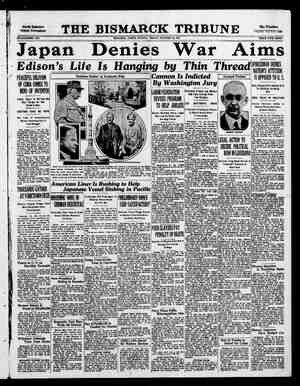

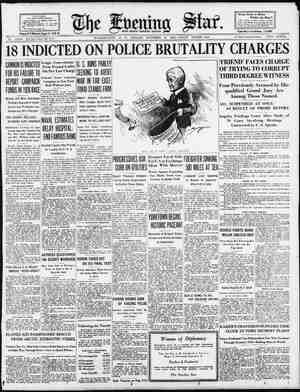

Evening Star Newspaper, October 16, 1931, Page 19

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FIN/ ANCIAL, THE EVENING STAR, WASHINGTON, D. .C., FRIDAY. OC 'OBER 16, 1931, FINANCIAL. *%% A_19 URB PRICES FIRM IN STEADY MARKET Pivotal Shares Gain Fraction- ally—Utilities and Oils in Demand. BY JOHN A. CRONI Special Dispatch to The Star. NEW YORK, October 16.—Opening firm, the Curb Exchange session today displayed steady strength. The merket leader, Electric Bond & Share, was up fractionally along with Cities Service. Although Standard Oil of Indiana, Standard Oil of Kentucky. Internaticnal Petroleum and similar oils advanced only fractionally, their tape actions indicated that this group was prepared to move toward higher levels. Miscellaneous industrials, such as American Meter, with a rise of 4 points, made the best showing in the forenoon. During this period pipe lines, like Cum- berland, were up from fractions to 2 points, while textiles, like Davenport Hosiery, up points, were firm, and chemicals were easier, with Heyden Chemical down a point. Chain-store shares were irregular. Great, Atlantic & Pacific Tea was down b points, while Neisner Bros. preferred advanced 23; points. The decline of more than a point in Ohio Brass B was rather typical of that group. An excep- ticn to the downward trend in the metal group was Aluminum Co. of America, which was up about 5 points around midday. In the aviation shares Niles- Bement-Pond was a soft spot. Spiegel May Stern preferred was the heaviest issue in the chain-furniture group. Stocks were firm at the opening Electric Bond & Share at 197, was fractionally higher. but lost most of its gain in the first few minutes of trading. Cities Service opened unchanged and then went to a small gain at 7'a. Standard Oil of Kentucky. the only active issue in the Standard Oil group, was up fractionally at 1635. Most utili- ties were firm, with small gains in American Superpower and United Light & Power A. Industrials were irregular. Aluminum Corporation gained nearly a point to 78. Great Atlantic & Pa- cific, however, dropped 5 points to 175. American Cyanamid B was un- changed at 4. In the mine group United Verde was a shade better at 5!2. Pennroad, the only active rail, Wwas up a small amount at 43g. United Gas was unchanged at 3's, as were other gas stocks. ~Aviation and Radio Shares were inactive. FOREIGN EXCHA};GE. (Quotations furnished by W. B. Hibbs & Co.) Nominal gold Selling checks value. today. . 34.8665 3913c 1301c 23.82¢ London Paris. franc Brussels. belga Berlin, mark Rome." lira Zurich. fran Ataens, drachma Madrid. peseta Vienna. schilling Budapest, pengo Prague. crown (nom ) Warsaw, zloty Copenhagen Oslo._crown Stockholm, pound crown crown BONDS ON THE CURB MARKET. Bales DOMESTIC BONDS. in thousands 2 Alabama Pw 4':s '67 891z 1 Aluminum Co 35 '52 101 1Am Cmwlh Pw 65 '40 48 2 Amer EI Pow 6s A '5T 45 BAmer G & E 55 2028 1Amer G & Pow 55 53 3 P &L 65 2016 1Arkans P & L 5s '56 2 Asso Elec Ind 4755 '53 BTAss0 G & E 412549 C 5 Asso Gas & El 55 '50 6 Asso Gas & & Bell Tel Can 55 A 5 Bell Tel Can 55 C 4 Boston Con G 58 3Can Nat Ry 4'as 5Can Nat R E 7s.E 2 Caterpillar Tr 5s 16Cen TP 8 4135 F 1Cen Pow & Li 5s 5Cen Pub Ser 5'3s 18 Cen Stat Elec 5s 4 Cen St Elec 5 1 Cig St Real 513 79 Cities Service 55 '3 5 Cities Service 5s ' 8Cit Serv Pow 5ius '3 3 Comwh_Edis 45 7 Con Gas Ut 65 A 8Cont G & E 55 A 1Crucible Steel 55 1 Cudahy_Pke 5! 1Det C Gas 6s A 2 Det Int Brdg 6125 5East Ut Inv 55 A 3 19 Edis EI Boston 4s 32 0 12 Edis El Boston 5s '33 1 8Elec P & L 55 A 2030 2 Empire Dist EI 55 /52 3 Empire O&R 51.s 7 Pederal Wat 53 1 Firestone Tire 55 8 Florida P & L 5s '54 52 Gatinesu Pow 5s '56 9 Gatineau Pow 65 5Gen Bronze 65 ' 3Gen Mot Acc bs - 1Gen Pub Util 65 1Gen Pb Ut 6las A 3 Georgia Power & 14 Gillette S Raz 55 1 Glidden ‘Co 5143 '35 44 Gulf 01l Pa 55 '37 3 Hous L&G 4% E 1101 Pow & Lt 65 A '3 1Tilinois P & L 5145 '3 1Mlin P & L 5125 B '3 5 Indnap P&L 55 A 2 Insull Utilit 65 B 2 Intercon PW cv 2Int Pw Sec 65 3¢ B 13 Int Pw See 6155 '35 C 11Int Pow See 78 D 36 11Inter Pw Sec 75 E 157 5 Int Pow Sec T 1 Iow, 5 5 Jackson'le Gas 5s 10 Jer Cen P&L 55 B 4 Kansas Pow 55 A 4 2026 1RLa P & L 5s'57_....° 9 fassachu Gas §5 '3 3 Mid West Ut 55 '32 cv id West Ut 3 v 5 Mid West Ut 55 Mid West Ut 55 iss Riv Fl ont L H&P 3 at Electric 222223 I3 14 Pacific 40Pac G & 1 Pac G 4 Pacific G&E 5 5Pac_Wes O1 1Pa Ohio P&L 2 Penn W&P 41 S No Til 415 b § No Il fs b S N Il 4'as el Manage 55 as_ 65 ' 77 00D v W 70 Shaw W&P 5% 0 1Snider Pack 63 ‘32 14SE P&L6sA 2025 xw 1 South Calif Ed 55 '51 6 South Cals Ed 55 '52 10 Sou Calif Edis 55 3¢ 3 Southw G&E 55 A '57 1Southw_Nat G 65 43 1Sothw P&l 65 A 2022 18tand O&E cv 65 35 4 Stand Gas & E 65 ‘51 58tand Gas & E 65 66 38tandard P&L 65 '57 B Swift Co 5s 40 wi . 1 Texas Ut 65 45, 2 Texas P & L 58 '56.. 2 gaton Gulf 5550 TUNI Lt & Ry 525 '$2 5Unit Pub Ser 65 A "42 1U S Rub 6las /33 53U S Rub 6135 '34 5 U 8 Rub 6533 5Utah P & L 418 "4 Van _Swerin 65 '35 ww Va Pub Serv 55 B ‘50 2Wes Tex Ut 5s A '57 FOREIGN BONDS. 2 Bogota Mtg Bk 7s 47 5Buen Alr Br 725 47 40 i Danish Con $1a& '3 4Fnid R M Bi’gs 61 4 Ger Cons Mun s 2Ger Con Mun 7s '47 1 Gestueral 6s '53 xw.. 3 Hanover Pro 6izs ‘40 1 Medellin_Col 7s"'51 2 Nippon_ EI P 8iss 5 § Ruhr G CO 6125 A '3 8 Saxon Pub Wk 55 5 Stinnes 7s ‘38 xw & Terni Soc 6las A 33 S United EI Ser 75 '56 3 Unit I Ser 7s ‘36 xw With warrants. | Stocks sold in 100-share lots except tho: ~Prev. 1931.