Evening Star Newspaper, January 10, 1930, Page 15

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

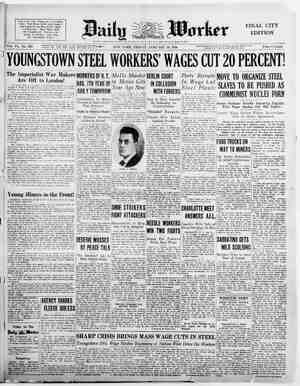

i ol " HARRISON EXPECTS HARD SUGAR FIGHT Proposed Tariff Schedule As- sailed in Forum Talk as Blow to Home. Assailing the proposal to increase the tariff on sugar as a movement both *indefensibl> and selfish,” Senator Pat Harrison of Mississippi declared last night in a radio address broadcast throughout the country that a higher sugar fatten the profits of domestic producers and place a greater burden upon the American people. Speaking through WMAL in the Na- tional Radio Forum, arranged by The Evening Star and sponsored by the Co- lumbia Broadcasting System, the out- spoken Mississippi Senator threw down the gauntlet to _proponents of the pro- posed sugar schedule in the pending measure, warning that a determined battle would be waged to prevent its adoption. Senator Harrison described the coali- tion of Democrats and the progressive group of Republicans as a “‘consumers coalition,” one to “safeguard the inter- ests of the consumers and also to pro- mote the welfare of American labor and honest business.” Decrying the “bartering of votes,” he asserted that the coalition proposed and the Senate adopted an amendment de- signed to eliminate this practice. He said this amendment intends that here- after increases or “decreases in tariff rates shall be adopted by Congress only after a thorough investigation by a com- mission of experts, proceeding under definite rules, to ascertain the competl- tive difference in production here and abroad. Vote Likely in February. The full text of Senator Harrison's address is as follows: The tariff bill has been before the Senate for more than 15 weeks. In all probability the discussion will be con- cluded and a final vote taken in the Senate early in February. But the length of time spent on the bill does not mean that time has been wasted. Quite the contrary; it means only that due atten- tion has been given to many details and blems connected with tariff legis- jation—problems that affect the pros- rity of farm and factory, the wel ing of American labor, and the con- tentment of the American consumer. ‘There are literally thousands of articles upon which tariff rates are fixed and each one has to be given careful and deliberate consideration. that equal jus- tice, as nearly as possible, may be ex- tended to all. Much has been written with reference to the so-called coalition in the Senate, the coalition that for the most part controlled the rate fixing and assumed 1in most instances the control of the bill. ‘This coalition, composed of the Demo- cratic organization and so-called Pro- ssive group of the Republican party, as been prompted by no desire to in- i’ure legitimate business. On the other and, it has co-operated to remove those obstructions, which, in the form of excessive tariff rates, close the channels of our commerce and stop the easy flow of our surplus goods and roducts to the markets of the world. ly. it might be called the consumers’ coalition—a coalition to safeguard the interests of the consumers, and also to promote the welfare of American labor and honest business. If proof is needed that such is the purpose of our action, it schedule would serve only to | THE EVENING of dollars; of the duty carried in the nt law, the cost to him would have been 219 millions of dollars. If the Senate committee increase is adopted S ASSAILS SUGAR TARIFF RAISE SENATOR PAT HARRISON. the cost will be approximately 273 mil- lions of dollars, and if the increase adopted by the House is adopted by the Senate the cost annually to the "American consumer will be 350 millions of dollars, In other words, the increase in 1922 of the duty above the rate ca: ried in the act of 1909 cost the Amer! can consumer $52,000,000 per annum, and if the Senate recommendation for an increase is carried out it will be a further annual increase of $54,000,000, and if the action of the House is ap- proved by the Senate it will add further $131,000,000. home. There is one State in' this | Union that uses approximately 1,250,- the Senate finance committee recom- mendation is adopted, increasing the | present duty on Cuban sugar to 2.20 | cents a pound, then the people of that one State