Evening Star Newspaper, January 10, 1930, Page 13

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

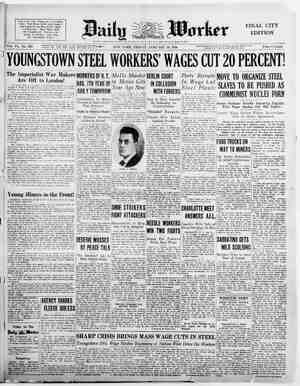

F INANCIAL, THE EVENING STAR, WASHINGTON, D. C. FRIDAY, JANUARY 10, 1930. NEW YORK CURB EXCHANGE CURB STOCKS GAIN | NEW YORK CURB MARKET Utilities, Oils and Industrials Featured in Upward Trend. BY JOHN A. CRONE. Bpecial Dispatch to The Star. NEW YORK, January opening strong, stocks on the curb be- came more active and moved higher today under the leadership of utilities, oils and a miscellaneous group of in- dustrials and trading corporations. Although popular utilities like Elec- trie Bond and Share, American Super- power and American Foreign Power were in demand they were compelled to share the limelight with some new issues. Commonwealth and Southern new preferred made its bow on the curb at the beginning of the second hour, and some securities, like Eastern States Power B, became active. ‘Commonwealth and Southern preferred opened at 96%3 after closing in the pre- vious session on the produce exchange at 96,. Later the stock pointed higher, but Commonwealth Power preferred, Southeastern Power & Light preferred and Penn-Ohio Edison preferred, all of which are being exchanged into Com- monwealth Southern preferred, did not regain the levels attained before the exchange was announced. Some holders of the outstanding pre- ferred stocks being exchanged for com- monwealth and Southern preferred have been selling their holdings rather than take a new security for their present seasoned issues. Brazilian Traction was again active here as well as in London on prospects of the receipt of 1 per cent stock divi- dends. Eastern States Power B shares were whirled on_prospects of an initial divi- dend, ;,which was announced after mid- day as 25 cents. ‘'Traders understand several public utility non-dividend pay- ing stocks will be put on a regular dis- bursement basis before the month ends. Indian Territory Illuminating Oil was the outstanding feature of the miscel- laneous oils, rising more than 2 points during ‘the forenoon. Standard Oil of Indiana was active in the Standard Oil group. Artificial silk shares came into prom- inence early as Tubize leaped more than 15 points within the first five sales. Celanese participating preferred ad- vanced more than 3 points. ‘ham, Inc., was up 2 points. Both the common and preferred of General Realty for a time moved higher. DEMAND FOR STEEL GAINS DURING WEEK Rebound From Depression of Year 10.—After | End Is Seen in Trade Figures. Special Dispatch to The Star. , January 10.—Specifica- finished steel and releases against pig iron contracts have ex- panded materially in the past week, says Iron Trade Review, Cleveland. Demand for practically all products has been heavier than in December, although considerably below the level of last January. ‘This betterment is appraised by most producers as a rebound from the repres- sion of buying over the year end. Pro- ducers generally continue confident of gradual improvement over the first half year, but recognize several conditions Precedent to it. Yo For cne thing, consumers still appear | 32412 120 Duke Power (35) determined to avoid commitments, ex- cept for actual spot requirements, until ¢ the price sitmation is clarified, and by common consent this clarification ap- proaches. The expectation of consumers that prices would go no higher and might go lower may be justified. Shading of tin plate has been formally recognized by a reduction of 10 cents a base box to $5.25, Pittsburgh. Auto body sheets are off $2 per ton, to 3.90c, Pittsburgh, while blue annealed plates and sheets have developed a downward range of $2. Strip steel and wire have been shaded $1 to $2 per ton. Heavy finished steel prices at Pitts- burgh, like pig iron in many districts, have yet to withstand the impact of tonnage requirements. There are re- rts that valley pig iron prices have en shaded and that $34 for sheet bars is not strong. Iron and steel scrap, having experienced several months of tobogganing, is an exception to general price softness. ‘The rallroads have started 1930 deter- mined to hold' their regained title of er consumer of finished steel. icluding the enlarged Chesapeake & Ohio-Pere Marquette-Hocking _ Valley program of 11,375 freight cars, 130 loco- motives and 55 tenders, about 30,000 freight cars are on active inquiry. Sea- board Air Line closes January 12 on 1,000 cars. Revised figures place 1929 Ireight car awards at 106,105. The Burlington, which has just dis- tributed 