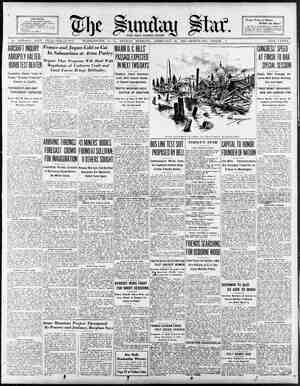

Evening Star Newspaper, February 22, 1925, Page 31

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIAL. . BOND PRICES HOLD FIRM DURING WEEK THE SUNDAY STAR, WASHINGTON, BOND SUMMARY FOR THE WEEK |NATIONAL BANKS IN STRONGEST ——1924— ——1025 High. 10128 10221 102 102 23 1034 10708 Low. 98-22 96-§ £8-4 99-8 98-8 99-8 High. 101-24 100-28 Liberty 314s 1933-47. 102-17 101-15 Liberty 1st 4%s 1932-47., 101-31 98-4 Liberty 2d 43 s 1927-42 101-18 101-1 102-4 105-3 104-4 Treasury 44s 1947-62. Money Outiook Confused. Trade News Good—Critical Times in France. BY GEORGE Special Dispatch to The Star. SW YORK, February ever the future of bond pr be, and as to that there is gr riety of opinion, the market holds re- markably firm. For a long time now the experts have been saying that quotations for strictly first grade in- vestment securities were high enough and that any change must be toward lower levels, hut sa far there has been nothing in the course of the market to justify these predictions Railroad mortgages of the first rank are slightly below the highest points reached last year, but the loss is so small as to carry no significance and the price trend of securities just be- low the highest grade is still distinct- 1y upward. T. HUGHES. —What- Money Rates Confusing. The future of money rates is just confusing as that of bonds. Theore cally continued exports of gold and the demand for expanding business ought to result in higher money rates. §p, the latter part of the week, there Yas a slight stiffening in the quoted rates for five and six months funds. Up to the middle of the week and for & long time prior thereto, loans were obtainable for this period at 4 per cent, but the week closed, lenders have ra thelr asking rate to 4% per cent. On the other hand, it was reported on reliable authority that offers of as much as $1,000,000 had been made for 12 months at 4 per cent, which would look as if this lender, at least, did not expect anv t change in the money supp! The position of the Federal Reserve Banks, for all practical pur- poses, Is as strong today as it was a vear ago. The reserve ratio this week was 77.0 per cent, compared with 81.4 per cent on Fehruary 20, 1824, a de- cline of no importance. Heavy Volume of Trade, Tt is hardly necessary to mention call money, because that rate is gov- erned by day-to-day fluctuations in sup- ply and demand, and yet it is not with- out interest to mote that this market, too, has been easier this week than in a long time. Turning to the business situation, the evidence is no easier to interpret Carloadings are at the highest point ever recorded for this season. Bank clearings tell the same story of a large volume of trade. The steel industry is operating at an extraordinary high rate, considering the increased ca- pacity. On the other hand, foreign iron is being imported in increasing quantities and the domestic pig-iron market is dull. Moreover, there is & feeling of doubt as to whether present steel prices are to be maintained. The textile situation is unsatisfac- tory, to say the least. Motor car man- ufacturers are proceeding cautiously, hut the outlook here is distinetly good. Great expectations are founded upon the {ncreased buying power of the ag- ricultural regiol Summing up, the favorable factors far outweigh the un- favorable, including among the favor- able features the abundance of credit. Forelgn Bonds Steady. Foreign bonds as a group have heen steady all the week. New for- eign offerings have gone very well notwithstanding the doubt with which most individual issues have been greeted by the dealers. In the eves of the investor the current high