Evening Star Newspaper, December 31, 1927, Page 23

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

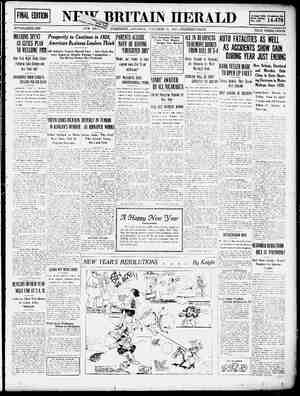

. _THE_ EVENING STAR. WASHINGTON. D. €. SATURDAY. DRECEMBFR 31. 1927. 23 Cheap Money Carries Stocks and Bonds Into the New Year on Crest of Wave STOCK AVERAGES 1927 BOND AVERAGES 1927 'BOND MARKET REFLECTS GOOD BORROWERS’ YEAR AMAZING VITALITY SHOWN DESPITE BEARISH EVENTS Signs Indicate Caution—1927 Notable fori BOND AVERAGES - 40 Issues Weekly high ond low average m.wT prices. | {Rise Small in Contrast With Stocks, but 92.00——— — Heavy Trade. Seat Price Rise | I8 ; Continuation of Movement o [ 4% 3 and Other Records. tarted in 1924. 2 ; & 3 a R IR RY GEORGE T. HUGHES, that was putting the market up, the i< From Consalidated Press Association—An- the form o stock rather thar by EW YORK. Decemh 21—~ enormous surplus of money. The 13 . hidel b | 1ssues of bonds. B e Tl Lhitie e e | i BY CHARLES F. SPEARE. ["\00C 00NN | cont raiirona st reward. These out o EW YORK, December 31.—In |mortgages now are closed, which in i ket of 1927 was the | teaped the lar side speculator stock ma most remarkable in the h who fared the hest | contrast with the stock self improves the market position of lory of the New York Stock | Wers thef ones wha bought in com market, the rise in bond prices | these bonds and compels the iss Exchange. 1t set up a new high baratively small lots, but held on during 1927 was small. While | of junior mortzages of large a: reconi for the number of issues throush the minor reactions. This the average upward swing of | ized amounts. The railroads were 3 traded in on any class also obtained large profits, | stocks covered a A of 50 Doints | able in 1927 to refund freeiv w one single day. It i | . - gl between the low of January and the 41, per cent eoupon bonds. One ooe sinele day. I ’ Cheap Money Plays Big Past. December level, that of bonds was a| the striking market movements | trifle over 31, points in the domestic |tha Jast quarter of the vear w |iist and less than 2 points in foreign | strength and popularity of thia {issues. However, the market for in-|of low coupon junior issues. Oriz | vestment securities was one of the | Lioch e S hich did not atriact most notable in vears. duplicating in | $ha” {nvestor. thev sventnalle towe 1o many respects the features of the|promiyma of 4 to 6 points over the last great period of abundant capital | {niic 0l Do T the 1t is unnecessary here to go into the technical details of tha money situation, which was the, dominant in fuence in the market the vear through. In brief it was the huge sup plies of zold held in this countey, be- twoen nd 50 per cent of the supply | of the entire world. that was the foun- | dation on which the structure of ris change seats sell for more than $300.000 each. eamething that never happened Before. 1t was a time of intense activity and uni- | mav | JUNE TJuLy 1 avs [sept 00’ l | ol ) | S | L] APR | MAY [ JUNE IJuLY | AUG ISEPT | 6cT T Nov | DEC CURB MARKET SETS NEW TRADING RECORD IN | | i i iag nd low interest rates, years ago,| | when first mortgage 4 per cent rail| U. S. Issues Buoy Whole List. :’:r.',.“ ,‘\.."'.fig';:.',;',‘ inz stock quotations was built. road bonds sold at substantial pre-| Obviously the domestic corporation e vean dail The effects of this surplus of gold T s @ miums, municipal bonds touched a | pond list has been assisted duting 108 Bty it s B was intensified by the deliberate poticy |~ BY WILLIAM K. HEFFERNAN. | was larger in 1927 than in any previ-|indiscriminate buying of stocks, De-|closely identified with the market |31, per cent basis and the old 4 Per|year by what has taken piace in 1 s Period of per- of *he Foderal Reserve Bank designed EW YORK. December 31.—The | 0US Vear, with annual transactions |spite such warning signals as falling | for oil stocks were emphatic in their | cent United States Governments eX-|field of Government financing. This Sitinils riatol to keep money rates low. There were New York Corn Fehange in | running well above the 100,000,000~ |off in car loadings, peak records for | assertion that the oil shares had been | ceeded by many points the price at!couid not have been effected =0 »c Quotations. economists whe disputed the expedi. | 1927 made zood its clim to |share mark. brokers' loans, a season ahead of keen | thoroughly liuidated and that the |which the present United Sttes cossfully without a low mones roe Bhe viene AT ency of the courss adopted. The con. | the disttnction ofbelng Ather: || Bond Sales Almost Doubled. 1'nm|w|:]l|n:| for lhs{aul(-nwbl}le‘ |ln‘d|lx|u- hetter gmc(lo issues were in a position | Treasury 4%, per cent Inaue Is now |\ "hein” ine refunding of e 331 o 3 troversy that arose when the redis fon's. - second ok £ i ins g try, and slowness of seasonal activity [ to discount any prenounced improve- | selling. = i £ 1000.000 secona Liberty 41, per ce ":r":jm?“l:': Jo e S | ot e Penita Res‘\‘r“\‘a e nd largest stoc |,.,'.‘u'1'5"‘:»'\||lu':§::(;" :;‘u‘":’(-”;‘l‘“-t:};:im""!' of |t ‘the steel centers, the speculative | ment in the industry. asmodic | This year'a advance was a continua- pongy”, SEERR, LVETY Sl per cent Gemix. Thes included the Wheeling | Bank of Chicago was reduc M- | olement was concerned only with the | Aurries gave renewed hope from time tion of the movement toward a hZher evarthe deadily rising leve| of pos. d by di ‘ The evolution of this market. which | pared with the previous peak of $459.- | 3 . - - X on o e Rese, 3 i | ** | tec B e market itself, | ¢ e s were ac ¢ | range in bonds that really bhegan in . ot S = E -;; Lake fe coruoe 1 l-th,nmx_\“ the '\\7,“.‘3,“,(,‘ '.’:.1 Re s Board m’ m-;\mi_ into its v Sx,‘uun_mw mm'.; | 000,000 in 1926. Of the annual financ ‘;‘”L;";[‘px:'ll ‘,'.‘S’.‘.'"'S"\J}.'.."I..,;'.'.