Evening Star Newspaper, December 31, 1922, Page 14

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

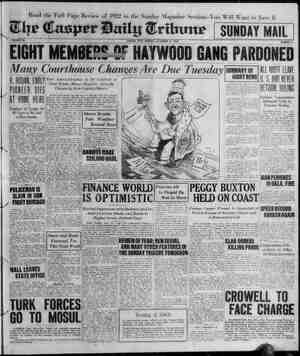

14 BID PRICES OF LOCAL SE- CURITIES ON MARCH 1, 1913 Interesting Comparison With the Going Figures of Today—Markets Go Into New Year Strong—West Prospers. BY L A. FLEMING. Some securities that were acquired hefore March 1, 1913, may have been sold during the last few weeks, so that the “fair’ market price as of March 1, 1913, might be interesting. n the matter of considering profit «nd loss, with reference to income tux statements. One of the cardinal rules in the matter of paying Incomes is that there shall be a gain, a profit, net income to a tax payer before the ;overrment wants income tax there- from. The reverse is also needed in order to claim & loss. “If the sale price is more than its fair market value of March 1, 1913, and that fair market value or price i* more than its cost, the gain is les price over the fair ce or value.” “If the sales price is less than the ir market price or valu® as of March 1, 19113, and tMat fair price or market value is less than cost, the loss IS the excess of the sales pri over the fair market price or value. Even if sold at less than cost, but cqual to falr market value March 1, 1813, no gain or loss results. Tt is the same way no matter what lie_article bought or sold. The bid price @ March 1. 1913, is a fair market price. there w o manipulation en at that time, un- | ces it was in Rallway common. o King hoom. or ‘in Washington | Gas on the Hume boom The hid prices March 1, 1913, also | offer some interesting comparisons t with the current prices of today. Here in the list: STOCKS. Bid price Capital Traction . (228, Railway common ... 01, Raflway nreferred . 8173 | Washington Gas ..... &g tseorgetown Gas American T. & T. . Mergenthaler . National Metropolitan Itiggs National Bank atlonal Saviags ... fon, Trust ‘ashington L. and T. Co. ank of Com. and Savings t Washington - ington Fire . National Union ac Tnsuranc phophone pfd: ...l s Transfer and Storage ington Market the cotton crop, it promises to be the | curities, supplied their needs only BOND BID PRICES. 163 | third or fourth most valuable crop|\hen e i aslity i At 100, LSS ST ETONR owing to the recent sharp | jgeas of reasonableness. Perhaps the 110 “hadvance in cotton prices. Corn—with | gituation could best be deseribed by 103 |an increased value this year of $700,- ving that both buyers and sellers | Ietropolitan 104 | 000.000—was our most valuable crop, | were confident of a fair degree of sta- iallway 4> . & |belng worth $1,900,287.000; cotton | in the market for prime secu- RS tomnc Seos “:"’. came next with $1,368.517.000; hay— ! rjtjes. Fotomae | 10 oug'_onl)' other one-billion-dollar crop | There is, of course, another impor- \merican T. & T. 3 99 |—being worth $1.331,679.000. On thetant factor affecting even the purely usges Rulding short & o1 :isls jor D«bc—mber 1 figures. wheat ment issues—namely, the busi- ixgs Building long 5 L1072 vas given, by government experts, a situation. A long period of good . :;.ac n",:::-s-;bou o8 . ’g‘o" valuation of $864.139.000. These fig- {trade res“unu n the gar‘::umulallofl of Markets Close Strong. The good old yvear 1922 closed its business career with all markets strong and apparently booked for higher prices. when the reinvest- nent of January 1 dividends and in- terest shall help out the buying de- mand. Uncle Sam, although a most persist- ent borrower during the entire year, will find the returns satisfactory when considered from the size of the income taxes earned during the year and 1o be pald with next year. Losses taken will little figure either in securities or in merchandis- | ng, for the year has returned galns CANADIAN EXPORT 0. 5. GROWING Increase in October Under New Tarlff Over Same Month Last Year. | Canadian exports to the United States for October, the first complete month in which the new tariff law was effective, totaled $32.883,109,,com- vared to $26.015,476. in the same nonth last year. The Canadian figures are the first, ubtalned by the government from any ' source indicating the new law’s effect. | and officlals sald, all tilings consid- | ered, that the result would tend to in- | dicate that the higher duties had not | curtailed the imports, Up to Septem- Ler 22, when the law went into effect, imports were averaging about 16 per cent above last year. Comparison of Figures. Attention was called, however, to total Canadian exports for the two months on which the comparison was based. 5 That country’s foreign trade for tober, 1921, was $73,052,695, while or October of this year the total was $102,695,588. In other words it was shown that 35.6 per cent of Can- ada’s exports entered the United States in October, 1921, while 32.02 rer cent of the total came into this country last October. Showing for September. The September exports of Canada to the United States totaled $32.786.- and seemed to indicate to officials that the law did mnot materially ‘hange the quantity of goods enter- ng this country from there. There had been a general increase in the amount of imports from Canada since July, when they amounted to $28,- $10,380. August imports from the same source were §51,608,305. While officials generally accepted the statistics as indicating the new tariff law had not cut down im- vorts, there were no flgures from other countries, and whether the Ca- nadian exports to the United States would serve as a criterion remained an unanswered question. Awaft November Report. The suggestion was made that fig- ures on November from Canada may present a more accurate picture of what the new tariff law will do. These figures, however, have not yet been received by the department. e e ARMOUR STOCK BOUGHT. New $60,000,000 Issue on Chicago Stock Exchange. CHICAGO, December 30.