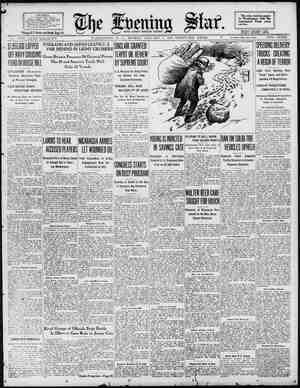

Evening Star Newspaper, January 3, 1927, Page 12

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

12 * TRADING IS QUIET INCENTER MARKET Prices Are Unchanged Today | as Dealings Are Greatly [ Restricted. Dealers reported the usual quiet Monday trading this morning. Re celpts of foodstuffs from nearby Ma land and Virginia were so light that market prices were not ha d, F day’s closing prices prevailir It 1 anticipated by dealers that an fmproved condition of the market will come later in the week, when con sumers who have been enjoving the holiday season will settle down to the regular routine. New prices may be reported tomor. row. Dealers b nticipated a bre in the egg marl s soon as the holi- day season was « but the break has not yet materialized. Today's Wholesale Prices. Butter—Fancy, one-pound pr 69a60; tub, 58a59; store packed, 38 Eggs—Fresh, selected, 48: hennery B0a52; current receipts, 45a48; storage 38, Poultry, alive—Turkeys, 40; chick-| ens, 27a28; White fowls, 7; roost old, 16 20; keats, Dressed- incy, heavy 45a48; capons, smaller, 40242 young, 80a90; 1, 35a3 Fruit and Vegetable Review. | Today’s market report on fruits and “wvegetables compiled by the Market News Service, Bureau of Agricultural Economics, says: Apples—Supplies moderate, market ginia, 1, Yor 2.75; boxes, Northwi large size, extra fancy Deliciou 8.50: my 3.50; Staymans, 2 00; Jonathans, baskets, no sales reported. Cabbage—Supplies _moderate; mand moderate, market stead stock, New York, bulk, per ton, ish type, 38.00a40.00; new Florida, 1%-bushel hampers, type, 2.25a2.50. Celery—Supplies moderat moderate, market firm; crates, 6.00; few higher. Lettuce—Supplies liberal; demand moderate, market steady; California, crates, Iceberg type, 4-5 dozen, 2.50a 8.00; Arizona, crates, Iceberg type, 45 dozen, 3.00a3.50; mostly 3.00a3.25. Onions—Supplies light demand moderate, market steady; Michigan, 100-pound sacks; yellows, U. S. No. 1, 8.00a3.25; Ohio, 100-pound sacks, yel- al; demand barrels, Vir- inches up, libe stock. round demand California, Potato Market Steady. Potatoes—Supplies moderate; de. mand moderate, market steady; Michi- gan, 15t und sacks, Russet Rurals, U. 8. No. 1, 4.50a4.75; Maine, 120- und sacks, Green Mountains, U. 8. No. 1, 4.00. Sweet Potatoes—Supplies light; de- mand moderate, market firm; Eastern FINANCIAL ! Received by Private Wire ! BY WILLIAM F. HEFFERNAN. | Special Dispatch to The Star. NEW YORK, January 3.—The new vear started on the Curb Exchange with the main body of stocks inclined to work higher, but this improve ment proved only shortlived, and when heavy selling made itself felt on the Stock Exchange it had an unfavor- able influence upon speculative sen | timent, which was inclined to favor the side of advance. Neverthele weakness was not pronounced in any quarter, and while the tendency most of the time was toward lower levels a number of noteworthy advances ed. When it became known that it the intention of the Standard of Ohio directorate to propose a recapital tion of the company to_ stockholde; at the meeting February the usual selling cropped out in th issue and carried price down ther sharply. At 345 it compared | with last week's final of 858. It is is a list of bonds ded in on the New urb Market today. iundreds. INDUSTRIALS. Hieh 5 Low 8 99 10015 HE NING STAR, WASHINGTON, D. C., MONDAY, JANUARY 3, 1927, NEW YORK CURB MARKET Direct to The Star Office understood the present shares of §100 par value will be replaced by par Value stock, which would involve a plit up in the ratio of four new for each of the present. Other Standard Oils reached lower levels in the afternoon, notably Hum- ble, Prairic Oil and nd Standard of ‘Indiana. The market for South American oils opened active and trong, but turned dull in the later dealings Phillip Mor among the industria there was a good demand for Rand Kardex. Gillette Safety Razor ared with the last previous nothing et out _strongly specialties, ood count for its strength. Fajardo from the the big board, which we by the pronounced upturn in the sugar market, both here and abroad. Serv pfd. . lumbia Syid. Seap A Superpow T am San Pr pfd 1 Am Writ wi.. ... 