‘sffn a:_;‘:‘r_, :‘m“:;:; Il’}‘|'z"t ';{n‘dr '::Iw]"n See) T"t::‘am By 17EF Aei lswde Tepis :-»".'"1'. nfi(":.!nc br rqu vn;“ comm reak that followed President Cool- Washinzton and over the protest of [only six years ago, has been xo rapid | ing of bond obligations, about one- o : ) : ‘ ! % red an average price of 75. In 192 ect to corporation bon fdges “1 do not choose” announce- the local authorities is fresh in the|that the practical | half ‘the entire amount Issued made | "5, A9itionAl holdinie, ndGincen (15 DEoveds ol HAVE Deain} (eee” A0 eactl n the high %/l continue to do so. | The backbone of the campaign for | nothing more than false starts and there was a reaction f higher prices evi ¢ was base : ed | level of the vear. It wi 5 1 vidently was based | renewed liquidation was encountered e cidant It is quite significant that the ad. vance in U. S. Treasury lon ment: the excited speculation that |minds of all who follow xuch matters. | problems of han- s not until N a their initial appearance on the Curh. followsd Henry ord’s re-entrance | But whether the policy was justified | dling and execut- | Recently the board of vernors | B0 > o vear followin 4 ¢ tor car |or not. the re 8 b wholly upon the abundant supply of ac the year certificates this bt Inte the field of active motor car [Of Mot the result way the same | ing the increasing voted to admit to associate member- | IV SR CAE SORACENL SUOBIY oF o with the beginning of a broader and ,M"‘fi"““”'“’ vear has bee Production, and many minor events | Week by week and month by month | volume of busi ship bankers and brokers representing | & N B i T niee siieks maEket: Rt thay n the standard first mo |in stock market channels. As long as| forts to reg | eredit remained plentiful, with indica- | duction, which had reached suc This action was taken to faciltate | jone of continuing %o for wme time, | portions as to hecome a menac rading by forelgn Investors in Ameri-| e public was willing to buy stocks. | the industry, failed of their purpose. can securities. Shortly following ap- || purpe . ortly ¢ such an abundance of funds was | with the result that the oils were v * lasy movement in the first vroval of the Iuropean assoctate |, vuiluble for speculative purposes was| relegated to the hackground in the |average gain between January. 1924 oo i Iast fow weeks had bees oo memberships, intenational banking > 4 e 1 3 4 5 and December, 1927, of 16 points in 1 <ks bas been much n e e Tt ional | DANKINE |due to the fact that credit which or-| speculutive = calculations a8 to their | And Decemper, B of T8 PUCE (L] rapid than in the second. During De: railroad 4 per cent bonds rise in three Treasury Mtich cansed Viclant swinsn one way | biokers’ loansmounted to higher @nd I neas has: iresesii] or another. The real feature of the higher levels. By the end of Novem-|tated radical ¥ear. however, was nat the hreadth | ber the total as compiled by the Stock | changes in trad- or the activity of the market or its | Exchange had ed the $4.000.000.- | ing methods. reaction to any specific development. | 000 mark. At first when these in i Some indication foreign enterprises and organizations. strength of all fixed-interest obliga- tions bhegan to assert itself. From that time on there has been a steady points. That in three i ® bonds was % improvement in prices and a ftota 4 po ¥t was the market's astounding vi- | ¢reases, announced weekly by the|of the growing tality. Federal Reserve and monthly by the | importance of the & Stock ixchange, o o { ¢y o . . dinarily would have been put to use| merit = # cember, Treasury certificates so " Sethacks Surprisingly Moderate. | naiket had a shock. Taward the ::;;',,:'r;,.?:,‘::tfil st ‘fa'm“n',‘"l';“:’f'p;'f,;'.‘,‘r'v’ :f,",',:":,'w;:f; for industrial and commercial pur-| There were. however, exceptions I foreisn dollar bonds. an average vield of rar?flmd 3 '.";:y There were setbacks from time to |Of the year an Increase in each suc-|the fact that the {uran ) colmitile “aramaphione: 65t [oys SRAIGE 0o I dse (0Tors: | aveii (ot hlalge tud mi e Y e e el s et W Averias ryluen time, as has alwavs heen the case CeSSive statement was taken as a|price of seats | Other " seasoned securities of foreign | V4llINE business conditions. | tnued to_be seriou Within the 12:month period Now On best rails of about 4.15 per com in advancing markets: hut they were Matter of course and was devoid of all [reached a new {origin, which now lack an American| ., JOWever. the more conservative | problem of overproduction. despite the | .\ jing & great many developments = If the suzgestion of Secretary Mei. ©of surprisingly short duration. Time efect. IHiEh Sikontin D et panerican| slement was inclined to the belief | tendency of consumption to increase. | pIS M n lice that emphasize the 100 that all Tuture Guvernment honds and again it would look as thougn | The one item At was waiched was | cember of $65.000. | shortly. :::;L;lf;";’"“":}"‘"m'f“fg'l"‘c"":':;"‘l“‘;‘; e ghea wed """"'l"‘\“P"r"'”‘l""_o"":;‘m“‘;‘:," changed conditions more m:; Joes ':,‘"l:::: free of all taxes is accey *the hack of the bull market had 'he rate for call money. As long as|This compares Wm. F. Hefernan. | The rules for admission of foreign | o Bl # ) the IOR S Ea %. the price advance itself. Amo em | Rot only will existing jssues be ie heen broken” but invariably it was |thix was not lifted, speculators looked | with & previous stocks (o unlisted trading privileges | "och higher levele. and that as the | strongly intrenched with huge capital|,re the rise in numerous junior rank | fited, but the bonds of cities, an iNusion. The market alwavs With indifference upon the showinz ' top of $37.500, and represents an in- | ot in most part to the furnishing | &% drew to a close any stocks | surpluses. They were in a wnhmrv\ (-‘- ing railroad and public utility b‘m‘d, ard all politieal divisions which eame back and the advance was re- |made by the lean figures. That this | crease of §33.000 over the low of the |oe'’qt ™ TIat BA L O aividends | Wore passing from strong hands inte | provide funds for storage purposes and | "prjce jovel approximating that | erjoy immunity fros tax will be o1 sumed, perhaps under different lead- | 1= & dangerous state of mind need not | vear. {Thess shares muat be representative | ¥e1K nccounts. This theary proved |to await a more propitious time when | peid in the two years preceding by led. Early in 1928 the Treasury r ership, bit still resumed. This char. he embhasized. ~Somewhere —there Trading Sets New Mark. of companies in countries on a gold | CO'rect and the gubsequent sharp |conditions in the industry itsell wWould | gyt mortzage bonds. This was aiteke up the problem of retirinz in acterittic was predominant well up MUSt be a limit to the amount which { : 3 [imsin " Brior 1 Codontion at “atowa | reactions suffered by a number of | warrant high prices for their product. | ocponse not only to the demand bY | third Liberty ' per cent fur toward the end. speculation can ahsorh with safety. | The daily average number of issues | WEE | (GO0 B SCORIDE BE DOV | speculative favoritex dampened en- | Rut this was a minor consideration. ,"jpvesting pubic for an income imounting to about $2.000.0u0o0. o | That, however, is not the point. For |traded in also established a new | f the time 'the stock |record. For the vear these have | *new highse.” Some of them were of Market of 1927 acted as if there were |ruled around the 500 mark. compared 4 | P e = i line com:- satisfied by the senior dye Gh TGt Ricse Y | thusiasm. But inasmuch as the |Issues representing pive return _unsatis 3 E e o T o mebT¢%NA" | 1 riet had grown 1o such large pro- | panies and a few of the more promi. | {{us, but to the greatly improved maturities are thoss of the fiyer ) com| Of the new bond issues admitteq | POrtions this liquidation passed un-|nent producers and refiners offered | .pedit’ standing of the companies in 1932 and the first 4% s in the tocks that simply sold higher than N0 limit to the supply of available |With an average of about 350 issues g . | noticed by a good portion of the|tha prospect of substantial stock dis-|\hoce bonds have appreciated inlyear, x5 stocks that simp H s b . 3 1 to the |8ince last January, the amount dealt ) i ac arently d trend at any time earlier in the year, but [credit. {daily in 1926. From January in totaled about $4.000,000.000, with | *Deculative coterie. concerned only | tributions, and this factor apparently | vyjye. Another outstanding Fisich a goodly proportion of them marked | Gold Movement Tide T end of December approximately 650 iodbtriod gl « person- | was the main consideration for their pue been that toward a lower coupon nch and Belgian Issues Strong. 3 old Movemen urna. Sew lssues bave Been sdmitted to |CUPTeNt tramssotions running st dov.| With lesues in which it w It was the usual thing all vear in eptember R e o every market chronicle to stress the |nine-tenths e y | exceptional strength rate fo w issues, or those repre- It was stated e bezinning new highs for all time. For instance, | ” - 5 ble the rate of ” | ally interested | exceptional s! g 8 rate for ne A ! , at the beginning of this thres, Atchison, General Motors and | Moreover. toward the end of the | (rading, making the total of seturl | iricyen L el ',,,,:,,; 350 Ok Bkkres Hive. Pose Wear (o The declslon of the Supeome Court | senting new cupital entirels, and on [review that the average price of for 7 B El istis ished Year the situation devels | ties dea in approximately M o ol . v . > h n 1921 holding stock dividends non- j,nds which were ol o place | eign issues in 1%: had advance e e A e | eveloped & mew | L o And bonds. Coincident with |%0cks, chiefly of the penny oil and| Since dissolution of the parent | 3 ati. was an incentive for these ' aturing obligations as well as obli-'about = pointe. In e roncd themselves in this respect during |fes A S ere arers acorer o others |fosture. That was the revelation that | ihe iisting of these mew lasues, it Is | and while there were stocks that (N® Eold tide had turned. Up to the | worthy of note that the character of | December Sets Specuation Record, | the so-called pe Belgian mining prospect class Standasd Oib Co me 16 vears wko. | cominniex to o italize their surpluses. cyiions that had been called in ad- however. the gain has been andard Oil subsid- | {hux rewarding . stockholders through | yynee to their maturity. for instance, in French and . n ev 'end of October there was a gzold im. | obligation is of a much higher stand- | e e , | tartes have had their principal mar- | gi{qend payments on additional stock. No vear in the country’s BISOIY <oiarnment. municipal bt ::,‘:d,,?,';“:i:;’, ‘.",,Jh:.lfir,.'md ,.,‘,';.d port balance on the vear of $39.142. ard than the vast majority which ’_’”“ most active apeculation In the | | "0 Tiho (urb. Shares reprexent- | o 192) fo 1926 the more prominant | pae witnessed such an active refund:: i ues The wonderfel ad for comment. 000. But when the accounts for the .Were brought indoors when the Curb | history of the curb occurred in the ng new industries have been added | . mpanies have distributed stock divie jng program as 1 It is etsimated in the French financial Now. before discussing the back- |11 months ending November 30 were | first hegan operations In its present | last month of the year when new daily | to the list, but because of the large | gonds ranging from 10 per cent to as | hat during the 12 months over $1.509- yvear and the ground of this phenomenal advance Made up it was found that imports to. QUArters . 'trading records for all time were es.