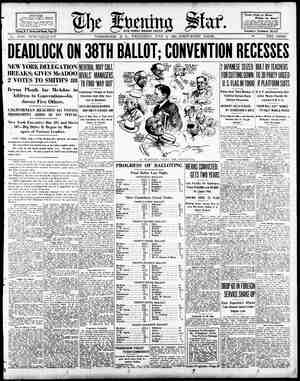

Evening Star Newspaper, July 2, 1924, Page 28

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

s, REALIZING SALES = HALT STOGK RSE el Common Freely Sup- fiplied in Afternoon—Many i Gains in Early Market. / BY STUART P. WEST. Special Dispatch to The Star. NEW YORK, July 2.—At the outset today, the market continued under (b twofold influence of the better feeling regarding the political out- 160k over business prospects. individual advapees outnumbered isdividual declines. But as the day went on, realizing sales were encoun- tered in sufficient volume to check the forward swing in the general list and to bring about a reaction. Steel Common Sold. Stecl common was freely supplied around 101. Bethlehem Steel after selling above 47 began to reflect the héaviness in the bonds and preferred stocks. The unexpected announce- ment that the Magnolia Petroleum had advanced quotations in the Texas fiwld 25 cents a barrel caused a moder- ate buying movement in the oil ks. Houston ran up over 2 points Royal Dutch over 1 point. Other ers of the group gained a halt point_or so. But this upturn did not last. It was followed by a setback in the assuring statements from Is of the company, there was further weakness in 'Daniel Boone Woolen. The market for Woolworth and other shares repre- senting retail enterprises continued to give evidence that bullish opera- tions had been overdone. Wilson & Co. stocks had a remarkable rise fol- lowing the reports that arrangements had been made with the creaitors to extend the notes. The street figured out that ¢ meant that Wilson would pull through. Pools Puxh Stocks Up. Pool activities kept on in other directions. Coiorado Fuel made a new high at 49. although this still remains the greatest mystery stock on_ the list. Allied Chemical reached a new for the year, but later reacted. The new Lorillard continued to push ahead as the result of the attention drawn to the disparity of its selling biice with that of Liggett and Myers. Allis Chalmers sold above 51 for the first time, reflecting the favorable earnings position. Again today, it was difficult to trace any connection between the market. movements and developments at the Democratic convention. Prices went -r on_the stock exchange during t half hour or so and later high top true that the reaction coin- cided with the announcement of the thirty-fourth ballot, showing a sud- den and vopsiderable accession to the McAdoo forces. Had Wall street at any time been afraid of McAdoo this might have been set down as the Teason for the check upon the for- ward swing. Midweek Steel Reports. The commodity markets, supposed- 1y governed almost nllogelherm\)y anging weather conditions, dis- S Taifterence to the weeKly re- ¢ of the weather bureau at Wash- aton. Corn prices made a new high and wheat went up despite the of- fictal statement that the winter wheat harvest was makirg progress and that the cool weather and rainfall in :s- northwest had been most favor- le for spring wheat. i B onr of - the record breaking shrinkage in May, pig iron output avcording to the Iron Age. fell off Sgother 20 per cent ir June. Taken fozether, the two months represent a falling off which in point of abrupt- ness and magnitude has never been equalied in our industrial history. There were, on the other ‘hand, one aF two reassuring hints in the weekly ade reviews. % he mormal period for shut- down of mills and reduced opera- tjons, consequently production is not expected to pick up in July, but mather to fall off still more. ' But Retter buying of steel has already Heen noted, and_the trade is looking for August to bring a definite turn. Wall Street Features. ! Stromberg’s recent advance, Carry- e Pl above Stewart-Warner, has indicated how the street feels about the latter's dividend outlook. Stromberg rays $8 annually, while much has been heard recently of the Prospects of a reduction in the rate af Stewart-Warner from the present 0. The opinion was expressed today t-Warner directors would e dividend to $8. AP ik Csfocks—notably Kayser and Mallinson—responded moderate- Jy to an advance in raw silk prices 2nd a better feeling in the trade. Double extra crack raw silk ~was duoted at $5.60 a pound against the Tecent low of $5, and $6 silk in the near future is predicted. CLOSING IS IRREGULAR. hat St Wilson and Kresge Strongest in Stock List in Last Hour. By the Associated Press. NEW YORK. July 2.—Profit-taking and short seiling interrupted, but failed to check, the upward movement of prices in today's stock market. Wilson issues made brisk_recovery from recent weakness Sales ap- 5 shares. nr;‘,r{-‘emfill:gmg s irregular. While many speculative favorites continued to lose ground. marked buoyancy was shown by Wilson Packing com- mon and preferred, and S. S. Kresge, up 5 to 12 points. Markets at a Glance irregular. exchanges tocks Foreign weak. NEW YORK Bonds firm. - steady. Cotton Sugar quiet. Coffee firm. CHICAGO.—Wheat steady. Corn ir- regular. Cattle strong. Hogs easier. FOREIGN EXCHANGE. (Quotations furnished by W. B. Hibbs & Co.) Nominal Belling gold valve. checks today. London. pound Montreal, dollar . Paris, franc Brussels, fra ‘mark. trillion. 131ty 2779 Madrid, peseta Vienns Budape: Pragye, crown Warsaw, mark en, cro 5 8, Stockholm,” crown By the Assoclated Press. NEW YORK, July 2.