The Nonpartisan Leader Newspaper, July 25, 1921, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

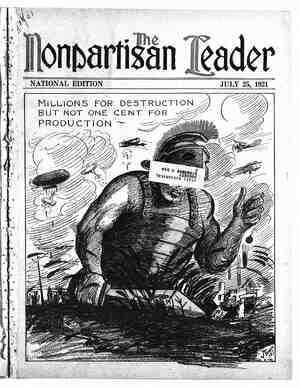

s = / Why the Land Speculator Fights It Congressman Keller Explains the Effect of the New Federal Tax System : He Is Urging—Says It Will Help the Farmer Mr. Keller, member of congress from Minnesota, was elected with the indorsement of the Working People's Nonpartisan league, which co-operates with the National Nonpartisan league in Minnesota politics. BY OSCAR E. KELLER VERY census shows that more and more farmers “are deserting agricul- tural production and joining the ranks of city wage-workers. Farm produc- tion no longer keeps pace with con- sumption. This condition should dis- turb every man who believes in the permanence of American ideals and of American institutions, in- deed, of the American government itself, for it was precisely this same condition that preceded the fall of Rome and of every other of the great collapsed civilizations of antiquity. This condition is directly due to the monopolization of land and natural re- sources, the control of credit and concentration of wealth. Wealth is concentrated in America and natural resources and land monopolized primarily ‘because our system of taxation protects unused privileges and penalizes industry. Monopoly of land, manipulation of credit, and burdensome taxa- tion, imposed because the holders of unused re- sources escape paying their just share, are the causes that are forcing farmers to flock into the cities, until production of sufficient food supplies to feed this nation has become a real problem. “Few people realize the colossal ex- tent to which the agricultural area of the United States is now monopolized by private individuals who are not us- ing it and the serious industrial conse- quences to which this may soon lead unless the monopoly is broken,” de- clares Emil O. Jorgenson, secretary of the Farmers’ Federal Tax League of America and well-known writer on economic subjects. He says: “The department of agriculture on January 28, 1914, stated that of the 1,900,000,000 acres in the TUnited States, 1,5600,000,000 acres are usable for agricultural purposes. Since the census report of 1910 shows only 478,- 000,000 acres to be in farms and im- proved, and further, since the govern- ment itself owns less than 430,000,000 acres of the above, this means that al- most 600,000,000 acres of potential agricultural land are in the hands of monopoly. In other words, for every acre of farm land in use, about one and one-third acres—owned by private individuals—are held out of use. “But this is not the most serious part of the evil. By far the greater portion of this enormous area is in the grasp of a mere handful of people. Full informa- ( 4ion is nowhere to be obtained, but such data as is available portrays vividly the high degree of con- centration of land ownership. Thus in Arkansas 265 holders own 3,318,000 acres, or almost one-half as much as all the improved acreage of the 214,678 farmers of the state. In Colorado 14 known holders own 3,355,000 acres, as against 4,302,101 improved acres owned by 46,170 farmers. In New Mexico, again, the Holland Land company has 4,500,000 acres—more than three times the combined improv- ed acreage of the 36,675 farmers of that common- wealth. Numerous other states, such as Texas, Florida, Mississippi, Oklahoma, Minnesota, North Dakota, Washington and California, reveal even worse conditions. Finally, 20,647,000 acres of land in the United States—an area as large as Ireland— is owned by only 29 foreign syndicates and land- lords.” FIGURES SHOW GROWTH OF FARM TENANTS AND MORTGAGES On the other hand, of the 6,361,502 farmers in the United States today only 2,588,696, or 41 per cent, according to the census bureau, own their own farms free of all encumbrance; 1,312,034, or 21 per cent, have their homes mortgaged; while the re- maining 37 per cent are tenant farmers renting usually from absentee landlords who absorb prac- tically all the profits of agriculture. The investi- - gations of the department of agriculture reveal Central Pacific railway Central Pacific railway...... saeeesee YUDA St aseese Central Pacific railway Stovell-Wilecoxon Co. ........ Agoure interests Southern Pacific Land Co........ ... Tulare Kern Land Co Miller & Lux that the annual earnings of the average farmer are approximately $450. Is it any wonder that farmers are leaving the farms and flocking to the already - congested industrial centers? Is it at all strange that agricultural production is failing to keep pace with the growth of our population? This deplorable tendency must be checked, and so far as possible the vicious existing situation must be corrected. It can only be corrected by a funda- mental change in the character of our tax laws; and that change I have attempted to incorporate in the program I have presented. : Estimates based on the last census reports show that land values and industrial values in the United States aggregate about $140,000,000,000 each. In- dustry pays a total tax of more than $4,000,000,000 - annually, while land values only pay a total of about $600,000,000, derived in the form of transfer taxes and income taxes derived from rents and profits on sales and resales of realty. The injustice of this distribution of taxes is apparent. But this is not all. Between 50 and 60 billion dollars’ worth of vacant land and unused natural resources escape without paying one cent of federal taxation, either direct or indirect. The only logical method of re- lieving the present oppressive taxes upon business is to place a proportion of this amount upon land THE TAX DISCREPANCY “Throughout the Sacramento valley in California,” wrote Edward P. Troy, taxation expert of the city of San Francisco, *the taxes on the farmer will average from $5 to $10 per acre; in the San Joaquin valley from $10 to $15. Over the Tehachipi, among the orange groves of River- side county, I found the small farmer’s tax to average $20 an acre and - many of them were paying $30, $40 and-even $50 an acre in taxes.” In contrast, what did land speculators in the same sections pay? The second annual report of the commission of immigration and housing in California, page 327, gives the following information on this point: Tax per Owner. County. Acres. Siskiyou ..... 