Evening Star Newspaper, April 20, 1937, Page 3

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

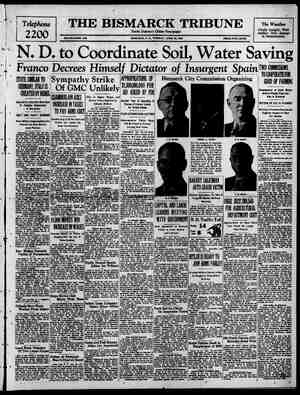

THE EVENING ‘STAR, ‘WASHINGTON, “D. C., TUESDAY, APRIL 20, 1937. CAMERAS BARRED » ATDENHARDT TRIAL Judge Swings Fists Photographer—General Is Confident. By the Assoclated Press. NEW CASTLE, Ky, April 20— Circuit Judge Charles C. Marshall em- phasized his ban against pictures being taken in the court house during the Denhardt trial by swinging his fist at & photographer before court opened here today. “Now get out of here, or I'll throw you in jail,” snapped the judge as the photographer, Rocco Padulo of the Chicago Times, swung around so that the judicial fist glanced off his shoul- der. The judge had not stopped to pose, but had made no objections as photographers *“shot” him on the way to the court house. “This is a trial, not an exhibition,” Judge Marshall admonished some 300 Spectators, who had gathered to see portly, 61-year-old Brig. Gen. Henry H. Denhardt tried for murder of his comely fiancee, Mrs. Verna Garr Tay- lor, on a lonely road near here last October. The defense charged in 49 affidavits that “passion and prejudice” against the former Spanish and World War veteran made it impossible for him to get a fair trial in this county and asked for a change of venue. Den- hardt, en route to court had told newspaper men it would be “an out- rage” if he were denied a change. He also declared he was “absolutely con- fident” of acquittal. “My conscience is clear and I sleep well at night,” he added. Charges that two attorneys who might have been employed to aid the defense had been threatened by “cer- tain prosecution officials” and that the comely 40-year-old widow had large family, social and business con- nections in this county were made in the affidavits for change of venue. The commonwealth, opposing a change, denied the allegations and as- serted Mrs. Taylor had only two blood relatives in the county, owned no prop- erty here and had no business rela- tions here. -The affidavit also declared that Denhardt, free on $25,000 bond since his indictment in January, had walked the streets here “not in’any way molested, but had been treated courteously.” . Accountants to Hear Allen. Guy F. Allen, chief disbursing offi- ter, Treasury Department, will speak before the International Accountants’ Bociety Forum at 8 o'clock tonight in the United States Chamber of Com- merce Building. VELLYN _ SETTER—Female: lton st. n.w. owner must show 1937 tag. Call Lincoln LOST. (GORA CAT. orange eves large male. ooks like bear, named “‘Buster.” Substan- ial reward. 1633 Monroe si. n.w. Adams 7800 vicinity ify and OOCH—Square diamond: lost _around Chevy Chase Club. Reward. Mrs. Mc- North 1796, MAN POLICE DOG._Kknown as Jerry. ast seen in vicinity of Grifith Farms. restville. Md. " Liberal reward offered. ‘ommunicate with O'Donnell’s Sea Grill. 207 E_st_n.w._ Telephone_ Met. 9431 (ALE BRINDLE SCOTTY PUP. 6 months. vicinity 5th and H n.w. Reward if re- turned to 430 H n.w. 2 KEC dlamond_set, k ony X . n.w., Monday morning. 'OCKETBOOK. containing _driver's per- mit. small amount of money, small check. Cali_Atlantic 5608-J. Reward . POLICE DOG_lost Sunday evening_ vicin- %L! R and 35th sts. n.w. Call Potomac o8t fOre GipyIm kS U FUR. silver fox; 1 single: April 19: Peoples Drug Store. Chevy Chase. or between there and Blessed Sacrament Church. Reward. 5815 Nevada ave. n.w. Clev. BAVINGS ACCOUNT PASSBOOK. ntain- bills. Owner’s address on_the passbook. Reward if returned small. dark gray. half grown, and_ tail: named ‘'‘Hugo.” D. Sterrett, 3425 Rodman Cleveland ( 101 blacl able paper Hulside aining bet. S18 and icinity Oakland. Md. Owner in dis- VA '\ $19.va Reward. ST Eas i e SnaT b e Wi pei e ‘WATCH—Lady's. near reflecting pool initials H. A. to E. C. Call District Reward. T WATCHLady's. old. Tound finrramu. i Bulova: Elgin, _ vellow 2 diamonds; between' Sth_and ational WRIST wrist var N WATC] ~Gruen._gol pand. “Finder call District SPECIAL NOTICES. EFFECTIVE AT ONCE 1 WILL NOT BE esponsible for any “debts contracted for gy any one other than myself. (Signed) . G. BOONE, 2406 18th st. n.w., Wash- ington, D. C. e L e ON AND AFTER THIS DATE I WILL not be responsible for any debts con- tracted for by any one other than myself. OOSEVELT ROBINSON, 1 rcoran n.w. . 