will have to pay annually 5%z million dollars more than they now pay, and they now pay $15,000,000 annually, by reason of the sugar tariff. Why tax all the people—of more than 90 per cent of the States in this Union—in order to increase the protection on sugar and give rather doubtful benefits to a few people in less than 10 per cent of the States of this Union. Much has been said by those who propose the increase on the present price of sugar and the spotted depres- sion in the sugar industry. It is said that there are sugar companies that have lost money and they allege that the industry today is depressed. The present price of sugar is due to an abnormaily large world production. It is the natural sequence to the over- to. —Star Staft Photo:| 7 duction of any crop. What, has hap- that time it was belleved that the duty on sugar was a fiscal necessity. But the conditions that prevailed before the enactment of the income tax law have | changed. Taxation by the Government on corporate and individual incomes | have almost eliminated the revenue | features of levying duties at the custom | house. Sugar is one of the few agri- | cultural products in the United States | upon which a duty is effective—that | is, upon which a duty increases the price_pald by the American consumer. It has always been and will ever be | necessary to import the greater part of our sugar into the United States from foreign lands. Except those that are imported from our insular possessions, such as Porto Rico, Hawail and the Philippines, more than 80 per cent of the sugar imported into the United States comes from the Island of Cuba. None will contend that sugar is not a necessity of life. It is used by every one—the rich and the poor, the capi- talist and the laborer, the old and the young. It enters into every delicacy from soft drinks to candy, from pastry to coffee. ‘The value of the many things which it necessarily enters amounts to billions of dollars annually, and the | price to you and the American public of these innumerable drinks and_deli- cacies in which sugar enters is influ- | enced by the price at which sugar is | sold. Huge U, S. Consumption. Last year we consumed in the United | States 1215 billion dollars’ worth of | sugar. Twenty years ago our consump- | tion was about 60 per cent of that | amount. More sugar per capita is con- | sumed by the people of the United | States than by those of any other | country and our increase in consump- | tion of sugar has been phenomenal. Indeed, the quantity of sugar consumed in the United States has been increased | proportionately much greater than has | been our increase in population. ‘With this background of the many and necessary uses of sugar and its large and increasing consumption, let | us see what the tariff on sugar has and will cost the American people. creases? of sugar in 1928, American consumer of the duty of 1.35 cents per of 1909, would have been 167 miilions pened to sugar production during the last year has been happening many years to other agricultural crops. This world overproduction in sugar has been influenced, particularly in Cuba, through the removal of the limitations on pro- Based upon the consumption - the cost to the pound, as carried in the act STAR, WASHINGTON Let me bring my {llustration closer | /000,000 pounds of sugar annually. If| B0 FRIDAY, JANUARY 10, 1930. duction and the abnormally large sugar content in the sugar cane in that country, due to long drouth and searcity of rainfall. Every expert who has studied the world overproduction of sugar believes that the present situation will change and that influences under way, together with natural conditions attendant to the crop, will naturally force the price of sugar up. Companies Not Losing. But the facts do not reveal that the economically operated and well located sugar companies are losing money. Of course, when those concerns invest their capital in localities the conditions of which are not adapted to the growing of sugar beets or the raising of sugar cane in competition with other crops | more_profitable, the industry will as- suredly lag and become depressed. And the history of many of our sugar com- ; panies reveals the fact that they have not prospered for these very reasons. But take the sugar industry as a