The Nonpartisan Leader Newspaper, November 1, 1917, Page 5

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

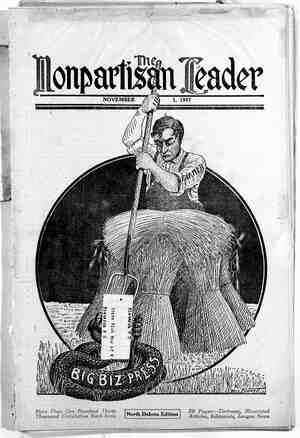

et e o S0 SOV Aty 1I di Vo staacsson ot cre s 4 e e e s x o ~— 2 e e o OO e & 5 ok - ~ - Nry. THADIERGLTE Y (s (e TR TP DS OMHEARA O T as» OSSR AR vt - Big Business and its Kept Press have decided to paint a picture of the farmers. They have decided that since it is necessar: body should be with the government in the war, it would be a clever thing to make out that the farmers and their or Foss, the Leader cartoonist, exposes the game in this cartoon. He shows Big people of the country (C. P. means Common People) have discovered the littl Thousands Stung On Crop Insurance Montana Company Assumes Four Million Crop Loss Liability—Can Not Pay Losses HE Bankers Insurance com- pany of Helena, Montana, which insured 2300 farmers of North Dakota against crop losses this year, and which is probably liable, according to investiga- tions by state officials, for about $2,000,000 in losses to farmers in North Dakota, is practically insolvent. Farm- ers will be lucky, it seems, if they get their premiums back or at best 15 to 20 cents on the dollar for their crop losses. £ Besides Commissioner of Insur- ance Olsness, Attorney General Langer’s department has been in- vestigating the company, and in addition to the company being practically ruined, state officials say they have discovered wide- spread attempts by the company’s adjusters to misrepresent the mat- ter to farmer policy holders, in an effort to settle the claims to the advantage of the company. Assist- ant Attorney General Brennan states that he is informed that the company's agents have told policy holders that the company is going into bankruptcy, and that after November 1 it will pay no claims. It is announced. that the attorney general intends to prosecute ad- justers of the company for these false representations wherever the evidence can be obtained, The commissioner of insurance says he also has complaints that the National Union Fire Insurance com- pany of Pittsburg is also endeavoring to dodge liabilities under crop policies in this state. " This company, however, is solvent and financially responsible for all farmers' claims, according to the state department of insurance. The commissioner says: “In connection with these matters, " we repeat that this company is sol- vent, that it must settle each claim according to its merits; that it has no right to make a wholesale denial of its liabilities in western North Dakota, or in any other section, and that threats of criminal prosecution against policy holders for alleged misrepresentation as to the condition of their crops amount to attempted extortion, and are illegal.” Commissioner Olsness desires farm- ers who have policies with either of these two companies, and who have had losses, to communicate with him, especially in cases where the repre- sentatives of either company have at- tempted to secure adjustments by in- timidation or misrepresentation. The case of the Bankers Insurance com- pany of Montana is a deplorable in- stance of the lack of adequate laws on the statute books of North Dakota to prohibit outside insurance companies coming into the state and assuming liabilities that their assets can not take care of in case of widespread crop losses, as was the case this year, It is pointed out that the farmers were un- able to get adequate laws on this sub- PAGE FIVE B A T s 2 Frurboe s, oHluo! soTHaTs THE GAME (5 ITS R WELL werL! Akt —uUrawn expressly for tne Leader by B. O. Foss. ject through the legislature last year on account of hostility by the hold- over senate majority to laws originated by the Nonpartisan league majority in the lower house. The attorney general says that the next legislature will take care of this matter. According to Assistant Attorney Gen- eral Brennan, the insurance laws of North Dakota in regard to crop insur- ance seem to be framed to make it as hard as possible for North Dakota mu- tual companies, managed by farmers or local people, to do business in the state, while making it easy for out- side, irresponsible companies to come in and exploit the farmers. Mr. Brennan went to Helena, Mont., to investigate the company and found that it has a paid in stock of.$102,000, with total assets of approximately $485,000. The company collected $285,- 864 in North Dakota, $73,975 in Mon- tana, and $37,715 in South Dakota, for premiums this year on crop insurance. This makes total premiums collected of $397,5655. On this business tle company paid gross commissions to agents of $75,812. In collecting the $397,355 as premiums on crop insurance, the company as- sumed a liability of practically $4,000,- 000. Of the 2300 policy holders of the company in North Dakota, 1916 have already filed claims for eithef partial or total losses. By Getober 13 the company had succeeded in getting agreements of settlement with 924 of these farmers, to’ whom the company agreed to pay $127,256, or an average of about $137 per policy. These séttle- ments have been made by merely re- turning the premiums paid by farmers in most instances, though in some ex- treme cases, Mr. Brennan says, a small additional amount has been given to cover losses. A remarkable fact is that prac- tically all of the policies of this * virtually bankrupt and irresponsi- ble insurance company were writ- y and right at this time that every- ganization and their leaders are pro-German. Business painting a German helmet and the Kaiser’'s mustache on the farmer. The e game, as Foss shows. ten for the farmers by North Da- kota banks, according to Brennan’s report. The banks took 15 per cent commission on the business. The officers of the company offered to pay $255,000 to the insurance com- missioner of North Dakota, to dis- tribute among policy holders. This represented the amount of premiums collected in North Dakota, less the huge commissions paid agents for writing the business. The insurance department will likely reject this offer, “The policy of the company in re- turning premiums, as a sole settlement for losses, is of course inequitable,” says Mr. Brennan, “as it results in the man with a $1000 loss getting back only the same amount as the man with a $100 loss, their policies being of the same amount. It also results in re- turning premiums to some policy holders whose losses do not equal their premiums.” The North Dakota. insurance depart- ment warns farmers not to permit ' themselves to be flimflammed, and that each farmer should attempt to get an individual settlement as fair as he can. There is nothing in the law that permits the state officers to act as attorneys for individual policy holders. All the state officials can do under the present law is to make the facts known, and to prosecute any fraud or misrepresentation by the com- pany or its agents in securing its ad- justments. The whole matter shows as forcibly as it could be shown the need for state-owned and operated crop inszur- ance in North Dakota under the plan advocated by the Nonpartisan league. The facts show the huge premiums ° private companies collect and the big commissions they give to agents, not- withstanding which, in this instance, the company is unable to meet its losses, and will probably ruin thousands of farmers who lost their crops, and depended upon reimbursement from this company. i Ji T