Evening Star Newspaper, December 31, 1936, Page 17

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

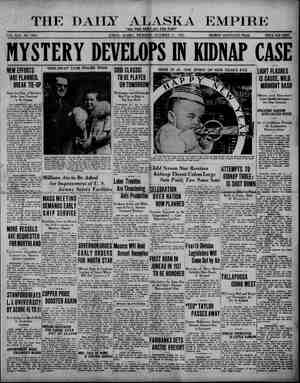

’. ) FINANCIAL. THE EVENING BTAR, WASHINGTON, D. C, THURSDAY, DECEMBER 31, 1936. FINANCIAL. ~ B3 JUNCOMES GAIN MORE RAPIDLY THAN COST OF LIVING IN YEAR L) PURCHASE POWER 1S LOSE TO PEAK Dollar Revenue of Average Family Keeps Ahead of Rising Prices. (By Cambridge Associates.) In the strange wonderland that we ‘Thave become accustomed to accept, the welfare of the average man is hard to gauge in reference to past dates. When dollars become nct dollars, but ¥ 5906 cents: when the value of the English pound depends on the day-to- day opinion of international specula- tors; when unemployment continues above the 8,000,000 mark and yet we are told that business is back to normal —who 1is to say that Americans have more or less material wealth than in 19292 ‘Wages in dollars in 1929 were approx- imately 35 per cent higher than in 1936. Yet this statement does not prove that the average man now has 35 per cent less real income. But there is a criterion which, regardless of fluctuations of currencies, prices and whatnot, reflects rather accurately the present status of John Q. Public. ‘This | indicator now states unequivocally that the prosperity of the average Ameri- a i 1931 1932 1933 60 stocks, monthlys 1927 prices, the ris Jor most companies. STOCKS CONTINUE STEADY ADVANCE Many Billions Are Added to STOCKS PUSH THROUGH 1927 AVERAGE LEVEL can family is no very close to that of the peak year * feceding the world- wide depression. Despite shifting sands and confusion f of thought, there is a certain logic in the use of goods rather than money as an indicator of the state of wealth. ‘Wages are in money; goods are pur- chasable with money. At any given time the money which is paid in wages has the same value as the money which buys goods. Therefore, if our figures on wages are accurate and we choose the right goods in the preparation of an index of prices, we can combine them to set forth the purchasing power of the wage earner in an absolute figure which is directly comparable with any other given period. This is the con- sumer’s “real income.” Arriving at Real Income. The average family spends a certain proportion of its income for food, for clothing, for shelter and for miscella- neous items. From this relationship we are enabled to prepare an index of the cost of goods which takes into ac- count the effect of increases and de- creases in the prices of certain items on its budget. Further, we can add to the wage index salaries, farm income, dividends and interest in their relative proportions to gain a comprehensive index of average income. These refined figures give as close an approach to the actual “real income” of the average man as it is possible to prepare without such extensive special research that the figures will have little current value when they are compiled. From an average level of 100 in the year 1929, the index of real income dropped more slowly than wages, reaching a low point of approximately 75 in the latter part of 1932. By the middle of 1934, after climbing with only one minor interruption, the index had reached the 92 level. But the influence of price increases and faded faith in recovery dropped it back to 80 before the close of the year. Since that time the index has fol- Jowed employment levels very closely, but at a higher relative level to the 1929 period than employment has shown. This is explainable by a rapid recovery of wage levels and a not so rapid recovery of retail prices. The average of monthly indices of real in- come for the year 1936 is approximate- ly 93, but the actual figure at the close of the year is estimated to be 98 or better, with 1929 as 100. Retail Sales Gain. Small wonder that department stores throughout the Nation were | enabled to report increases in sales | averaging better than 10 per cent higher than last year, and ranging (or“ some districts as high as 19 per cent. | Samples of the improvement reported for the first 11 months of the vear: | New York 9 per cent up; San Fran- cisco 10 per cent up and Chicago 13 per cent up. Not one of the Federal mrve districts showed a decline in that period. Again, dollar volume is| now a conservative indicator of the wvolume of goods moving over the coun- ter, because retail prices have not fol- lowed recent sharp gains in prices of raw materials. The prospects for real income gains | in 1937 are somewhat clouded. While production is likely to expand mate- rially, a large part of the expansion will be accounted for by the production of new machinery and facilities for manufacturers, not by consumers’ goods. And it is likely that the increased > 2 2 ‘wages made available to the public by the employment gain which is almost sure to come, will be largely eaten up by substantial increases in prices of . ‘The raw material prices just referred to will begin to have effect on prices of goods at retail as soon as current supplies in the hands of manufacturers begin to dwindle. FINANCE COMPANIES SHOW BIG GAINS ? " Commercial Credit Chief Points to High Volume Attained by All Major Firms. (By Cambridge Associates.) Howard L. Wynegar, president of Commercial Credit Co., declares: “The year 1936 will go down as & high- volume year for all the major finance companies, including our own, and ‘with satisfactory results to their stock- holders. This record makes evident ‘that the services of the larger finance companies are in demand and that they are playing an increasingly im- portant part in our national indus- trial and finance program. “The great development in the finance business has not been of a chance character, but originated pri- marily with the program of our large tindustrialists in manufacturing on a mass basis to put quality merchandise and articles in the hands of our home market at modest cost. It was prop- erly calculated that this cost could obviously be reduced if such articles or merchandise were manufactured on a mass basis. “However, to support mass produc- tion it was necessary to have mass dis- tribution, and in turn this brought in the necessary requirement of mass credits. It is in connection with this program that finance companies have experienced their greatest development, or installment credits.” Values—Selling at Year End Restrained. (Continued From First Page.) | proximately doubled the quoted value | of shares, “a more rapid advance than | any that took place during the bull Foreign Funds a Factor. | markets guring the year, reflecting fears of currency devaluation and armed conflict abroad, was widely re- garded as a contributing factor to the | rise at times. This influx was so large as to prompt Washington to consider | means of controling it, on the grounds | that it was “hot” money—that is, sub- ject to quick and, perhaps, unsettling withdrawal. Despite the scant increase in the | use of credit in the stock market the potentialities of cheap credit and ris- | ing prices prompted several leaders | publicly to warn against dangers of excessive speculation, including Chair- man Landis of the Securities Exchange | Commission, President Gay of the| | stock exchange, and President Smith of the American Bankers’ Association. S. E. C. Investigators Active. The S. E. C. steadily developed its program of securities’ trading control. Investigators actively followed trading, | and charges of manipulation were pre- | ferred against a few members of the exchange, including two of the larger | houses. { The commission tentatively pro= posed segregation of dealers and brok- | ers and made detailed studies of the | amount of trading done by members | for their own account. | circles viewed segregation as revolu- | | tionary proposal and prices of mem- berships declined. Campaign Disturbance Slight. At various times during the year, tension in Europe was regarded as unsettling. When the French franc actually was devalued in September, however, it caused scarcely & ripple. The national political campaign failed to become a seriously disturbing fac- tor, and the market advanced sub- stantially between August and early November. It flattened out somewhat, in the final two months of the year. It was notable that many of the in heavy industry issues, such as steels | and railway equipment. Other leaders were farm implements, rubber tires, and electrical equipment. Some of | the consumers’ goods issues which were | prominent in earlier years of the re- | covery, notably tobaccos and foods, | made little progress. Rails came for- ward substantially, Utilities advanced ! moderately. CURB SHARES SET NEW PEAKS IN 1936 Industrials Outstanding Favor- ites—Volume Reaches Highest Point in 6 Years. BY the Associated Press. NEW YORK, December 31.