~ Stock and Bales— High. Low. Dividend Rate. 95 5% Adams Mill 1st pf(7) 508 63 45 Aeolian Copf (7).... 60s 244 11% Affiliated Prod 1.6! 3 % Allegheny Gas Corp. 1 70 Aluminum Co of Am 1400s 2% AmCit PELBb10%. 8 Am Com P A (b10%) 22 4 Am Com Pr B(b10%) 2 3% Am Corpn (f30c) 3% Am Cyanamid B. 17% Am Equities, 4% Am For Pow w 1 Am Founders. . 3214 Am Gas & Elec (11), 8 Am Gas & EI pf (6).. 20% Am Lt & Trac 23). 4 Am Maracalbo. . Am Meter (3) Am Natural Gas. . Am Superpwr (pd0c) Am Util & Gn B vtc.. Am Yvette (25¢) Anglo Chil Nitrate Appalachian Gas. ... Appalachian Gas wr. Arcturus Rad Tube. . Arkansas Nat Gas... Arkans Nat Gas A. .. Ark N G cu pf (60c). Assoc Elec Ind (30¢) Asso GREL A(b2-25)., Ass0 G & ELA dbrts, Ass0 G & El War. ... 2 Asso R Atl Coast Fish. Atlas Util Corp AutoVM cv pr pt 50e. Axton Fish To A 3.20 Blue Ridge Corp. Blue Ridge cv pf(a3) Bourjois Ine (25¢) ... Brazil Trac Lt&P( 5 Cable Radio T vte... Canadian Marconi. .. Carnation Co (j114). Cent 111 Pub S pf (6). Cent Pub Sve A b5%. Cent Stat El (b10%) Cent West PS Aal'y Charis Corp (13).... Cities Service (g30c) Cities Serv pf (8)... Claude Neon Lts Inc. Colon Oil.. Col Oil& Gas vie. Colum Ple v.te. { Cmwlth & Sou war. . Com Wat Ser g12'3¢ Consol Auto Merch. . Con Gas Balto (3.60) Contl G&E prpt (7). Copeland Pr Inc (n). Cord Corp. ‘orroon& R P Creole Petroleum. Cresson Consol (4¢) Cuban Cane pr opt w Cumberland P L (2).110 Davenport Hos (2).. Dayton Alr & Eng. Deere & Co. . De Forest Radio. Derby Oil Refining. . Detroit Afreraft. Duquesne Gas. Durant Motors. Duval Tex Sul wi. cast Sta Pow (B)... t Utll Inv A, Elec Bond&Sh(b6%) ElecB& Sh'cupf5.. Elec B & Sh pt (6) Elec Pow Assoc (1). Elec P& Lt op war. . El Shareholdg (b6 %) Empire Corp....... Emp G & F cu pf(8) » Europ Elec deb rts Evans Wallow Lead. Falcon Lead. ... Fedders Mfg Co A. Fiat rcts (94%:¢) Fischman & Sons Flintkote Co A. Florida P & L pf Ford M Can A (1. Ford Mot Ltd 36 Fox Theater (A) GenE Ltd rcs 36 3-Sc. Gen Theat Eq cv pf.. Glen Alden Coal (4). Gold Seal Elec new. . Golden Center. Goldman Sachs Gorham Inc pf. ; Goth Knitback Mch.. 1 Gt At&Pac Tea pt(7) 108 Gt At&P T nv (1634) 408 Gulf Ollof Pa (134). Hamilton Gas v.tc... Hecla Mining (40c).. Helena Rubenstein. . Heyden Chem (2). .. Hollinger Gold(65¢)+ Hudson Bay M &S.. HydroElec Sec(1.20) Hygrade Food Frod.. Imp Ch Ind(10 Imp Ofl of Can Insull Inv (b6%).... 2% Insurance Sec (40c) . # Intercontinent Petn, Int Petroleum (1)... Inter Equ cv pf (3).. Int Utilities B. . Italian Superp war.., Lakey Foundry Leonard Oil......... Libby McNeil & 1., Lone Star Gas n 88c.. Long Island Lt (§0c) Long Iscupt B(6).. Magdalena Synd. . Mayflower Asso (2) Mead Johnson (15).. 8 3 K @ 0 N ey SeravarunN—En-Snandaen 9 = » =S © S P EIEPANEE JOTOTA SR RUT- 91 JUPH SR PRBPD]. SR TUPIEE J0- ST IoPN » o g 3 @esignated by letter “s.” Add 00. Open. High. 16% NEW YORK CURB MARKE 8tock and Dividend Rate. ~Prev. 1931.~ High. Low. 124 Fi 36% 4% 25% 8415 25 11 107% 10 3914 Low. Close. 80 80 32 40 16% 1674 % % 76 82 2% 2% am B% 8 8l 1% 1% n an 2% 2% 6% Tl 1% 1% sy Al 93 93 2 Meiph Mesta M Mid Sta Mid We: 0 2 80 40 167 £ 83 2% bl 84 1% 4 2% T 1% (S 8 2% 4% Mid Wi Mo- Nat Avi Nat Hre Nat Ser Neisner Nelson New En; Newmo! Nitrate Nordon Nor Am Nor St F Ohio Br: Ohio Col Oversea: Pac G & Pan Am Pénn W: Plymou Powdre Pratt & Prod Prudent Prudent Pub Utl Pub 1ti 4 Midland Ut prIn (6). Nat Bd & Perryman Electric. . Petrol Corp war. Philip Morris Inc.... Phoenix Secur Corp. Pitney Bowes (b4% Pittsbgh Plate G (2 oalty (b10 Received by Private Wire Direct to The Star Office Sales— Add 00. Open. High, Bls Bl 18 18 1% 1% 10% 104 66 N Gas (60c). lachine (2 Pet vic A 22¢ st Ut (b8%) . t Sts U(h8%) an Pipe Line. .. Mohawk Hud 1st(7). ation. ......0 S Corp (1)« es, Lid.. Stores. .. wel Nat Fuel Gas (1) Nat Rubber Mach. vice Co. . . Nat Sh T Sec A $60c. )ee Bros pf ( (Herman). New Bradford Oil. g T&T (8) New Jers Zinc (13).. nt Mining NYP&Ltpt (7). 4 Niag-Hud Pow (40c). Niag-Hud Pow A w.. Niag Sh Md (40¢)... Niles-Bemt-Pond (1) Corp Chile B. CorpLtd.... Aviat A war, North European Oll. Pow A (8) or St Pow pf (7). .. 50s ovadel Agene (4).. 2 ass (B) (2)..100s pper 2 s Sec.... o E1stpf1%. 2 Pac Western Oll... Alrways. Parker Rust Pr (3).. Pennroad Corp (40¢) at & Pow (3) POCPEA ). th Ofl (25¢).. 11 & Alex 31z, Lambert (3) ). fal Invest. .. ial Inv pf(6) 150, 1 Hold war 1 Hold xw Pub Ut Hold cu p! Reiter-Foster. Reliance Int A, . nce Int B.. iance Manag. tepublic Gas Corp. .. Reybarn Co... Reynolds Invest. Rich Rad cum pf Rock Lt & P (90¢)... Russek’s Fifth Ave.. St Anth, it Cr RIECO2) .. o0sse c Allied Corp (1).. al L e Ind al ctfs(513).. attucl henandoah Corp. Sherwin Wil pt (6).. 2 Silica Gel ctfs g uth Py So Cal E Souther So New S W Gas Utl Spieg M. Stand Ofl of Stand Of Stand O Stand P Starrett Corp. .. Starrett Corp pf (3). utz M Sunray Swift & y Gold.... k Prod (1).. 5 & H (as0c).. k Den Min. Son e T e Nanh FAR AN R AN A E =N enn Ofl (1) dpfB (1%). n Nat Gas. .. Enz Tel (8). ties. rnpf.. (1).. il of Ky 1.60. il Ohio (213). wr & Lt (2).. 