—First actual trading in the $60,000.000 preferred stock of the newly chartered Armour & Cn.' of Delaware, a !:;Ihsldl?r}‘coh(‘ Armcglr { Co., was reported on the Chicago Stock e today. A sale of 100 shares at & share on the basis of when is- sued was recorded. ‘The issue is expected to be offered to the public next Tuesday. " FINANCIAL | high level of May 1, 1920. This show- | has stimulated the demand for goods HOOVER'S REPORTS VITALTO FINANCE Exparts of Gold and Larger Imports Sure to Strengthen Business Outlook. to nearly every one to a dggree at 1 3 % teaing ts prevatent S =<|BOND TRADERS WAITING shall have another era' of easy money. interfered with only by the periodical borrowing operations of the Treasury in keeping the old pot boiling pending the liguidation of some of the frozen foreign debts, which are beginning ‘to have the ap- pearance of fixed obligations. And easy money tends to make good bond markets and to make business prosperous. Personal Mention. W. W. Spaid of W. B. Hibbs & Co. is spending his New Year holiday with his parents in Ohio. Business in Midwest. “Prevailing conditions in the middle west are_much more satisfactory. says the Natlonal City Bank of Chi- cago, “than they were a year azo, and the large holiday trade reported in this district has given new courage to merchants generally. Retail trade has been excellent and sentiment has improved as a consequence of the in- creased turn-over compared with a year ago. The trade situation throughout the middle west is favor- able: people are conservative and not inclined to overdo things. There has been a decided increase in manufac- turing activity during the past twelve months and, while there are difficult problems yet to solve, the outlook is & reassuring and suggestive of further | TSt that our, huge surplus of gold ! 3 o further constitutes « fositive menace in its improvement during the coming year: | threat of inflation. A good deal of i ce to f he risc in speculative securities dur- the necessity of cutting living costs | fhe Fis¢ in specul i 2 price baiis. The new year beginsi, oy supply. If 8o, and Secretary witniithe " generals &veragoifof (CON | oovers orediction i verified, that mercial prices In the United States | GOo3Er's Preq/clon (s verfefl et 538 per cent higher than on August |(enESr Wil be removed, but the rel kn}‘“‘-)“}_‘f".'“l’; egEid . D ""'x‘;’“' causes for the advance in the price ough Dun's figuree of December |,r hoth securities and commodities. 1 showed an increase in commercial | °f b4 fecutitles and commodioen o uices of jonly 1% per coent for the |has been freely expressed ‘that under A hnt e . wrage was thelour new tariff foreign trade could h{fl_“ ToT0e1. A Y ith | nOt prosper. Mr. Hoover is, of course, ry 1. 1921 As compared with |, ¢ne position to know the facts, and the low level of the recent deflation | theortes are of no importance when period touched on July 1, 1921, the [¢neOries Are of 1o present price average shows a gain s bl T of 16 per cent. It is, however, some 29% per cent lower than the record| How far speculators and investors are consciously influenced by consid- erations of this kind is uncertain. It is a fact. however, that there has been no sign of any large advance in | the price of high-grade securities this j week. ~ Even _liberty Stability in High-Grade Securities Noted in Market Dur- ing Week. RY BYRON SELLER. Special Dispatch to The Star, NEW YORK. December 30.—Secre- tary of Commerce Hoover is credited with two statements this week, both of which have a vital bearing on the future of the securities market and of the business outlook. First was the expression of opinion that the time will shortly be at hand when the enormous stock of gold held in this country will begin to be dimin- ished by exports. The other was the statement that statistics covering Im- ports for October and November will show an increase in such imports, the new tariff law notwithstanding. As to the first of these matters, it has long been held by some econo- ing gives interest to the international wholesale price index of the Federal Reserve Board, which indicates that during October prices rose in the United States and Canada, while they declined in England and Japan and remained unchanged in France. These calculations are based on 1913 prices in the currency of each country and converted to a gold basis by allowing for the rate of exchange on the United States. “Estimates lately given out by the Department of Agriculture show that the nation’s crops this year are worth $7.572,890,000, based on the farm val- ues of December 1 last. This figure shows an increase of $1.8 8,000 for the year. Despite the falling off in considerable period, wavered on some of the days of the week. The same was true to a greater or less degree fundamental conditions. Investors simply desirous ¢f buying for income were willlng to the market quo- tations, byt they did not rush to bid up the price. Financial institutions, which are always large buyers of high-grade se- ures are very interesting and show how the financial position of the farming classes has been strength- ened during the last twelve months, in spite of the drawbacks. “The year just closed was in many respects a banner investment year, and, with the movement to start va- rious enterprises. it is probable that 1923 will rank high in new financing. = = The United States government ps|the Situation s not greatly different likely to figure prominently in the |from that prevailing a week ago. The money market, and when conditions | European problem is still unsolved. are more propitious the Treasury may | The best that can be sald is that the attempt furtfer long-term financing. part America should take is under In addition, there are numerous de- |constant discussion, in and out of mands to be financed in connection | Congress. . with the reorganization and re-equip-| In Paris the entire reparations ment of railroads as well as the ex- |question is to be reviewed at the con- pansion of productive facilities in |ference of the allied premiers next arious industrial line lweekA No one is greatly concerned jover the faces the Turks make at DIVIDENDS IN TEXTILES profits available for investment. This process, however, is a very slow one and long before it begis to operate on investments it shows itself in the speculative market. Foreign Problems U ived. the general business outlook. Here I iLausanne. IEven the announcement {of the despatch of the British fleet to ithe Dardanelles was received by the i > > markets with Indifference. It will be AMOUNT TO $3,642,050;quile another story when any real e by {progress §s made toward the impro- ment of the European economic €on Fall River Corporations Make !dition whether that improvement is made with or without the aid of the — Very Heavy Payments {Tnited States. i {7"At home the railroads stift nave oL : Itheir troubles. Chairman Reed of the ¥ the Associated Press. {Kansas Public Ctilities Commission F. VE. ;complains that the Atchison spends FALL RIVER, M: December | too much money for maintemance, and Dividends of textile corporations in this i.