The Nonpartisan Leader Newspaper, March 30, 1916, Page 12

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

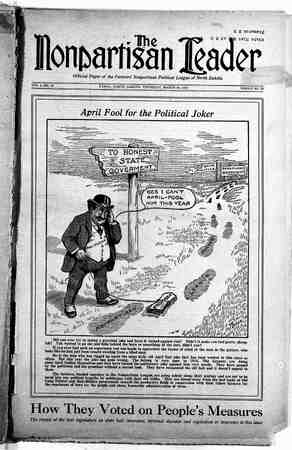

e S > 5 VALUATION INTOS] AR A LUMP SUM! X \fib‘nca'm SIZE OF SCHEDULE.! THE NONPARTISAN LEADER Making the Rounds With the North Dakota Assessors j 22222 e | .OH PUOT 1T § Z IN AT $800: § ] A IN.THE CITY : This is the way the town merchants were to have Vbe'én assessed under,'_th_é original plan of Jorgenson and the state’board of equalization. changed somewhat due to the Leader’s exposure of the facts. Just how badly the farmers of North Dakota are hit by the new per- sonal property schedule drawn up by State Auditor Jorgenson and approv- ed by the state board of equalization is demonstrated by the instructions to assessors just sent out by the state tax commission. As the readers of the Leader know it was intended at first, under this schedule, to lump the assessments of all businesses except farms, the latter being required to go into minute de- tail as to their personal property while every other kind of bu$iness did not have to go into this detail. The fight made by the Leader on this feature of the schedule resulted in the board of equalization finally consent- ing to eliminate it. So the instruc- tions to assessors are to ignore the lump assessment plan. All business- es, including farms, will have to clas- sify their personal property holdings in the various columns, without lump- ing, as first intended, for everybody except farmers and city householders. HIGHER FARM TAX Nevertheless the instructions to as- sessors show that farmers are going -to pay a greatly increased tax this year on personal property—on their household furniture, live stock, ma- chinery, etc. On page 1 of its- instructions to assessors the tax commission points out that there are many radical changes from the former schedule. For instance the commission says: “Every animal of whatever descrip- tion, born on or before April 1 should - be listed at 25 per cent of its actual cash value.” Formerly animals of under one year were not assessed. The commis- sion further says: “Items 28 and 29 in the schedule require the listing of all poultry and dogs, born on or before the first of Light Tax In instructions just mailed to as- sessors throughout the state, the state tax commission has provided a plan for taxing moneys and credits, to take the place of the plan provided in the moneys and credits law of the last legislature, which was recently declared unconstitutional by the state supreme court. The commission has instructed all assessors to list every ceat of moneys and credits they can find, but to list them at only 5 per cent of their actual value, instead of at 25 per cent, as other property is listed. As there is estimated to be $350,000,000 worth of this kind of property in North Da- - kota, the assessors are expected to put over $17,000,000 worth of taxable property on the books, which mostly has hitherto escaped. In the past the amount of moneys and credits return- ed for taxation has amounted to only It has begn HI'AM' A RUBE ALRITE , THEY 'GOT 52 CLASSIFICATIONS FOR ME AND IN TOWN THEY LET ‘EM PUT 1T ALL INTO A LUMP SUM! And this is the way the farl.ner is to be assessed ‘this year, as told in great:. er details below. Jorgenson and the state board to thank. Details of How the New Tax Plan Will Work Are Shown by Instructions to the Assessors April, at 25 per cent of their fair cash value.” Poultry and dogs were not hitherto assessed. Another new item on the schedule on which the commission puts emphasis is fences. Fences were never taxed before. “This is a new departure,” says the commission, “and requires not only the miles of fencing but the value in dollars. A different value should be placed on different kind of ' fences, governed by the cost of construction.” Besides these addifions of property to the list which farmers have never . before had to pay taxes on, the new schedule goes into much greater de- tail regarding household furniture. and machinery, etc., on the farms. This is intentionally intended to raise materially the taxes of the farmers on these items. A comparison of the present and former classifications of household goods will illustrate this point. - TWO. SCHEDULES COMPARED The former schedule had the follow- ing classifications: : 1. Melodeons, organs and - other musical instruments. 5 2. Pianos. 3. Household furniture. 4. " Gold and silver plate and-plated ware. 5. Diamonds, watches and jewelry. The present schedule: cowers' these items in the following detail: : 1. Furniture, utensils, wearing ap- parel and stoves of every description. 2. Rugs and carpets. 3. Sewing machines, power driven washing machines, vacuum sweepers, refrigerators. 4. Watches and clocks. 