0 SUGGESTED SOLU- sold at public auction for storage charges on Thursday, April 22, at 10 a.m., in our warehouse. 420 10th st. n.w, lst floor. UNITED STATES STORAGE CO. ~ AUCTION SALE—FURNITURE OF EVERY description to be sold for storage charges on Thursday, April 22, at 10 a.m., in_our warehouse, 420 10th st. n.w., first floor, eonsisting of living room suites, bed room sultes, dining suites, dressers, tables, chairs, beds. linens, _dishes, books, rugs, UNITED STATES STORAGE CO WE ARE PLEASED TO ANNOUNCE_TO our many friends and customers we have moved to our new building, where we will be able to serve you in a bigger and better way. NATIONAL DELIVERY ASSOCIA- . INC., 639 N. Y. ave. n.w. Phone Natl. 1460, DAILY TRIPS MOVING LOADS AND PART 10ads to and from Balto, Phila, and New o Freauent trips fo other Eastern “Dependaple Service Since 1804 TRANSFER & STORAGE Phone Decatur 2500. FIRE ESCAPES In sccordance with D. C. Building Code. Dupont_Iron Works, National 3768. _21% OLD DAGUERREOTYPES. TINTYPES, KO- dak prints or any treasured ‘“keepsake pictures” restored. improved, copted. = ED- ONSTON STUDIO. 1333 F st. n.w. 1s one of the largest CHAMBERS 1 fre of the larsgit Combplete funerals as low as $75 Bix chapels. twelve parlors. seventeen v hearses. twenty-five undertakers an Bscistants. Ambulances now ohly $5. 1300 04 Chapin st. n.w. Columbia 0432 617 11th st._se. Atlantic 6700. RECIG 600 N s Expert Planograph Reproductions Our modern plant is equipped to afford you finest reproductions in a minimum of time. Complete satisfaction guaranteed, We reproduce all books. maps and foreign language matter etc. Extra copy work and reprints given spectal attention. Columbia Planograph Co. 50 L St N.E. Metropolitan 4892 ROOFS WILL LEAK —plaster fall, decorations ruined. just 50 long & you keep putting off those Make sure of & sound, tight To0f: d_for_us. el safe! YONS ROOFT 953 V 8t. Nw. KOONS comfy?g North 44 ANNOUNCEMENT. OPENING OF NEW_STORAGE MANHATTAN STORAGE & TRANSFER 639 N. Y. Ave. N.W. Met. 2042. Moviug, Packing and Shipping. Local abd Long Distance Moving. Rug Cleaning, Private Rooms. NOTICE TO MEMBERS OF THE UNIFORMED FIRE- MEN’S CREDIT UNION, DISTRICT OF CO- LUMBIA. At i) of the members held April #1037 the following RESOLUTION was unanimously adopted. BE IT RESOLVED, “That the par value of each share shall be ten dollars, end the maximum number of shares available for subscrip- ton shall be twenty Vhousand shares.” A INSBON, President. ete. at| YOUR TAXES What You 'Would Pay and How Under the Bills Proposed in the House. ESTIMATED YIELD—$300,000 to PURPOSE—To increase revenue. dollar of paid-up capital and surplus would be levied an- nually on each and every corporation organized or doing busi- ness for profit in the District, under the terms of H. R. 6034 now being considered by the House District Com- mittee. The tax levy, amounting to $2 for each $1,000 of paid-up capital and surplus, would be levied on corpora=- tions for the privilege of transacting their business within the District. ganizetini fee of 1 mill for each dollar of authorized capital stock, or $1 per $1,000, levied against every new domestic corporation when it applied for registration of its incorpo- ration articles and every foreign cor- poration applying for admission to do business within the District. Corporations established elsewhere, but engaging in business within the District, would have to pay such pro- portion of the tax that their prop- erty in the District bears to the value of their entire properties, here and elsewhere. “Initiation” Fee. The proposed 1-mill tax for ad- mission may be described as the “initiation” fee, since it would be ef- fective only when a corporation first comes within the terms of the act, while the proposed 2-mill tax may be described as the annual “dues,” since it would be applied annually to the total of the paid-up capital and surplus. The corporation privilege tax would apply to all “corporations” which are organized for profit. Accurate infor- mation is not available, but the num- ber of domestic corporations is esti- mated roughly at 2,400. There is no estimate of the number of