whole, those campanies in Continental United States that have been economically op- erated and the location of their plants wisely determined, have shown enorm- ous earnings. The only sane way in which to determine the difference in cost of production of a product here and abroad is to take a product or article produced or manufactured economically and under efficient oper- ation. To do otherwise would only add unjustified burdens upon the American people and assure too great profits to those competitors. the business of which is operated economically and efficiently. In 1923 an aroused and indignant public, when forced to pay more than 12 cents a pound for sugar, and that under the present tariff rate, caused President Harding to direct a thorough investigation by the Tariff Commission so as to ascertain the difference in cost of production here and abroad, and determine any change from existing rates, Following that investigation this commission made a report in which it recommended 1.23 cents per pound as a fair rate on Cuban sugar. In view "WoODWARD & LoTHROP 1880 COLDEN ANNIVERSARY YEAR: 1930 Qur Entire Stock of Men’s Winter Suits and Overcoats Reduced 259, and More (With exception of formal clothes and certain groups which we never reduce in price.) 333.75 Were $45 Boucle and Kersey Overcoats and Were $35 Our well-known Young Men's Two-Trousers $37.50 Were $50 and $55 “Woodward Fleece™ and Fancy Overcoats; at the close of Dusiness on December 31, 1929. of that report and the facts disclosed by it, there is no justification for an increase over the present rate of 1.76 cents per pound, but there is every ar- gument for reducing it to the Trates found adequate and recommended by | the Tariff Commission. But what about the poverty that it is alleged has been visited upon these sugar companies in our country? Com- panies representing over half of the sugar production in Hawali have earned on the average per share as high as 30 per cent in one year and in the lowest 15 per cent. Over half of the Porto Rican production shows a profit paid of over 11 per cent, with earnings rang- ing as high as 28 per cent. Over three- fourths of the beet sugar production shows earnings, after depreciation and taxes, per share of between 6Y; and 34 per cent. Huge Profits Paid. Recently the Great Western Sugar | Co., an_American concern located in the Rocky Mountaln section, a concern that produces nearly 48 per cent of the beet, sugar produced in the United States, paid profits at the rate of 40 per cent on the original investment. This concern, the business of which is well managed and whose factories are cconomically located, has earned in the last 10 years more than $75,000,000. It has paid out in that time in dividends more than $50,000,000. Its assets today are worth many times more than when it began business in 1905. Few con- cerns in this country have made such enormous profits and evidenced such a high degree of prosperity as thi: the largest of all sugar beet companies. The Holly Sugar Corporation, which produced nearly 10 per cent of the beet sugar produced in this country last year, according to its own statement, showed a year’s profit of over 1!z mil- lion dollars from a sale of only two- thirds of its output. The Dahlberg Corporation, engaged in the business of producing sugar from sugar cane—an organization which con- Reserve District No. 5 REPORT OF _CONDITION OF THE Seventh Street Savings Bank vashington, D. C.. at the close of busi- O W 05 D r 31, 1929, 'SOURCES. s, 1,520,170.62 21199 1.748.00 T 25110184 Btk 2,838.11 2,046,475.61 ,995.71 . . Cash and due from banks . Outside checks and cash items . 100,000.00 £ 100.000.00 divide: 65,977.69 . Reserves for 35 6.000.00 3. Time deposits .. 26. Bills payable an Total 1,100.563 66 10,000.00 ,046,475.61 District of Columb 1. JOHN D. Hi of ' the mnly swear that e to the best of ledge and belief. ks J. D. HOWARD. Cashier. Bubscribed and iworn ‘to before me this 8th day of January, 1930 (Seal.) H. R_HOW. ARD. Notary Publie. AUGUST H. PLUGGE, JOSEPH B. THOMAS, JOHN R. WRIGHT, above-named ban Correct—Attest: ors. [4 No. 11633, __Reserve District No. 5. arter TREPORT OF CONDITION OF THE Liberty National Bank Of Washingtén, in the District of Columbia, RE e d dis ..