The Nonpartisan Leader Newspaper, August 8, 1921, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

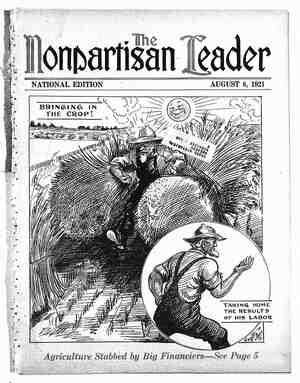

= L | {o&\ g » ) <4y » \ ¢ Ay & 4t s I ey ¥ A~ <} - w il ¥ L¢ Mg « 3 v g & el 4 .\'_‘ o ;) & Agrlculture Stabbed by Blg Fi Inanciers Dehberate Plan to Make Him First and Worst Sufferer From Deflation— The Inside Facts by a Financial Editor Who Knows First of several articles by a flnnm:ial writer who writes under a pen: name for obvious reasox%s ~ BY JOHN LORD HE facts about the deflation of the farmer which-I am going to relate in ‘this article have never to my knowl- edge been told in a way to reach the eye of the farmers themselves.. The deflation plot was laid before election last year, but the tragedy was enacted in the three weeks following the election of Mr. Harding. Dur- ing that period the writer was financial editor of a well-known eastern daily and had a chance to ob- serve things from the ms1de, so to speak. In actual figures, here is what was dehberately done to the farmer: Let us take wheat:” On September 9, 1920, dark northern spring wheat was quoted on the Minne- apohs market at $2.62 per bushel. Om-October 7 the price had fallen to $2.22, on November 13 $1.80, "~ and on November 27 $1.56. And here is what happened to. the price of cotton: On September 9 cotton was quoted-at $28 per bale. l())x; November 27 the pnce had fallen to $14.60 per ale. And this is the tale of the hog: On September 9 hogs were quoted on the Chicago market at $15 per ‘hundred. On November 27 the price of hogs had fallen to $9 per hundred. Every other commodity produced by the farmer— corn, oats, rye, barley, etc.—suffered a similar col- lapse, and there was no corresponding decline in the price of commodities produced in the factories and workshops. ‘Hides went down from 50 cents per pound to 3 cents without materially affecting the price of shoes. At the height of this decline, the value of an ordinary pair of shoes became equal to the value of the green hides of six cows. The value of all farm crops, animal products and the animals for slaughter on December 1, 1919, was estimated by the government to be $24, 960 000,000 Assuming that these products had a similar value September 9, 1920, the shrinkage in value of farm - products between September 9 and November 27, 1920, was appro:umately 40 per cent. Forty per .~ cent of $24,960,000,000 is practically 10 billion dol- lars. But this does not tell all of the story. The value of all farm lands began imme- diately to shrink to correspond with the decline in the price of farm prod- ucts, and if we are to include the book losses of the farmers as well as the actual losses the total sum can not be far from 20 billions of dollars, or-a total shrinkage in values per average __farm of something like $3,000. ; NO OVERPRODUCTION TO ACCOUNT FOR IT ‘While the farmer was taking his dose of deflation, rents were sharply advancing in every city in the United States. Careful estimates of rent ad- vances in Chicago for the year 1921 over that of 1920, place the figures at 25 per cent. In other words, while the farmers were having to set their gross income back by billions of dollars, the ‘people of the city, for the most part, of course, the wage-working class, were having their rent costs set ahead by other billions of dollars. Reduction of labor costs in the face of advancing rent was of course impossible. But to return to deflation of the *farmer. .How did all this come about? Was' there an overproduction of farm . products in'the United States? Was _ there an overproduction of farm prod- ucts in the world? The answer is that * ' no such thing took place. Millions of . people all. over the earth, including .our own fair America, were underfed .- and underclothed, even after the price ‘of raw materials had shrunk nearly a “half in value. ‘' 'We must look for the explanation of s ithis phenomenon elsewhere. ! .Go back in your memories to what 'thé newspapers began to say, and to repeat daily, about the closmg days of August 1920. We began to read in the daily newspapers long preachments about deflation. Prices were high, said the newspapers, because everybody was specu- lating. Then they told us there was too much money in circulation. Our currency was inflated. The federal reserve banks had issued too much cur- rency and it was time to deflate the currency. (As a matter of fact, the currency had been expanded by some billions of dollars, or from less than $40 per capita to $60 per capita.) It was said that the federal reserve banks had extended too much credit to member banks and the member banks had ex- tended’ too much credit to their customers.” We had inflated currency and credit to carry on the war. The war was over and we must now deflate. It was— urged-that the federal reserve banks take action and stop speculation, especially