—Stocks climbed sturdily on the curb exchange in 1936 to new recovery peaks in the heaviest trading in six years. ‘With let-downs in the late Spring and at the year end, the market car- ried on the prolonged advance of the preceding year and widened the per- spective of a major bull trend going back to the Summer of 1932. Backed by broadening business im- provement and a rise in basic com- modity prices, industrial shares be- came outstanding favorites. A few rose feverishly. Oil and mining shares, except golds, lured buyers. Utilitles formed the rear guard of the advance, despite new records for use of elec- tricity. Advancing operating costs were considered an obstacle to the utility group. The setback late in the year, follow- ing a post-election spurt in November, was held to modest limits. The curb acquired many new list- ings as the capital market opened wider to financing and rising prices :;: l:muuu increased popularity of RECEIPTS INCREASE AT POWER LAUNDRIES By the Associated Press, Power laundries last year received $361,602,000 for work done, Census Bureau statistics show, an increase of 223 per cent over 1933. ‘These laundries, which work with 16 per cent over 1933. ‘Wages aggre- gated $151,185,000, a rise of 19.3 per cent. —_— PASSENGER CAR EXPORTS HIGHEST SINCE 1929 By the Assoclated Press. Passenger car exports during Octo- ber reached the highest level for this month since 1929, the Commerce De- partment reports. Introduction of new models, the de- it says, brought a resumption of foreign demand, and exports for the 000 over September. A market that reached its peak in 1929.” A heavy influx of foreign funds into | | the New York money and investment |: Exchange | sharpest gains of the year were made | | AVERAGE OF 60 ST 1934 1935 1936 The wide upswing in stock values during the past two years is shown on this chart, based on the Associated Press average of ange. Pushing through the average level of reflects increasing earnings and dividends LIFE INSURANCE RECORDTOPSL.S. National Average - Below Policy Mark Here, Riggles Announces. The first 11 months of 1938 showed the life insurance business in Wash- ington to have been even with the same period of 1935 and ahead of the national figures, which were slightly lower throughout the country than last year, remarked Laurance H.Rig- gles, president of the District of Columbia Life Underwriters’ Association, in a review of the year's progress. He attributed xthis excellent showing to two things — increas- ing interest in life insurance because of the record made during the de- pression and to the fact that the | personnel representing the various companies in Washington is of an exceptionally high caliber, due to Dis- trict requirements. In looking over the last 12 months, the underwriters' leader praised the immediate past president, J. E. Mc~ Combs, for accepting the chairman- ship of the board of governors of the newly-formed Life Insurance Insti- tute of Washington. which offers higher education in life underwriting. He considers establishing the instie tute one of the most important steps ever taken by the local association. ; During the past year the association broke all records for membership, reaching a new high of 303 active | members. This shows an increase of | almost 100 per cent over the preced- ing year and is an indication of the growing interest on the part of the District underwriters in the local and national associations. In September 28 Washington underwriters attended the national convention in Boston, this number far exceeding any previous attendance on the part of local underwriters. Mr. Riggles stated that with a defi- nite upturn of business in December, 1936, all indications point toward a | pronounced increase in life insurance | sales for 1937. The association will hold the nine- teenth annual joint sales congress with the Marylahd Asscciation of Life | Underwriters on January 12 in Wash- | ington. This will be followed by the regular monthly luncheon meetings throughout the year and the observ- ance of Life Insurance week in the Spring. ia L. H. Risgles. COFFEE PRICE HELD LIKELY TO STAY LOW (By Cambridge Associates.) Coffee prices remained in the doldrums during most of 1936, although the latter part of the year saw some slight firming. The recently an- nounced Brazilian “A. A. A.” to con- trol production, and the continuance of Brazil's destruction program, may affect the supply-demand ratio some- what, but -undoubtedly surplus stocks will still be sufficient to hold prices close to present levels. An upward movement is not so likely to result from an improved statistical position of the ctommodity itself as from a sharing of the upward trend of commodities in general A strengthening of the Brazilian ex- change rate would also be a bullish influence. ‘The oversupply of coffee obtains even though imports into the United States, the largest consuming country, were the largest since 1931. European stocks are reported as heavy and, in the light of visible supplies, it does not appear probable that the back- ground situation is likely to improve greatly during 1937. —_— DROUGHT CHECKS RISE IN LEATHER PRICES (By Cambridge Associates.) 