The Nonpartisan Leader Newspaper, January 7, 1918, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

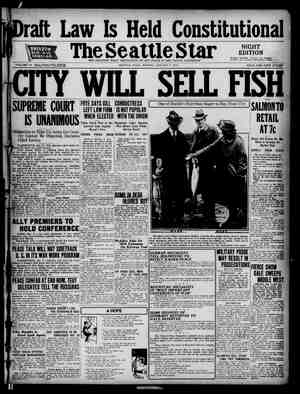

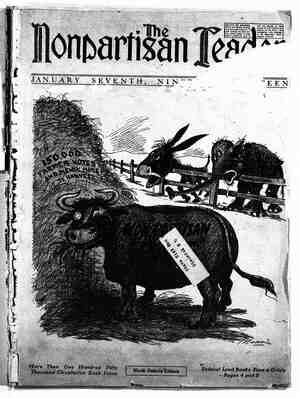

> - _bonds and can not make any more A . tary of the Treasury McAdoo caused . M\';oney Lenders’ Attack Mékes Headway ~ Fund of $25,000 to F\ight Government Rural Credit Banks—United States Senate Refuses to Give Adequate Relief — Agriculture Threatened. : prompt action by congress. Farmers who " . have asked for $100,000,000 in loans from the government through the federal land banks are in danger of being foreclosed. At best; if congress does not act promptly and refrain from half-way meas- ures, these farmers will be'sent back into the clutch- es of the high-interest money lenders. They will again be the victims of the usury that the govern- ment promised to rescue them from. The government rural credit system was estab- lished by an act of congress two years ago. Twelve government land banks were established under the law at strategic points in the country. The banks proceeded to approve security offered by farmers % g federal farm loan banks are facing a 4 T crisis. Their very existence depends on. for loans and to issue bonds against that security, - enabling farmers to borrow money on their land at 5 per cent, in place of 8, 10 and 12 per cent which private money lenders were charging. The federal land banks had an agreement with a syndicate of four big Wall street and Chicago bond selling firms to sell the bonds. This syndicate sold about $30,000,000 worth of the bonds, enabling farmers to get that much in loans. But this bond syndicate refused to renmew its contract with the federal land ‘banks December 1. The result is that the federal banks can-sell no more bonds. Farmers who have applied for about $100,000,000 in' loans, and have been promised the money by the govern- ment, will not get it, unless congress acts. NO MORE LOANS TO FARMERS | UNLESS IMMEDIATE ACTION - : Under the financial system of the country, no big bond issues can be sold except with the approval and assistance of the financial powers that be. These big private bond buying and selling syndicates have branches all over the country.. It is difficult or im- possible to dispose of big bond issues without get- ting the consent and aid of these financial syndi- cates. : The federal land bank law was weak in an impor- tant point. It did not provide an appropriation or machinery for the land banks'to dis- pose of their own bonds.. The land banks had to use the existing financial machinery, dominated by interests that oppose government rural credit systems on principle. They oppose government rural credits because such a system takes profits away from pri- vate money lenders and gives farmers loans at greatly reduced rates. i So the land banks, when the big pri- vate syndicate refused to renew its contract, have been unable to sell their loans to farmers, The banks will have to quit business—close down—unless congress comes to the rescue. This means that the government will break its- promises to farmers who have asked for loans of $100,000,000,” whose security has-been approved and .who have been led. to believe they would- get the money at 5 per cent. The refusal of the big private syn- dicate to handle federal land bank bonds follows an organized campaign against the federal land banks by the association of farm mortgage brokers, thes members of which had a virtual corner on the farm loan business be- fore the government established a sys- tem_ of rural credits. This organiza- tion- of money lenders appropriated $25,000 last summer at a convention to fight the government 'banks, ac- cording - to the testimony of persons : who attended their meeting. The or- ganization maintains a paid lobby at ‘Washington, D. C., and has a publicity bureau that has been poisoning the people against the federal land banks .. “and: against their management. PRQVISlON 1S MADE IN BILL TO PROTECT FUTURE LOANS ' Facing this condition, the manage- hag gone' to: congress for aid, : Secre- . a bill to be introduced in congress making an appro- priation of $100,000,000 to buy the land bank bonds, to take care of the loans already promised farmers at 5 per cent. These are the bonds that the financial _ plutocrats of America have refused-to handle} This is not asking a gitt from the government. It is merely asking the government to invest its money temporarily in gilt-edged bonds bearing 5 per cent interest—bonds secured by the land of farmers. The bill also provides for ancther $100,000,000 appropriation to take care of future applications for loans by the farmers. - With this second $100,000,000 the land banks propose to create a revolving fund. ‘With this revolving fund the banks can buy up their own bonds and hold them temporarily until they can be resold to the publie, through a bond selling .organization that the land banks can build up for themselves. This will make the government rural credit system independent of the financial syn- dicates that have refused to sell the bonds. Farm- ers who have been promised