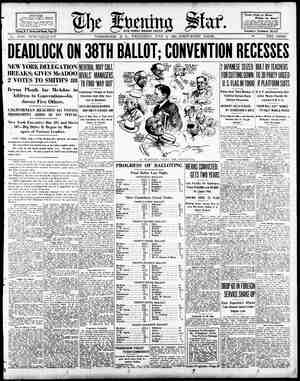

Evening Star Newspaper, July 2, 1924, Page 29

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

" LIBERAL ARRVALS ATCENTER ARSET Cantaloupes and Peaches in Best Demand—New Potato Prices Drop Off. Today's fruit-vegetable review by United States Department of AgFi- Iture Cantaioupes follows Supplies market tints mostly mostly few some liberal: de- Califor- 368 and Jumbos, Bas. and stand- jumbos, flats, mand good nia. salmon steady: standards 00; 50: pony flats, full ripe mostly 2.25, 2.50; L10a1.25 and 5%, pony 0 s, 100, Peaches in Good Demand. Peaches. ht; dema sood: market sstrong: North Carolina Greensbor Supplies | . large 23,00 medium s small & A230; Arps und Carmans, mostly 3.50 Potatoes— New stock: supplies mod- erate: market slightly weaker: North carolina, cloth-top stave barrels, Irish Cobblers. United States No. 1, mostly 4.00; Virginia. Norfolk section. cloth- top | stave barrels, Irish Cobblers, United States No. 1, 3.50a3.75; stock, no sales reported Tomato Market toes—Supplies market firm nd turning. wrapped, leaky, wide range in 0a1.00. South Carolina, sixes. wrapped ey, count choice count, mostly around rown, half-bushel Firm. moderate Miss de- fours, Noi T, prices. turning, 300 mostly 3 Watermelons demand moderatd Florida, bulk, per Watsons n 85.00; 2426 1b. average, Cucumbers—supplies i maderate; market_steady Norfolk tion. 7-bushel hotbed stock, fancy. 2.50a3.00 1.5022.00 Today's Prices on Corn. Supplics moderate: demand market crates. 1 beans—Supplies homegrown: demand crate; market steady. uncovered slat barrels. Peas —Homegrown supplies demand moderate market Homegrown, uncovered slat 7.00210.00. Raspberries—Homesrown moderate: demand slightly stronger. crates. red varieties, 5.00a8.00 Cabbage Homegrown supplies liberal: Norfolk hoat receipts light; demand light: market weak. Home- | srown, uncovered slat barrels, T 1.25; mostly 1.00. Norfolk section no early saies melons, Tom rage, 80.00a ).00a60.00. nt: demand 100 hampe choice 2 Corn moderat Carolina String moderate ™ mod- 5.00. i light; firm barr supplies moderate; market Homegrown. 32-qt REDUCTION IN RENTS REPGRTED IN BOSTON| Prices for Apartments Being Cut $2 and $3 Per Month From Previous Levels. Bpecial Dispatch to The Star. BOSTON, July 2.—One emplovers labor in who has canvassed the i of the largest this district Boston terri- n apartments renting from $35 to $45 a month heing shyded two or three dollars a month level reports that rents are from previous DENVER. July and managers heen advised 2. —Building owners of this section have by some building e perts that a slight decline in build- ing activity and building costs is to be expected in the next few months. DETROIT, July 2.—Construction projects for which permits were is- sued in the last week here demanded | expenditure of $5,380.658 as compared with $2.834.702 for the preceding week | and 90.959 for the corresponding | weck of last year _ A Fool and His Money. The fact that a stock certificate 13 | printed in fancy green scroll work s | no proof that it is worth any more | than ordinary wallpaper. Thousands | of people in Washington would have | saved their money if they simply had | sked their banker to tell them what he knew of some supposedly wonder- ful investment. WALL STREET BRIEFS. TUtility Industry Faces Great Pros- perity—Dividend Voted. NEW YORK. July 2—Unbroken Mprosperity in the utility industry and »a favorable basis upon which to con- tinue expansion to meet the demand for larger facilities is shown in a survey of the reports of leading com- panies. Few of them show an in- ability to make gross and net income keep pace with their growing invest- while many earn enough on additional capital to increase the | equity for junior securities at a rapid rate American Light and Traction Com- pany declared a stock dividend of 1 per cent in common stock and the regular quarterly cash d dend on the common and preferred, all payable August 1 to stock of re ord July 11. Indiana Refining Company reports net profit of $121,782 for the first quarter of 1924, against a deficit of $161,025 a year azo. equal to $5.09 on the preferred after deducting the Central Refining preferred dividend. A t was reported for 1 of 7, against a deficit of $629,104 $1 of | i | | ————— CHERRIES FLOOD MARKET. | Strawberry Prices Decline Today in New York Quotations. &pecial Dispatch to The Star. NEW YORK, July 2.