returns have fully compensated for o risks. The case of French bonds {5 2vecial one. Cabled dispatches, lleging a loss of confidence in their own currency by the French them- selves, hbrought some selling cf French dollar bonds on this side, but there was support from important . banking interests and a meoderate rally in quotations. o confirmation is obtainable here of the report from the other side| that a new French loan has been promised by American banke once the French budget |s balanced. It is doubtful whether a new French loan could be floated on any reason- able terms now, with the new French 7s selling in the open market nearly four points below the offering price. Critical Year for France. At this distance the solution of the French financial probiem looks almost impossible. 1f the French once lose confidence in themselves it will be impossible. The battle of the ‘franc is now being fought on the home sofl of France. It is no longer a matter of outside speculators for the decline selling francs short and being “pinched” when the Bark of ¥rance comes to the rescue. Added to all these uncertainties is the dis- truet in French politics which is felt by most outside observers. Under the circumstances the wonder is that French securitles meet with as much favor as they do. There is no doubt that this is the eritical vear for French finance, nor is there any doubt that if this crisis is successfully passed French se- eurities will rebound upward in brisk fashion. In that event those who now axhibit their faith in France will be richly’ rewarded. peculation Overdone. A good deal has been heard this waek about the cunsolidation of elec- trfe 1ight and power companles Into superpower systems Much spec- ulation has been based on the ad- vantages expected to accrue to se- curity holders from these combinations. Some of these advantages will un doubtedly materialize, but it is vei easy to overestimate them. There are some indications that the specula- tion along th line is being overdone. This applie however, more to the common stock than either to the bonds or preferred shares. (Copyright, 1925.) $42,000,000 IN BONDS SOON TG MATURE Little New Financing Expected in ] Wall Street in Near Future. » ebruary 21.—With more than $42,000,000 in corporate maturities falling due in March, little new financing is expected in Wall Street. This amount compares with about $22,000,000 in February and nearly $36.000,000 in March, 1934, The majority of the maturing issues are “ar small emounts which can be paid off with treasury funds, while others have béen provided for through re funding. The largest item is the Canadian Northern $11,000,000 three- ar 5 per cent notes due March 1. vania Railroad also will pay off $2,100,000 equipment trust bs on the same date. . BUTTER PRICES HIGHER. CHICAGO, February 21 —Butter higher; creamery, extras, 40; stand- ards, 39%; extra firsts, 381;a39; firsts, 361483734 sceonds, 32a34 4. Efgs lower; receipts, 16,898 cases; firsts, 32%a33; ordinary firsts, 30a3l, Hll:h’. 96 108% 98 111 109 91 4 lo(é 104y 10914 i, 2644 101% 101% 111% 99% 9974 105 109 84y 85 93 Low. 8914 100% 854 High. 96% 108 aTy% 856 i 108% 4 109 4 100 4 103% 4 100% % 108% 95 78 84% 1% 204 9814 974 94 107% 884 104% 82% 89 91% 66% 102 95% 101% 117% 5814 90% €9 89% 133 64 86% 108% 97% 105% 83 95 108% pysy 36% 995 96% % 87% 8% TAN 89% 88 89% 82% 6644 8% 92% 9% 86% 89% 78 102 109% 50% 92% 99% 97 101% 6% 3% 3% 1025 7 %) V. S. BONDS. Hi Liberty 3d 415 1928. 