The Nonpartisan Leader Newspaper, January 24, 1921, Page 8

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

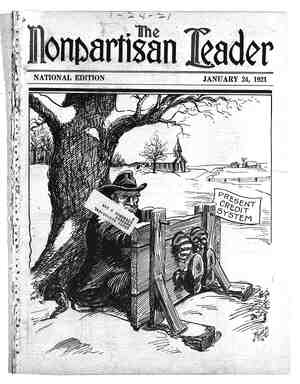

Somebody “Convertedf’ Head of Big' Business Tax Committee Denies Changes in Plans and \ Claims Approval of Farm Bureau Federation RESIDENT J. R. HOWARD of the American Farm Bureau federation was quoted in the last issue of the Leader as stating that his organiza- tion had “converted” wicked big busi- ness, as represented in the National Industrial Conference board, and had induced that organization to give up-its plan of urging congress to shift taxes from big business to the consumer. The exact words that President Howard used were as follows: ¥ “The National Industrial Conference board is a powerful organization representing the large east- ern business interests. When I learned this organ- ization was appointing a committee on federal tax- ation to make exhaustive research and recommen- dations I took the liberty to ask that agriculture be represented on the committee. Just that much in - way of explanation of how it came about. Mr. Mc- Kenzie has been in conference with the board since April. At that time the whole thought of the pow- erful business interests of the country was that our national taxes, totaling five or six billions of dollars every year, should be so readjusted that the burden of taxation would be passed from those powerful and wealthy interests and individuals and trans- ferred down to the consumer or common citizen of the country. Mr. McKenzie, in the beginning of these deliberations, was practically the only person who opposed such a program and I want to tell you “at this time that he has the majority of that pow- erful committee with him recognizing that it is a wrong economic principle to transfer the burdens of taxes to those least able to pay. We never can estimate in dollars the services which Mr. Mec- Kenzie has rendered and is rendering, but I con- sider it, as I said, very great indeed.” When we printed this statement by Mr. Howard we doubted whether Mr. McKenzie had really suc- ceeded in converting big business, as Mr. Howard claims, especially in view of the fact that Mr. Mec- Kenzie made no such claims himself. To get the facts in the matter the Leader asked its Washing- ton correspondent to look up the question and tell us exactly what the situation was. Following is the report of our Washington correspondentr— “The National *Industrial Conference board held a conference at New York on October 22- 23, as you know, and adopted a tentative program, which you are familiar with. I have it on the authority' of James Craig Peacock, chairman of the taxation commit- tee, that H. C. McKenzie, representing the American Farm Bureau federation, did oppose the repeal of the excess profits tax at that meeting and he was the only one ‘present who did. SAYS McKENZIE HAS SIGNED FINAL REPORT ~ “However, since.that meeting the final report has been signed and Mr. McKenzie signed the majority report, although it declares in favor of the repeal of the ex- cess profits tax. Evidently McKenzie’s op- position was lip opposition only. “The final report has not been made public, but Mr. Peacock informed me that it favors the repeal of the excess profits tax and the only change (to quote him) ‘is not a change in principle, but instead of recommending specific excise taxes on tea, sugar, coffee, etc., merely recommends that the balance of the amount to be raised to replace the income formerly obtained by’ the excess profits tax be derived by con- sumption taxes.’ passes the buck to congress. They want the excess profits tax repealed and the deficit raised by con- sumption taxes but they kindly permit congress to say what shall be taxed and how much. “I finally flatly asked Mr. Peacock if there was any justification for the statement that the Amer- ican Farm Bureau-federation had induced the Na- tional Industrial Conference board to change its tax program. He declared there was not and ex- pressed his surprise that such a report should be. put into circulation. He reiterated that there had been no real change in the program and could see no possible basis for such a statement. His state- In other words, the committee Most readers of the Leader have heard the story about the camper in the woods who called out to his compan- ions, “Come quick, I’ve caught a bear.” “Bring him here, then,” his friends shouted, but the other called back, “I can’t; he won’t let me.” For some rea- son the facts set forth on this page re- mind us of that story. We won’t tell you why. Read the article and see if you can judge