—Cherries were more plentiful on the New York mar- ket today. Fruit of large size and fancy quality met a moderate de- mand, but ordinary and small cher- ries sold yery slowly. The market in genera; was barely steady. Four- quart baskets. depending upon size and quality of stock, realized the | following pri : Sweet varieties. White, 50 to red, 75 to 1.00; bl §5 to 1.15. Red sours, from 40 to 75. Strawberries snowed a further de- sline_on liberal arrivals, selling at 7 to 37 per quart. e . EXPORTS ON INCREASE. tmports, However, Show Decline at Port of Baltimore. Bpecial Dispatch to The Star. ck, sippi. | baskets, | Is. | Received by Private Wire BY WILLIAM F. HE NEW YORK, July One | outstanding features in the cu ket dealings today was th ‘lh‘lllnhll Hudson and { Issues, und for the holding campany. Hudson Company, preferred of these stocks reflected the change [ for the better in the curnings position | of Hudson and Manhattan. All three issues sold at the highest prices of the year. Oil shares were taken up for a time, the active leaders advancing a half point to a point. Gains in the high- | priced Standard issues extended to 4 puints, with Solar Refining the leader RNAN. of the b mar- Buying NEW YORK, July 2 an ofticial list of bonds traded in on the New Market today: ollowing is and stocks York Curb BONDS. Low. Close. Allied 1 Alhied 44 Am Gas & 15 Am Tee O Anucondu s Anglo Am_Oil Asso Sim Hdwe Packers o Packers 8< 13 Both S 3 Ca | Bie | 8wt 1 Cous Gan It 1 Conn Textid 11 Cudaby Jeere & Asphalt neral | Pet | aud Trank 6 | it il {1 Hood 100 10 Ka [ i I 1 1 1 ¥ « 1063, 10014 Leh Val 1 Libby MeN 2 Munitoba 62 Mo P'ac Cop R 3s Wi & L Tower Ry 5% wi 11 Noril w 6 21 Nor St Po M6 Pen Lower & a2 il Eloe 6x 106 Phile Blee Bigel ] 108 Phila ¥ 10 Al 101% c 1017 NN AR Vil Co_6ls Shawsheen 7 Homegrown, | 2 Sun_ Oil 6y & Swift & Co Tidal Oxa UnE 1L Un Ky of Hav Vir liy A wi T Web Mills Glax wil 10 FOREIGN BONDS 1 Czechosiosak S I &P 5 1001s T S S0l & Co G 5 L Nwiss Govt 70 Anglo A 0 Buckeye esel Mg new wi ) Bureka P L Hum_ 0l & 0P L 100 lmp Ol of Can Intl Pet Co Lul Pet ) Northern I* 300 Obio 01 new 60 Prairie 0l & G S, 15 L Washington Stock Exchange. SALES GxSLO00 at 8715 $300 Potomac Tel. Bs- SLOOO at £00 at 102750 & S10.000 a1 g9 S0 at 99, $1.000 000 nt 99, 10000 at Tracti 10 at apital 021 Washington Rwy. & Eiee. eom.—10 &t 10 at 35, Riges Lans 10 at National M 83, 50 at 8 AFTER CALL. Washinzton Rwy. & Elee. 4 $1.000 at Mergenthaler Linotype—3 at 1360, Washington Gas s B S100 at 101t Capital | Traction S0 at O, at s Washingt $1.000 at $17000 at [ Money—Call loans—5 and b per cent. ' Bid and Asked Prices. BONDS. PUBLIO UTILITY. 10 at at Bank 10 National Moot spe & Inv. prd.—10 at &% & . $1.000 American Tel. & Telga. 43 . Amorican Tel. & Telga, dlas o . Am. Tel. & Tel. ctl._tr. 3s. Am. Tel. & Tel. conv. fs Anacostia & Potomac' 5 Abacostia & Potomac gu CUC P, Telephone 5s. C. & P! Telephooe of Capital Traction It R. City & Suburban s Georgetown Gas 1st 5 Metrapolitan R. K. 5 Potomac Elee. Potom Patomac Potomac_Elec Tiee. Pow. £ m n. Alex. & Mt. Ver. s. Wash.. Alex. & Mt. Ver. etf. wash., Balt & Anoap. s Washingion ¢ Washiogton ¢ Rws 5 MISCELLANE! D. C. Paper Mfg. Co...... Riggs Realty 0s (lon) Riggs Realty 58 (short).. Southern BIdg. 6las. . Wash. Mkt. Cold Storage 5s. Wardman Park Hotel. STOCKS. PUBLIC TTILITY. American Tel, Tts... American Tel. & Telgu.. ... Capital Traction.. Washington _Gas. Norfolk & Wash. Wash. Rws. & E Wash, R Terminal Taxi com. Wash, Capital Colnmbia - Commereial District ... Farmers ‘& Mechanics’ Federal-American Liverty - oln 111l National ‘Metrop Rigge - Second tiona American Security & Trust Continental Trust Merchants' Bank. tional Savings & nited States. Washington Mechasics’ ¥IRE INSURANCE. American Corcoran i’ BALTIMORE, July 2.