Evening Star Newspaper, December 31, 1926, Page 18

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

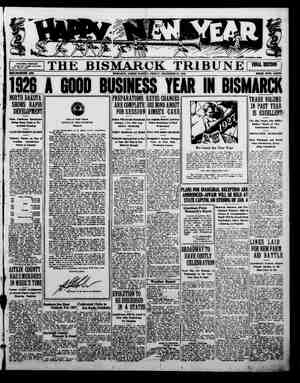

‘Bus 'BUYING POWER IS ABOVE |~ ANY PERIOD IN HISTORY “Farmers Share Least of All in General Good Times, But Reaps Industrial World Heavily BY J. C. ROYLE. NEW YORIK, December 31.—The #1de of prosperity rose to new heights in the United States in 1926. Jven records es! 1 in the remarkable year of 1925 surpassed, those who w expectantly the fall of flood saw * gurges of bus volume sweep down upon the gauges This for the new does each in business man and every company or ¢ ration was cessful Ud ever; rommerce trade sl quate pre of the co hetter ea the last ei enced the have ever had. ens of this country in zeners - off today in cash, in Tredit ut the great majfority erns in operation showed | gs than t expert W 1. e clouds disappeared from there were Not all t the busin fawer thr fabric than industries Fome periodis these were br had behind of production. tide of consumpt buying power, whi Pprofits from recec Two Out of Three Did Better. There {8 no room for d gregate corporation p have been ennual pe three individual than in 19 of chain = scals, metals, iron and ste to 35 per ce trial concer e flood of pre rendous vol in turn met th acked by huge | prevented bt that ag- this the previous year, whila z sorted &ains of These profits were undet boom conditions. made under the most petition. There were no markets” There was no of business, which almost invariably is followed h iness blow-up. Profits in general resulted not from advance in prices, but from decrease in costs. The results were produced by following the American formula providing for high production, high wages and high worker and mana- werial efficency, combined with low prices. To the end of the year there as a strong buyer resistance to price ndvances. Buying Power Unequaled. power of the United oped during the vear ims equaled, or even ap- il sales during the 12 In not_piled They se up were inflation never heen proache Re months addition, savings bank deposits in- creased, the amount safeguarded in _ high-grade investment securities grew and the year closed with thi ment trend still undiminished. 8 of course, was due to steady and al. most universal employment at high wages. While production some lines, such as automobiles, tires and building materials, as the year «losed, retail sules were maintained at & level even higher than in 192 In most industrial lines, however, the highest profits were piled up in the first three quarters. The check in the last quarter was due as much to cau- tion as to constriction of demand. Exe ives ¢ ind al concerns are almost a ‘unit in admitting that a prime factor in profits this year has VLeen the marked increase-in- worker efliciency. This was especially notice- able in the steel industry, in metal mining, in transportation and in #cores of other lines of endeavor. The five-day week put into operation by Henry Ford was based -primarily on worker efficlency, and operated suc- cessfully for this manufacturer and for some of Ford's nearest rivals. It creat wide discu on, and although 3t was along the lines advocated by the American Federation of Labor, workers expressed themselves in many iinstances as opposed to it. They argued it was not suitable to all in- dustries and was calculated to reduce “the total earnings of the individual, Farmers Not Satisfled. Efficiency and more modern equip- ment, allowing a reduction of man- power, helped the . avhich ‘was not the agriculturists. Crops were esti- nated as 2.9 per cent heavier than in 1925, but prices were below the level of the latter year in most lines. Pur- ehasing power of the farmers un- soubtedly was cut but the de- crease was rendered less heavy than might otherwise have been the, cas because costs o duction “were Jower and the financial position of the ¥ural districts was excellent, Wheat farmers got cents & bushel less for their grain than year, but the crop was o much that bigger output made up for the Jower price. This was especially true of the Winter w wers, I’rices, all in all, were f y and in sured a good profit to the successful &rower The corn farme: than last 1 the sam nnder growers live st Ligh prices ynargin on cuttle it s estimated live velved § slowed down in | Wwas no worse off price was about ch means it wa production, but 1 up profits by feed! 1 ige of Although b was s < growers r 000,000 more than last ye: i 11 Huge Cotton Crop. The o history, Avhen this be yeturns had yower in the South Was high and financi growers to hold the amore favorable m uccessrl w gound ba which ton crop was the 1 and prices dropy ame evider some effect on by but consum g to e cotton u 2 ket developed was tribute to the present pro: factor did South e in gen South were ment orofitable asure to unco-ord sthods, by