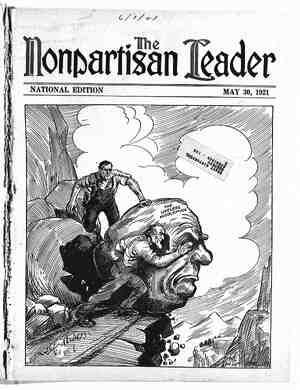

The Nonpartisan Leader Newspaper, May 30, 1921, Page 11

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

STICK AND WIN Editor Nonpartisan Leader: I am ~ sending you a copy of a letter I sent to Ole Kaldor, Fargo, N. D.: “Inclosed find cash for $10. Four dollars of this is for the North Dakota Leader for the past two years and one year more. The balance is for the knockout blow of the I. V. A.s.” Why not make it a national drive for the victory fund? We all know that it isn’t right to let North Dakota do all the fighting. Take the western part of North Dakota, where the farmers have had crop failures for four years. It’s mighty hard for them to even give a little. But give they will. They would rather see their FINANCIAL DATA Present Bonded Indebtedness, $247,000. Bonded Indebtedness, including this issue, less than 1% of 1 per cent | of Assessed Valuation. Value of North Dakota Property, estimated, $3,000,000,000. Coal Deposits, Estimated Sepa- rately, $6,000,000,000. Assessed Valuation of Property, 1920, $1,500,000,000. Total Value of Property Owned by the State, $80,000,000. families go hungry than lose the re- call election. let us stick once more. So, kick in, all you honest-to-God ° farmers and workers. Give it a punch that will be heard the world over. Let us all act and do it quickly. You would not see Wall street, grain gamblers, railrcad trusts and the like hang back. So why' should we? What is good for North Dakota is good for all the states. Let us hear from more Leaguers in regard to this. WE’LL STICK. OLIVER MATTISON. Borup, Minn. - ADVERTISEMENTS And win we must. So- North Dakota Bond Campaign Winning Labor Men and Progressives Aid Farmers in Plucky Fight Against Wall Street Dictation UPPORT from all parts of the United States is coming to back North Dakota in its plucky campaign of going direct to the people to sell its state’bonds after Wall street and bond firms had instituted a boycott against them. “That the bonds are an absolute!y safe investment is demonstrated again by the fact that the Chicago Tribune, AGRICULTURAL STATISTICS Population, 1920 Census, 645,730. Area, 70,000 square miles. Farm Acreage (in actual culti- vation), 17,033,885 Acres. Value of 1920 Farm Products, $225,000,000. Produces More Hard Wheat than any e*%.r State imthe Union. Value of Live Stock Production, 1920, $33,000,000. Value of Dairy Products, 1920, $23,000,000. The State of NorthDakota Offers at Par for Public Subscription $1,000,000 State Bonds Mill and Elevator Series Exempt From Federal Income Tax Including Surtax Interest payable semi-annually. Payable in Gold, January 1st and July 1st of each year, at the office of the State Treasurer at Bismarck, N. D. DENOMINATIONS: $100——-$500—-$1,000; These Bonds are a full faith and credit obligation of the State of North Dakota. MATURITIES: 1941—1946 They 'have back of them the entire taxing power of the State and contain additional features of security by the deposit of first mortgages on improved North Dakota farm.lands, in an amount equal to the par value of this issue. These mortgages run about 40 per cent of the value of each farm and are limited by law to 50 per cent of the appraised value. The payment of both principal and interest of these bonds is guaranteed and pfotected by the taxing power of the state of North Dakota and may be enforced by a direct tax levied on both real estate and personal property. This constitutes one of the best pro- tected and highest grade obligations ever offered to the public in the form of State Bonds. BANK OF NORTH DAKOTA Bismarck, North Dakota Make all checks payable to the Bank of North Dakota. Enclosed find $ follows: ... THE BANK OF NORTH DAKOTA, Bismarck, North Dakota. for which please send me 6 per cent bonds of the State of North Dakota as The right is reserved to reject any applications for the above bonds and also to award a smaller amount than applied for. NOTE: All payments must be made by check, draft or money order to the Bank of North Dakota. No representative of the Bank of North Dakota is authorized to accept payment for bonds in any other form than checks, drafts or money orders pay- able to the Bank of North Dakota, at Bismarck, North Dakota. (Write legibly) If for any reason you do not wish to order mow, mail the coupon anyway and ask for more information. advise early action. PAGE TWELVE * bonds besides. before accepting advertisements for the sale of the bonds, investigated them thoroughly. The Tribune has the reputation of being one of the most conservative financial papers in the nation, - Moody’s Investment Service, recog- nized everywhere as the highest finan- cial authority, has the North Dakota bonds listed in~its latest manual as “AAA”—the highest rating given. Some of the most prominent men in the country are enlisting in the move- " ment to sell bonds. Ex-Governor Foss of Massachusetts heads a Boston com- mittee that has promised to sell $100,- 000 worth. The Mount Vernon Sav- ings bank of Washington, D. C,, is receiving subscriptions in that city. In Cincinnati, Ohio, the People’s church, headed by Rev. Herbert S. Bigelow, not only subscribed to the bonds but adopted a resolu’lion sup- porting them and undertook to organ- ize a drive to sell $100,000. One me:a- ber of the Public Ownershiy lcagie sold $20,000 in one week in Chicage. Organized labor is supporting the drive manfully. One of the largest subscriptions to date has been $50,000 by Brotherhood of Locomotive Engi- neers Co-Operative bank at Cleveland, Ohio. The International Association of Machinists started the Washington (D. C.) drive with a subscription of $5,000 and is helping to bring the Washington quota up to $50,000. The Railroad Telegraphers’ union has deposited $50,000 in the Bank of North Dakota, many of the system federations have made deposits of from $2,000 to $5,000 and are selling More than $45,000 worth of bonds are reported to have been sold as the result of a single ad- vertisement in the Nation, New York, which circulates“largely among pro- gressives and liberals. . FINANCIAL WRITERS PREDICT SUCCESS In spite of the efforts of the news- papers to back up the Wall street boy- cott, financial writers on eastern jour- nals admit that the bond sale is going over. George Wheeler Hinman, finan- cial expert of the Chicago Herald- Examiner, commenting on the sale of $50,000 bonds to the laber banks in Cleveland, Ohio, commented, “That looks like success,” and C. B. Evans, financial writer for the Philadelphia - Public Ledger, wired his paper and others that take his service that the North Dakota campaign was “going over” despite the opposition of the banks. Governor Frazier and other mem- bers of the industrial commission at Bismarck are particularly anxious to have the terminal elevator bonds sold. This will enable work to be taken up again upon the state-owned terminal élevator at Grand Forks. It is de- sired to finish this, if possible, so that it can handle the 1921 crop. The publicity service of the Ameri- can Farm Bureau federation is boost- ing the elevator bonds and sent out a statement to newspapers throughout the United States recently that the mill and elevator bonds would be sold as a result of their indorsement. Usher L. Burdick, state president of the North Dakota Farm Bureau fed- eration and member of the board of directors of the United States Grain Growers, Inc., declared on his return from Chicago recently, that he found it necessary in the Chicago conference to speak plainly about the situation in North Dakota. : “There were so many knocks at North Dakota by members of our own