| public fnterest in oil stocks. both |much as 408 per cent. and in the case 000 of corporation honds and ROt Currency in 12 =g s n stocks, the fundamentals con- | talled $98301.000. compared with ex.| All thése issues have hid o stand |(ablished. Public participation reached | independent and Standard issues. |f stlantic Refining, which now has s have been called for payment before a,preciation in the value of the eerned, the investment element that Ports of $112.8%5.000. making an ex-|the test of the board of governors, junprecedented volume, with many of | they rank among the most important market on the Stock Exchange, 900 they were legally due. The & to % ternal loans. The French s w Plaved sn prominent a part, it may |C°S% of exports for the vear of $14.- have been carefully selected, and as |the issues selected for leudership ex.| groups which have their market on | per cent. per cent issues that were compelied ' retired in March. Four F 1 - tablishing their hizhest prices for 1927 | the Curb. Failure of this group to That these distributions Wil con ', the stringent times following the <how an averaze gain of the strictly speculative viewpoint. | It Was in November also that the oil and mining prospects has been re- fand in numerous instances the peak | share in the upward movement as ¥ tinue fs the common belief of the ur have largely been redeemed LY The <me number of Belgi A market which enjoyed so prolonged Federal Reserve agents at New York |duced to a minimum. the character |for all time under the present form | unit in an appreciable wav was due|holders of high-grade oil stocks. and | ymerican corporations and replaced e today berween §2 and 5 po and uniform an advance, would rea- | €ave to Wall Street the first informa- | of securities now listed ix unquestion- | of capitalization to conditions which prevailed within apparently has been the only incentive by jong-ierm bonds, carrving 3 €0U-'gyverage higher (han they were a: o monably be assumed to be one in |1on that $40,000.000 had been addod(\nhlo. Consequently it Is reasonalle | This was more noteworthy because| the industry itself and not because | for the buying which had taken place | non e of 5 per cent in many iN- and of 1 % 3 which speculators and traders |10 the gold held here in “earmarked” | to assume that the volume of business | of the fact that conditions outside | of technical market consideration. |in oil stocka of this character during ances, but with the popular coUPOR | Along with these there has been a amassed huge profits. That at least |Accounts for foreign interesis. When |in issues of recognized intrinsic value |husiness were not such as to warrant| As far back as June, interesis |the greater part of the past year. in the second half of 1937 one of |general improvement would be the conclusion of the out- |£0M ix “earmarked” in the United 41, per cent of most of the bonds of S s sider. e has always been led to |Siates it is equivalent to an export as Tt has been & vear of oppOFtunity | can republics. In spite of the hocuy ini fces in stocks |f4r as making the gold available for | : for the borrower. [f he has beed ufferings of oy SR L T S 2 | 1927 SEES ABOUT FACE IN UNSTABLE COTTON MARKET | n i o il 52 s £t part such & belief was well founded, | Tetary Mellon in his annual report | 0y his house in order on a basis Of wise the issues of Bra Por only in part. Statistics on the | Pointed out that foreign countries now -v:i:)ert Tobviously are unobtainable, |hAve balances here amounting to up l cheap monev, and to finance 1.~;~x» Peru have gone higher w term commitments at a rate that ternal credit conditions. £ b1 ward of $2.000,000,000, “which con-{ o _ : g 4 3 i but it is doubtful whether the av-| RO O oM O eold rensrven | BY GEORGE DEWITT MOULSON st any price and nnless a concerted | with the thres previous ye De In order to say a few words from | 584.000. | the number of low-priced speculative will help greatly in carrving him | Jislian severnment. m (hrongh the later periods of business publie 1 ctpl and has, first in three vears, added to the ex Shing fi-‘,"‘fi"..’.'no’.,'if’{..'"ff.',m""h‘. which may be exercised at any time."” VENTS of tHe past 12 montha MOvement could be made effective been pronounced. When the slow.|eitement. In some sections of Geargia. (IOUEE (W0 G TGS LS lic UUlicy doliar Toans have mad Sopposed 1o make in a market of |10 December came the first gold ex present one of the most dra.|for a smaller acerage in 1927, serious | protracted decline from cents in | the Carolinas and Louisiana. the crop ) lod at strens . s the past sear sxperianced. |Port 1o London in weveral vears and matic and interesting records |1epression appeared inevitable. If a | the Fall of 1924 to the close of last|proved a virtual failure. fields vieldink Public Utility Loans H . A 1 = > This wax followed by shipments to ever made in the history of *"Mciently large number of planters year culminated the price had de hurdiv enough cotton to pay for the of Mand. Am 2 matter of fact, some unfortu- Pates had no profits at all. and a good many had large loxses. It is human Lower Money Rates Uniikel, nature to brag ahout one’s winnings but to say nothing ahout the other wide. And yet every customer’'s man atest to get hack to their Holland. cotton. The year witnessed a |COUld be aroused to realize the neces. ' creased 25 cents a pound. or $125 « | picking. Probably the most "‘”‘;‘-"»‘”;" - . X complete about face in the market, |*tV of & common agreement to put bale. Instead of $185, mills found — Just when the market had reached ©f 'he verr's investment mar ';” " e P o, benefited by the Ifting thousands of planters from |less land under cotton cultivation, | themselves able to procure an almost | ity most inflamed state and acute ap. b=en the enlarx: ment of :n- field o© more stable nnancial conditions in Po This outflow of gold, in itself unim. misery to afMuence, and changing the |4nd so reduce tha total acreage, the | unlimited supply of raw material (or | prehension prevailed, the Bureau of Public uiility securities, OF all Amert: land, thoush b ssue of s did portant because of ita relatively small proplem of the Industry from one |Arst and most important step in the |§50 or less. The record production cf | Economics of the Department of Agri- ‘40 borrowers in 19 - thal cUBS | notigo lans of e e orant eouid 1o miories’ of |AMOUNL nevertheless started a dix | of "curtailing production to one of |I*Sloration of normal conditions could | 1976 had created an abundance of col | culture fssued a regular monthly 10N pn-u‘.nlngm Sisctric e (i Tm;ni’.