1 1 28 ay S otor Car. oil. Co ( 1 2 8 2 0 Switt Internat’l (f4) Tampa Electric (32). Technic Teck Hi olor Inc. 1ghesGM 14 43 e Texon Oil&Land (1). Thatcher Sec Corp Tob Prod Exp (10 ). Todd Shipyard (4).. Trans Lux DLPS.. Tri-Con! t Corp war.. rieider Fin Cp.. Unfon A m Invest. Un Gas of Canada (1) Unit Corp war. Unit Dr. a Unit Lt 1S Rub Unit Ve Ut P& Util & I Util & I Walker 519 1% Wright Utility Equities. . Van Camp Pkg. ¥ Docks. s Corp war.. pL (D). &Pw A (1).. Unit L & Pwr pf(6). 7S Dairy (B)..... Slec Pow ww Finishing..... Foil (B) (50¢) Inter Sec 1st pf. pber Reclaim. rde Exten (1) Lt(at1.02%). nd pf (1%).. 1 (H) (50¢) Woolworth (FW) Har (112%c) RIGHTS—EXPIRE. 2% Peop G Dividend rates in | nual payment. *Ex @ 24 " ividend. 1| & Pavabie in cash or stock. L&C.Jan15 1 doliars based on I ividend. 3y t quarterly or sem!-an. b £ Plus 6% in stock. hPlus 1% in £ Plus 8% in stock. lus 2% k. k Plus 10% in stock. mPlus 3% 1 5019 © Paid last year—no regular rate. Everybody’s Business Laval Optimsistic on Visit to U. S—Dropping of Steel Merger DlantMfbarenty Approved by Market. BY DR. MAX WINKLER. Special Dispatch to The Star. NEW YORK, October 16.—The gravity | of events should not prevent the find- | ing of a fundamental solution, ac- cording to Plerre Laval, French prime | minister, in a statement made prior to his departure for the United States, where he is expected to confer with President Hoover on the world economic crisis. Being naturally optimistic, M. Laval hopes that somethirig tangible will come of the conference. Although no information is available | as to the problems which the two ex- ecutives will discuss, it is within rea- son to expect that the one dealing with intergovernmental debts and repa- rations will play a prominent part. A detailed statement regarding the status of war debts, published in Washington the other day, appears to substantiate this contention. The discussions are also expected to | include such important international questions as maldistribution of gold, the silver problem, gold standards, their possible early restoration, and last, but not least, the question of disarmament and of France's security. Dropping of Steel Merger. The market apparently approved the dropping of the plan to merge the Bethlehem Steel Corporation with the Youngstown Sheet & Tube Co. Accord- ing to E. R. Grace, president of Bethle- hem, changed conditiorfs make it im- practicable to carry out the original contract for the merger. and his cor- poration has consequently exercised its option and canceled the contract. The announcement had little effect upon securities’ price movements and changes in the quotations of the shares of the companies affected were merely nominal. It is becoming increasingly evident that money rates are getting firmer, situation which should find proper re- flection in the prices of commodities and securities. As regards the former, a rise in rates should be accompanied or followed by an advance in prices. As to securities, higher money rates should result in lower quotations for high-grade bonds, while advances should be registered by | backed by enterprises with relatively that silver-producing countries should large inventories. |levy a countervailing tax on the pro- The effect of higher rates upon high- | duction of new silver. grade bonds is already beginning to | make itself felt, as evidenced by pres-| An adequate advertising campaign, | sure upon United States Government which features the liberal use of space | issues. Tt is not unlikely that the con- | in local newspapers, is an important | tinuance of high rates may render |part of every aggressive sales programg | necessary another advance in the re-|and there is every reason why this discount rate to as much as 4 per cent, | should be employed by leading gas com- as compared with an existing rate of | panies, according to Morse Dellplain, 214 per cent. | president of the Northern Indiana Pub- ic Service. Assurance for Banks. Mr. Dellplain adds that the kean com- ©One of the principal features of the |petition which companies are now National Credit Corporation, which is|meeting, and which they will meet 2| one has more and more, makes it essential that to begin functioning at once, is the 8s- | 3ny sales program that is adopted take into account every factor which will build up sales appeal or break down sales resistance. surance to banks that they will be able to convert sound, slow assets into cash whenever necessary. It is, of course, possible that con- troversies will arise as to what may be regarded as sound assets. Many insti- tutions in need of assistance are under- stood to own relatively large blocks of foreign bonds, which they acquired be- cause of the excellent sponsorship under which such bonds were distributed and because of the liberal return. The de- mand for foreign issues, regardless of merit, may be said to be non-existent, with the result that sales cannct be made except at great sacrifices. 