Evening Star Newspaper, December 31, 1926, Page 22

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

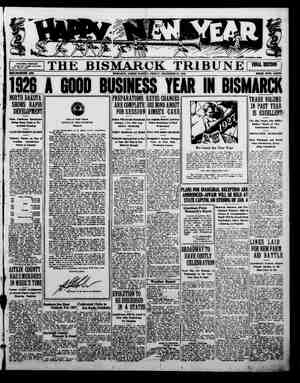

THE EVENING STAR, WASH Bonds Higher at Close of 1926 Than at Any Time Since Before Outbreak of Wa UNIFORM RISE PERSISTENT | DESPITE UNEASY STOCKS Cheap Money and Lower Commodity Prices Influence Markel—Foreign Investments lmprm'(-. BY GEORGE NEW YORK, December 31, HUGHES. by the same mort The | Was Willing to pay a relatively higher year 1 closed with the average | Price for the lower coupon issue, price of investment honds higher | €duse it had possibilities of market than at any time since 1913. During | Price advance which the other did not most of the period A quotations held abov anything seen in a decade that is to say, since late in 1916 and early in 1917 and in the last month the ad vance was carried through the old war-time high un til quotations were comparable with those obtaining before the finan 1 strueture was disrupted by the outbreak of world hostilitie The low nt in the cy¢ far as bonds ge. The investor Convertible Bonds Popular. In one respect the activity and strength in the stock market was re flected in bonds. At times the spec tacle of rapidly rising prices for stocks detracted interest from honds, but the mvestment bankers surmounted this obstacle by offerings of bonds with rticipating or conversion privileges. Not at any time sinice the war has this type of bond been as popular as it was in 1926, Its use answers the objection that the bondholder, though he assumes apprec; not in the same degree, of course the stockholder, gt still tn some ex tent—has no share fn the the enterprise if it proves su Advocates of the superiority of con- | diversified list of common stock over cerned, was reacied in May, Just | bonds fo long-term investmeny when commodity prices touched “the | pressed their claims and peak of a generation. The ensuing re. | With much success all the it covery did not get well under way un- | Some concession appeared advisabie til the middle of 1921, but there there |and the convertible bond was the 1 was a prolonged rise lasting approxi- | sult ANy new issue carryin mately a year, after which there was | ture of this kind was quickly = A mild reaction, and then a new ad- | Up. Seasoned bonds of this type, both vance beginning in the second half of | rails and utilities, scored stiiking md- 928 and continuing with only minor | vances as the market of their Interruptions right up to the present | respective stocks went up in the series time. {of “bull” movements of which the The feature of the 1926 stock market was made up. was {ts uniform char ronvertible bond had another which dem advantage, in that it could be bought the violent by financial institutions which were market. While there was, of course, ohibited by law from investing from time to time, slight set It ix no secret that a good ere was never any real let-up in the | 1 these institutions embraced inquiry for h ade investments or | this opportunity to acquire a specula any sign of doubt as to the essential | tive security which they could not ol stability of the market. There is no | tain in any other way. Of course, this better illustration of thix th pportunity had to be paid for. The in which the Jast longterm United | conversion privilege was used to sell States Government finuncing was ae- | obligations which could not have 1 complished in March of this year, just | marketed on any terms so favorabie at the time the speculative campaign |to the borrower otherwise in stocks was collapsing | The fundamental reason for the re The Secretary of the Treasury an-|markable and persistent strength ir nounced this new offering in the very | the 1926 bond market was the abun week that the stock market was break- | dance of investment capital, the com ing after its prolonged advance. The |paratively low rates for money and new bonds, carrying a 3% per cent)the widely prevalent bhelief coupon, which was a lower interest | conditions were going to persist for rate than any long-term offering_ by |long time to come. It is true that the the United States since the fir money rates did not fall to the ex erty loan 3%s in 1917, were offered at | treme lows of two or three years ago, 10035 to the amount of $5 and were at once oversubscribed by $100,000,000. They never sold ther after more than 15 below the offering ¢ price, and that in =mall amount and for only a brief tme, while today the are quoted at a premium of something like 3 points and on a yield