Evening Star Newspaper, April 2, 1935, Page 30

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

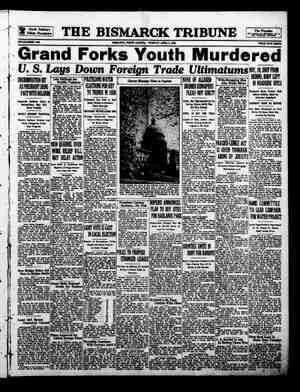

_B—14 = ADANS CITES VAST BANK BILL POWERS! Colorado Senator, in Forum Speech, Sees Uncertainty in Other Regimes. ‘The banking system of the country would be subject to a far greater measure of control by the National Government than ever was exercised by a kentral bank if the pending bank- ing measure sponsored by the admin- istration becomes law, Senator Adams, Democyat, of Colorado, last nighi de- clared in a speech in the National Radio Forum. The Forum, arranged by The Star, was broadcast over a coast-to-coast network of the National Broadcasting Co. Senator Adams, a member of the Banking and Currency Committee considering the legislation, explained in detail the measure, which is de- signed to revamp the Federal Reserve System. He said that it “maintains the de- centralized form of the original Fed- eral Reserve System, but centralizes in Washington the actual control of | that system.’ “The extent of the power thus con- centrated in the administration in Washington is almost inconceivable,” | he concluded. “For the present, it may be a source of efficiency, comfort and security. I am sure that under the present leadership of our country only good can be expected from this concentration, but we know not what is ahead of us. Franklin Roosevelt will not always be President of the United States.” | The text of Senator Adams’ address follows: The presentation by the national | administration of a new bank bill modifying in essential respects the banking system of the country is a matter of vital importance to the entire citizenship of the United Btates. The proposed bill consists of three subdivisions designated as Titles I, IT and IIT Title I. The Title I provides for the merger of the present temporary deposit in- surance plan into a permanent plan. All banks now insured under the temporary plan will come under the permanent insurance plan without further examination or certificate. The permanent plan will insure the deposit of each individual depositor to the extent of $5,000, as under the | present temporary plan. The existing law, which would have put the perma- nent plan in effect July 1 of this year, would have imposed an unlimited lia- | bility upon insured banks for assess- ments to replenish the insurance | funds. The new bill proposes to | change this requirement so that the | obligation of banks insured in the ! permanent fund will be limited to an | THE EVENING STAR, WASHINGTON, D. C, TUESDAY, APRIL 2, 1935. on Bank Bill SENATOR ADAMS, —Star Staff Photo. the existing practice each Federal | years of the depression, many hun- regulations relating to open market transactions of such banks, the in- dividual Reserve banks are not obli- gated to participate in any open mar- ket operations recommended or ap- proved by the Federal Reserve Board. New Board Provided. The new act proposes to substitute for the existing Open Market Com- mittee a board of five, which shall consist of the governor and two mem- bers of the Federal Reserve Board and two governors of the Federal Re- serve banks selected by the governors of the Federal Reserve banks, in ac- cordance with the regulations of the Federal Reserve Board. The present Open Market Committee can only make recommendations, but the pro- posed statute makes it mandatory upon Federal Reserve banks to com- Open Market Committee. Many do not understand the sig- nificance and importance of the powers sought to be conferred upon the Open Market Committee. These provisions are probably more vital not only to banking and financial operations, but to our national welfare than any other single provision of the Federal reserve act, either as it exists or as proposed to be amended by the new act. The supply of money available for business and financial operations has upon business activities. i interest, prices of bonds and securities of money. In the hands of the Open Market Committee as proposed by the new bill will rest the power to in- crease or decrease the supply of money in this country. Therefore, upon the action of this committee may | rest the country’s financial welfare, By going into the market and selling subject to the direction of the Pres- ident of the United States. Gov. Eccles of the Federal Reserve Board complains that the present Open Market Committee is unsatisfactory because it represents the views of commercial banks; that it has the local and not the national view. In other words, that they represent the views of