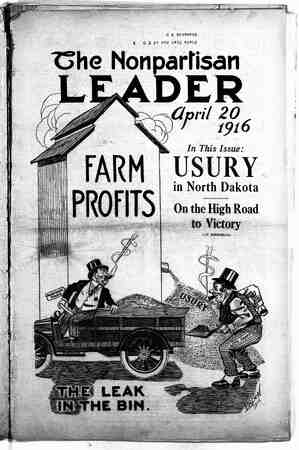

The Nonpartisan Leader Newspaper, April 20, 1916, Page 11

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

] L3 -4 v g3 e - = P & e ha in certain sections, have been charg- ing rates of interest on some of their loans which are not only illegal and usurious but which are intolerable and if continued inevitably must sap the strength of their customers and injure the communities in which they operate.” WHAT COMPTROLLER FOUND IN NORTH DAKOTA What did Comptroller Williams find in North Dakota? He reports 96 national banks in this ‘state which admitted in their state- - .ments of condition that they were charging on some of their loans rates in excess of those permissible under the national banking act and the laws of the state. He reports that 90 national banks in North Dakota admitted under oath September 2, 1915, that they were charging an average of 10 per cent per annum or more on all of their loans and discounts—10 per -cent, over which is usury, was not their highest rate; it was the AVERAGE charged by the most benevolent of “these banks; others of the 90 exceed- ed that average. He reports that 69 banks in North Dakota admitted under oath Septem- ber 2, 1915, that they were charging on some of their loans 12 per cent or more, 2 per cent or more over the deadline of usury. Why, say bankers who do a legiti- mate business and keep within the law, why do not these people forced to pay this interest sue to recover it or refuse to pay the notes? The law of North Dakota makes it possible for a person charged usury to sue and collect twice the illegal interest he paid. If pleaded before paid all in- terest can be forfeited." Comptroller Williams answers this. A man who pleads usury as a defense against paying a loan to a bank is blacklisted—he can never get a loan again. Farmers must have loans of- ten; they dare not protest. Comp- troller Williams gives a_concrete in- stance of why it is foolish to expect present laws to protect against usury. SHOWING WHY FARMER DOESN’T BRING SUIT P ays “Tt is: impossible in many cases” he says, “for the injured party to bring suit. I have before me the case of a farmer who borrowed $200 or '$300 in_ the spring from a bank to make his crop. It went on three or four years. They charged him 50 to 125 per cent. 3 ‘The poor fellow probably paid back the principal and a decent rate of in- terest, perhaps 10 or 12 per cent, but at the end of the fourth year he was sinking deeper and deeper because of the usurious charges and the bank swooped down on him, taking every- thing he had, taking the cows, the milk from which he required for his six children, also his plow horses, plows, harrow and everything he had. “The poor man was then driven out to find some other way ef feeding his large family. He took a contract to clear some wet land in the middle of the winter—went out practically bare- footed because he could not buy shoes. He contracted pneumonia or some other trouble, went along without a doctor’s attention, medicine or nour- ishing food and finally died. “His six children were shipped a- cross the line into another state and the county buried him. It can easily be seen that these six children were in no-position to bring .suit against that bank to recover the money which had been exacted from their father. “The victim of usury rarely pleads it in court. - He is afraid he will be blacklisted.. No matter what may be his exigencies he will never be able to get any further accommodation if he pleads usury.” ’ What is the remedy, then, for usury. Comptroller Williams recom- mends two- courses: first, that con- gress pass a law authorizing the nationa{’ department of justice , to bring suits against usurers upon in- formation furnished by the comptrol- ler of the currency or through other sources, to collect back for the bilked borrowers the amount extorted from them. This would protect national bank customers. Second, he recom- mends that usury be made a misde- meanor by the legislatures of the various tsates. This would protect " customers of state banks to a greater degree. e MAKE USURY A CRIME AND IT SOON STOPS - There is-no fine or imprisonment for the usurer in North Dakota. | As before stated the- victim can: onl been extracted V. bring suit to collect back what has n extr. illegally from him. - ve states, however, have laws mak- THE NONPARTISAN LEADER Usury in North .Dakota (Continued from page 5) ing usury a crime. And in all but "~ two of those five states the comptrol- ler failed to find any usury. In one state there was little usury reported and no banks collecting an average of over 10 per cent interest.” So laws making usury a crime have been ef- fectlyq. The following shows the conditions in those states where usury is a crime: Connecticut—Charging more than 12 per cent makes person eligible for six. months imprisonment or fine of $1000 or both; no banks found violat- ing usury laws; no banks collecting an average of 10 per cent or over. Iowa—Charging more than 8 per of $25 to $500 or imprisonment from- cent makes a person eligible for fine 30 to 90 days, or both; few banks found breaking the law of usury; no banks making loans, on an average, of 10 per-cent or over. South Dakota—Charging more than 12 per cent punishable by a fine of not more than $500; no banks found prac- ticing usury. 