in food products. BEGAN WITH THE FARMER NOT THE FOQD SPECULATOR Now, those who know the ways of big daily news- papers understood that this was propaganda—what newspaper men call “inspired stuff”—and that it indicated that “something was going to happen. Then suddenly like a bolt of: hghtmng from the skies came deflation. Did the federal reserve banks begin with the speculators? Not at all. Speculators are big financiers. Speculators sit on boards of directors of big corporations, of credit companies and of banks. Deflation began right where it was bound to begin—on those who had no power to resist— the farmers. X “Why the farmer? To answer that question we shall have to recall some history. This history begins with the time when Charley Schwab came back from Europe with his first bunch of war orders, at the time when the banking house of Morgan was appointed the pur- chasing agent of the British government. This was in 1915, the second year of the war. From that date the American financiers and the American manufgcturers began to make billions of dollars by selling goods to the allies at any price that the " sellers might choose to fix. Our American export- ! ~ RIP VAN WINKLE UP TO DATE l YES I GUE.SS THERE 1S SOMETHING " WRONG WITH ers bled the alhes white of everything they possess- d-—gold, American securities and credit—each of which in turn was finally exhausted so that when America went into the war the allies had given up their gold, their American securities and exhausted their credit. One of the /first acts of our govern- ment after we declared war was to take up the paper of the allies held by the New York banks. That’s how and why Europe owes our government over 10 billions of dollars and our exporters, the banks back of the exporters and American in- vestors almost another 10 billion dollars. In other words, we made and sold to Europe dur- ing and immediately followmg the war, goods'to the amount of billions of dollars in EXCESS of what we purchased from Europe. which our government assumed represents cash transferred from the pockets of the people to the exchequers of the banks and the exporters. The remaining billions represent amounts which the eastern banks and private financiers are carry- ing. Big business made billions of dollars in prof- its on our export trade. It was such easy money, the game was so intoxicating, that every effort was made to keep it up. But it had to come to an end. Having taken all the gold, all the securities and exhausted the credit of Europe, our export trade had to come down to the basis of exchange of goods. narrow our export trade to the exchange of our products for such things as Europe could spare ~~ from her scanty production. Some things, however, Europe had to have, or starve and freeze. These things were flour, meat, cotton, wool, etc. So when the hour set for defla- tion arrived and with no thought of the hungry stomachs and freezing backs of the Europeans, but wholly to keep the purse of the exporters and the export banks filled as long as possible, it was decid- ed to drive down the price of the things which Eu- rope was buying. The farmer was selected for the slaughter. Canada had some surplus wheat, not enough to . supply European needs, but still a surplus. Our exporters said that if something wasn’t done Cana- da’s wheat would go into the market first, so the dnve on the American wheat market began. Egypt had some cotton. We must beat the Egyptians, so a drive was made on the cotton market. Argentine had some meat. We must beat the Argentin- ians, so a drive was made on the meat market. Australia had some wool. We must beat the Australians, so a drive was made on the wool market. WENT ON EXCHANGES AND BROKE MARKET How did they doit? The export- ers raided the cotton and grain ex- changes and sold millions of bush- els of wheat and hundreds of _ thousands of bales of cotton short. They sold and sold until the mar- ket was broken. The price of wheat was broken from $2.62 per bushel on September 9, 1920, to $1.56 per bushel on November 27, and then after they had all the wheat bought in that the farmers could not avoid selling, they rais- ed the price to the Europeans and cleaned up on the hungry and naked on the other side of the water. The price of cotton was hammered down from $28 per bale to $14 per bale. The export ring skinnetl the Amer- ican farmer, cleaning up millions- of* ps ned the starving Europeans. I have it on the authority of a former high government official whose ‘name I am not at liberty to reveal, that British ing the cotton market short and real- ized no mean sum in the transaction. The federal reserve banks put the squeeze on the farmer banks -so that the farmer could get no money with That part of the debt ' ‘We had finally to - dollars in the process, and then skin- . financial agents - co-operated in sell-