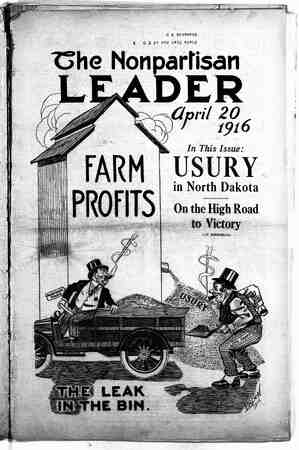

The Nonpartisan Leader Newspaper, April 20, 1916, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

- Two Thirds of Nation Excessive Interest La HE taking of interest for the use of money up until a few hundred years ago was deem- ed unconscionable, because it was exacting tribute from those in want and necessity. The laws of primitive society prohibited it and those laws were kept on the statute books of most civilized countries until the fifteenth and sixteenth centuries, Then the growth of commerce and manufacturing caused a change of attitude and interest was legalized. But dating from the time of its legal- izat_ion strict laws were passed against taking more than a fair inter- est. The laws_today prohibiting usury are practically the same laws as were made when Interest was first legal- ized. The taking of usury now, as at the dawn of civilization, is considered by humanity as one of the vilest practices. It is so considered not only because it is a violation of the law but because it is extortion from persons unable ‘to defend themselves—because it is exacting unfair tribute from those in mecessity and least able to pay it. - There are 151 national banks in North Dakota. Two thirds of them during the calendar year of 1915 were charging usury on loans. . Probably the bulk of all loans made in this state last year were made at from 10 to 15 per cent. The govern- or signed a bill in January, 1915, mak- Ing over 10 per cent usury. Previously 12 per cent had been the limit of legitimate interest. NINETY NORTH DAKOTA BANKS CHARGE USURY About 90 of the 150 banks of North ! Dakota reporting to the comptroller of the currency during 1915 admitted under oath that their average rate of interest was 10 per cent or more. From 24 to 48 per cent is charged in North Dakota for small loans. A list of 40 national banks in North Dakota reported to the comptroller of the currency under oath that ‘during 1915 ‘they had loaned over $2,760,000 at rates from 12 to 15 per cent. Over 10 per cent is usury now, over 12 per cent for years has been usury in this state. . The admitted extortion of those 40 banks above referred to alone amounts to over $100,000—that is, the interest.above what they were author- THE NONPARTISAN LEADER sury in North Dakota ized by law to take on that $2,760,000 amounted to over $100,000. The in- terest these 40 banks took above a fair rate—6 to 8 per cent—was close to $200,000. These are not guesses. These are not generalities. They are facts ad- mitted under oath by officers of these banks in reports to the United States comptroller of currency. One of the outstanding facts in con- nection ‘with-this situation is that farmers were practically the sole suf- ferers -of this system of usury. In- vestigations show 6 to 8 per cent is the rate for commercial loans. It is seldom ever 10 per cent. Agricultur- B —————————————————————————————————————————————————————————————————————————— WHAT THE COMPTROLLER SAYS The following statement regarding usury in North Dakota ‘was ‘made by United States Comptroller of the Currency John Skelton Williams to a:committee of congress last January: “In North Dakota there are 151 national banks, of which 96, or approximately two-thirds, were charging usurious rates of interest during the calendar year 1915. The legal rate of : _interest-in North Daketa is 6 per cent and the maximum rate --of interest allowed by contract is 10 per cent. “A VERY LARGE PROPORTION IF NOT THE BULK OF THE LOANS OF MOST OF THE BANKS IN'NORTH DA- JKOTA WERE MADE AT FROM 10 TO 15 PER CENT. “About 40 per cent of all the national banks in North Pa- kota reported that they received an average-of 10 ‘per cent or more on all loans, some hanks averaging on all of their loans 11 per cent, which is‘in excess of the maximum rate permitted by contract on any loan. 4 . “A CONSIDERABLE PROPORTION OF THE NORTH DAKOTA BANKS REPORTED THAT 10.PER CENT WAS THE MINIMUM CHARGED ANY BORROWER. “While 12 per cent is quite a ecommon rate in that state, comparatively few loans are made at the exorbitant rates of interest charged in other sections, ALTHOUGH FROM 28 to - 48 'PER CENT IS CHARGED IN SOME INSTANCES FOR COMPARATIVELY SMALL LOANS. ABOUT A DOZEN BANKS IN NORTH DAKOTA REPORTED LOANS AGGRE- GATING FROM §1000 TO FROM 15 TO 24 PER CENT.” $8000 AT RATES RANGING . This map shows the location and n of charging 12 per cent or more on their loans. The fi number of such banks found by the United States banks were found charging this excessive interest, three states where usury was found to be the most prevalent. : i ) 1 union in ‘number of banks charging