The Nonpartisan Leader Newspaper, April 5, 1917, Page 19

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

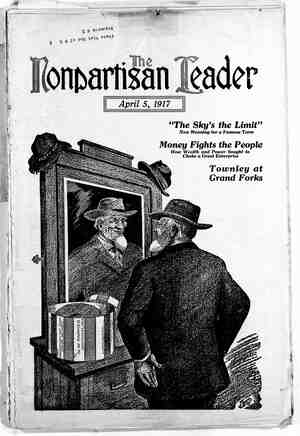

Every year at this time the Old Gang politician has his little joke ready for the people. "BY HECK! THEY CAN'T FOOL_ME WITH THAT Ul el w I A FARMER, I iz RN ¥ 3NN N T FAKE.) N (fF?TISAN i UE ; ‘ Y7 He springs them at other times, too; but he always tries to have ona handy for this season of the year. The Old Gang politicians in Minnesota fixed up the funniest April fool joke of the lot. They rigged up a dummy “Nonpartisan League,” made to look like a farmers’ league, to attract the attention of the farmers and stop them from rushing to the real Nonpartisan League. Farmers used to bite on such things, and why shouidn't they now, thought the gangsters of Minnesota. The trick didn’t work. The Old Gang was too clumsy about it. The farmer sees the gangster around the corner with the string on the on the pocket-book and he marches right along on the road to economic freedom. When the farmer is once aroused he is not a very easy person to fool. Gross Earnings Tax and House Bill 44 More False Charges of League’s Enemies Answered—Some Clauses Dropped From the Constitution and Some Reasons Why NEMIES of the Nonpartisan League who are friends of the railroads' and corporations, have been trying to make the people believe that important clauses of the constitution were omit- ted from House Bill 44, the new consti- tution proposed by the League, and that these alleged omissions are im- portant and in favor of the corporations. It is the purpose of this article to show . the falsity of such charges.” Not one power to curb corporations that was contained in the present constitution, was omitted from House Bill 44. The vague hints contained in the anti- League text book “A Socialist Consti- tution,” and the direct charges are well known by those who made them to be false as will be shown. It should be remembered first of all, that if House Bill 44 had passed both houses of the legislature unanimously, it would not have been the constitu- tion. All that the League did was to draft a new proposed constitution and offer to submit it for approval or re- jection. House Bill 44 could never have become the constitution without the vote of a- majority of the people of the state. If the people at a special election had voted ‘it down that would end it; if they had approved it, then it would have taken the place of the present constitution. The state-owned industries it proposed to permit, which the present constitution prohibits, could have been established by the legislature or by the people on initia- tive. It contained provisions by which the people could call a halt on their legislature in anything the legislature should undertake by much easier means than they can now. Or if the people wanted to do something that a contrary legislature refused to do, they «could initiate such legislation them- selves more easily than they can now. But the Old Gang killed House Bill 44 that would have made these things possible, that is refused to let the people vote on it, and it killed every individual bill proposed to amend the worst sections of the present consti- tution so as to make the present un- workable initiative provisions work- able. Then it set out deliberately mis- representing House Bill 44 as a corpo- ration document which the Nonparti- san League legislature was trying to put over on the people. The defenders of Big Business have harped particu- larly upon its alleged friendliness to the railroads. Judge Young, ‘Northern Pacific attorney at TFargo, the other day himself pretended to be against the railroads by asking “Who was it cut out all the knocks on the rail- roads?” The old constitution contains no knocks on the rajlroads. Neither does House Bill 44 relax to the slight- est degree any power over railroads or other corporations that the constitu- tion contains. 0. J. Sorlie and some others who are out fighting the people in behalf of corporations, have tried to make capi- tal out of the fact that Section 179 of the present constitution was wholly omitted from House Bill 44. This sec- tion deals. with only one matter, the method of assessing railroad property for taxation, and it is omitted from House Bill 44 as the Old Gangsters as- sert. But House Bill 44 retains Section 176 of the present constitution which provides for taxation of railroads ac- cording to their gross earnings. The present constitution gives permission to the legislature to establish either form of taxation. In territorial days the gross earnings system was in force. ‘When North Dakota became a state, the alternative system permitted under the new constitution, was adopted and has