‘r;.n\:.‘? countries and those to elionts 10 whom 1927 had heen a dis- CUS%ion as to the ultimate result if the | aaguring suficlent production in 192§ | be made effective. . | ton of all descriptions, and so much of | pamphlet containing the laconic state. Wit-r or telepho ol gl A et hefr way in et movement should continue. President |, meet the world's demands. | With this objective in view, finan- | jower grade became available that|ment that the world's carry-over from Communities of the country have beefl the hands of investors at gradua |strous year. | Mitchell of the National City Bank In| During three years of steadily in. |cl2] intereats, educational institutions, | prices for cotton of this character had | the previous vear was some 7,800,000 the most active. Their demands on rising prices througho i Many Specalators Guessed Wrong. |an address at Chicago deprecated the | creasing production in which the an. |C0UoR assoclations, farm oranizations | feclined several cents below middlins. | hales and prices probably would be Capital have been an expression of Europe has freely repurchased her ex: Lat us see how this came about. In “MPhasis put upon gold exports on the | gl yield exceeded world consump. | And the Southern press all united |“;n|m- reds of thousands of bales| 1o during the next few months the zrowth of those enterprises that. ternal loans during 1 ound exportn were neutralized | Anactive o ¢ in the past 20 years, have contributed the first place. the average profes. KToUnd that exports were neutralized | o, piling up # surplus und depress. | @0 Active campaikn during the Winter ged hands under $50 & bale, Which | phough the Government earryover | the past 20 vears, have contributed Germany Heaviest Borrower. sue price, b an 4 uence « -y by the | 7 ‘i 5 t o clency of busines 1 ulator was skeptical about | #% #n influcnce on maney rates by the | yny ' prices from 37 cents In the Fall [Months and fur In advance of the exented an outlay of 375 dayeseagainy % i mOst to the eficiency of n & ::‘."a,r,l,rs.‘l:,”: :;,\( ,,,,' ",,,,.. The OPen market operations by the Fed cents at the cloxe of last | SPHDE planting season. Where only ‘:"":"'_:“.','.:.,: most sections of the belt :‘. tes by ~.’;.‘.. .‘m .:ul\“.I":n.\S‘x:‘..",‘,“" to the satisfaction of domestic life. Some . W few years before experimental st | | ' ’ Public utility borrowing in 1927 ap eign dol n more experience he had had in Wall “T3l Reserve banks. KUl & note of | wyuon, the course of the cottc Consumers, realizing the unique oD 1 iy she subject than with the smaller ‘o s p cantion tan through the address and ¥ tions had been engaged in disseminat N ueh proximated §2 0o do0. T how. the Americ i Kireet the more skeptical he was. The a » ket had been lacking In feat s X - prtunity afforded by A price so mu ptal put out by the New Orleans ntirel . at- the | tlare 1 bocvower a consequence was that even when he i War sice 1ed l[i;«nl the .v«:ILnfl: I»‘x sll noteworthy, Kach year ln" :nhnmsfllun 4% 10 the bext methods Dtaw the cont of production, and con “:‘ A 1RA aseiivady of | h: cam | 8Y1L GIEF 0ok entirely | xeprusent (he | in torrower an bought stocks that subsequently wold 21l concerned would be subsery cotton had heen added erves un | Of Increasing production, discussion | SO0l i was only & question of [ LG L EECL Y be aseertained he SMission bptghol gt pretis, sl bbb, n bonds in December were n in the was due oniy to an excessive supph of slightlyv higher Interest charges even | o ) those companies that have been maost prominent in redeeming high covpen issucs are the es. Fre Y hetwe er oo wver had grown from 00K the form of crop diversification, wugh it dld check speculative opera- {0 1, SEEEENED R one af (Of how 10 muke the farm more self tions in the stock market. The whole | 1 o0 s o 7750000 at MUDPOrting through the raising of subject in much complicated but one o FRIOR FERE LU Thin repre. C¢reala. vegetables and live stock, but point i very clear sented the Inrgest surplus, with the |Above all of fewer acres for cotton ones may Temain av single exception of 1921, in over a | Though many were skeptical rry much higher he never walted for the large profit he might have secured but 100k a few points when he might have had 16 Worse yei, he all himsel! 