—Foreign ex- changes, firm quotations (in United States dollars): Great Britain, de- mand, 4.33; cables, 4.33%: sixty-day bills on banks, 4.30%. France, de- mand, .0518; cables, .0519. Italy, de- mand, .0430%; sabies, .0430%. " Bel- gium, demand, .0455; cables, .0456, Germany, demand (per trillion), .23%. Hplland, demand, .3762. Norway, de- mand, .1342. Sweden, demand, .2653. Denmark, demand, .1590. Switzerland, demand, .1781. Spain, demand, .1319, Greece, demand, .0173. Poland, de- mand, 0019 5-16. Czechoslovakia, demand, .0294. Jugoslavia, demand, .0119. Austria. demand, .000014. Ru- mania, ~ demand, .0041%. Argentina, demand, .3262. Brazll, demand, .1080. Tokio, demand, .42. Montreal. .95 31-32, RATES ON BAR SILVER. LONDON, July 2.—Bar er 34%d per ounce. Money 1% per cent. Dis- count Yates short, 3a3ly per cent. Three months. 3%a3 7-16 per cent. July 2—Bar silver 66'%. Mexican doilars 50%. i FINANCIAL, NEW YORK STOCK EXCHANGE Received by Private Wire Direct to The Star Office Adams Exp (8).. Adv. Rumley... Adv Kum pr (3). Air Reduct 14) Ajax Rubber. ... AlasGold Mines Allied Chem (41, Ailis-Chalm (4).. AmAgriChem pt Am Beet Sug (4) Am Bosch. Am Can (16). Am Car & Fy2). Am Chicle. ... Am Drug Synd Am Express (g). Am & F P 25%(7) Am For P £ pd(7) Am Hide & L pf. Am Ice (7. Am Tnternati. Am Linseed. Am Locomo(6). Am Radiator (4) Am Saf R (56c). Am Ship & Com. Am Sm & Re (5) AmS & Rpf (7Y Am Snuff pf (6). Am Stl Fdys (3 Am Sugar..... Am Sugar pf (7). Am Sumat Tob. . AmT& Ta (9). AmTel & Tel rts. Am Tobac (12).. Am TobB (12).. Am Water Wks AmW W pf (6). Am Woolen (7). Am Zine. . Am Zine pf. Anacorda. . Arn Cons & Co Arso Dry G (5). As DG 1st pf (6). Asso Ol (1%) ., AtT&SFe (6). AT&SF ot (5). Atl Coast .. (18). AtGulf & WI.. At Gulf & W I pt Atlan Ref (4)... Atlan Ref pf (7) Austin-Nichols. Rald Loco (7) Bald Loc ptf (7) Ral & Ohio (5).. Rai & Oh pf (4). Bk of Com (116) Barnsdall A. Barnsdall B B'ch Nut (2.40) Beth Steel (5) Br & Edison (8) Brk-Man Tran. . BrklynUnG (4) Burns Br (10). Burns Br B (2 Burns Br pf (7). Butterick Co..... Caddo Cen O & R. Cal Packing (6).. Cal Pet (1%) Cal Pet pf (7) Callahan Z Lead. Can Pacific (10). Cent Leather Co. Cent Lea Co pf. Cer de Pas C (4). Chand Mot (6).. Ches & Ohio (4) Chicago & Alton Chic & Alton pt. Ch & East Ill pt. . Chic Gt West. Chic Gt West pf. Ch Mil & St Paul. Ch Mil & St. P pf. Chi & Nwn (4) Ch Pneu T (5) ChicR1& Pac. CRI&P pf (6) CRI1&PDL (7). Chi Yellow C (4). Chile Cop (2%). Chino Copper. Coca-Cola (1) -.. Colo Fuel & Iron. Colo Southern. ... Col G & E (2.60).. Col Carbon (4) .. Com Ir Tr (63c).. om Solv A (4)... Com Solv B. Congoleum (3) Coneol Cigar. . ¢on Cigars pf(7) Consol Gas (5) Consol Textile Cont Can (4).... Cont Motors (20c) Corn Products. Cosden Co. . Crucibie Stl (4) . Cub Am Sug (3) Cuban Cane Sug. Cub Cane Su pt.. Cub Dom Sugar... Cuyamel Fr (4).. Dan! Boone M (3} Davidson Chem. . D're & Co pf (3) Del & Hud (9) Del L& W (6) Det Ed Co (8)... Dome Mines (2).. Doug-Pectin (1) . DuPtdeN (8)... Du P de N db (6) Dugq Lt st pf (7). Eastman (16%). Eaton AX (1.60). End-Jobn (5) . Erie..... Erje1st pf.... Erie 2d pf. B Exch Buffet (2).. Famuus Pl (8)... Famous Pl pf (8). Fed Lt & Trac FaM&Spt (D). Fifth Av B (64¢). Fisher Bdy (10). Fisk Rubpf A... Fleishman (3) Foundation (6).. Preeport-Texas.. Gen Asphalt. Gen Cigar (8)... General Elec (8) Gen El spe (60c). Gen Mot (1.20) Gen Mot db (6).. Gen Mot db (7) Gen Petm (2). Gen Retr (4) Goodyear pf..... G'dyear pr pf (8). Granby Consol Gray & Davis Gt North pf (5). Gr Nor Ore (3) 6rt Wstn Su (8). Gt West Spf (7). Gr Canan Cop. Guantan Sumar Gulf Mo & Nor..... Gu Mo & N pf (5) Gult St Stl (5)... Hanna 1st pf (7). Hartman Co (4). Hayes Wh'l (3).. Homestake( 7).. Househ'd Pr (3). Houston Ofl. Hud Mot C (3)... Hupp Mot C (1)... Tilinois Cent (7. Indep Ol (1) Indiahoma Ref. Indian Motorcyc. Indian Refining. . R (128).. Inland St (2%). Inspiretion Cop.« Interb Rap Tr... Int Bus Ma (8) Int Cement (43 Int Com Eng (2). Inter Har pt (7). Int Mer Marine. . Int Mer Mar pf. Internat Nickel. . Inter Nick pf (6) . Internat Paper. Int Pap pfst (6). Int Shoe (4)..... It T&T (6).... Intertype (M%) . Invineible Oil. ... . 1ron Products (6) Tones & Lau (7). hun City South. . Kayser Jul & Co. Kelly Spr Tire. .. Open. High. 824 834 9% 9% 35% 854 9% 9% 6% 6% ® W 4% 75% 5(% Bl 25w :5% 41% 4l 31%' 81% 114% 116% 165 168 204 21% 4% 4% 109% 109% 95% 95% 96% 964 66% 66% ‘90 90 28 23% 16% 16% 74w 16 108% 108% A 64 12% 12% A% 65% 100% 101 98 98 86 36% 45 45w 87% 87 91y 10% 121% 122% 3% 3% 146 147 142% 142% #5% 91k 89 914 3% 3% % TR 2% 2T% 31 31 10 10 98% 99 85% 85% 204 29% 103% 105% 90% 90% 121% 1224 18% 19% 25% 264 94 94% 13 113 22% 22% 115% 116% 115% 115% 68% 8% £9% 59 321 826 214 214 15% 15% 52% 52% 47 aTh 1125 112% 22% 22% 67% 68 108% 108% 25 98 18 1% £4% 23% 234 96% 96% 3% 3% 147% 148 2% 12% 45% 45% 4% 4T 47 4% 83 83% 4% 4% 10% 10% 44 44 5% 5% 164 16% 14 14 24% 24% b56% 56% 86 86 29% 30% 2% 2% 84% B4% 49% 49% 28% 28% 18% 18% 8% T4 4T%- 49% 35 85 39% 40% 46 46 3 85 56 66 48% 48% 41 444 15% 16% 66 69 68% 63% 3 3% 63 63% 6% 6y 35% 5% 281 29% 55 5 30% 8b% 4% 14% 62 62% 4% 4% 58% b58% 20% 20% 48% 484 62 624 . 117% 117% 124 124 Low. Close. 