whic somejna atted and others neglected fon of some frults w housands I in all, howev agricuitural indust including ng, which had a fine year, to- close to $11,500,000,000. After the nnthracite coal strike was J #ayary there were com p L5 wer Produc jous and unpicked 18 from ¢ time in | | not {to 1 {months of the vear. | trade with China. paratively few lahor disputes, al though the trouble in the Passaic wool industry kept thousands i{dle and had profound effect on the industry. here were also some building trade troubles of minor importance, and strikes took place in the garment trades, but all were sporadic or sec. tional. iffect of British The British coal strike had a wide. | spread effect on American agriculture and industry. This dispute, which tied up British industrial plants and shipping, caused an intense demand for Ame n coal and, for a time at ifted two of the most backward nerican industries, bituminous mining and shipping, into the Strike. The dem exh: 1 for coal cargo space sted all available ships. Frelght cross the Atlantic rose sharply. 1t was impossible to move large quan. tities of grain, cotton, copper, meat 2 zar and other commodi- es which we d for export. Demand from rope for some American goods almost ceased On the other hand, Amerfean soft coal ines which had been closed or work ing only a day or two a week were | put on full-time basis. Operators in Ny cases raised wages voluntarily | to levels equal to or above those of | the J mville agreement. With collapse of the British strike, how ever, freight rates softened, coal prices | dropped down from the high level th reached and moving E Shipments by Water. Increased ship tonnage entered and left Pacific ports, intracoastal ship- other goods began ropeward. ® |ments through the Panama Canal ac- | co nting for much of the gain. East- hound dry cargoes through the canal increased by over a million tons and westbound _ shipraents rose several hundred thousand tons. Petroleum shipments eastward were heavy, but up to the 1924 level. But east- ind_ shipments of all commodities ded those westbound by 2 to 1. Canned fruit shipments were steady Dried fruit cargoes advanced about 20 per cent, exports to foreign countries from San Francisco alone amounting 000,000 pounds, of a value of $10,000,000, during the first nine Orfental trade Japanese exports and im- making up for the decline in The California ex- porters, however, secured a good vol- ume of Chinese trade. The great lakes shipping season was a phenomenal one, the lake fleet car- ing 113,291,886 tons of ore, coal, stone and grain before insurance ran out on lake vessels for the season. Barge shipments on the Ohlo, Mis- souri, Mississippl and Warrior rivers rose to new record heights. Wonderful Railroad Year. The rallroads had the best year they have experienced since their proper- ties were returned from Federal con trol. lHere, too, efficiency was the watchword. There were no sharp rate increases. Wages rose under late year adjustments, but profits increased ma- terially, with new records both for gross revenues and net operating In- come. Gross was about 4.2 per cent above that for 1925, while net oper- ating income showed a gain of almost 10 per cent. This was accomplished through in- crease in the weight per trainload, in car miles per car day, in trafic dens- ity and through economy in fuel con- sumption. Physical condition of the roads in general is better now than ever before. Condition of equipment is fine a= a result of the expenditure of approximately $875,000,000 in bet- terments and fmprovements. Ilad it not heen for the ability of the rail- roads to move nearly 55,000,000 cars of freight during the year without undue delay of car shortage, the vol- ume of business of the country could not have been maintained. Passen- ger revenues were good, although per- haps not so satisfactory as in some previous year: The tourist traffic was very heavy and profitable. Do- mestic travel was alded by the anti- American outburst in France. Motor transport of freight and pas- sengers continued to gain appreciably. Rallroads, instead of complaining, of this competition, adopted in most in- stances the policy of entering the bus and truck fleld themselves. As a result many routes were established and keen competition for franchises resulted. Tt has become evident that | stose-door delivery of both passengers and freight is a development certain to ensue. The expensive building of toll roads by private capital also is forecast. Extensive Road Bullding. The volume of trafc forced con- tinued highway and paving construc- tion. The amount expended on this work advanced to more than $1,000,- 000,000 for the year, and provided a big outlet for steel, concrets and stone. It also furnished employment for many thousands of workers. The trend in the congesfed districts was towayd the