500 cars and 67,050 tons of rails to Western makers, may buy 2,000 more cars. The Nickel Plate is award- ing 29,860 tons of rails. Track fasten- ing orders at Chicago have totaled 14,000 tons in the past week, with twice that tonnage on inquiry. Many car- riers are placing their first quarte: finished steel requirements. Automotive demand for iron and steel, while somewhat improved over Decem- ber, still reflects a hesitancy, which will ot pass until the verdict of the shows on new models is in. Farm implement manufacturers are more generous buyers at Chicago, which has experienced a greater revival of demand than any other district. Building continues sea- sonally slack and prospective pipe line ‘work has not yet matured. Weakness in sheets and tin plate has depressed the Iron Trade Review composite 16 cents, to $35.72, its lowest since October, 1928. In December the l.x‘!i%eé; averaged $35.95 and last January — NEW YORK COTTON. NEW YORK, January 10 (#).—The | cotton market opened steady today at an advance of 2 points to a decline of 5 | ints. Scme overnight buying orders rought in by the firmness of yesterday and a bullish view of the Standard Cloth | statistics for December was reported. It ‘was supplied by realizing and some local or foreign selling promoted by the in- different showing of Liverpool and the | report of the New York Cotton Ex- change Service estimating domestic con- sumption for December at 477,000 bales, | compared with the census report of | 544,150 for November and 533,301 re- ported for December last year. The de- mand seemed to taper off after the | opening and prices eased under the | offerings which sent March off to 17.33 and July to 17.75. The general market showed net declines of about 6 to 9 ints at the end of the first half hour. rivate cables said advances on local and foreign buying in Liverpool had been checked by realizing. B. & 0. CAR LOA;I_)‘IGS. BALTIMORE, January 10 (Special). —Following the usual seasonal trend, each week in December brought lower carloadings on the Baltimore & Ohio. gs originating on the lines in the first three weeks of the month totaled 108,224 cars, compared with 121,558 a year previously. addition. Joads received from connections totaled 61,061 cars, as against 63,534, Coal ‘egated 38,245 cars during pe;fis compared with 40,230 in .Prev. 1929.~ Sales— Low. = Dividend Rate. Add 00. 5% Aero Sup Mfg B 2 13 Aero Underwrite: 7 Aeronautical Indus 15 Agfa Ansco.. .. 164 40% Allied Pwr&Lt pf(3) 71 ANP&L1stpfs % Allison Drug St A 1% Allison Drug St B. 103 Alu Co of Am pf (6). 5 Am Brit & Cont. 16% Am Chain (3) 76 Am Cigar Co. i 29% Am Cit P&L A (a3). 30 AmCP&LB (b10%) 18 AmCwithPADb10%. 214 Am Cmwlth Po war. ) 70 Am Gas & Elec (§1). 6% Am Invest IncB.... 190 Am Lt & Trac (10).. 59% Am Phoenix Corp(3) 51 Am Salamandra (3). 184% Am St Pub S(A)1.60. 15 Am Superpower (1). 89% Am Super 1st pf (6). 6 Am Yvette (new) wi. 14 Anglo-Am vot (73¢). 11 Anglo-Am n-v (73¢). 2% Anglo Nor Hold. ... 7% Arcturus Rad Tube. 3% Arkansas Nat G: 615 Arkansas Nat GasA. 4 Ark N G cm pf (60c) 85% Asso G & E A (12.40) 3 Asso G&E Adebrts. 5% Asso-Elec Ind Ltd... 1% Asso Laund (320c: 3 Asso Rayon. 80% Asso Rayon p! % Atlantic Lobos. 24 Atlas Plywood ( 23% 12 Aviation Credit..... 139 34 29% 55 1021 3 28 Bickfor Inc pf (213). 31 Blue Ridge Corp. ... 23% Blue Rdg cv pf (ad). 27% Blumenthal (S) 1 Blyn Shoes, nc. . 31% Brazil Tr & Lt (2) Brillo Mfg (1.20). 98% Bunk H & Sull (19). 34 Burco, Inc (war). 1% Cab&Wire LtdB rets 1% C A M Co ctf: 8 Can Marconi.... 1 Carib Syndicate 80 Carnation Co (31%). 20 Celanese Corp. 80 Celanese Corp pf(7). 6 Cent Atlantic States. 19 Cent & Southw Util. 20 CentPSvA (al75). 12 Cen States El (340¢c) 19% Cen States Kl war... 4} Centrifug Pipe (60c) 9 Chain Stor Stk (b6). 13) Chseebr'gh Mfg 1615 20 Cities Service (330c) 84 Cities Serv pf (6)... 2 Club Alum Uten 40 Colgate-Pal-P (2%). 3% Columbia Syndicate. 4 Colon Oil S 25 Colts PatFire A (2). 449% 210% Com'wlith Edison (8) 93% Comwith Pow pf (6). 1% Comwlth & Sou war. 81% 27% 165 8 5% 17% 3 1 1 7 3 1 5 7 5 4 Consolidated Copper. 4 Consol Cortes Silver, 12}s Con Dairy Prod (32). Con Gas, Balto(3.60) - 19 1 00 10 031 89 Oh b 09 e 00 10 Continental Oil. 15 Coon (WB) Co(2.80) 30 Cooper Bess pfA(3). 124 Corroon & Reynolds. 10 Cord Corp. 5% Creole Petroleum. % Cresson Cons (8¢) 1% Cusi Mex Mining. 3% Dayton Air & Eng. 20 3% Durant Motors 55% 22 FEastGas&F Asso 77% 17 [East States Power B. 324 10 Eisler Elec Corp.... El Bond & Sh (b6 El Bond & Sh pf (6). Elec Pow Ass0 (1)... Elec Pw Asso A (1).. 