824 9% 854 8% % % 8% 50% 26% 41 30 114 185 200 4% 108 95% 6% 65 90 22% 164 T4% 106 6% 124% 64% 100% 98 35% 4% 8% 916 121% 3% 146 142% 85% 9 2t T4 274 30% 10 98 86% 29% 103% 0% 120% 18% 25% 92% 113 224 114% 115% T4 59% 321 20% 15 52% 45% 11% 22 67% 108% 25 98" 18 1% 84% 224 6% 8% 4% 12% 44 46% 46% 2% ah 10% 44 5% 15% 13% 23% 6 86 29% 1% 84 49% 28% 18% 3% 4ATH 85 89% 45 35 ~b6 48 41 15% 66 68% 3 52% 6% 344 27% b4% 30% 14% 61% % B7% 17 46% 62 117% 124 103% 103% “103% 16% 16% 10% 10% 124 125 89% 89% 106 105 107% 108% 12% 12% 61 61 28% 284 364 6% 32 32% 18% 19% % 1% 96k 96% 5% 5% 4T% 48% 1% 11% 186 186 40% 40% 56 66 n Y 8% 8% 42% 42% 88% 881 237 288% 1% 11% 18% 13% 82% 82% 94% 94% 41% 41% 36 36 % 4% 93% 93% 14% 4% 5 5 60% €0% 27% 27% 87% 87% 107% 107% 12 12 6% 6% 18% 18% € 68 1 % 8 89 3T% 3% 85% 86% 3% 37% 83 33 1% 78 \23% 23% 12% 12% 106% 106% % 8 % % 1% 17% 6% 6% 212 220 34 34 2¢ 24 26% 28% 96% 97 . ey 28% 108% 108% 8% 9 86 36% 15% 1% 83% 83% 48% 49% 72 12 76 764 MR T 29 29 12% ‘124 “w o« 110% 110% 19% 19% 24 214 12% 12% 40% 41 1% 1% 66 67% 16% 104 1225 89% 105 107% 12% 61 28 36% 82 18% 6% 96% 6% 4T% 11% 186 40% 55% 7 8% 42 88% 236% 11% 13% 82% 94% a1 36 ATH% 3% 4% 5 60% 27% 87% 107 12 6% 17% 67% 0% 89 3% 34% 87% 33 1% 28% 12 106% % 6% 212 34 28% 264 96% 3 23% 108% 8% 35% 16% 83% AT 2 76 6% 29 82% 9% 35% 8% 6% # 73% 51 25% 41 30 114 165 21% 4% 108 95% 96 55 20 28 164 74% 106 6% 12% 654 101 98 85% 44y 87% 10% 122% 3% 14° 142% 90 91% 2% % 27% 30% 10 98 85% 29% 103% 90% 1224 19 26% 92% 113 224 114% 115% 58 59% 326 21 15% 52% 4514 111% 22% 6% 108% 25 98 18 1% 22% 26% 3% 48 186 un 8% 42 88% 2364 1% 18% €23 4% 41 36 4% 8% 4% 13 60% 27% 8744 107 12 6% 17% 6% 0% 88 3% 4% 37T% 33 2% 23% 12 106% 8 % 17% 97 43% 28% 108% 9 86% 16% 833, AT% 72 6% 6% 29 2% “ 110% r19% ° 24 12% 0% 1% 12% 40% Krasge Dept Stor. Kresge D 8 pf (2) Lee Rub & Tire Leh Val (3%). Lig & Myrs (3).. Lig & Mvrs B (3) Lima Loco {4)... Loews Inc (3). Loft, Incorpor. .. Loose-Wiles Bis. Lorrillard (3).... Louis & N'sh (8) Mcintyre (75c) . Mack Cos pf (4). Mack Trucks (6). Mack T 1st (7)..: Magma Copper. . Mallinson & Co. .. Man El Sup 4).. Man El modgtd 4. Manhat Shirt (3) Maracaibo Oll. .. Mkt St Ry prpf.. Marland Oil. Mathieson Alka Maxwell Mot A.. Maxwell Mot B... May Dpt 8t (5).. Metro Ed pt (7). Mex Seaboard(2). MexSeabd ctfs(2) Miami Cop (2) Middle St Ofl. Minn & St Louls. . M StP&SSM (4). Mis Kan & Tex... Mis K & Tex pf Missour! Pacific. . Missour! Pac pf. . Mont Power (4) . Montgom Ward. . Mother Lo(755c). Munsingw'r (3).. Nat Acme Nat Biscul .. Nat Cloak & Suit. Nat Dalry @3).... Nat Dept Stores. . NDS1stpf (7). Nat En & St... Nat Lead (8).... Nat Supply (3 Nev Cons Cop. ... NewO,T&M f23% NYAirBr ... NYABraA®) N ¥ Central (7).. NYC&StL (6). Ny C&StL pt (6). NY NH & Hart... NYOnt& West. . N Y Stea pf (7). Niagara F pf €7). Norfolk South. Norf & W (18)... North Aner (2).. North Am pf (3). North Pac (5).. Nunnally Co (1). Okla Pr & Ref. Ontario Mining Onyx Hosiery. ... Orpheum pf (8).. Otis Elev (n) (4).. Otis Steel. . ... Otis Steel pf. Owens Bot (3. Pacific Develp. PacG & E (8) Pacific Oil (3) Packard (1.20) Pan Amer (4) Pan Amer B (4).. Park & Tilford. .., Penn Ratlrd (3). Penn Seab Steel. . Penney JC pf (7) * Pere Marq (4). Pere Mar pf (5).. Pere M pr pf (5). Phila Co (4) ..... Phila Copf (3).. Phila& R&1. Phillips Jones. Phillips Pet (2). Pitts UL € 1 Pitts Ut ctfs 1.65. Pitts & Wem Va.. P& W Vapt (6). Postum Cer (4) Press St C (4)... Prod & Refiners. . PubSer N J (4) Public Serv rt: Pullman Co (8) Punta Al Su (5) Pure Oll (1%). Ry St Spg (8) - Ray Cons Cop. Reacing (4) Reading rts. Read 16t pf (2) Read 2d pf (2). Reis Robert 3 Remington 2d(8). Replogle Steel. .. Rep Ir & Steel. Reynolds Spr (2) Rey Tob B (3) Rey Tob pf (7). Roy D'tch (3.46).. Royal Dutch ris.. St L San Fran. St L-San Fr p! St L Southwest. 8t L S'th pt (5) Savage Arms. ... Schulte (8)...... Seaboard Air L. Seab'd Air Lipf. . Sears-Roeb'k (6). Shattuck-Ariz Shell Un Of1 (1 Simmons Co (1) Sinc Con Ol (3)... Sin Con O pf (8). Skelly Oil. South Pac (6).... Southern Ry (5). Std Gas & El 3). St Ofl Cal (2). StOUNJT (1).. Stew't War (10).. Stromberg C (8). Studebaker (4) snbm-mgnnun Superior Sweets Co of Am. Tenn C&Ch... Texas Co (3). Tex Gulf (6% Texas & Pacific. Tex & PacC&0. Tide Wat Ofl (4) Timken (13%).. Tob Prod (6). Tob Prod A (7). Transcont Oil. ... Underwood (3) Un BagPa (6)... Un Pacific (10)... Un Pacpf (4).. Utd Clgar Stores. Utd Ry Invest. ... Utd Ry Invest pf. U S Cast Iron P... U S Distributing. U S Hoff Mach. .. U S Ind Alcohol. USR&Im (8). U S Rubber. USR 1st pf (8).. U S Smelting.... U S Steel (16) Universal Pipe. .. Universal E pt(7). Utah Copper (4) Utah Securities. . Vaulc Det pf (7) Vabash. ... Wabash pf A. Wald Sys (1%).. Web & Helib (1). Wells Far (3%) . ‘West Pen (4).... West Mary 2d pf. ‘Western Pacific. . West Pacpf (€). West Un'Tel (7). West E& M (6) Wheel & L Erle. Willys-Overland. Willys-Over pf. Open, High. 51% 95 9 47% 56% 56% 600 15% 6% 631 8% 5 18% 65 88% 98 28 224% 44 40 34% 29% 47% 31% 45 51% 13% a1 93 21% 21% 21 1% 2 85 14% au 16% 46% 65% 29% % 82 6% 57 656 32% 40% 93y 22 - 142% 68% 13% 100 44 50% 104% 95 87% 24% 21 94 27% 18% 119% 2Th 48% 9% ki 2 5% 19% 94% 5% 8% 53 42% % 93% 48% 10% 62% bl1% 28% @5 2 105 50% 651 57 125 11 24% 95% 6% 17 24% 19 87 20 98 63% 34% 67% 84% 65% 8% 85% 9% 89% 831% 48 186 4% 47 11 38% 28 25 1% 69% 95% 29 8% 223 100% 18 67 1% 28% 2% 108% 1% 67 31 T 32 6% 57% 56 32% 40% 934 22 144 58% 18% 100 44 60% 106% 95% 8T% 24% 21 91 27% 19% 120% 27% 49% 59% ™ 2 5% 19% 4% 65% 8% 53 56% 95 9 4% 564 56% 60% 15% 6% 62 38% 85 16% 65 "8 98 28 22% a“ 0 4% 288 AT% 314 4% 50% 13% 9 9 21% 21% 20% 1% 1% 35 14% 4l 16% 46% 66% 29% 7 32 6% 57 56 Low. Close. 