development of highways to parallel those already in use and to the widening and straightening of the latter. The tendency to supplant solid truck tires with pneumatics, it |is estimated, will assure present high- ways of additional longevity, The steady growth in traffic un- doubtedly has alded the traction com- panies and street rallways this year more than the advent of the bus has hurt it. Street congestion and lack of parking space has driven the pub- lic to the street cars and earnings of the electric roads have improved ac- cordingly, New and improved equip- ment affording an increase in luxury and comfort has also been a factor in_the fmprovement. Net income of five prominent trac- tion systems in the first three quar- ters of the year surpassed the cor- responding perfod of 192 by 18.3 per cent, and for the whole year showed gain of approximately 21 per cent Teduction in operating costs and light increases in fares in some cities were incidents of the vear. The verage fare for the country today 7.69 cents, as compared with 7.57 a year ago. The number of big 12-passenger air- planes now under construction in fac- tories all over the country fs suf- ficient {ndlcation that the transporta | tlon of passengers by air has become UNDERWOOD tion, and Alfred P. Sloar Crowley board of exceeded. 000,000 figure of 1925. vances. This was not confined to any one section. Florida got down to a less Inflated basis of land values, to the relief of the real estate business in general. Despite the hurricane which strucl the State in the Fall, Florida is strid- ing steadily forward on the road of Progress. The ocean fronts on all three sides of the country showed gains in prop- erty values. This was specially no- ticeable along tha Gulf coast of Louist- sissippl, Alabama and Texas, huge developments are under way. In other sections developments sprang up wheraver there was a lake or a golf course, and if the locality had nelther promoters were not lack- ing to butld both. Construction Gained. The building industry, despite all predictions to the contrary, had a year in which nearly $6,500,000,000 was ex- pended for new construction. This was & gain of more than 4 per cent from the figures of 1925, hitherto the highest ever known. The volume of building in the first six months was enormous and, while it dropped sight- ly as the vear drew to a close, there was still enough work going on to in- ‘sure & high degree of activity during the next few months. The industry was alded by a slight lowering of build- ing material costs, but wages ad- vanced In some sectlons. Ruilding was one of the bulwarks of business in the last year. Hundreds of thousands of workers were employ: ed and their wage scales were the high- est of any of the skilled crafts. Ma- terial production accounted for addi- tional ‘employment, and the benefits spread to the office equipment, carpet and rug end household furnishing flelds. Easy credit conditions continued throughout the vear. There was am- ple money on hand to finance sound building projects and this is likely to continue. A huge sum was obtained through sale of real estate and bufld- ing bonds. Activity Is now turning, however, more largely to municipal, public utility and other heavy -cof structfon work and away from resi- dential types. The demand for resi- dences has been filled in some sections, as has that for commercial buildings; This is shown by e lower level of rents than prevailed a year ago. Easy Money. There was, in fact, an abundance of funds for the financing of all legiti- mate business enterprises and for the adequate movement of crops. Banks were bursting full at times and this had a stimulating effect on the market for honds and investment securities. The average rediscount rate for the 12 Federal Reserve banks was a trifle higher than in 1925, but was under 4 per cent. Call loans ranged from 3% to 6 per cent, as compared to 8% to 6 in 1925. Loans and discounts of na- tional banks showed a gain, ax did de- mand, time and Government deposits avings deposits increased to over 24,700,000,000 during the year, but this diie, In some part at least, to interest and dividend payments to de- positors as well as to acquisition of new accounts. The extent to which the banks profited was shown at the year end, when huge sums in bonuses to employes were distributed by bank- ers and brokers. Never before has such a huge amount of the public’s money gone into investment securities. The vol ume of new bond offertngs for the first a reality, Strict “maintenance of schedules and high percentage of safety on freight routes has given the passenger trade a hig hoost. i Real Estate Development. Without the new ods of transportation, that the real estate not have risen to the heights ed In 192 Much of the de- lopment wi ihurban in type and marked a growth in home owning which the American