—Collector Holtzman's report of the business of the port for the week ended June 28 shows an increase in_the value in ex- yorts and a marked drop in the value ©of imports, compared with the week ended_June 21. Exports were valued at $1,715,835_ an increase of $939,9 Imports totaled $1,268,386, a decrease of $1,169,013. Articles imported free of duty were valued at $885,039, and dutable, $383,347. Customs collections from imports for June totaled 3585,214.07, against $890,13115 for the = corresponding month of 1933, o Tnion % TITLE INSURANCE. bia Title.. ST Betate Titie. MISCELLANEOUS. . C. Paper pfd Dievihants. Branter & Siorage. Mergenthaler Linotype National 81 Manhattan | NEW YORK CURB MARKET Direct to The Star Office National attract priced Tea, new, continued to attention among_the high- speciultios, getting=to . new at Omnibus Corporation i ed and voting trust certificates prexenting the common stock were admitted to trading The new or- | ganization is a holding company for the KFifth Avenue Bus (orporation. | Arter cpening at 86%, the preferred ran up to 8 and the certificates | changed hands between 18% and 19. | Radio stocks maintained their place of prominence under the lead of Dubilier, which established another | new high record. Ware Radio wus | ravo d in the buying, getting up to 161 The new Rova was not disposed o advance, but held firm just above the price at which it was offered for public subscription. | otin outh Penn iern B S0 In 80 8 0 K S 0 Kent 0 Neb 0N Y 8 0 Onio Vacuun Washington ! s new Ol new 0il NDENT 011 STH Boston Carib Citiey Citie Wyom yud ot o0 Serv serip te Nynd 01" vat oi Ol Nutural Omar Oil & Gas Peer Oil Corp. . Benver 01l Pennock Oil Red Bank Oif Rov Can 0 & Salt Ck Prod Sunstar Oil Osage 01 Wilcox Ol & Gas Woodley It Y ol INDUSTRIALS Adirondack Power. 41y Amal _Leuther Am Cyoum Am oG Tow & Co & Co rte Tob con Coow i Ir Pipe Auto Pow'r Tord Rrit-An Candy P'r Centrifugal i Tob 1 3 Ed R nw: 104 Die € Cwi 19% & Radio 407y Toe. 26 Contin Detroit Doelil bubilier ¢ Duuhill Intl Durant Mot Du Pont Motors 233 “Telegraph. Grand St wi Corp w1 0 Chem Hudson & Man KR Teh Lehizh MeCrory AleCrory Mixs F Nat o Ny Val ( st Storis ver Pow Tea Co I Co pfd Omnibus Corp v 1 ¢ 4 Omni Corn & pf wi Radio Co-p Rova Rudio tr kieul Nilk Hos o Mot it Rova Radio tr cf Sierra Pac B 5GP new vt wi 0 C & 1 new Standard Motor Stutx Motor Swift Tatl Tean ¥ Toba e Tiox i : 3t o ro 24 pf Prod Export UnitedBakeries Tuit Bak Tuited G & Uni Gax Uni Retail Un Ret « &P il E new k ‘Cor pla Radio wi.. w Power axi Corp N ¥ MINING. Alvarado Min Arizonn Globe Cop B ak Gold Mines Canario Copper Cone Cop’ Miin Corter silver tack Butte Develop. . Ware West Yol ons .. Cop Corp <on Val 30 Nevada Ophir 3 Nipissing_ . NY & Hond Ohio Copper .. Piymouth Lead Premier Rocky M ~»a® - * 3--n2 o Alliance Realts Ateh, T & 8 F Atlantie Iltef pf. Fajurdo Sugar. . fth AT Bus Sed Fisher Body..... Gen. Developm't, Goodsear T&R pf Holley Sugar Pow pf ER &L pf.. NN&HRGB.. N Y Transp Peon Traftic. ... PS NI $100 par. Do. 1o par.... Do. pf. 8 Aug. 1 Reynolds Spring. Q Aug. 1 e e COAL PRICES ADVANCED. Big Companies Add 10 Cents Per Ton to Anthracite at Mines. NEW YORK, July 2.—Several large anthracite companies, among them Reading, Lehigh Valley, Delaware, %xc%(aw:n,l:‘sfland Western, Lehigh ‘oal and Navigation and Lehigh and Wilkes-Barre, ~ have advanced the price of domestic sizes of anthracite larger than pea 10 cents a ton at the mines. Aug. 15 July 31 Aug. 1 July 15 Aug. 1 Avg. 1 Aug. 1 Icoeo|cocceocto & —_— CHICAGO LIVE STOCK MARKET CHICAGO, July 2 (Urited States Department of Agriculturs).