‘?(‘nl!or Johnson of California ‘\\'-'L‘n!s city for the year 1922 amounted t .- |railroads prohibited from declaring D050, am roeae of 8.ome onted 10 83 |Gividends 'unless they have spent 2,080, crage of 8.32¢ per cent on 4 {cnough money for maintenance, capftalization of $41,960,000, according to though it is equipment on which Mr. statlstics furnished today by G. M. Haf- | Johnson lays the stress. It is cer- fards & Co. This is $509,17, more ihan i tainly hard to please everybody. was distributed in 1921, but $6,344.250 Rail Eaniings Better. The close of the year finds the capi- ; Senerally made a better showing talization of local corporations in- ‘than those of the month befora and creased from $41,960,000 to $44,815,000 | freight loadings are the heaviest on 23 & Tesult of stock dividends declarcd {1acor for this time of vear. Prob S ably aside from the purely political N tacks on the railroads, their most 1922 IN DRY GOODS. rious difficulty is in their inability tor unwillingness to compose their difference with their employes. Continuousy Improvement Noted. | Larger Sales Predicted. This, of course, does not apply to CHICAGO, December 30.—The John all rallroad executives, but some of them still seem to feel that nothing V. Farwell Company Review of Trade says: is so important as to break the power of the unions. As to the right or wrong of this, the writer has no opin- fon to express, but the effect, on earn- ‘The year 1922 in the wholesale dry goods business was one of slow but continuous improvement, affected, however, by a good many uncertain- ings is not encouraging even to stockholders. ties, 1lke the coal strike, the ralflroad strike and'many strikes in the textile Aside from fhe foreign _situation and the troubles of the railroads all manufacturing companies, especially | in New England. Happily, all these indications are still for industrial ac- tivity and reasonable profits for well- difficulties were overcome In most cases long' before the year was over. anaged industries. The automobile trade Jooks forward to a great sea- Son and as a preliminary of the auto. Thobile show prices of motor stocks ave been marked up. Copper Prices Higher. Aw a result, the last three months| y¢ must be admitted that income o ales nd Hegitimars %0 i, the Way | statements and balance sheets in most The rise in the three basic. textile |cases justify the advance. Talk about commodities—cotton, wool and silk— |the sutomobile {ndustry having reached the saturation point is_ not heard very often just now. Steel business is phenomenally good. There has been a further rise In commodity prices, particularly of copper. Sugar Deople look forward to a prosperous year and even the rubber and tire Foiks are not without hope. And so o hines considered there is no rea- &on to be anything but conservatively made of these materials, especially during the latter part of the year, when it was evident these frices would hold. Now, nearly all the goods owned at the old prices have been disposed of and every one is getting rapldly onto the higher-priced goods. With low stocks at the end of the year, indebtednesses very much re- duced, higher prices for farm prod- | cheerful. ucts, as well as a better outlook f« (Copyri 3 the stabilization of affairs in Pusons, _‘_‘w we look forward to the coming year with confidence and the expectation of much larger sales and excellent net results. 2,000 PER CENT MELON. Shoe Machinery Company Has Thirty-Year Surplus. . ST. LOUIS, Mo, December 30.—A 2,000 per cent stock dividend has been declared by the Landis Machine Com- pany, shoe machine manufacturers, it ‘was announced today. The capital stock thereby was increased from $50.000 to $1,000,000.. The dividend was from a surplus fund which had ‘been accu- mulating for thirty vears, it was ex- plained. e PARIS PRICES FIRM. PARIS, December 30.—Prices were firm on the bourse today. Three per cent rentes, 59 francs. Exchange on London, 63 francs 50 centimes. Five per cent loan, 76 francs 50 centimes. The dollar was quoted at 13 francs 703 centimes. WALL STREET NOTES. NEW YORK, December 30.—Thir- teen new ships are to be ordered from British shipyards for use on great lakes in the grain service. Bethlehem Steel Company has ad- jvanced price of foundry pig iron $1 ton. .Cahles from Berlin say Chancellor Cuno will offer 40 per cent of fixed indemnity. Buying of the equipments continues because of the excellent outlook for 1923 business. BaldWin has $43,000,- 000 worth of orders on books, with prospects of good orders being placed next year from the railroads. NoVember net additional railroad earnings reports for November indi- cate net for all classes Al roads may be somewhat higher than the $76,000,- 000 estimate which was made after recelving returns from twenty roads. 1 Based on reperts of fifty-three roads, ovember net is estimated at between $77.000,000 and_ $78,000,000. Norfolk and Western reports a No- vember deficit of $408,017 after tax and charges, against surplus of $1.