101-20 Liberty 4th 43 1933-3, Prev. Low. 95 101% 57% FOREI . Argentina 6s A 1957. Argentina 7s 1 Austria s f 7s 1943 Belgium 65 19 Belgium 7%8 134 Belgium 8s 1941. Bordeaux 6s 1934. Brasi 831941, Canada 58 1952 Canada §%s 1929, Chile 85192 Chile 8s 194 Chile 85 1946. Chinese Govt Ry s 1 Copenhagen 5145 1944 Czechoslovakia 85 1951 Denmark 65 1942. Denmark 85 1945 Dutch East Indles 6s 1947. Dutch East Indies 65 1962. French Govt T3s 1941. French Govt 8s 1945. 983 German Ts 1949, . 79 Holland-American s f 65 1947 82 Japanese 4s 1931. g 90% Japanese 6%s 1954 §8 Jergens Utd Margarine 65 1947. £41% Lyons 651934.... 84 Marseilles 68 1934 104 Netherlands 6s 1972 102% Norway,8s 1940. 76% Paris-Lyons-Med 65 1953. 101% Queensland 65 1947..... Queensland 7s 1941. Rio de Janeiro 8s1 Sao Paulo, State of, s 1936. Seine, Dept of, Ts Serbs Crotes Slovenes 83 1962 Sweden 6s 1939 . Swiss 5lzs 1946... United Kingdom & 104% United Kingdom 814 1957 INDUSTRIAL AND 94% Amer Agri Chemical 73s 1941, 951 Amer Smelt & Ref 15t 55 1947. Am. Smelt 1st 6s 1942, Amer Sugar Refining 6s 1937 Amer Tel & Tel cl tr 45 1929 Amer Tel & Tel cl tr 55 1946. . Anaconda Copper 6s1953. Anaconda Copper cv deb 7s Armour & Co 41681939 Atlantic Refining deb 55 1937. Bell Tel (Pa) ref s 1948. . . Bethlehem Steel p m bs 1936 Bethlehem Steel s f 68 1943 Central Leather 5s 1925. Chile Copper 65 1932. Cons Coal (Md) 1s ref 5s 1950. Cuba Cane Sug cv deb $5 1930.. Detroit Edison ref 6s 1940.. Du Pont de Nem 7%s 1931. Empire Fuel & Gas 7%81937. General Electric deb 5s 1952 Geodrich (B F) 6%s 1947 Goodyear Tire 8s 1931 Goodyear Tire 85 1941 Humble Oil & Ref 5338 1932. Indiana Steel 55 1952 Inter Mer Marine 6s 1941 Inter Paper 5s B 1947, . Kelly-Springfield 8s 1931 Lackawanna Steel 55 1950. Liggett & Myers 5s 1951. Magma Copper 7s 19 Manati Sugar s f 7%s 1942.. 4 Midvale Steel 551936.. ... New England Tel 551962, New York Edison 1st §%s 1941... NYGasELHG& P 5s 1948 New York Tel 4%s 1939 New York Tel 6s 1941 North American Edison 6s 1952 Pacific Gas & Elec bs 1942 4 Pacific Tel & Tel 65 1952 Philadelphia Co ref 65 1344. Sinelair Ol 7s 1937. Skelly 6%s 182 South Porto Rico Su| i Union Bag & Paver 65 D United Drug 6s 1944. U S Rubber 1st & ref fs 1947 U S Rubber 7%51930. U S Steel s £ 551963. Utah Power & Light s 1944. Va-Carolina Chem s £ 7s 1947, Va-Carolina Chem 7345’37 war. ‘Western Union Tel §34s 1936 Wilson & Co 1st 6s 1941 ‘Wilson & Ca cv 7%s 1931, RAILROAD, Atchison gen 431935 Atlantic Coast Line 1s s Balto & Okio gold 45 1943 Balto & Ohio cv 435 1933 Balto & Ohio ref 55 1995 Balto & Ohio 651929, B&OPItts LE& W Va'ds 1341.5 B & O Soythwn div 3%5 1925.... Brooklyn-Manhat s f 65 A 19 Canadian Northern 635 1946. Canadian Pacific deb ds. ..... Central Pacific 48 1949, Chesapeake & Ohio cv 4331930 Chesapeake & Ohio gn 4145 1992, Chesapeake & Ohio cv 68 1946... Chicago & Alton 3%s 1950. Chi B & Quincy 1st ref 5s 1 Chi & Eastern Ill gen bs 1351, Chi Great Western 4 1959. ChiM & St Paul cv 43451932, .. ChiM & St Paul gen 4%s 1989, ChiM & St Paul ref 4%s 2014. ChiM & St Paul cv 55 2014. ... Chi & Nerthwestern 63%s 1936. Chicago Rallways bs 1927. g ChiR I & Pacific ref 43 1934. Chi Union Station 434s 1964 Chi Union Station 6%s 1963. Chi & Western Ind con 481952 CCC & St Liref 65 A 1929 Cleveland Term 5%s 1972, Colorado & Southern 43%s 3935. 105 84 96 101% 102 102 106% 106% 41% 94w 98y, 993 109 98% 98% 981 102 94 884 85 103% _ 100% 116 991 %64 100% 99% 102% 85 973 90% 93% 100 107% 861 99% 106% 1063 97% 101% 100 119 99y 6% 89% 8815 102% 83% 9% 82% 116 Kt 86% 94% 87% 102% 44% 100% 4% 59% 55% 80 50 55 111% 82% 83% 91% 116% 6% 103 104% 90% £3% 101 82 57% 91 70 63% 64 2% 106% 116% 100% 109% 864 67% 102 68 92 68 80% 70% 88% 97% 95% 91% 104% 84% 102% 80 76% 86 99 " 99 54 87 61 88 127 60% 84 106% 96% 103% 81% 93 101% 109% 34 97% 1% 1% 84% 83% 1 864 93% B4M 6% 59% 4% 84% 96% 84 884 3% 100% 106% 42% 90% 