The Nonpartisan Leader Newspaper, October 18, 1920, Page 7

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

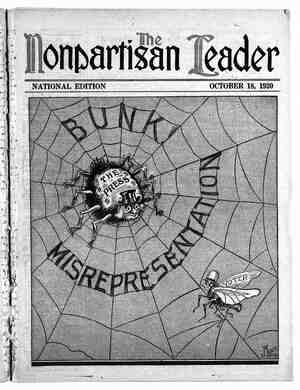

Farming, National Stockman and Farmer, Okla- homa Farmer, Orchard & ¥Farm, Power Farming, Southern Agriculturist, Scuthern Planter, West- / ern Farm Life, Western Farmer, Wisconsin Farmer. * In February, 1919, a joint meeting was held by representatives of the National Implement and’ Vehicle association and the Agricultural Publishers’ association. The purpose of the meeting' was to devise means of influenc- ing the farmer to believe there was mno possibility of price reductions. A - statement to this effect, prepared by C. S. Brant- ingham of the Emerson- " Brantingham . company, was reéad. This was sup- ported by statements of four other implement manufacturers. Three arguments were present- ed by all these men as the basis of the ‘“bunk” that should be fed to the farmers. These argu- ments were that: (1) The increased value of farm products emabled farmers to buy high-pric- ed implements. (2) Lower implement prices would start a general price-cut- ting movement and would Taxes bring lower prices for farm products. (8) Farm- ers should buy more high-priced implements and increase production while prices of farm products remained high. Notice that while the meeting’ was a joint one, between the implement manufacturers and the rep- resentatives of the so-called “farm papers,” the I PUZZLE—WHO PROVIDED THE BREAD AND CHEESE? I —Drawn expressly for the Leader by W. C. Motris. propaganda was prepared altogether by Branting- ham and his four aides, all 1mplement manufac- .turers. It was decided to issue a pamphlet setting forth the statements of Brantingham and the four other implement manufacturers. It would be perfectly proper, of course, for the implement manufacturers to put out such a pam- phlet, under their own name. It might even have been proper, by straining a point, to put the pamphlet out as the joint production of the ° implement - manufactur- ers and the “farm papers,” since the “farm papers” were represented at the meeting, although they did not prepare any of the data and knew nothing about the truth of the statements they- contained. Instead of that, how- ever, it was decided that the so-called “farm papers” should - deliber- ately sell out their mil- lions of farmer readers. The pamphlet was put out under the name of the Agricultural Publish- (Continued on page 9) Are Lowered in North Dakota Frazier Administration Keeps Promise to the People—Economy of Farmer Off1c1als Bears Fruit in Big Savings ORTH DAKOTA taxpayers got a pleas- !| ant surprise when the state board of equalization recently fixed state taxes and property valuations. That is an unusual sort of a surprise for tax- payers to get in any state. . Total state taxes in North ;Dakota, payable next year, will bé $828,853 less than the state taxes paid this year. At the same time North Dakota will raise for its returned service men nearly half a million dollars more than was raised last year. But for the increased tax levy for " the soldiers’ bonus North Dakota taxes would be reduced considerably more than $1,000,000. Here are the levies, in mills, made in North Dakota in 1919 and 1920, the taxes of both years being paid the followmg spring: rection of the last legislature, and the balance of the saving has been handed back to the taxpayers. Farmers in North Dakota will find even greater savings than the 221 per cent indicated above when they get their next tax assessments, however. The reason for this' is that the state board of equaliza- e £ North Dakota’s taxes, dufing allthe time since the Nonpartisan league started to operate, have been lower than those of other states, in propor- tion to population. Here is a comparison with anesota of 1919 taxes: Population by S(:nte ta.xes, u. Sf lggtasus $14,400,743 2,386,371 $6.03 3,678,039 645,730 5.69 Minnesota EErsTnanTsanresm $6.03 North Dakota.. SRy 5.69 North Dakota taxes have also been much less in proportion to acreage. Here is the comparison Per capita Minnesota North Dakota.. _ with Minnesota: 1919 levy 1920 levy taxes taxes Funds paid in 1920 paid in 1921 General ... 