- 628,292 a year ago; For eleven monthe surplus was $14,137,162, against $8, 106,292, same petiod 1921 | | i to our abundant| bonds, which | Liberty 1st 4s have been very slowly rising for u | Liberty 2d 4s. of all securities, prices of which are | Liberty 3d 414 responsive only to money market and | Liberty 4th 474s. | | This brings us to consideration of {0 ey THE SUNDAY STAR, WASHINGTON, D. ., DECEMBER 31, 1922—PART 1. FINANCIAL. RANGE OF MARKET AVERAGES | ‘The following chart shows graphically the action of forly repres sentative stocks dealt in on the New York Stock Exchange. covered is the past mcuth, up to and Including the close of the marl e lower sectdon of the chart Friday, December 29. Th activity of the market. The period arket indicates the relative CEMBER —mox————————— ———— DE 891 245678 9111213141516 8192021 2 2% 78 D — ~——SCALE FOR INDUSTRIALS 2 e r=3 S, R SV ¥Od 21V (SRRt MILLION SUARES (Copyright, 192: ntrials, 1921. 63.90, August 24 Ralls, 1921, . 81.50, December 15| High by W. SIYVHS NOIMIN. 103.43, October 14 78.59, January 10 Ralls, 1922 to Date. Low. BANKERSPREDICT |VEAR EAST AND GERMAN FURTHER ADVANGES Stock and Bond Prices May Go Still Higher Dur- ing New Year. STEADY GAINS IN 1922 Railroad Traffic, Exports and Higher Foreign Exchange Make Outlook Bright. By the Associated Press. NEW YORK, December 30—Stock and bond prices generally close the year at materially higher levels, which is not only a reflection of the marked improvement that has taken place in business and industry dur- ing the last twelve months, but also construed by conservative New York banking interests as an indlcation of stlll further progress in the coming year. The conditions vear closes with favorable for a further appreciation High. . 77.56, January 15 .. 93.99, September 11 |of commodity and security prices in T .. 65.52, June 20 «.. 73.43, January 9 the opinion of the financial com- Twenty Industrial Common Stocks Used Are: munity. Unfavorabls and nexpected e " o evelopments in the political and eco- R SRR e D e e nomic situation abroad are generally Am Locomotive Texas Company Westinghouse consldered as the only probable ob- Am Smeltiug TS Rubber Western Unioa stacles to arrest the dmprov ut in Twenty Railroad Common Stocks Used Are: o e iy e endla] oy Atchison M & St Paul K¢ athersn Northern Pacific Reading €0 2 v £ timore & Ouio el & Hudson Lehigh VaRey New Haven Routers Bacife | 500 N pontiumes, Wil ew gem- adian Pecific hirie Loy & N Norfoll: & Western Sonthern Ry e PLONE = s & Ol Iilinois Central N ¥ Centrai Peaussivania Union Pacifie ont w’é‘:‘;"l:l";d‘f!"g:s&f Jurey = Daily Movement of Averages: eral well known facts. Foremost Industrials. Rails. | Industrials. Rail among' these Is the easiness of the November Tuesday . N3.50 | December 14, Thureds PE1H 54, money market and the huge sums November 20, Wednesday ... 04.03 8456 | December 15, Friday . D oRaT available for commerctal credit. December 1, Friday i 85.34 | December 18, Saturday . - &wn:: . 82:: December 18, Mond: Rafiroad Trafic Boeming. oo St | eemnec 10 Moeany In addition, most stocks of merchan- Decsmber nl | pecsmber 20, Wednsetay, dise are low, rallroad traffic is close ecmber 4.9 | Decomber 22, Friday to record levels, exports are increas- December 84.58 | December 26, Tuenday ing, the principal KEuropean ex- December 9, 84.60 | December 27, Wedneaday changes are heading back to par, and Il:::!mfir }5. fiz‘i‘ mel':r Thursday the European economic situation Breember 12: Tueday 434 | December 20, Fride shows signs of Improvement, exports U. S. BONDS Maturity e. Liberty 3%s. . 6-15-47 . 6-15-47 .11-15-42 Liberty Ist 4%4s. . 6-15-47 Liberty 2d 44 L11-15-42 . 9-15-28 .10-15-38 Victory 43s.. 5-20-23 United States 4%s. 1952 ® Closing bld. STANDARD OIL GROUP LEADS CURB TRADING Closing Week of Year Sees Ex- treme Activity in Many TIssues, By the Asscciated Press. NEW YORK. December 30.—The was extremely active all through the last week of the year and trading included many interesting and important movements. A feature of the dealings was the resumption of the leading market positions by the Standard Oil group speculative inter- est being largely concentrated those _issues, especially last £6w days, when many Sold at the highest prices touched in recent trad- ing. This display of strength was a natural sequence of the advances in crude oil and in the increased volume of production, refining and distribut- ing adding largely to the profits of the petroleum industr: Independent ofl stock: creased Interest, advances of sub: tial extent being in order. Mumm 0fl moved up from 42%_to 45. _Cit Service ranged from 170 to 1 Gulf Oil, after declining to 43 up to 54. Salt Creek iesu n strong position as a result of the pew selling contracts, Sa@ Creek Produc- ers ranging from 20% (0 21 dustrial issue: doretite week. Durant Motors. after selling at 75, dropped to 687% and Durant Motors of Indiana first ad- vanced to fl;;lnew,}‘\elfl::sl; to 3 from 73 to 82. Gillette Safety Razor had the widest rang@ advancing from 2523 to the high record of 265. Other stocks in the motor group were in supply at moderate declines, including Goodyear from 10 to 9% an: reflected in- stan- irregular first few davs, but reacted before the end of the week. ——————— LIVE STOCK MARKETS. MORE. Md.. December 50 (EALTIMORT eneral Jive cattie market_rules firm Tde;t;—‘kgogg a for top grade ;?l;l:l‘:. eolrpeclllly l':hmgfec]e?g‘tgsn:';:: -weight veals. R arves, and only fair at the stockyards. ‘Quotations today at Light street wharf: e—Firs meBdel:' c‘l’b‘, 6a7: bulls, as to quality, Cok .. 3ad; CoOws. choice to fancy. 5a I imon to falr, 2ad; oxen, as to qual- ity, 3%abl; milk cows, choice to tancy, head, $0.00 to 75.00; common to fair, head, 30.00 to 35.00; calves, veal, choice, 1b., 1 2a1212; ordinary t:) , Ib.. 11a111%; heavy, smooth, ;r;z‘ll;lbrn 10a11; rough, common, thin, 1b., 7a8. . heep—Old, choice, 1b, 4as; old nfm’&"m common, 1b., 2; lambs, spring. cholce, 1b., 14a15; fair to good, b, 1%a13; common, thin. Ib., 9al0. ‘Hogs—Straight. 1b., 9a9l3; sows, as to quality, lb., 6a stags and boars, Ib., ¥a5; live pigs, as to size and qual- ity, 1b., 8a10; shoats, as to size and quality, 1b., 8al0. CHICAGQ, December 30 (United S A tment of Agriculture)— Hogs—Receipts. 