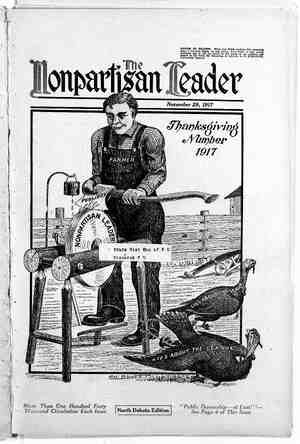

The Nonpartisan Leader Newspaper, November 29, 1917, Page 9

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

¥ ADVERTISEMENTS Where You Get Value Received For Your Money Hotel Metropole —and— The Cole Hotel European Plan REP. E. E. COLE, Proprietor Rates 50c and $1.50 BOTH ON _N. P. AVENUE FARGO, N. D. N R G TS S R R RTIE TR THE GARDNER European Plan. FARGO, N. D. | 13 ;om)%ionation sample rooms with bath, 70 rooms with running water, $1 to $1.50. 80 _rooms with bath, $1.50 to $3.00. Finest cafe in the Northwest. Cuisine unequalled. Restful, quiet—only hotel in the city not on a car line. A. H. Leimbacher, Mgr. The WALDORF and ANNEX HOTELS 240 rooms. Recognized as the pop- ular stopping place for Nonpartisan Leaguers. Prices Reasonable. _Keller & Boyd, Props., Fargo, N. D. Year 23 Endowment is the Best Life Insurance in the world today. For full particu- lars and also a free facsimile of Lincoln’s famous Gettysburg address write today to TOM HUGHES, Vice Pres. Lincoln Nat'l Life Ins Co. Ploneer Life Branch Fargo, N. D. Help Wanted Our I The war is creating a big de- mand for young women and young men with a knowledge of bookkeeping, shorthand, type- writing, etc. Attend the Union Commercial College, Grand Forks, N. Dak., and prepare for a good position. Board $3.25. Send for free catalog.—Adv. ave 30%, On your Plano or Player. Let us ex- plain you our prop- osition, Fargo Music Co. Factory Distributors 516-1st Ave N. Fargo, N. D. WesternHide &FurCo. 301-303 Front St., Fargo, N. D. Pays the highest prices for Wool Hides, Pelts, Furs and Tallow. 1 Write for Price Llist ~working order, State Managed Rural Credits at Cost Farmers in Canada Now Have Short Term Loan Law and Prefer It to Bank Borrowing TATE managed rural credits at cost. Did anyone ever hear that phrase before? It is one of the planks of the Nonparti- san league platform. It has been signed as a goal to work for by nearly 140,000 farmers in the western United States. That is one of the things they want, This phrase was first coined and made part of a polit- ical issue in North Dakota—along the Red River of the North—and today it is in operation on both sides of that same river—but on the Canadian side .of the international boundary, not on the American side. This Canadian law was enacted at the 1917 session of the Manitoba legis- lature at Winnipeg, at the very time when the Nonpartisan league in North Dakota, was putting the first parts of its program up for enactment at Bis- marck, It is now in operation in Manitoba and giving immense satis- faction to the farmers. CANADIAN LENDERS FOUGHT LOAN LAW As on the United States side of the line, this plan had the opposition of the money lenders. There were men in the Manitoba legislature who declared most farmers were prosperous enough’ without “state aid,” and that those who weren't were shiftless. They said the money lenders would give every worthy farmer all the credit he de- served, and that the only farmers who would want to join a rural credits as- sociation would be those who were financial and agricultural failures. After the law was enacted some still continued 'to treat it with contempt, and tried to get farmers to shun .it, but the farmers knew it was their sal- vation and they eagerly did their part to make the law effective. Under this Manitoba provincial (state) rural credits law, farmers can get short term loans for any legitimate purpose for which funds can be want- ed on the farm. It thus gives a form" of relief that the federal farm loan law: of the. United States does not give— namely short term loans upon security other than farm land. It is in being re- stricted to long time loans and to realty as the only security, that the United States law fails to meet the full requirements. Canadian farmers now are getting loans running from a few months up to nearly one year for the purpose of buying livestock, farm machinery, pay- ing wages to hired help, contracting for the breaking of land, planting and harvesting crops, and the purchase of feed and other supplies. Many farm- ers have already been saved the neces- sity of sacrificing crops where in former years they had to let go of everything to satisfy the local bankers. They are getting abhead hundreds of dollars this year, where in the past they have been only able to hold their own or have suffered an actual loss— Jjust for want of a ready short term loan, which their local bankers refused to give them. Also a great amount of breaking has been done, that farmers were unable to do in previous years. PROVINCE COMES TO AID OF FARMERS To get these loan facilities it requires 15 farmers to form the nucleus of an association. When the 15 have organ- ized, the provincial government ap- points an expert to act as temporary secretary and treasurer until a perma- nent one is named. When 60 farmers have joined, each subscribing $100, and when 10 per cent of their subscriptions have geen paid in, then the government puts in its share, which is 50 per cent as much as the individual farmers have subscribed, and the municipality in which the society is formed, puts in 60 per cent as much. That is to say, when 60 farmers have subscribed for $5000 worth of stock at $100 each, the province subscribes for $2500 and the municipality for $2500, The munici- pality may use its bonds instead of cash if it wishes. ‘With this $10,000 as a basis, the so- ciety establishes a line of credit with some bank, and borrows money at 6 . per cent, which it reloans to its indi- vidual ‘members at 7 per cent. One such society now in operation has es- tablished a $30,000 credit on this basis, and it is. confidently believed by those who are watching its operation at close _range, that $100,000 of credit will be available on $10,000 original security as soon as the law gets into general No interest is paid until the money is actually withdrawn. Thus a farmer who has secured $1000 of credit through the local association begins to pay interest on the install- ments he draws out when he draws, and the balance remains to his credit but without drawing interest until he actually wants it for use. HAVE STATE RURAL CREDITS AT COST With this 1 per cent margin between what the society pays and what the farmer pays, the expenses of adminis- tration can be met. Thus the Canadians have state managed rural credits at cost. These farmers by putting up $5000 of cash (or part notes for the still unpaid portion of the $5000) have se- cured $30,000 of credit immediately available, through the co-operation of their state and county government, or what in the United States would corre- spond to state and county government. The province names three out of nine directors for the association, the muni- cipality names three, and the farmers name three, and these decide upon the financial soundness of the applicants for loans, decide how much to allow, and see that the applicant gives proper security. It is in the kind of security allowed, that this rural credits act excels. The farmer has no red tape to unwind. He simply gives his personal note to the society, together with a mortgage upon what he purchases, or the produce from the land he is to cultivate, and gets his money. This of course be- comes additional security beyond the farmer stock subscriptions and the provincial and municipal subscriptions on which the line of credit was origin- ally established. These notes can not run longer than to December 31 of the year in which they are negotiated. If the farmer needs an extension he ap- plies to the society and if his applica- tion is approved, he gets an extension. ALL PARTIES MADE FINANCIALLY SECURE . Suppose a farmer borrows $1000, half of it to be used in buying livestock, $200 for machinery, and $300 to put in a crop. For the first $500 he gives his note and mortgage on the livestock and all of their offspring, pretty good se- curity, but security upon which bank- ers generally refuse to extend credit; : for the $200 he gives his note and mort- gage on the machinery; for the $300 his note and mortgage on the entire crop. Thus the society is entirely safe, and the interests of the province (or state) and of the municipality are fully safeguarded. The advantages of this kind of credit- have already been shown by the fact that Canadian farmers are now using it for all of these purposes. And these are not the so-called shiftless farmers either, but the well-to-do. Some of them have large loans, some small loans, sums as small as $150 for a few months’ time having been advanced. And the farmers say they like it far better than dealing with the local banks under the old conditions. Farm- ers who had plenty of assets to get their loans from the banks, preferred doing business with the society, which is doing business with the state, KEEP UP THE FIGHT Dunkirk, Mont. Editor Nonpartisan Leader: Inclosed find clipping I just ran across. I thought it might be of in- terest to you to see how the plutocratic press will grab everything they can find to try and halt a forward move. But stop for nothing, we are on the right track and will sure crush them at the switch in November, 1918, Yours for the Nonpartisan league and more of it. CARL. E. FORSHEND. The clipping, from the Spokesman- Review of Spokane, Wash, attempts to create a false impression that the League is bankrupt.—THE EDITOR. ANXIOUS TO WORK Synarep, Wash. ‘Washington State Headquarters, National Nonpartisan Ledgue: Please advise me as to what is being done in this county in regard to organ- {zation of the Nonpartisan league, If you give me authority to organize here, I can round them up. I am the principal of the Synarep school. Keep me posted. be able to.take the field and help push the League, § i W. A. THOMAS. ORD IS BOOSTING Orb, Neb. Editor Nonpartisan Leader: Nebraska has a Valley county of which Ord 1is the county seat, that takes care of 11,000 true blue “Sam- mies.” Ord has two of the leading weekly papers of the state. Both read the Nonpartisan Leader and are boost- ing the League along. J. THULL. = PAGE NINB ‘When school is out I may. ADVERTISEMENTS ceocecccecccccccccee “A Diamond store for a Generation’ SHOP EARLY Christmas is not far away. Why not, this year, give her a watch or wrist watch? It is certain she will enjoy one wonderfully well. We have them in a wide variety of styles at $12 and Up Then we can please her in neck- laces, brooches, lockets, rings, tea sets, knives, forks and a thousand and one other items in gold, silver and novelty goods, at prices to suit every purse. Call and see us or write us today. ‘Mail orders given special atten- on. Hagen-Newton Co. JEWELERS—OPTICIANS FARGO, N. D. YCANDINAVIAN H. J. Hagen, President Lars Christianson, Vice President . J, Hastings, Vice President . G. Eggen, Cashier . J. Brevig, Ass’t. Cashier We invite the Accounts of Banks and Individuals The Bank of Personal Service. 74 % MORE LIGHT ON THE ROAD ROAD RAYS NOT "SKY"RAYS. NO GLARE NO NEED FOR DIMMING § COMPLIES WITH ALL STATE LAWS The Fargo Cornice & Ornament Co. Fargo, N.D. If You Love Mother see that she has plenty of Manchester Biscuits Always on hand. Then no matter if you have company come in unexpect- edly she will be able to get up a nice meal in short order. The children will appreciate it if you put them in their lunch basket. We have biscuits for every occasion. Try them with jam or jellles instead of tarts or ples. Made in a sanitary factory. Manchester Biscuit Co., Fargo RADIATORS SERVICE TIRE CO. WADE H. MURRAY, Prop. 419 N. P. Ave,, Fargo, N. D. ‘_ Tire Repairing and Vulcan- izing. All work guaranteed. CYLINDERS REBORED And. fitted with larger pistons and rings. We weld and machine every- thing. Satisfaction guaranteed. Phone or write us when in a hurry for your work, Dakota Weld’g & Mfg. Co. 203-4 Fifth St. Fargo, N. D. Mention Leader when writing: advertisers W