basis of not much above 3.50 per cent. Com- parison with the Liberty 31s is unf: to the new bonds, unless it be remem- bered that the former are entirely ta exempt, whereas the latter are not. profits HUGHES, peessful e 1920, vigoronsly vear, s ten ped rise this year | cter, the way in nd persisted regardless of fluctuations in the stock in he waye ness activity and the large demand upon the supply from stock market operations they were remarkably low indeed. Call Money Variable. Call money ranged between ! per cent, the low rate obtaining April and the higher for the most part at month ends, when interest and dividend requirements were heavy. The range for time money was from 4 to 5 per cent, which was a little higher than in the preceding year, but sfill low measured by war and post-war standards. Commerci paper fluctuated between 4 and 4 per cent. At no time during the y |did the Federal reserve weekly sta ments reveal any drain upon credit resour On balance the United States v an importer of gold during the vear, thereby adding to the huge stocks ch have accumulated in this coun- and 6 Other U. S. Issues Soar. Tn the months that followed the marketing of the Treasury 3%s. the | two other Treasury issues, the 4%s of 1947-52 and the 4s of 1944-54, went to ew record high prices. The older iberty loans were in brisk demand all ar, but they did not reach the record ighs of 1924 and 1925, and the reason Tor the greater favor shown toward the Treasury bonds over the Libertie: was simply that investors wanted the until it is estimated half the world be- | that these | 0,000,000 | but considering the high level of busi. | in | whatever | jAaL <rewe. gnos e cBR Uy o f =2 TS TON,. D: C.., FRIDAY, DECEMBER 31, 1926. Q XICAN GOVERMMENT DECREES CONFISCATIN OF CHURTH PROPERTY- URGKERS ) QEDRESENTATIIES AGKEE A 1 A 90 ’ : [Clrr oes ano cmew 0.5, waes o ~ K s presien. s RQose JELT EEFECT BRAVE. P e R TS gy - cRossE e OoEAN — B‘ JiEEan war: A amren w) TED Gov. 520 OF NEW YORWK EOR FOUR ™ TERM ~ I jrernarions, EucuaRIST I ONGRESS OF RamAn CATHOE CHUREM AT NEARLY & ML 10 ATTENDANCE PaRs. e NOTABLE i ) vDEAD * BY WILLIAM F. HEFFERNAN, o (eomar ods ot To © Co0L068 o vamia ‘Bomarec e SS o pernens e e O Ron Toop LNWN Yo mELETT R BaRD Comtans ToyEem ARNON RUDOLPK VALENTINO [larris e ldustrial and commercial enterprise ENATE vores| A pown e, \FARM W\ RELER e large distributions in stock have been | duly Eluw:'. ] 205 o= R “corrou syrs PRICE BELW €0sT o= PRICTION FLYER MAT MARIO DE BERNADI w3 SOUNE DER QP AT MORFOLR. A reflected in increasing activity r STOCKS GRADUALLY RISE AS COMMODITIES DECLINE {1926 Stands in Financial Reckoning as Investment Rather Than Speculative Period—Europe Strides Forward. BY STUART P. WEST. year 1926 will figure in financial | reckoning as an investment rather than a speculative period. The price of money has been low*atid therefore | yis & RscEiption of the present situa, e 1 we have the same comfortable e gt low money rates, the same healthy re LT g lation between buyer and seller e LboLhi most departments of trade, and Ed end |m3mP!llH withal, no suggestion of anoth i L L I buying movement that of jopward: This s which, for three months, gave a tre sl R Ll mendous push to Wall Street oper: ;‘j“:""““ ]‘;““"( f:(‘]‘i‘ tions and wound up in a sudden an wsy money condi- el tions, while they g g have counted g hodin greatly in the in- el | vestment. portions Ebices A Tow of the market, L g, | have counted little Street boom has eve: | in the speculative, | et Speculative op- e Crea i L | rieultural prospects have mot | been helped by the constant assur.|bettered by, ihe happentige of 193 ance that it did not matter whether | Fforts to-bring about a lurger retus call funds were available from day to [ for the farmers are still looking t day at 8% per cent or whether they | Ward artificial - that is, ioward leg pse occasionally to 51z and 6. An | lative—means rather than toward r {abundant supply was certain, and so | ural meaus. long as there v no overtrading | there was no danger of the banking | authorities suddenly curtailing their advances. On the other hand, as part of the | excellent equalizing system of the | Federal Reserve, Wall Street specul {tors do not look upon the reserve | ratfo of more than 70 per cent for the | {country as a whole as an invitation | to go recklessly ahead. They realize that no actual drain upon bank sur- ! | pluses, however large these surpluses | 1918, inclusive. | were, ‘would be tolerated if intended| Il word. th merely for speculative uses, | ued to plant abou they have been | Investment Demand Exceeds Suppl | in normal yes The past year in investment j AUl B Detny been remarkable for the accumula-|With i year a tion of great sums of capital seeking :‘"*I'ml 1I-Imlu-'\ { employment. ormous offerings of | &nd the heef and b new securities, both home and foreign, | CAuse ratula have not entirely served to take up|What has o 1 in the slack. In November United States | Then there is the Treasury loans sold at the highest on | Uation in cotton record. In December, getting ready |high as 24 for the new year reinvestment de-|tember. 