8,000 head; market 10 to 15c higher; lighter weight up most; bulk 225 to 300 pound butchers, 8.40; ‘bulk 150 to 210 pound averages, §.50a8.55; top, 8.66; bulk packing sows, 7.60a7.75 desirable pigs, mostly, 7.7528.00; estimated holdover, 3,000 quality, Ib., 8a9 .35a8.50; light, 8.50a8.65; light lights, $.35a8.55; packing sows, smooth, 7.80a 8.00; packing_sows, rough, 7.40a7.65; Xilling pigs, 7.50a8.25. Cattle—Receipts, 500 head; compared with week ago beef steers largely 50 to 1.00 lower; medium and good grades showing most decline; extreme top matured steers, 1190; yearlings scarce; best youngsters, 10.50; beef cows and heifers, largely 50 higher; bulls, 36 _to 50 higher; veal calves, 1.0021.50 higher; stockers and feeders, steady to 25 lower; plainly bred Hght kind reflecting _decline; week’s bulk prices follow: Beef steers, 7.7629.25; stockers and feeders, 5.85a6.75; butch- er she stock, 4.40a6.60; canners and cutters, 3.00a3.50; veal calves, 10.002 11.00. Sheep—Receipts, 2,000 head: market compared with week ago, fat wooled lambs, weak to 15 lower; heavy 4ind, off more; handy shorn offerings. largely sfeady: extreme top wooled lambs, 16.60 to city butchers; packer top, 16.50: closing top wooled lambs, 15.50 to shippers, 15.00 to packers; AT A during thel1, ! | Toth | horns moved ; 4nd 3 es were in | T00Sters doing hetter at 15 and 16. 53 and then ! selling at 32 (o 25, Motor was | bringing top quotations. Tire, which ranged | hence closing prices today will hardly a preferred stock!hold good. fairly active, advanc- | fair to good, 45 to 48; old toms, 40 | Thich sold from 30% to 281. Glen ’“d"f‘rucmamss“;;“m 567. Hudson and|and R hattan issues were strong in the I t | head; heavy hogs, 8.25a8.40; medium, ) i shora lambs, aumerous; bulk, 12.75a. GLANC 1922 Close iligh. “Tow. Yesterdny. Yield. 103.02 9484 10100 3.37 101.69 9600 *9890 407 10080 9560 4828 412 10178 9600 99.08 31 10100 9574 10100 9674 6898 445 101.86 9586 9894 435 10098 10002 100:34 390 100.10 9890 9294 426 earlings, closing unevenly | sheep, largely best aged | wethers, upward to scarce, steady few lots, 14.65. W YORK. December 30.—Cattle i ceipts, 597 head: no trading. Calves—Receipts, 690 head; steady; medium veals culls, 7.50. E Receipts, 4,900 heep, 4.50a7.50; culls, ‘0 good lambs, 0: culls, 9.00a10.00. Hogs—Receipts, 5,140 heas um to light weights and 9.35a9.50: heavy logs, roughs, 1.50a8.00. BALTIMORE PRODUCE. BALTIMORE, Md., December 30 '(Spu ial).—Shippers of game to this market are notified that the season closes on Monday, and all shipments arriving will he a dead loss, as the in {1aw prohibits the sale after January | The live poultry market has ruled | flrm_nll week under only moderate and an active market kept desirable stock closely cleaned | The market closed firm at 45 to 1000.600 in 1920 and $3.7 | { period m 1921. are increasing und unfilled orders for rallroad equipment are the largest in yvears. Other favorable signs are seen in the facts that no big strikes are threatened or pending, a_great amount of construction work is still in arrears despite a record-breaking year of activity.in the building in- dustry, automobils production reached a new’ peak, which probably will be exceeded next y while gasoline 4.36 { consumption has been the highest in history. and electric companies are {doing a record business. Sales of Stock Emorm Sales of siock during the vear totaled approximately 260.000,000 last year, 307,800,000 year Was at its height. year reached the of approximately £4,155 against $3,505,000.000 in 223,000,600 in the ‘in 1920, and record-breaking of 1919, when post-war inflation Bond sales this unprecedented total ns 000,000, 21, $3.94 75.000.060 in peak of bond prices for the reached in the niddie of ptember, and tlhe lowest level early in January. One of the features of the bond ‘market was the return of United States government war bonds to par, the refunding of the victory I notes, and, barring war loans not_vet refunded, the record-breaking vol- ume of foreign government, corporate and® municipal flotations, which reached a total of $685.160.000 for the first ten months of 1922, as compared with $403,100,000 during the same 1918, Wildest Fluctuatio: The widest fluctuation in the stock market took place in shares of the Atlantic Refining Company, seldom dealt in, which ranged from a low of $900 to a high of $1 or $675 difference. Among the active industrial issues Mexican Petroleum provided the chief feature, getting as low as 106% and as high as 322, or a range of 2151 points. Approximately 95 per cent of this stock has been acquired, through conversion, /by the P, merican a pound for young turkeys. 40 for i old toms and 33 for poor and crooked | reas Small to medium and large sprin chickens~are selling 25 and ZG.BlegE 2. but poor thin stags are neg- | s)lected at 20. Fat old hens in good | nd | 4emand at 25 and 26. medium 22 to 24 sma¥l and leghorns 20, old The market rules firmer on ducks, but a shade easier on geese, with demand centered on fat stock, and poor, thin stock always hard to move and not desirable even at sharp discounts. Ducks are bringing to 27, and 20 for small and poor. with Kent lslands Pigeons and guinca fowl are steady under a fairly active demand at 30 to | 35 a pair for the former and 70 cents each for young and 40 for old of the latter The demand for dressed poul- try will ease off the coming week, Cholce to fancy youn, turkeys closed at 50 to 52 a pounds; 42." while poor and drooked breasts will not bring any more than ve. e ‘| Choice young chickens selling 27 and 25; 0ld and mixed, 25 and 26, and old roosters, 17 and 15. Ducks and geese are bringing 25 to 30. Receipts of strictly fresh native and nearby eggs continue light, and the demand keeps pace with daily offerings of desirable stock. While the market was easier the forepart of, the week, a better feeling prevails today, and the market closed steady at 48 a doz- en for firsts and 45 and 46 for aver- age receipts. Seasonable native and nearby garden truck continues in fair demand, considering the increase in offerings of early southern vegeta- bles, and the market closed steady at lh;gfollov\éinz guotations: ets, 75 to 90 bushel; braccoli kale, 40 to 50 bushel; savory e.