3 Asso Gae & T Iy Corp. Bliss E W n Rrill Corn A 1 Brit-Am Tab Res 1 Ruesrus Co n wi Celotex Co pfd “ommonw P C n 5 Commnw P n_pf 1 Cansol Dairy P 11 Con G Bal rte 16 C 1 De 3. Domirion_ & Dunhill_Intl 8 Durant Motor 2 Duz_Co A 1 Bond 3 Foundation ] 11 Freshman 4 Fulton Sgl Rk Elee iMette S_R. . 1 Gleason Prad ¢ 1Glen Alden Coal. 1 Gobe 1" A & odvear T & R Hapniness C St A 58 Ind Ravon Co A 7, Insur Co N A w! 12 Leh Pow n il & Leh Val € ofs 1 Leonh Tietz The 3% Tib Owens Sh Gl 4 Mad Sa Gar vie 2 Mare Wire Ton. Ps Shore, Maryland, bushel hampers, yel- Jows, No. 1, 1.25a1.35; North Carolina, cloth-top, stave barrels, yellows, No. 1, few sales, 3.2523.50. Spinach—Supplies moderate: de- mand moderate, market steady; Texas, bushel baskets Savoy type, mostly 1.00; Norfolk section, Virginia, cloth- top veneer barrels, Savoy type, 1.50a 1.75, mostly 1.50. String beans—Supplies of good stock light; demand good and market slightly stronger for good stock; Flor- ida, %-bushel hampers, green, 3.50a 4.00: poorer low as 2.50. Strawberries—Supplies light: de- mand light, market steady; Florida, missionaries mostly 70 per quart, few higher. Peppers—Supplies moderate; de- mand moderate, market steady; Flor- ida, pepper crates, fancy, 4.00a4.50, mostly 4.00. Peas—Supplies light; demand mod- erate, market steady; Florida, 7%- bushel hampers and bushel hampers, best, 2.50a3.00; poorer low as 2.00. NEW YORK PRODUCE. NEW YORK, January 3 (Special).— State apple receipts _were rather heavy. Western New York grade A 23-inch Rhode Island greenings wholesaled at 3.00 to 4.00 per barrel; A 2%-inch ranged from 4.00 to 5.00 and A 3-nch 5.00 to 6.00. Baldwins, 2.75 10 3.00 for A 21;-inch. McIntosh A 4-nch sold h: s 10.00 for the fanciest and as low as 6.00 on the off grade. Hundred-pound carrots sold sacks fancy State 0 to 1.60, while’ ordi- Round beets, same ! , brought 1.80 to 1.90. | The very finest yellow onions the Middie Western States realized 3.25 per 100 pounds. Orange County onions rarely exceeded 3.00 and West- ern New York shipments seldom + more than 2.50. Upstate celery, best shipments, wholesaled 2.25 to 2.75 per two-third crate. Ordinary and poor worked out from 1.00 to 2.00. Western and Central New Yor round white potatves in bulk peddled out 4.75 to 5.00 per 180 pounds. Maine | Green Mountains sold from 5.35 to| 6.60. BRINGS HUGE CARGO. NEW ORLEANS, Januany clal).—The towboat St. Louls of th Government's Mississippi barge serv fce has brought into this port 12 loaded barges from the upper Missis- sippl containing 18,000 tons of cot- | tan, grain, tobacco and general mer- chandise assembled from 19 State mostly for export. This ree breaking cargo is eq alent to 600 freight car louds, 3 (Spe- . RUBBER IS HIGHER. NEW YORK, January 3 (Special).— Crude rubber, smoked ribbed sheet: advanced 5 cent s today’s noo quotation of 39 cents. This compare with 38 cents a month ago and 91 cents a year a | MONTGOMERY WARD. NEW YORK, January 3 (). Montgomery Ward & Co. today repor ed its December sales of $23,103,429 were the largest for any month in the i exceeding those the previous or the fifth con- ar Montgomery W ales aid the mecutive 1926 sales aggre increase of §15,166 over 192! FOREIGN EXCHANGE. ,ondon, pound doll | the 3 Nat Pub Ser w New Eng Co. ... i New ET & T ¢ 3 Nor Sta_P C nfd 3 Northe Pow n - 3 Ohio Brass B 3P Oh Sec wa hila Elec. .. . 3 Philip Morris. . 2% Pillsb FI_M_Tnc 1Pitteb & Lake E1 1Proct & Gamble 1 45 Rand Kard B n 19 Reo Mot ..... 1Re Mot Trik Yte Rickenback Mot Serv El Corp.. B Silica_Gel vie. i gnia_ viee T repts EEREE AR SRR s B a D D G et FANR 2. Southw n Splitdorf Be E € St Regis Paner B8t Com Tab. 7 Stand P & L n 1 Stand Pub C A 3 Swift Tntl 2 Timken Axle 1Todd Shiv 3 Trans Lux Pic 1, Tubize A § B vic 160 i7ni Biscuit A. JF S oy N u 1 i B Talk ‘Mach. 1 rer Bros Pie 1 West Dairy Pr A West Md 1st pid 100 2 White Sew Mach 19 Sales MINING STOCKS, in hundreds. 