people ha ne experienced before. In 1 cities values of many wsections were only bharely maintained for re lene property, although business sites con- tinued to command high prices. It as In the suburbe and resort sec. ons that prices showed largest it is acknowl business ver t and efficlent meth- | 11 months of the vear totaled $4,317,- 1235,762, as compared with $3,958.950,- 308" in’ the corresponding period of | 1925, The total for the year seems { likely to approxin $4, ,000,000 or | more. There are now some 25,000,000 | holders of stocks and bonds in the | United States as compared with about 3,000,000 prior to 1914, The chief gain | in Lona offerings was in the public utilities. | Power and Gas Consumption. Production of electric power in this country rose about 12 per cent in the |Jast year, and the power and light util- ity companies had a most active and prosperous twelvemonth, Thelr earn- ings improved approximately 20 per cent over 1925, Conzidesable of this i TLower, left to right: Lammot ‘du Pont, president of New York Central Ral Instead of the building boom being over, showed a volume totaling about $6,500,000,000, the highest sum ever expended for & similar purpose in the same time. USU, 1 , Teft to right: Charles E. Mitchell, president of the National City Bank of New York; W. C. sey; : lg*r;nql'){ .:r;‘nixh. chairman of the board of directors of the Bethlehem Steel Co.; Adoiph Zukor, president of the Famous Players-Lasky Corpora- 1, president of Southern Pacific Railroad; Patri Fquitable Trust Co.; James S. Alexander, chairman , president of General Motors Corporation. resident of E. 1. du Pont de Nemours & Co.; Willlam §; fi 'W. Krech, chairman of board of directors, irectors, National Bank of Commerce of New York, and . Edson White, president of Armour & Co, LINKS IN THE BUSINESS CHAIN OF 1926 road; Alvin v.so. BY J. C. ROYLE. WO out of every three industrial concerns in the United States did better in 1926 than in the previous year, Not every individual or concern, and not every line of endeavor, was successful, but even the weak sisters had perlods of strength and profit. Records for production, distribution, sales and consumption Employment was universal, wages were high, labor dls- putes few and sectional in character and prices fairly stable.” Farm products prices in many instances were far lower than the previous vear, but some crops were tremendous, and the total returns came within reaching distance of the $12,000, construction was due to the expansion in use of current for household use, especially refrigeration. Industrial use accounts for a tremendous amount of power and no sharp recession is antcipated either in production or profits. Operating costs of some compantes which went up temporarily owing to high coal prices may be expected to recede. Many new plants, efficiently equipped, cams into commission dur- ing the year. Farm electrification made more progress than in any pre- vious perfod and sales of eiectric power grew rapidly. Gas companies made remarkable progress. Fully 110,000,000,000 cubic feet of manufactured gas was con- sumed during the year, a gain of ten Dillion feet. Much of this gain was used in heating operations. With the natural gas burned, consumption for the year is estimated at between 440, 00,000,000 and 450,000,000,000 cubic feet, Telephone ahd Telegraph. New and improved apparatus was put into use by the telephone and tele- graph companies, which handled a re- markable volume of business. There were also rapid developments in the radio fleld, in broadcasting and re- celving apparatus, and in commercial transmission of messages by wireless telephone and by the so-called Marconi “beam” system, which was put into ef- fect between England and Canada and which is slated for adoption here early in the year. The forelgn trade of the United States was both hampered and helped by the British coal strike. While large quantities of grain and cotton were moved abroad, the drop in prices held down the dollar value of the exports. Imports continued heavier than those of 1925 throughout. This reflected the high level of prosperity, the demand for certain foreign luxuries and the sustained consumption of rubber, silk, tin, coffee, tea and other commodities produced outside the United States. The general expansion of foreign trade amounted to about 5 per cent as com- pared with last year. For the flrst 10 months of 1926 exports totaled $3,666,800,000 and imports $3,705,- 800,000, Installment Selling Continues. Business men have learned that how- ever much experts might differ as to the merits, the disadvantages, the profits and the dangers of instaliment selling, that method of mierchandising has come to stay. The system has grown for five years and fs being used to a greater extent than ever before, Those who followed old Omar's ad- vice to “take the cash and