‘hba‘e,.:g to 75 bushel; carrots and parsnips, 50 to 65 per_four-eights basket; Mary- land and Virginia caulifiower, .00 to 6.00 barrel; celery, 5.00 to 7.00 hun- dred; horse radish, 3.00 to 4.00 bushel: onions, 2.75 to 3.00 per hundred pounds and a little over half-price for No. 2 stock; oyster plants, 6.00 to 8.00a hundred; spinach. 80 to 1.10 bush- el, and turnips, 35 to 40 per four- eighths basket. Recelpts of white po- tatoes continue light. with a fairly active market for choice quality stock at 1.10 to 1.25 per hundred pounds and 50 to 65 for No. 2. Eastern ‘shore Maryland and Virginia McCormicks, however, will not bring over 80 to 1.10 for No. 1 stock. Sweets and yams also in lighter receipt and the market rules firm at 1.50 to 2.50 per barrel for the former and 1.50 to 2.00 for the latter. Bushel stock of both sells. at 65 to 90. Apple receipts continue ample and the market rules easy at 3.50 to 5.00 per barrel for packed No. 1 stock, all varieties, and 2.00 to 2.50 for No. 2, bushel stock selling mostly 50 to 1.50 and loose, 1.40 to 1.65 per hundred-pounds and 40 to 50 per four- eighth basket. PRICES OF STOCKS SOAR. NEW YORK, December 3.—Stock prices were bid up vigorously during the greater part of today's half-holi- day session of the market, the last of the vear; but values were shaded somewhat just before noon on ex- tensive profit-taking. Predictions of further business prosperity during the coming 'year from divers sources, combined with the more hopeful out- lock for a settlement of the repara- tions problem, influenced bullish sen- timent. Virtual cessation of tax sell- ing and an increase of 25 cents a barrel in the price of prime crude oil also aided speculators for the ad- vanee in’ their “efforts to mark u prices. Petroleum and Transport Compan thus virtually removing it as a n ket factor. Among the railroad hares Michigan €entral fluctuate the most, selling between and 320, or 174 points. The smallest luctuation took place in Alaske(iold Mines, which sold between 7 and 34 of $1.60. Another interesting de- velopment in the stock was the declaration of stc dividends totaling mope thun $2.060,000,000. Record ber of Faflures. While most industries showed sub- stantial recqvery from post-war in- flation, the number of failures during Wwhile geese are{the vear was the largest on record, l and the volume of liabilities next to the largest ever recorded. Severe labor troubles, particularly the miners’ and shopmen’s stri also had disastrous effects. costing each ofhe principal raiiroad systems mil- lions of dollars and even more to business generall For the first time on record there was a marked shortage of manual l.bor, due in part to the restriction of immigration. whereas in 1921 the number of unemploved was estimated 2s high as 4,000,000 or 5,000,000. lendid Year for Crops. Crops, with few exceptions. were of record 'size, and the higher prices brought vastly greater purchasfig power to the agricultural regions, particularly the south. The foreign demand for foodstuffs was not very heavy until near the close of the year. Exports as a whole were the smallest since 1915, although in No- wember they were $89,000,000 over those of November, 1921, and the highest since March, 1921. LIBERAL REPUBLICANS ASK WORLD ASSOCIATION Petition the President to Create Plan or Submit Covenant of League of Nations. The Liberal Republican League, with headquarters at 53 State street, Boston, Mass, is circulating 10,000 petitions addressed to President Hard- Ing, earnestly réquesting him imme- dlately to submit to Congress a plan jfor the creation of a world associa- tion of nations, or to submit the cov- enant of the league of nations. ‘The petition® says that “there has not yet been established the world association of nations promised by the republican party and approved by the American people in the great mandate of the largest popular election ever given an American President,” and that “the moral and physical well- being, peace, happiness and prosper- ity of the world and of the American people are greatly diminished, injured and endangered by the failure of the United States elther to establish said world assoclation of nations or to permit the participation of the Amer- ican government, with the other fifty- two nations now also signatory ther to, in the existing league of nation “If this continues the undersigned citizens of Massachusetts, irrespec- tive of former or present political !afilations, do hereby petition the President to immediately submit to the Congress a plan for the creatjon of a world assogiation of nations, or to submit the; eadenant of the league of nations.” ¢ The petition was drawn up by Prof. Irving Fisher of Yale University, one of the mest eminent authoriti on the league pf nations, and Willlam J. Hancock, treasurer of the organiza- tion. Chajrman C. W. Crooker ex- pects 100.000 signatures wijl be ob- tained wifthin thirty days, according to info; received bere, shares, as compared with 171.000,000 { | o REPARATIONS MENACES: 'Biggest Clouds on Financial Horizon as BY STUART P. WEST. Bppcial Dispateh to The Star. EW YORK, December 30.