1If severe drought conditions had not occurred 1936 would undoubtedly have been a year of soaring hide and leather prices. Consumption remained high throughout the year. During the late months of the year it even exceeded the 1920 rate. Particularly .note- worthy has been’ the record of the boot and shoe industry, which for two years has maintained production above all previous high points. In spite of this activity in consum- ing channels, liquidation of drought hides forced heavy supplies on the market and kept prices soft during much of the year. In more recent of | Weeks there has been a decided firming tendency and it appears that the low point has been reached. The general opinion is that prices are due for ?’t:’mhmlulnmummmol —_— ‘Water Consumption Heavy. A locomotive uses from 70 to 120 gallons and a freight loco- motive from 150 to 350 gallons of water per mile, Russian Activity Gains. Russia’s industrial production s {for they have supplied the required | month totaled $16,556,000, or $3,260,- | nearly 25 per cent ahead of last year. ‘consumer’ Food supplies are adequate. CAPITAL BUSINESS MOVES FORWARD Deposits and Many Other BarometersRegister Further Advance. (Continued From First Page.) |ARMS RACE CASTS | SHADOW ON TRADE New World Gains Due Un- less Tension Brings War or Breakdowns. (Continued From First Page.) expected that the full year's trade in this city will surpass the record of 1935 by about 15 per cent. This is considered by merchants to be a con- servative estimate. It may run higher because of the wild rush in final Christmas shopping. i It has been estimated that holiday trade alone was between 10 and 20 per cent better than last year. An estimate by the Department of Com- merce placed total December sales in the Capital at $40,000,000, although no attempt was made to separate regular shopping from extra holiday sales, the different ways the money wag expended having no bearing on the total 1936 retail sales volume. Merchants were delighted with the year's business. They point with pride to that fact that the increased busi- ness followed very important gains during 1935, when retail sales were the best since the days before the de- pression. The progress attained since 1934 has been nothing less than phe- nomenal, leading merchants assert. Busy Year on D. C. Exchange. The Washington Stock Exchange enjoyed an excellent year. The year 1936 closes with prices of most stocks and bonds considerably higher than they were in 1935. The market was also much more active, the demand for many local securities being larger than the supply. Exchange members report many orders on their books which they cannot fill. In some cases quotations are too high at which stocks are offered, in others investors do not want to sell at any price. ‘The most important new issue reg- istered on the Washington Exchange in 1936 was listed by the Potomac Electric Power Co. This concern put out $15,000,000 first mortgage 3'4 per cent bonds, refunding an issue of 6 per cent bonds due in 1953. The first sale on the exchange was made at 1041; and the bonds went to 104%. Public utilities have done well dur- ing the year, with the exception of | Capital Transit stock. This issue is now selling around 14. The company has had a hard battle with increased expenses during the year, which have not been offset by mounting revenues, Officials expect the picture to change with the adoption of the universal $1.25 weekly tickets in the place of the $1 passes so long in use. One of the high lights on the Washington Exchange has been the increased popularity in bank stocks. ‘Their comeback has been rapid. They have grown stronger, many surpris- ing advances in quotations being chalked up on the board. For a time after the bank holiday bank stocks were in complete disfavor. The turn came in 1935, but the real demand has developed in 1936. It seems here to stay, especially with *“double lia- bility” doomed. Bank Stocks Much Higher. During 1936 Riggs National Bank common reached $325 a share, the highest-priced bank stock on the board. American Security & Trust got up to $280 and Washington Loan & Trust to $250 a share. Other issues made as good gains proportionately. The year ended without a single sale in Washington Railway & Electric common stock, the highest-priced is- sue on the exchange. For some time the bid has stood at $600 a share. Higher earnings, together with sev- eral increases in regular dividends, as well as some “extras,” have been vital factors in forcing bank shares back to their former rungs on the financial ladder. ‘The per share turnover was greater than last year. Broader interest was also disclosed in the exchange, as was | evidenced by the number of new members admitted, eight in all. This was the largest number of seat trans- fers in several years. The hunt for good investment me- diums did the rest in making 1936 such a notable 12 months on the ex- change. Bond Dealers