The cash dividend is payable July 2. PG, COPPER STOCKS SMALLER. NEW YORK, June 12 (#).—Stocks of refined copper on May 31 declined to 138,735,000 pounds from 145,288,000 pounds the month before. The month’s production of refined copper amounted to 227,796,000 pounds, com- pared with 232,604,000 pounds in April. Forelgn and domestic shipments total- ed 234,346,000 pounds, against 237, 728,000 in April. TR, FAILURES IN UNITED STATES. NEW YORK, June 12 (#).—Com- mercial failures in the United States this week are compiled at 378 by R. G. Dun & Co. against 341 in five business days last week and 330 & mun’'s heat and, in turn, control in- land weather. Because the oceans are slow to respond to changes in solar radiation, and because of the time | required for the flow of ocean cur- rents, certain lags doubtless must be calculated. Hence, according to the theory, the most intense effect of sub- normal solar temperatures would be felt only after several years. Acocord- ing to the measurements taken by the Smithsonian Astrophysical Ob- servatory, the sun's heat has been below normal since early 1922. Re- cent measurements show a rising tenden but the solar heat iz still considerably less than the average for the past eight years. If there is @ relationship between solar heat va- riations, ocean temperatures and in- land weather one would expect a tendency toward extreme fluctuations and unseasonably cold spells this year and next. The above theory seems reason- able. On the other hand, both farm- ers and business men should clearly recognize that all scientists do not agree as to the conclusions reached At a conference on this subject at Babsor: Park last Summer, the chief of the United States Weather Bu- reau took a decided position against the populir conclusions that 1926 would be a cold vear. Apparently the best opinione of the United States Government gupport the position of the Weather Bureau that 1926 will be a normal year and that there is a good deal of bunk in most of this long-distance forecasting. The Gov- ernment belleves that some day long- distance forecasting will be possible, but that no method has vet been worked out by which such fore- casting is now possible. On the other hand, Mr. Browne and his fol- lowers have been taking an oppo- site stand and have the support of the country. To show how doctors disagree, I have two reports: one from Henry H. Clayton, who is now working with the Smithsonian Institution. relat- ing to olar conditions and weather. many of the best private interests in | COTTONRALLIES INTRADING TODAY Advance of 2 to 7 Points Scored by Staple Follow- ing Sharp Declines. By the Associated Press. NEW YORK, June 12 tures opened steady: July ber, 16.38; December. 16.37; January, 16.31; March. 16.42. Shrrp declines in the cotton market the past two days were followed by moderate rallies at the opening today. Liverpnol did not fully respond to Friday’s decline here and the local opening was steady at an advance of 2 to 7 points on covering for over the week end. Otherwise there appeared to be very little huying and prices soon eased off, oWing to continued favorable weather Cotton fu counts. July declined from 17.74 and December from 1641 to 16.24 uctive months showing net decline: 7 to 10 points at the end of the fir hour. to 17.58 4 ew Orleans Quotations. NEW ORLEANS, June 12 Cotton futures opened steady 16 October, 16 January. 16.08 bl m}trl’hl was activ today, and Liverpool was better than due f trades showed gains of 8 to 12 point the advance heing due to short cov- ering for' over the week end. Pric advanced a fev points additional after u_ls_s!an. with October trading at 15.87; December, 15.85, and January, 15.88, or 17 to 27 points down from the early highs and 13 to 15 points |under vesterday's close. Continued €00d weather and excellent crop ac count encourage selling - . CLOSES TWO MILLS | NEW YORK. June 1: (P).—Beld: | Heminway Co. announces consolic | tion of two of their smaller mills | larger units for economy in prod of broad silk and silk thread 2 Young. president, said the move did Mr. Clayton has come to the conclu- | not indicate reduction in output. The | sion that the South is growing cooler, but that the North is growing warmer and has no fears as to 1926. The other report is by the Abbe Moreux, director of the Bourges Ob servatory in France, who believes that we will see the shortest Sum- mers and the longest Winters dur- ing the next two or three vears that have been witnessed for over u hug- dred years. The personal observations of my own associates lead to the conclusion 160 for all commodities with & spread |that the weather is apt to be rather . . oo 2854310, erratic during 1926 and 1927, but we index |are just s liable to have exceedingly | hot weather as exceedingly cold. This is demonstrated by the fact that while we have heen having an exceptionally cold Spring, England has been having an exceptionally hot Spring, and What Course to Pursue. the past month. Frankly, I do not believe that any of these forecasts are definite enough to depend upon absolutely. Without doubt, there is some truth in the sua spot theory, but our record of the sun’s rays is so limited that it is very difficult at the present time to make forecasts based on