—Hogs— Receipts, 36,000 head: slow; mostly 10 lower; heavy butchers, 7.10a7.2 medium weight, 6.85a7.05; packing sows, 6.10a6.40; pigs, 5.50a6.75. Cattle—Receipts, 10,000 head; strong to 15 higher; top steers, 11.10; year- lllnnzxs!v ::1.:‘5!. veln.ler',' %g higher, 10.00a .25; light calve .00; feeders, 5,5037.25.“ Meckersiand Sheep — Receipts, 15,000 head: tive: bulk fat nuv.s' lambe, 13508 ;:3“ few, u.nn:lnofi to cholce fed ngs, avcraging unds, 12.00; Texas wethers, 8. -po . $57,400,000 IN MERGER. NEW YORK, July 2.—Acquisition of the El Paso and Southwestern rail- road, now being sought by the South- ern Pacific Company, wiil cost the latter $57,400,000, for - which pyament will be made in securities, according to detafls of the agreement flled with the Interstate Commerce Commission. The Southern Pacific proposes to give 280,000 shares of common stock of $100 par value and $29,400,000 b per cent bonds in exchange of securities of all the El Paso of sub- sidiaries, | = ELECTRICITY GAINS RAPIDLY IN FAVOR Superpower Plants Meeting Demands of Industry. Acute Shortage. BY J. C. ROY Special Dispatch o The Star. NEW YORK, July 2.—Daylight sav- ing time, which has been bitterly and successtully opposed by the farmers of California for the last two years, probably will be placed in effect there within the next week. It is expected this will be accomplished by special orders of the governor and the state railroad commission. The expectation of such orders is based on the acute shortage of electric power throughout the state, caused by low water in the streams. The state has been in the &rip of a severe drought which hax prevailed almost without a break since last September. The output of hundreds of factories and industrial plants has baen cur- tailed by this shortage of power and some municipalities have been put on 1ght rations.” Three-hour use of the current for lighting purposes is the limit allowed in some cities. Steam- generated electrical plants are in a minority in California and in late vears electric current has become widely popular for domestic cooking and heating purposes. Use of Power Reduced. 1 use of power in southern Cali- fornia has been cut about 25 per cent in the industries, and as a re- sult several hundred ‘oil companies now engaged in drilling operations have placed orders for gasoline en- Eines (o supplement the clectric cur- rent supply. Some drillers have made plans to install as many as fifteen " of these auxillaries. This tendency, it is felt, will increase the use of “gasoline and distillate and ease the oil situation in the state now burdened with heavy stocks in storage. A “somewhat similar situation existed last summer in the industrial plants along the Atlantic seaboard As a result, adjustments have been made which probably will prevent a recurrence of the shortage even in years when the rain and snow falls have been light. This has been as- complished largely by remarkable de- velopments in super-power lines and arrangements for the interchange of current .in_various sections be- tween coal-burning power plants and hydro-electric stations. Power Demands The building of new is proceeding at an forced by the enormous increase in demand for lighting as well as in- dustrial purposes. The reduced prices for electric light bulbs has now been placed in effect by the larger manu- facturers. Engineers in commenting on the reduction declare that it has been made possible by quantity out- put rather than any drop in manu- facturing or labor costs The sale of the lighting equipment produced in thix country in the las vear Increased 136 per cent, and the improvement has continued in late months without a check. The valup of the bulbs alone totaled $53.681,479 avy. power unusual plants rate, MIDYEAR TRADE BANKERS FAILED Abrupt Slump in Industry BY STUART P. WEST. Special Dispatch te The Star. NEW YORK. July 2.