56% 95 9 48% 56 56% 61 15% 6% 62 39% 6% 15% 65 88 98 28% 221 4“ 40% % 28% AT% 31% 4% 62 18% 91 93 21% 21% 20% 1% 1% 85 41 16% 67 30% 7 32 6% 56 68% 8% 69 1% [ Woolworth n (3), 112 115% 112 113% 65% 67% | Worthingn Pump.~ 28 28% 27% 28% 452,600 Kresge S8 (3)... 434 434 430 430 |WrightAero(l)., 10% 1% 10% 10% | 1Dm.....62L500 _ 2p.m,....716.400 WILSON BONDS UP OVERFIVE POINTS $300,000,000 Canadian Loan Also Gives Encourage- ment to Investors. By the Associated Press. NEW YORK, July 2.—Strength of forelgn obligations -and another spurt in Wilson & Co. issues marked today’s bond traling, which dis- played a firm undertone in sym- pathy with the rise in stock prices. An advance in the French liens car- ried the government 8s to the year's highest price at 103. Announcement of the Canadian finance minister that the Dominion’s forthcoming $300,000,- 000 loun would be floated in the best market possible encouraged invest- ment bankers. Wilson & Co. bonds ex- tended their gains from 1% to 5% points. In addition to the $2,700,000 offer- ing today of the new 7% per cent Hungarian reconstruction loan bonds at 87i, yielding 8.85 per cent, other issues " included $4,500,000 Northern Indiana Gas and "Electric Company 5% per cent gold notes at 99% to yield about 5.75 per cent, and $3.000,- 000 White Fagle Oil and Refning 5% per cent sinKing fund gold notes at 99 to yield about 5.72 per cent. Rails and Industrials Also Remain Steady. BY GEORGE T. HUGHES. Special Dispatch to The Star. NEW YORK, July 2.—Although the main trend in the bond market today continued upward, there were enough exceptions in specific issues to give the appearance of irregularity. The money market was a little firmer, and while this was probably temporary it had some effect upon sentiment, in- asmuch as the supply of time funds was affected as well as the rate for call loans. After the half-year set- tlements have gone through the chances are funds will be as plenti- ful as ever. Foreign Group Prominent. Foreign bonds were again promi- nent in the day's trading. French 8s made a new high record for the year. At 103 today they were ten and a half points from the low of January 15. French 7%s sold at the high ot the year. Speculation continued agtive in the Jukoslav $s around the top for 1924. In general foreign bonds were strong, but there were two ex- ceptions, the Finland 6s where the situation with regard to the new loan seemed to have an unfavorable effect on the outstanding bonds, and the Japanese 6128 which had another sinking spell following cable dis- patches descriptive of Japanese re- sentment over the exclusion act. In the speculative rails, M. K. & T. adjustments were the leaders, being active and strong above 61 and around the high of the year. The Missouri Pacific 6s weakened following the an- nouncement that the road had asked authority to issue $23,810,000 addi- tional <bonds. The Chicago and East- ern Illinois 53 were very heavy. The slump in the soft coal industry has unfavorably affected earnings. New Orleans, Texas and Mexico income 5s were strong, but Chicago, Terre Haute and Southeastern 68 reacted a little. Wilson & Co. lssues furnished the fireworks among the industrials. The convertible 7%4s opened at 61 and sold up to 65 on a single string of trans- actions. This was doubtless in .re- sponse to the announcement that the company had made satisfactory ar- rangements covering its financial needs. Among the utilities, North American Edison 6%s sold at par. Libertys and high-grade rails and industrials were steady. There was special activity in B. & O. first 4s. CHICAGO GRAIN MARKET. CHICAGO, July 2.—Hot, dry weath- er in Canada led to upturns ir wheat prices today during the early deal- ings. Wheat opening prices which ranged from % to % higher. Septem- ber, 116%all17%, and December, 1.20%a1.20%, were followed by an adéitional advance and then by a re- action to about the same as yester- day's finish. After opening %4 to 11 higher, July, 97a871. and September, 94%a 943%, corn declined to 96, July, and showed losses for September and De- cember. Oats dropped with corn. July oats in particular. Starting at a shade to half a cent up, September, 46%a 46%. the market soon underwert a decided setback. Provisions were firmer owing to higher quotations on hogs. Wheat cloged unsettled, % to % net higher, September, 1.16% to 117 and December, 1.19% to 1.20. Closing prices foilow Wheat—July, 1.16%: September, 1.16%: December, 1.19%. - Corn—July. 96%; September, 93%; December, 83%. September, 45%: Oats—July, 53; December, 47%. Lard—July, 10.8: September, 11.05. Ribs—July, 9.75; September, 9.95. SHORT-TERM SECURITIES. (Quotations furnished by Redmond & Co,) —Noon.— = Bid. Aluminum Co. of Amer. Aluminum Co. of Amer. Sugar 6s 1937, Tel. & ;‘ll"’h‘ Allllou(me?p(‘;;l Tihs 1925, ‘Associated Oil 6s 1935. Bell Tel. of Canada 5s 1925, Canadian Northern 3%s 1924, Central Leather 1925, Chi., Mil. & St. Paul 6s 1834, Chi.. R. & Pac. His 1926 Colum. Gas & Fl. 1 1! Fisher Body Corp. Sorens T e T ae 1831 year Great Northern 7s_1936. 