foreign corporations—those established out- side the District—which do business here. The yield from the corporation privilege tax is estimated roughly at $300,000, but this is more or less of a guess. This figure may prove much too low, if the Federal capital stock tax collections offer any reliable guide. For the fiscal year 1936, this Federal tax from District corpora- tions (not including foreign corpo- rations) amounted to $521,545, ac- cording to reports by the Bureau of Internal Revenue. The Federal capi- tal stock tax is 1 mill per dollar, or but one-half the rate proposed in the District corporation tax bill. This would seem to indicate the revenue from the proposed District 2-mill tax would exceed $1,000,000. N Number May Be Increased. The number of corporations to be affected also may be higher than now estimated, since the report of the Bureau of Internal Revenue for the fiscal year 1933 shows there were then 2,445 District corporations filing Fed- eral income tax returns. That was in the dark days of business, as revealed by the fact that but 653 of the 2,445 corporations making returns showed any net income. Business, of course, has greatly improved since then. This number of corporations making re- turns covered only District corpora- tions, and did not include the foreign corporations doing part of their busi- ness here. Imposition of the corporation privi- lege tax would add to the trend to multiplicity of taxation against the same assets of a corporation, as previ- ously shown in the analysis of the proposed District income tax. For one reason, the corporations to be affected by this tax already pay the Federal capital stock tax, and it is now proposed to place a 2-mill per dollar tax on the same assets for the purpose of raising additional District revenue. If this bill is adopted, then a cor- poration doing business here would have to pay the following series of taxes: Federal capital stock tax. Federal 5 per cent tax on profits exceeding 12.5 per cent of the capital stock value. Federal income tax. Federal tax on undistributed profits. District real estate tax. District personal property tax. Unemployment compensation tax, 2 per cent of pay roll in 1937; 3 per cent in 1938 and thereafter. Old-age benefit tax, 1 per cent of pay roll, rising 12 of 1 per cent each three years until in 1949 it becomes 3 per cent. In addition there would be the pro- posed District income tax, or if this were not adopted, then there would remain the District intangible property tax, for which the proposed District income tax would be substituted. Privilege Taxes. H. R. 6034 is titled “A bill prescribing privilege taxes to be paid to the Dis- trict of Columbia by corporations for doing or seeking to do business in the said District; prescribing the method and basis of computing such taxes; requiring certain annual reports to be filed by corporations; providing for the collection and disposition of the moneys received under this act, and prescribing penalties for non-com- pliance with the provisions thereof.” First, it is provided that every domestic and foreign corporation “hereafter” organized for profit shall Pay to the District assessor an “organization fee” and for the priv- ilege of exercising its franchise in the District a sum equal to 1 mill upon the dollar for each dollar of the “authorized capital stock” of such corporation. This would be required when a domestic corporation filed its articles of incorporation and when & foreign corporation applied for admission. Second, it provides that each cor- poration “heretofore or hereafter” incorporated here, or admitted to do business here, shall pay a proportion- ate fee upon each and any increase in its authorized capital stock made after the passage of the bill. The fee for foreign corporations would be computed on that portion of its authorized capital stock represented by the portion of its total property that was owned and used in the District. Division of Opinion. From the wording of the bill, it appears that corporations now en- gaged in business in the District would not have to pay the “initia- tion” or original registration fee of 1 mill per dollar. Some observers believe it was not intended to exempt corporations already existing