$2,730.558.96 B 129.40 FINANCIAL. A—I5 trols six subsidiary companies—in a statement by its president two months ago, stated that the total capital em- ployed by his companies was in excess of $50,000,000, and that the affairs of all his companies were in excellent shape and -the outlook for each most favorable. ‘Then, what justification is there for adding to the swollen profits of these prosperous corporations by imposing heavier burdens in higher taxes upon the breakfast table of every household in this land? The press of this country has spoken in no uncertain terms con- demning such a step. Labor has lifted its voice through its president, William Green, against such action. He sayg “In my opinion, the increase in thi sugar schedule is unjustifiable and in- defensible. If passed in its present form it would levy an unfair tax on millions of workers whom I have the honor to represent, for the purpose of protecting an industry which the facts show employs women, children and Mexican labor at indecent wages and under intolerable conditions of employ- ment. _The great masses of our worl T REPORT OF CONDI OF THE Washington Savings Bank Of Washington, in the District of Columba, at the close of business on December 31, 1929. | Overdrafts ........ . United States Government se- 1,009.06 95,151.00 67,285.08 33,052.09 28.334.7: 558, . Banking how T ture and fixtures, $13.285.08. . Real estate owned other than banking house . Cash and due fr . Other assets .. Total.. 1892,768.82 LIABILIT! Caplital stock paid in $100,000.00 Surplus ......... 26,000.00 d profits—net 5552.46 for dividends, gencies, etc..... 22. Demand deposits. 4 LEONARD, tre: above-named bank, do solemnly swear that the above statement is true to the best of my knowledge and belief. JOHN D. LEONARD, Treasurer, Subscribed and sworn to before me this th_day of January, 1930. (Seal.) JAMES_H. MARR. Notary Public, My commission expires July 5, 1931. Correct—Attest: . E. JARRELL, H P. GIBSON, 3. DES, . Loans and discounts . . Overdrdfts . . United State: . Cash and due from banks .. ‘Total . Capital stock paid in 16. Surplus . Undivided profits—net . paid Due to banks, including c standing 22. Demand deposits . 23. Time deposits .... Total ... District of Columbia, e . Other bortds, stocks and securities owned . Banking house, furniture and fixtures ... . Real estate owned other than banking house . 0. Outside checks and other cash items ... . Reserves for interest, taxes and other expenses accrued and un- ing people in the United States are un- willing to be taxed for the purpose of protecting an industry which resorts to such ' uncivilized practices. I register my protest against the proposed in- crease in the sugar schedule in behalf of the men and women affiliated with the American Federation of Labor.” This matter is now before the Senate Speeches were made in that body toda: in support of the proposal. The line: are being drawn and the only reinforce- ment that those of us who are now in the trenches, fighting against this in- crease, have is the articulate sentiment of the millions of people who, back in their homes, are not conversant witn what is being attempted to be put over on them in this indefensible and selfish movement. I do not venture to prophesy its defeat, but I do say to you, in clos- ing, that it will not be put over unti’ and after a most determined battle shall have been waged to prevent it. —_— T QF S North Capitol Savings Bank Of Washington, in the Di; 3 ‘ONDITION e RESOURCES, . Loans and discounts . 36.276.77 X s 74.128.42 Real estate owi banking house 32.292.28 . Cash and due from banks 139:409.87 . Outside check t LIABILITIE: . Capital stock paid in. Surplus . Undivided 'profits—n . Reserves for dividends, con- tingencies, _etc. 4,500.00 ue ' to - banl certified and cashiers’ cheeks outstanding . . Demand deposit Time deposits 2,775.93 855,069 848,355.20 3$1.668.567.16 City" of ‘Washinston, I.'P. HENRY COATES. cashier of the above-named bank, do solemnly swear thal the above statement is true to the best of my knowledge and belief, P. HENRY COATES, Cashler. Subscribed and sworn to before me this 9th_day of January. 