5. Diamonds, jewelry, silver plated ware. ~ . Pianos. 3 7. Phonographs, graphophones and talking machines of every description. on Money class by itself, where it would payb a tax of two mills on the dollar. This is the law that was amended by the legislature in such a way that - it could not stand the tests of the courts, and this intentional attempt to kill it sucéeeded. : WILL TRY SMALL TAX In lieu of this: unconstitutional law, then, the tax commission proposes to tax moneys and credits as provided by present laws, in a separate heading ~in the personal property list, where a few hundred thousand dollars. 7 The tax commission -believes from its experience and the experience in in other states that the reason for this is that the rate of taxation for this class of property has been entire- ly too high. Consequently owners have hid their moneys and credits and" the assessors have not found :the roperty. The law of the last legis- ature was intended to rectify this by removing moneys and credits from the . personal property list, where it had to bear the full amount of the tax levy, and placing this property in a it is taxed at the full amount of the .levy, like all other property. But it is to be listed at only 5 per cent of its true value, while other personal prop- erty is listed at 25 per cent:: In this way it will pay only one-fifth of the tax other personal property will pay. The tax commission believes a mod- erate.tax of this kind will work out much the same as the law of the last legislature would have worked out, and that owners of this class of prop- erty will not hide it but allow it to be assessed. * \ The tax commission has notified as- sessors that if they fail to list moneys- and credits as instructed the tax com- mission will order a‘reassessment and the expense of the reassessment will be ‘borne. by the local taxpayers. The tax commission has’the approval of the state board of equalization and the recent convention at Bismarck of the county auditors for this new . assessing moneys and scheme - of eredits. gold and ° . 00000000000000000 8. Player piano music rolls and playing or talking machine records. 9. Organs, violins, mandolins, gui- tars, band or other musical instru- ments not listed foregoing. 10. Shotguns, rifles, revolvers and all other firearms. 11. Books, pictures, works of art. 12. Other. property used in the equipment and furnishing of the home or by the family and not listed foregoing. In order to figure how he is coming out this year in his personal property assessment as compared with last year all a farmer has to do is to take the five divisions of household goods bric-a-brac, Pure Bred Live Stock and Farm Sales GEO. McKNIGHT Merchandise and Real Estate AUCTIONEER Graduate of the Jones National School of Auctioneering, Chicago DEVILS LAKE N. D: GUARANTEE Without exceptions other than “Cyclone” is the way we build. SILOS For ten years we protect youf SILO. No danger of fire; no ex- pense of any kind. Order. early. NOT IMITATORS FARGO SILO CO0. Estab. 1912. Fargo, N. D. Metropfle Bltvig'.' .— BERG 6' MAGNE 2000000000000000000 Every Patriot Should Fall in. Line to “Let the People :.Vote -on - It, That’s* Fair!” DO YOUR PART— - SEND IN FIVE, NAMES TOS REPAIRED Paid Advertisement ‘ R 906000000000000000000000000800000006 2 c‘Stands Between You and Good Government 2 C NOW -C’i‘pit‘al_'iilei.novnl.f'As'sb‘ciatipn, i 10090000000000006000000000 For this plan to make the farmer pay a higher tax: they havg : in .last year’s lists as given above and : . put a value in each; then take the 12 divisions into which his goods are to be divided this year and put a value in each. Add both up and see wha the results are. 3 IF YOU WANT THE BEST GOODS MADE IN- Men’s and Boys’ Wear —You Will Find Them at— J. F. HOLMES & CO. 102 Broadway This store only carries stand- ard makes at the lowest prices They are agents for the fol- lowing well-known goods: Gordon, Knox and Stetson | HATS : Hanan and Packard SHOES Hart Schaffner & Marx CLOTHES The spring goods are in and it will pay you to look at them. NEW SUITS AND OVERCOATS : - $10 to $25 J. F.Holmes & Co. 102-104 BROADWAY FARGO, N. D. The C.0.D. Tractor PRICE $785 ° FARMERS ATTENTION Do not fail to see this Tractor when in Fargo at the Tl : Nonpartisan League. Meeting: March 31-April 1 HARRIS FARGO, N. D. AVOID EXPENSE—Your Magne- to should be overhauled periodic- ally. Timely adjustment gssures efficiency and prevents the exten- sive repairs that neglect will incur. We repair all makes of magnetos, . WORK GUARANTEED HOWARD B. TILDEN Dept. O 71 5th Street N.- Fargo, N. D, . CUT OUT PETITION IN YOUR LEADER March 9. .4 Page 3, New; Rockford, N. D, & & e il e ° ° 4 Ak 90000000000 000000 T e 4 - v A N r > - - . ) v L) - - > 2 1] g e R | \ a~ = < v 5 - 2 N o N7 ~rd, Y - \ 3