1 It went down pi mand, it was difficult for institutions | cally continuously until, late in 192 wishing to buy good-sized blocks of | the price wis almost cut in two. The e bonds to get offers|1925 production of slightly more tha: 21, which | 16,000,000 bales was largely in ex {of requirements. On top of this, wit the aid of the most favorable growins conditions known in a generation, the op has piled up & probable tot of well over 18,500,000 bales, hands of merchants and manufactu ers, and that the policy was to b only for immediate needs. It is cur ous to ohserve how closely this also fits a description of the present situ: pse fundamental and it is havd Wl of depression condition to foreses commodit and the fact remair hoom and Wa heen founded ¢ Thero may be a change e situation later on. But ¥ WEST. Reverses in Grain and Cotton. The provaganda to diversify ere | planting in the West has not accor plished much. Wheat farmers had larger acrzage in 1926 than in 16 1924. There was a sl | compared with 19 decrease as compi years preceding 11926 area under than the average t reduction and @ fair-s ed with the thre ut then again i} wheat was large of t 1913 t farmers have as much wi stomed nothe pas Phice e plar The re 18 compare The same is true « The wheat srowe i raisers have 1 themselves fo 1926 dmost tragie s Spot cotton sold cents o pound in 19 | very high-gra {around the prevailing lev | was also close to the top level of the | yeal Capital has had to be content with a constantly diminishing return. This i has been one of the central featur of the financial situation in 1926, In- Vb e Cottti e vestment issues of the highest rank : A | were pushed up to what were almost Ave the cotton planters of the Sou prohibitive premiums. Then the de-|E8INE o do what the wheat planters {mand shifted over to bonds of in-[of the West did not do under similur {ferior grade because of thoir high |conditions and divert a substanti ! yield, to investment stocks, and espe- | Part of their area to other crops | clally to the securities of foreign gov-| This is a auestion upon Vhich ernments. Wl deal depends for the otitiook | ihe rise in Buropean obligations, The only way out of the de number of which reached their high- | pPressed condition in the cot(®n tra« | st for the year in the closing weeks, |8 either through restricted producti nd a few broke their records for all | O through a shortage in the new ere time, constitutes a chapter by its which will mat next Anutumn ! How much of this advance is to the meantime the assumption explained by the urge to buy for the reasonable that those who have hee sake of a comparatively large return, | Burt by the cotton slump will have and how much can be set down to|Cut down their outside purchases, and tmproved economic conditions abroad, |that this will affect demand for ge is a question. Both considerations eral merchandise. This point er have entered strongly, of course. phasized, along with the lowered fars | “Before going further into foreign | brices where, by who. 100 | financial conditions, which have play-|for some sort of u slowing down in any |the general trade movement in 197 ed a more vital part than year since before the war, it is well to take up some of the main aspects of the situation at home. ‘Wall Street Overoptimistic. The year 1926 started out with ex- pectations in Wall Street that were not destined to be realized. There had been a big speculation on the ock Exchange in the Autumn of and the keynote of this was the idea’ that the opening months, per- haps the first half of the succeeding year, would witness a trade boom. Leaders in the business world wer talking about this: prominent banl ers were for the most part optimistic. | The public_got its anticipations up, only to find that 1926 was not to be as much of a boom year as it had Dbeen led to expect: that it was to be a vear of good business in the main, | but with exceptions in certain indi