1 Anglo Chil € N 3 Cons Cop Mines Eng Gld M Lid T i Faleon Lead Min . 20 First Thot G M 3 Hawthorne M T 136 Kay Copner C 11 Macon Val 1 Nipissing . t Mines ~. 60 San Tov . 0f 10 Stand Silv’ Lead. | EVERYMAN’S INVESTMENTS BY GEORGE T. HUGHES. Pt Janoary “Investment Demand.” This is the time of the year ‘when the p-called January e n\'f-sl!nont demand”’ makes its appearance. Finan- cial writers use this term to expl any unusual strength in the inv - ment market coinciding with the end of the y . I Wi securities terest is the buying of | with the proceeds of in hd dividend . disbursements which are unusually large in_binu- ary and July. On the first day of; these two months, more bond coupons | fall due than at any other time inj the year, April 1 and October 1 prob- ably coming next. Quarterly dividend | che also more numerous on of January, April, July it Arst and Oc is very large. Probably the total disbursements on these two accounts this y be greater than ever history of the Unites all this vast sum cz to remain idle. It must be rei that is to say, be used to buy stocks i or honds or property of some kind. Even if it is left on deposit in thel vank, that institution will use it in) the security market, The influx of this capital on many ! occasions in the past has served to) advance sharply the market price of {the particular grade of investments then in most demand. Finally it came be a tradition that the investment rket would enjoy a substantial iy b nnot be allowed vested, | so that the aggregate Paniico. nt Prod w Bedford O 10 Roval Con 0 & R 3 Salt Ck Prod dal Osage O o 2 Tid Osage O N 'V 5 Tide Water 0il 1 Tide Wa Ol pfd & Venezuelan Pet. 8 Wilcox 0&G n 100X RGI. <. . v S Rb Sales STANDARD OIL ISSU! in units, 800 Anglo Am Oil.. 2014 1100 Continental O n’ 3017 50 Cumberland P I, 106 00 Humble Ol & R 611 00 Int Pet C Lid.. H2% 100 Nat *Transit’ . . | 800 Ohio 0l .. ! 1% 700 Prairie O&G 600 Prairie P L. 40 Solar Refin. | 100 Southe P L0 SONI'n 1708 0" Obio. . 100 Swan & Fanel 500 Vacuum il Sales in thousands, BONDS. 5 Alum 7s n ‘33 26 Am 24 Am 5 Am 9 Am 4 Am Th 6Am 11 Am 2 Anaconda 6s A 1 Appal El Pow G Ars P & L 5s. 4 Ass0 G & E Ga 6 As Sim Hard 618 19 Beacon Oil 6s. 5Bell T Can 5 2 Bos & Me 68 M BBrun T & E 7% 1 Can Pac Ry 415 19 Caro P & L 5s.. 86 Chili Cop 5s. . 59 Cit. Serv 6s 3 Cit Serv 7s 10 CI El llum_ 58, 5Cons G B 58 F 1 Con G Bal 5 4 Cons G Balt fs A 107% 5 Cons Tex 8s.... 90 1 Con Corp Am’ 65 98% 2 Det Ci Gs A. 107 1100 1018 s 101 14 o a P ¥ 1 1Gal Sig P 7s '30 92 10 Gatinean Pow s 94% 3 Gatinean Pow 6s 9814 70 Gen Pet 6s. 1011 3 Grand Trk 5% @ Ind Limestone Gs 3Int Gr Nor bs B 4 Int Na 2 Inter Paper 6s.. 15 Lehigh Pw 6s A 5Long Isl Lt 6s..1 10 McCrory 53 s wi Mani P 58 1 Mass Gas' B3y Mont WPC, ] 714810230 Bis 983 10hio Riv_Ed b 2 Pan Am Pet 6s. 10F 0 B i 4 Phi E 2 Pure C 6%s i 1R K B 518 ww 09 2 Richfld O 68 A Sou Cal E bs '51 P & L 6 105 3 Transcont 16 Un. Ol STni Ind 614s wi 10 Ru 6 130 : Ru 618 "33 ITSR 6% 39, 1 Wab Ry Co 53 B 1 Webster Mil % 28 West Union T 5s. 101 Sales in FOREIGN BONDS. thousands. 8 Baden 7s . 6 Buenos' A 7s @ Buenos A 7 6% .. 4 Cun Am 78 A" wi 2 Danish Cons 5% 6 Denmark 514u . 5 Free St Prus 6 1 26 Ger Con Mun 7 Great Con E 1 1§ Hune ¢ Mun rupp Fried 1, 82 Leonh Ttz C 7% 45 Miag M Mach 7s 6715 M M Tewwi 017 nk Chile s 98 3% uni Medellin 85 1048 - 100 15 Hal 7s " o & S&H olos it o Thys Ir & Stl 7s 10 T8t Wks Bur 75 081 DECLARES DIVIDEND. NEW YORK, January 3 (@) Iron Products Corporation declared a dividend of § a share on the common _stock, payable January 31, The company is controlled by Uni- versal Pipe and Radiator Co. FEDERAL LAND BANK BONDS. (Quoted by Alex. Brown & Sons: Closing) Approx. Asked. yield, Australia is seeking to learn exactly how to determine just what is a living wage. The country has a law providing fer a living wage based on the ‘cost of living index, but whether that cost of living should jance just after the first of th : The expected result, however, doe: not alw sme to pass, and for thi -ason L it was expected. Antici-| pating this demand to appear along