59 95 Delaware & Hudson 5%s 1937 Den & Rio Grande con 4s 1936 D. & R. G, West 5s 1955.. Detroit United 43;s 1232, Erie 1st con 45 1996. Erie gen llen 45 1996. .. Erie cv 4s A 1953 Erie cv 4s D 1953 Grand Trunk s £ deb 65 1936, Grand Trunk 751940, Great Northern gen 5% 1953, . Great Northern gen 75 1936..... Hudson & Manhattan ref & Hudson & Manhattan adj 58 1957 Illinols Central 53%s 1934. Inter Rapid Transit 68 1966, Inter Rapid Transit cv 7s 1932 Inter & Great Nor adj 6s 1952. Kan C F't Scott & M 481936 Kansas City Southern 3s 1950 KansasCity Southern 55 1950 Lake Shore 45 1928, Lake Shore 45 1931. Louls & Nash unified 45 1340 Louis & Nash 1st ref 5%s 2003 M1l Elec Ry & Lt 1st ref 55’61 MStP&SSM6%s1931. Mo Kan & Tex 1st 45 1990. Mo Kan & Tex adj 68 1967. Mo Kan & Tex pr In 6s A 1962, . Missouri Pacific gen 45 1975. . Missouri Pacific 65 1943...... New York Cent deb 431934 New York Cent ref imp bs 2013. New York Central deb 65 1935 New Haven deb 4s 1957 NYNHG&H cvdeb6s1945. N Y West & Boston 435 1946. Nortolk & Western con 4s 1996. Norfolk & Western cv 6s 1929 Northedn Pacific 35 1947..... Northern Pacific 43 1937, Northern Pacific ref imp Ore Short Line ref 4s 1929 Ore Short Line gtd 55 1946 Ore-Wash 1at ref 45 1961 Pennsylvanla gen 4145 1965 Pennsylvania gen b5 1968. Pennsylvania 63s 1936. . Peoria & Eastern inc 4s 1990 Pere Marquette 1st 65 1950, Reading gen 45 1997.. Rio Grande Western clt 4s 194 RIATk &L 43%431934.... StLIM&SR &G 451933 St L &San Fran prin 4s A 1850, St L & San Fran pr In bs 1950, StL& San Fran5%sB19i2. St L & San Fran adj 8t L & 8an Fran inc Seaboard Alr Line ref 45 1969, Seaboard Alr Line ddj 5s 1949 Seaboard Alr Line con 65 1945 Southern Pacific cv 45 1929, Southern Pacific col 45 1949 Southern Pacific ref 4s 1955. Southern Ry gen 45 1956. Southern Ry 1st 55 1994 Southern Ry dev 6%s 1956 Third Ave adj 55 1960. $ Union Pacific 1st 4s 1947 Unlon Pacific cv 4s 1927 Virginian Ry 1st 55 1962. . 100% Wabash 1st 5s 1939. 63% Western Maryland 481952...... 80% Western Pacific 55 1946 .~ 80)% West Shore 1st 43 2361.. v " 104 igh. week's Close. 97 108% 96% 8% 19 1073 854 96% 103% . 1034 . 102% . 108% 107% 44 97 100% "l 103 110% 100% 100% . 100 103% 9% 854% 82Y% 91Tk 93% 8514 854 106 111 8% 104 110% 964% 102% 90 86% 102% . 116% 108% SCELLANBOU 100% 97 106% . 101% 96% © 100% 100% 103% s & 101 9245 96% 1004% 110 89 101% 107% 107 101 102% 103% 109 120% 101 101% 9014 90% 100% 91% 9974 125% 101% 91 997 114 91% 85% 89% T7% lfll% 109% 48 9215 99% 9% 101 664 3 8 Low. . 101 28 101-18 101-28 101-23 101-3 100-26 . 101-16 10}~ 101-31 10125 104-31 104-23 High, 96% 103 95% 88 9% 110 107% 85 Last. Yigd. 101-28 3 10128 3 101-29 3 93 101-13 3 87 101-29 8 99 104 31 392 Low. 926 102% % 87% 109% 107% 84 96% 103% 103 102% 108 107% 33“ 100* 101% 110% 100% i 100% 3% 3% 98 Last. 96 102% s! 109% 107% 84y 9% 103% 103 102% 108 108% 44% 06% 100% 101% 111 101% 102 99 102% 95% 86% 82% 9% 984 84Y% B4% % 108 i 1% 103 110% 96% 102 20 8514 104 101% 116% 106 101 96% 4 106% 102'5 96% 100% 100% 102% 88% 99 100% 91% 96% 100% 108% B1% 101% 107% 107% 102 103 103% 109% % 120 100% 101% 90 904 98% 93 99% 1234% 101% 914 99% 114% 102 9% 107% 100 95% 94 104% 94 116 102% 95% 103% 87 106% 105% 94 8% 49% i10% 94w 67 89% FIs 824 92 T9% 103% 86% 99% 87 174 79% 875 196% 89% 104% 57% % 101% 112 82% 86% 924 116% ke 108% 105% 9214 85% 102 8444 57% 91% n 65 67% 2% 107% 116% 101% 110% 88 72 102 T0% 93% 2% 833 71 89% 98% 97 984% 106 87T% 103% 81% 84% 90% 64 944 9 63% 55% 80% 51% 55% 112% 83 86% 92% 116% 19% 103% 106 92% 864 1024 84% 59% 9144 1% oK 3 3% 107% 116% 101% 110% 88% 8% 108% % 93% 7% 84% ik 0% 98% 97% 94 108 883% 104% 824% 86% 91 661 101% MUk 1014 115% 60 9% 9 9% 127 