the eun spot theory. Furthermore, the weather in any definite state or section is deter- | mined by the air currents and not by the sun’'s rays. In other words, even granting that our country is short 6 per cent on sun’s rays at the present time, certain sections of the country may vet have the hottest Summer in their history while other sections may have the very high maximum and very low minimum temperatures—that is, very changeable weather condi- tions. My own advice to a business man is to diversify his merchandise so as affected as little as possible by eather conditions. That is to say, instead of speculating on either a cold Summer or a& hot Summer, I should try as far as possible to regu- late my business so as to be as little dependent as possible on the weather during the next few years. (Copsright, 1928. Publis Bureau.) RUBBER IMPORT PRICE IS ON THE DOWN GRADE Rubber import prices are on the decline, preliminary returns to the Commerce Department = yesterday Financial showing an average import price per | pound during May of 55.47 cents as compared with 79.78 cents in Febru- ary, the peak price month of the vear; 74.76 cents in March and 62.99 cents in April. In May last year the average price was 36.8 cents. The figures were based on ship- ments moving through the ports of New York and Boston, which consti- tuted 96 per cent of the total of 29,724 long tons of crude rubber valued at $36,930,000 imported last month. — HEADQUARTERS MOVED. NEW YORK, June 12 (#).—Sales executives the Westinghouse Electric and Manufacturing Co., re- cently reorganized, have made New York City their headquarters. The change was decided upon in order to administer better the Westinghouse service to the transportation, light, heat, power and manufacturing in- dustries of the country mills closed are at Winstead, Conn. |and Haverstraw, N. Y. The company now has 11 mills in the East, Central | West and Pacific Coust. SoTEE POTATO VTR.ADING SLOW. CHICAGO, June {2 (#).—Pota | —Receipts, 1 58 cars: old, 31 cars | total United States new, 732; old, 184: on t L 167 market weak: Wisconsin sacked | round whites, 2.60a2.85; Idaho sacked New stock trad- rather slow. market barely Alabama, Louisi sacked trimmphs ing | steady: { homa | mostly blers, 3 | rel , or 8 points against the | France has had a snowstorm within | : Octo- | in the South and improving crop ac- | ! Prompt Actlon |First Mortgage Loans ; Lowest Rates of Interest and Commission Thomas J. Fisher & Company, Inc. 738 _15th Ktreet Announcement Some very || merdiai s special _second for sale Tdeal wites for laun warehouses. manifactiuring Dlants. garages. storage. ot One’ special site containing 15.000 1. with two street fronts. Jos. A. Herbert & Sons 1013 15th St. N.W. | We have a limited amount of 1 1% First Trust Notes for sale in denominations of il $100, $500, $1,000 AND. UPWARD Secured on Real Estate in the District of Columbia Our experience extending over a period of Thirty-five Years insures your protection Percy H. Russell Co. 926 15th St. N.W. | BUY Real Estate Gold Bonds Secured by First Mortgages Guaranteced By | The United States Fidelity & Guaranty Company Resources, $46.000.000 To Yield 6% Plus tax refund up to 4'y milis Call or Write for Descriptive Circular CHAS. D. SAGER i Since 1900 924 14th Street N.W. Main 36 i The New York Life Insurance Co. Ofers On Improved Rea trict of Columbia in Montgomery Business Properties 1321 Connecticut Avenue to Mcke First Mortgage Loans 1 Estate in the Dis- and Nearby Suburbs County, Maryland FOR 3, 5 OR 10 YEAR PERIODS 5% ON APPROVED SECURITY Apply RANDALL H. HAGNER & GOMPANY MORTGAGE LoAN GORRESPONDENT Apartments Office Buildings Telephone Main 9700 | | A Third of @ Century's Main 2100 B. F. SAUL CO. We Study Your Rental Property and by careful, experi enced analy deter mine just what changes will make it earn better for you. This costs you nothing. Then, if you tell us to apply our proved management methods. our charges are small but they pro- duce results. S1S 925 15th St. N.W. REAL ESTATE LOANS _ ANY AMOUNT r APARTNENT HOUSES 2 BUSINESS PROPERTY RESIDENCE LOANS AT LOW RATES FRED T. NESBIT [ 1avestment migs. * Main 0392 |i first deed of it ental TUIRE interees and. commlsmione i s Wash. L8 WE l-'lN w—all classes of income-producing property Large Loans a Specialty Current int. rate‘and commission Higbie & Richardson, Inc. 816 15th St. N.W. Funds . immedjate] av st notes D. C. :‘ Sos Mr. Read: Local A rtun, Nwe Loan In Any Amount on lst—2nd—3rd Trusts ‘We provide suitable and satis- factory solutions for your finan- cial problems. Immediate deci- sions and settlements. You will find our charges the lowest. Realty Loan Co. 1417 F St. NW.—M. 9411 Open Evenings countless other millions of loss for each note is Twenty Years Without Loss to An Investor Don’t Fear for Your Savings —Protect Them! If there was a slump in the market tomorrow, would it affect you? Or would your savings go the same way as, of hard-carned money? Think This Over If your Financial Sur- plus is invested in our First Mortgage Securities you will suffer no fear secured by improved real estate in the Nation’s Capital Annual Return 62% Safe and Dependable Mortgage Investment Dept. HANNON - & LUCH 713, 715 and 717 14th St. Main 2345