about the first of January, dealers and | a month or more cumulate the kind of| think they can sell| or recelves his Jan- uary income. Their buying serves to advance the price level that much sooner and when the actual January buying begins it is without effect. In recent years, too, the investor himself, being able to borrow on favorabl terms, has anticipated his January requirements beforehand, so that this also helps to smooth out the price curve, be an average of the entire country or for each section is the problem. armers do not want it on a city- price basis, and city employers do. And the argument may scrap the law. e ¥ it Japan to Build Big Tunnel. The Mo, Shimoneseki Straits rail- way tunnel, construction- of which was delayed by the earthquake in Japan, is to be constructed in 1928 by the Japanese government. The tunnel will do away with the ferry service ~connecting Kyusha and points in Honshu, which often is in- terrupted for 24 hours at a time by storms. The bore will cost $10,000,000 and 3,000 men will ke e ged in the work. I TOBACCO BODY FILES FINANCIAL REPORT Statement of Virginia, North and South Carolina Firm Sub- mitted Today. By the Associated Pres: RICHMOD ating « erg’ Co-operative influde wini: North and South Carolin its or fon to M 1, amounted to $20,011,285.60, while the income from tot during the period aggre 0, cording to the ceivers, ubmitted to the of the three States tod: The report, signed by James H. Pou, Hallett S. Ward and Merton L. Corey is intended to show the 100,000 grow- what became of the proceeds from ale of tol 0. The cost of operating the as from February until s aiv “ation May 31, General ing ex- charges, | The general overhead expense in- cluded $556,983.05, ies of off and directors, and torneys’ fe of whi as receiving et paid. About 100 attorneys and firms in ad- dition to Sapiro are listed, the assoc tion having conducted much ligita- tion, including suits against its mem- be MEN By M. S. Rukeyser. (Copyright, 1927.) AND MONEY Ex-office boys and ex-stenographers | who rose from obscurity are today | for the first time sitting at the desks of partners and senior officers in the great money reservolrs of Wall Street. The beginning of the New Year is the traditional period for recognizing merit. What qualities raise favored individuals out of the ranks into high places? No easy formula can point to the se . Usually 3 hired man is honored with a _partne; ship because of re i i ployers that he contributions to the unless tied fast by a profits, he will eventually drift to a rival house or set up on his own. Wall Street banking houses, howeve rarely bring an employe into the bus ness family unless he reveals a ca pacity to get along with the o ‘An attractive personality—the abilit to co-operate—-is neces no matter what other personal a the indi- vidual may_pos: Daniel Lipsky, who entered the employ of the Manufacturers Trust Co. of New York as a stenographer seven years ago, h the vice presidenc advice to beginners Be enthusiasti tains. Be punctual—a great boost. Bo courteous—both to your co- worker and your bo: Be rational—at all times and in all things. ; Dress neatly—appearance counts a lot. Forget _college—generally better without it. Business Endless Flux. The birth of the New Year em- phasizes the fact that business, like life, is subject to endless. flux. When the management of an entér- prise believes that conditions have be- come static, the business faces decay Conditions and market preferences change endlessly, and the only safet for investors is in an enterprise who management perpetually battling against adverse tendencies. Progress is the price of business success. The Studebaker Corporation, which for decades had heen wagon build had the good sense to change with the times and become makers of auto. mobiles. Other wagon builders who, instead, tried to argue the motor car out of existence have withered and decayed. ~ Advertisers can rarely afford to rest on_their oars. Endless repetition is the price of being heard and remembered. make business, and, re in