vidual lines. Some manufacturers were unable to get selling prices up where they would leave a reasonable profit margin. Wall Street, in consequence, had to face a radical readjustment of its ideas, and starting with the second week in January and not terminating until the early part of April, there was a heavy and persistent selling movement on the Stock Exchange. - It swept individual prices down all | l0 at least somethir the way from 15 to 50 points in the | VOlume. speculative leaders. Then the slump | The delav in the Nick was checked, and after two months | DS apparently held up some of uncertain variations the market | MeTREr prospects in other ficld started forward again. Once more | Nickel Plite expericnce hus 1y the rise in July and August was based | Minder to big interests in the " upon too sanguine a judgment of the lw~l-|-l consolidations that they business outlook, and in the latter [ IKelY o find it cusy dealis part of September and the first half (Norities. sl 1927 1 of October a reaction occurred which | I8 €very reason to by extinguished a good portion of the |Program of railway consolidation wi Midsummer gafn. make substantial headway during tl After the middle of October the posi- | Year. This is the wish of the heads of tion was improved. Stocks rallied con- | the Government, of the railway, labor sistently until the general and shipping interests, and finally of was brought up to and even ahead of | MANY of the railway cxecutives thenis the previous high of the year. But |S€Ives who at first were opposcd. there was no excited speculation, such U. S. Steel's Stock Dividend, as there was in October and Nove i $ Wall Street shaped The United States Steel's 40 operations with due conservatism as |Cent extra stock dividend wus to 1927 Extreme ideas either way [$04e by itsell. Tt had no significance were not popular, for trade conditions in general, except Twelve months ago the point most | 10 permit of the conclusion that o insisted upon was that there was no |SUCh extraordina step would h overaccumulation of supplies in the |Peen taken I > been any doubt about the continuance of good times The Steel Corporation simply f |itself in the position, after years | saving and plowing k ~ surplus | into property, where it can safely cap- italize pare of these accumulations fo the benefit of shareholders During the war the huge profits « » period_were zed as abne mal. and United States Steel paid par of these out, but in « form where ther payments could readily be st that s, the form of extra eash div dends, Now, however, the situation i | auite diffevent. The corporat | Justing its capital account to an (creased earning power in full |that this increase has proved | permanent. And also it is | 2 £ 01 ST oy} UL SUmaoon’ sjonst | fanswonr puv sonpea juerd poSagiue A[snoutious eyy 0} junoove [uide Europe Makes Big Strides, | While here and there exceptions are to be noted, it will be generalls ]u.m-.-d that the financial and eco nomic rehabilitation of Europe made satisfactory pr during 1926. 1t was in April, 1925, that Great Britain resumed gold payments and that the pound sterling returned I..II'I IllIIllI I virtually to parity with the dollar | This gave an incentive to the res Weekly Volume or Shares Sold on N. Y. Stock £xchange | of the world to attempt in one degrec or another the same thing | For more than half of 1926 the ef forts at stabilization in continental | Furope were discouraging. In July tke French situation had reached the (Continued on Twenty-fourth Page,) bond with the longest term to run, This in itsell was an expression of confidence in the future of investment walues, otherwise the nearer maturi- tles would have had the preference. ~ TEven those investo were not quite convinced that the long-term trend of corporate bonds was upward were willing to admit that there was no. prospect of any material shading of prices for United States Govern- ment securities, no matter what might happen eisewhere in the mar- ket. 