61% 85% 107% 97% 104% 82% 944 108% 110% 35% 29 95 4% 8% 87% 4% 884 MK 874 8244 664 1% 92 96% 85% 89% 7 POSITION IN D. 0, THEIR HISTORY Controller Reports Recent Resources of Local Institu- tions Were $144,485,000—Mail Order Sales Heavy—Prices of Unlisted Securities. RY CHAS. P. SHAEFFER. Despite a decrease of 135 in num- ber in the last 12 months, or from 8,184 to 8,049, national banks of the country on Decembre 31 last ,were in the strongest position ever at- tained, according to abstracted Te- port just made public hy Controller of the Currency J. W. MelIntosh. The surplus of these institutions on December 31, 1924, amounted to $1.088,880,000, or an Increase of $20,- 521,000 in the last 12- months, while the capital stock increased $3,011,000 to $1,334,836,000. Total deposits gained $2,171,347.000 in the period to $20,000,208,000. Likewise, bills pay- able fell off from $324,166,000 in 1923 to only $202,304,000 on the last re- porting date. Total resources banking fraternity amounted to $24,381,2 $22,406,125,000. Resources of the 13 national banks of Washington contained in the re- port amounted to $144,485,000 at the end of 1924. It is significant that there were but 52 overdrafts report- ed on that date, testifying to the thoroughness of the local fraternity. These local members valued . their banking houses, furniture and fix- tures at $8,406,000, and carried real estate owned at $1,030,000. The ro- demption fund and money due from the United States treasurer amounted to only $317,000. On the other side of the ledger the capital stock of the Washington na- tional banks totaled $9,327,000 with a surplus of $5,713,000 and undivided profits less expenses, interest and taxes paid of $2,494,000. The reserve for taxes, accrued interest, etc., amounted to $342,000. Demand de- posits totaled $71,503,000, time depos- its (Including postal savings depos- its) totaled $33,370,000 and United States deposits, $3,143,000. Total cash In national bank vaults in this city on December 31, 1924, amounted to $3,353,000, classified as follows: Gold coin, $86,000; gold cer- tificates, $1,668,000; silver and minor coin, $240,000; and paper currency (other than gold certificates), $1,- 359,000. Heavy Outlays Predicted. Expenditures of the electric rail- ways of the United States in 1925 are expected to aggregate $342,000,000, according to the current issue of Util- ity News. That total, it is explained, would be an increase of 10 per cent over the 1924 total expenditure, $262,700,000 Both totals are exclusive of labor costs. 1t is estimated the electric rallways will spend $211,500,000 for new plant and equipment, an increase of 59 per cent over the amount expended for that purpose last vear. The remainder of the $342,000,000 total includes an estimated total of $130,500,000 for maintenance, mate- rials and supplies. Expendituges for new plant and equipment include such items as new cars and car equipment, track tools and materials, shop machinery and tools, power equipment, buildings and structures, and other items which will become & permanent part of hte com- panies’ plants. The expenditure of the national of the country 81,000 as against for mainten PRIGES IRREGULAR INCURB MARKET Week Sees New High Marks and Also Several Sharp Price Breaks., By the Associated Pres NEW YORK, February 21.