the He offers this it moves moun- you're Newcomers are even entering the | buying area—and need to be told what at first blush seems a universally familiar stor: It is estimater that 2,500,000 new- born Americans begin consuming each year, 400,000 graduate from the high schools and 100,000 quit the col leges and universities to start their business or professional cs and a quarter million young couples start housekeeping each 1,400 000 persons die annually-—and near as many cease to be gainfully em- | ployed Thus old favorites who fail to keep, their names before the e <hanging public soon fall into oblivion. Railroads Paying Off. The American railroads, credit has been heightened proved earning power i will have to pa ing 1927, compa in 1926 < 847,360 in 1924, The carriers long ago gave up the idea of getting out of debt and adopted whose by im- nt years, 8,710 dur- 212,783,000 and $147, The tonic and laxative ef- fect of TLaxative BROMO QUININE Tablets will fortify thes system against Grip, Influenza and other serious ills resulting from a Cold. Price 30c. ‘The box bears this signature ers | 7.03 for at-| been elevated to | | the system of paying off one group of creditors by borrowing from an- other. | | “This year the railroads are in a! better position than they have been in more than a decade to raise fun | through the sale of stock, instead of | bonds. During the war perfod and | immediately thereafter, few, if any,; of the railroads could have sold new stock, because of the declining_pres- | tige of the fers. Today all the | rong railr could readily find | e blocks of new stock | »m whose outstand s elling at least 15 above par could easily market shares. } Period of Stock Financing. The country secems on the verge of a period of stock financing by rail | roads, mot only to meet maturities, | but also to finance development and | extenston. The chief advantage in selling stock is to better balance the capital structures, which, during the period of railroad adversity, became topheavy with bonded indebtedness The paradox of the sit now that the strong rc | to sell stock many of them prefer to market bonds because it consti- | tutes a cheaper way to raise funds, especially in view of the high tax rate on corporate earnings. Tax selling to establish los: depressed stocks is now over and in- stead there may be a new form of tax selling to establish profits in favored stocks. The prospects of a lower tax rate for 1927 no doubt in- duced numerous traders to hold their stocks through the turn of the year. With the Federal tax rate declining the tax factor is becoming progres- sively less important as a stock market factor. new tion is that ds are able THE BUSINESS OF GETTING AHEAD. BY M. S. RUKEYSER. FKconomics of Children. Sophisticated moderns are figuring the cost of rearing children, and are consciously limiting the size of their families. With a new sense of economy, the present generation is multiplying by reducing the number of infant mor- talities. r The ancient fears of the economist Malthus that the population would in- crease faster than the food supply | have largely disappeared. The intro- | duction of machinery in the field of | agriculture has heightened the bounti- fulness of nature. In America the late Theodore Roosevelt was the fore- most advocate of large families. There was more justification for hold- ing that doctrine in America, which was comparatively thinly populated, than in densely settled Italy, which | has for decades found it necessary to export a surplus population every vear. And yet Benito Mussolini has of la espoused the cause of large familits in Italy. With the gates to America partly closed as a result of restricted imr tion, Italian states- nen are cultivating a .new imperial- sm and seeking new outlets for | populationsin northern Africa. | Restrict Families Here. | In America, parents maintaining @ comparatively high standard of living | restrict their. families to a number | which they can afford to educate well | and give a good start in life. | In accounting terms, children