—The two most formidable problems con- fronting world finance at the year end are German reparations and the conflicting claims in the near east. In the main the. domestic business outlook is favorable, but no forecast of 1923 can be attempted which does ‘ot take into account the possibility of a clash between Great Britain and Turkey and the complications to which this might lead in the rest of Europe, or, secondly, which does not consider the probable results of an unsatigfactory handling of the Ger- man war indemnity. Without anything untoward hap- pening on the other side of the water it would be altogether reasonable to look for a continuance of the gradual business recovery which has been in progress during the second half of 1922, Credit which twelve months ago had only begun to loosen, is now abundant enough to take care of all conceivable needs. Production is back to what before the war would have been regarded as a normal volume. zlthough still Well below the actual cepacliy of mills and factories. zs this has in- cres. during the last nine years. The most important item of the coun- try's wealth has always been the crops, and these have turned up to the average, while the total value is some $2,000,000,000 greater than it was in 1921 Buying Power Increased. It is true that o large a part of the grain and cotton crops was marketed early In the harvest season that the farmers by no means got the advan- tage of the large advance which o curred between the middle of Sep- tember and the close of December. It is also true that high freight rates have made the discrepancy unusually great between prices on the farms and those at the djstributive centers. upon which compilations of total values rest a.\'n ertheless, the rise of the last three months in the commodity mar- kets has improved immensely the buying power of the agricultural dis- tricts, as this will be turned to the good of the business community dur- ing the coming vear. Granting, more- over. a continuance of present price Jevels, the complaint so cften hear in the spring and summer that the farmers as u class were worse off than eny other laboring body will be in a fair way to disappear. ] t l ' Metal Producers Profit. It was mnot until the third and arters of the year that the foner "cop zinc and other of the to get down serfous effect shopmen’s neutralized by inabilit labor costs and by the of the coal and railw: strike: 50 The steel mills are now employe A beimcin and S0 per cent of capacity, Lut, as alwavs happens in a perind of industrial recuperation rices do not progress toward norma With the same rapidity as m—r._dm-i tion. Consequently, the less favored steel producers are forced to do busi- S a margin of profit \\'hif‘h ;\:‘F:‘Skl them in relatively litile (™ ow largely this position will be ered by the AT &oel companies which have bec put through during the vear remai 1o be seen. In the meantime the pre- Giction. mada twelve months ago. that 1922 would be a season of gradual improving business, conducted, how ever, under active competition and for o comparatively small return. has been abundantly borne out in the ma- Jority of industrial lines. Betterment in Foreign Trade. o question has been more vexing than that of foreign trade. and one of the most agreeable features of the | situation has been the marked ev | < 0f & change for the better in e Setober and November export figures. To be sure, the rise in wheat in nd cotton had as much effect velli the totals as any increase A lume. But the main point is that foreigh nations, despite their depreciated currencies. were able to Pur during these two months $250. 000,000 more in the American market than during the 1 onths of Jan- nary and February last. Here was a o ic Somplete upset of the cconom lthpo‘:) that whilé the gre: »cr'p.nrl of Lurope was virtually —bankrupt our foreign commerce could not hope )r any turn. T T fact 1S, that even bankrupt na- tions do mot lose their buying power. o long as they are exchanging the iproducts with thoge of other coun- ftries. They must supply their needs {in the shape of food and raw ma terials at any cost, and it is evident llhll when Ameriean exports were Irunninl:, as they were 2 Year ago, -ll !less than $200,000,000 a month. this irepresented the irreducible minimum iJevond which foreign effort to cur- tail expenditures in this market could tnot go. H Recerd Car Loadings. There has been mno more "olr‘:hy measure of the extent of the industrial recovery than the record- preaking railway car loadings during the autumn. These cannot be ac- counted for by an unusual crop move- ment, for the harvests were of ordi- nary size. What they do reflect is a general volume of distributive trade exceptionally large according to all past standards. _As the year ends the problem of the shortage of rail- way-equipment has to a considerable i ree been solved. ldegflll the railroads are far behinad where they ought to be in cars and locomotives in order efficiently to handle the business offered. The need of buying free new equipment and o tton intenance of way mounts for maintena: \.Indu the effects of the period of go ernment operation is the mos® power- ful argument against reduction in ht rates. e Tar ihe agltation for com- pulsory lowering of rates will appear among the problems of 1923 depends upon whether or not_there is to be an extra session of Congress, intro- ducing the radical elements which Were successful at the November elec- tion: At the mmoment it appears doubtful whether the administration, against its will, can be forced into calling Congress together in the late epring. If the business world could be assured positively that the new Congress was not to assemble until next December it would be a cause of profound relief. Recovery of British Finances. Turning to conditions abroad, the most notable achievement of the year was the recovery in British finances, reflected in a rise in the pound sterling at one time, three weeks ago, to within 17 cents of the pre- war parit: This was brought about by a balancing of the budget so ef- fective as not only to show a large excess of receipts over expenditures, but to make this showing while re- ducing the Income tax a shilling in the pound. 