from this initial fee. The bill, however, is worded otherwise. Then comes provision for the tax of 2 mills per dollar upon the amount of the “paid-up” capital and surplus, In addition, there would be an or- | Article No. 8—Corporation Privilege Tax. $1,000,000. AFFECTS—AII corporations in business here. TAX of 2 mills upon each®" Rk ety S e to be levied annually on all domestic corporations, and, on the proportional basis, on the foreign corporations, The minimum fee would be $50 and the maximum $20,000, regardless of the amount of the actual base. Cor- | porations having paid-up capital and surplus of less than $25000 still would pay no less than $50 per year and corporations having paid-up capital and surplus of more than | $10,000,000, if any, would still pay no | more than $20,000 per year. In computing the tax to be paid | by foreign corporations the District assessor is directed to determine the total value of the corporation's “property” here and elsewhere so as to arrive at the ratio between that in the District and outside. This would be needed for calculating the portion of the authorized capital stock “owned and used” in the District, and to determine what portion of the corporation’s paid-up capital and sur- plus, severally, are owned and used in the District. Term “Surplus” Defined. The only definition found in the bill is stated here. The term “surplus” is deflned as “the net value of the corporation’s property, less the out- standing indebtedness and paid-up capital.” It adds that there shall be allowed no deduction from the amount of “paid-up capital” by reason of impairment of the same, in the com- putation of the tax to be paid either by a domestic or a foreign corpora- tion. None of the property or capital located without the District and none of the capital or surplus represented by property used ‘“exclusively” in interstate commerce, the bill states, shall be considered in the computa- tion of the net amount of tax to be paid by a corporation. This restric- tion suggests that the railroads would be exempt, since their business is interstate. In all cases, the assessor would be authorized to require the corporation to furnish detailed and exact information on the above matters. Each corporation affected by the tax would have to make annual returns during March or April of each year, showing its condition at the close of December 31, preceding. These reports would have to contain, among other data, the name af the corporation, place of business, if located outside the District; the names and addresses of its officers and directors, the amount of the authorized capital stock, the number of shares of each class authorized, the capital stock subscribed and paid for and the par value of each kind of share authorized, the market value of and the price fixed by the cor- poration for the sale of its shares of no par value, if any; the nature and kind of business in which the cor- poration is engaged, and the nature, location and the valie of the prop- erty owned and used by the corpora- tion in and out of the District, given separately, and a complete and detailed statement of the assets and outstanding liabilities of the corpora- tion. The District assessor would be authorized to require additional infor- mation he deemed pertinent. The president or vice president and the secretary or general manager of the corporation would have to sign the returns under oath. Three Methods Outlined. In the case of stock having no par value, the bill outlines three methods to be followed, and stipulates that the assessor shall apply the one show- ing the highest tax. For the pur- poses of this act, it is proposed that stock of no par value shall be con- sidered to have the value of at least $1 per share. Secondly, the assessor would determine the value as it may have been fixed by the corporation for the sale of stock. The third method would be for the assessor to determine the ‘“book” value of the stock. The bill provides for appeals from th decisions of the assessor. For this purpose the Commissioners, or their designated agent, together with the District auditor and the corporation counsel, would constitute the appeals board, which would be directed to recalculate the tax, using the