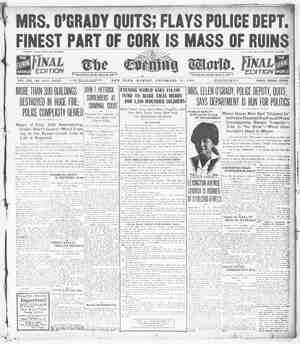

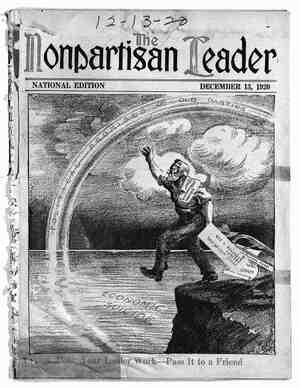

The Nonpartisan Leader Newspaper, December 13, 1920, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

' IN THE lNTEREST OF A SQUARE DEAL FOR THE FARMERS ¥ med as seeond-clm matter at the posl:omu :t Mlnnen der the act of M lflnn tiulédz;_gdramh emltu “ea) The N rti s all r nces n san Leader, Box 2075, Minneapolis, Minn, Dfl VOL. 11, NO. 14 e lonnartigan Toader o] Official Magazine of the Natmnal Nonpartisan League—Every Two Weeks VER S. MORRIS, Editor. MINNEAPOLIS, MINNESOTA, DECEMBER 13, 1920 A MAGAZINE THAT DARES TO PRINT THE TRUTH One year In ndvmee 32 .50 ; eix months, $1.50. C]ns other adverualn ra s Member Aud". Bureau of Circu Spe ency, advertising repreuen uuves New York. Chicago, St. Lo Louis, Kansas City. WHOLE NUMBER 261 on a llcnu cpp okwllh ‘Bank Wreckers Trymg to Rum a Whole State NE year ago bank wreckers seized.the Scandinavian Ameri- can bank of Fargo, believing that by “breaking” it they could break the Nonpartisan league. It was an astounding plot. It failed because the bank wreckers, adopting illegal methods, were thrown out by the supreme court of North Dakota. But the plot to wreck the Scandinavian American bank, hatched up by anti-League politicians and bankers, ‘was a The Situation small matter compared with what the same in- terests are domg in North Dakota today ) One Year Ago As this is written 18 country banks in North —and Today Dakota have been compelled, at least temporarily, to close their doors. More are being added to the list every hour. By the time this issue reaches our readers the num- ber of banks closed may-be doubled or quadrupled. It is hard to write calmly of a deliberate attempt to bring finan- cial disaster and suffering upon a whole state. But here, in plain words, is what is happening in North Dakota today: ORTH DAKOTA has two main geographlcal divisions. The ; eastern third of the state, principally in the Red River val- ley, was the first portion settled. It has abundant rainfall, is more convenient to the markets of the Twin Cities and conse- quently has as much wealth as all the rest of the state. The' western two-thirds of North Dakota is newer country and is largely farm- . Why Bank of ed under “dry North Dakota tons. While bad Was Organized et years may mean partial or total crop failures, on the other hand farmers have on occasion grown on its virgin soil in one year a crop that would pay the total cost of the land. But both eastern and western North Dakota are but parts of one state. When the Bank of North Da- kota was organized it was planned to help bind the two sections closer together and to enable them to help each other. In a year of heavy rain,’ for instance, many of the farming .sections in the east will be flooded. Or the eastern crop might be spoiled by rust, while the west was bearing bumper crops. -Under such circum- stances eastern counties would need help from the west and this help the Bank of North Dakota, custodian of all public funds, could easily give. : INCE the Bank of North Dakota S has been in operation, however, the demand for money has been in the opposite direction geographically. For four years western North Dakota had partial- or total crop failures. - Farmers were compelled to get their notes renewed at their couyntry banks and to borrow more money. This year the western part of the state had a fair crop. It was not a bquer crop, ‘but under ordinary conditions farmers could .. have sold it and paid off all their loans. But just “Blg‘ Squeeze”\fis the crop was harvested graln gamblers at Chi- Started b cago and Minneapolis, anxious to get the wheat arted DY - fora fraction of what it was worth, “rigged” the the Gamblers market and beat the price down, down, day after day, far below the cost of production. western North Dakota would not and could not force nelghbors to dispose of their grain. ; : ank of North Dakota dozens of banlk- failures in the la mer and early fall. How was - ;v\‘lso anofallpubl .0 r t ‘apkers of | funds allows the e posats the great l : THE BIG SQUEEZE l : ¢ : Under. 4 )I,hese clrcumstances the farmers refused to sell and the country prevent this? %& The law ereating " Bank of North Dakota sees ede PAGE THREE * bulk of the public funds in the same section that raises the funds, but to help the western part of the state, just as the eastern part of the state would need help if it had experienced four successive years of crop failure, more than $1,000,000 of the public funds were re- deposited in the western counties in addition to their own funds. With this help the western banks could have continued business ‘until the farmers of their section sold their crops. If they needed any further help the Bank of North Dakota stood ready to give it. ESIDES using the public funds to prevent bank failures the Bank of North Dakota had loaned approximately $3,000,000 to farmers at 6 per cent interest, at least 2 per cent lower than the rate prevailing throughout the state before the people’s bank started operations. It was this use of the people’s funds to benefit the people, instead of to E‘Oh%i?lcltlfime benefit the private bankers, that aroused the 5 € bankers and professional politicians. They pre- - - People’s Bank pared an innocent looking bill and submitted % at the bill, they said, was to allow cities, school districts and other po- litical units to get a better rate of interest on their funds than they could get from the Bank of North Dakota. But the bill did not re- quire these funds to be placed at higher interest. It allowed the local politicians, controlling the city, county or school district, to deposit their funds with any private bank they chose, regardless of the rate of -interest or Whether they got any in- terest at all. The Nonpartisan league called attention to the dangerous features of this bill, but misunderstanding of its purposes enabled it to be adopted by a margin of less than 8,000 votes, although it received less than half of the votes cast at the election. HE adoption of the initiative ’ law not only prevented the . Bank of North Dakota from lending any further aid to the banks in the western part of the state, but with I. V. A. politicians of eastern ; N orth Dakota Impos sible demanding im- mediate surren- Now to Help der of their Western Banks funds, the Bank : of North Dakota had to notify the western banks that they must be ready, if necessary, to pay in cash the $1,000,000 that would probably be demanded immediately by the bankers in the eastern part of the state, and much of which ale ready has been demanded by them. The result was that the western banks, one after another, with no hope of securing the comparatively slight help that would have enabled them to pull through the next few weeks or months, until the farmers could sell their crops, had to close their doors. THERE is’a bad financial condition in North Dakota today.. But in Minneapolis, Saturday, November 27, the little group of conspirators who deliberately brought about this condition had a meeting to congratulate each other. The secretary of the North Dakota Bankers’ association met with s the “investment bankers” of the Twin Cities ll;fi‘zpfi(;l:;l lgeg to tell them what had been done. These “in- Bank gage vestment bankers” are the members of the ankers Rejoice Mortgage Bankers’ association, which claims credit for putting the federal land banks out of business. With the federal land banks out of business the farmers’ only source of cheap money was the Bank of North Dakota. Now they believe that the Bank of North Dakota is out of business and they announce in the Minpeapolis Tribune that they are ready to “re-enter the state of North Dakota to assist the farmers”-—thh 10 and 12 per cent money! ey s e P s e e LA S the recent election by initiative. The purpose of - 8 { | IS E § i e T 1