The Nonpartisan Leader Newspaper, January 7, 1918, Page 4

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

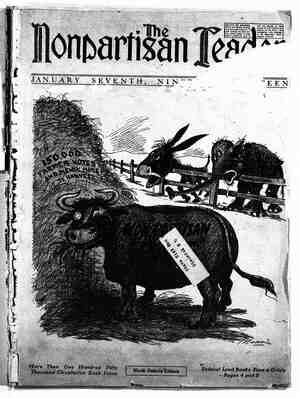

'Federal Land Banks Appeal to Congress Statefnent by President of St. Paul District Bank Shows Agriculture is Facing a Crisis this is no burden to the government in any way. The government will receive the profit of one-half of one per cent while they are carrying these bonds. The provision can also be made in law that if these bonds are not resold to the public within ten years’ time, that —Drawn expressly for the Leader by W. C. Morris This is how the farmer gets a loan from the organized money power of the United States. This i§ the system that the federal land banks were established to break up. No wonder loans cost up to 10 and 12 and 15 ‘per cent under this ° system. '‘And of course this system is fighting the direct loan plan. at cost, - provided through the federal land banks. See showing how government rural credite work. ' PAGE FOUR- .« /© ‘opposite page for another cartoon, for all of us.. They must be helped and assisted in every way possible so that they can supply, not only our country but also so that they can send a sur- plus across the water to our allies. In that congress will mot only be asked * (Continued on page 21) ) o order to do this it is highly probable - . 3 . T4 r'S ‘Through Lack of Needed Legislation to Perfect Federal Rural Credit System. : : : 5 ‘. 2 - [ BY E. G. QUAMME : : ! President, St. Paul Federal Land Bank _ 31;: time, Whlch: they can not possibly do at this - : - . LA o $ gi;:g:&;‘:%gu‘:a:xeszz;%: bfigstno?igz " This is the official statement of the man- During the first six months of the operation of banks were organized last March and April agement of the federal. farm loan b.anks the banks, while the conditions were normal, experi- 3 and opened for business about May 1. The regarding the need of immediate aid by ence taught us that our bonds sold readily on the = § work has now been carried on long enough to form congress in order to keep the govern- open market at four and‘one-half per cent, and !:-ti :l some idea of how the federal fafm loan system oper- ment rural credit, system on its- feet. premium. The ‘unnatural and distu;bedd fln?lf‘i':he o~ - ates in actual practice. Up to December 1, 1917, over President Quamme of the St. Paul dis- condition on account of the war interfered wi 1800 farm loan associations have been formed in the trict land bank sh " that legislati ready sale of our bonds. We feel that the present United States, comprising a total of 97,716 farmers, isln e d:d inaor dei fi:;i rgm' eglsba ::‘l)ln condition is abnormal and the embarrassment that - DR | = totaling $219,760,000 loans asked. During that' promises by:the we now have in selling our bonds is temporary. The . & period the banks had closed loans to the amount of government of loans to farmers can be _resolution has been taken to increase the rate of ° $29,816,000, which was all paid out to the farmers. ca}’ned out. He says this legislation is interest o» loans from b to 514 per cent to the farm- - a The banks had issued and sold bonds to the amount being opposed by the selfish farm mort- ers, thus permitting the federal land banks to sell of $26,970,000. These totals have been greatly added gage brokers, who had a monopoly on their new bonds in the future at a 5 per cent rate, Aol ~ to during the month of December, which is the the rural credit business before the gov- Considering the class of security and the t:la.(;r-fre?fi ; heaviest loaning menth of the year, and the federal ernment established its land banks. feature, it would seem that the bonds would sé & land bank of Saint Paul, on December 1, had ap- The financial powers that be in this . readily at this rate. LS & proved loans in the amount of $17,700,500, and dur- counizy are against giving the land- ‘We are asking congress to appropriate $100,000,000 Ing the month of December there was added to this banks a fair deal in 1 e 1 % Th to purchase 414 per cent bonds, in order to take care .total $2,707,900, making a grand total of $19,408,400 fan sha. L €081 Jepieation. dhey of promises and commitments made up to this time. = 2 of approved loans. To this must also be added loans Jear the government land banks, Wl_nch To avoid any future embarrassment of thig kind we that are not yet approved, but which have been have already cut tremendously into also asked congress to create a revolving fund of = < appraised and are in the bank ready for approval, their business and threaten to take $100,000,000, giving the secretary of the treasury in the total amount of $2,542,100. more of it away. See article on oppo- authority to purchase the bonds from the federal This makes a total of approved loans in the federal site page for further details about the land banks, at any time, at the then going rate. The O land bank of St. Paul of $21,950,500 up to this date, big fight that is on against the govern- land banks can then form their own syndicate and ; which is eight