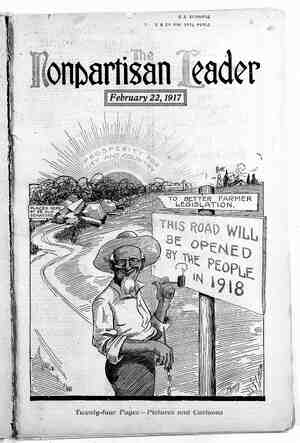

The Nonpartisan Leader Newspaper, February 22, 1917, Page 14

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

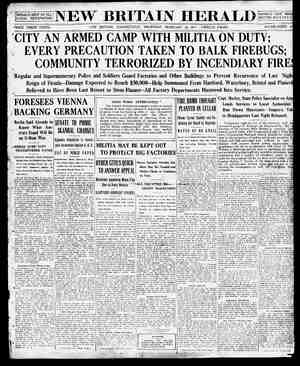

s C—_— \ W ?W‘wm;‘ifi Costly State Audit Concealed A Report Criticizing Harina “Business” Administration Which the State Paid $15,000 to Get, Never Made Public years, there lay in the North Dakota capitol at Bismarck several copies of a certified account- ant’s report upon the state auditor's office, that cost North Dakota $15,000, but the suggestions of which were never put into effect by the “business administration” of Governor L. B. Hanna. The report made several urgent suggestions for sweeping changes in the methods of accounting in the auditor’s office, pointed out that North Dakota had owing to it over half a million of dollars in uncollected taxes, and in detail pointed ‘out the shortcomings of the methods of book- keeping that made the discovery of these facts difficult. By accident one copy of this expen- sive report was discovered January. 30 in the governor's office, and inquiries at once developed the fact that five copies had been made and filed with various state officials, but nothing was ever done to abolish the inefficient methods it condemned, and the public was never informed of the inefficiéncies peinted out. The examination was made by Temple Webb & Company of St. Paul and Minneapolis, well known chartered accountants, whose business extends all over the Northwest. It was certified to by Herbert M. Temple at St. Paul, September 23, 1913. The facts recited in this report go much further than the charges made by Auditor Carl Kozitzky, who asked for a legislative investigation to deter- mine how large an appropriation would be needed to straighten out the tangled affairs of the office, but Auditor Kositzky's request to the legislature was made 10 days before it was that any such report had ever been made, no trace of such a report being dis- covered in the auditor's office, although one copy was filed with the auditor when the work was completed. UNHEEDED for more than three UNCOLLECTED TAXES MAKE A LARGE SUM On page 179 of the report is a table of uncollected taxes by counties, show- ing that most of the counties owed the" state sums of money dating back many years prior to the time the report was made, and an examination by Mr. Kositzky of such records as the office contains, shows that the amount is about the same now as it was then, although some collections have been made in the meantime, while new de- ltnquencies have“occurred in other in- stances. A summary of the amounts due, taken from page 179, shows that the uncollected taxes at that time totaled $585,889.50. It is as follows: Uncollected taxes by counties: 1908 and prior years.....$245,081.22 1909 . icvwdensishvensanas, 21253766 1910.. 20,581.07 1911.. . 19,321.37 1912.. ..., 288,368.18 1913 ccececnenessioensions 585,889.50 On the following. page occurs this ccmment by Temple Webb & Co.: “The value of this statement is to disclose that each year’s tax revenues or collections approximately are slight- 1y behind the actual levies made, and to further demonstrate that steps should be taken to effect a settlement by and with the counties in respect of the $585,000 of uncollected taxes at July 1, 1913, as expressed in the preceding schedule of ‘uncollected taxes by coun- ties’.” IMPORTANT RECORDS COULD NOT BE FOUND When Mr. Kositzky, in response to letters of auditors, and some taxpayers for general information, sought in' the books the information asked for, he found that there was none such 'to be had. Inquiry among former clerks still retained by him, showed that it was not customary to - enter certain classes of records in the ledgers, but the original slips of paper coming from taxpayers, boards of equalization, or county auditors, were tucked away in drawers or tied up in packages and some of these were missing. As a re- sult duplicates have had to be asked for. This condition was found-in sev- eral different accounts, and is referred to by -the Temple-Webb report as fol- laws, on pages 188 and 189: “It is recommended to the considera- tion of those interested that some plan pbe devised for establishing upon the ledger of the state auditor and Sstate treasurer, a record of amounts due the state of North Dakota,” under appro- pl;ia.te control, and-so-as.t9 enable the state auditor and possibl§ the state treasurer, to know, at all times, the amounts due to the state, both as to - the items of revenues and other re- ceivables, and to express in a monthly statement, the uncollected receivables from all sources. “Particular attention is invited to the deferred revenue