loans, as well as farm- ers who apply for them in the future, can thus be taken care of. “The organized farm mortgage bro- kers and their friends in congress are opposing this bill. ; Under the influence of the private money lenders, the United States senate has amended the bill intro- duced in congress. The senate has stricken out the ‘provision for the $100,006,000 revolving fund to take care of future loans and make the land banks inde- pendent of the money trust. And the senate has amended the provision for taking care of the farm- ers who have been promised loans. .vision has been amended so that the money appro- priated can bé used ONLY to buy up bonds in cases where the farmers need loans TO INCREASE PRO- DUCTION. This means that where the farmers want the loan to replace an old loan drawing a higher rate of interest, they can not get it. They must be fore- closed or go back into the clutches of the high-rate money lenders. : - Eighty-five per cent of the farmers who seek loans through the federal land banks want the money to take up old loans on which they are paying 8, 10 NOW IF YOU BANKERS WANT Y0 HANDLE OUR BoNDs we wiLL PAY YOU L4 % | Loy ' —Drawn expressly for the Leader by W. C. Morris This is how a government rural credit sygtem works—the system that the money lenders are attacking. 'Farmers orgznize co-operative associations, pool their ment ‘of the government land banks security, and get loans at low rates through government fand banks. Then the money lenders Took small and the farmer looks big. page for the way the old money .Io‘yan_ln‘g' system wo lfkg. : PAGEFIVE The latter pro- -See cartoon on opposite and 12 per cent. The way the senate has vamended the bili;- therefore, means that it will help only 15 .per cent of the farmers asking land bank loans. It means the rest of those who have been promised loans—the 86 per cent—will either be foreclosed or forced~to borrow money from private sources, and pay the old exorbitant rates. But it is more serious than that, because private money lending sources will be unable to supply all the money needed and thousands of farmers will be foreclosed outright. They have been led to believe they would get gov- ernment land bank money. They have made -no _other arrangement to take up their old, expiring indebtedness. ous crisis. THE LAW WORKED BETTER THAN THE BROKERS THOUGHT ‘With this situatien impending a big fight is prom- ised in congress. If the bill finally goes through congress as amended by the senate, noe adequate relief will be given. Farmers have been asked to exert every effort for greater production. They are making that effort. Is this a time to slap them in the face by denying them the land bank loans they ‘have been promised? How can we win the war if we. treat farmers that way?” The financial interests thought the government rural credit law would not work. They thought they had it amended before passage to prevent it really being a menace to the farm mortgage brokers and corporations., They did have it amended so that it was weak in many points. It left the rural credit banks in the clutches of the private financial syndi- cates, so far as selling the land bank bends was con- cerned. But the law has surprised those who thought it would not work. To date the federal land banks have lcaned $30,000,000 at rates away under those charged formerly. The federal land banks threaten to take over all the farm land mortgage business of the country. . And so the opposition to the federal land banks and to the- measures of relief asked by the banks is intense. The money power of the United States has decreed that government rural credits shall not succeed. They have lined up the senate against the land banks. Will the:bill pass as amended in the senate—a useless bill that will ‘only aggravate the situation, instead of relieving it? seen. The Weeks’ Joker Washington Bureau, Nonpartisan Leader ETWEEN 80 and 90 per cent . of the $30,000,000 thus far Agriculture never faced a more seri- loaned by the federal land " banks, under direction of the federal farm loan board, has been used to pay old debts, drawing 8 to 10 per cent interest, with money draw- ing only 5 per cent. The scarcity of available money for farm ' loans ‘caused the board (on December 7) to raise the rate to 5 1-2 per cent, and to cut off the premium placed upon the bonds. The board had-approved applica- tions for about $70,000,000 more in loans and it felt under obligation to secure this money for the farmers at the old rate. In order to do this, it called on congress, through the Glass amendment to the farm loan act, to direct the secretary .of the bonds up to $100,000,000 in this fiscal year, and as much during the bonds without loss when conditions permitted. X the house January 3. was through, Senator Weeks of Massachu- putting the same banking interests in Boston, offered’ G (Continued on page 21) It remains to be e s treasury to buy federal land bank next fiscal year, and to resell the This measure will be voted on in | In the senate | on December,18, when Senator Hollis measure setts, identified With the investment |