Again Happy. Much more might be said of 1936 prosperity. Bond dealers have ex- perienced a splendid year, the array of refunded issues giving them a chance to get back into old-time form. There have also been a very satisfy- ing number of senior issues represent- ing “new money.” “Best business since 1929, dealers add. New life insurance written in Washington in 1936 was about the same in the total amount as in 1935. This means a Iot, as 1935 saw gains of something like 30 per cent over 1934 and set a very hard pace to follow. The 1936 record would have been well above 1935 except for the presidential election, insurance leaders state. Many Government workers holding non- civil service places were unwilling to sign up for insurance during the cam- paign because of the uncertainty of their positions, Brokerage houses here report most substantial increases in business over 1935. Margin trading is at a low ebb, considering what it might be with the present supply of credit. But investment business and “buying for cash” are far, far ahead of 1935. ‘The long upswing in the big markets has drawn a great many old-time in- vestors and speculators back into the fold. 1937 Outlook Held Bright. The magnitude of the financial re- sults in 1936 has developed mo- mentum that bodes well for 1937. Bankers, merchants, investment ex- Winthrop, M cial responsibilities. A new charter of industry has been set up since the election. This is the most convincing guarantee that the major problem to- day facing the country, that of un- employment, will be corrected, but not wholly cured. Permanent Jobless Group. The latest figures on combined un- employment place the total at around 8,500,000. This is & decrease of 2,- 600,000 within a year and compares with the maximum of 15,000,000 at the bottom of the depression. Labor leaders, economists and technologists cannot see ahead to a period of full employment of those physically fitted to work. The probabilities are that there is a permanent unemployment quota in the United States of 3,000,000 to 4,- 000,000 persons Politically, the labor situation car- ries disturbing implications for 1937. The split in the ranks of labor has intensified the movement for more | representation in business councils | and for both higher pay and a shorter | work week. It is in this contest that the eco- nomic as well as the social philosophy of President Roosevelt is expected ultimately to determine its merits. Decisions in cases pending before the United States Supreme Court also will play an important part in the controversy. We are at the beginning of a four- year period when the relations be- tween capital and labor in this coun= try for the next few generations pere haps will be established. There is no doubt today that these are to take a form in which a higher standard of living for the low income classes of this country is to be the issue, Living Costs Climb. Associated with this as an increasing factor in controversial wage matters is the steady rise in the cost of living. Pay roll increases in 1935 and most of 1936 kept slightly ahead of the living cost advance. Then a multitude of wage advances in November and December, and other money benefits in the form of bonuses served to counteract a sharp rise in food costs and the start of what is ‘evidently to be a definite. and per- haps prolonged, increase in the cost of living. Commodity prices in December had the sharpest advance since the infla- tion boom in 1933. According to the Standard Statistics chart, such prices | at the end of 1936 were nearly double the range at the low point of 1933. Investment and Interest. More significant, and affecting a wider area than the rise in 1936 in | the market for stocks, was the great strength in investment securities. Not only did the public issues of corpora- tions and municipal bonds combined represent the largest total in years, all financing including stocks reach- ing nearly $6,000,000,000, but prices for the best grade mortgages and de- bentures exceeded those of any period |since the early days of this century. This was primarily the effect of low money rates, which were not confined to the United States, but were quite universal in the fyee money markets of Europe. . The investment market was mainly devoted to the needs of the institu- tions, as life insurance companies, savings banks and commercial banks. Their portfolios at the end of 1936 contained the largest aggregate of prime long-term bonds, in proportion to their total assets, In their history. And not within this generation has the average return on this portion of | their resources been so low. (Copyright. 