45% El Sharehold pt (6. 14 Empire Fire In: % Engineers Gold..... 3 Evans Wallow Lead. 5% Fansteel Products. .. 29% Federal Screw (3) 20 Fed. Metals t1%.... 4% Finan Invtst, N Y... 20 First Nat Copper.... 8 Fokker Alrcraft..... 15 Ford Motor Can A... 10% Kord Motor Ltd. 9% Foremost Dairy P 34 Foundation For Shs 20 Fourth Nat Inv. 415 Fox Theat Cl A. 35 FrenLineB (2.54 18% Garlock Pkg (1.20).. 8% Gen Am Invest new. 2in General Baking..... 45 General Bak pf (6).. T4 Gen E Ltd rets (50c) 19 Gen Empire Corp.,.. 13% Gen Gas & EL¢A). .. 10 Gen Laun Mach 1.60. 9 Gen Rity & Utilities. 60 Gen R & Util pf (6).. Gen Theat Equip v ilen Alden Coal (10) obe Underwriters. 2l Golden Center. Gold Coin. Gold Seal El n. .16 Goldfield Conso : Goldman Sachs (b6). Gorham Inc pf (3) Graymur Corp. ..... Gr A& P Teapt (7). Groc Stors Prod vtc. Ground Gripper (1). Ground Grip pt (3).. Guardian Invest.... Gulf Oil of Pa (1%). Hambleton Corp cfs % Happiness Candy. 4 Helena Rubensteil 98 Horn & Hard pf (7 15% Houd-Her cv pfA2i 6 Houston Gulf Gas 6 Hudson Bay M&S.. 74% Humble Ol (2)..... 27 Hydro Elec Serv (2). 12 49% Hygrade Food Prod. 15 340% 260 Iilinois P L (20).... 508 22 ImpOilCann (50c). 7 5 Indian Terr lllum... 183 26 Insull UtInv(b6%). & 70 Insull UtIn2dpf6.. 1 52 InsCoof NAm (2).. 4 17 Insurance Sec (1.40) & % lutercontinent Petn. 89 15 Intl Petrol, n(623%¢c) 24 25% Intl Superpow (31).. 4 3 InternatlUtB...... 26 10 Interstate Equities.. 3 11% Irving AirCh (1.50). & 6% Italian Superpow A. 18 4% Itallan Superb war,. 14 100 Jer. Cen. P&L pt (7) 29 Johnson Motox Co. .. 1% Kirby Petroleum. 30 Lackawanna Sec(4). 173 90 Leh Coal & Nav (4). 136 63 Lehman (The) Corp, 6% 1 Leonard Oil g 72% 354 L ) 27% 124 Lily T Cup (150). 38% 18 144 2 P BN R AN AT AR B s N0 e g womammE 46 1 1 208 261 4 41 . 23 105 60 3% 45% 14 Lion Oil Refin (2) Loews Inc war. .. 67 28 Lone Star, new (80¢) 91 40 Long Island Lt (40e) 14% 2% Louisiana Lan & Ex. 43% 20% Mac Marr Stores. ... 1% % Magdalena Syndicat. LIABILITY INSURANCE IS NOW 50 YEARS OLD Special Dispatch to The Star. BOSTON, January 10.—The year 1930 marks the golden jubilee of liability in- surance. Just 50 years ago in London this form of insurance came into being with the establishment of the Employ- ers' Liability Assurance Corporation, 3 4 1 H 1 2 2 9 2 3 23w 10 12% 117% Babcock&Wilcox 19.100s 122 122 122 122 1 28 28 28 28 5 4 4 4 4 . B0s 470 470 470 470 1 6% 6% 164 150% 164 5% 6 5% 0 5% 1 100% 100% 100% 10 1 29% 20% 20% 2! 2% 4 36 36% 1 106% 106% 1067 1067k 10 79 9 8% Open. High. Low. 10 28% 12% 12% 12% % T 38% 29 1% 38% 14% 0% 4 T%h 38% 294 1% bl 3% 1 30 341 874 6 22% 35% 22% 5 5% 18% 12% 12% Y 1 166% 166% 1661 166% 260 - 29% 29% 29% 29% 2 88y !E% lgh 88% 5 N 2 53% b63% B3% 3% 1 % % 5% 5% 5% 5% 1 284 28% 28% 284 108 240 240 6 99% 99% % 240 240 9 3% 95% 13 9% 3% 10% 14 23% 28 13% 12% % bd % 2% 1% 3 6% 3 2% 1% 3% 6% 6% % 1 261 26% 264 26% 38 20% 22% 20% 22 6 14% . 443 85% 86% 83% 83 2 108% 103% 108% 103% 28% 28% 28% 4% 14% 14% 28% 26 304 18% 85% 26% 30% 18% 4% 33% 34 119% 119% 13% 13% 3 3w % Y E & 37 32 g 878 32 99% 22% 10% 104 B5% al% 1% 206% 306% 306% 26% 26% 264 82 30% 31m 69% 58 59 B6Y% 6% B6% 2 % 1% 19% 18% 19% 1% % 21% 21% 85 34% % 8l 1% 11 144 14 100 9% % bW 2% 2% 36 2% 36% 8% 1% 4% 18 19% 3% 35 44y 3% 23% # ~—Prev. 1920.— igh. Low. Stock and Dividend Rate. Received by Private Wire Direct to The Star Office A 7 Marc Int M(52%c). . 28 Marine Mid Cp (1.20) 8% Marion Steam Shov. 86 Maryland Cas (4%). Mavis Bottlin; s Ct 15% Mer Chap & S(1.60).. 5 Met & Min Inc (1.20) 25% Met Chain Stores. ... 18 Mid West Ut (b8)... 21 8 Midl Unit (b1% %) .. Mo-Kansas Pipe L. . 1% Montecatini deb rts. 7% Nat Amer Co (2) 10% Nat Investors (new) 20 Nat Pub Sv A (1.60). Nehi Corpn (1.30)... 115 Neisner Bros pf (7).100s 11 2 2] R7% 60% New Jer Zincn (14). 100 236 24% 56% 19 474 8C% 9% 21% 85 17 N Y Merchandi 2 12 10 4 5 20 % Ohio Copper. 64% Ohio Oil (2) North Am Util New Eng PS pr.1.(7) 89 Newmont Min ($4).. 7% N Y Auction (13%) 20 N Y Invest (1.20). 8% N Y Rio&Bu Aires. . se (2) 11% Niagara Hud P(40c) 2% Niag Hud Pw A war. Niag Hud Pw B war. Niagara Shares(50c) Noranda Mines (3).. North Am Aviation.. Sec Novadel Agene (2) 58% Otis Elevator new. .. 10% Outbd Mot A (1.80).. 3% Outboard Motor (B). 24% Pac G&EI 1st p: f1%.. 124 Pac Western Oil 1 Pandem Oil.. 6 Param C Mfg 10 98 12 25 85 17 10 Pennroad Corp PeoL&P A (a Patterson Sargnt (2) Penn O Ed pr pf(7) 2.40). Pepperell Mg Co (8) Petrol Corp (1%4). ... Pick (A) B & Co pf.. 6% Pilot Rad T A (1.20). 84 Pitney BPn (20c).. 