let the credit go” would have hard sledding in modern business. The list of com- moditles sold “on time” s rapldly broadening and includes automobiles, furniture, household, mechanical and farm equipment, clothing, furs, jewel- ry, paints, building materials” and other products. The volume of in- stallment sales this year Is expected to total at least $10,000,000,000. But sin the average cash payment is 25 per cent and the remainder is reduced monthly, only about 42.5 per cent of the installment debt is outstanding at any one time. Since some $130,000,- 900,000 is now loaned hy one part of the population to another, the amount outstanding fn this form of indebted- ness does not seem to have assumed extraordlnary proportions in view of the fact that losses in this form ‘of credit have been only 0.18 per cent. Its proponents say it has raised stand- ards of living, and certainly present- day standards of living in Arherica are the highest ever known in history, and the American population is lving up to them. Advertising Dominant Factor. Advertising, particularly newspaper advertising, has been another domi- nant_factor in sales, both cash and Iment. This influence was espe- 3 ence toward the close of the year and had much to do with the record-breaking volume of holiday sales recorded. Advertising volume of 105 riewspapers in 27 major cities was larger than in 1925 in every month of the year. Life insurance registered its hest year in history by securing about $10, 'fered from low pr un 4Ey, Iz Teagle, president of the Standard 0il Co., of New Jer- Raflroads had the greatest year they ever knew, with record car loadings, exceptional management, startling gains in worker efficlency and splendid profits. Retail sales were larger than ever before, with 25 per cent of the total of more than $40,000,000,000 represented by install- ment buying. Progress and profits were made, not through boom condi- tions and runaway markets, but without inflation and in face of sharp competition, The British coal strike had its effect on nearly every Ameri- can industry, ¢ Demand for electric power and gas has never been ap- proached. Money was easy, insurance companies wrote $10,750,- 000,000 in new business, theres was a huge demand for invest- ment securities, savings deposits increased and buying power was higher than among any people at any time. Favorable signs for the future are unmistakable and in- dleate six months of thoroughly prosperous conditlons, although perhaps the outlook is less rosy than it was for the remarkable first quarters of 1925, 750,000,000 of new business. This was accomplished through the trend toward group advertising and by the demand for income insurance whereby beneficiaries are paid in installments or through benefits from a trust which gives no opportunity for wasting or loss of the sums accruing to them. Millfons for Amusements. The inhabitants of the country not only had money to buy goods, to live up to high standards, to invest and to nsure against the future; had plenty to spend on amuse and sports, and billions were paid out for this purpose. Fully $150,000,000 was spent just to see others partici- pate in sports, and other hundreds of millions were spent by active par- tiipants. Foot ball drew at least $30,000,000 from spectators. The world series, to say nothing of the regular big league base ball season, accounted for more than $2,000,000. Close to 130,000 spectators paid nearly $2,000,000 to see Gene Tunney take the heavyweight prize ring crown from Jack Dempsey. Tennis, golf, hockey, track games, swimming meets and other forms of sport drew millions of spectators. The circus still held fts place at the top of the amusement list, but was more closely pressed than ever before by the movies and by theatrical enter- prises of the speaking stage. Sales of dlamonds were heavier than fn any year since 1919, and other gems experienced similar demands, espectally pearls, sapphires and emer- alds. The general prosperity was re- fleoted at the holiday period in heavy sales of silverware, manufacturer Jew- elry and watches which were about 10 per cent larger than a year ago. The more'expenstve lines were in best demand. Commodity Trends. A preponderant number of the coun- try's industries had highly successful years. In automobliles, however, the trend was spotty, with some com- panies showing gains over 1925 of 12 to 20 per cent and others suffering severe reductions in sales volume and consequent profits. Steel produced most satisfactory profits, gains rang- ing as high as 25 per cent. Electrical equipment concerns showed gains in new business of 10 per cent or ahove. In the rallroad equipment fleld loco- motive manufacturers were amply rewarded, but frelght car huilders did mot do so well as the previous year. Only a part of the concerns en- gaged in the production of non-ferrous metals