1t would seem highly desirable if the new corporation could see its way clear | to suggest concrete measures tending to assist banking institutions which may be large holders of foreign issues. It is expected confidentially that a good deal of constructive work will be accomplished at the meeting of leading copper producers, scheduled to convene later this month in New York. Surplus stocks of the metal are now larger than they have ever been, including the war period, when large surpluses were built up against munitions needs. A plan is likely to be evolved to pro- vide for curtailment of output by lead- ing producers, who include, in addition to the principal American and Can: dian companies, representatives from British Rhodesia_and the Katanga Co. in the Belgian Congo. Restriction of output should have a favorable effect upon the commodity as well as upon shares of leading en- terprises. Silver should be stabilized at around $1 an ounce, according to John Ford Darling, director of the Midland Bank, one of England’s “big five” financial institutions. ‘This, says Mr. Darling, would provide China and other silver- countries with a silver coin which is practicable to carry around. Today to drag tremendous weights if one wishes to convey real money in China, because the coins are worth so litt) Hhri Darling feels that stabilization on the basis of 20 ounces of silver for 1 ounce of gold could be arranged by an international conference, which either the United States or Canada ought to call. so-called second-class bonds and com- mon shares, especially thoge which are In order to combat fear of overpro- duction, the Lomdon banker suggests A curious situation exists in the for- eign bond market, due, it would seem, to lack of information rather than un- satisfactory fundamental conditions. The City of Carlsbad 8 per cent bonds, payable in United States dollars and listed on the New York Stock Exchange, are available at 75, giving a current yleld of".close to 11 per cent. ‘These bonds, a secured obligation of one of the world's most famous resorts, are outstanding at less than $1,500,000 and are secured on assets appraised conservatively at more than 14 times that figure. The chief reason for the abnormally low quotation lies, in all probability, in the fact that holders regard Carls- bad as a city in Germany and are dis- posing of bonds because of fear over possible complications in that country. The city is located in the northwestern part of Bohemia in the republic of Czechoslovakia. (Copyright, 1931.) TACOMA PARK BANKERS. BALTIMORE, October 16 (Special). —The Tacoma Park Bankers Inc., with headquarters in the Baltimore Trust Building, has been incorporated under the State laws of Maryland to generally do an industrial loan business. The capital stock consists of 100 shares, ng per value, and Horace A. Teass, WY llam F. Treiber and Franklin Q‘Wfl) all of New York City are the”'” corporators. i 4 Curry of Pork. / Cook one cupful of .sncea/‘““" in two tablespoonfuls of porydriPPings for a few minutes. Add /U cupfuls of diced tart apples, cqft 8nd cook until tender. Add two cugdls of chopped lean cooked pork, one/ et p‘o‘,_ , one teaspoon: Sor, o tablespoonfus Ot lemon. juice, heat the mix- salt to taste, stir, ture thoroughly. ¢ hot with flaky rice. Green tomsioS M3y be used in place of the l% AUTOMOBILE TRADE LOOKS FOR UPTURN Industry Is Prepared to In- crease Operations With Gain in Sales. BY DAVID J. WILKIE. ‘Written for the Assoclated Press. DETROIT, October 16.—Although that branch of the automobile industry having to do_with the compilation of comparative figures on output, ments and new-car registrations con- tinues to record low figures, the manu- facturers are displaying more imterest in a prospective upturn in production than in the past performances of the industry. Numerous compilations have been made to show that production and new- car registrations during recent weeks have fallen below five-year averages Extensive model changes are in process of preparation right now, however, anl substantial improvement is looked for within the next few weeks. Unusual activity has been reported in several tool and die shops, forecasting in- creased operations in automobile plants. Predictions Are Few. Generally, automobile executives are reluctant to make any predictions or even discuss just what effect the new model introductions will have on the in- dustry’s immediate future. Earlier in the year statements came rather fre- quently as to the more cheerful pros- pect for production and sales accelera- tion. Most of these predictions fatled of materialization. 4| At the same time not a few of the 4| leading manufacturers hope that with | eonstructive forces at work to improve business conditions generally, the ac- | celerated production incident to the I bringing out of new models may carry | over into the early months of next year. { This, they believe, would give a much- needed impetes to the industry and if | the increased vroduction could be cou- { pled up with the seasonal improvement that will come with the arrival of good i driving weather it might even develop 5!into the definite passing of the spotty | condition of business in the motor car | industry. | The whole picture admittedly s one of hope more than expectation, but most_automobile executives still believe the automobile industry will lead the way in the restoration of normal busi- ness conditions. The industry, they sav, invariably has been first to feel the effects of a depression, but it likewise almost always has been the first to show the beginning of a return to rormalcy. Seeking Improvement. Automobile manufacturers have not stood still waiting for an upturn; they have called upon all their resources to hasten general improvement. from the elimination of all wasteful |toward aggressive salesmanship; the introduction of new models has been postponed in large measure from Mid- summer to November and December, %0 the end that employment conditions might be bettered during the Winter months; plants have been established in Canada’ when tariff restrictions threat- ened to curtail the sale there of cars made in the United States, and steps lso have been taken to stimulate Fal buying to further increase the Winter manufacturing activity. Several reasons why Fall buying is advantageous for the motorist have been advanced by merchandising executives Urging_that worn-out cars be turned in at this time, one leading sales man- ager points out that “drivers now de- mand the maximum in_motor car per- formance during the Winter months, when worn-out motors can caufe the most_trouble, when old tires are most apt to skid.” Referring to cars not in the worn- out class, he claims that in most cases “the motorist can get a better price for his present car in the Fall than in the Spring, when it is a year old.” John L. Lovett, general manager of the Michigan Manufacturers’ Associa- tion, is one of those who believe the policy of the motor car industry to in- troduce its new models in Midwinter rather than during the Summer months will help materially in relieving un- | employment_conditions this Winter. He | predicts at least a moderate revival in the industry, with an increase in fac- tory pay roils probably more marked after the National Automobile Show in New York January 9 to 16. Change in Purchasing. “The trouble is,” Lovett said, “that it has got to be the fashion to scrimp and save even where there is no necessity. Rich men will drive a motor car for three years, and think they're rather smart in doing so, whereas formerly the bought a new car every year. Once get people buying ford it, I mean—and prosperity soon will begin to return. New York Cotton Special Dispatch to The Star. NEW YORK, October 16.—Cotton prices were 1 to 4 points lower at the opening today. Favorable weather re- ports from the cotton belt increased the volume of hedges, but there was still good trade buying in near months. ‘The widest losses occurred in January and March, which still harbor specu- lations for the short side. Opening prices were: _December, 6.12, off 1: January, 6.20, off 4; March, 6.38, off 4; May, 6.60, off 2, and July 6.78 off 2. Grain Market By the Associated Press. P CHICAGO, October 16.—Grains ' ed upward early today, mnuenceg{““ unexpected advance in Liver oodt quotations and by indicationg’ Narin export business overnight fy” quickly America. The market, howe”" ran into profit taking. - Opening Y47 cents updhoet 2iter: ward held near the initipguance. but started unchanged to 4 subsequentlv reacted. New York wheat plnases included takings of United grades as well as dispatehes told of millers and_ sai lest since 1923-24. age s the Sasserted that United CAR0 exPOrifh at Gulf of Mexico States wheat, fiis “was now cheaper e A"""‘%fie wheat, a notable cir- tl “"‘A’BE view of high quality’ of cumstancfies wheat and low quality ship- | Aside | manufacturirg and merchandising prac- | tices, there have been energetic steps | those who can af- United fne. °‘CA" faints of serious deficiency of ‘e in Argentina were a handicap hO4eat bears. 1t was pointed out that Argentine crop had reached a stage Yere questions of seasonal rainfall re important. PETITION IN BANKRUPTCY. BALTIMORE, October 16 (Special). —Arthur E. Sixsmith of Chevy Chase, Montgomery County, has filed a peti- tion in the United States District Court asking to be adjudicated a bankrupt. An order was signed adjudicating him a bankrupt. Judge Coleman signed an order ap- pointing Hyman Paul Rome, receiver under bond of $1,000, to take charge of the assets of the defendant. order signed upon a petition filed by the Murphy Door Bed Co., Inc. ‘The appointing the receiver was gt The Pennsylvania Railroad system covers a trackage of 26,000 miles, _ _ STOCK AND BOND AVERAGES By the Assoclated Press. From Yesterday's 5:30 Edition. High, 1931 931 High, 1930.... Low, 1930. High, 1925. . Low, 1929. 20 Indust Today. ¥ Previous Week ago. Month ago Year ago...... Two years ago. Three years ago High, 1931... Low, 1931. High, 1930... Low, 1930. High, 192! Low, 1929, ay. BY CHARLES F. SPEARE. Spectal Dispatch to The Star. NEW YORK. October 16—The sore | point in the market for securitie | tinues to be in the bond depar! | Within this department the issues that |affect sentiment most seriously are | thoge of the railroads. In the past two days the decline in these obligations age as great as any in the period of reaction. Nothing has yet been done in & concrete way to check the liquida- ticn in railroad bonds and thereby spread a more hopeful sentiment over the financial district. The situation in the market is that it is being supplied with as many offerings as 1t can absorb, with other offerings in the background Bonds Sway Markets. The point cannot be emphasized too often or with too great fcrce that an improvement in the stock market de- pends primarily on a stabilization of the prices of bonds. This is why Wall Street listens eagerly day after day for intimations from Washington that a plan is being formulated to relicve the embarrassment of thcse carriers that have maturities ahead of them and whose treasuries are short of cash. It was rumored today that an issue of matuPing Seaboard Air Line Railroad equipment_trust certificates was not to be paid off, though the interest on the certificates is to be met, and that the policy of the receivers of the road toward subsequent maturities will be to | defer payment of principal, but to take {care of all interest obligations on their maturing equipment issues Delay in preparing and putting into operation a relief plan for railroad ob- ligations is excused by the pending de- cision of the Interstate Commerce Commission in the 15 per cent freight rate case. No one apparently wishes to act until the opinion of the commis- sloners in this case is known. There were rumors today that an announce- ment from the commission would come immediately. have about abandoned the idea that the commission will allow an advance in rates of sufficient size to permanent- ly improve the credit of the carriers. A 10 per cent advance, which is the maximum expected. would undoubtedly have a sentimental effect, but a tem- porary one. It could not soon enough change the actual cash position of the railroads to relieve them where they have maturing equipment trust cer- tificates or mortgage bonds in the next six months. Inasmuch, therefore, as the effect of a persistently weak bond market is that of disturbing credit conditions in general and unsettling the stock mar- ket, to which the average American today is looking for his clue to business symptoms, it is obvious that of as great importance in correcting the gen- eral situation as may be the $500,000,- 000 banking pool is a secondary to specifically resurrect the market * raflroad bonds and to bring them Rl to an approximatation of theirhe values. The contributions Whic'the large banks will have to makep in present “‘pool” are relatively fwhen the aggregate; inconsequentiof the | considered from the standpg’ in any | first installment. They do ary allo- sense approximate the arhe mana. cations that were made find Englis gers of the several Germjergencies o last Summer to theiried States. ates throughout the grgyed that the Therefore, it may Jent is a_second prime need of the Beed not be half banking pool, whighunced in Wash- the size of that ington last week Washiton Produce One-pound prints, 37; tub, 36. Butterionnery, $3835; current Te- m“:’?onza. i ’Ary, alive—Turkeys, old toms, 208 Bung toms and hens, 30; chickens, | 2%unds and over, 18a22; 2 to 2'z| Ands, 20a24; broilers, 1': to 2 pounds. | a25; hens, large, 20a23; small, 18a | 20; Leghorn hens, 14a16; roosters. 12a 14; keats, young, 45a50; old, 25a35. Poultry. dressed—Turkeys, old toms, | 25a30; young toms and hens, 35 cmcl‘(’-{ ens, 3 pounds and over, 22a25; 2 to 2} unds, 25a28; 1': to 2 Pounds. 28a30: ens, large, 25a28; small, 23; Leghorn | hens, 18a20; roosters, 16a18; Long Is- land ducks, 18a19; keats, youns, 55a60; | old, 30a40. 4 Meats—Beef, prime, 1712a18; choice, 16a16'%; good, 15a151s; fair, 12'2al4: cow, 10a11; lamb, top, 16; good to fair, | 14al5; veal, top, 17; good, 15a15':; fair to medium, 13al14; pork loins, 8 to 10‘ pounds, 21; 10 to 12 pounds. 19; 12 to| 15 pounds, 17; fresh hams, 16a17 smoked hams, 20a21; strip bacon, 22a2 lard, in bulk, Q‘iasllfl; in packages, 10128 11; col und, 8a8'2, | L!vem:omk—flogs, heavy, 5.00a5.70; | medium, 5.4085.70; light, 5.25a5.50 pigs, 5.00a5.25; roughs, 3.00a4.00; calves, 5.0029.00; lambs, 5.00a7.00. Pruits — Watermelons, California, crates, 2.00; honeydews, 2.00; oranges, 3.50a5.50; lemons, 550a6.50; apples. bushel baskets, 5081.50; box _stock, fancy, 2.2582.50; pears, 2.75a3.0 peaches, 2.00a2.25; limes, per 100, 1.75; grapes, Cancords, 35a40; Tokays, 2.00a 2.25; Zinfandels, 1.25 Muscatels, 1.25; n seedless, 2.50; Malagas, 1.50a ‘Thompso! g les. 4.5 juinces, 1.50a 2 e s casabas, 2.45; ba- 1.75; plums, 2.50 nlnu,pljnnl.'m: grapefruit, 4.00a5.00. Vegetables—Potatoes, 150-pound sacks, 175a1.90; Idaho bakers, 100-pound sacks, 2.50; sweets, per bushel, 50aT7: tomatoes, ~two-peck baskets, 50a75; California lugs, 2.25a2.75; beets, per 100 bunches, 4.00a5.00; carrots, per 100 bunches, 4.50a5.00; caulifiower, 1.50a 1.75; string beans, 75a1.00; limas, 2.00a 2.25' cucumbers, bushel baskets, 3.50; squash, Florida, bushel baskets, 3.00a 3.50; Winter squash, nearby, 50a60; eggplant, 50a75; celery, 2.75; lettuce, Ice- berg, 3.25: 0: onions, 50-pound sacks, ‘white, 1.50a2.00; ye}(lo'l,zl‘.sln&zt‘:,orn. flvl:- dozen sacks, 1.75; okra, 2.5023.00; musi- rooms, 90ai.00: peppers, 75a1.00; arti- BONDS. rials, has been pronounced and on the aver- | Railroad men and railroad bankers | credits provided in thenking assocl- | absorb the neces- | | to September 30, $1,005,069 | bunker fuel oil and Diesel oil 19 cents 20 Utilities, 116.5 114.4 122.0 141.0 191.8 160.7 98.6 203.9 1015 2813 1465 352.1 156.3 Rails. 50.7 404 51.9 53. 109.8 123.0 100.7 106.2 43.5 1416 86.4 1678 177 20 Rails. 20 Utilities. 