1091 Gult Ol Corp. of Pa, 5i%s 1728, 100: Humble Oil 5%s 1932.. 99 Kennecott Copper 73 1 M., S8t P. & 8. 8. M. 6 Morris & Co. 73%s 1830, New York Central 8¢ oIl 5343 1925, Eo % G oz TM:'.;.QI lolé-fi 1%%0; Unio ') r 78 U, Rubber Ti4n 1830, Western Unlon 8%s 183 Westingbonse Bl & M 78 Wheeling Steel 6s 1926, TREASURY CERTIFICATES. (Quotations furaished by Bedmond & Co.) ——Noon.——. Bid. 1924... 100 1i-16 1009 1924. .. 100 29-32 101 132 e September 15, 101582 101% | s December 15, 1 15, 1925. M 15, 1925 June 15, 1925. December 15, Mareh 13, 1926, September’ 15, reh 15, 3 December” 16, 1831 BUTTER HIGHER TODAY. CHICAGO, July 2—Butter higher creamery, extras, 38%; standards, 39; extra firsts, 37%a38. lower; firsts, 24%a25; ordi- | n.E‘.nflrm 23a23%. WrigWJIr(3)... 88% 38% -38% 38% YollowCab (5)... 64 54 53 53 D s e o e e are the snnual cas Paymeats based on the iatest quarterly or haif-yearly declarations, otherwise extra wpecial Sividends’ are ot incloded. 52 High. Low. Last. Call Money 2% 2H By _HOURLY SALES NF STOCKS. 1lam..... 201,700 12 M. l ON NEW YORK BONDS STOCK EXCHANGE I Received by Private Wire Direct to The Star Office. (Bales are in §1,000.) UNITED STATES BONDS. Hons- represent thirty-secomds. 101-3 means 1013-33.) Sales. High. Lo Close. 873 10119 101-17 101-18 79 10210 102-6 102-10 - 2080 101-18 101-12 10117 . 662 102-9 102-7 102-7 - 1002 10211 102-7 102+7 US4%s1983. 130 105 104=30 104-31 FOREIGN. o Bales. High. Low. A 61 nlf 93% 98% 42 102% 102% 102% 23 92% 92% 11 100% 100% 26 105% 105% 13 1044 104% 110 110 92 92% 86% 864 87% 8% 99% 29 101 101% 101 101 102 102 102% 102% 98 98 105% 105% 105% 105% 46% - 46% 109% 109% % 94% 26l Lib 3ys. Lib 1st 4%s... Lib2a 4y Argentine ¢s'37 Argentine 7s Austria 7s. Canada 68 1952 Canada 5%s 192 Chile 75 1943 Chile 85 1941 Chile 85 194 Chinese Gov Ry Christiania 8s. Copenhagen 6% Cuba 6%4s. ... Csechoslovakia 3s. Danish Munic 8s B. Denmark Denmark Dutch E16% Dutch East I 68°47. 98% ElSalvador 8s°48. 2 Finland s f 6s 1945.108 Framerican 7%s. . French Govt 7% French Govt Holland-Amer 6s.. Italy 6345 1926, I Japanese 2d 43%s.. Japanese 63 132 Jergens U M 68'47. 31 Lyon 6s.. .82 Marsellle 6s. 25 Montevideo 78..... 2 Netherlands 6s.... 20 Norway 6s 1943.... 46 Norway 6s1952.... 16 Norway 8s. 1 Orfent Dev deb 6s. 10 Paris-Ly's-Med 63. 32 Prague 7%s....... 15 Queensland 6s..... 15 Queensland 7. 2 Rio de Jan 85 1346. 23 Rio de Jan 8s 1947. Rio Gr Do Sul 83 Sao Paulo Citv 8 Sao Paulo State 83 Seine Dept of 7 Serhs Crotes Slo 85 Soissons 6s Sweden Swiss 538 1946 Swhiss Confed 8s... TokinBs.......... 2 Ud Kingm 6%5'37. 77 1044 103% UdKingm 6%5°23. 1109 109 MISCELLANEOUS, Ajax Rubber ss. 35 84% 81 Am Agr Chem 7%s 26 85% 854 Am Chain s { 6; 94% 94% Am Cotton O1l 90 90 Am Repub deb 6s. . 92 92% Am SmIt&R 1st bs. 94 93% Am SmIt&R 6s.... 105% 105% Am Sug ref 6 100 99% Am T & Tcltrés.. 86% H6% AmT& Tecltr 100% 100% AmT & Tdeb5% 102% 101% AmT& Tcv és 115% 115% Am Water Wks 5s. 91K 91 Am Writ Paper 6s. 4% 4T% Anaconda 1st 6s. 96% 964 Anaconda cv db 7s. 974 9T% Armour & Co 4%s. 864 86 Armour of Del 5 89% 874 Associated Oil 6s.. 11 100% 100% Atlantic Refin 9% 9T% 99% 99% 100% 100 88% 88 95% 95% 88 88 96 96 105% 105% 9676 96% 101 101 109 108% 99 99 5% 954 98 98 99% 99% 101% 101% 100% 100% 99% 99% 9934 99% 83 92% 88 87w 90 89% 9% 94% 99% 99 108 107% 89% 89% 82 82 108 106% 10815 108% 105% 105% 2% 91% 100% 100 102% 102% 96% 96% 103% 115% 102% 29 96% 94 101% B4% 844 93% 98 90% 98% 110 98% 106 88% 7% 76% 100% 111% 86 964 106 107% 94% 99% 934 103% 87% 95 93 28% 934 102% 93% 1% 1% 85% 85% 92% 94% 6% 9Th 111 85% 8 89% 101% 108 99% 96% 98% 101 102% 89% 86 85% 103% 96% 85% B5% 2% 95 7% 9% 111 85% 8% 89% 102 108 99% 97% 98% 101 102% 89% 86% 85% 104 96% 113 112% 61 61 Beth Steel pm 5s.. Beth Steel rf 55 Beth Steel 5% '53. Beth Steel s f 6s. Braden Copper 6s. Brier H St 18t 5%s Bklyn Ed gen 53 Bklyn Edison 7s D. Bklyn Union G 5s.. Bush T Bldg 5s'60. Calif Pete 6143. ... Central Leather 53 Chile Copper 6s CinG & E5%s'62. Col Gas & El 5s.... Col Gas & Fl 5s sta Commonwth P 6s.. Con Coal Md 1at bs. Consumers Pow 53 Cuba Cane cv 75 '30 Cuba Cane cv d 8s. Cuban-Am Sug 8s. Denver Gas 5 Donner Steel 7s. Det Edison ref 6s.. Du Pont de N T%s. Dugquesne Light 6s. 11 Empire G&F 1%8..104 Fisk Rubber 8s. Gen Elec deb 5s Goodrich 6%s Goodyear 8s 1931 Goodyear 85 1941 Hershey 68 1942. Humble O&R 5% Ilinols Beil 1st & Iilinois Steel 4% Indiana Steel 5: Int Mer Marine 6s. Inter Paper 55°47.. KCP&LtSsA'S2. KanG & El Lackawa S 58 ‘50 Liggett & Myrs bs. Cop cv 7a.. Manati Sug sf THs Mexican Petrol & Midvale Steel 5s ct Montana Power 6s. Morris&Co 1st 4%s New Eng Tel 58... N Y Edsn 1st 6% NYG EL H&P 4 N Y Tel 4%s. Norta Am Ed 6 North Am Ed 6%s. Nor States Pow 5s. Northwst B Tel 7s. Otis Steel T%8..... Otis Steel 8s. PhilaCoref 68 A Phi) & Rdg C&1 bs. rce-ATrow 8 1024 9% 96% 97% 103% 95% 113% 113% 81X 80% 101% 101% 101% 101 104% 104% 98% 93 68 62 324 31% U 1% 91% 101% 101 . 98% 98 ‘Western Union 6% 110% 110% ‘Westinghouse Ts. lg:\t |fl% 98 97% 90 87% 58% 56 Y 101% 1014 %% 9% Por Rico Sug Q’:nmnn Bell 6s. 117 Sug Est Orjent 7s. 5 Tenn Elec Pow 6: Tide Wat Ofl 6% RAILROADS. Sales. High. 64% 83% 90% 85% 9% 87 20 85%% 102% 100% 99% 83% £0% 88% 113% 113% 80% 102% 103% 95 89 97% 36 99% 82% 90 0% 56% 55% 9% 53 58% 9% 52 56% 99 109% 7% 82% 814 801 92 17 6% 103% 103% 99% 89 83% E8% 101% % 920 44% Low. 64 83% 89% 86% 99% 86% 89% 86% 1024 100% 9% 83% 80% 88 113% 113% 80% 102% 102% Atchison gen 4s. AtlanticCLecl 4s Bklyn-Manhat Buff R&P{tt 4% Canad North 6%s.. Canad North 7s Canad Pac deb 4s.. Car Clinch & O 6s. Cent of Ga. Chew & O cv 4% Ches & O gn 4% Ches & Ohio cv bs. Chi & Alton 3% Chi B&Q 1st rf bs. CB&Q-Ill 3%s CB & Q-1ll div Chi & EIll gn Chi Great W, C M & Puget Sd Chi M & St P 48 '25. CM&StPdb 4s Chi M&St P cv 4%s CM&StPgn4%s Chi M&St P rf 4%s ChiM & St P StP ChiUn Sta 4% Chi Un Sta 6% Chi & W Ind cn Chi & W Ind 7% CCC&StLrf6sA. Cleve Term 5 Colo & Sou 4% Cuba R R 5s. Del & Hd 1st rf 4s. Del & Hudson 5%s Den & Rio G cn 4s. D & Rio G imp 6s. . D&RG l1st rf 58.. Det United 4%s. Erle 1st con 4s. Erie gen 4s.. Erle conv 4s A. Erieconv 4s B Erie conv 48 D. Erie con ext 7s. Erle & Jersey 6s. Gr Trunk sf db 6 Grand Trunk 7s. Gr North gen 5%s Gr North gen 7s... Havana ERL&P 5s 111 Central 5% Int Rap Tran 6 Int Rap Tr 6s stpd. Int Rap T 6s... Int Rap Tran 7s... Int & G Nor 1st 6s Int & G Nor aj 61 Iowa Cent 1st b3 Kansas City S 3s.. Kansas City S 5s. Kan City Term 4s. Lake Shore 45 ‘31 Louis & N uni 4s. Louis & N 6s B M & StLlstref ds M StP & SSM cn 4 MK&Tadjbs.... MK&TprinSsA. MEK&T6sC Mo Pacific gn 4s Mo Pacific 55 '65 Mo Pacific 6s. New Or Term 4s NOTex &M in §s. N Y Centcn 4s'98. Ne: New Haven 7 New Haven 7, NY Ont & Wret 4s New York Ry rf 43 NY Ry rf 4s ctfs.. NY W & Bos 4%s. Norfolk & W cn 4s. Northern Pac 3s Northern Pac 4s. Nortnrn Pacr 1 6s. Ore & Calif 1st 5 Ore Short Liret 4s. Ore-Wash 1st rf 48 Pennsyl gen 4%s3.. 2 Pennsyl gen 5s.... Pennsyl 6%s Pennsyl goid Peoria & E inc 4s.. Pere Marq 1st 6s.. PCC&StL5sA. Reading gen 4s. Reading gn 4%s. .. Rio G West 1st 43. Rio G West cl 4». RIArk&L 4% St L IM&S 4529 St L IM&S R&G is. StL&SFplisA. StL&SF prinbs. StL&SFb5%sD.. StL&SFadjés StL&SF ine 68 StL&SFplésC.. StLSWlst4s.... StLS W con 4s°3. St P Un Dep 5%s.. San A & Arn B ds.. Seab'd A Liref4s.. Seab’d A L adj 5s.. Seab’d A L con 6s. Sou Pacific 48 '29. Sou Pacific ref 4s. Southern Ry gn Southern Ry 1st 58 Southern Ry 6s ct. Southern Ry 638, . Sou Ry Mobile 4s.. Third Ave ref 4s Third Ave adJ & Tol StL& W 3%s. TolStL& W 4 Union Pac 1st 4s. Union Pac 1strf Union Pacific 45’27 Union Pacific cv 6s Virginia Ry 1st 5s. Va Ry & P 1st bs. Wabash 1st Wabash 2d 65 Western Md 4s.... Western Pacisic §s. Wess Shorg Iut b, ee cn 4s. 68 Whel & LErf 4%s 03: 63% 25: TOTAL SALES (Par Value): 11am.. 3508000 12noon 6171000 1p.m.. 8302000 2p.m.. 9941000 STOCK JUMP EXPLAINED. NEW YORK, July 2.—The sharp upturn in Wison & Co. securities yesterday was attributed in the financial district to reports that re- financing of the company would be completed Without a regefv, that. more than 90 ber cent o ino $3,000,000 notes outstanding have been renewed. It is expected that the auditors’ report will be submitted within ten days and that the plan to rehabilitate the company will be considered when the figufes are avail- able. % DAIRY PRODUCTS. BALTIMORE, Md., July 2 (Special). —Live poultry—Spring chickens, pound, 35a45 ; leghorns, 30a37; old hens, 18a26 ; leghorns, old, 18a20; old roosters, 15: ducks, ls?j)ofl; I'P'I?“‘ dl:-'cu 24a25. Egge— oft; native and mearb; frate, dosen, 2% ; southern, 24%. > Butter—Creamery, good to fancy, pound, 38a42; nearby creamery, 35a3 prints, ladles, 30a32; store packed, 2t process butter, 34a35. TODAY'S METAL PRICES. NEW YORK, July 2.—Copper, quiet; electrolytic, spot nd futures, 123 ; spot and futures, 46a25. No, 3 wouthern, 30.0 5 spot, 7.00. nc, eady; Kast' St. Louls, spot and nearby, 5.5 8352 Antimony, spoty 848 8214 82% | 1.003 78 POINT BREAK IN COTTON PRICES Government Report Showing Fine Crop Conditions Starts Wild Selling. By the Associated Press. , NEW YORK, July 2.—The government cotton report today, making the con- dition 71.2, was the signal for a heavy selling movement in the cotton market, under which prices broke 56 to 78 points below last night's close. July sold down to 2915 and October 24.40. The trade was looking for a condition under 70. Cotton futures closed barely steady. High. Low. 000 28 24.30 e @ March < 2! Opening —July. 20.95; October, - cember, 24.48; January, 24.25; March, 24.39, NEW ORLEANS, July 2.—The cot- ton market opened slightly irregular, July s.owing a gain of 9 points over the previous close, but October was 4 points down and eased off 3 points additional right after the call. As Liverpool was better than due, prices promptly rallied, July trading up to 28.04 and October to 2450, or 13 and 8 “points, respectively, net higher. Rains were reported in the early sec- tion of southwest Texas, where not wanted, and also in the eastern beit. There was evidence of some further short covering in advance of the Liverpogl, due at 11:30 am., central time. ' Cotton futures closed steady at met declines of 90 to 104 points. July . October December January . Close. 27.01-03 24.18-20 Low. 27.01 2415 2320 % y, 26.005 October, bid: Japuary, July . October December Junuar. L4 5 bid. 24.38; De- 24.10, vid NEW HIGH RECORD IN YEAR’S IMPORTS Steady Gains in Foreign Trade Made at Baltimore—June Income Lowest. Special Dispateh to The Stas BALTIMORE, July 2.