10 be frightened out of commitment and 100k an entirely months hefore every hale purchased o another season discloses the A prove profitable. begun SocKink | ooy qvar of 1928 That total will be up for the future. As the low kb naiderably smaller than the one | made low cost of goods to the public. |, g0 Gicenasion, and less likely to he | 00 w0 cotton of & new public ntility bond issue silers were soon selling the aubject of o much difference of jean employed to take up ol donds nervousness amons holders over the lower in s and armany. dhut e the < loans out of ¢ lable on eaxy ' cale unknown in recent | A Decersary fome on a roinor reaction terma dexpite gold exports, but there decade and created a wituation where BATAIng the suceesstul o 8C (g | R9SAN oK :\:.'l h‘“"““::’m"“ i | opinton. bean emplaved o take up oM beeds |nervousnees ame e Then there were thoxe that “plaved % BOL g0Ing 1o be any Jower Jevel of |y "y wer was compelled to accept | OVeMent, confidence among those | Sear® A0 FFEC a0 that —— . et R o con the short side.” They 4id not believe 141 than now, DIcve a price tar below the' cost of p | mont active in the work never waned | s became enormous | of cot CEMENT SALES LOW. reducing fixed charges. On the whale, | payments of el and interest of e R o s . e 0 i Ingerianee | The campiien was waned 1o avery | TU0 SICUEAUL tNe: South . \bout 30 per cent of all public BULTY | these loans As ASANSE payments foe oty “tan b of them svere wmall (o 150 s ”»’ l””!") "'.'.':.".',""'fl nditions Deplorable, Stute, county and township through | 100 '4»;:'y||fimlu figures on both domes - —_— - Anancing this vear has been for cap tepar " either There were plenty of that Should ihere Be and Butlel e | Awricultural conditions in the Sauth | *' " SADESS aptttitaRI O Fy. Lo forelgn consumption mounted. | Industry Working Only on 28 Per (131 replacement purposes PRI e recaiad that French don King for the techniaue of whort mell vices. Every speculation wntered |8 the hegining of the present cualen- Curtailment Feasi the expunsion being apparent States and lrge insurance corpors | ke donds shunped tadly following the Inz is hetter underrtood today than it Drices. | Fvery specitation SOt 4, o were doploruble. The cultivii: | That grawers can be united fn ac. |off as Indin, to which over 300000 Cent Capacity. tons have been very slow (o tak: French invasion of the Rubr and ihe ever was before. and the siory of the Into a long tim e " tor of & few wcres found himself | e an e Amearican cotton were shipped. | By Cansolidated Pross sk B LARLE R o AR B e Bt Snown oot B Sraant ymprn | B0 e i heavily in debt [tion for mutual wdvantage is abundung. | iles of Am rensions on of public utility bonds and to lesalize MARY Americsn investors soid them e alerst thar ¥ ement in the problem ia the busi. | PeEVIIY in debt und unble 1o realize | ¢ | hix wins one of the few occasion At S SR R o ) e : e a0 hix exploits along that line b e et ot | enonizh for hin crop to pay for dn |1V Droved by the reanita, According | Moo s wien mercan grown staple | 5 Mem and include them i their port | & o . s ohe known by hewrt 10 e 1o enters o Tuts wan s period of mild reaction in | SUltiVatlon und harvest. An ubnormally |to afficiul Agures. the Rcreuge was cut [ pniared " into _competition with. the | YOUT BOPERE 8 OB Aot PEr alion. 1t was only last vear thar ' Do hem in the betie? that Fraace evere baardroom Bt big men” 1923 wan u period of mild veaction in | GLUSIICR LIS ARG BOABIOTINI | 19 oMol fires, the uf entered " into competition SR Gor. | cent o capacliy. This was mot due | Maroichusetts maased s Rermitting woukd correct Rer intecnal sond tns made mistakes and costly ones #lso e ’:A‘: £hs yeur closts |'v'l‘:“:”."“|" s record yleld of nearly 15,000,000 balex | 45 730,000 wcren last year i ":,’;:_""'I" e 3 10 & cents difference |t any slackening in bullding con NPT savings Banks and trusiess to poliicadly and ecanamically, and dave A Mitlion Dotiar Loser. I would b husty, however, to draw | 07 AVOUL $000000 more than ever 000 thix Spring. Had It not been for | {1¥ i, urice, hut Indian apinners this | giryerion or, indeed. to any alacken. [ MY the bonds of telenhone and lees | SRS BREEY 60Tl W e . AW | hefo ventes which nduc avier pla gl crRden South v b Ul Lol oo do lnre z Just to mention & case of two per | the conclusion that busineas recovery | “cotton wan wo plentiful that many |ink in Atintie sectionn Than i feag | Your bought low graden i (00 8O ing In coment demand. The (et i Which were the mast substanial bus the hoer of Gscrian basds Wil B et ey il o It s }""""‘“"‘ by u wtill higher level | g 1450 some Western States remain. | intended, In order to offset the reduc "'::‘:‘I:'"‘ cant of ¢ :h.u:“lh: ‘t‘ml Y hat b Up 8 | Do enterpia Tn New Eniiand < 8 8 an Trom ‘e Bomines camp in the Adiron | Ty renson 1s wd hall plcked, ax the teturn did | o o Minninn y o Leountry. e stimated At betv cen 225,000, 4 . v oto earry out g bk i s oners 1 R e 1 stocks hove heen |, 4 “y,, n: t the outlay nun‘l’\":-vl ':l’n [.'m" ! ..','-'.m:'.' ‘:.mhll h:\“e""lfr-.:ml} 00 wnd 230,000,000 bare. . 8 vear Tnsurance Companies Change Polley. 1 nd taking care of et durks 10 one of the largemt banking aavancing regardiess of the reaction | UL WATEAR (RO LELWY IRbolved b jeut i ecreake i Production tn 1937 tanged between | e tions are made. Pasahiy e The ever-growing demand, stimulated | | PEOdwEion 1 195F FARES Retweer leen, WIS WUE | which wis @ galn of hetween §.000,000 over the and 10000000 barrels as compared with the output (1906 Extreme | competition did not prevent cement houses in the Bireet asking themn 10 | 4iendy veferred to, Many of them send up as 8 week end guerl s mAD L girendy have discounted the im to 4o shan! L vemen that hope for. € “L He was o ger the fact that the declining pr bosa of ne 1 both of industrials and railionds strongest of all imfuences over tas xroup Will be that of & more or fess forved investment in them as the v & Ret for all other Mghsrade iwues Kives a wualler and smalier reiusn 1 daughters of outhern families | The wecond and equally Important 3 wi unable o continue thelr edu- | fuctor in this year's smaller crop | by sbnormally low v cation In school or college owing to | came from a serles of unfavorable | mented by sales for delivery the diminixhed returnm trom the plan- | climatic conditions. Both 1924 and tmnted that | year and It was estin tatton Lower grades that hud cont | 1925 had proved unually dry, but | O™"% 518 ahoad somes In attitude owant this group of s