49 Pitts Plate Glass (2) 12% Polymet Mfg ($1)... 4% Potrero Sugar. 60 Powdrell&Ale: @%) 39% Power Securities pf. 1% Premier Gold (24e).. 20% Pressed Met of 6% Prin Amer Whitely Prince&Whitely p Propper Silk H 5% Prudential In 15 M (2) Pub Util Hold w 98 PugSP&Ltpf( 7% RainbowLumProd A 3% RainbowLumProd B 12 .65 Repetti Candy. 4 1% Reiter-Foster (40c). Rel'nce Managemnt.. Reynolds Bros Inc. 18% Reynolds Met n 2.40. 2% Richmond Radi ator. 27% Rike Kumbler (2.20) 22% Roan Antelope Min 45 Ruberoid Co (4). 13 14% St Regis Paper 241 Safety Car H& 9 25 47% 229% 1 Russek’s Fifth Ave ). L(8) Salt Creek Prod (2). Schiff (The) Co (2).. 214 Schulte Un 5c-31 St. 80 65% 9 3% 4 gg'fi 49% Select Ind pr (5 28% 28 3 111% 65 89% 63 440 10 Sisto Fin Corp. 25 3814 Seeman Bros (3).... Seiberling Rubbe: Selected Industri % 50% Sel Ind allot cfs 514 3% Sentry Safety Cont. Shattuck Den Min. .. Shawingan Wa(21). 6% Shenandoah Corp... 14% Shenan Corp pf(a3). Singer Mfg Co (126) Skinner Organ (2%) % Sonora Products. ... 80 S'east P&L pr pf(5). 26 So Cal Ed pf A( 1%). 20 So CalEd pfB(134).. 21% So Cal Ed pf C(1%) 18% So Col Pow A (2 4 13 11% Southland Roy Southern Corp. So Pipe Lina (1).... (1). 9% 8 W Dairy Product: 4% S W Gas Util. . 70~ Stand Inves pf(5 % Standard Motors.... 45 Stand Oil, Ind ( 2%). 18 Stand Oil, Kan (2)... 29 1 Stand Oil. Kv (i Stein(A)& Co (1.60). 0). 1% Stutz Motor Car. 9% Sun Inv. 4 Sunray Oil (40e). 30% Superheater (335)... 34% 33% Swift & Conew 149% 121% Swift & Co (8). 26 6 108% 40% Tampa Electric 36 21% Taylor Milling 4 2) Syrac Wash M B (1). (12). (13).. Teck Hughes (60c) 7% Texon Oil & Land 19 Thermold Co (2). 25% Third Nat Inv (1). 18 Thomp Prod A 12.40. 5 34% Thomp-Star pt 40% Todd Shipyard Thomp-Starrett. . (%) “).. 20% Transamer ($1.60). 3% Trans Air Trans cfs 6 Tran Con Air Tran.. 3 Tr-Lux DLPS (A). Tri-Cont Corp war. . 10 % 40 Tri-Utilities Trunz Pork m 15 Tri-Continental Cor. Tri-Cont Corp pf(6). Tub Art Silk B (10). 24% Ungerleider F Corp. % Union Tobaceo. Utd Carr Fastnr 1.20 Tnited Ch pt pf (3).. 10 25% 8% United Corp wa: 6% U s ited Gas Co Unit Lt&Pwr A 854 Ttd Lt & Po pt v, ited Dry Docks. (80c) (6).. 2% United Milk Prod 22% Unit Molasses Ltd. 1'% United Profit Shar. 1% Unit Reprod A. % United Ret Che; m A % Utd Ret Chem B ctf. 714 Unit Rt Ch pf ( 314). 48% U S Dairy (A) (5). 14 13 5 USFoil B (1) U S Lines (50¢c Shares Fin. . 1% United Stores....... 11% Unit Verde Ext (4).. % Utah Metal & Tunnel Utility Pw & Lt(al1). UtP&LBetfs (11). Utility & Ind. . Ut & Ind pf (1%).. 10 Utility Equities. cuum Ofl (t4%) Van Camp P pf. 1% Venezuela Ptm 6% Vick Fin Corp. (1%). (20¢). 16% Vogt Mfg Co (2). 13 Wenden Copper. i % 37 120 ~ West Point Mfg (13) 10s 1 14% Williams R C ( 1.40). 3% Winter (Benj). 44% 13 Zonite Prod (1.60)... RIGHTS. So. Cal. Edison. .13 .07 Trans Corp... annual payment. Sales— dd 00. Open. High. 2 13 18 5 1% 96 = FoBraanmEm A~ s - 1 2 0 1 3 5 1 v A %).1508 1 * | buildings - - s - I - SrraBonanSenamunans PET TN San I8a I SO o o RO wan~aSSan 12 18 4% 1 20% 4% 20% 20% Expire. .Apr.12 4 2% 2% 2% 2% ..Mar.§ 56 .06 .06 .06 .06 Dividend rates in dollars based. on last quarterly or semi- *Ex-dividend. tPartly extra. $Plus extra in stock. & Payable cash or stock. b Payable in stock. Limited, and just 44 years ago a branch lish f that company of Boston, gu first com| States write em surance. Thus the Employers’ Liability Assur- ance Corporation, Lim! % ing this year the golden jubilee of lia- bility insurance, also celebra golden jubilee, a period during which dollars have been paid satisfy claims of or against its assureds, millions of was established y in the United yers' liability in- ited, in celebrat- d Payable in preferred stock. Takes Schooner in Tow. SAVANNAH, Ga., January 10 (#).—A radio message received here today from the Coast Guard cutter Yeamacraw said taken the disabled schooner Blakely in tow off Daytona and was proceeding American road used by the Iraq Beach, Fla., to Jacksonville. Yo Sstniste achinery is being ernment. COOLIDGE POINTS TOGAININ SAVINGS !Former President Gives Fig- "ures Showing Extent of National Wealth. BY JOHN F. SINCLAIR. Special Dispatch to The Star. NEW YORK, January 10.—Calvin Coolidge, speaking last night at St. Petersburg, Fla, on the economics of life insurance, commented on the fact that America has very few hereditary fortunes. “For the most part they represent | the success of a single generation and great wealth tends to become dis- tributed in public charity, while the moderate wealth of the people tends to increase,” said the former President. Savings deposits are the evidence or general prosperity. In 1910, according to Mr. Coolidge, the deposits in the savings banks were about $4,000,000,000 and today $10,500,000,000. Deposits m the national banks and trust companies in 1920 were $10,500,000,000; today, $34,000,000,000. 