found thelr profits equal to those of 1825, The terrific slump in silver prices was a feature of the year. Ofl companles had better suc- cess than for a long time and thelr outlook 1s encouraging. Clothing manufacturers gained ground in the last half of the year, but, while the position of the textile trades undoubt- edly improved, adequate profits were reported only by certain groups or individual companfes. The producers of cotton and wool had an unsatis- factory season, and makers of rayon, after turning out the largest volume of goods in history, found it expe- dient to cut prices as the year drew to a close. The domestic sugar companies, the refiners and producers in the island possesstons did well, but Cuban pro- ducers suffered reverses. Troubles Not Over. Coal operators had a better year than was anticipated, but their trou- bles are by no means over. The building material men had little to complain of, and the course of the markets for drugs and chemicals in the main was advantageous. The fruit growers had a rather un- satisfactory vear and the cattle grow- ers only a moderately prosperous one, but the hog raisers profited and so aid dairymen and canners. The posi- tion of the packers was comparable to that of 1925, Tire manufacturers found occasfon for some complaints, but the huge volume of automobiles built and in use kept the factories at a high point of production. To- bacco manufacturers made more and manufacturers closed the year in splendid position. Future Prospects. Business will enter 1927 with a tre- mendous momentum behtnd it. It seems almost beyond question that this momentum will suffice to carry most lines forward at an undimin- ished pace for some months to come, even {f the motive power is cut down. There 18 no indication that there will be a lack of new impetus, and any sharp decline in sales or industrial activity is unlikely at present. It is almost as hard to break a benign business circle as a vicious circle. Money fs plentiful, production is continuing at a high pace in most lines, employment is general and wages high. This means that buy- ing power {s tremendous and that 2oods to supply the buying urge will not be lacking. General prices are somewhat below the level which ob- tained a year ago, and this in itself should stimulate sales. The favorable signs for the future are unmistakable. The unfavorable signs are as vet only possibilities. The raflroads are in better position physically and financially than at the beginning of this wonderful year. A turn for the better in the affairs of many of the automobile and tire com- panies already is apparent, with pro: pects for additional incre: of act! ity around January 1 The cha acter of present operations in steal is such as to show executives that their mills will be well engaged in the first quarter. It has heen repeatedly said the crest of the bullding boom had passed. Fven {if it should prove true this vear, the volume of construction now under contract is sufficlent to keep demand for men and materials at a high point. Demand for power for industrial purposes is undiminished. Industries Well Fortifled. ‘The conditions in the basic indus- tries indicate that the prospect for the early months of 1927 are well fortified. On the other hand, there are undoubtedly some unfavorable factors. It is Impossible to overlook the effect of the huge cotton crop. The situation and buying power of the farmers might be a lot better. Trouble looms in coal. -Production has heen proceeding at such a tre- mendous pace in some lines that it would he but a short step to cross the line to overproduction. The most comfortable assurance that the first half of 1927 will be a thoroughly prosperous period lles in the fact that the American business man 1s watching his step. He is not glving three cheers and throwing his hat In the air unless he is sure it will not come down in a mud pud- dle. Amerfcan business of il char- acters is more intelligently managed, and more efliciently equipped, man- ned and run than ever before. This gives the most adequate as possible that, even if the tr trade should be downward, the drop will be of extremely small’ propor- tions in the next six months, since there has been no inflation. Business will meet the conditions of 1927 like a skilled boxer facing an opponent he has never seen per- form. It is prepared to advance, to smother opposition under a whirlwind attack. Tt is prepared to give ground warily if conditions make it neces- sary. It {s set, if need arises, to stand toe to toe with the opposition and swap punches to a finish. It is on its toes and no development is ltkely to take it by surprise. The prospect, therefore, is for six months of exceedingly good business and prosperous _conditions, which, however, probably will not be as good as those of the first two quar- ters of 1926, After that time weather and crop conditions will join with other factors in dominating the sit- uation for the last half of the year. (Covyright. 