receivables from counties for care of insane. The large amount involved in this disclosure merits prompt consideration from those interested in the collection of this money, for the reason that the loss to the state of interest on deferred pay- ments is of a considerable ttem in it- - self.” But the suggestions that “this dis- - closure merits prompt consideration from those interested” got no action from “those interested,” and the same lack of records was found by Mr. Kositzky in January 1917 as are here referred to in 1913. Another item not recorded in the books, which the Temple-Webb report Winter at N D. Capital called attention to, related to aba,te-“ ments by counties, and the confusion of the records is referred to on page 159 of the report as follows: “While provisions are made in the auditor's tax collection register to dis- close abatements by counties, and by months, such abatements have never been entered therein. “It is suggested to the consideration of those interested, that a plan be adopted of having the auditor's tax collection register disclose the actual amount due from the county, and that the ageregate due from counties be expressed in a control account upon the auditor's ledger. “An additional confusion appears up@n the auditor's tax collection regis- ter, arising from a condition incident to the division or segregation of coun- ties, it appearing to be the custom that collections as received from a county - treasurdr, are credited to an account with that county, even though the auditor's tax collection register does A winter scene at the North Dakota capitol showing a flight of 14 steps that do not rise as high as the snow drifts shoveled from the iyewalk. This is the front or southern entrance. ] 3 . Explains the Medicine Bill Dr. Ladd Tells What Measure Before N. D. Legis- lature Will Do if it Becomes a Law As might be expected, the state is now being flodded with letters from every patent medicine and proprietary house that can be induced to take up' the campaign so as to kill the patent medicine bill (House Bill No. 123) now before our state’legislature. These let- ters are misleading. The bill does not require that they shall print their formula on the label. It gives them a choice; print their formula on the label or to deposit the formula with the commission. One of the letters states: “No citizen should be restrict- ed by law in the conduct of his own legitimate business; whether within or without the state’”” On the other hand, should any man be permitted to perpetrate a fraud on the public and sell suffering humanity without any hinderance, those fake preparations such as have been expaged in repeated instances by the food department. The bill does no injury to anyone with an honest product. It simply states; tell the truth, cut out your false adverising, stop preying upon suffering humanity, be fair in your business methods, and no honest man- -ufacturer or producer of proprietary medicines has anything to fear; but woe be onto the man who through fraud- flourishes by preying upon fuf- -fering humanity.. Would you hava it .otherwise? .-~ ; : Not all patent medicines are bad, far from it; some are.to be recommended ‘and I would be the last to injure any “honest préparation. I repeat again;. ““Shall we continue to permit the pres- ‘ent system of quackery,'fraud and de- ‘ception to be practiced in the sale of patent medicines and in the practice of quacks, or shall we weed out the frauds? ' ; Is it likely that men who know noth- ing in many instances of medicine or of disease, or who have been failures as practioners, can prepare a product which at long range for a patent they have never seen, will produce a cure where physicians who have stufiied for vears and prepared themselves for the work, know of no cure for consump- tion, or tuberculosis, for diabetes and other ailments? Harper's Weekly says: “Six hund- red thousand people die each year in the United States whose lives might have been saved by prompt and proper treatment. An equal number may be set down due to the cruel activity of the patent medicine industry.” This bill will interfere with no hon- est preparation. It does not prevent the sale without advertising the for- mula of any United States Pharmaco- poeia. preparation or any National Formulary preparation. It does not prevent the sale of any product which is not falsely advertised or misrepre- sented and put ou by the local drug- gist. I am responsible for the drawing of this bill and it is not in the intergsts of the doctors as insinuated, for it will reach some of the fake and quack doc- tors who are practicing upon the peo- ple of the state as well as those who make quack nostrums. Has the time