—Customs re- ceipts on goods' imported through Baltimore increased more than $4,- 000,000, or 41.3 per cent, in the fiscal vear that closed Monday, and collec- tions established a new high record here with a total of $13,823,944.61, ac- cording to a statement by Collector of Customs Charles H. Holtzman. Every month except the last four showed substantially larger receipts than the corresponding months of the fiscal year 1923. The 1923 collections represented an increase of 400 per cent over collec- tions for 1922. Until 1923 the high record of $6,000,000, collected in 1907, bad not been exceeded. Mr. Holtzman said the increase fairly reflected the growing im- portance of Baltimore as a foreign- trade port. The month of June, which shows the smallest income of the year, is normally lower than others. he explained, while the slump that began in March is partly due to the general slackening of business and partly to the arrival of larger cargoes of free sugar than formerly. COTTON CROP PLACED AT 12,114,000 BALES Agriculture Department Reports Land ip Cultivation Now at 40,408,000 Acres. A cotton crop of 12,114,000 bales this vear was forecast today by ‘the Department of Agriculture. The area of cotton in cultivation is about 40,403,000 acres, an increase of 1,702,000 acres, or 4.4 per cent, as compared with the revised estimate of acreage in cultivation a year ago. The condition of the crop on June was 71.2 per cent of a normal, compared with 65.6 on May year, 69 on 4.5 'the average on June last ten years. B GRAIN AND PROVISIONS. BALTIMORE, July 2 (Special).— Potatoes. white, 100 pounds, 50al. 150 pound a3.00; new potatoes barrel, 1.50a3. Asparagus. dozen, 00, eans bushel, 1.00al.75. Beet: 100, 3.00a6.00. Cabbage, 100, 3.00a5.00. Carrots. 100, 3.00a5.00. Corn, 1.00: Cucumbers, crate, 50al.2, Eggplants, crate, 2.00 a3.50. Lima beans, bushel, 2.5023.50. Spring onions, 100, 1.75a2.00 Peas, bushel, 1.25a3.00. ' Spinach, bushel, 1.25a1.50. Squash, basket, 2.00a3.00. Tomatoes, crate, 1.00a3.00. Apples, ' barrel, 1.50a4.00. Cherries, pound, l4al5; quart, 12ai8. Straw- berries, quart, 10al6. Pineapples, crate, 2.50a4.50. Peaches, crate, 1.00a 3.00. Watermelons, 100, 30.00a70.00. Settling Prices on Grain. ‘Wheat—No. 2 red winter, spot, 1.20; o. 2 red winter, garlicky, domestic, 118% Sales—Bag lot of nearby at 1.00. Corn—Cob, new, 5.00 per barrel for yellow and 4.85 per barrel for white; . 2 cern, spot, 97; No. 3, 94; track corn, yellow, No. 2, at 1. Si -None. No. 2 June 25 last vear and 25 for the white, 66; No. 3 white, Nearby, 75 and 80; No. 2 rye, Hay—Receipts, none. The supply of oid hay is ample for all trade, and the bulk of the stock on sale here is of an undesirable low grade sort for which there is little sale, Of top grades of timothy and light mixed there is no surplus and prices held steady. Quotatio 29.00; No. 2, 24.00; N No. 1 timothy 27.00a28.00; No. 3, 0a 1 light clover mixed, 26.00a light clover mixed, 24.00: . 1 clover mixed, 25.00a25.50; . 2 clover, 0223.00. Straw—No. 1 straight rye, 23.00a 24.00 per ton; No. 1 tangled rye, 18.00a . 1_Wheat, 17.00al7. No. 1 50a17.00. DEFENDS ROAD'S PLANS. NEW YORK, July 2.—Proposed consolidation of the Southern Pacific and El Paso and Southwestern Rail- systems was defended in a statement issued here by Julius Kruttschnitt, chairman of the South- ern Pacific company, who sald the Union would insure preservation of existing routes and channels of trade and commerce in harmony with the policyl of the transportation. act. WOOL PRICES RAISED. BOSTON, July 2. (Special).—The qptimism_ihat has been growing in Summer street for several days has found reflection in m willingness of buyers in‘the west to pay more for the new clip. Prices there have in- creased 1 to 3 cents in the last few days, it is stated. Meanwhlile, busi- ness’is picking up a little here and some wool is beginning to move to mills. ¥ LIVE POULTRY LOWER. CHICAGO, July 2.—Poultry alive, lower; fowls, 20a22; brollers, 2933, Plant Turns to Electricity. HOPEDALE, Mass., July 2 (Special). —The new contract of the Draper Company, makers gf textile machin- ery who are about to scrap their steam power plant, entered into with the New England ' Power Company, calls for a supply of current total- ing 300 horsepower for fifteen years. FINANCI | plied 25 this | | 389 BUSNESS LETS P - INTHS DISTRCT Reserve Board Calls Slump More Seasonal—Farm Loans, $76,637,515. BY CHAS. P. SHAEFFER. A distinct slowing down in business activity of the fifth federal reserve district is reported in the current re- view of conditions by the Federal Re- serve Bank of Richmond. Part of this decline, however, is held as only sea- sonal. The decline was somewhat greater than can be accounted for by sea- sonal influences, howsver, the report fi:lds. and was due also to unfavor- able weather for crop planting and Browing. to sepressed conditions the textile and coal industries, and to the nervousness which seems to exist throughout = the country during & presidential year. ‘In spite of the re- cent recession in the volume of busi- ness done, however, the available evi- dence seems to show that fundamental conditions are sound. In a review of certain important busi- ness indicators, reports from sevents- SIX regularly reporting member banks show 1>duced loans to their customers at the middle of June in comparison with the preceding months this year, al- though loans’ this year are fomewhat greater than a year ago. The reporting banks are in much easier position at Ppresent than in June of last year, this fact being evidenced by increased de- Posits, reserves and cash in vaults, and by greatly reduced rediscounts with the reserve banks. “The strength of the bank credit situ- ation is further shown by an increase in the federal reserve bank's cash re- serves in comparison with June, 19 and a marked decline in rediscounts member banks,” the report concluded. 