1t i quite possible, if the hopes placed in the new political regime are borne out, that Italy will accomplish in 1928 what Great Britain did in 1922, The position in France and in Bel- glum is 50 wholly dependent upon the German reparations settlement that the outcome Is impoesible to figure upon at the present time. France Is unwilling to cut down its outlay for the military establishment, and this means, along with the re- quirements of the devastated regions, continuance of a huge deficit unless the major part of the war claim against_Germany is ceflected. Ger- many’'s ability or inability to meet is the most disputed | time providing extra to out well ! steel, copper, L Tetil producers bigan to operate i the Lluck. Incr.ased output was mergers of independ- | trust- | 1923 Enters—Other Vital Factors Are More Encouraging. I matter in financial discussion at the present time. Output of New Securities. | The rise in the investment markets was continuous and fairly rapid from | June, 1921, to September, 1922. Then came what has proved to be a de- | cisive check. This check was brought |about in some degree by the tre- | meendous output of new security is- ISues. Total bond offerings, which iwere $2.645.000,000 in 1913, rose to | nearly $4,000,000,000 in 1921, and to | approximately $4,500,000,000 during | the past year. | While this has meant severs com- petition for the older established {bonds, a still more important_ influ- | ence was the giversion of funds into trade channels which had formerly |been available for Investment. Rates of money interest at the same tims stopped ~ going down and turned slightly the other way. This tend- ency may be expected to continue the coming year, as all the indica- i tons point to a larger absorption of bank money in industrial lines. Gold Holdings Excessive. At the close of the year total go! reserves held by the Federal Reserve | Bank were $3.040.439,000, a rise of over §150.000.000 in the twelve imonthe. The best opinfon is that { these gold holdinz< are excessive. and that it would be well, if nataral cor Altions in international trade permit to send back 10 the rest of the wo part of the enormous accumulatl which occurred in the vears follo™ - ing the war. 1t is quite poesible that the uny expenditures of American tou abroad, cambined with the increast: investment of American capital foreign bonds and in foreign busin jenterprises, might produce invisiblc credits against this country great.: than the visiBle excess of mercha:.- dise exports over imports. In th case gold exports would occur, & besides reducing the danger of flatlon at home, these exports wou | be of great benefit in helping the 1 | turn of forelgn currencies to a x i basis. | (Copyright, 1922.) —_—— 0L FORES T0 BAK HOSPTALF NEDED ) |New Veterans' Institution for : Fourth District Depends Upon Proof of Necessity. 11 a study of hospitalization coud. ions in the fourth district veterans ureau reveals a need for a new vet crans’ hospital Col. Charles R. Forbes, director of the bureau, will recom- mend 1o the President that such hospital be built. In making this announcement y day. Col. Forbes said he hud p nor would he recommend an ular site to the President, if it mes necessary to recommend i new hospital. Baltimore Friday, through a dele- igation of representative men, pu- }in a strong contention for a mnew fourth district hospital at Baltimore {10 take the place of the one at Fort McHenry, which is.o be vacated in ebruary bes has long been oppos ntonment type of hospital as being no longer fit for patients on account of fire hazard. Not_only_would the director va- cate Fort McHenry. but would als. {be in favor of taking from Walter Reed Hospital the Veterans' Bureau | patients housed in temporary struc- tures. The old fight | i for another gover: | ment_ hospital in the District of C: again tlumbia has been raised i l eriuin quarte , as each time {the past. it hus Been lost to i District througzh arguments of the | showing that the city had man: { hospitals and vacant beds already lavailable. ~The prespects of Was ington obtaining the hospital wers considered today by persons in el {touch with the situation to ke i remote. The Fourth District Veterans Burcan includes Marvland, the Dis trict of Columbia, Virginia and Wes { Virginia. {MRS. COHEN ASKS $25,000 IN SECOND BALM SUIT | Epecial Dispatch to The Star. BALTIMORE, December 3o.—Mear: balm of ,000 is sought by Mrs. Li' lian Cohen of Waushington from Mrs | Henry Rosenfeld and Mrs. Florence {Lobe. both cf this city. in @ suit file i the court o nmon pleas, i which the plaintiff alleges that the defendants, mother and daughter | prejudiced ner husband. Mux Cohc: a 8 nst ber. Numerous attempts were imade Mesdames Rosenfeld and Lobe to p uade Cohen to abandon his w it s through her attor- ine: . she alleged { i shund wers j reconciled u ration cause she alleg the defendants, The suit’ just filed is_the secon: brought by Mrs. Colen. The previous suit was abandoned after the recon- clliation. They lived happily togeth- er until October 1 last, when Cober once more descrted her, the plaintif Istates. l DISC USS LUMBER TARIFF. TU. S. and Canada May Make Reci- procity Pact. Negotiations have Leen opencd through proper channels between the TUnited States and Canada, it is said at the White House, to consider whether uny countervalling tariff duties may be placed in this country on imports of Canadian lumber. At the same time, it was added that President Harding has no proposition before him involving immediate | alterations of present tariffs on the roducts. - P rovisions of the Fordney tarifi bl now in effect, it was sald at the tariff commission. provide that United States may place a tariff on certain types of lumber, which now come in free. when produced in a country which puts a duty on similar products exported to it from the United States. Canada waus said to have a 25 per cent duty in effect on imports of the American types of lumber in question. and thus to have raised the question as to whether American schedules should legally be raised to an equal amount. BUSY DAY IN BONDS. NEW YORK, December 30.—The closing session of the year in the bond market was featured by another brisk rise in St. Paul Rallroad mort- gages and further improvement in United States government securities. In the industrial group Cerro de Pasco 8s eclimbed 314 polnts and United Stutes Steel 5s one, with the other popular lines showing only tractional changes. Total sales (par value) were $7,096,000. ' ORDER FOR 18 ENGINES, PHILADELPHIA, December 30.— Baldwin Locomotive Works received an order from Ualon Pacific for elghteen Tocomotives, involving about B j ¥ 4 \ ’ / {,