not come when it is for the interests ‘of the people of North Dakota to de- ‘mand that they have some protection ‘against the salé of 'this class of pro- ‘ducts? If so, then you are requested to take your stand and let it be-known by the legislature that you desire the ‘enactment of this law. The bill is generous and fair to all who are doing a legitimate business and to those who ‘cannot come out in the open, there can “be no excuse for protecting them., Yours truly, g ! E. F. LADD. FOURT not disclose the taxes receivable due from the new or segregated county.” On page 200 there is a long list of the things the auditor’s books ought to _ contain, which they did not contain, enumerated below: A “It was observed tHat the auditors ledger does not state the amounts due to the state of North Dakota from counties for taxes; nor does the audi- tor’'s ledger recite property owned by the state; nor does the auditor’s ledger recite the permanent fund investments, Nor does the auditor’s ledger recite the floating and bonded debt of the state, or otherwise present the features of a financial statement, as would be expected from the ledgers of an indus~ trial or financial corporation. “BUSINESS” ADNiINISTRATION WAS MERELY A NAME “The information contained upon the auditor's ledger is restricted to a state- ment of the fund balances, and the receipts and payments relating to such fund balances. “A few supplemental registers are maintained in the state auditor’s office containing information in respect of taxes due from counties, amounts due from counties for care of insane, and sim#lar data, but such information does not come to the surface in a compre=- hensive balance sheet, prepared from the auditor’s ledger. “Further observation is made that " no record is made in the state auditor's office disclosing a numerical, progres- give, or other list of claims, filed against the state of North Dakgga, nor is there kept in the state auditor's of- fice an alphabetical index to the vouch- ers in the files of the state auditor.” As to the kind of a “business” ade ministration that had charge of state affairs during the past four years, the Temple-Webb company makes this observation on page 112: 3 “Much labor and inconvenience could be avoided in the state auditor's office, thereby reducing the liability of error to a minimum, by the adoption of a plan of payrolls for state departments similar to the general scheme of vay- rolls used by large industrial and com- mercial ‘organizations. ~Such a. policy, once adopted and in proper working order, will reduce the multiplicity of vouchers and warrants to be prepared, .and at the same time comply with the spirit of the provisions of state laws, though in some few particular in- stances, modifications will possibly be necessary in order te carry out the suggested innovations. “At the present time, the state audi- tor makes out an individual warrant for nearly every individual in the state employ—this is a waste of energy, as well as of the printing and stationery.” A FRIENDLY PAPER \ Garfield, Minn, Editor Nonpartisan Leader: Fargo, N. D. Gentlemen: Under separate cover I am sending you the Jan. 9th issue of the “Park Region Echo.” You will notice that this paper contains articles taken from the Leader and that its editor is and has been working along the same.line as the Nonpartisan League. Would like to see you give this paper special mention in the Leader, as it deserves all the praise it can be given, and that ° you reprint some of its articles such as, “President Vincent and the Farmers,” “Just Common Cattle, Maybe,” etc. The editor, Mr. Wold, was our repre= sentative at the last legislature, but lost out at the last election by only 31 votes out of a total vote of nearly 3,500, although he had 200 votes more now than two years ago. This shows that the sentiment against “Big Business®™ has been gaining in this county. We will sure put him back in 1918, with the aid of the Nonpartisan League. The Echo has saved the county hundreds of dollars in printing alone, since~it¥started in Alexandria only about 10 years ago, when it had the smallest circulation of the three papers at that time, but it now has by far the largest. Its value to the taxpayers can not be emphasized. too strongly. There ought 'to be one in every county of the state. Hoping the Nonpartisan League will continue as it has and thus may the people of the state secure the truth and nothing but-the truth. I joined the League last September and am as- sured that $16 could not be better in- vested, when the object of good gov- ernment is concerned. The League is non-leakable and graft has no place in it THEO. G. WINKJER.,™ » ) AR T L 2 R e S o s e @A - b el ) D