664,830 22,061 69,008 385,600 16,000 naiiis 1399 Kern ........ 428,000 Kern ........ 147,000 cesssees 650,000 Tehama Colusa Ventura sescee cesee If these vast holdings, held out of use for speculative purposes, were compelled to pay their fair share of federal, state and local taxation, it is manifest that the producing farmer would not be taxed 100, 200 and 300 times as much as these monopolistic obstructors of progress. values, which, after all, are created by the com- munity and rightly can be taken by the community in the form of taxation. Excluding agricultural land in actual use—and practically no productive farms would be taxed un- der this bill—the total worth of land values in the United States is approximately $108,000,000,000. About $45,000,000,000 of this amount consists of land which has iron, copper, lead, zine, gold, silver, marble, granite, coal, timber, oil and gas. deposits; about $40,000,000,000 consists of city, town and suburban lots; about $12,000,000,000 consists of franchises, pipe lines, stockyards, railroad rights of way, terminals and government land grants; about $8,000,000,000 consists of timber rights and timber lands; and about $3,000,000,000 are in the form of waterpowers, fishing grounds, harbors and water- fronts. . = A 1 per cent tax on these holdings, after deduct- ing improvements and allowing the $10,000 exemp- tion, would produce approximately $895,000,000 an- nually and about $85,000,000 more would come from the owners of unused agricultural land who are “holding it out of use for speculative purposes. For instance, three railroads—the Northern Pacific, the Southern Pacific and the Santa Fe—still own a total of 33,493,000 acres of undeveloped land, or enough, if divided into 80-acre tracts, to give de- cent homes to: more than 400,000 of our tenant farmers. Under the land values bill the specula- tive holders of land would pay more taxes than PAGE TEN all the producing farmers in the rest of America. The largest proportion of the billion dollars rais- ed annually by this bill would fall upon the owners of natural monopolies — waterpowers, fishing ‘grounds, mines, railroad rights of way, pipe lines, stockyards and telegraph, telephone, water and steam heating franchises—in short, upon those who have been given some special advantage or privi- lege by the government which enables them to prof- it off the social necessities of the rest of the com- munity. Approximately one-third of the wealth of the entire nation, and at least one-third of its in- come-bearing property, is included in this classifi- cation, and simple justice demands that the owners of these privileges pay for the upkeep of the gov- ernment that protects them in their monopoly. PUTS BIGGEST BURDEN ON LAND SPECULATOR It is also significant that between 50 and 60 bil- lions of dollars of this property consists of vacant city lots, untilled farm land and undeveloped or at least unused natural resources, so that the first ef- fect of this bill will-be to transfer a large propor- tion of our federal taxation from those engaged in productive enterprise to those who are holding property for speculative purposes. This land in- : creases in value largely through the creation of social values by the efforts of otMer owners who improve their property, and it is sound economics to compel industrial drones to pay ade- quately on values which were created by the efforts of their neighbors. More than 60 per cent of the entire sum raised by the land-values tax law will come from this class. Let us consider the facts and see whether this bill will fall upon the farmers: . In the first place, the bill * provides for the complete exemption of all farm improvements in or on the land, whether buildings, machinery, implements, fences, wells, livestock, crops, clearing, draining, fertilizing, or preparing the ground for cultiva- tion. Not only this but the bill also allows an additional exemption of $10,000 of land value to each land- owner.- More important yet, however, is the fact that in determining the value of farm lands this determination “shall primarily take into considera- tion the land’s capitalized potential -productive return when put to its best . use, and its proximity to markets and availability for purposes other than farming.” Under these provisions it is extremely doubtful whether more than 1 or 2 per cent of all the farms in the United States would pay one penny of taxes under this proposed law, and those farms which would pay would in practically all cases not be “bona flde” farms at all, but the estates of “country gentle- men.” ; As a matter of fact, at least 98 out of every 100 farmers will have their tax burdens measurably lightened by this bill. The amount of federal taxes has risen from $35 per family in 1910 to $214 per family in 1921. The adhering profits added to the tax through the increased price of commodities makes the real burden much heavier. The dand values tax, if adopted, would relieve the average farmer of at least one-fourth of direct and indirect taxes levied upon him. The whole tendency of the law is to shift the burden of taxation from the pro- ducer to the nonproducer, and, as the most purely producing class in the country, the farmers would receive some of the greatest and most immediate benefits. The-land-values tax, unlike taxes on industry or the products of industry which are always shifted, can not be “passed on” to the tenant or consumer either in the form of higher rent or of higher prices for goods. This is one of the established dictums of political economy. It has been ac- knowledged by every economist of-repute from Adam Smith and Ricardo, of a century ago, on down to the present time.. The land values tox will increase production. acre. Cents.