'The fact that the outstanding supply was constantly diminishing through operation of the sinking fund and that the Government seemed able to accomplish its financing at pro- gressively lower rates was very ime pressive. The upward movement supply is on this side of the Atlantic. & < For the first 10 months of the y On the New York Curb Exchange | gold imports totaled $179,349,261, year 1926 set a new high record | against exports of $100, In | for total of transactions 1925 the movement was directly _The bull campaign versed, exports largely exceeding im- | November, 1925, which ports. tion in the excited It was not so much these concrete | SPeculation in the statistics, however, that the bond | motor shares both market was reflecting, but rather the | here and on the historical analogy of conditions exist- | Stoc chan: ing after other great wars, and es-|and subsequenily pecially the apparent downward trend mmunicaie | in_commodity pric For it is not |self to h {only interest rates that affect hond list, W <, but the amount of goods that proceeds of a bond coupon will save the railroads, of which there are awarded share owners. Standard of [in the market for tropical oil shares. but few. Therefore, it has been | New York distributed approximetely | Public utility stocks, which have natural that price movements | $72,000,000 S sa I3 per cent stock | commanded a pluce of prominence in throughout the year have been sim-|dividend. Standard Oil of “Nebraska | the speculation of the past vear, are Iilar to those on’the Stock Ixchange (gave $1.500000 us a 50 per cent stock | selling in many instances at prices jand have been governed by the same | dividend. Subgcription privileses wers | considerably below those established | , | influenc granted shareowners of the Hamble ) in the late months of 1925 and the The money situation played but a|Oil & fining Co. and Standard Oil| first quarter of the succeeding year. { minor part in the speculation. There [of New Jersey carrying the rizht to| But as was the case on the side of fwas an abundant pply of funds|purchase at par 6 cont and | higher § <, Wall Street went too available for Wall Street purposes,|16% per cent, respe of their | gar in discounting actual property and st no tme did the Feder: holdings. These increases in capital | values. Hence the vear ends with the serve find Jt necessary to exert its|stock explain in large part the in-|public utility shares at prices gener- influence. Tt would appear that the |crease in the total paid in cash dis-|ally considered attractive, with. the movement of prices has been gov-|tributions, but increased ividend { market inclined to its proper erned chiefly by developments in the |rates by various companies also |level industrial situation i . as they [swelled the total. | related to individual industrics | Payments in the fourth quarter ex- | The 0il Shares. ceeded those of the third by $16,000, Because of the large number of ofl | 000 and were $20,000,000 lacger than | 3 ares dealt in in this market, they |1 the final three months a vear ago. | industry were similar to those ex- are to he ranked as the group which | xtra dividends by Vacuum Oil, Jn- | perienced in the radio industry during | holds most public interest. sStandard | (ernational Petroleum, Imwerial Oil | the first few years of its inception. v | Ol subsidiaries, since the dissolution | Ltd., South Penn Oil, Chesehroush|pu: it has been generally agreed that . > {of the parent company 13 vears ngo, | Manufacturing, Standard Ofl of Ne|he financial hackground of the for- funwaLrant F. Meffernan | (ith few exceptions have maintained | Praska, along with extras by Standard | mer was superior and that competi- such as that of the late months |their market on the Curh. Standard o oW jiorsey and Standard of Call'|tion has not become keen enough for abatement of the investment de- |yl lO T (U CUVE 1) Bloted, which had its culmination in | Oil Co. of New York, was the latest | fovnia dealt dn on fthe Stock EX-|iho industry to reach the saturation mand. It did have this distinetion, st Rk ilrhie AT ““ | the break in prices some [to be transferred to the New York|? & . ¢ T L tad I b is ' |the tendency is not upward. ! ¥ : 3 o increased the amount of distributions | ™"(0% otition haa to b itminated however, from the market of other | “'pary oSt 10 VPN Be thrown | three months later. Stock Exchange, famillarly known as | [1ereased, the amoun _Competition had to be ellminaf Years —the gains were more Pro-f,n {ha subject by examination of @| It is conservatively estimated. that |the Big Board. It seems reasonable V35" (e Olilh Ol1"6l I outl] e o WA poselbis. FRISE VAN nounced in the high-grade public util-| ;¢ of typical commodities, comparing | total sales of stocks for 1926 will ap-|to assume, however, that the market | For 192 the Ohio O s G ts | ccomplistien b & Iarae extatt by tid Ay Gbligations than in the old-line | p jcay today with what they were 4 |proximate 125.000.000 shures, while |for the remaining so-called Standard |to stockholders $2.50 a shure on its | consolidation