—The thing which stands out most strikingly in the markets of the mid-year is the failure of most of the prophecies which were made at the beginning o’ 1924, These ranged from moderate to quite extreme optimism. It is hard to recall a single instance where a business leader or a banker, speak- ing of \the future, foresaw ths really severe downward turn in industry Which set in toward the end of March, In the same way few looked for such a drop in Wall street prices as oc- curred between the close of January and the early part of May. Thesz recollections are of intercst in that they show why it is that, hav- ing been wrong in the past, business and financial representatives are cau- tious about what they say of the fu- ture. Opinion went wrong at the start of the year, first because it made the political outlook altogether. tos clear, and, second, because it greatly underestimated the forward demands for manufactured goods. The stecl mills, the automobile makers and other of the leading industrial pro- ducers extended their operations too far. They found that they were ac- cumulating surplus supplies at an un- pleasant rate, and had to cut down operations abruptly. The decrease in little more than two months from 40 per cent to 45 per cent at the steel mills has been one of the sharpast in a similar period ever known. It was not only a case of over-pro- duction in certain lines. In others. particularly in the textile industries. causes for depression were found in the inability of the manufacturers to raise their own prices enough to effect the raise in costs of labor and raw materials. The cotton goods (rade in New England has perhaps never been through ' worse experiene. Even now, only 20 per cent of its productive capacity is employed and there s no prospects of any pick-up, certainly until the sutumn. i Commodity Decline Checked. The general average of commodity prices went down continuously from the middle of Mgy to the middle of June. in a number of cases quota- tions were brought back to a pre-war basis. Inasmuch as production cosls are far above what they were in 1913, this means that in certain industri operations are being conducted at a loss. A situation like this can never ntinue for long, because it is eco- nomically impossible. It was not sur- prising. therefore, o note in the lat- ter half of June, indications that the price decline had run its course. The low commereial price level has to be emphasized because it consti- tutes one of the ‘essential points of difference between the present situa- tion and that of four years ago. The second point of difference is that pro- duction in most lines has been se- | verely cut down so as to meet a con- | sumptive demand based upon only the NoSt necessary and immediate re- |Quirements. Along with this, money | |rates are lower than they have been in 1 and the number turned out thi er. Farm electrification has marked strides in the middle west, and experimental rural lines now have been established in about ten states Power Experiments Made. On the Red Wing, Minn., agricultural test line costs have been figured down to a point where the farmers on the line pay a service charge of $6.90 a month and regular meter rates for power con- sumed Power for the experiment is being furnished free by the Northern States Power Company, which for a time will utilize the current generated at the new plant of the Ford Motor Company at high dam outside St. Paul. The waters of the Miesissippi were turned into the turbines of the plant for the first time this week, and the Northern States Company will purchase the power developed until it is needed by the Ford Company, which expects to have the factors in operation by January 1, 1925 The great difficulty in the transmission of electric current to the farms, accord- ing to William A. Baehr. general man- ager of the lllinois Power and Light Corporation, lies in the fact that it is too expensive to tap big power lines carrving from 6.600 to 200,000 volts and reduce the voltage to where the current can be utilized for the farms. “The only feasible plan evident so far.” he said, “seems to be in the building of low-voltage lines to the farms extending from a transformer gubstation in some nearby town.” FEWER NEW CONCERNS. Shows Smallest Monthly'| Total Since Last August. NEW YORK, July 2.