—After the opening demand had been filled trading on the curb exchange today assumed a pre-holiday appearance and subsequent dealings dwindled to small proportions. There were a few higher priced issues that stood out in point of strength. Delaware- Lackawanna Coal made a further gain of 2 points, selling to 129%, and Nickel Plate improved more than a point to $8%. Several radio shares displayed strength, especially those that had suffered material - losses early in the week. Petroleum stocks held fairly steady areund their recent trading 'levels. In the closing hour oll prices were inclined to yvield moderately on small offerings. The majority of curb stocks trav- eled over a wide range during the week, but movements and tone con- tinued irregular, some stocks being pressed on the market at sharp de- clines, while others were in scant supply and moved up violently on only moderate buying. Glen Alden Coal was a special feature, first de- clining to 113 and then having a quick advance to 135%, making a new high record. Lehigh Valley Coal after selling at 43% gdvanced to above 46. Electric Bond and Share, after selling at a new low record of 581, advanced to 66%. Many of the public utilities also moved over a wide range. American Gas and Electrio fell to 69 and then advanced to 74, and Commonwealth, after selling at 1083, moved up to 116. Lehigh Power se- curities ranged from 82 to 101. Petroleum stocks refiected the fur- ther strengthening in the industry, indicated by the advances in crude ol and gasoline during the Wweek. Sl WOULD PROTECT POULTRY Agriculture Department Points to‘ Sanitation and Vigor. Losses sustained recently by the poultry industry of the United States because of infectious bronchitis and Buropean fowl pest, and the consequent State embargoes, quarantines and shipping regulations, have empha- sized the supreme importance of maintaining the flocka on the farms and in commercial poultry plants in ss healthful a condition as possible, says the Department of Agriculture. The unhampered shipment of birds from State to State is dependent upon healthy fowls. Factors that stand oyt as being of equally vital importance, 2ays the de- partment, are' (1) Stock of sound constitutional vigor; (2) the main- tenance of -.nu-ry urroundings. TRADE REVIEWS GOOD. Special Dispatch to The Star. NEW YORK, February 21.—The week end trade reviews, although stressing the point that buying is being done with a considerable degree of caution, reported that the industrial improvement had struck a swift pace. So much was said for the volume of business that more thought was' being given to this side of the situgtion in the stock market of the day than to the question of the profit margin, [4 materials and supplies includes regu- lar repair and maintenance work in all company departments, and sup- plies and materials required in opera- tion and replacements. The figures, of course, represent only a part of the enormous outlay of moneys by the electric rallway industry to cover all operating expenses . and charges to capital account Continyed gTowth in “feeder” motor bus service also is.anticipated, as the number of strect raflway companies furnishing that transportation facility increased in 1924 from 121 to 156. Approximately busses are be- ing operated 1 ay’ itles in the United The num- ber of busses In street railway aux- iliary service at the close of 1924 was approximately twice the total for the previous year, and the expansion was confined to no one section of the coun- try. Mail Order Salex Grow, The two leading mail order: houses Teport an increase of i4 per cent in sales for January over a year ago. A group of chain stores show a gain for the same period 6f 173 per cent Both are significant in that they show the business improvement is finally ginning to spread from the producing industries to the retall trade. Another important _indic: called attention to by the current bul- letin of the Brookmire Ecopomic Service, which states that car load- ings of revenue freight for the first five weeks