1930. (Seal) BENJAMIN ROBINSON, Notary Public. Correct—_Attest: Theodore Michaei, A. Eckert, Jos, A, Herbert, Br., E. Floeckher, C. E. F. Hall, [~ Geo. E. Phillips, I Allen” Hollandes Paul_Allen. Total ... District of Columbi 58, John . P REPORT OF CONDITION WASHINGTON LOAN & TRUST CO. Of Washington, in the District of C%l;ur;bgizus at the close of business on December RESOURCES. $9,831,844.25 7,694.44 772,714.28 1,936,165.57 2,076,161.39 97,669.37 6,076.694.91 15,815.35 .$20,814,750.56 . $1,000,000.00 «. 2,300,000.00 224,954.94 1067312 50¢,263.91 12,854,423.49 3,916,443.50 ..$20,814,750.56 I, CHARLES R. GRANT. treasurer of the above-named bank, do solemnly and belief, Overdrafts | swear that the above statement is true to the best of my knowled; States CHAS. R. GR. is only necessary to point out that we In 1928, the last year for which com- have, taken as the basis of our action | Plete figures are available, the tariff on | the rates of the present {ariff law, |Sugar cost the American _consumers | “Woodshire” , ‘Treasurer. Subscribed and sworn to before me this 9th day of January, 1930.. (Seal.) FREDERICK A. GENAU, Notary Public, D, C. Suits “Woodward Fifty” ‘Government i 505,818.15 which at the time of its passage re- ceived the benediction of business and satisfied the avaricious appetites of the greediest special interests. So up until this good hour the tariff battle has waged over increases rather than over reductions in the present law. And it is only in those instances where the pro- posed increases were conscienceless and | unjustified by the facts that we have | opposed and accomplished their defeat. ‘Those careless critics who from rostrum and through the press have found fault with the work of those of us who have tried to fashion the tariff law based upon the difference in the competitive conditions here and abroad and to some extent equalize the advantages of agri- culture with that of other industries, have either deliberately attempted to deceive the public or were grossly unin- formed as to the facts. We have looked at the swoolen profits of pampered and favored pets of tariff legislation and to the efficient and economical conditions under which those industries operated, 88 the best and surest guide for our rcourse of action. Inquiry and Discussion. ‘The fixing of rates in a tariff law naturally requires intensive investiga- tion and provokes long discussions. One of the worst influences in the framing of tariff laws has been the manner in which the rates too frequently have been fixed. The old method of trading and bartering of votes is well known. By it rates were increased upon products in which the constituents of a partic- ular Representative or Senator might be interested, independent of the justi- fication for such increases and without consideration of their effects upon the whole industry or upon the consuming F\lbll& This practice has been a stench in our history of tariff legislation. The coalition proposed and the Senate adopted an amendment designed to | eliminate this character of tariffl making. In effect, the legislative flexible tari: provision, as adopted by the Senate, in. tends that hereafter increases or de: creases in tariff rates shall only be adopt- ed by the Congress after a thorougn investigation by a commission of ex- perts, proceeding under definite rules, to ascertain the competitive difference in production here and abroad. One of the main reasons why there has been 80 much dissension and difference of opinion between members of the tariff commission in the past in arriving at the - competitive difference here and abroad has been the lack of specific in- structions to the tariffl commission upon which their conclusions as to competi- tive. conditions might be ascertained. If this amendment should be adopted, little excuse can be found in the future for difference and dissension because | deed, one of the strongest arguments we will have given them, in this Senate | presented for the annexation of Hawali, amendment, & vardstick which they must apply in measuring and ascertain- | ing those differences in competitive con- | ditions. That amendment _intends | further to provide that when gress a change in duty upon the par- ticular product or article investigated, the | at all times and to meet every emer- tariff commission shall report to Con- | gency, whether in war or in peace, an more than $219,000,000. Under the | present tariff act, to the end of 1928, | it had cost them mors than $1,400.