exorbitant interest, but in proportion {o populaticn this state is Over 10 per cent is usury in North Dakota, so that the map does as it doesn’t include those gefting 11 per cent on high as 12 per cent interest. It will be noted that second if not the first in this practice. ) not show all the banks in this state charging usury, loans. -States in black have no banks charging as ) the agricultural states suffer the worst from this extortion. FIVE al Banks in This State Charged st Year, According to Records — e o | el . N ITEXAS A ™ al loans are seldom under 10 per cent and they range up to 15; small agri- cultural loans were reported by North Dakota barks as high as 48 per cent. BANK DIVIDENDS ARE HIGHEST IN NORTII DAKCTA Hand in hand with usury goes big bank dividends. The comptroller of the currency has compiled a table of state bank profits. It shows North Dakota state banks in 1915 paid an average of a little over 18 per cent in dividends. This is more dividends than state banks in any other state made in 1915. It is 8 per cent high- er than the average for the United States, which is only 10.38 per. cent. The average state bank dividend in the New England states is 7.26, in the eastern states, 11.11, in the Pacific coast states, 9.70. North Dakota state banks paid an average of 18.01 per cent. ? North Dakota national banks also “-pay among the highest .dividends in the United States. Their net earn- ings on capital and surplus for 1915 was 11.75 per cent, while the average for the United States was only 7.08 per cent. Eastern states showed average national bank earnings of 5.99 per cent and Pacific coast states average earnings of 9.70 per cent. Yet North Dakota .national banks earned 11.75 per cent .on surplus and capital. The comptroller’s table of bank earnings shows banks make the most money in .agricultural where farmers are universally charg- ed high rates, and pay ‘the biggest dividends in farming territory where usury is practiced, as in North Da- kota and Oklahoma. SMALL BANKS CHARGE MOST EXCESSIVE RATES Let John Skelton Williams, comp- troller of the currency, the man who has exposed these usurious rates in North Dakota and other -states, be heard on the subject. “The investigations which have been made show that the most excessive rates are being charged by the small ; “Among the safest loans that banks make are the loans to farmers,” says . Comptroller Williams; yet farmers are paying the highest rates. districts, : umber of national banks in the United States making a practice gures in each state on the -map represent the comptroller of the currency. Thus, in Oklahoma, 287 in Texas 168 and in Nerth Dakota 69. "'These are the North Dakota is ‘the third worst in the banks in the rural communities,” says: Mr. Williams in his formal report to congress on the subject of high inter- est rates. “Especially from the south and southwest .and west and the Northwest many bitter complaints have been received of excessive inter- est charged the farmers and others engaged ‘in agriculture. In many in- stances the exactions of the money lenders make it impossible for the farmer to live comfortably and pay the banks the enormous rates demand- ed for the use:of the money nceded to produce his crops. “The:enormous rates charged farm- ers are the more inexcusable when it is considered that the losses of banks on agricultural ;paper have been light renerally,. The records show ‘that .2rmers’ loans sooner or later nearly always are paid, however great may be the sacrifices the farmer must make to meet his obligations. “It-is estimated by those in a Position to judge correctly that the losses -on loans to farmers throughout the agricultural reg- ions .amount :to not more. than .a fraction of 1 ‘per ecent ‘on the money loaned them. Yet the farmer ~has been and is ‘obliged to pay, in thousands of cases, - not only twice the rate of interest usually charged ‘in the cities to merchants and manufacturers, where the risk is just as great, but ‘he-actually has been required to pay, in many -instances, three, four, ‘five, .and sin ‘many instances ten times the interest rate which he ought :to-be charged or which is permissible under the law. “I .will say that the investigations which T have made have justified me in drawing ‘the conclusion ‘that among the safest loans that banks make are the loans to farmers. The farmer usually pays his indebtedness, never minding whether he has to give up his last cow or his last plow. “An analysis of the reports filed by the national banks shows that some * national banks in nearly every part of the country, and nearly all banks (Continued -on -page 11) S e e PR i t i