1 Life insurance has progressed even more rapidly. Think of one nation adding to its life insurance at the rate of $20,000,000,000 a year, while receiv- ing in matured policies about $2.000,~ 000,000 a year, of which about three- quarters goes to living policyholders. ! ‘There are 67,000,000 policyholders i the United States. Perhaps half c.! the people of the United States carry life insurance. The former President's plea for life insurance should gladden the hearts of every insurance executive. “A stu- pen?:ms force enlisted on the side or public health, sound finance, good judg- ment, economic betterment and moral well-being.” It is a big responsibility to live up to such a challenge. The numbers attending the New York automobile show are increasing as the week progresses. Prospects for the year are more optimistic now than they were when the show opened. ‘With 26,000,000 motor vehicles in the United States it is safe to say that one out of eight needs to be replaced annually, Few people use a car eighv This estimate, conservative as it is is estimate, col : calls for a replacement of about 3,000,- 000 cars annually. Last year the num- ber of American vehicles sold outside of the United States was 1,015,000. Now add 1,000,000 more to the replacement figure and we have 4,000,000 automobiles annuall; se. Perhayps another 500,000 cars can be absorbed by the natural growth in popu- lation and the improvements in high- way facilities. The production for 1930 will not reach that of the record-break- ing year of 1929, when 5,651,000 cars were produced. But it should be a good ear. " How important is the automobile in- dustry? Of the 34,700,000 cars in the world, 26,024,000 are owned in the United States, and 4,300,000 are em- loyed in the motor vehicle industry and ?fl allied lines. The industry takes 85 per cent of all the rubber produced in the United States, 67 per cent of all the plate glass, 19 per cent of the iron and steel produced, 15 per cent of the copper, 18 per cent of the lumber and hardware, 27 per cent of the lead and 80 per cent of the gnsolm]e consumption. A glant dustry, surely! mThe:ey figures are furnished by Alfred Reeves, general manager of the National Automobile Chamber of Commerce. Is money the driving motive of busi- ness research? Or is it fame or achieve- ment or admiration of one's fellow men? Mme. Curie, co-discoverer of radium, who two months ago was presented by President Hoover with $50,000, raised by American friends to enable her to carry on her research work, recently made the statement that scientists who work for the pecuniary reward find that their “brain power will sag and become sterile.” The famous woman scientist believes that curiosity is the basis of re- search work. “What matters it to Einstein whether | he makes money or not?” she asked. “Wealth should not be the motive and oftentimes is a bar to its continuous development.” But Mme. Curie made a plea in a Te- | cent address in Paris against making; the road of the dynunx research worker too difficult and’ hard. One needs to live, even though one's wants are small. “Why not endow ability instead of and universities,” asked a business friend in Chicago recently, who is contemplating giving away sev- eral millions shortly. Prankly, I like the idea and I hope he does. (Copyright, 1930, by North American News- Daper Alliance.) BONDS ON THE CURB MARKET. BONDS. faieatn,, DOMESTIC BQHED: tow. Neon. 10 Alabama Pow 41;s '67 95 95 95 BARB &L 6 2008 95’55999;9‘.’;’» Yot jen Rayon 6s jen Theat Eq ... 5200000 ! 5 i % 3 356 {olel 20= nlan 165 nterstate Pow Inters Pow 55 '57 221 1031 5s '37 9434 ‘44 ww 1037 55 A ‘51 99 10500 a0t oo B o S ek BB o o Bt E ot e S ik e s el B e Ton B Suen: 95200, *HO0’ S ‘EEE 2950, o0° RO -:aa:,:“ 22 gy a 32 ww 97 025, xw 103% s '31. 101% 101% ZOQt 0! 09 35352558 ss e 223 823, 105 15 102% | s West Tex 10 Westvaco 2 S2822232888%23 Fese r'Gas 1 Santiago_Cl fll s 2 Uni 1un"xrf!u§§' it 2333 American tractors are being used to clear snow from Poland roads. FINANCIAL. TO HAVE MODERNISTIC HOME The facade of the new building designed to house the New York Curb Ex- Until 1921 curb trading actually was conducted on the curb, as the change. picture at lower right shows. BY WILLIAM R. KUHNS, Financial Editor, Associated Press Feature Service. NEW YORK, January 10.