remained in force up to'the pres- ent time. Now enemies of the League are pre- tending that they have discovered a tremendous political trick in the sec- tion relative to gross earnings. They openly assert the railroads wanted the gross earning system ‘“restored” be- cause it would mean that they would pay less taxes. And if the railroads pay less taxes, they adroitly argue, why then of course the farmers will have to pay more. Conclusion: The League is for the railroads and against the farmers. GROSS EARNINGS SYSTEM WAS NEVER ABOLISHED As a matter of fact the gross earn- ngs system has never been abolished in North Dakota, but is only suspend- ed. The very act which established the present.valuation system in 1890, contains a clause that provides for a return to the gross earnings system any time the legislature desires to do so. If the railroads wanted the gross earnings system ‘“restored” so badly, why have they not. “restored” it? They have been in control of the legislature most of the time since statehood. They showed their control even in 1917 by defeating practically all railroad legis- lation favorable to the public, through their complete domination of a few hold-over senators. They have never had less power than this year. They have had their own representatives in state office, and on the supreme bench.’ If the railroads wanted the gross earnings system, why did they not use some of their influence and get it “re- stored.” They didn't want it. They are highly pleased with the present system. Article 20 of Chapter 34 of the poli- tical code contains the law under which railroad property is now assessed for taxation. This is the statute enacted in response to Section 179 of the con- stitution. It provides all the necessary regulations for levying the tax accord- ing to property value authorized in that section, and it also contains Sec- tion 2246, which provides for setting aside this method at”any time. Read this to some Old Gang critic of House Bill 44 and watch him squirm: READ THIS SECTION TO A KNOCKER “Section 2246. If at any time the legislative assembly shall provide by law for the payment of a per . cent of gross earnings by railroads as authorized by Section 176 of the constitution of this state, THEN AND DURING THE TIME SUCH LAW SHALL BE IN FORCE the provisions of THIS article’ shall be inoperative.” That is article 20, the article provid- ing for taxation of railroads by prop- erty valuation. It is true the railroads did escape with a very light gross earnings tax in ter- ritorial days. They themselves framed the laws under which they were taxed and they saw to it their taxes were made light. And when the first state legislature proposed to change this system, and put in force the valuation system provided in Section 179 of the then new constitution, the railroads objected.. The legislators knew the railroads were ‘dodging their taxes under the gross earnings system then in force. They had only the voluntary word of the railroads for their gross earnings, no real power to compel the railroads to report fully or correctly, little system, no public sentiment. But the railroads did have a vast property built up out of the profits they had made from the people in this pioneer country and the legislators could see this. They could see cars, and build- ings and real estate, and they decided to tax those things as they taxed farm- ers’ property and other property. The railroads were opposed to the new system because they knew it would make them pay a more just portion of their taxes. But the railroads managed somehow to survive for a quarter of a century, went into politics, (and they are still in) got control of strategic positions, some men on the supreme court bench, influential senators and representatives, and they soon had the valuation sys- tem where it wasnt’ hurting them any. They got tax dodging under this sys- tem down to a science as they used to have it under territorial gross earn- ings. And now they don't want to change back. TOO MUCH INTEREST AND PUBLIC SPIRIT The reason is plain. Public senti- ment now takes a lively interest in corporation affairs. Most states, in- ‘cluding North Dakota, have laws that * compel the railroads to make public their business information. Chances to dodge taxes are getting slimmer and slimmer every year. ' With a gross earnings system as provided in Section 176 of the constitution (167 in House Bill 44) backed up by Section 4630, of the statutes the railroads are compell- ed to divulge the innermost secrets of their profit making. Under section 4630 they have to make detaile[k re- ports of the amount of their b percentage of their earninga._ their total earnings, the’ mile for main-line aiting advertisers = (Continued ¢ { [ { H i i