same methods. The bill provides that the decisions of the appeals board “shall be final” as to the tax levy, but it is not understood that this would prove & bar to a court test of legal questions involved. For failure of a corporation to make the prescribed returns and tax pay- ments on time the bill provides a pen- alty of $100, plus an additional pen- alty of $5 for each day of delinquency. Also the tax levy would remain in ef- fect, on which interest would have to be paid, but the bill fails to state what would be the rate of the penalty inter- est. The penalties would be collected under actions instituted by the cor- poration counsel. Receipts Go to Collector. Receipts from the tax would go to the District collector of taxes and be deposited in the United States Treas- ury to the credit of the District and be disbursed for charges against the District's general revenues. Corporations filing articles of in- corporation would be required to file a certified copy with the assessor and the same rule would apply to any amendments to incorporation papers. Study of the measure indicates it is looseley drawn and should be revamped and its terms made more concise, if it is to be favorably considered. This is based on the opinion of highly quali- fied legal and financial experts. For one thing, there is but one definition stated in the bill, and many terms governing vital phases of the bill are unexplained. For instance, what is a corporation? 1Is it intended in this act to mean an association, joint~ stock company, an inter-insurance company, a common-law trust, a “Massachusetts trust,” a business trust, an insurance exchange operating through an attorney in fact, and cer- tain partnerships of the type author- ized by the laws of Pennsylvania? All these types of organizations are in- cluded in the meaning of “corporation” Blessed relief has been the experience of thousands who have used PILE-FOE. This soothing ointment relieves burning and itching of Blind, Bléeding, Pro- truding Piles. Promotes healing and tends to reduce swelling. Don't suffer needlessly . .. get a tube'of soothing PILE-FOE today for aranteed re- sults. At Peoples Drug Stores or other good druggists. under definitions stated in the Federal revenue act of 1935, No Exemptions Listed. Also the proposed District capital stock tax lists no exemptions from the tax, except in that it applies the levy to corporations “organized for profit.” The Federal capital stock tax law, however, leaves no such important things to doubt. It states definitely those charitable, fraternal and other organizations that are exempt. For instance, it lists community chests, business leagues, fraternal beneficial societies; labor, agricultural and horticultural organizations, mutual savings banks not having capital stock represented by shares; cemetery companies owned and operated ex- clusively for the benefit of their mem- bers, or which are not operated for profit, and domestic building and loan associations, substantially all the business of which is confined to mak- ing loans to members, and co-operative banks without capital stock, organized and operated for mutual purposes and without profit. Whether a Massachusetts trust or a common-law trust is intended to be included in the meaning of “corpora- tion” in the proposed District law is believed highly pertinent, since some 84 per cent of the common stock of the Washington Gas Light Co. is owned by & Massachusetts common-law trust. This trust was permitted legally to gain control over the Washington company merely for the reason the La Follette anti-merger law — which prohibits foreign corporations to hold control in Washington utilities—did not include the term *“common-law trust” along with the word “cor- poration.” Holding Companies. Then there is the question of whether the proposed tax would be applied to holding companies having business here. If so, would the tax be applied to both “parent” and “child” companies, or to but one, and if that be the case, which one? Would the proposed tax be applied to banks? National banks are not organized under the laws of the Dis- trict, but under Federal laws. They are not “District” corporations, under one meaning of the word, nor yet are they “foreign” corporations. National banks may be taxed, under Federal laws, only in certain definite ways, experts warn. Some banks here are “District” institutions, some are “for- eign” and there is one at least char- tered by a special act of Congress. The proposed District corporations tax specifies that all corporations shall submit “detailed and exact” informa- tion to the assessor. Possibility that this requirement might prove in con- flict with rules of the controller of the currency is suggested by some experts. —— JOSEPH KENDRICK DIES; RITES SET TOMORROW Was Familiar Figure Among Early Pilots on Potomac. Joseph Kendrick, 72, of 312 Ten- nessee avenue southeast, retired Navy Yard employe, formerly known along the Potomac River as “Captain Joe,” died Sunday at Mount Alto Hospital after a long illness. Kendrick was a familiar figure | among the early pilots on the Poto- mac River, and operated merchant sailing vessels for years. He sen-ed’ in the Navy as a quartermaster, and later was employed in the Navy Yard, from which he retired several years 8go. Funeral services will be held 2 p.m. tomorrow at Chambers undertaking establishment, 517 Eleventh street southeast, with Rev. H. M. B. Jones of the Second Baptist Church offi- ciating. Burial will be in Cedar Hill | Cemetery. Surviving are the widow, Mrs. Hester E. Kendrick; one brother, | Frank, of Charles County, Md.: one | daughter, Mrs. Margaret Lynch of | this city, and one granddaughter. “Captain Joe” New Radio Beacons. So that all aircraft on main routes | may be in constant vocal touch with |= NOYES RE-ELECTED PRESIDENT OF A.P. Robert McLean Is Renamed First Vice President by Directors. By the Associated Press, NEW YORK, April 20—Frank B. Noyes, president of The Washington Evening Star Newspaper Co., re=- elected president of the Assdciated Press at the annual meeting of the Board of Directors today. Robert McLean, publisher of the Philadelphia Bulletin, was re-elected first vice president. Other officers are: W. H. Cowles, Spokane Spokesman-Review, second vice president; Kent Cooper, New York City, re-elected secretary; Jackson S. Elliott, New York City, re-elected as- sistant secretary, and L. F. Curtis, New York City, re-elected treasurer. The following were elected members of the Executive Committee: Mr. Noyes, E. Lansing Ray, St. Louis Globe Democrat; Stuart H. Perry, Adrian, Mich., Daily Telegram; Mr. McLean, Paul Patterson, Baltimore Sun; Paul Bellamy, Cleveland Plain Dealer, and William J. Pape, Waterbury, Conn., Republican American. Small Town Dailies Studied. The small town newspaper, with its year-by-year fundamental content of birth, marriage and death, was trans- lated into a personality as small town publishers met in convention. The smaller daily was limned as a modern town crier, as the problems it presented were laid for study before & portion of the annual convention of the American Newspaper Publishers’ Association. The caucus of publishers of small dailies preceded the association’s golden jubilee celebration tomorrow in the grand ball room of the Waldorf Astoria Hotel, on the second day of the four-day convention. Announcement was made that two new directors had been elected by the membership of the Associated Press at the annual meeting yesterday. They are Clark Howell, jr., of the Atlanta (Ga.) Constitution and William J. Pape of the Waterbury (Conn.) Re- publican. They take the places of the late Clark Howell and Stuart H. Perry of the Adrian (Mich.) Daily Telegram. Mr. Perry, whose term expired, was elected to a new position on the board, one of three directors to represent members in cities of less than 50,000 Ppopulation. The others were Houston Harte of the San Angelo (Tex.) Standard and Josh L. Horne of the Rocky Mount (N. C.) Telegram. These directors were re-elected: Paul Bellamy, Cleveland (Ohio) Plain Deal- er; John Cowles, Des Moines (Iowa) Register and Tribune, and J. R. Know- land, Oakland (Calif.) Tribune. Before the luncheon meeting yes- —_—_— v re ves * HATS CLEANED BLOCKED AND TRIMMED BacaracH Millinery and Hat Blockers 733 11th St. N.W. THE NEWEST THING IN OiL HeaT BEFORE You Buy See THE NEw HE D SHERWOO OIL BURNER the chief landing fields, six short-wave | I radio beacons will be established in