months after the bank opened for ment rural credit system . sell their own bonds and they will sell bonds out of i business. This represents the commitments that 4 7 this revolving fund, thus creating a condition where- B ¥ this bank has, which constitute a contract of agree- by the federal land bank can at all times make loans ° ment with the farmers, to the farmers in a steady flow, and there will be at « k¢ From this it is plain to be seen that the farmers 5 gha1) pe repurchased by the federal land banks all times funds to take care of their bond issues, ] of the country have been quick to avail themselves ., t1¢ request of the. secretary of the treasury, when the bonds are issued. Such funds as the treas- g [ of the provisions of this law. lTht"fi' thaé;;e :Ogml:‘l thus assuring that this one hundred million dollars ury will have invested in these bonds will bear 5 ~ v farm loan assoclations lsobrapid );.'ama od :vit":x ethe of bonds will not become a permanent investment per cent interest or more, according to the then EDam} banks;t h‘lwe simtpbs‘; k: etl;l i: mmé’ that the fed- = Ior the government. _If the banks at that time had prevailing rate. This will introduce into the system ot 4 e;’:fi:fji ban?(ss %,Eg:,sdzed thfl, business, which was t0 resell the bonds at a discount in order to absorb the elastic feature that the system needs. The re- g entirely a new system in this country. Systemshave the bonds from the United States treasury, they will volving fund was part of the original bill as draflied Py A been established, employes have been trained in be in position to do so without entailing any great but was stricken out just before the law was passed. } their difficult and new work—all this has been done financial loss at that time. They will be so firmly It is the one thing that the law needs and requires in the first six months of the bank’s operation. established that they can absorb the loss, if any, at in order to make it a practical success. No further proof is needed that there ~ & was a real existing demand for this law ’ ; - 3 G:?IESLE:EE lB'rAss'qug':'D::;:Y' & a e °c°$?é’e?f§ei§f°im3§ iors than { BLESS You Under the plan as outlined. no burden commitments totalling $100,000,000 that Y CHILDREN is tl:.rog uponetrl::n gp:e;;gz;::; ;gl; t(;:; 7 ' mers cen e gov en B e o f;“dera.l 3 : any-funds to be used; it is merely loan- o B s APl o e : ing its credit for which it is repaid: b ¥ —-land banks in good faith to secure At : loans for the pfrposes stated in the no loss or burden is thrown upon the law. All of these loans were applied Nt government in any way. Agriculture e 5 for with the understanding that they will carry its own burdens. The farm- o . would be granted at a 5 per cent rate. ers are always willing to pay the rate ; The government can not afford to break :: ?:::fi:e;héglfi gl: t;l:::ss;rgeinm:;d:: o % with the farmers of the country : - :fihespecia"" so now when extra bur- outlined would give farmers of this < sl .dens are thrown upon agriculture for country the relief they demand without - increased production in every way. To any cost to the government whatever. aggravate the situation, it is also more This point we want to make clear. = Ly “gifficult to sell mortgages on the open Nothing unreasonable is asked of con- 41 market, except at very high rates of gress—but only this: that the system i interest. If the farmers were forced nov;l :stablistlllle% i??vl l‘l)eb perf;ct::gdhlg e o w to secure funds through other é il suc way _thai e es she 2§annels, they would be compelled to - — dl. for all timé as a practical and depend- G ra pay rates ¢f interest largely in excess =] srAnnING —= iJL‘\; :.;vle ma?hinedth::t wtillxl tafg: care oft;clh: Tt f the rates paid prior to the time the BEHIND NG rmers’ needs for the ure, so tha q ga:fk: were gstab?isbed, if they could they can rely on it and plan their busi- o e secure the money at any rate. ness affairs accordingly. Nothing can : be done at this time that will give ag LAND BANK BONDS SOLD riculture more encouragement or that READILY AT FIVE PER CENT will assist the farmers in their cam- Agriculture is asked to make a tre- paign for increased production than to mendous effort the coming year. To give them this relief, which they now assist the farmers now is one of the agk. To refuse this at this time would most important war measures that discourage the farmers and would ere- could be undertaken. The admmistra- ate'a condition nothing short of a ca- tion therefore has asked congress to lamity, when we consider that at the assist the farmers at this time-to au- present time there are $100,000,000 of * thorize the secretary of the treasury to loans matured, or maturing, that must purchase at par the four and one:half be met immediately. per cent bonds issued by the banks. Agriculture s the basic industry of Inasmuch as the government has se- s : this country or any other country. The : cured it§ funds from the people at 4 = %,,,;:; farmers furnish the food and clothing s per cent, it can readily be seen that :