—It is a 14-story vote of confidence that the ;l;sw York Curb Exchange has given 0. The exchange's new building, of mod- ernistic carved stone and elaborate metal work, will replace the present structure on the same site, overlooking Trinity Church. Thus is shown the growth of the organization which visitors to New York nine years ago remember as an excited, gesticulating, shouting crowd in the open air on Broad street. From 1792, the year of the first writ- ten agreement between stock brokers in New York, until 1921, when the Broad street curb traders put a roof over their heads, there was always an outside mar- ket _for securities in New York. These traders were the overflow of brokers who were not members of an inside exchange. Since 1921 there has been no outside curb market, many of the functions of this ancient institution having been taken over by an organ- ized “over-the-counter” market. GOOD BUSINESS SIGNS SEEN BY CITY BANK Bpecial Dispatch to The Star. NEW YORK, January 10.—The Jan- uary 1930 issue of the Monthly Let- ter of the National City Bank of New York expresses optimism over the pros- pects for American business in the new year. Itdeclares that apprehensions proceeding from the Stock Market de- cline are probably exaggerated, the country’s resources and productive ca- pacity having been affected scarcely at all. “The real value of stocks is what the properties can earn from year to year, which certainly has undergone no such changes either up or down” as the Stock Market fluctuations have in- dicated. The review offers the opinion that “the present situation is not to be judged by that of 1920-21, when all commodity prices were involved, every merchant and manufacturer was taking heavy losses, and the relations between agriculture and all other industries were violently disrupted.” It is stated as a good sign that the machinery and heavy equipment in- dustries are busy practically to capaci- ty and carrying good order books into the new year. This includes machine tool manufacturers, agricultural imple- ments and electrical equipment. “It is probably not too much to say,” continues the review, “that the outlook for large construction work of the n: ture of municipal, highway, rallroad and industrial improvements never was bet- ter, and the subsidence of speculation has the very important effect of cheap- ening capital for these purposes. Capi- tal and credit had been steadily be- coming dearer over the last two years, not only in our own country, but throughout the world, and the Stock Market had been the dominating in- fluence. We are of the opinion that in more ways than can be traced the re- lease of several billions of credit from employment in that quarter, and the resulting decline of interest rates for all purposes, will be beneficial to gen- eral business, and that the effects will be cumulative as they spread.” Satisfaction is found in the fact that exports of machinery in the past year exceeded $600,000,000, an increase of 20 per cent over the figures for 1928 and affording evidence of the country's ability to compete in all kinds of pro- duction. Dividend declarations of corporations in 11 months of 1929 aggregated $3.- 929,000,000, against $3,032,000,000 in 1928. All leading corporations show a Jarge increase in number of share- 4 | holders for the dividend payments of January 1 over the number on their books on October 1, indicating that the fall of stocks had resulted in distribu- tion rather than concentration. GENERAL CONDITIONS DECLARED FAVORABLE B. F. Keech & Co.'s latest review says: “Pundamental conditions seem sound, money conditions are normal, stocks are selling at reasonable levels and in many cases below what would seem to be their real values, based on past and prospective earnin; labor is efficient and free from disturbances, commodity prices are not unusually high, invento- ries are not overexpanded and corpora- tions, taken as a whole, are in exceed- ingly strong financial condition. Gold has been going out of the country fast, but will probably do more good in Eu- rope than in this country, and with our creditor position in world finance we ses no danger on this acccunt.” ———— PARIS BOURSE PRICES. PARIS, January 10 (P).—Prices were firm on the Bourse today. Three per cent rentes, 87 francs 75 centimes. Five per cent loan, 107 francs 85 centimes. Exchange on London, 123 francs 92 centimes. The dollar was quoted at 25 francs 433, centimes. STOCK AND BOND MARKET AVERAGES From Yesterda: By the Assoclated Press. STOCKS. 