early in 1926 of three B e hciknse ralls Vear ago. Taking the foodstufts fis sales Wil disclose fain of |issues will continue to be the Curb, | 60,000,000 shares capitalization. prominent manufacturers, namely the The progress made by the electric [ J5I" W60 ACNE THE Fo0ds Tl ‘ $25,000,000 10 a total of $300-| The close of the vear finds the ofl 000,000, Motors Qutlook More Faverable. The outlook for the automobile dustry is more favorably regarded . | the cl of the vear than it was tw | or three months ugo. Then the a good deal of talking about increasir competition, necessitating price e ting and reduced profits. This prove. to be much exaggerated. A few con | panies did not make a good showin: |in their semi-annual and third -uarte | reports, Mostly, however, at the automobile ¢ tumn and early W praised as mainly a seasonul ctio In the closin, the year new orders were on the increas: Record Rail Tonnag hrough the great railway ton the history of |reflected i “of October- had its incep- the reduced output \ters inthe A iter was to be a Electric Refr In many respects confronted the electric refrigeration £ rrator Stocks. weeks of | maximum 600,600 | While this volume has been excecded {in the y just {ended. it the resuli unwarrante therefore, there downward trend in prices for com pora- I - . hek Pora- L modities it must mean higher quota tlon bonds paralieled that in Govern- | fHtCtEs 1F T OHINIonS Thav. aifrs \ ment issues. The average was i the s Sant as to whethe: ich trend Lias heer low in January and it reached the top | 510 Whether any such trend has been in November oitd 1t reached the 10D | definitely _established. The various eVer There was o e adven- | index figures show only that the high For there was o bausc in the advance | o, ¢, year was recorded in January, it was short and due principally to . B i , 1¥ 10 land that fluctuations since have been Tealising sales. There was mever any | yncertain, It the curve is plotted, is any major conditions which i - part of the 1 > broke all is the countr is w 1 unusually la KTOSS r¢ enues, and, becatuse of return t normal maintenance expenditures, |showed also quite strikingly in ne earnings. Numerous dividends were increased in the course of the yea and & still more liberul policy regar. ing the distribution of railway profl is looked for in 1927, provided eral business keeps up, as is expectec like the recos WS Jght and power companies, as m\n." . e 000:000 " e migritficant Toutnie tov. | abaras in sy {hataices; Mowsi Hub: (‘::xn::;:‘:»:':“fll:;:‘-ll»:}:;::n:{‘ l:‘-wmm e ’Z.‘;if."'(3.-';2’,{.’1”'{53'.‘,'1‘.1;\'xii‘.-ixfii’é?lfi fied to by their earning siatements, | Sosntisy, Rye and oats are much the | this increased volume if busi- | stantially from the high prices estab.[Ofl of Indiana sharehold | cot “Follawing the combination ot was chiefly responsible for this turn: li‘,‘,‘m 1, but sugar is up. Butter is that it wa lished kite in 1925, but with the out-|amount to $3.50 as compared with | what was commonly referred to at utility AN0Th e L0 anirar . Bt cis aie dovar boy & 5 rdeslv hoioe iook for the immediate future brighter | $2.50 for the previous South | that time as the “Big Three,” Kelvina- 2 narrowing of the spread in | 1avd nofic and beot ave all very much |and accountab] by th {than it has appeared at any perfod | Penn OIl's distributions Will total §2.75 | tor and Nizer shares were eliminated price between the best secured obliga- | g~ b e i during the vear. a share as compared with $1.50 for | from trading o1 the Curb Exchange. ¥ 3 t 84 | Jower. The average for foodstuffs is |new issues v enti Lo droua an 2 " tions in thix and in the railway field. | gyl UfG S 600 panies were listed, bringing [ Despite ail this, oil 1925. These are a few instances of | mppo of 1926 finds the Curb Another influence was the bronder NoWw také the mothl the total number of sto bonds | the better grade report the ‘ability of oll_companies of the | yrarket “with only one issue of prom. Htude taken toward public utility In-|pu¢ steel is unchanged. dealt to approxima and profits In_excess of those for|first rank fo show increased earnings | ndhla epresenting this industrs stil vestments hy various' State Legisla- | 1o\ S0 in copper and zinc. The | pared with 1,100 in 192 1925, When * distribution has been | in & period generally considered un- | pejn® ot e (I RGUSER SOT tures. Massachusetts, for instance, [ g DO 8 COPREE SI0 MRS U g e completed cash dividends of the | favorablo for the ofl industry, and | g gectric reriigration. stocks. heve