The Nonpartisan Leader Newspaper, March 21, 1921, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

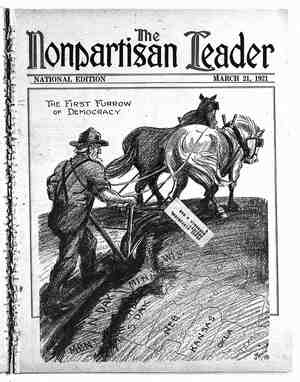

‘tion taxes would be passed on to the - new taxes. IN THE INTEREST OF A SQUARE EAL FOR THE FARMERS Entered as somnd cla« matter at the poslofflce at Minneapolis, Minn., under the Publication address, 427 Sixth uvenue S Mlnncapolh N Minn. Address_ail remittances to The Nonpartisan Leader, Box 2075, Minneapolis, Minn, VOL. 12, NO. 6 Ilonparnxan Iader Official Magazine of the Nnflonll Nonpartisan League—Every Two Weeks LIVER S. MORRIS, Editor. MINNEAPOLIS, MINNESOTA, MARCH 21, 1921 A MAGAZINE THAT DARES TO PRINT THE TRU Onb year, $1.50. Classified xates on clnssmod pnge o her advertising rates on application. Member Audit Bureau of Circulations: C. _Beckwith Spectai Agency, advertising: repunem.atlvm New York, Chicago, 8t. Louls, Kansas City. WHOLE NUMBER 268 $40,000,000 Battleshipsl and the Farmer’s' Taxes cussing the proposed Ralston-Nolan bill, some -for the bill as it stands, some desmng to see it amended ;and then passed and some against it whether in its present form or amended.” But one letter that asks, “Why should any new tax legislation be passed ?”’ goes to the heart of the matter better than THE Leader has received many fine letters from farmers dis- A Deficit any letter we have seen. That May The reason that the question of new federal Gr oW Sozn - taxes is before the government today is that the gov- ernment is spending more money than it is taking in. - At the same time large business interests have started a nation-wide propaganda for the repeal of the excess profits taxes, or the lowermg of such taxes, and the lowering of income taxes on ldrge incomes. If excess profits taxes should be wiped out altogether the annual deficit’ would be ralied to approximately $1,500,000,000.. If excess profits taxes should be cut in half the deficit would be about $1,000,000,000 a year. F THE program of the business interests goes through (and from present indications the president, congress and nine-tenths of the large newspapers appear to be ‘committed to this program) one of two things will have to be done if this coun- try is to escape bankruptcy. Either (1) expenses will have to be reduced so there will be no de- ficit or else (2) some- body else will have to pay the taxes of which big business is being relieved. The business interests are advo- cating the latter method. Their pro- posal is to raise a billion dollars a year by “consumption taxes.” Such taxes might be either general sales taxes of, say, 1 cent on each dollar’s worth of goods’seld, or specific taxes on certain articles, such as 10 cents a pound on tea, 2 cents on coffee, 2 cents on su- gar, etc., as recommended by the Na- tional Industrlal Conferénce board and officers of the American Farm Bureau federation. It is plain that such consump- CAN 1 HAVE THE CORE' Big Business Would Shift Tax Burdens consumer in every case and that farmers would pay just about as large a part of the taxes as the pro- portion that the farm population bears to the population of the coun- per cent of the population of the United States farmers would pay approximately 38 per cent of the billion dollars’ consumption taxes. S IT possible to reduce expenses so that the present deficit can - be met without imposing new taxes? For our last fiscal year government expenditures were divided as follows: Expenses of past wars, 67.8 per cent; present military and naval expenditures, 25 per cent; admmlsu'atlon of government, 3.2 per cent; public works, 3 per cent; public welfare, 1 per cent. These A Chance are the figures of Dr. E. B. Rosa, chief physicist, to Redil ¢ United: States bureau of standards. € Militarism, past and present, therefore accounts EXDenses for 92.8 per cent of our expenditures. We can not save on the cost of past wars. The money has been spent; it is “water over the dam.” Any savings that might be made on salaries of officials and clerks would be insignificant compared with the total amount of the national debt. The only chance for considerable saving is on the money we are now spending for militarism. If our naval and military expendi- tures could be cut in half and our excess profits taxes and income taxes kept unchanged, there would be no deficxt and no ne,ed for Why not do it? : 1 THE GLUTTON Of our total federal expenditures, 92.8 per cent go for war, past and present. No wonder there’s no core for the farmer, as John Baer shows. ‘try. As the farm population is 38 X tory durmg peace times, but by far the most expensive army in proportion to its size, because enough officers are being carried on the payroll to command twice the number of enlisted . men. We are building great battleshlps costing from $23,000,000 to $40,000, 000 apiece, at a faster rate than any Do We Want other nation in the world.. And there is serious to Get Into doubts in the minds of naval experts whether these Another War? great floating fortresses are worth their value in Another war: junk. Many experts declare the modern battleship would be an easy prey either to airplanes or sub- marines and for this reason Great Britain has ceased building them. Whether the dreadnaughts are effective fighting machines or not, it is plain that a race of armaments will lead Great Britain and Japan to compete with us and eventually some ruler will want to see whether they will work and we will have a disastrous war — disastrous whether we win or lose. A race of armaments will mean sure war. Agreement with Great Brit- ain and Japan to reduce armaments will not only mean peace, but will allow us, as a nation, to make both ends meet without lqvying any new taxes. HE United States senate has passed a resolution calling for a conference between the United States, Great Britain and Japan to dis- cuss disarmament. - If the new admin- istration wants to show that it stands for peace it should take steps toenter this disarmament conference without delay. There is no reason why the three coun- a. T PRESENT we not merely have the largest army in our his- Why Not " tries named ‘should a “Naval not reach an agree- Holi o ~ment. The test of oliday”? president Harding’s sincerity in regard to disarmament will be the representa- tive named to speak for the United States. " If the three governments name men who are sincerely anx- ious to bring about world peace, it can be secured. But if our repre- sentative is one of the ,]mgmsts who are all too plentiful in the high places, the conference might better never have been proposed. F ARMAMENTS can be cut in I half and excess profits and in- come taxes (the taxes nowPborne by big business) can be kept as they are, there will be no need for either the passage of the Ralston-Nolan bill or any other new taxes. Therefore farmers of the United States ought to fight, first of all, for reduction of armaments and for leav- ing taxes as they are at present. But if dny new taxes are to be created, farmers should pay close attention to see that such changes are not merely intended to throw the burden of taxation from the rich to Farmers Must the poor. . g Pt ¥ consumption taxes are levied, as explained Watch Their above, 38 per cent of them will be borne by the Congressmen farmers, and the small farmer will pay approxi- mately as much as the great landowner. The ad- voeates of the Nolan tax bill claim, on the other hand, that under this bill only about 10 per cent of the new taxes raised would be borne by farmers, and these only by the farmers with the largest holdings. The Leader believes that there should be no necessity of levy- ing any new taxes upon farmers. But if congress refuses to reduce afmaments and relieves large business interests of taxes they are now paying, the farmer should at least be alert to see that any new taxes that may be levied should be as equitable as it is possible to make them. i - PAGE THREE