1936, by the North American Newspaper Alliance, Inc.) . Loans Repaid in Full. Twenty-five railroads have repaid in full loans made to them by the Reconstruction Finance Corp. perts and all other financiers are ex- pecting a great year. The huge Government pay roll in ‘Washington will make conditions here much better than in other cities. Even if there are cuts in the Federal personnel, there will remain tremen- dous buying power that will keep the wheels of trade spinning at a very high clip. Every individual has his own rea- sons for visualizing still beiter times in 1937. All the forecasts are built on one vital factor. Recovery this year has been on & sound basis, “genu- ine,” as a former bank president put it. That's why the rise will go further. For 1937 ... Arrange for Additional Protective INSURANCE Your “wife and kiddies will have a happy New Year, as long as you, too, are present. But if something should happen before next New Year, what then? Give this practical gift! J. Blaise de Sibour and Company INSURANCE BROKERS 1700 Eye St. N.W. NALL 4673 itchell & Co. Members New York Stock Exchenge Ground Floor Securities Building 729 15th Telephone N St. N.w. ational 0084 PRIVATE WIRE SYSTEM Rerai. Saves CompareDd wiTH 1935 11 Mowt Basis PROSPERITY SEEN ATEND OF YEAR Depression Problems Open 1936 — Boom Control Talked at Close. (Continued From Pirst Page.) fourth year of the recovery move- ment. Of course, as has been often said, this money may be used to finance speculation rather than a healthy ex- pansion of production and consump- tion but, in spite of the sharp rise in prices in the late months of the year, it is difficult to delineate such a trend as yet. It is evident that prices will continue to rise in 1937; for the year the increase will prob- ably be as great if not greater than in 1936. If consumers’ income keeps ahead of prices, as it did in 1936, the effect will not necessarily be harmful to the national The chief danger is that it won't, that the growing cost of living will | rob Mr. and Mrs. John Q. Public of the substantial increase in “real in- | come” that they have gained these last two years. Will an epidemic of strikes, sit-| down and stay-out, sweep across the | United States in 1937 as organized labor attempts to capitalize its alleged political strength and recruit the great mass of unorganized workers in the mass production industries? Industry Goes Half Way. ‘That is quite possible. Labor un- rest is always a concommitant of growing prosperity. The rivalry be- tween two schools of labor organiza- tion will naturally increase the ag- gressiveness of both. And both feel that they can depend upon the back- ing of the Roosevelt administration within certain limits. Labor men in both the A. F. of L. and the C. I. O. camps have legislative hopes that they are anxious to back, by the power of the strike if need be. The element of Lope lies in the changed attitude of industry. The belligerency which was once charac- teristic of the barons of commerce has been muted since November 3 when an administration which most of them opposed was recalled to office by an unprecedented majority of electoral votes. Since that time the voice of business, as expressed through trade associations and public relations councils, has been unwont- edly pacific. The principle of colle kB C CamriDGE AssOCTES, BosTon Big Consumption Of Cotton Likely To Be Maintained By the Assoclated Press. NEW YORK, December 31.—John C. Botts, president of the New York Cotton Exchange, in a year-end state- ment today saw prospects of “contin- ued large consumption of all growths of cotton,” providing business and political conditions are favorable to world buying power. He found encouragement in the ILESS BUT BIEGER STRIKES FORECAST Labor Spends Anxious Year, in Futile Effort to Settle Rift. BY CAMBRIDGE ASSOCIATES. For American business as a whole the year's significant development was the increased determination of indus~ trial unionists to organize mass-pro- duction workers. Well financed, ag- gressive, experienced, the leaders in the drive intend to so change the com- plexion of the national organization of labor 5o that the industrial unit rather than the trade union will be the domie nating influence in the future. If they win—and both economic and political trends favor their success— the big question is whether there will be more or less industrial unrest. The answer, so far as one can be given now, is that there will be fewer strikes —many jurisdictional and sympathy strikes will be eliminated—but more | serious strikes, involving more workers and more crippling to production, | when issues between labor and man- agement are not soluble by arbitration. outlook fdr further reduction, and pos- | For organized labor itself the year economy. | sibly entire disposal. of