the banks whose moneys have, in the main, supplied the funds with which the operations of the Open | Market Committee will be carried on. Gov. Eccles proposes that the Open Market Committee shall be a national agency and shall use the funds of the Federal Reserve banks primarily for national purposes without any control by the banks which provide the funds. He recognizes the power of this committee, and when asked by a mem- ber of the House Banking and Cur- rency Committee: “So it really gives ply with the recommendations of the | you complete control of the money | supply?” he answered: “That is right, namely, to that extent it is centraliz- ing that function to a greater extent than it has ever been centralized.” The bill under consideration is a reversal of the fundamental theory und purposes underlying the Federal Reserve system. The Federal Re- serve system was not organized to conduct governmental financial oper- ations or as a financial arm or agency of the Government. It was designed primarily to be an agency partly un- a direct effect upon all prices and‘der governmental control and with | Rates of | governmental assistance to protect and | co-ordinate the resources of the banks are all affected by the available supply | of the United States for the benefit of agriculture, industry and commerce. There has been, however, a gradual diversion of its functions into chan- nels of Government finance. As stated before, decentralization of financial power was an essential thought in the planning of the Federal | Reserve system. Projects and designs Reserve Bank fixes the rate of in- | dreds of banks which closed their | securities the amount of money avail- | for centralized control of the banking terest which it charges its member | doors could have continued to operate banks upon moneys borrowed from | successfully, effectively and soundly. it, but under the law the rate of in- ‘ The present statute provides for an terest to be charged member banks | Open Market Committee which cor upon their borrowings from the Fed- | sists of 12 members, one being selected eral Reserve bank may be fixed by | by the board of directors of each of the Federal Reserve Board in Wash- | the Federal Reserve banks. As a mat- ington. The Federal Reserve Board | ter of practice the 12 governors of may thus make borrowing by individ- | these banks have constituted this ual members attractive by a low rate | or prohibitive by a high rate. The present statute fixes the char- acter of security that may be ac- cepted by the Federal Reserve Bank | from the local bank to secure its bor- rowings. ‘The original limitations | upon these securities which are com- monly designated as ‘“eligible paper” were quite narrow. Paper eligible to | discount was restricted to certain | specified types and among those types | to that having early maturities. These restrictions proved to be unduly nar- row for times of emergency and among the emergency legislation of the depression have been statutes widening the definition of eligible paper. However, those statutes either | have or are about to expire. It is estimated that the total amount of | eligible paper in the hands of member banks in 1929 did not exceed $4.500.- | 000,000 while the eligible paper at | the height of the depression did not exceed $2,000,000,000. As the depres- sion deepened, the amount of paper held by the member banks which was eligible to discount with the Federal Reserve Banks under the statute de- annual payment into the insurance fund of one-twelfth of 1 per cent of | the amount of their total deposits, | insured and uninsured. i Title III. Title III contains a number of | amendments of various features of | the banking law which seem to meet | the approval of the administration, the public and the banks. My limited time will not permit a full or ade- | quate consideration of the more im- | portant provisions of title II, so it clined until many banks throughout the country had no eligible paper. In many communities, especially the | smaller communities, banking prac- tices were such that none of the paper held by the banks met the require- ments of the Federal Reserve statute. | The result was that as deposits de- clined the banks were compelled. in order to pay depositors and to main- tain their cash reserves, to sell bonds. As deposits were declining through- out the country, bonds were will be impossible to discuss the pro- | visions of title III Title TI. Title II, if adopted, would make radical and fundamental changes in our banking system. Under the exist- ing law the 12 Federal