curities in that taken by the lite in wrance companies, wha buv oaly after thorough investigations and are wallv the original investment trusis whe could 1€l him wha his position in the mar short and hsd & ps 31606 050 9 1927 coneided with risIng | 16 e ’ 1 exporters companies from making profits, al. | It w ot Amer ! i ¢ ing 7 3 o cents Lo prod were selling for | none the hiy favorable fe e | denlern and exp sappisbepting W L & - oot t 1o the investw all swet A tain large brokersge firm “OROIE ey waords she kel paid no wen- |G, s i v 926 ha G cten | tlon of which was shipped abroad out the vear in most sections of the |10tal percentage of public wtiliey N Dasis and & Jurse nember eve H . I Muation had become w0 acute thit | Summer of 1926 hiad been character | Hon of w v the huyer. | S0 00 Tanged from 20 (o 30 centa | curitien which they hekl was Ty oot Dasis and A durwe ber @ min whort 506 shares of b deading AR L e (uiling off in e T Dottt R et Iy even dixtriby. | be stored until called t ety e hoontshultay | sthong e Sty W wan ealled | zed by an exception trisl early in the J e COMIANY |y the wversge. There were, of Lunon 1o devise wayn and means of |ton of sunshine and molsture, Heginning with the activities of the | T ynder those of laat year, | In that year over 48 per cent of theiv CRCl (8 B0 (ER0 I 8 i 3 In which e had a reverse interest 8o 5 giviual stocks which re- | jeeting the pricea that threatened ! Ryt 1927 started with un 1 | Fedoral Government during the ClORINK | gioekn on hand are slightly under the | INVestments were tn raitioad taswes 03RS BT (ORI 0 e clared 8 large stork Aividend. increan cred Aimappointing opersting resolts, | wide sprend omie disaster .|'.. e, which not nlv.A .'..',:‘T'.." ithe of 192 when Presldent |y 0000 whown at the end of 1926, The |A™ aver 42 por cent in Government | oG 5 GG TR cont Sng his ik, 804 wtill he wtayed short L U0 ker wu w whole wak Unc | Thut the ontire situution conld | mont oisantrous fined in the. history lidge appointed ® Apecial commIt | grgn Ty prices hus been wade up to | And municiml bonds, By 18 they | (O (CRR ST E 0 IR e kept pustnk BD IDAIEIN US| Seartan o within laus then nina montha, |of the Mississipp! FIvar. but nravent devinn wiayn K means 00 e gl dugres by the mathods taken | had increased their public wtibity vatie SO0, (O LG CHFEE (S0 S ime fin SIS R %S X Wi Lomsi Lior nd (fhe ilicice e MiSABIlY. 100 08r e hubes Tritice ot iha DIt e tonding credit facilities and veleving fig cut production costs by using new |t above 20 reduced thele Govern |\ "o and for municipal ooy yan wix figures Then he gou thred | cCautbon Migmale Kat for W28, | R o e it hioyer ¥ | the strain i the Houth, the press | and impraved machinery | ment “and “municipal provortions 16\ GIUA! S0 Mhevedure. sowalior T e "oy inesents | With public utiitien welling 1 20 went of 1927 and one without prece- |critieal month of Augint, Fersiutont | given more apace (o catiun develol | | The industry hus suffered to aome |atont = ant S0Is G0 (IR0 ORI number of munciat Wit im Ve carnings per share dndustelals et dn over half a4 century The [und frequently excessive precipitation | ments thun for many years Prove the market tor inesa of & of 1his Kina 1o undo profitable (rades 8 ' ew wnd vuilroads not much i o are elkn mad e At | cent o ale $n other siocks 0 1o e and gailioads ot mach nearent analogy oceured in 1921 when | foxtered weevil propagation and, fol | tire country became deeply interested | elgnmade cement. - especially - that L e t:u Whole, uted te thia| O the ONE leauen, o e were traders who Piow 10 times it I8 ohvious thut the | prices yows from 12, cents { cents | lowing (hree sewsons of virtual dm | in the efforts to avold demorallent from Belglum. The methods of han Wo elerients contributed to D coupas thers e " arket price of the stocka b 10n | in six weekn But during the past few | munity, felds becams infeted to o |and, by long-term fAnancing, prevent fdling the crushed stane have mproved | reversal af_ poliey Frimatity :n.‘hm( Outlook tor 1 made money and some of them big L el , o e o q, b PR Y X Aurane o Mea TRcos nieed y T e were ot s psrer Ahead of income statepents and that |monthe, cotton th 1 wan without a | destiuciive degres i parte of the | the necemnity of hoklers sactifcing | materialty bt ool cvipssg R b & the aut v Nonds our a3 dx commonly beliesed i upturn b profits, porsibly quite Liparket In the Bou'hoat 10 cents A [ Capolinas, Georgln, Alabama, Loulsl | thelr vear's production | Al 1 BEE Gwe questions must st Yo aubstantial would Bt Y | ind ut the beginang of the y . wnan, Avkansas, Okluhoma and Toxas Kxcitement had hardly nluih-ll'.:‘llll"‘l:‘ FARM |MPLEMENTS SELL. ‘l,.‘.’..\l.‘-:-l'\‘A:‘l«““."m-‘\‘-‘-:‘\::v‘\‘\\:“ “"“"l‘:; e :unn L These e will movey Fyen Corporstion Heads Far e oy furthes ise dn guotations s been sold for aver 22 cents, while Fhe predominantly wet Bummer became a front page f At ntihnne sasy N the sup 5 o pre . not | the food becam oy SO gt B R “ v Voven e and eaer s ool Tor the shisres nvolved by conttacts on the w K lxehange Loty peduced fraiting, but i aned | of the daily news wnd public u'lvml:n \I\“n‘ ln'\.:\.(m.‘..”\': '...\"‘-I\-T;l\\'...\ et gty hosyen 43 e i R b o vorgorations. the stke e i e of the Industriais advanced from n low cecord of VS8 [ T from the imbted number of | wan agaln drawn (0 cotton week® | Goncerns Report Ranner Year fop( 'iv Thewfie such an isalion | conterm with the stswbog o e hih were e ulative favorites | The guioads and the utilites a0 the close of 1926 1o over 25 cents [Lin e make Ale and | the disaster srew daily move appaliing | PR S i it E S aned L TR PN Yorked faith I Vhe tnarkel € would bw wffected wdversely by mny thin Fall top crops. Had it ren hint n b | i 1ee Joss of lite, tive stock, furm iy Last 12 Months, l““““”l"‘ :‘:"‘ “‘:~‘ s G '\“;*‘:'l":l, There in every Indicaths nat then one Girect sl bie stk be m:» sdvanoe In commodity prices Under 51,500,000, 000 Istantial bottom ¢ matured dur erments and houses I(nulh;ll |l‘\‘v | o pannoiitame: Prae .