- | 000,000. During the last 20 years it has cost them in round figures, nearly | 3 billions of dollars, and of that enormous tax, only about 500 mil- lion dollars went to the producers of sugar in continental United States;, and of that 500 million, a large | per cent went to the sugar mill opera- | tors and a very small per cent to those engaged in the actual production of sugar cane or sugar beets. And during | that time the producers of sugar in the insular possessions of the United | States, namely, the Philippines, Hawaij | and Porto Rico, realized approximately 700 millions of dollars as a result of the tariff. With all these additional costs piled upon .the American people because of these sugar rates, what has been the re- sult? Last year 2,344,000,000 pounds | were produced in Continental United States. This did not approach our con- | sumption; it was only about one-fifth. | In 1909 we produced 1,681,000,000 | pounds, which was little more than one- | fourth ‘of our consumptive needs. In | other words, while the consumption of sugar has increased slightly over 70 per | cent, since 1909, production in Con- | tinental United States has increased less | than 40 per cent. Thus the proportion of consumption supplied by the domes- | tic production has actually declined. | The result, then, of 20 years' protec- | tion for sugar and of six years of the highest protection ever granted, is a relatively small increase in our domestic production, an increase which in no sense has kept pace with the increase in consumption. There is no industry in| America that has received higher sub- sidies, more favored treatment and greater assistance from the Government than has the sugar industry. And cer- tainly none has responded =o weakly in development and real progress. It is| today, after depressing the home with | heavy burdens for more than two cen- turies, still an overgrown infant, petted | and pampered and crying for more | favors. Necessary to Import. No one who has studied the subject can possibly seriously argue that Conti- nental United States will ever be able to supply anywhere near all of its con- sumption of sugar. Expert after ex- pert, interested in the large sugar en- terprises of the United States, in testi- fying before the ways and means com- mittee of the House and the finance committee of the Senate, have stated | that the United States can never pro- duce sufficient sugar to take care of the consumptive needs of the country. In- the acquisition of Porto Rico and the Philippines and our benevolent interest in Cuba was the benefits that would necessarily accrue to us in having ready adequate supply of sugar. In the face of the situation, despite it shall be determined by the Congress! the failure of the present rates of duty free from the consideration of the tariff | to stimnlate production of sugar in Co; on other articles. Such an amendment, 1f adopted, will put a stop to loxvolling, insure prompt consideration upon the part of the Congress and prevent in the future any one man taxes upon the American people by ignoring the honest recommendations | of a tariff commission. Essentiality of Facts, | Uninteresting to the public as is the tariff question generally, I shall try tonfght to sweeten it by taking sugar as my subject. into my confidence and speak to the firesides and hearthstones of the land of what is attempted to be done through the proposed increased tariff on sugar, the consideration of which item began today in the United States Sen- ate, I feel sure if the facts as they exist can be made known to you and 10 the people of America, that not only will the course of those of us who are battling against this increase meet with your commendation, but a universal rotest, poihtet! in character, will find Fis way to Washington, In the past tariff duties have been imposed on- -sugar -coming into the United States largely because of the need of obtaining revenue to run the Government, Before the enactment of the income tax law our greatest source of revenue was from custom dutics levied at the custom houses, and at A I want to take you| tinental United States, we are now asked for a further increased duty on | ugar. The American consumers are sked to dig down in their pockets and | from increasing | put up more money to aid this long- | subsidized industry, | In 1928 the cost of the duty to the American consumer was about 11 cents | a pound for_every pound of sugar pro- duced in Continental United States. | For the last 20 years the cost of duty to the American consumer was nearly 7 | cents and during the life of the present | tariff law nearly 10 cents for every | pound of sugar produced in Continental United States, i A resume of the rates of sugar under the past few tariff acts will afford a | background for consideration of the proposed increases. In 1909, when the Payne-Aldrich law was enacted under | Republican lead=rship, the du'y against | Cuban sugar was placed at 135 cents per pound: in 1922, under the same party leadership, that duty was in- creased to 176 cents per pound.‘ In the tariff bill now pending the rate on Cuban sugar was placed by ths House at 240 cents a pound. The Benate} finance committee, under the chairman- ship of Senator Smoot, has recom- mended an increase (o 2.20 cents per pound. What will be the effect upon the con- suming masses of the proposed in-| Two-Trousers Suits ‘THE MEN'S STORE, SEcoND FLOOR. Suits English Overcoats Reduced 25% and More 556.25 Were $75 #4875 Were $65 363.75 Were $85 5 Were $100 and $125 Imported Fabric Suits Reduced 25% 548.75 $4]_.25 Were $65 Were $55 THE ENGLISH SHOP of THE MEN's SToRE, Srcoxd FLOOR. $56.25 Were $75 360 Men’s Fancy Shirts Reduced More Than a Fourth to Almost a Half Less i $2-85 Were $3 $7 .85 Every shirt taken from our own regular stock at the higher prices mentioned . . . and drastically reduced for quick dismissal. Woven madras, some with rayon stripes, and rayon-and-madras shirts included. Two laundered collars to match and collar attached styles. 1,200 Pairs Imported Half Hose Reduced Wool and Silk-and-Wool Hose A Third to Almost Two-Thirds Less Were $3 and $5 Were $2 and $2.50 §].8 $].35 Were $1.50 95¢ Every pair bought for our own regular stock for this very season. Stripes, plaids, fancy clocks and ribbed hose in the combined groups which include a full size range. ‘THE MEN'S STORE, Beconp FLOOR. High-Cut Bowling Shoes aid you in better- $ 5 ing your average High-cut Shoes, with uppers made from soft, black kid leather. In the pair—one shoe has leather sole and rubber heel— the other, crepe sole and rubber heel. They may be had for whichever side you bowl. BSPORTING Goops, FOURTH FLOOR. |t 5"Best o8 my knoieate, g bl ned 246,267.14 house, and fixtures, Sirities 3 Bn{nkméz iiniture $9.748.05. 231,028.14 Reserve wii Bank.... 210,266.56 9. Cash and d 301.518.81 . Other asset: Total.... . LIABILITIES. Capital stock paid in Burplus ...... . Undivided profits $500.000.00 79.530.06 22,536.38 79.380.12 1.557.645.90 Total... District of Columbi I. M. F. CALNAN the above- named bank. do_solemnly swear that the above statement is true to the best of my knowledge and belief. M. F. CALNAN, Cashier. 'EVERETT G. NASH. Notary Pubiic. GEO. Q. WALSON, E. J. McQUADE, J. 1. CULL, Jr., Directors. REPORT OF CONDITION B Tor T Woodridge-Langdon Savings & Commercial Bank Of Washington, District of Columbia, at the close of business on December 31, 1929, RFSOUR Loans and discounts. Overdrafts .... . United States curities ownes i . Other bonds. stocks and se- curities owned Banking house. niture and fist . Cash and_due from . Outside checks and items L...... Correct—Attest: ...$425.681.23 : 220.62 Government se- d 1,015.63 152,608.37 | 41.801.35 45.454.365 1.080.57 ..... $667.871.15 L1 Capital stock paid in . $50,000.00 Surp 9 50.000.00 ndivided’ pro Reserves for d sencies. etc. . Due to banks. includin fied and cashiers’ chec! standing . 22. Demand dep Time deposits ... - 26, Bills pavable and rediscounts. ends Total .. strict of Columbin, ss: Dll. EPI‘A’ L. NORRIS. vice president and cashier of the apove-namad bank, do solemn. T uar that "tha above statement s Vice President, Cashier. Subscribed and svory to before me thls Bth day of January SiH P. ARMSTRONG. (BeAE) RBNNETE: H L Notryseuslin: 8 SYMONS, JOHN B RUBINO, 08. 8. M = Directors. _ Correct—Attest: REPORT OF CONDITION OF THE 5 East Washington Savings Bank Washington, in the District of Colum- Ofiar 'at B Close of busiiness on Dec. 3L, 19%0. $021,538.25 1,010.00 110,437.50 RES . Loans and discou! . Un s saiid xtures, g 25,000.00 6,200.00 132,890.73 119.19 Real estate owned other than bANKING HOUSE ............ Cash and due from banks . Other assets . ¢ .$1,197,195.6 $100.000.00 100,000.00 8,857.72 c gossanacs 3,000.00 fnciiding cer- ashiers’ checks 23. Time deposits & Total.. R 1 District of Columbia, City of Washington, 8. I, H. H. McKEE, lcunT treasurer of the a\mve; med bank, do solemnly swear that the ai statement is true to the best of my knowledse of belier 250,000.00 | Correct—Attest: JOHN B. LARNER, JNO. JOY EDSON, H. G. MEEM, ARTHUR PETER, FREDERICK V. COVILLE, FLOYD E. DAVIS, L. W. ESTES, S. H. KAUFFMANN, Charter No. 4247. . Loans and discounts .. . Overdrafts s . Other bonds, stocks and securities owne: . Banking houses, $341,687.36; furniture . Reserve with Federal Reserve Bank . Cash and due from banks . . Outside checks and other cas 5 . Redemption fund th U. S. Treasu ‘Treasurer Other assets Tobal cocciecsnoasoone 5. Capital stock paid in . v . Surplus ... . Undivided profits—net. . Reserves for dividends, contingencies, et 20. Circulating notes outstanding . Demand deposits Time deposits .. United States deposits Washington, District of Columbia, ss: Correct—Attest: F. E. DAVIS, A. S. GATLEY, W. W. GRIFFITH, M. C. HAGNER, H. B LEARY, H. R. NORTON, Charter No. 3425, In the District of Columbia, at the close . Loans and discounts . . Overdrafts . . . United States Gover . Real estate owned other than banking h . Reserve with Federal Reserve Bank . 9. Cash and due from banks ........ . Outside checks and other cash items . Treasurer . . Other assets 5. Capital stock paid in IEHIHINA L £y i 17. Undivided profits—net . Reserves for dividends . Circulating notes outsta Due to banks, i Demand deposit: 23. Time deposits 6. Bills payable . 5 31. Other liabilities ... Total . City of Washington, District Oi Columbia, that the above statement is true to the best (Seal.) Correct—Attest: CLARENCE F. NORMENT, EO. L. STARKEY, 1. McKEE. Acting Treasurer. Subscribed and sworn to before me this Notury Publie. Wi, N Payne. Jr Walter H. Mario Directots Gl JAMES TRIMBLE, EDWIN C. BRANDENBURG, EO. P. SACE G. W. FORSBERG, MORRIS E. MARLOW, PATRICK J. WALSHE, . United States Government securities owned . Real estate owned other than banking houses 3 nment securities owned . . Other bonds, stocks and securities owned ... . Banking house, $486.500; furniture and fixtures, $93,995.79. . Redemption fund with U. S. Treasurer and due from U. B. J. FRANK 3 Subscribed and sworn to before me this 7th day of January, 1930. ALBERT F. FOX, DONALD WOODWARD, J. LEO KOLB, JOHN A. JOHNSTON, GEORGE A. KING, JOHN H. CLAPP, C. B. KEFERS Reserve District No. REPORT OF CONDITION Lincoln Ngi;::)nal Bank Of Washington, in the District of Columbia, at the close of business on December 31, 1929, RESOURCES, = $4,620,072.09 599.76 711,295.00 849,275.51 364,513.67 241,548.44 423,942.31 766,912.76 58,352.00 6.000.00 12,995.62 titesssesssasiseeaess..$8,055,507.16 and fixtures, $22,826.31 LIABILIT] 1ES. oy « $400,000.00 400,000.00 “en 297,100.59 c 20.000.00 000.00 .o 120 . Due to banks, including certified and cashiers’ checks outstanding 209,252.07 2,446,860.91 3,506.357.09 20,036.13 450,000.00 95.900.37 $8,055,507.16 I, JAS. A. SOPER, cashier of the above-named bank, do solemnly swear that the above statement is true to the best of my knowledge and belief. JAS. A, SOPER, Cashler. Subscribed and sworn to before me this 8th day of January, 1930, (Seal.) HELEN. A D. REED, Notary Publie. HENRY T. OFTERDINGER, GEO. C. PUMPHREY, SAML. C. REDMAN, FRED. A. SMITH, W. McK. STOWELL, HOWARD L. WILKINS, Directors. TVe Tict No, REPORT OF CONDITION National Ban]o(‘ t(e)f . Washington of business on December 31, 1929. RESOURCES, $6,484,856.24 148.87 2,554,781.88 163,925.75 580,495.79 180,868.36 561,654.36 1,389,222.18 11,492.87 35,000.00 21,847.62 sesessassnseeasss.$11,084,203.02 ouse . veess $1,050,000.00 1,050.000.00 131,268.89 73,500.00 voo 700,000.00 hecks outstanding 298,319.19 4, 5 450,000.00 117,600.53 teessnsecnsaasss.$11,984,203.92 s I, J. FRANK WHITE, cashier of the above-named bank, do solemnly swear of my knowledge and belief. NK WHI d SALVADOR J. COSIMANO, Notary Public. ‘ CLARENCE F. NORMENT, JR., ARTHUR MAY, ODELL S. SMITH, MAX FISCHER, MAURICE F. FLYNN, WRISLEY BROWN, Directors. b