made public utility bonds that meet |5 gjavsudvance, Coming to the tex Price Mov 8 Beleckive | Standard Oil group for the full vear fto reward stockholders through dis- |una alsewhere sill endeavoring to seek rortain rigid requirements legal in-| s Cotton, as every one knows, 1| J3xchanze memberships have not|will amount to $200,263,504, the Jarg- | trfbution of larger dividend payments. | ft e Tovel Nestments for savings banks in that | e qoin. Print cloths Aind sk are |¢xperienced the phenomenal rise | est annual payment sinee the Stand: | Much has been said about the posst | | down also. In the miscellaneous class | Whic ».] occurred during 1925, when a fard Oil of New Jers: olution, and | bilities of companies engaged in de- | rubber is much Jower. Hides are|record price o I down a little. Gasoline and crude oil | that at whic "! ] o AL [Show sivancel n ey ing moved BEANGE | ) maintatn the |Eroater * Dortion of | total.amounted 1o $62,621,548, the the rest. 1f this showing means any- 48, the The utilities and their bankers were | {pine St richs 68 alohiols srcl appreciation in value, + several | largest of any single qu and ex- thing it is thut prices as a whole ar inds close to the maximuu: | ceeded by more than $10,000,000 p: not slow to taken advantage of this|{rending lower. 1 pew situation as busis for refunding | o Spaned’ movement in foreign {ments made during 1912, the first pperations. In January the Common- | jonds. paralleled that in domestic obli- | vear after the dissolution of the waglth ILidison Co. of Chicago sold »| parent company, $15,000,000 {11 mortgage bonds with a | 1o dn aqaition. to 435" per cent coupqn, which was the first time since the World War that a jong-term utility obligation had been tflll out it so low u rate In May the New England Telephore & T EXaph finunced its requirements also ith a 44 per cent bond issue, d in ¢ 1 instances the offerings were read v absorbed. Later in the year there | other issues of this kind, and as per 1o first mort shed public uti ny could he purcl cerning ness accompanied movemer fact that than wits e ot with 1 gins companies of net income as ther hat Tron is dow n| Lead is mucl Of the various new indutries whick have their representation in Curk tocks. considerable attention has been directed to consolidations which have taken place among laundry companies. The largest consolidation of this kind was effected in New York City through formation of Consolidated Laundies Corporation in the latter part of 1925 by the amalgamation of 17 independ- ent units. Btate. A similar movement in New York failed, but its promoters believe the setback is only temporary. Refunding Ope xcess of 19 sbursements by 495. Dividends payable in the el | fourth quarter, and included in this veloping of South American properties | around the Maracaibo Basin. During | the past year operations have gone a long way toward eliminating the dif- ficulties experienced in the first few vears of development, and the fact that many of the large American anc other interests affiliated with Standard Ofl are becoming concerned with the possibilities of this field, has been ed | in at | 346,757, ons. 0! the Anging ure sk their represent per compunies which ha cipal market on the Cu practicaly every line of (Continued on Twenty-third Page) | the cash payments, (Covyright. 19269 COURSE OF STOCKS DURING YEAR 1926 WEEKLY AVERAGES OF 50 LEADING RAIL & INDUSTRIAL SHARES ) 1 T ew no T (| seasoned Iy it ned | belief itselr djusting $tiew and railroads, broug nence t tion ation the pon descriptions &age bond calluble not very wel price, no atter b property vi or how well protected by earnings, ximply because investors were alwayvs afraid that the corpora- | tlon would exercise the redemption privilege under money market condi tlons such as existed during most of | 1926 | With bonds of higher coupon rates | the argument was even stronger. In | fact, if & company did not refund a 7 per cent hond provided the in denture perr it was regarded as a sig weakness The result was that o higher current income yield | could be had on 6 per cent bonds than on 8, even when both were the obliga. | tlon of the same company and secured 4 it into prom the to further appre. of the higher cou A 6 per cent say, at 1074y ¢ abov vined importanc redemp g || s I 1+t ] | | | | price as a bhar - that cured by much wowell s issue, rmitted 0 ¢ nwes J 015201 6152229512192 3101724317142 265 121922 9 162530 § an. 1320274 1116251 81522293 111824 Feb. Mar. Apr May June July Ock. Nov. Dec