90.9 91.2 923, 98.1 99.5 974 99.6 101.5 89.5 101.4 96.6 99.8 96.0 82 84.0 90.6 107.7 1028 105.4 105.7 80.6 100.8 97.3 106.0 100.8 (Copyrizht, 1931, Standard Statisties Co.) RECENT DECLINE IN RAIL BONDS HAS AFFECTED ALL MARKETS sitous liquidation that has taken place and thereby check the fears | spreading_throughout the en- | ship in railroad fixed | ‘This is as essential in bonds, that are | tire field of owne interest obligations. to a betterment of the situation as was the creation of the $500,000,000 bank- ing pool. Pole’s Ruling. It is taken for granted that the States in which railroad bonds are legal for savings banks investment will not impose on the holders of these obliga- tions the strict letter of the law and that accommodations to the present sit- uation will be made in the same spirit that prompted the controller of the cur- Persistent Liquidation of Carrier Issues Results in Depression of Other Securi- ties—Rate Plea Decision Awaited. FOREIGN EXCHANGE STABILITY PLANNED Brazil, Argentina and Latvia Take Action to Protect Standards. The government of Brazil, Argerting and Latvia have instituted measures 1o regulate banking and forelgn ¢ichange in order to maintain their Ipeciive currency standards, the COMmierce De. partment has been informed by i< eom. mercial attaches in those countries ‘With certain provisions to be filled b debtors, Brazil has authorized a 60 extension in the time for the pa of all debts owed in foreign Cir and maturing up to December department was advised. It vwas ex plaind that the Latvian 80'rnment now “has practically & moncpoly on foreign trade.” Uncertainty in Brazil. The Argentine government thorized a committee headed by a bank president to regulate “all exchange oper. ations,” a cablegram to the depariment disclosed. Carlton Jackson, commercial at Rio de Janeiro, said some uncer ty exists in Brazflian banking circl upon the exact scope of the new ex- change regulations. which are inciuded in three articles. The folloWing outiin of the articles has been transm the department by the attache Article 1—Bills and contractu ments maturing up to December foreign currencies will be extended days beyond their Yespective m= dates. A—This is not applicable to corira for the purchase and sale of exchay B—To avail himself of the of Article 1, the Brazilian debtor deposit the equivalent in milgny the Bank of Brazil or in the through which the draft has by | the milreis being calculateding purpose at 4 pence, taking {its par value. The differefhe peye change to be liquidated Wb’ ment is made. 4§ effective Article 2—The decrefion (Octo- upon_ the date of pub | ber 9). ovisions _con- | Article 3—Previousations are re- | trary to the new re voked. ri ist P at in ex. v ations. New Rf cording to Jack- Brazilian bankqncertain upon the rency. and after him various State su- | son, are somewihe new regulaticas perintendents of bank: tutions to carry at c on _the June 30 basis. The original alarm among institutions and trustees that bonds which did not ment ofowing meet the legal test would be disbarred | to permit insti- bonds with a | supersede certain rating. This plan has just been approximated in New York State, where fire insurance companies are now al- lowed to value their portfolio of stocks law of 1908, theche debtor to liguidate which permit} by making a judicial | his indebtedeis at the official rate deposit of ,f foreign exchange was of exchan The new regulations do | not availeto provide for any pay= not apierest to creditors. statement was re- The om Commercial Attache Lee extent to whignking after January 1 is passing. This, how- | ceivet, at Riga. regarding Latvia's ever. has not dispelled the anxiety re- 1 C. Ms of carriers with | megrd: garding the ability early maturing obligations to find ti cash to meet them. The function of the to maintain its monetary 512 an effort to maintain the sta- ¢ of the currency unit the Latvian suggested secondary banking pool would | krnment, through the Bank of Lat- be mot only to act in the capacity of a k, is now in complete control of all supporter of bond prices, but as aNyreign exchange, so much so that the agency to which the distressed railroagovernment now has practically & might go and, on the basis of & norm monopoly on foreign trade. high credit, obtain the assistance nr| “The government has requested a essary to carry it through an abnor | committee to pass on all requests for period. e (Copyrizht, 1931.) CORPORATI® REPORT CTS OF TRENDS AND PROyrions. LEADING ORGA_ | | lowing is & Surprepared by corporation Standard Statist Press: | for the Associs Xs Trend | .5 continued to decline, | Brokers’ 10,000 to $928.000.000 in dropping $led October 14, according the weekgly repori of Federal Re- to the *of New York. This is the serve Botal sinec December 28, 1922, smalleskers’ laans were $898.541,000. whennade by New York banks for | Loajwn account declined $99.000,000. the’loans for account of out-of-town wls increased $8.000.000 and those | Faccount of non-banking loaners rose | 8,000,000. | The Companies. | Consolidated Retail Stores Septem- ber sales off 24.7 per cent; nine months off 12.7 per cent Stewart-Warner Corporation reported | | shipping 1.200 radio sets daily; behind | in_deliveries. Beldino-Hemingway Co—Sales off about 50 per cent in first eight months: | Belding and Putnam plants operating t 50 per cent of capacity: Tetcluma lant at 33 per cent, while Northampton | mit idle. | Consolidated Railroads of Cuba cuts salaries as much as 25 per cent. Gimbel Bros.—Cuts executives salaries about 10 per cent: pay of clerks and sales persons unchanged. Industrial Rayon—Average cost per pound of rayon yarn produced by com- pany has been lowered 48 per ccnt from average cost in 1929; sales for first ninel months reported slightly over 9,100,000 pounds. Mathieson Alkali Works common | share earnings, nine months, to Septem- | ber 30. $1.43 vs. $2.26 | MeclIntyre Porcupine Mines Ltd.—Net income before depreciation. six months s. $1,026,- 276. Pepperell Mfg—Lindale plant in- creases working schedule to 5215-hour week: formerly on three-day week. United Aircraft & Transport.