Reserve banks, which are located in commercial cen- ters in the 12 Federal Reserve dis- tricts of the country, exercise a high | degree of independence in their oper- | ation. The capital of these Federal Reserve banks is furnished by the | banks affiliated with them. Of the | | greatly and banks suffered | dous losses to their depositors. thrown upon the market in great quantities with the inevitable con- | sequence that bond prices - declined losses of hundreds of millions of dollars | through the forced sale of their bonds at prices far below their fair values. The losses so suffered brdught ine solvency to many banks and tremen- | Can Fix Securities, It has been quite generally recog- | nized that the definition of paper eligible for discount at Federal Re- committee. The Open Market Com- mittee thus created naturally repre- sents the views and interests of the 12 PFederal Reserve banks. While the existing act provides that the Fed- eral Reserve Board may transmit to the Open Market Committee, and te the several Federal Reserve banks, 2.Piece English Lounge Suite English Lounge Sofa and serviceable Frieze, Loose, spring-filled, reversi- ble cushions. Kiln dried frames with heavv ball feet, lable for agriculture, industry and | system were deliberately and definite- | commerce will be reduced, while by |ly rejected | going into the market and buying se- curities the supply of money will be | establish a central bank increased. mittee will have under its control, | under this, new statute, for the pur- chase of securities all of the resources of the Federal Reserve banks, and for the purpose of sale all of their vast holdings of Federal and other se- ‘The present bill does not propose to It main- The Open Market Com-|tains the decentralized form of the original Federal Reserve System but | centralizes in Washington the actual control of that system. The control by the national administration of the | banking system of the country if this bill is adopted will be far greater that inasmuch as the bill provides for 12-year terms for the members of the Federal Reserve Board in whose hands this vast power is lodged they will be independent of political con- trol, but the Supreme Court of the United States, in the case of Myers vs. United States, 272 U. S. 52, has held that every officer appointed by the President of the United States, other than members of the judiciary, may be removed by him at any time with- out a hearing and without notice, and that Congress cannot place any lim- itations upon this power of removal. Consequently the President may re move any member of the Federal Re- serve Board at any time, therefore | provisions of the law in reference to | the length of their terms constitutes no | limitations upon his power to control | that board. though, of course, it is expected that with rare exceptions | | the terms of office so fixed will not be | disregarded and that neither the | | President nor the members of the, | board would yield to political motives The Federal Deposit Insurance Corp. act provides that after July 1, | | 1937, no banks except those affiliated | with the Federal Reserve system can be insured. This provision will compel | all the banks of the country to afliate | | themselves with tpe Federal Reserve | System, and thus bring under the | | control of the Federal Reserve Board |and the President the entire banking | structure of the country. Every commercial industry and financial interest, even agricuiture, is to a large extent dependent upon the | | banks of the country. Even agricul- | | ture must look to the banks, and, inso- | | far as agriculture does not look to the | banks for its capital, its loans already | {are in “the hands of Government | agencies. The bill must, of course, be viewed in the light of the problems of today. | We cannot allow the voices of the past, however much we may revere them, to control, yet it is impossible for one schooled in the ideas of the great men of the past to refrain from a lingering thought of wonder as to what those great men would have thought of this bill. A good guess| ment signed by the Treas: and could be made as to Andrew Jackson | Agriculture Departments. = who, in a message on September 13, For a year the unlimited importa- 1833, said, “It is the desire of lhe‘ tion of foreign liquor had been re- President that the control of the | stricted to 60-day periods. Now it banks and the currency shall as far as | will be “until further notice.” For & possible be entirely separate from the | short time after repeal imports were political power of the country * * ** | handled through quotas for the vari- The extent of the power thus con- | ous countries, centrated in the administration in | - Washington is almost inconceivable. | For the present it may be a source of | U. S. HIRES WRITER efficiency, comfort and security. It must be remembered, however, that | 2 " whenel;reer g;denl“powe; is granted it | hfiha':; ,,C,,;‘;‘;;g- b';afi;?n%::;m;; may productive of great evil as . 