‘. i R i ke ‘~r :M “‘J money Wil continue At v New Derght 1t was ton high and and ax the yeur draws (o 6 clss com | wpwll o ) i At followed the slow - . ool veras Ay e ra . o niust " 1 and o e ! et o A yaiy A tin MON D U thian (ines [T . KDWIL: 508 na B (etory thownd Weat followed 41 SIOWE | e Cmont prominent agrieultural s The secand factor was (hat | e e Sate e o R o Shes had 10 ¥ 0 baek fve, ten 1 Jrices weemn A be Gending 001G L veeenied k total value of | Wenther enrly o July the tota) dam | eising tide in the Minslasing tmplemant_ converns declare that: nat | ot the conakierably Righer yiokt e fow Bakers beleve (hat we sha or even twenty pointe bigher More wardCThen oo, there b e politieat LSS ERTEGE UGG GunCtar 2 a0 oon | ake Infllcted wonld have proved even | waters trom the overflowed vivers v GGECCE 5T TG GG Dave, After (he turm of the vewr, A v veeord bt utilites thAn on government A fand municipal bonds it ion 1o b con, 4 Whatever hapens wt Washington, al the best ¢ i not likels o Dnnee Uhe inarket e of stacks told de (riend i ponred down the TenewAl tute of B per cent, and pe DAl 3 per cent. The action of (o e Eren it they had betier sell the stock [hnben, which included the Livgent coop | kreater. Ro (ew bolls formed the | the weat and i cver grown, fogether with the s | UDDEr Bart of e plant, wnd weevils | valley, ® bright for 1998, Produotion] B e e i vuriown aris o | BUBOLurad s many. of {hess, that « | | Tavess broke an tha Missourl tunk, | fUilY, ae beight for AREC Bmeuotion ] New Raltwad Financing ernment tands forecasts something world from previous scasons. AL Lop cron wan alinost entively lacking on the Mississtop side, and Jater | amption As (he developmen: pogiam of the IS st Twice during 1427 the ma werrant e ket price A Rumaming 3 sl up caution from | Ume this Fall, the mauch smalier |over the greater portion of the by ol il aeven i Loubstana | it TR ¢ (e af (he | PAI0AS GF Ehe countey Ras been prac | K€U Was Dadly congested — The co g both Uue specubation and Investinent g of 1927 and the carry over bad | Had (0 not been for the bottom crop. | Anxtety over the mportant Saple | Ui the tremendous inerease tn | HOH completed. and ax they have | condinion of (his st doveliped out e pointe dx wtrongly indicated, Incvensed 10 market value to approxt fand the uniquely favorable Fall v hich P In the Detta regton broukht mill | Gopiand for combined harvester | Dl Ehioughout the yeaar & surplus of (9F the sisat embssons of industrial A 8 breueh . mately $2,600,000,000 permitted the muturity of lute planted | fntevests tnto the market, not only | (hpanhers. Tractor sales gained stead | SAUIIMENE (0 Was Dot necessary fur | POBES duiing the Sping and early for them, but that the prospe concern in which he was § B becnuse Wr Bnanctsl position did “t Vailably soeaptance of 1k ud voiied loss 1 would be dmp onfidence i« o) mpecific " Thin vadical readjustment resulted [cotton in the Misslssippi Valley wne | here but in Liverpool and Alexandila, | iy, wa qid those for two and four vow {(hem to fnanes o (he extent of & | SWMer months whivh B 1o & Wi Mains of (s king. ¥ Paint Industry Flourishes. 1 DarL from the deiiuerate sRars on | 1e Westarn ssotione, the ADET oul ' ank Dhlas For Amerloan ARG (OralEn | ol e T T o | bubiie MU Thate el ot ve | Aenaion Netwoeh Sles AN, Maseks et i the mases of corporation | Fhe peint and varnish o manufer e part of planters (o meet the de | en undoubtedly would have been | growths advanced steadily Tabor saving machines 1 e extimated | 1927 were less than Ralt thase of the | AT Serously crippiod S a white wa denis and chairmen of bosids turers wound up 1927 10 s splendid | pression caused by over produeti ng the crop (ullures (hat the Baborsaving machinery [ other gioup, and (he propartion we ) SEREHIG Roises The troabie thea wiie b ihie wiO ude could be e position with one or twe exceptions | through a curtaliment in sereage, and 6 annual estimate of the Depart Halns Nweep Helt. BOUMNE Qurig 1937 vemulted Dh (1o | Fefunding 1 new oaWtAD over 48 par | WAS ROU ORIV 10 KTOAT & swnly, bt A e woutd e duternationalis | Demand was tnsistent raghout O L part by vavious unfavorable weather [ ment of Agrioulture places the yield [ Then, In Augunt, vaine swept over [ ygleays af 100000 (nerant workers [ cent 1t iy uatiative of the fmprov: | PEEeS That weie wnrsassivai brown cntiie yeur and the leading interest in | conditions Al 1LIND000 halew, or an average pro | the cotton belt day after day, With the | i the harvest felds [ing credit of the vailiwads that sev . Vim one group tial pead the warket e ndustey reported sicady snd o A rertes of thiee gomd crops Auetlon of 1628 pounds per acve, com [ exception of Texas, and stead of the | Pra use of thewa Thor saving wa [eral of them as (he Southern Ralth | Becent statistics show that Amerd ,; Sgalivasype 5ia G et gainm from week do week from Ling with e enovmoos production of | sared with 17907000 hates Tt year [ hot, dev weather, vaquistta (r Gt foninery units tn some focatithes sphit | more & ORIG AERIson. Now Yok con gl 4o mach e s i te Fotiog than ans otber clase ther tea | lanuary to Januai; ae compared wita 1926, Rad furnished the workd with for 152 & pounds per acpe Ing molsture fostered nsect propasa ' the cost of the NIRRT TVACTOr fUentinl ond ST Lonts & San Francisea | tha uee of make up (han tasie Reit sy In the vontratt macket the contiast ton A wideapiead weoevil scare, the Laed Wi polency of 1he Cue laclu ' sl yess. PR Wee eoltun Lhan could be Gonsum: ‘I 200,000 unita, BAVE LIS bedr ralsed Wew vajutal in sbten