—Car- ried 17,980 revenue passengers and 618 tons airmail in third quarter. Beatty Bros., Ltd.—Declared 25 cents common dividend; paid 50 cents Au- gust 1. Burmah Oil Co. Ltd—Declared in- terim common dividend of 5 per cent. less tax, is 10 per cent less tax last year. Fox Film.—No action believed taken on Class A and B _dividends. Freeport Texas.—Earnings continue to exceed current dividend requirements. National Service Cos—Fuel oil sales of subsidiaries in 12 months, to Septem. ber 30, 20,819,427 gallons vs. 10,087.427, Standard Oll N. J—Reduces prices| a barrel. Eastman Kodak Co.-—Acetate yarmn plant of subsidiary on commercial basis | at 25 per cent of capacity. Gillette Safety Razor common share earnings, nine months, to September 30, $1.14 vs. $3.96. Atlantic Refg.—Deflcit, nine months, to September 30, $2,771,362 vs. net in- come $4,844,423, equal to $1.80 a com-| mon share. Art Metal Works.—Declared common dividend at rate of one share of each 50 ‘shares held; paid 15 cents a share in cash August 1. CHESAPEAKE & OHIO. NEW YORK, October 16 (Special). —While all of the stocks of Eastern railroads that are party to the con- solidation scheme have had substanial advances lately and also abrupt de- clines, none has had as uniform a movement as Chesapeake & Ohio. This is due to the ability of the road to cover its dividend requirements this i 16.—The fol ! r 16.—The fol- | potatoes NEW YORK. Oy of important | potatocs. @ the | 1.00a1.7 newCo., Inc., New York, | per 100, 1.50a2.50: cabbage, bushel. 40a | 60; carrots | per_crate, 2.50a3.50: caulifiower, crate, exchange. and unless approval is se- cured hange cannot be purchased. | This committce has refused importers permission to purchase the exchange for import of “automobiles, perfumes, | etc., as non-essentials.” Baltimore Markets Special Dispatch to The Star BALTIMORE, Md. October 16.— 100 pounds, 75a1.00: sweeg™ bushel, 35a50; beans, bushel, : yams, barrel, 1.50a1 beets, per_100, 2.50a3.50; lettuce, 50a2.50: celery, crate, 1.75a2.75: lima beans, hamper, 75a1.10; okra, 2.0082.50; peppers, hamper, 25a35; onions, per 100 pounds, 1.75a2.00; spinach, bushel. 50a 80; tomatoes, hamper, 25a1.00; canners’ stock, 50a60; apples. bushel, 25a1.25; cantaloupes, crate, 1.25a1.75. Dairy Market. Chickens, voung. 20a22; Leghorns, 18 a20; old hens, 18a24; Leghorns, old, 12a 16; roosters, 12al4; ducks. 12a20; pigeons, pair, 15a20; guinea fowl, pair, 25250. Eggs—Receipts. 477 cases: current, 18 a26: hennery whites. 34a36; nearby firsts, 28: Western firsts, 28. Butter, good fancy creamery, 32a37: a22; process, 23a24; store packed, 15a16. Hay and Grain Prices, Wheat—No. 2 red Winter, export, no 0. 2 red Winter, garlicky, 523; October, 5235; No- quotations: spot. domestic vember, 531 Corn—No. vellow, domestic, spot, 51a52; cob corn, 2.25a2.50 per barrel. Oats—No. 2. white, domestic, spot, 32a33; No. 3, 31a32. Rye—Nearby, 45a50. Hay—Receipts, none. New hay is starting to arrive in inereasing quan- tities, but so far no official grading has been' attempted, selling being strictly on merit. Demand for old hay slow and market is dull and quiet, with prices in buyers' favor at a range of 14.00a18.00 per ton. Straw—No. 1 wheat, 9.00a9.50 per ton; No. 1 oat, 9.00a10.00 per ton, RAIL MERGER FAILURE FORECAST IN STREET By the Associated Press. NEW YORK. October 16.—News of the definite abandonment of the plan for the merger of Bethlehem Steel and Youngstown Sheet & Tube was not in the nature of a surprise. As E. G. Grace, head of Bethlehem, pointed out in his statement dealing with the can- cellation of the contracts, conditions have been subject to vast change since the deal was first undertaken. Wall Street had for some time realized that it would be more or less impracticable . to put the merger through on the basis set nearly 18 months ago’ in March of last year. Release of Bethlehem from its obligations under the contract was reflected in & rise of several points in the stock, while Youngstown fell away a point on a few transactions. BANKERS' ACCEPTANCES UNDER BILLION DOLLARS By the Associated Press. The volume of bankers' acceptances 2 | outstanding at the end of September stood under the billion-dollar mark for the first time since August, 1928, the American Acceptance Council reports, Last month brought a contraction of $94,034,771 in the total to $996,365,078. The contraction since January 1 now foots up to $559.000,000, or roughly 36 per cent, while the current figure stands $370,369,079 below the total reported for the corresponding date a year ago, The heavy shrinkage is ascribed chiefly to the sharp contraction which has oc- curred in our foreign trade in the in- terval and business based on interna- tional transactions. Change in Capital Stock. year and keep its bonds in the legal list; also to the estimates that have been made showing that it will benefit in earnings from the merger plan morc than its competitors. The Chesapeake & Ohio is the backlog of the entirc chokes, 4.50a5.00; kale, 50; spinach, 7 peas, 3.75; tu?(ps. 50875, Van Sweringen system and a property of great strength and potentiality, - NEW YORK, October 16 (#)—The New York Stock Exchange has receiveq notice from the Peerless Motor Car Corp., of a proposed change in author. ized capital stock from 750,000 shares par value, $10. to the same number of shares, par value, $3; each share to be exchanged for one new share, t ’