—Available re- turns indicate that 482 new enter- prises with autborized capital of $100,000 or more were organized in the United States in June, involving $455.022,400, according to the Journal of Commerce. This is the smallest monthly total since August, 1923, When 251 new concerns took out charters representing capital of $33,- 462,000 Since the first of the year 4250 new companies have been chartered with authorized capital of $3.852,463,300. EVERYMAN’S INVESTMENTS By George T. Hughes June Thirty-Eighth Article—Par Value, One of the unimportant things about a stock is its par value. Time and again I have received inquiries as to the advisability of investing in this or that low-priced stock, the writer appearing to believe that be- cause the selling price is below the par value the shares are therefore cheap. Now par value has nothing whatever to do with investment merit. Some stocks sell at two ot three times their par value and others sell at a mere fraction of their par value. As a matter of fact par value is mean- ingless. It only serves to confuse in- experienced investors. It you own ten shares of stock in a corporation which has 100 shares outstanding you own one-tenth of the business and this tenth is no larger if the par value is $100 than it is if the par value is $1. You are a partner in the company, not a cred- itor. In the event of liquidation you will receive your share of the assets, but the par value of the stock has ng whatever to do with it. In “mt'yun it has come to be the practice in those states where the law 2lows it _to issue shares of no par value, just avoiding all this misunder- standing in the minds of investors. Then it is plain that the holder of common stock owns the equity in the Pusiness and pothing more. '‘Occasionally, even a preferred stock is issued witheut par value and the dividend is expressed in dollars and not in per cent. In that case it is usual to fix a certain sum, say $100, as the liquidating price of the prefer- red, the ce, if any, going to the mmon. w’l‘hfl ‘moral to l:} this is to pay n: attention to par value as an argumen for or against the purchase of any particular stock. it, 1804, by the Consslidated Press }m 7 . year is expected to be far great- | taken | |in seven years, and the credit supply | ix the most abundant in our financial ory. All these are features which represent the antithesis of conditions {making for prolonged depression. They are a picture, on the contrary, |of deflation at a rather extreme | stage. | Investment Values Leap Forward. | Very low money rates are never a | prime case of business improvement | They can be of material assistance only where the relation of production to consumption is right. The experi {ence of the last two years has shown | forcibly also that cheap money does not of itself stimulate speculation The principal effect of the cutting of the federal rediscount rates to what may be regarded as the lowest since the formation of the federal reserve £ystem, and the extraordinary piling up of surplus funds, has been felt in |the increase in investment values. | The rise in the better class of invest- ment bonds und investment stocks has been the feature of the last two months. It has seldom happened in the vear of a presidential election that much fresh initiative either in business or finance has occurred during the sum- mer. Everybody is waiting to see how the campaign develops, cspecially what are the chances for or against a radical change in policies at Washing- |ton. " The trade movement and