50 Industrials, Two years ago ‘Three years ago, High (1929). Low (1929) . .. Total sales, 2,397,330, Three years ago, weekiy aver.. High (1929) . Low (1929) . Corporation News NEW YORK, January 10.—The fol- lowing is today’s summary of important corporation news prepared by Standard Statistics Co., Inc., New York, for the Associated Press: News Trend. Summary of bank clearings for the full year of 1929 gives an excellent pic- ture of the high rate of activity reached in that year and the sharp recession experienced in the final month of the year. Total clearings were $727,848,~ 371,330, an increase of 14 per cent over 1928 exchanges, the previous record year. Clearings of New York City, with a total of $477,242,282,161, showed an increase of 21.8 per cent from 1928. December clearings, however, reversed the earlier trend, with a total of $53,297,309,677. They were 18.6 per cent below November and 12.6 per cent less than December, 1928, and the smallest since September, 1928. New| York City clearings in December de- creased 15.6 per cent. The Companies. American Department Stores Decem- ber, 1929 sales up 5.1 per cent; year 1929 53.3 per cent above 1928. Carolina Power & Light November balance, after charges off, 6 per cent; 12 months up 6 per cent. Caterpillar Tractor estimated sales quarter to December 31, 1929, up 111.7 per cent; year 1929 up 46.8 per cent over 1928. Alfred Deceker & Cohn, Inc., earned $2.63 in year to October 31, 1929, against $2.08 mgrecedln. fiscal year. Ford Motor schedules January output of 125,000 cars and trucks. Park Utah Consolidated Mines shipped 229,390 tons of ore in 1929, against 274,447 in 1928. s A3 WHOLESALE BUYING ON LARGER SCALE Activity Resumed as Cor- porations Prepare for Re- newed Production. BY J. C. ROYLE. Purchasing is still active, but the center of interest has been transferred from the retail counters to the whoie- sale and manufacturing departments. The retailers wound up the year with a burst of speed, and since they were disinclined to allow the heavy piling up of inventories, their shelves on Jan uary 2 were pretty well cleared. Now they have n to lag in stocks for immediate needs, and the manufactur- ers are feeling the effect. Wholesale buying is still in small lots, but manu- facturers no longer are afraid of that trend. They know that even if the in- dividual orders are small, the total volume is undiminished. The automobile show undoubtedly has been the outstanding business event of the week, since the automotive in- dustry is the leading manufacturing in- dustry of the country, so far as valuc of products is concerned. The results of the show have been satisfactory and factory production is being speeded up in consequence. The effect of this on other industries can scarcely be overestimated, since the automobile business absorbs almost a quarter of all the iron and steel made in the United States. The industry uses 85 per cent of * the rubber manufactured, 15 per cent of the copper, 67 per cent of the plate glass and other materials in similar proportions. Bullding Shows Progress. Building is progressing satisfactorily with a good volume of lumber, cement, steel and hardware being absorbed. S& far as municipal building and construc- tion is concerned the trend is on the increase as shown by present volume of municipal financing. th lumber and cement are in somewhat precarious sta- tistical position so far as supplies a: concerned, but prices are steady. In the manufacturing lines, mergers still are in prospect, since competition is severe and producers are chary of ad- vancing prices, for fear such a move would check buying. This is apparent in automobile, steel and rubber divi- sions. The non-ferrous metal mines are still on sharply curtailed production schedules, and it is evident that most producers desire to keep them so until stocks are materially reduced. Textil> mills also are on reduced schedules. This is a seasonal tendency as well as attributable to lack of buying demand. Rural communities seem likely to be in a strong position during the Spring and Summer. The corn crop was not perhaps as large as hoped for, but the price is advantageous to the grower who markets his crop in the form of meat and the live-stock men are look- ing forward to a good year. As to cotton, some States had a successful season and some did not. spects seem_ favorable for the wheat growers for 1930, while the potato producers have had favorable conditions as to prices and markets. /| Agriculfural