be- | { | come an investment from the day of birth—and a long pull investment. It is better family bookkeeping to regard children as an expense, rather than an | | | HERE is one whose name shines forth as the father of modern Iberian poetical drama— Gil Vicente. Though at- tached to the Portuguese court, he wrote with equal facility in Spanish and Portuguese. Nineteen of his dramatic productions employ both languages in the same play. In another field—that of first mortgage invest- ments—Swartzell, Rheem and Hensey Company stands out as the father of this modern investment in Washington. As the oldest, prominent, First Moytgage iouse ‘in the NatW¥nal Capital, this company has the added distinction of never having lost a dollar in principal or interest for any investor for over fifty-seven years. ‘When you are in the market for a safe invest- ment, it will be worth your while to consider these mortgage notes, which not only have be- hind them this half- century of prestige, but now return the investor 614 %. Swartzell Rheem & HenseyCo., Mortgagebms T127~15% S§t.NW. Washington.DC. Without Loss To flye:r: Investor investment on which a financial re- turn is expected. Rearing children properly is the most unselfish of all pursuits. Sidney Howard, in his new American drama of mother love, “The Silver Cord,” urges this policy in re spect to children: “Have ‘em, love 'em and leave 'em be. Unfortunately, there are no actu- arial statistics allable concerning what children do for parents in their old age. And yet it is common knowl- edge that the system of economics of the average aged and infirm parent is to rely on his children or other rel atives. Where propertyles parents find their children unwilling or unable to contribute to their support, they frequently become charges on the community. 2 Sometimes, excessive ifidulgence of their children deprived parents of even modest competence for their old age Frequently parents deliberately ex- haust their own finances to stake their children, giving them a start in life- perhaps capital for entering business |in the expectation that the grateful children will look after their parents when they become too old to earn their own living. Highly Speculative. Frequently, this reckless gamble on the future of children ylelds richer returns than any other type of finan- cial commitment, but it is a highly speculative undertaking. A parent first duty may be toward his children but he has a second duty to his wife and himself. The father should not consciously Improverish himself and stake everything on an offspring. The hazard is too great, for premature death, illness or incapacity or incom- petence or ungratefulness may make the child of no financial value to his parents in their old age. The relations of a parent to chil- dren are rightly based on love and sentiment, but because of this man: parents fail to use common sense i the matter. In fairness all around, the father from the time of his ear! manhood should begin to set up re- serves against old age. His contribu- tion to his children should be made unselfishly, with no thought of a di- rect return. The father who pro- vides for his own future is lkely to be happily surprised by.grateful chil- dren, who, through their contributlons, will ‘supplement the bare necessities of life with luxuries. The law recog- nizes the obligation of children to parents, and permits them to take special deductions in computing their income for tax purposes if titey main- t ain parents under the same roof. Unwillingness of parents to think realistically about these questions leads in the aggregate to countless | miscalculations, disappointments and | misunderstandings. INCREASE VIS EXPE&TED, NEW YORK, January 3 (Special). —The officials of the National Elec- tric Light Association anticipate that electric «urrent production in 1927 will exceed 75 billion kilowatt hour: an increase of 8.8 per cent over 192 The incre: in output in 1926 over 1925 was 11. per cent. Listed stocks and bonds bought and sold on commission. Accounts carried on