the | markets are apt to wait until the autumn before attempting to discount the election results. Juropean Outlook Brighter. he European outlook at the end of the first six months of 1924 ap- pears distinctly brighter ‘than it did at the beginning. Foreign capital is pleased with the new French min- istry. It sees in it an abandonment of the extreme nationalism w h more than anything else stood in the way of the settlement of the repara- tions problem and the economic re- suscitation of Europe. The Dawes plan has been accepted on all sides, and with the change in the French government, there would appear to be no obstacle to an agreement being Invest Your ' Savinmgs First Mortgages “The Safest Security on Earth” 7 S e Denominations $100 to $10,000 JMORIS CALRITZ: Ca 1416 K Street N.W. Main 617 Northwest Residential and Business Property Only When Buying Our 7% First Mortgage Notes You Can Be Assured First.—A very careful and con- servative appraisal has been made: Secomnd.—Thoe lcan'we recommend is less than 50% of the market price. Third —After you have purchased one of our notes Yoy get a serv- ice that assures you interest the day due. Notes om hand in amousts of Chas. D. Sager REVIEW SHOWS IN PREDICTIONS and Crash in Money Rates Were Not Foreseen—Price Cuts Appear to Have Run Course. reached whereby it will be success- fully put into effect. The French franc was stabilized, but only after a severe object lesson had been given of the necessity of really balancing the budget through increase of taxes and postponing extraordinary expenditures until com- pensation means of revenue had been found. Britixk Pound Ix Puzzie. The failure of the British pound to make any progress on the road to recovery is one of the phenomena of the period which has been a sub- ject of much discussion. It can no longer be ascribed to the labor re- gime in politics, because British busi- ness has got used to this and has become convinced that no revolu- tionary measures stand a chance of getting through Parliament. It can- not be set down to uncertainty over the continental outlook because the British share in the moderate optim- ism felt on this matter in other parts of the world. The visible trade bal- ance is not running o heavily against the country that it is not more than offset by such invisible items as American tourist expenditures and ocean freight charges. Sterling Position Explained. The explanation for the poor rally- ing power of sterling is two-fold. First, there is the necessity of pro- viding over $150,000,000 each year on the service of the American war debt. Second, there is the very large British subscription to foreign gover: ment and foreign corporate loans. This is being done with the object of stimu- lating home trade, for in the case of many of these loans the government attaches its guarantee on condition: that the proceeds be spent upon Brit- ish products. (Copyright, 1924.) « BUYERS FAIL TO APPEAR. GRAND RAPIDS, Mich., July 2 (Special).—The first week of the Grand Rapids furniture sales found £33 buyers present, as compared with 1.458 last vear and 1,047 two vears ago. The low attendance is attributed to statements by local hotels that they were full and advising buyers to come later and to the fact that the Chicago sales begin July 7, per- mitting late arrivals to attend both —_—— Arnold Guaranteed Certificates ranteed Certificates e and profitable in for wurplux funds. They are wecured by first mortgages on improved income real estate and homes, and are a direct obligation of Arnold and Company. 