the remaining | wag an anxious one. Hailed as a show- stocks of cotton held by the United | down year for American labor, 1936 States Government. | fell far short of its advance billings. But full recovery of foreign demand | Events marched rapidlv. but served for American cotton, he contended, only to re-emphasize the grave and walts upon the ability of buyers abroad | fundamental nature of the problem to obtain dollar exchange readily dividing union ranks. through trade channels. Remains Unsolved. ‘This problem—whether workers in Chemical; Save Trouble. the vgenernlly unorganized mass-pro= PRIe (o el breat e of water | ductu;n industries should be enlisted many railroads now operate locomo- | jo o ’"g:’ industcy or to trade—is of tives from 2000 o 6,000 miles and in | 7€ sndiog ) & wes, bronght; into 5 open at the American Federation some cases as high as 10,000 miles |t vention in 1934: it bec before it is necessary to wash out the | * o conyertion in i s boilers, whereas some years ago it | acute at the 1935 convention, and the was the practice to do 50 after & run formation of the Committee for Indus- of from 200 to 800 miles, | trial Organization by industrial union — e | proponents within the A. F. of L. in tive bargaining is, by the majori November, 1935, brought the issue to unquestioned. New concessions have the crisis stage—where. more than & been and are being granted which, | Year later, it still remains. before the balloting, would not have| The Committee for Industrial Ore been considered. In spite of the ganization was formed by the leaders provocative truculence which organ-| of 10 unions representing a2pproxi= ized labor is likely to assume in 19 mately a million and a quarter workers, it is not wise to assume that indus- | chiefly in the mining, clothing and tex- trial unrest will be a particularly | tile industries. This means nearly 40 adverse factor in the business picture | per cent of the total A. F. of L. mem= of the coming year. bership. Led by burly John L. Lewis, Congress—Left or Right? head of the United Mine Workers, the Another eventuality possible dis- C.I. O. proceeded to raise enthusiasm | turbing to business in general is the Aand a substantial campaign fund to | legislation which may be brought be- | Promote the organization of workers in | fore the Seventy-fifth Congress which | the steel, auto. rubber, aluminum and convenes in January. Left or Right? | textile industries. | —this, too, is another question that Separatists Suspended. |is supposed to be troubling industry.| In a dramatic racio broadcast Lewis |1n reaching for an answer, it is most | launched the C. I. O.’s drive to organize important to remember that the vast| the steel industry last Spring. The majority of Congressmen are neither | Executive Council of the federation Left or Right. They are politicians | followed with a move to suspend the responsive to the will, so far as it can | unions supporting the C. 1. O. Ale i be gauged, of their constituents. | though the door to peace was left open, The surprisingly puny totals record- | the terms were not acceptable to Lewis ed by the minor parties in November | and his fellow members of the C. I. O, | indicate that the temper of the public Strategy committce. Charged with fos« is not toward further unorthodoxies | tering “dual unionism,” fomenting ine in legislation. With each point passed | Surrection and failure to abide by tpe toward another prosperity period, | decisions of the federation, suspension orthodoxy fades even further into the | Of seven C.I. O. unions became effece background. Legislation in this com- | tive September 5. |ing session, therefore, may be pro-| At the federation convention in labor and pro-consumer but it will| Tampa in November the action of the inot be of the type likely to retard | council in suspending these unions was | further expansion and re-employment | upheld, but no decision was made on trends. the question of outright expulsion. LOCK AND CALENDAR WE'VE GONE AHEAD We Doubled 1935 We Quadrupled 1934 IN SALES OF WASHINGTON REAL ESTATE Total Sales.._.___°____151.6% of 1935 Total Value of Sales.__209.0% of 1935 $1,215.00 in Sales Every Working Hour This record is a two-fold satisfaction, because it manifests gubh’c confidence in our organization and our methods and use 1t estate as manifests a reawakened faith in Washington real an investment. We and our clients are looking ahead with every confidence to 1937 and its potentialities. Gratifying gains in the operation of our Manage- ment Department also indicate that business activity in Washington is in a very healthy condition. 1505 H Sales Realtors St. N.W. Natl. 2345 Experts in Investment Properties for More Than 30 Years