1 The first woman licensed to inspect and grade f&l'muc(l 1s Mrs. J. L. Landrom joma City, OKla., money than ever, but growers suf-| Radio dealers | who will becgme a Federal broom corn r'l'g‘ By the Associated Pres NEW YORK, December 31.—Con- servative optimism fs the keynote stness forecasts for 1927 of th leading bankers and Na bustness With two successive y usual prosper t d close, and stock and around the highest levels corded. it is natural that pr for the future should be with an unusual particularly by those the cycle theory of in number of executives indi slowing down in general | Itkely, fundamental condi Iy are regarded as sou ous depression Is responsible quarte ears of un prices atter committed Wi iness ns gener id no sert looked for in ar volume of securities over the low p rticular ton, sible effect on the country's pirct Ing power; over the growth « ment buying the decline in b i ever, the ordina rs of busl ness depression as prices, high inventories and ove panded credit are absent The views of some of the nation recognized spokesmen for bank and business follow BY CHARLES E. MITCHELL. President. Natlonal City Ban “The yvear 1926 has been one comparative stability in banking. over a decade the financial world b been tossed ahout in a sea of alternat- ing inflation and deflation caused by war and great shifts of gold on a scale heretofore unheard of. Gradual- Iv the effects of the war are clearing away, and banking conditions the world over ars getting back more nearly to normal. “In this country commercial mands have shown a healthy expan huge banks, owned of comim aver Hor with the activity of industr excuse. In fact, the conspl ture of the present the abllity of t finance themselves with comparative Iy little recourse to bank credit. Such increases as have occurred in com mercial borrowing have bee in part by a decline in bank invest- ments and security loans, so that the vear closes with but a moderate ad- vance in total bank credit outstand- ing over the levels prevailing at the beginning of the year. “Concern has been expressed in holdings of banks of secur] s and collateral loans which are ineligisle for rediscount or pledge at the reserve banks. The expansion of these held- ings in recent years has been due largely to the fact that gold imports have caused supplles of funds to in crease faster than they could be al sorbed in the ordinary commercial channels, so that banks have had no other alternative than their employ. ment in the security markets. The problemof maintaining liquidity shonld engage the attention of 1 bankers, but there is no evidence that the hank- ing position thus far has béen im paired. If we do not get any more gold, the savings of the country will gradually absorb this large floating supply of securitles, and banks will Increase their holdings of commercial paper. “Desplte the large amount of funds employed in the securlty markets, growth of instaliment credit and other demands upon the banks, the impor- tant thing to note is that the total volume of credit required of the re- serve banks is less than that of a year ago. The country Is thus carry- ing on its business without draw. ng upon its ultimate banking reserves, a fact that speaks strongly for the underlying soundness of the credit situation. “With the resources of the reserve banks practically untouched, money conditions continue easy, with no prospect of strain. What the trend of rates will bring during tha coming vear depends, in the last analysis, upon the course of business. No one expects anvthing in the nature of tight money, but it {8 true also that aside from' such temporary seasonal easing as always occur in Janua no large reductions are likely so long as business holds up to current lavels. Tt should ba remembered that demands for capital have increased very rapldly during the past been met, with funds to spare, largely because of the replenishment of our bank reserves through gold fmports With the probability that the period of large gold imports is now over, we can hardly expect to enjoy Indefinite ly the unusual combination of I gh business activity and abnormally low money rates. BY W. C. TEAGLE, President, Standard 01l Co., N. J. “With a perversity that was nicely timed, Nature released a fresh flood of new crude ofl production last Sum mer. just as a large section of the public had become convinced that we are practically at the end of our ofl resources. “There 18 no major business activity 80 hard to forecast as crude produc tlon. No sooner do experts complote their charts and commit themselves to predictions than some little-consid ered area is sure to break loose with a lot of oil. “In the past year there was good reason in the early months to lank for a substantial decrease for the 1 month perfod compared with 192 The first six months’ loss amounted to 22,000,000 barrels. Now it appears that ‘not on s the deficiency the first half vear been overcome by Increased production in later months, but it is a practical certainty that total yield for the full year 1926 will exceed that for 1925 by a substantial amount and in so doing establish an- other new high record for the United States, above 765,000,00 barrels. “With the record-breaking output, increased imports and seasonal decline in consumption, a large amount of current production is now going into storage. Nevertheless, and taking into account the recent reduction in, posted prices, the producer iz averag- ing 8 cents a barrel more on his mid- continent production now than ha was a yvear ago. For all the light crudes produced in Kansas, Oklahoma and Texas, an average of 3% cents a bharrel more has been paid so far this year. “The remarkable gain in produe- tion has been due mainly to the de- velopment of three major pools in the latter half of the year. These are Pan handle and Spindletop, in_Texas, and Seminole, In Oklahoma. Tow impor- tant they have been in effecting the change in the statistical position may be judged from the fact that they were doing only 70,000 barrels on July 1 and by Thanksgiving were produc- ing 867,000 barrels daily. “Even with this new top for produc- tion, it Is the expectation of the in- slon during the past year, in keeping |} in | some quarters over the present large | five | years, and that heretofors they huve | | u { which m: iness Enters New Year With Tremendous Momentum on Tide of Prosperity SLOWING DOWN LIKELY: FUNDAMENTALS SOUND Some Concern Expressed Over Huge Volume of Securities Owned by Banks and Farmer ? Plight. reduced 15 00,000 barrs: yoar will 1 ‘YY R0, this Some concern s expressed over the | nd its pos- | inflatea | forelgn manuf: 1 at o ma v mark [Avages, w | manufact: clency and econor not mere makes envi th rers, reasor pr reall n & pro prod: as we wa must | sive scal thers is no evidence of borrowing to | desirable. | ived on & mc t be grea al pre to ou 1o ¥ nd _succes torles. Waste in mar mintmized on the farm try. These things can and will ba done the co-operation of 1} t industries, farmers, bankers reet men and greatest and with inte f of humanity and with faith inother nothing is beyond the pow of achievement. RY ADOLPH ZUKOR. President, Famo ers Lasky Corp This count | of large gent effort an than ever before. e reason for thls, to my mind, > in the mental attitude of and individuals ing the war and in have followed t through a pe: activity. aking money o pace. < two years, however, particularly in the year now ending, ve been banding our re- e more con- not only to ' comm 1 enterpi s also tru most of our citizens |in the handiing of their priv | fair: g more, when they spend money they do so more Intelligently; they demand greater value in return. Business 1 even sounder s applies mmitments eve. In other words, |ing fts position with the the ng on to the gains it has this argues well for continued prosperitv of the countr " T think, will ses us all on better foundation than ever before. BY ARNOLD B. SLOAN, JR. President of the General Motors Corp. “There {8 more reason to expect | 1927 Wil be another good vear for o automobile {ndustry—perhaps n %o good as 1926, but a satisfactor vear. Tt must ba borne in mind that 1928 has exceeded any pravious year n the volume of automobile produc nd sales at dome: demand ha | 4 500,01 ks and busses were pre n the Uniteg St 1 Cs some 6 7 | | | been abou wera | one. of mately four Aht) a vear. It n > i3 to expect that it it does product “It must volume of Dbusiness is that the ov expanding from the: toward he rep il seas ( nd is steac d additional velw o sources in 1927 will go far v reduction this coun ed. e uncerta ol general offsetting “Althoug whnt the the fundamental present s conditions r ve the availabla supply and interest rates there ha sn 1o price infl ventories have not heen pliing up; the efficient operation the rafiroads it delivery of the mate- hed products possible; gricultural purcha power, while perhaps somewhat less than a ago (primarily because of the decline in the price of cotton), is, on the whole, good, and the present volume of in a rial employ rnt and the current level of wa promise the cont uance, at least over near future of a satisfactc m sing pow from this source. T building st uation, because of the high level ¢ activity in this industry, holds an ele ment of uncertainty, and the possi- bility of a decr @ in building opera tions must be reco It is not uniikely, however, t any shane drastic reduction of building will o cur next year, dustry that stocks of crude and products on hand at the close of this “In _view of the foregoing. T thir (Continued on Nineteenth Page.)