1,607 Failures in June. Insolvencies in the United during June, according to the r of R°G. Dun & Co.. number 1,6 which, as usual is considerably 1 thar for the earlier months this yea but contrasts with 1,358 defaults re- ported im June, 1923, Likewise, for the second quarter of this number, 5.130, contrast with 5, the first three months this vear and 4,408 for the second quarter of 1923. For the first six months of there were 10,785 business failu against a' year ago. As to the tedness this to date, $304.- 459,959 contrasts with $259,124.068 for the first half of 1923, and of the total of liabilities this year 61 per cent applies o the first three months leaving for the second quarter of this year an indebtedness of $119.554,3%5, and for June $34,099.031, the mentioned figures contrasting $28,678,276 for June, 1923. Trading on Local Exchange. Selling of the 6 per cent debenture bonds of the Washington Railway and Electric Company featured trad- ing on the local stock exchange this morning. total of $48.000, face value. of this security changed hands, recording a rise of one-eighth point to 9934, Capital Traction stock was in good demand at unchanged prices, seventy- four shares selling at unchanged prices. Railway common was again active at 78, with Lanston selling at ational Mortgage and Invest- ment preferred _brought 8%, and Riggs National Bank, 290. New Savings Device. A new savings device, known as the calendar bank, has made its debut in_Washington. vings with it is compulsory with the holder if a cor- rect calenddr is to be kept, a coin being necessary to record the passage of da The device is being distributed by the National Savings and Trust Com- pany. wit Matters Before I. C. C. The Seaboard Air Line Company today received authority from the Interstate Commerce Commission to authenticate and deliver $4,750,000 of 4 per cent refunding mortgage bonds, and to pledge them under the first and consolidated mortgage. ‘The issouri Pacific railroad ap- to the commission for author- ity te issue $23,810,000 of first and re- funding mortgage 6 per cent gold bonds with which to reimburse its treasury for cxpenditures made in paying off $880.000 of Pine Bluff and Western Railroad bonds, and $22,930,- pent for additions and better- ments Over $76.000,000 Loaned Farmers. The federal intermediate cred ban have made loans aggregati $76,637.515 to the farmers of the cou try in slightly less than one ye since the new credit system was or- ganized. it was announced today by the Federal Farm Loan Board at the conclusion of the semi-annual confer- ence of the board and officails of the farm loan and intermediate credit banks. Up to May 1, last, $27.593 of the loans had been repaid, show ing that $48.943.758 of government money is being used by the farmers to fina e current crops or live stock produc- tion and marketing. A formal statement issued by the board said ‘% was “highly gratified” with the record made by the banks, and regarded the system as having established itself as a useful and nec- essary American institution. BUSINESS AHEAD OF 1923 Bank Clearances, However, Fall Off in Baltimore Area. Special Dispatch to The Star. BALTIMORE, July 2.—While bank clearances for the first six months of the year indicate a falling off in volume ‘of business in the Baltimore district, total clearings are ahead of the same period of 1923, according to figures of the Baltimore clearing house, Taking the six months' figures as a whole, they are about 3 per cent ahead of the corresponding period in 1923, thus indicating that business in the Baltimore district during the first half of the current year has exceeded last year. Clearings from January 1 to June 30 totaled $2,495,116,217, an increase of $74,844,616 compared with 1923. e 100,000 BANANAS DUE. Record Shipments Are Arriving in Baltimore This Week. Special Dispatch to The Sta BALTIMORE, July bananas this week will exceed the 100,000 mark. The Port Antonio brought 25,757 bunches to the United Fruit Company; the Oritani, 28,050 to the Banana Sales Corporation, and the Princess May, 25079 to the Standard Fruit and Steamship Com- pany. The Oradell arrived today with 29,500 to the United. All the fruit is from Jamaica with the exception of part of the cargo in the Princess May, from Cuba. e NEW YORK DAIRY PRICES. NEW YORK, July 2. — Butter steady: receipts ‘18423 packages: creamery, higher than extras, 41%a 42%; creamery, extras (92 'score), 41%a41%; do. firsts (88 to 91 score), 38240%. Eggs easier; receipts, 29,618 cases; fresh gathered, extra firsts, storage 28%a20%. Pacific coast extras, 39 steady’; 213,242 —Receipts of récipts, NEW YORK, firmer; high, 3: 21: closing bid, last loan, 3: call ceptances, 23 mixed collateral, 4-6 months, 3a3 paper, a3k, money ruling rate, offered at 31 loans against ac- time loans, rasy 0-90 days, 2%a3 prime commercial