3 Tennessee—Charging usury punish- able by fine of not less than $10 nor greater than amount of usury collect- ed; this state is the only exception to the rule that making usury a crime cuts down the practice; usurers thrive in Tennessee, but the rates of interest on the average are lower than in North Dakota. Wisconsin—Fine of $25 to $300 for charging more than 10 per cent inter- est; no usury found in this state; no banks collecting, on’ an average, as much as 10 per cent interest. All the above data refer to national banks only. In comparison with these states here is the situation in North Dakota: North Dakota—Usury not a crime; 96 national banks out of 151 charging usury—that is, in- excess of 10 per cent; interest rates as a whole among highest in United States; great bulk of loans probably made at usurious rates; 90 national banks admit charg- ing an AVERAGE of 10 per cent or more on all loans. It must be remembered that the figures of the United States comp- troller of the currency are the ad- missions of the banks themselves, taken from their reports to the comp- troller. They are sworn statements of bank officers. The comptroller has reason to believe the admissions .ob-. tained greatly under-estimate the number and amount of loans made at usurious rates. In many instances after a bank had reported a certain proportion of its loans at usurious rates the comptroller uired an itemized statement of each loan made at the extortionate rate. The result in almost every instance was that the bank revised its first sworn statement and admitted sometimes twice and three times the original amount of usurious loans reported. The comp- troller’s figures therefore are conserv- ative and probably do not show the real extent-of the bank graft being carried on in North Dakota and other agricultural states. WAKE UP, farmers, and attend to business, or else be the other fellow’s goat. . Hurrah for the Leader! I have had my money’s worth a long while ago.—W. D. CROSKELL. acy. The “Just as good as the Underwood” argument, ad- vanced for the sale of other typewriters, sums . up all proof of Underwood suprem- “THE MACHINE YOU WILL EVENTUALLY BUY”. ELEVEN Remember This Le ks that the law demands are not legal. They are simply blanks, and are worth nothing. Legal blanks, to be LEGA L, must be changed to meet existing laws. Our legal blanks are legal because we have an attorney that keeps them so. Buy your legal blanks and supplies from us and when your man puts his name on the dotted line, you’ve got him. , We also publish the complete line of Elevator forms as adopted by the Railroad Commissioners. WALKER BROS. & HARDY, Fargo, N. D. : : Fargo’s Only Modern Fire Proof Hotel : : POWERS HOTEL Hot and Cold Running Water and Telephone in Every Room FIRST CLASS CAFETERIA IN CONNECTION. On Broadway, One Block South of Great Northern Depot. FARGO, N. DAK. | Reboring and Grinding of Cylinders This is the time to fit up your steam engines and gas tractors for the coming season. We can rebore and grind your cylinders, fit new oversize pistons and rings, make and fit new crank pins, straighten shafts, bore and bush worn gears and clutches, or any kind of machine work, reflue boilers and replace stay bolts. . _We carry in stock all sizes of stay bolts, patch bolts, bracket bolts, rivets, boiler flues, staybolt taps, boiler taps, shafting, shaft hangers, cast iron and wood split pulley.. 00000000000000000000 0000000000000 0000000 Write and let us quote prices on any work you have. CRAIG BROTHERS N. P. Avenue, Fargo, N. D. Farm Loans at Lowest Rates AND ON A PATRONAGE DIVIDEND BASIS Farmers—Place your loans with a cooperative Rural Credit Associa- tion where you can not only get low rates to begin with but share in the profits of the business—a proposition that must interest every man who wants long time loans at lowest rates? . This Association was created to serve the farmers of the northwest. It is owned and controlled by farmers who seek to make it of the high- cst use in the development of the farming business of the territory in which it operates. Become a member of the association—join hands with the farmers who seek to throw off the yoke of the money lenders and high-interest- rate exploiters of the agricultural interests. The Farmers Rural Credit Association A COOPERATIVE FARM LOAN AGENCY Chartered in 1915. Authorized Capital $500,000. Home Office: Herald Building, Fargo, N. D. Rentan UNDERWOOD Typewriter . TS simplicity of construction and ease of operation have made this machine the choice of the greatest typists and largest cor- porations. : :