1.7025 mills 1.044 mills *Bond interest and sinking ... .2100 mills .106 mills 3 Soldiers’ bonus ... .5000 mills 760 mills Total ... il .2.4125 mills 1.900 mills This is a reduction of 21 per cent in the total levy in mills. - However, the reduction in money actually raised will be even greater than this because the total valuation of property for taxation purposes was lowered slightly. ONE MILLION DOLLARS’ SAVED IN GENERAL FUND Here are the levies, in dollars, the amount levied in 1919 (and paid this year), being com- pared with the amount levied in 1920 (pay- able next year): 1919 levy- .. 1920 levy . taxes taxes Funds ' - paidin 1920 paid in 1921 General ..................$2,694,179 $1,566,655 <Bond interest and i sinking ................ 319,987 155, Gg " Soldiers’ bonus ... 761,873 1,125,000 Total ......cee..-...$3,676,039 $2,847,186 : This is a reduction of 22% per cent in the " total state taxes. The general fund has been reduced 40 per cent and the bond sinking and interest funds 50 per cent. A part of this saving has been applied to increasing the sol- diers’ bonus fund 48 per cent, under the di- N. Dakota, 1920 smmesm : STATE TAXES, PER QUARTER SECTION 1919 Minnesota. North Dakota. L 10.10 But with the North Dakota tax reduced, the’ per capita tax in that state is reduced o $4. 41 and the difference becomes; still greater, as shown: by this diagram: STATE TAXES, PER CAPITA 1919 AND 1920 Minnesota, 1919: North Dakota, 1919, S North Dakota, 1920.. SEEsEmm 5.69 441 The amount of the tax on the acreage basis is also reduced still further, as is indicated by this diagram: STATE TAXES, PER QUARTER SECTION, 1919 AND 1920 A ~ Minnesota, 1919 —_I—$28.25 : N. Dakota, 1919 meesmmmes 12%3 North Dakota and Minnesota are compared be- cause both states pay soldiers’ bonuses. figures for anesotas 1920 taxes are not-yet avallable s —~ PAGE SEVEN . State taxes 2 Definite - § T B T T R T A T r ST oo tion found that farm property was valued somewhat tou high in proportion to the returns that were be- ing earned. Consequently the ‘valuations of farm property were reduced quite generally. On the other hand,. the board of equalization found that city property, owing to the high rate of returns being made by rent profiteers and business houses generally, should be assessed on a higher valuation. The result is that city property will pay a considerably higher share of the state taxes than it has previously. It is an unusual thing for any state admin- istration to reduce taxes. Last year every state in which the League operates had -a- creased taxes. They were necessary because of the increased grice of ‘everything. In addi- tion North Dakota, Minnesota and Wisconsin provided soldiers’ bonuses, North Dakota $25 per month, Minnesota $15 per month and Wis- consin $10 per month. In spite of paying the largest bonus North Dakota’s taxes increased less than the taxes of elther Minnesota or Wisconsin. - < PROMISE OF ECONOMY /IS BEING FULFILLED North Dakota’s farmer officials promised their people, however, that not one cent of the money would be wasted and that as soon as it was found possible a reduction in taxes would be made. That time has now come. When the state board of equalization met the state treasurer reported that the balance of money-on hand in the general fund was the largest in the his- tory of the state. This was because the state industries had largely been put on a self-sus- taining basis, and had returned money ad- — vanced them to start operations. It was also due to the economical administration of Gov- ernor Frazier and other farmer officials. Anti-League papers in North Dakota and other states, which were full of wild stories - about North Dakota taxes a few months back, are strangely silent now since the state board of equalization has fixed the 1920 levy. As this article is written the Leader has not learned of any other states that have reduced " their taxes. {The Leader intends to secure whatever information is possible from other states and will present it in future issues so that the people can learn the full truth about the tax situation: