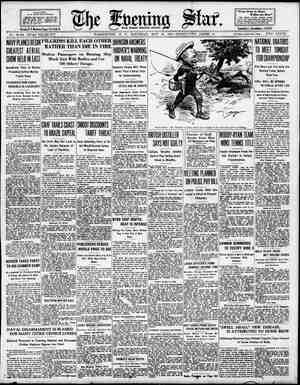

Evening Star Newspaper, May 24, 1930, Page 14

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIAL CHANGE INLENDING Bankers Doubt Wisdom of Relaxing Rules on Federal Reserve Credit. @pecial Dispatch to The Star. NEW YORK, May 24.—Serious eco- nomic disadvantages, especially the dan- ger of inflation, are found by the eco- nomic policy commission of the Ameri- can Bankers’ Association in current pro- posals aimed at making it easler for members of the Federal Reserve Sys- tem to borrow from their Reserve banks. These are offered as a remedy, it says, to overcome the difficulties many banks suffer under because great shrinkages| have occurred in recent years in credit instruments eligible for rediscounting or borrowing under the present rules. IA a detailed study and report by the commission. taking up specifically the question of admitting installment finance company paper, municipal issues and railroad bonds to Federal Reserve credit operations, it is declared that “such ac- tion might tend to make Reserve credit ~less liquid, throw its workings out of step with fundamental business changes, and also increase the task of preventing the Federal Reserve system from being employed as a facility to inflation.” The members of the commission are R. S. Hecht, New Orleans, La., chair- man; George E. Roberts, New York City, vice chairman; Nathan Adams, Dallas, Tex.; Leonard P. Ayres, Cleveland, ‘Ohio; Frank W. Blair. Detroit, Mich.; ‘Walter W. Head, Chicago, Ill.; W. D. Longyear, Los Angeles, Calif.; Walter 8. McLucas, Kansas City, Mo.; Max B. Nahm, Bowling Green, Ky.; Melvin A.| Traylor, Chicago; Paul M. Warburg, New York City; O. Howard Wolfe, Phil- adelphia, and Gurden Edwards, New York City, secretary. Debt Retirement. “Sound Federal debt retirement poli- cles have resulted in contraction in United States Government securities of $4,400,000,000 in five years, or almost 21 per cent,” the report says, in discussing the shrinkage in paper now eligible. for ‘borrowing or rediscounting. “Open mar- ket commercial paper showed last Sep- tember & contraction in five years of $660,000,000 or more than 71 per cent. Eligible paper in Federal Reserve bank members in 1926 stood at about 22 per cent of their loan portfolio; last De- cember it amounted to only about 16.7 r cent. There was a drop of half a illion dollars, or 10 per cent, in the volume and more than five points, or 24 per cent, in the ratio.” ‘These changes reflect, in part, the re- port comments, “the driving out by chain store and other direct merchan- dising methods of large numbers of middlemen who formerly created con- siderable volumes of commercial paper”; ‘also the rise of the practice of large corporations to replace bank loans with security issues. It continues: * rs’ acceptances have shown an increase in five years of nearly a billion dollars. However, due to low yield, this paper has not been expedient Tor banks to carry in any great volume, and therefore has not materially helped the situation. There is no question, therefore, that there has been a very serious contraction in available eligible instruments. Finance Company Paper. “On the other hand, there has been ‘eonsiderable expansion in non-eligible instruments. It has been estimated that the volume of finance company paper| arising from installment selling in the “'banks is more than $1,000,000,000. An- nual output of municipal issues has been in excess of $2,000,000,000, with a Jarge increase in the hands of banks. Collateral loans by member banks since 1925 show an increase of $3,430,000,000, ‘or 51 per cent. These changes in bank- ing credit have led some to feel strongly ‘that a_change in the eligibility rules ‘was called for.” Another aspect of the subject treated by the report is the actual use of eligi- ble paper for rediscounting and bor- rowing by the member banks. It points out that in December all member banks held a total of $8,429,000,000 in eligible instruments, but only about $879,000,000, or not much more than one-tenth. was ‘being used at the Federal Reserve banks. “It would appear that the banks as a whole have no need for enlarged sources of eligible paper, since they are using so small a proportion of what they have at the Federal Reserve banks,” the report says. “These gen- eral figures, however, do not reveal the important fact that these ample sup- plies are not evenly distributed. The country State banks appedr to be espe- clally deficient in eligible paper. “Rej show that country State ‘bank ,members of the Federal Reserve system held almost 9 per cent of the total loans of all member banks, but Jess than 6 per ¢ent of the eligible pa- r, and only about 11 per cent of their| joans were of this class. City State ‘bank members held about 33 per cent of the total loans of member banks and almost 27 per cent of the eligible paper, while more than 13 per cent of their loans were of this class. The national banks held about 58 per cent of the | sary for the new | 36% Shattuck(FG)(11%) 4 Shell Union (1.40, Shubert Theatres. 