implement manufactur- ers are not only working at a high capacity rate, but have prospects for a profitable export trade season. This true also of machinery and machine tool manufacturers, with few indica- tions of a drop in domestic demand. Manufacturers, however, are dubious as to the situation of some of the “coffee” republics in Central and South Amer- ica, where the fate of the coffee crop will have a major effect on credit conditions. Airplane makers are overstocked. The difficulty seems to be rather with the small planes rather than large pas- senger and freight carriers. » Mergers in Radio Field. ‘There has been no lessening of un- filled orders on hand in the electrical equipment industry. The replacement of obsolete power plants seems likely to be more extensive in 1930 than ever before. Radio manufacturers have fair stocks on hand. Mergers are ing talked of in the radio field. (Copyright, 1930.) —_— Western Maryland Railway. BALTIMORE, January 10 (8] ). Western Maryland way Portland Electric Power to spend $4,300,000 in 1930 on expansions. Royal Dutch-Shell group and sub- sidiaries produced 25,141,800 metric tons in 1929, against 22,063,411 metric tons in 1928. Schulte United 5 Cent to $1 Stores, Inc., December, 1929, sales up 160 per cent over December, 1928. Scuthern Grocery Stores December, 1929, sales up 35.3 per cent; year 1929 14.9 per cent over previous year. United Cigar Stores revised net for 1928, $4,525,609, contrasted with $8,352,~ 762 previously announced. Surplus of $21,951,523 on December 31, 1928, changed to deficit, $776,286 as of June 30,“39&:.5 abash Railway to pay 1928 and 1929 dividends of $5 el%:\ on B pre- ferred stock. Regular quarterly pay- ment of $1.25 on A preferred also declared. o MORE CHEERFUL VIEWS EXIST ON BUSINESS Hemphill, Noyes & Co., with local offices, in the latest issue of its pub- lication, the Situation, states: “The business situation is dominated by year-end influences. Quietness pre- vails and many plants are shut down for the usual year-end inventory check- up. A hand-to-mouth buying policy is being followed by most consumers, pending a more definite idea of condi- tons, generally, after the New Year. “However, a slightly more cheerful feeling exists, due to recent results of Christmas trade, which, in dolar vol- ume, was about equal to 1928 and was much better than was generally be- lieved possible after the October-No- —The closed 1929 with a gain in gross earn- ings of $387,303, or 2 per t, com- pared with the previous year, prelim- inary figures just issued show. Shrinkage of $202,650 in coal ceipts, $59,119 in passenger and $13,372 in milk revenues were more than off set by increases in other classes of traffic. Tonnage other than coal was responsible for a gain of $522,076, while miscellaneous traffic contributed $85,078 more to receipts than it did a year ‘The higher rate for handling mail also was a factor in the better showing of the carrier last year, that item amount- ing to $49,862 more than a year ago. STEEL PRODUCTION. By the Assoclated Press. Steel production in the United States last week showed sharp recovery from the usual holiday slump of the preced- ing week, but was still below levels for the same week last year. The Census Bureau figures out the percentage of steel ingot capacity kept active in American plants for the week and com- parable periods as follows: Week ending January 4 Preceding week. Same ek last year NEW YORK BANK STOCKS. NEW YORK, January 10 (Special) America .. iy American Uj Bank U. 8. un... Bank of Yorklown Broadway National Bryant Park Central Nation: Chase . Chat Phenix Chelsea . vember stock market collapse. Reports | City from the various Federal Reserve dis-| & tricts express optimism in the prospects for 1930 and indicate that Christmas ?::’129"“ ‘was about normal in most dis- Film- Agreement Signed. NEW YORK, January 10 (#).—The Radio-Keith-Orpheum Corporation has signed an agreement with Associated Talking Pictures, Ltd., of England, for the distribution of the latter’s produc- tions in this country. s 5:30 Edition. cees 904 ‘Total sales (par value), $9,050,000. (Copyright, 1930, Btandard Statistics Co.) mi Commereial . Continental . Fifth Avenue First National Grace. new Harbor im | 3sEERIEEA N County Empire. Equitable, Fidelity new ' Fulton Guaranty ibernis nterst Int. ! Irving .. Lawyers' Manufacture: Murray Hill N. Y. Title & Mort. cfs New 'Yor! Pacific Plaza State Tiile ‘& Mortgag mes _Sauare Title Guaranty " Trust Cn. of Noi United Siates 3385285820303 2o ey aens 323 8 83