1 w well as great good according to its | Depar%vmenv. o heip: i anle G haty exercise. I am sure under the present | leadership of our country only g can be expecv.kend from this concentra- tion, but we know not what is ahead of us, Franklin Roosevelt will not al- | {iar o, e Bublicity for the sale of ways be Presidént of the United | = States. ! TR 1 Irish Fear Flax Shortage. The linen industty of Northern Ireland fears a shortage of flax. Rus- sia is the main source of supply, but Abandonment of the quota system | the Soviets are using more than ever, for liquor imports was announced yes- | while Germany is importing flax as a terday by the Federal Alcohol Con- |substitute for cotton and wool. Flax trol Administration under an agree- prices are expected to rise. \ S+ = Crowell will assist Ray Tucker, an- | other magazine writer, who was en- gaged more than a month ago to LIQUOR QUOTA ENDED ! Fit.ALL.Tor* MIR-O-KLEER* HOSIERY..|-\3 with plain top . ..1.00 uwp TORMEATS curities. This vast power would be concentrated in the hands of a board | of five men, three of whom, con-; ZelL oo , | stituting a majority of the committee, | Will Force Affiliation. are members of the Federal Reserve| To those who argue that this means Board, and for all practical purposes political control, it has been stated than was ever exercised by any cen- tral bank Chair covered in s79 | S A quickly pacified. For efficient help use concentrated OosL Station G New York / ik SUITE Choice Walnut Veneers, Dresser and Vanity with L E at the Hub! and a Poster Bed. These suites at this low price won't last long. Better hurry! E\AYSEE STRADE MARK V. 8. PATS. NOS. 1.880.259 AND 1.949.307 4.Pe. Venetian Mirror Suite 79 Triple Venetian Mirrors, Chest of Drawers nine members of the Board of Direy | Serve Banks should be broadened. The tors of each Federal Reserve bank, six are elected by the stockholding banks, or, as they are designated, “the member banks,” within the district. Three members of the board are selected by the Federal Reserve Board, at Washington. The executive officer of each of the Federal Reserve banks, known as the governor. is selected by the Board of Directors of the Federal Reserve bank and paid by the hanki which he serves. The Federal Reserve | Board has no control over the selee- | tion or compensation of the governors of the Federal Reserve banks. The | deliberate purpose of the framers of | the Federal Reserve system was to se- | cure a decentralized banking and cur- rency control to avoid a centralization | of banking and financial control in | ‘Washington or New York City. It was | planned that there should be a con- nection and relationship among the | Reserve banks so that the resources of | one or more of these banks would be available to the other Federal Reserve banks when their own resources were | inadequate to meet the demands. The funds in the control of the Federal Reserve banks consist of the capital all of which is subscribed by the mem- | ber banks, the deposits of the mem- ber banks and the earnings of the Federal Reserve banks from their operations. The new bill proposes to Tepeal the statutory requirements which now require member banks to keep on deposit with the Federal Re- serve bank as a reserve not less than a. fixed percentage of their deposits and to give the Federal Reserve Board complete discretion to fix the amount thereof. The new bill places no lim- its whatever upon the discretion of the Federal Reserve Board in fixing these reserves. They can increase these requirements over the present statutory requirements or can reduce them. The act further provides that there need be no uniformity in these Reserve requirements, so that there can be different rates in the several districts and different rates in the several classes of cities within the same Federal Reserve district. The proposal would give power to the Fed- eral Reserve Board to control to a large degree the lending capacity of the individual member banks and, as & consequence, their earning possi- bilities. Control in Washington. Under the present law the gove ernor or executive officer of the Re- serve Bank is naturally