a conservative marginal basis. ‘We invite correspondence on securities HARRIMAN & Co. Members N. Y. Stock Exchange 111 Broadway, New York WASHINGTON OFFICE 72915th St. N. W. | Telephone: Main 1603. Our Service Is Available in Preparing q a q | nent which is subject to the based on values of January FINANCTAL. COTTON1S STEADY AFTER EARLY DROP 0ff 7 to 11 Points at Opening in Response to Easy Liverpool Cables. By the Associated Press. NEW YORK, January 3—The cot- ton market opened barely steady today at a decline of 7 to 11 points in re: sponse to relatively easy Liverpool | bles. There was some Southern | selling on the opening decline to 12 for March and 13.10 for July, but offer- | ings were comparatively light and | rices held fairly steady during the | st hour on covering and a little trade | buying. Private cables sald there had been | hedging combined with local and con- | tinental liquidation in the Liverpool market, but reported an improved de- | mand for cotton cloths from the conti- | nd Near East. | A feature of the trading here was | the switching from March to July at | a difference of 33 to 34 points, and the { first business in December, 1927, con- which sold at 13.40, or about points above the price of October. New Orleans Market. NEW ORLEANS, La., January (P).—The cotton market opened easy | here today owing to unfavorable Liv-| cables. First trades were 3 to down except January, which | opened 1 point up. Prices cased off | on all months, after the call, on re- | ports of continued good weather and | lack of trade buying support untl anuary traded at 12.60, March at | 12.65 and May at or 9 to 10| points below the previous close. The | market was steady at the end of the | first half hour. | TREASURY CERTIFICATES. | (Reported by J. & W. Seligman & Co.) Rate—Maturity. 4% s March 15,1 June 15, 19 Dec_15. 19 927 OIN THE CHRISTMAS SAVINGS CLUB OF THE FEDERAL-AMERICAN “Everybody’s Doing I’ FIRST MORTGAGES FOR SALE 6%2% THE TYPE OF SE CONSERVAT INVESTORS BU In denominations of $250, $500, $750, $1,000 and upwards, se- cured on improved real late ated in the District of Columbia. JAMES F. SHEA 643 Louisiana Ave. N.W. We will gladly receive and give prompt attention to applications for Loans on Washington Real Estate Current rates of inter- est. Should you hayc Morey to Invest —we can also take care of you. Our experience, ex- tending over a period of Thirty-five Years —insures _vour protection. Percy H. Russell Co. 926 15th St. N.W. Stocks Bonds 0dd Lots Carriea on Margin Buck & Company —BROKERS— Established 19516 312 Evans Building 1420 N. Y. Ave. N.W. Tel. Franklin 7300 Direct Private Wires to New York EXECUTIVE Accountant, Office and Sales Manager, with 20 years experience desires to make an investment and become active official. Interviews in confidence. Address Box 34-2 We Buy and Sell Liberty Bonds Treasury Notes Etc. Bond Department The Washington Loan and Trust Company 900 F Street 620 17th Street & Co. Members New York Stock Ezchange Successors to JOHN L. EDWARDS & COMPANY 1416 H Street Northwest 52 Broadway, New York Richmond, Va. E. A. Pierce & Co. Successors to A. A. Housman-Gwathmey & Co. HOME OFFICE 11 Wall Street Stocks - Bonds - WASHINGTON OFFICE 17th & H Streets . New York Cotton - Grain arch 31, 1927. 823 15th Street, N. W. . Telsphone, Main 593 Your PersoNAL Tax RETURN Basep oN JANUARY 1 VALUES A change in the law requires a return of personal property, istrict of Columbia Intangible Tax, 1, 1927 (closing securities quotations as of December 31, 1926), instead of July 1, as heretofore. This tax is five mills (Qfo 1% of the current value) and must be paid not later than you will send us a list of your securities, we shall be pleased 0 assist you in preparing your return by indicating those which are taxable and furnishing the necessary quotations. ‘We shall be glad to offer suggestions to strengthen your in- vestment position and to assist you in placing current funds to the best advantage. By consulting us you incur no obligation. CRANE, PARRIS & COMPANY Investment Bankers Since 1883