for yourselves. ment and the fact that McKenzie signed the final report refutes the claim made by the American Farm Bureau federation officials. : “I tried to get McKenzie’s version of the affair but he is located in New York and seldom visits the local office.” : g This makes the matter a_straight question of veracity between Mr. Howard and Mr. Peacock. Mr. Howard says that big business, as represented by the National Industrial Conference board, was plan- ning to shoulder five or six billion dollars’ worth of taxes upon the common people, but that Mr. Me- Kenzie stopped them. .Mr. Peacock denies that any change has been made in the essential plan of the National Industrial Conference board, which is to repeal the excess profits tax, lower the income taxes on large incomes, and make the consumer‘pay the difference. - The ‘only change made in the program, according to Mr. Peacock, is that instead of recom- -But Who? mending definite taxes such as 10 cents a pound on tea, 2 cents a pound on coffee and sugar, etc., the committee recommends that whatever consump- tion taxes are necessary to lift the tax burden from . the shoulders of big business be levied. Mr. Pea- cock glso says that Mr. McKenzie has already sign- ed this report, in spite of the fact that he first said he was opposed to repealing the excess profits taxes. 3 According to Mr. Howard, 'the American Farm " Bureau federation has “converted” big business. | SO HE SAYS | 170 -/ /’/ /) AV, N \ o\ N 95 N A N NN NN N R NN NN N — 3 —Drawn expressly for the Leader by John M. Baer. . PAGE EIGHT ‘ * /A 1/ 7 / 7, // A ) 7 / [ According to Mr. Peacock, big business has “con- verted” the American Farm Bureau federation. Which do the readers of the Leader think is right? Since our last issue the Leader has had another letter from President Howard of the American Farm Bureau federation in which he says: HOWARD CLAIMS HE IS STILL STANDING UP FOR THE FARMERS “As a result of the work of the National Indus- trial Conference board committee a tentative report was made in October. That is the report concern- ing which Mr. Gregory’s article was sent out. It was merely a report of progress and not of finality. After three days’ discussion the tentative report was not adopted but the committee was instructed to further consider the matter and issue a final re- port, which I understand is now in the hands of the printers. This final report will be followed by an- other conference called by the National Industrial Conference board, which may accept or reject or amend the report. ¢ “I do not know the exact date of this final con- ference but Mr. McKenzie and myself will both at- tempt to be present and enter into the discussions. We will give them clearly to understand that we will not be a party. to this report if in any sense it does not conform to our original four proposi- tions. * * * “So far as the 12 proposed new taxes, which were listed by Mr. Gregory in the publicity which he sent out, I wish to assure you that the matter was one of information and not of adopted policy. Any rumor that we favor repeal of the excess profits tax is pure ‘bunk.’ ” : The Leader wishes to make only two com- ments in regard to Mr. Howard’s statement. Mr. Howard says that the report sent out by Mr. Gregory was merely “a tentative report,” and that “the matter was one of information and not of adopted policy.” If it was not a matter of adopted policy why did Mr. Gregory’s report state: “Farmers have won a great victory. * * * They can no doubt indorse most of the proposed new taxes”—10 cents a pound on tea, 2 cents a pound on sugar and coffee, ete.? Mr. Howard says: “Any rumor that we favor repeal of the excess profits tax is pure ‘bunk.’” But according to our correspondent at Washing- ton, Mr. McKenzie has already signed the report recommending the excess : profits tax repeal. As "the Leader stated in a recent is- sue a number of or- ganizers of the American Farm Bu- g &> “ first attempted to deny the truth of the Gregory report, while individual farmers who wrote to headquarters of the American Farm Bureau fed- of the report failed to get them, be- ing told, in some cases, that the of- fice in question knew nothing of the Gregory report. ; We are glad to say that one or- ganizer, who knew nothing about the Gregory report until it was called to his attention by a Leaguer at a farmers’ meeting, is on the trail after the truth. We quote the fol- lowing letter verbatim: : Editor Nonpartisan Leader: In your issue of December 27 you. pub- lished a letter from W. H. Hawkyard y - ‘reau federation at eration or to state offices for copies - L4 ‘U, wlle