of 1 have broken all records for a similar period. New Life Insurance Reeord. Sales of - ordinary lif¢ insurance started the new year by making an- other new record for ¢he United State in January, 2 compilation by the Life Insurance Sales Research Bureau shows. The combined reports of the com- panies whose sales are reported jthrough the bureau showed a total jfor the country of '$360,000,000, and as these companies do about $8 per cent of the total business, it is fair to assume approximately $635,000,000 was placed during the month. The bureau’s files show that this is the greatest January on record, ex- ceeding January, 1924, by 4 Der cent and January, 1923, by 20 per cent Unlixted Securities Prices. The following latest “bid” and “asked” prices for unlisted sacurities are quoted for the guidance of holders of these issues BONDS Bid. Asked Army and Nary Club 3 Cosmos Club 4148 5 Commercial Club ist s, Metropolitan Club 435 Anafastia Bank Bauking Trust & diorign hapin B Chapin- Chapia Departméntal Bank. District Title Insurance Co.. Frapklin National Baok... Munsey Trust - P ings Bank . Bank E Bank. Park Bavings Bank Potomac Savings Bagk Raleigh Hotel Co Washington Title In BlG RAIL MERGER LAID BEFORE L. C.C. Nickel Plate Would Issue Stock With Par Value of $282,568,642. rance Co.. Formal application was m terday to the Interstate Commission for authority out the Nickel Plate consolidation railroads effected by O. P. Van Sweringen of Cleveland. Big Stoek Issue Asked. The New York, Chicago and St Louis Railway Company, which is the central corporation created to take over the present Niekel Plate, Chesa- peake and Ohio, , Pere Marquette and Hocking Valley, asked for per- mission to issue new capital stock, common and preferred, with a total par value of $282,565,642, to finance the enterprise. The application declared the con- solidation was authorized by the ex- isting transportation act, and that ownership and control of the various railreads had been assembled in such a way as to make the consolidation effective immediately when authority is given. 9,160 Miles of Railroad. A sufficfent number of stockholders of all railroad companies named have given their assent to security ex- changes and leases, the application said, to insure operation of the con- solidation plan, < The newly created New York, Chi- cago and St. Louis Railway will take over the lines of the six railroads under §99-year leases. The capital stock of the new cor- poration will be exchanged for the securities of the constituent com- panies, in part, and the balance either used for raising funds to fa- cllitate the operation or held in the treasu; FIRST MORTGAGES FOR SALE Denominations of $250, $500, $753, . $1,000 and upwards 6%2% All Loans Made o Located in the Di Columbia JAMES F. SHEA 643 Louisiana Ave. N.W. to carry and M. J Property rict of We Have For Sale a Limited Number First Trzlst Notes Bearing Interest at 7% Secured on New, High-class Residential Property in Chevy Chase, D. C. Denominations of $250—$500—$1,000 Toan Dept. Ma-‘ucoss FEBRUARY' 22, of | REALTORS 1415 K St. Main 4752 1925—PART 1. BONDS G STOCKS Bought—Sold—Quoted Full New York and Berlin Market Received Dally Send for Special Market Letter Peter Whitney 203 Investment Bldg. Telephone Franklia 3078 T IIIIIIXI'IIIIIIIII IlIlIIl||lIIIIHHIIIIlEv Continental Trust Company Capital One Million Dollars 14th & H Streets LOANS | FROM $50 TO $100 Can Be Obtained by Using Our Certificate of Inventary, Appralsal and Title. CHATTEL TITLE COMPANY 805 Fifth St. N.W. s = = Spec:al thd at 537 In Sums of $10,000 and Up Immediate Reply Reasonable Commission See WELCH, Loan Specialist 15th and New York Avenue