4 Stmmons Co (3). Simms Petrm (1.60).. % Sinclair Con Oll (3).. Skelly Of1 (2). .. Skelly Ofl p£(6). ... Solvay Am pt(5%). . 4 So Porto Rico Sug (1) Southern Cal Ed (2). Sou Dairies (B). Southern Pacifig (8) .. Southern Rwy (8)... Sparks Withngta(1). Spicer Mfg Splegel-May-8 (3)... Stand Branas (1%).. StandG&E (3%)... Stand G & Epf (4. Stand Gas& E1 pf(6). Stand O of Cal (3%). Stand Ofl of N J(12). Stand OII N Y (1.60). 3 Stand Plate Glass pf 100 Sterling Sec (A)... Stewart-Wa: 1 4 9 0Bul F BBownalrraowrwnnes s 1 D Studebaker Co pf Sun Oil pf (6)... Superior Ofl. Symington (A Texas Corp (3) ). Texas Pac Land Tr. Thatcher Mfg, (1.60). The Fair (2.40).....: Thermold Co (2). Thompson Prod( mpson Star: Water As (60c). Tide Water Oil pf(6) ‘Timken Roller (3)... ‘Tobacco Products. ‘Tobacco Products A.. Transcontl Ol (30¢). o BremSme - Truax Traer (1.60) Und-Ell-Fischer (5). Union Carbide (2.60) Union Ofl of Cal (32) Union Pacifie (10)... Union T'k Car (1.60). Utd Afreraft. .. Utd Alreraft pf Utd Biscuit (1.6 Utd Carbon (3) Utd Cigar Stores. Utd Cigar Strs pf. Ttd Corporation. .. - RS R manaaa S 38% 29 1% 54% 84 9 59% 52 a o PROPOSED TRUCKING SERVICE IS OPPOSED BALTIMORE, May 24.—Despite the predicted saving of $20,000 a year in freight rates which would follow the inauguration of the proposed Pennsyl- vania Railroad trucking service on the Eastern Shore, hostility, fostered by the chamber of commerce in several shore towns, has handicapped the project, the public service commission was told. Saul C. Hoffberger, vice president of the Baltimore Transfer Co. laid the charges against the Eastern Shore civic organizations which opposed the truck- ing service. The Baltimore transfer firm and the Peninsula Auto Express Co. were named by the railroad to form the proposed truck delivery system. After first expressing friendly interest in the system, Hoffberger said, Eastern Shore residents became prejudiced after chnmbersmot pi:omme{‘c: took ?” m against the plan. e organ! Hoffberger said. have refused the truck- ing companies the advantages neces- service. ‘The commission was fold the new system would greatly facilitate the effi- ¢ient handling of fish and perishable produce to Baltimore and Washington markets. o . CHICAGO STOCK MARKET By the Assoclated Press. CHICAGO, May 24.—Following is the complete official list of transactions in stocks on the Chicago Stock Exchange today: Sales in, thousands. 58 fi§=§5=3€32238§ ST W By=goin. ¥ U gevsseaniay SES XS FES 2 o 3 = > total loans and more than 67 per cent of the eligible paper. The proportion .of national bank loans classed as eligi- ‘ble was 19.5 per cent. “This is a spotty condition that is further accentuated in respect to many articular localities and individual glnh. While the stronger banks have an_excess supply, many banks, espe- .clally in the country, but sometimes in the cities as well, are in a much weaker tion in this respect. The foregoing acts indicate the source of the demand for broadening the eligibility rules and also present a large measure of justifi- cation. However, we question whether the sound remedy is to be found in easier eligibility. Change Suggested. “It has been suggested that the rules be brogdened to include finance com- pany paper arising from installment selling, municipal securities and rail- Toad bonds, so that banks will have wider avenues of access to the Federal Reserve banks, from which many of them are almost disfranchised by the present restrictions. “The economic theory back of the resent rules !s that paper of the des- mated character is fundamentally sound, since it is created by responsible bank customers engaged in praguctive enterprise, further reinforced "by a bank’s indorsement; ®at the volume Tises and falls with seasonal changes in business and the longer business cycles; and that it is inherently liquid both in respect to maturity and to the self- liquidating character of the underlying transactions, since these involve the production and distribution of goods the Proceeds of whose sales at each turn- over supply the funds to pay off the original notes. Eligible paper, there- fore, tends to keep expansion and con- traction of credit and currency in step ‘with business. “Neither rallroad bonds, municipal dssues nor finance company installment paper quite qualify under this theory as classes of credit instruments suitable for eligibility. Railroad and municipal bonds as collateral security are almost as good as Federal securities, but these themselves are an anomaly as a basis for loans at the Federal Reserve banks. ‘They were admitted only as a war 400 Duquesns 1198 Bietirie 50 Emp G & Fuel 250 Pitz8immons 650 Foote Gear & 30 Gardner-Denver 300 General Theater 00 Ge W Tal Wat :' WIIQ Wks Great 8139 Griasby-Oranow 240 Hariscnteser = i Conn 86 Mach 16% 162 . 9% 89% Eq 46%. 45% s A 29 29 26 27200 Ma) Hhold & 150 Manhattan i3 600 Marshall ¥ “Dearborn. Pield A finance measure. They do not tend’ to . keep member borrowing co-ordinated :rlt;\'the expansion and contraction of ade.” —— Equipment Trust Certificates. NEW YORK, May 24 (#).—A new dssue of $14,040,000 4% per cent Equip- ment_Trust certificates will be sold to the highest bidder May 27, by the +»Chicago, Rock Island & Pacific Coast Railroad Co. The issue will he kno%n ¢s series @. Preeeed- will be used to Wurchase new equipment. 1000 Unit Am 65 '40 Stock ‘saies tody, ales tods has front-wheel-drive 45% ‘s | and rails by only 43.3 per cent. % | concluded here. 19 " | were formulated at the closing session _THE EVE Low. T% 4T% 20% Warmr Warren Warren w 1% 1% % 1% 5 Unit of trading in stock. §Payable i 5% in stock. NING STAR, WASHI Utd Gas & Imp(1.30). Utd Gas & Imp pf(5). Utd Plece Dye W (2) Util Pwr&Lt A (e2).. Vadasco Sales Corp.. Vanadium Stl (14).. Vick Chemical (2%). Va-Car Chem..... Vulean Detin pf (7). Walworth Co (2). Ward Baking (B). Ward Baking pf (7).. Warner-Quinlan (1). NEW YORK STOCK EXCHANGE Recelved by Private Wire Direct to The Star Office. (Continued From E 13.5 Sales— Stock and Dividend Rate. Add 00. High. Low. Close. Close. 514 B1% B1% 10% 104 110% o1 90% 44y 101% 31% i 35% 24% 92% 20 32% 20% 65 29% 284 171% 145% 65 39% 4% 114 - 19 o A Beanin T ouern enaR SnonrnmRe 9 S Bros Plo (4). » Bros (3)..,. Fdy &P (2). oil & Snow (2). Penn El pf (). West Penn Pw pf(7). 4 Western Dairy (B).. Westvaco Chlor (2).. White Motors (2)... White Rek MS(t4%) Willys-Overland Woolworth Worth Pump. . Worth Pump(B) (6) Wrigley (Wm) (4).. Yellow Truck. Youngs Spri! Zenith Radlo. RIGHTS EXPIRE Am Roll M..June 16 Am Tel & Tel.Aug 1 % DuPont deN..July 15 1% Phillips Pet..June 16 & Truax Tra C..May 29 Dividend rates as given in the above table are the annual cash Payments based on the latest quarterly or half yearly decl less than 100 shares. {Partly extra. 40000 ations. 1Plus 4% 1Plus 9% in stock. a Paid last ock. d Payable when earn in ed. e fPlus 10% in stock. % Plus 6% in stock. h Plus 2% in stock. J Plus 8% in stock. k Plus 3% in stock. n Plus Speculative interest in rail stocks which previous to the World War occu- nl:d a ?uiuon of outstanding market dersh &chu in recent years been steadily lining, says & current survey of the Standard Statistics Co. of New York. During each of the three major upward swings which have occurred in the past decade appreciation in this section’ of the list has been smaller than in either the industrial or utility groups, n;.mayheuentmtholppended chart. Between April, 1926, and August, 1929, while industrials advanced by 142 per cent, appreciation in the carrier group, measured by the Standard Sta- tistics Co.’s weekly index, amounted to only 89 per cent. Likewise, between July, 1923, and January, 1926, indus- trials gained 729 per cent and rails only 47.4 per cent. In.the 19-month Peflod ended March, 1923, Standard’s industrial index advanced by 69 per cent Moreover, on the recovery following the 1920 debacle the railroad issues generally have made an extremely poor RECOVERY IN RAIL STOCKS PROCEEDS AT VERY SLOW PACE showing. Less than 15 per cent of the ground lost on the preceding major downswing has thus far been regained. Industrials, taking into account the minated on May 3, have retraced 27 per cent. of the ground covered between the highs of .Jast August and the lows of November. Ttilities have already made good more than half of the loss gustained on last year's severe break. Admittedly, railroad stocks in the past have shown greater stability dur- ing periods of general market weakness than any other major group. Percent- age decline in the index in each of the four important downward swings of the past decade has been smaller than in the case of either industrials or utili- ties. Sound transportation issues, more- over, usually offer a better current re- turn than is afforded by high-grade equity shares in other sections of the list. Railroad stocks, therefore, appeal particularly to th. investor interested primarily in safety and yield. Those seeking long-term appreciation are like- 1y to fare better in other groups. Washington Ticker BY CHAS. P. SHAEFFER, Associated Press Pinancial Writer. Intelligent conduct .of the canning industry of the Nation through creation of a vast statistical organization was tentatively planned at a meeting just Realizing that adequate information is necessary if the trade is to function at the highest standard of efficiency, directors of the National Canners’ As- sociation, together with representatives of the various State associations, named & committee to carry out the idea. ‘The industry now depends almost en- tirely on Government information for its guidance. While this was held of invaluable assistance, it was the con- sensus there was urgent need of some agency to assemble and present avail- able data of use to the industry in such form that it may be easily interpreted and intelligently followed. It was emphasized that the association has an opportunity to do the canners a great service by working out this pro- organization, which will co-oper- ate with Government agencies and also undertake such additional work as the study of the problem may show to be needed and feasible. Recelipts of the association for 1930 were estimated at $275,414, with a cash balance of $30,248. Estimated expendi- tures were given as $271,914. Member- ship now represents 75,313,165 cases of seasonal and 23,375,485 cases of non- seasonal products. With silver being maintained on the free list by the tariff conference com- mittee, proponents of a duty on the metal are now expected to direct their efforts toward securing favorable action on Representative Arentz's bill which would place an embargo on silver, ex- cepting ores imported for the purpose of rennlnf. minting, etc. This proposal h;&: before the ways and means com- mittee. Measures looking to an intensified movement in checking stock swindlers who reap an annual vest estimated at not less than $500,000,000 annually of the National Conference to Suppress Praudulent Securities. These call for closer co-operation on the part of Gov- ernment and business agencies as well as on the part of the public. Paul V. Keyser of the Investment Bankers' Assoclation suggested that the mmu;ugrummmmm:umw: hands of Post_Office Departmen which is, within the limits of lu“x:'- Teport . | ment in the form of possible losses may be curtailed to the minimum. ‘The Department of the- Interior an- nounces plans for the surveys that will be conducted in Alaska during the com- ing season by field parties of the Geological Survey, in continuance of the investigation of mineral resources. The projects include exploratory and recon- naissance geologic and topographic surveys in several parts of the Territory, and more detailed examinations of cer- tain tracts and mineral commodities. The chief Alaskan geologist will carry on general studies of recent mineral | developments in certain of the mining districts, with the aim of gathering facts essential to preparing the annual statis- tical canvass and maintaining a general administrative oversight of the Geo- logical Survey's work in Alaska. Plans for this work will be dependent upon fleld conditions and the time available for such studies. Coal mining in the United States in April resulted in the death of 159 men. e Mines Bureau reports that 128 of these fatalities occurred in bituminous flelds, with the remainder in the an- thracite mines of Pennsylvania. ‘The death rate per million tons of coal produced during the month was 3.90 for the entire industry. American advertising abroad has been an important factor in the development of the Nation's export trade. The De- partment of Commerce reports that in- Creased export orders have resulted from the use of skiliful advertising in tore!fn countries not only through the usual channels, but also through the aid of the increasing number of Amer- ican publications which are sent abroad each year. PRAISING WORKERS, SAVING MILLIONS ‘The general side-steppi: which 13 prevalent in American bubiates units today costs ess hundreds of millions of dollars’ worth of held-back energy, Initiative and go-the-limit devo- tion from the earners of hourly wages. of monthly salaries, declares Whiting ‘Williams, author and personnel rel.luoni consultant, in System. He is supported in his opinion in statements published with his article by W. T. Grant, chair- man of the W. T. Grant Co.; Thomas J. Watson, president of the Interna- tional Business Machine Corporation, and Dr. E. C. Sullivan, vice chairman of the Corning Glass Works. “I belleve in giving praise,” declares Mr. Grant; “the praise of the head and the heart, rather than the the mouth. I believe in further encourage- creases in salary, provided th‘tl;d = G are based on a firm foundation of real ac- complishment.” O S S Rev. James A. Adam, who is to retire as pastor of the Bruce Memorial Church, Cambus| Scotland, at 74, has promptly all questionable stock-selling Germany N never had a day’s {liness in the 43 years schemes to State officers in order thatof his ministry, . NGTON % |on June 2, but there is no further evi- sharp intermediate reaction which cul-! and a still greater sum from the earners | o0 D. C., SATURDAY BONDS ARE STEADY IN QUIET TRADING| Price Changes Confined to i Narrow Limits—High- Grade List Firm. BY F. H. RICHARDSON. Special Dispatch to The Star. NEW YORK, May 24.—Bond prices were at a standstill today in a small trading market. About all that the market was able to do was to maintain the week’s average advance of about % point. In a session of such limited dealings, quotations represent little in the way of definite price direction, as the spread between bid and asked quotations al- ways increases under such conditions. The high-grade issues were firm, with a little better market for such bonds as International Telephone 4!3s, Interna- tional Match 5s, Baltimore & Ohio le- gals, Columbia Gas and Philadelphia Ch! Co. 5s and Duquesne Light 413s. Persistent liquidation in St. Paul ad- Jjustments brought them down to a new low for the year, with a decline this week of 4!; points and a range of 15 points from the 1930 high. The earn- ings of the road are not favorable to this bond and unless there is a decided improvement in them in the next six months 1t may be necessary to read- Just _interest payments to the smaller surplus. Convertible issues that showed mod- erate strength were International Tele- phone 41;s, Texas Co. 5s, Atchison 4158 and Baltimore & Ohio 41;s. Philadel- Phll & Reading 6s were fractionally ower. Foreign issues were steady, with just the slightest suggestion of accumulation of German descriptions as a means of window dressing for the new repara- tions loan. This is booked to be offered dence of what the yleld may be, al- though the coupon rate has been defi- nitely established at 512 per cent. Jap- anese issues were strong. Exclusive of the $60,000,000 Treasury bills offered this week, the total amount of new issues was $121,000,000 against $191,000,000 the week previous. GRAIN MARKET CHICAGO, May 24 (Special). —The wheat market held within a narrow .price range today, but the trend was downward. Closing prices were unchanged to 3; cent_higher and for the week 13 lower. May, 1.04%; July, 1.05%; Sep- tember, 1.08Y; to 1.08%; December, 112% to 1.12%. Corn was under general selling pres- sure early on account of the weakness in wheat and favorable weather, but encountered buying on the break, cred- ted to cash interests and holders of | for the belt. The close was 1, to 115 lower and for the week 21 to 314 lower. May, 77%; July, 79% to 9% September, 80% to 803; December, 2 Y. Exports of corn during April were officially reported at 954,000 bushels, raising the total to 7,883,000 bushels for the season, against 38,874,000 last year. Oats were lower with other grains. Longs were liquidating May. The close was Y, to 1% lower and for the week 4 1% to 2% lower. May, 41; July, 391, bids. Rising temperatures are forecast | S: z,/stm; September, 387%; December, Provisions had a qulet featureless NEW_YORK, May 24 (#).—Stocks firm; General Motors leads upturn. Bonds firm; prime rails advance. Curb firm; Goldman Sachs trading breaks to new low. Foreign exchanges easy; leading European rates sag. Cotton lower; favorable weather forecast. Sugar steady; Cuban buying. . Coffee higher; Brazilian support. Baltimore Stocks Sales. STOCKS. 488'Arundel Corpn. 25 Appalachian G 'y 22 Union “Trust Gor o 21U 8 Pidelity & Gu 95 Western Maryland BONDS. 000 hlted Rallvay & e atone s 453 Business Notes NEW YORK, May 24.—Awards an- nounced for heavy construction and engineering work throughout the Na- tion aggregated $87,694,000 in the past week, compared with $108,751,000 in lr‘: News Record. The total was con- siderably below the previous week, when awards totaled $135,498,000. ‘The Plate Glass Manufacturers of America reported today that production of polished plate glass for April was 11,429,728 square feef, against 10,415, m'm March and 12,554,979 in April, ‘The Motor & Equipment Assoclation views the April business of the auto- motive parts-accessory industry as ‘“very satisfactory” and anticipates a slight increase in May over April. The Canadian Hydro-electric Corpo- ration, Limited, controlled by the In- ternational Hydro-electric System, a di- vision of the International Paper & Power Co., reports that the electrical energy it produced in April set a new It totaled 214,330,000 kilowatt hours, 2 per cent greater than the previous high month and 30 per cent over April, 1929. A shipment of gold dust, tendered by 2 Honduran merchant in payment of & shipment of cotton goods from the Fabyan & Co, Inc, New York selling agents of the Southern concern. The merchant takes much gold dust in pay- ment from natives, and adopted the | same procedure in buying goods from America. ! e | 3 | Make-up School in Church. Realizing that a great deal of atten- tion was %einl given to the physical ys the various activities of the Methodist Episcopal Church of Evans- , Ill, the church authorities have sanctioned the use of the church rooms for instructions to girls on the subject of feminine degofl.ment and make-up, embracing all the features of dress and conduct which go to make a girl more attractive than she would be ordinarily. The instructor in the case is urging the girls to be real girls and to avoid the mannish manners which have been the order of the day in recent times. While not absolutely forbidden, the girls are advised to refrain from smoking, as it adds nothing to the feminine charm. Another Use for Electricity. A m-xlng plant in Munich, Germany, has talled an electrocuting apparatus for killing hogs. Two hundred hogs can be disposed of in an hour by this method and th: current and mechanism may be controlled by one man. What- ever faults there may be in this way of kiliing is certainly less revolting than slaughtering by stjcking the animals. the like week in 1929, reports Engineer- | [/a high company record for a single month. | p Alabama Mills, now is en route to Bliss, | S! MAY 24, 1930. UNITED STATES. (Sales are in $1.000.) Bales. High. 11009 1009 Low. Close. 00 9 1 10118 10118 10118 FOREIGN. Argentine, May "61 Argentine 63 Oct Argentine 5348 - an eReeESornaRuafiennSen ShownShooneEraanivantinavssxoionn B atonnn o German EI P 6%, Ger Gen Klee 7 German 7s, Halti 6 Hungary 7% Italy 78 italian Pub Svo - e - %! Jugoslavia Ba Kreuger&Toll Norway 6385 Ortent dev 53 Rio de Janeiro 63 . Rio1e Jan 85 '46. .. Rio Gr_du Sul 6s'48 Rome 6%s........ R'y'l Dutch 4 %sww Sao Paulo '50. . Serbs-Crot-Slo Swiss Confed 8: Toho El Pwr Toho El Pwr 78 Toklo 63 '61. MISCELLANEOUS. High. Ho% 101% 2 101% 5 105 15 106% 5 1 10 27 Sates. Abitibi P&PEs'63. Alleghany Cp 6344 19 Alleghany 6s°49... Am Agri Chem T%3 Am1GCh5is'49. Am Metal 53 *54 100% 101% 104% 108 9914 20 Atl Refining §s. Bethlehm £t1 pm b8 Certn-Td 53 s rets. Chile Copper § Colon Oil 68 * Col G&EI 53,May’52 Com Invest 63°48. . Con Coal. Md. bs. .. ConGasN Y 34s. . Cuban Am Sugar 88 Denver Gas 6s..... Donner Ste ave Duquesne 438 '67. Fisk Rubber 8s. Gen Mot Ac Cor 63. Gen Pub Sve 5%s. . Gen Thea Eq 65 '40. Goodrich 6%s, Goodyer bs reti . Humble O & R 645 Intl Coment b 4 Int] Match - 101% 100% NG00 R T RN DI ND 0 i 2315 n a0 I T GBS I 08 Ot 5 03 TN T B Midvale Steel bs. .. Montana Pwr "43 - - Nor Ohlo Tr&L Pacific Gas & K1 PacT&T 58 @ Pure Ol 5 Rem Arms Sinclair Of1 6 Sinclair Ofl 7 . Sinclair Crude 5%s development and entertainment. of the i Youngstn 5 &T RAILROAD. 9 94% 5 134% . 82 86% 5 98% 10 94 1 100% 100% 28 108% Atchison gen Atchdeb 4 At & Bir 48 AtICL 4%s B&Ogold ds... ref bs. . O 53 2000 (D). Bklyn Manhat Buft R & Pitts 4%s Can Nat 4%s Can®Nat 4148 '57... Can Nat 4%s°68, ., - 6 15 8 1 3 6 5 2 8 L] 8 1028 1028 1028 50 10518 10518 10518 25 11210 11210 11210 % | Pere M 4348 1980. . 9T Low. Close. BLY 100% 108%| 109% ¢ 100 98% 93% 95% 56 .FINANCIAL. | ON NEW YORK BONDSsmc: sxcnmcnl Received by Private Wire Direct to The Star Office Low. Close. 1024 102% 102% 102% 114% 114% 6% 7 998, 99% 100% 100 98 108% 1% Sales. High. Can Nat 6s. July'sd. 5 Can Nat bs. Oct " Can Nor 6% Ci Ches & Ohio con 5s. Chi Gr West 43°'59. ChiMiIStP&P 68’75, CMSP&Pac adjbs03 Chi & NW con 4% CCC&StL 4%s (E). CCC&S!L 58 (D). .. (C Cuba Nor 53 s ref Del & Hud 5% Den & Rio G ¢ Den&RGW b8 Duluth§ § & Atl 68 Erle 1st con 48 Erie gén 4s. Erie bs, 19 Erie 68, 1975... Erie (Pa) elt tr Gt Northern 6% Great Nor gen 7 Hud & Man adj §; Hud & Man ref §i 111 Cent 45 '5: 11l Cent ret 4 Il Cent 4% Il Cent 613 Int Rapld Tr: Int Rap Tr6 Int Rapid Trans7s. Int & Gt Nor 65 ‘56 Int & Gt Nor adj 6 Kan City Ft S 4s. Kan City Sou 3s. Kan City Sou Kan City Term 4 Lake Shore 43 ‘31.. Leht Val con 4s. Long Ist deb bs ‘34, - - e [ N N e T - EnBrbal anmSaants i = o M K&T prIn 5s Mo Pacific gen 4s. . Mo Pacific 55 A "65. Mo Pacbs F'77. Mo Pac %8s 49 ev. 125 NOTex&MSsB 5 - 109% 96% 101% 92 100 107% 106% 97 101% 3% 0 2 4 13 3 NH&H 4%s'67, 6 NH&H ev b 6s 20 NYW&B 4% Nor Pacific 3s Penna 4%8 1970 Penna gen 4% Reading gen 4% A. StL & SF pl 4 SIL&SF 4l StL & SanFr in b3 StLSW lst4 StL S Weon 4832 SIL S W 5a'52 SLP Un Dep 53 San An&Arn P Seatd AL adi 58'49. Sou Ps Sou Pac re! Sou Pac 4% Sou Rwy con Third Ave ref 4s'6 Unton Pac st 4a Union Pac 4568 Union Pac ¢%s. Wabash 4% s'78 ret West Shore 43 61. Wheel & L Ecn 4s. PRICES FOR CATTLE MAY SHOW RECOVERY Low Point of Deoline Believed Reached—Former Upturns Recalled. 8% BY FRANK I. WELLER, Associated Press Farm Editor. Recovered 25 cents to $1 from their semi-demoralization, cattle prices in- dicate a bare possibility that the annual low spot of the market may have been passed. There is little more to back up the suggestion than the fact that the bot- tom is reached somewhere every Sum- mer and that, usually, when such pre- cipitous breaks as that of last week occur about this time of year the first substantial recovery marks the end of the downward swing. Both live prices and dressed meat prices are higher than a week ago. In 1927 the week ending May 31 brought the seasonal upturn. In 1928 it was the week ending May 24. After hurtling downward in March, 1929, prices jogged along until May 24 to start the upward curve. In 1926 feeders held back their cattle and pushed the year’s low point into the week ending August 16. Economists, who see the present sit- uation about as uniformly as the six blind men described the elephant, admit that, as in 1926, feeders may upset the schedule. Cattle were put on feed late last year, which would indicate a pos- sibility of holding them past the usual May and June deadline. However, there has been a tendency to get stocks sold, excessive runs being responsible for the break a week ago that sent prices $3 below those for the same period last year. HOW WOMEN FIRST GOT “PIN MONEY” ‘The origin of the term “pin money” for women is revealed in System. n the fourteenth century,” that publica- tion states, “the English Parliament an act allowing the pin maker 1o sell his pins in open shop only on the first and second of January of each ear. On these two days women of the tter households were provided with money to buy pins and this is the origin of the term ‘pin money.’ Pins at that time were known to the trade as ‘corkings.’ " . " NEW YORK COTTON NEW YORK, May 24 (Special).— Prospects of clearing weather in West- | S ern sections over Sunday offset the ef- fect of more rains where not wanted and cotton prices lost 10 to 15 points ay. Both July and new crop months were under more or less pressure through- out the session and final quotations were around the low. Spots were re- duced 10 points to 16.30. The {: board unced the tak- larm ANno 108 Ing up of sbout 575,000 bales on the ition. gh, 27 79 . Loy 0 6 2 October, ne 79 December, old. 15.15 December, new 1. ary, ‘old.. new. anuary, March .83 .08 b I S People in 000. Amefican ettt i e e B 2 555 Germany ate nearly 2,000,- sausages last year, o ost | 10 SUMMER BUSINESS " QUTLOOK 1S GOOD Major Industries Expected to Continue Activities at Fairly Brisk Pace. BY J. C. ROYLE. Reports from the so-called key indus- i tries of the country tend to substanti- 4 | 8te the declaration of the Secretary of Commerce, Robert P. Lamont, that the steel industries can be expected to con- tinue definitely at the present of oprations, which are fairly satisfactdry,, Operations in the steel trade are nsu’ approaching capacity, but it must borne in mind that what was capacit: two or three years ago now represents only 80 or 85 per cent of capacity. This - has been brought about by improvement, in worker efficlency and mechanical equipment. Since the production of iron and steel is based y tivity in the automobile trade, in build- ing and construction and in railroad operations, activities in the three great industries also may be expected to con- tinue at a fairly brisk pace throughout the Summer months. Export Trade. Export trads in steel is likely to suf- fer to a certain extent during the next three months, until foreign nations know definitely what effect the American tariff will have on their international trade. The demand from oil and gas oper- ators can be counted on to maintain fairly stable proportions in view of the construction of large and expensive gas pipe lines over long distances in nearly every section of the United States. De- mand for steel from the mining indus- try is not expected to be up to normal The non-ferrous metals have suffered sharp price cuts in some instances. As a result copper, silver, lead and zinc production is being held down and not an unnecessary 5-cent plece is being spent by mine owners. So far this year has been an un- satisfactory one for the railroads. Car loadings have dropped below the level of 1929, but the carriers are now ap- proaching the season when both their freight and passenger business is on the upswing. This is certain to continue until the end of the harvest and until the end of the tourist season next August. No sharp curtailment of equip- ment expenditures by the roads is to be anticipated. In the textile field raw materials are in an unfavorable position, but this is to the advantage of the manufacturers. Wool production undoubtedly will be heavy, and wool consumption is un- likely to be in excess of that of last year. Strenuous efforts have been made to hold down cotton acreage. It is still far too early to gauge exactly the effect of these efforts, but it is be- lieved the weather will be found to be a determining factor in the size of the cotton crop, as it so often has been in the past. The statistical position of cotton is not unfavorable, but the pros- pective demand from abroad does not ho) very high as to prices for the staple. Cotton textiles are in far better shape than they have been for some time, and the more progressive manufac- turers are undoubtedly showing a profit at the moment. This is also true of the .woolen manufacturers. The tire cord and fabric producers, however, are feeling the effects of the diminution of automobile output on the tire trade. Radio Industry. ‘The radio industry is approachiing the slackest period of its year, but sales of receiving sets still are of remarkable proportions. They have been stimu- lated, however; by sharp price cuts. A many radio manufacturers are supplementing their original lines with refrigeration units, which they hope will go far to take up any slack that may follow the dull period of the radio year. ‘The construction industry is piling up impressive totals, but most of these figures come from operations devoted to the construction of streets and high- ways. City paving contracts are at & high level, and this is causing consider- able anxiety to street railways, which in many cities are compelled to bear the cost of new paving between and alongside their tracks. (Copyright, 1930.) Baltimore Markets Special Dispatch to The Star. BALTIMORE, Md., May 24—Pota- toes, white, 100 pounds, 2.25a2.50; new, bushel, 1.00a2. sweet potatoes, bar- rel, 2.50a4.50; yams, barrel, 3.0024.00; asparagus, dozen, 50a2.50; beets, 100, 5.00a6.00; beans, hamper, 1.00a2.00; cabbage, hamper, 1.0041.25; celery, crate, 2.50a3.50; corn, bushel, 2.25a2.50: cucumbers, hamper, 1.50a2.75; kale, bushel, 35a50; lettuce, hamper, 50a 1.25; lima beans, bushel, 6.00a6.50; onions, 150 pounds, 90a1.00; green, 100, 75a1.25; peas, bushel, 50a1.50; peppers, crate, 2.50a4.00, radishes, 100, 1.00a 3.00; spinach, bushel, 45a50; tomatoes, crate, 1.50a3.75; apples, bushel, 1.25a 3.00; grapefruit, box, 2.50a6.00; oranges, box, 3.50a9.50: pineapples, crate, 3.50a 4.00; strawberries, quart, 11a20. Dairy Market. alive—Chickens, Springers, Leghorns, 25a33; old , 14al7; old hens, 26a27; Leg- horns, 17a20; Spring ducks, 24a25: guinea fowls, each, 50a75; pigeons, pair, 25a30. Eg Receipts, 3,802 cases; nearby, firsts, 21; hennery, whites, firsts, 22. Bu'ter—Good to fancy creamery, pound, 3315a35%%; ladles, 24a25; rolls, 24a25; process, 29a30; store packed, 20. WEEKLY CLEARINGS Bank clearings this week at leading cities in the United States, as reported Dun’s Review, of $10,000,521,000 show a decline of 13.4 per cent from those of a year ago. At New York City clearings of $6,613,000,000 are 16 per cent lower, while the aggregate for the principal centers outside of New York of $3,387,521,000 is 7.6 per cent below last vear's. Exceptional activity raised bank clearings above the average both in May 1929 and 1928, with which comparison is now made. Hence, this month’s statement makes a somewhat less satisfactory showing than for April. Although losses in May continue quite large, there is continued improvement over the record for December and the first three months of the year. Clearings for this week, as 1cported to R. G. Dun & Co., and average daily bank clearings for the year to date are compared herewith: . Week ay 22, 2 1930, R B285 2222 8EaEE3S i Dalla; San Fri ngel Portland Seattle . INSURANCE ASSETS. According to the Praternal Monitor, assets of fraternal Mfe insurance organi- zations increased about $54.000,000 in 1929, and the present financial strength of the fraternals is almost $1,000,000,000.