1ssued in amounts of $100, $500 and $1,000, to run for term of 2 to 10 vears. ARNOLD AND COMPANY Incorporated. Capital and Surplus, $1,250,000, 1418 Eye Street N.W. Telephone Main 2434. First Mortgage Loans Lowest Ra of Interest and Commission. Prompt Action Thomas J. Fisher & Company, Inc. 735 15th Street INVESTMENT BONDS Our current list of se- lected issues includes offerings of well se- cured bonds at prices = f | To Yield From 6.00% to 6.90% We shall be pleased to send you a copy of this list upon request for W-483. E. H. Rollins & Sons | Founded 1876 416 Woodward Bldg., Washington | Boston, New York, Philadelphia, Chioago, Dewver, Sam Francisco Worth Double The Amount Of the Loan— Interest Rates Today 6% to 79— Denominations of $100 to $5,000— Partial Payments Received. SHANNON & LUCHY) INC. 713 and 715 14th St. N.W. 924 14th St nan 37 At a8 Main 2345. NANCIAL PARIS MARKET HEAVY. | PARIS. July wure 1& ree par Pri Y COMMODITY NEWS WIRED STAR FROM ENTIRE COUNTRY per cent loan framow was quoted at 19 frames LANCASTER, Pa., July 2 able weather the lust week has en- abled Pennsylvania growers to com- plete planting their tobacco. Many farmers are diversifying their crops 80 that no large acreage of any one crop demands attention at the same time. Thus disbursement for farm help are kept at a minimum. MINN July 2.—Officials of the Twin City Rapid Transit Com- pany are reported to be preparing to operate a fleet of motor busses in interurban traflic in competition with private bus lines. The dollar 43 centimes. EQUITABLE Co-Operative Building Association | Organized 1879, , Calif., July 2.—A survey | made here by the California Prune and Apricot Growers' Association estimates the world prune crop to be 40 per cent less than in 1923. Cali- fornia’'s production is placed at 185,- 000,000 pounds and Oregon's at 45,- 000,000 pounds, while it is believed Bosnia and Serbia will combine to produce 77,000,000 pounds, | CHICAGO, July State en(omol-j ogists from Missouri, lowa, Kansas, | Nebraska and Oklahoma report that whinch bugs are causing severe dam- | age in the wheat and other :l’lin’ crops and are advancing on corn sec- | tions. Destruction amounting to over $100,000,000 will be done to these crops in the midwest unless the ravages of the bug are checked. NEW ORLEANS, July 2.—The pro- duction of the Southern Pine Asso- ciation mills last week increased 7.2 per cent, orders gained 1.4 per cent and shipments 10.5 per cent. BEAN MARKET TUMBLES. DETROIT, July 2 (Special).—The Michigan bean market has lost most of the June zains in the last week, dropping 25 cents a hundred pounds, because of light demand and the sur- plus left over from plantin, The Is Right Now . The systematic saving plan of the | quitable leads to tie greatest fuan | 1 accomplishments. Join pow Subscription for the 87th Issue of Stock Being Received Shares, $2.50 Per Month EQUITABLE BUILDING 915 F ST. N.W. JOHN JOY EDSON. President FRANK P. REESIDE, Sec's. Money to Loan Secured by first deed of trust on real estate. Pievailing ioterest and ccmmission. 20 Wash. L. & Tras Joseph I Weller §3.7%% & § V¥ Property Owners APARTMENT HOUSE MANAGEMENT We believe Apartment House Management is a business in itself, and one that requires the experience of an organization that spe- cializes in this particular field of the real estate business. Over a period of 31 yvears we have special- ized in property management. and we offer our clients an improved service for the proper han- dling of rental property. We shall be glad to discuss this matter with vou in detail. B. F. SAUL CO. Specsalists in Apartmeni House Management Main 2100 1412 Eve St. NV Otilce ©23-925 15th St. N.W. (Opposite McPherson Sq.) Reasonable Rents Now Nearing Completion B. F. SAUL CO. 1412 Eye St. N.W. —————— “WE, THE UNDERSIGNED BANKS AND FINANCIAL INSTITU- TIONS, hereby agree to close our institu- tions for Saturday night business during the months of July. and August.” Lincoln National Bank Franklin National Bank Penna. Ave. at 10th Street Bank of Commerce and Savings Security Savings and Commercial Bank Standard National Bank 9th Street Office American Security and Trust Company Cantrall wnd Spulrpast Beache United States Savings Bank Seventh Street Savings Bank Riggs National Bank 7th and Eye Streets Office Mount Vernon Savings Bank