Main 4346 When You Have Funds to Invest, Consult WELCH, Loan Specialist Established 1509 6.9 and 77 Real Estate Notes for Sale in Amounts from $250 Up to $1,000 or More. Consult Welch, Realtor cialist 15th & N. Y. Ave. M. 4346 Reference: Any Bank, Trust Co. or Title Co. in the First Mortgage Real Estate Bonds Booklet on Request Bay Crest Hotel Co., Inc. 912 15th St. N.W. WE FINANCE Apartment Houses Business Property Residence Property Hotelx, Ete. Higbie & Richardson, Inc. 816 15tk St. N.W, ~ Money to Loan Secured by frst deed of trust on real estate Prevailing interest and commission. Jo&ep 3 We ‘ 420 Wash. L. & Trust Bidg.. 9th & F_ When You Need a Loan Think of WELCH, - Loan Specialist Money to Loan At 5.9, and 6 INTEREST Bofors Placing or Remewing Your 1st or 24 Trust Consult WELCH, Realtor Loan Specialist Quick Replies Reasonable Charges 15th and N. Y. Ave. Main 4346-4347 “WHEN” buying FIRST MORTGAGE 612% INVESTMENTS You are assured due precaution has been taken to safeguard your interest. A per- sonal inspectiou and comservative valuation two. of our strict requirements, Prompt and courteous serivee follow the purchase of our securities. Notes now on hand in amounts of $100 up. Send for Booklet CHAS. D. SAGER Loan Department 36 M. 37 924 14th St N.W. Mr. O’'Donnell, Manager Mr. Hughes, Assist. = Protection to the investor afforded by close scrutiny of surrounding condstions. Our First Mortgage Notes may. be purchased in ~amounts of $50 up, paying 7% interest. “They may be -purchased by monthly pay- ments. «Consult Our Trust Dept. or send for Valuable Booklet. FINANCTIAL. Stock Exchange Building New York STOCKS and COTTON BONDS GRAINS MEMBERS New York Stock Exchange N. Y. Cotton Exchange Chloags Htbek Mxchauss Chicago Board of Trade o N. Y. Produce Exchange New York Curb Market Minneapolis Chamber of Assoclation Commerce WASHINGTON OFFICE Main Floor, Woodward Building Phone Main 2040 JOHN CALL COFFEE SUGAR Large Loans Available S%2% Interest Insurance Company Loans Long Term Financing Building Loans Refinancing Weaver Bros., Realtors 735 15th St. N.W. Main 1821. Webster Says: SECURITY means: “To put beyond hazard of losing; to make certain the fulfillment of an obligation.’ Shannon & Luchs Say —that this definition may be applied with emphasis to the FIRST MORTGAGE NOTES they are offering today— paying 637 Interest What do you say —to calling up their office and asking for full information: free? Mortgage Investment Department SHA INC 713 and 715 14th St. N.W. BUCK and COMPANY Established 1916 STOCKS AND BONDS Our weekly letter of last week gave our clients BALDWIN for a purchase 1287, In this week’s letter we are advising our customers to purchase a stock which is now selling in the 40s. Visit our office or write for this letter. Ladies Invited Our Marginal Requirements are reasonable and attractive to small traders. BUCK and COMPANY 312 Evans Bldg., 1420 N. Y. Ave. Franklin 7300 We Offer Roger Williams Apartment Providence, Rhode Island First (Closed) Mortgage 6149% Sinking Fund Gold Bonds Due January 1, 1945 $750,000 Security: Land and building conservatively appraised at $1,300,000, or 170% of the principal amount of the loan. Earnings: Estimated net, 234 times interest requirements. Sinking Fund: $20,000 par value, to be retired annually from January 1, 1927. Denominations $100, $500 and $1,000 At Par Plus Accrued Interest Union Discount Company, Inc. OF NEW YORK BOSTON NEWARK Washington Office, Room 300, Southern Building PHILADELPHIA WASHINGTON HARTFORD ALBANY OFFICE SPACE High-Class Offices In the Financial District of Washington Saul Building 925 15th St. N.W. Reasonable Rent B. F. SAUL CO. Main 2100 925 15th St. N.W.