Australia. owe 1723 coNmMECT KCATUR 4101 PRICE in YEARS Buy Your Coal Now Before Prices Go Up . If you buy your coal before May 1st you can effect tremen- dous savings, because not in years have prices been so low on ‘blue coal’ Pennsylvania’s finest anthracite. before you see pric so low again. You may wait for years Enjoy better heating next winter and save by ordering NOW. (@wFiTH- (ONSUMERS (GMPANY 1413 New York Ave, o pleasant surprise. for estimate. MOGNIM ANLLNOL ¢ SANI'TE NVLLINIA © SEAVHS MOGNIM ANLLNOL ® SANITI NVLLINIA w.stekn: the shade shop 830 THIRTEENTH ST. N. W. SHADES ¢ VENETIAN BLINDS ¢ TONTINE WINDOW SHADES ME. 4840 @zptuui‘k’pfiny & the ycat‘ koaml[ The Shade Shop custom-made blinds give that final touch of smartness to any room. Available in colors you desire—specially made to fit any window. The cost will prove Phone Dlistrict 3324 sammons terday the members voted unanimously to create associate memberships in the Assoclated Press. The change em- powers the Board of Directors to change regular memberships to asso- clate memberships or associate mem- berships to a regular status. Associate members will not be re- quired to furnish their news to the A. P. exclusively. An associate mem- ber, however, must waive all protest rights and his voting power. ‘Tomorrow morning the association will hold its golden jubilee celebration in the grand ball room of the Waldorf Astoria Hotel. Receptions, dinners and other social events are planned be- tween business sessions throughout the week. Rising costs of newspaper produc- tion with particular reference to labor and newsprint, problems of the news- paper boy, social security, traffic and mechanical affairs and other common problems will be threshed out by the publishers. MRS. T. M. POTTS DIES Mrs. Templin M. Potts, widow of the late Capt. Templin M. Potts, United States Navy, died after a long iliness in San Francisco on Saturday. Officials at the Navy Department asserted that interment will be in Arlington National Cemetery at a date to be announced later. Secretary of Commerce Daniel C. Roper (right), who ad- dressed members of the Associated Press at their annual lunch- eon yesterday in New York, is shown with Frank B. Noyes, president of The Evening Star Newspaper Co. and of the Asso- ciated Press. —Copyright, A. P. Wirephoto. W.¢& [./SLOANE 39 nnversary Featuring Domestic Rugs You know that for nearly a century the House of Sloane has been famous for quality and char- acter of domestic dugs. The pro- ductions of the best looms in this country are under their con- trol, which means that our represent the choicest selec- tion of assortments patterns. For the Anniversary event regular prices have been cut drastically. Heavy Axminster Rugs, in modern, Colonial and Orlental effects. Size 912 Regular Price $60___________________ e I 349.50 Texture Rugs, offering @ most unusual effect in eut and uncut pile. Splendid selection. Size Sx12. Regular Price $36.50. Beautiful Texture Rugs, in plain ribbed effects. Size 5x12. Regular Price $39.75 Worsted Wilton Rugs, closely woven in a specially selected group of colors and designs Regular Price $110 Y Size 9x12. Selectionof 16 Dif ferent Designs Sloane-Blabon Linoleums The quantities are limited which will be available at these special prices. Regular Price $1.75 sq. yd._______________ — Sl-ls Anniversary Specials in Oiriental Rugs They are indeed specials, coming from looms that are famous for their beautiful designs and col- orings. These rugs represent perfect master- pieces. A group of genuine Kermanshahs, 9x12, in the wonderful Kerman- shah designs and colorings. Regular Price $395 Group of Sarouks—in the fascinating designs and luminous colors —prize selections of this famous weave. Size Sx12 Regular Price $295 = $235 Heriz—With all the dignity, charm and becuty for which the Heriz looms are famous. Size 5x12 Regular Price $235. India Rugs from our own East India looms—rich and beautiful. Each a masterful design, masterfully executed. Size 9x12. Regular Price $425__________________ NSRS $285 Lillehans—in scatter sizes. The Lillehan is just the rug for that awkward space. Size 3x5. Regular Price $35_ . ______ ol B i $27-5° 711 Twelfth St. The House With the Green Shutters DI 7262 [ A