sympathetic and responsive to the needs and policies of the individual banks which are really responsible for his selection. ‘The new bill provides that the selec- tion of governor of each Federal Re- serve bank must be approved by the Federal Reserve Board, thus bringing the executive officer of each of the Federal Reserve banks under at least partial control of the board at Wash- ington. The individual banks constitute at the same time the stockholders, the depositors and the borrowers of the Federal Reserve Banks. Under | new bill, in the place of widening and expanding the statutory classification | of paper available as security for bank borrowings at the Federal Reserve banks, propose to repeal practically all statutory definitions and limita- tions and to give to the Federal Re- serve Board at Washington full and unrestricted power to designate the kinds and classes of securities that may be accepted for discount by Fed- eral Reserve Banks. The new bill provides that “subject to such regulations as to maturities and other matters as the Federal Re- serve Board may prescribe, any Fed- eral Reserve bank may discount any commercial. agricultural or indus- trial paper and may make advances to any such member bank on its prom- issory notes secured by any sound as- sets of such member bank.” Gov. Eccles of the Federal Reserve Board in Washington says in refer- ences to this provision “What is pro- posed is that the problem of liquidity shall cease to a large extent to be a concern of the individual bank and shall become the collective concern of the banking system.” It is proposed tc make it possible for banks without abandoning prudence or care to meet local needs for short-time and long- time funds and to be assured that in | case of need they can resort to the Federal Reserve Banks on the basis of all their sound assets regardless of the form or nature of the collat- eral.” This provision constitutes a funda- mental departure from the theory heretofore prevailing as to the char- acter of securities acceptable by Fed- eral Reserve banks. Had this or a similar provision been in effect, and liberal use made of it, during the first ’Reci;lcés Swelling Soothes Piles Swelling promptly subsides when you apply soothing Pile-Foe. Pain, itching, or bleeding is checked and blessed relief follows. Thousands attest its remarkable healing prop- erties. Don’t suffer needlessly . . . get Pile-Foe at any drug store. Money-back guarantee. Refuse substitutes. The New Washington TELEPHONE DIRECTORY CLOSES SOON You owe it to your family to be in it Call MEtropolitan 9900 to order a telephone or to ar- range for additional listings [} Modernistic? Choice Walnut Veneers? s109 10-Pc. Dining Room Suite Exactly as illustrated with Dresser, Vanity, Chest of Drawers and a full-size Bed made of select Walnut Veneers with contrasting high- 79 7-Pe. “Neo Classic> Dinette Suite Exactly as illustrated with Buffet, China, Ex- tension Table and four Chairs. Made of $ selected hardwood and artistically decorated in > @ Neo Classic motif., 3.Piece Living Room Suite For those who like a very massive suite, here fs real value! Sofa, Button-Back Chair and Wing Chair with carved base and panels, Cov- ered in heavy tapestry! Inner Spring Mattress $8.95 One hundred tiny coil springs, heavily padded with layer felt, to insure comfort. Easy terms ., . only 50c a week! 79 | e VALUES! s5 D OWN 9x12 REVERSIBLE FIBRE RUGS Patterns én both sides. Plenty of new colorful designs in this group. Easy terms , ¢, only 50c a week. = 9x12 GRASS RUGS Closely woven and a attractively sten- .89 cilled. 810, $2.39; 6x9, $1.89; 27-in., 49¢ SATEEN OVERDRAPES %1.49 RUFFLED PRISCILLA CURTAINS Choice of Ivory or 590 Ecru supesnncemone Pr. Complete with valance and tie- sbacks. TERMS AS LOW AS 5 Side Chairs and Arm Chair. Sturdily con- structed of selected woods with rich Walnut Exactly as pictured with Buffet, Server, $7 Veneers, China Closet with linen drawer, Extension Table, Exactly as pictured, the suite con: of a bed-daven port that opens ® a full-size and comfortable bed high-back chair and club chair.. The suite is the last word in space saving and most convenient, It s attractively covered in a fine grade tapestry. 4.Pe. Colonial Bedroom Suite 9 Comfortable Chaise Lounge $8.95 Sturdily constructed and attrac- tively finished in a fine quality cretonne. Choice of several col- orful patterns. Easy terms . only 50c a week! Exactly as illustrated, Dresser and Vanity with swinging mirrors, Chest of Drawers and a Poster Bed. Made of select woods richly finished in Colonial Mahogany.