The Nonpartisan Leader Newspaper, January 24, 1921, Page 10

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

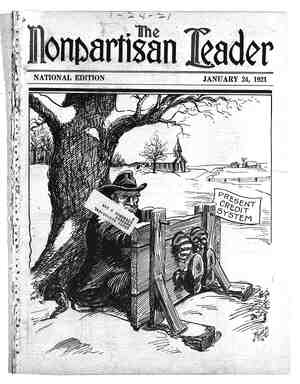

‘products. L Why Kaiser Bill Nearly Won the War Government Aid to Farmers and Co-Operation Built Up a Poor Farming Country Into One of the Most Powerful in Europe This is_the third of a series of articles on agricultural co-operation and government aid to farmers in Europe. The bfourth article in the series will appear in an early number. URING the war Germany stood off most of the rest of the world for more than four years, during which time virtually all foreign imports were shut off by the British navy. Germany’s area is less than that of the state of Texas, but the population of the country at the time the war started was 66,000,000—two-thirds as large as the population of the United States. Ger- many’s soil is poor—even the early Roman invaders commenting on this fact., With its small area, its poor soil and its large population, how was Germany able to feed its peo- ple during the war? : The answer is that agricultural co-operation, gov- ernment crop insurance and cheap money to farm- ers enabled German farms to increase their produc- ,tion far above the production per acre in the United States. Government help made it possible for every German farmer to put every acre at work at a profit, no matter how poor its soil. : Government aid in getting German farmers money on easy terms started in 1776 under the reign of the late kaiser’s ancestor, Frederick the® Great, more than 150 years ago. In this year the first “landschaft” was created by government au- thority. The German landschaft corresponds roughly to the federal farm loan bank of the United States. It is an association of landowners to borrow money on real estate mortgages. The German landschaft takes the property that is pledged and issues bonds against it, which are sold on the open market, just as the federal land banks do in the United States. But instead of selling the bonds itself and giving the owner of the property cash the landschaft gives him the bonds which are readily negotiable. The landschaft system was highly successful in getting money needed by landowners. Loans were made up to two-thirds of the value of the property (instead ot one-half as in the United States). In 1912 the landschaften of Prussia (only one prov- ince or state of Germany) had issued bonds of 3,000,000,000 marks (about $750,000,000), prin- . cipally at 8% per cent interest. 3 In other words, Germany 150 years ago was as far ahead, in giving government aid to farmers, as the United States is today. But Germany did not stop at this point. GOVERNMENT AID AND CO-OPERATION WORK TOGETHER Under encouragement from the government co- operative associations of all kinds were organized. These included co-operative granaries of from 5,000 to 10,000 tons, much like the country elevator sys- tems of the United States, co-operative dairies and creameries, co-operative societies for the purchase of fertilizers and agricultural machinery, co-opera- - tive insurance societies, even co-operative societies for the purchase of electricity at wholesale and its distribution to members. Hand in hand with the co-operative activity, which was itself encouraged and aided by the gov- ernment, went government ‘action. There was gov- ernment ownership and control of railroads and representatives of the farming interests were ap- pointed or 2 national board to determine what would be fair rates for farmers to pay on their To encourage deposits.in savings banks, which could then make loans to farmers, the gov- ernment guaranteed savings bank deposits. There was also government fire insurance and hail insur- ance for farmers and insurance against the loss of horses and other livestock. It is difficult, in' many cases, to draw the line be- tween what was done for German farmers by the government and what they did for themselves by co-operation. In the line of insuranece, for instance, the German government has insured buildings against fire at cost since 1811 and has insured crops against hail since 1884. In both of these cases the individual farmer deals directly with the state. In the cas. of livestock insurance, however, the insur- ance is first written by local co-operative societies, and the local insurance societies’then reinsure their risks with the state. Now that the war is over military men make no secret of the fact that early in 1918, before the United States had- been able to get into the fight with both feet, Kaiser Bill had practically beaten all Europe. The allied line had been broken and one or two fresh divi- sions, thrown through this gap, would have meant the complete rout of the allied forces. How did it happen that a small country, smaller than one of our states, was able to become a world power? It was because Germany’s ar- mies were backed hy a food supply from some of the most productive farms in the world, in spite of the fact that Germany’s heritage consisted of lands so poor that most Ameri- can farmers would turn up their noses at them. One of the greatest developments in modern co- operation started in Germany approximately 70 years ago when the organization of Raiffeisen banks was undertaken. Up until that time Ger- many had, in the landschaften, approximately what the United States has today in the farm loan banks. - Owners of improved farms could get mortgage loans, as in the United States today, but there was * no provision for the tenant farmer or for short- time loans pending the sale of crops. F. W. Raiffeisen, born in 1818, is responsible for - GOING UP! Farmers in the United States have only a few publicly owned markets and warehouses compared with the the development of the mew system. Raiffeisen said: . “Basing credit only on land ‘vélue is wrong. . Every man is entitled to credit based on his earning ability. In the case of any one man there is an ele- ment of risk; he might die or prove dishonest. But in the case of 20 or 50 or 100 men, grouped to- - gethel, each guaranteeing the other’s accounts, there is no risk.” The Raiffeisen banks were started. They got government approval early and proved a tremen- dous success. . Each bank was organized in a country town or village. Farmers, agricultural laborers and others subscribed to member shares, which ranged from $10 to $25 apiece. the society. ; The Raiffeisen banks also accepted deposits from ‘laborers, townspeople and others, paying 4 per cent interest. Repayment of these deposits was guar- anteed by the government. Before the Raiffeisen banks. were organized the German laborers and small farmers in the main kept their small savings wrapped up in an old stocking or in a strongbox at home. Deposits of a few marks were neither sought nor welcomed by the commercial -banks, which operated principally in the larger towns and cities and were out of touch with the farming popu- lation. The Raiffeisen banks therefore opened a tremendous field of hitherto untouched -credit. Thousands of German emigrants who had gone to the United States sent their savings back to the local Raiffeisen bank, rather than trust them to the commercial banks of the United States, which lack- ed government or state guaranty of deposits. RAIFFEISEN SOCIETIES GIVE PERSONAL CREDIT AT LOW COST But besides the revenues that were obtained from members’ shares and from deposits the Raiffeisen societies found no difficulties in selling securities, based on the earning power and personal credit of their members as a group, at 4 per cent interest, enabling them to make whatever short-time loans were required by their members at 4% per cent. The expenses of the local Raiffeisen society were small. The only paid officer'was the cashier and he was paid a commission on the amount of money handled. One small room constituted the bank’s- offices and often this room was in the private lodg- ings of the cashier. To give them greater strength - and add to their borrowing power the local societies banded together in each German state and the state federations were in turn federated in a national fed- eration. Both the state and national federations received government support and aid. Such-tremendous success was met by the Raiffei- sen societies that they rapidly spread all over con- tinental Europe and then to the British isles. As a matter of fact the United States today is the only large civilized country which has no provision for short-time personal credit to its farmers. In 1912 there were 20,431 agricultural co-opera- tive societies of various kinds in Germany. Ap- proximately one-half of these were credit societies, thousands in Europe. This picture- was taken at onie of them—the public warehouses of the port of Se- attle. It shows sacked Washington wheat being elevated in the warehouse, where it can ‘be “held: at* the farmer’s: order, until a good market opens. " - PAGE TEN : L) ’ \ This constituted the capital of ryl“”! L4 o L 1" S