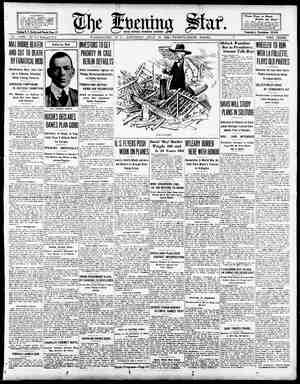

Evening Star Newspaper, July 19, 1924, Page 11

You have reached the hourly page view limit. Unlock higher limit to our entire archive!

Subscribers enjoy higher page view limit, downloads, and exclusive features.

FINANCIAL. S ———— TODAY'S RECEIPTS AT CENTER MARKET Peaches Cheaper—Potatoes Also Lower—Heavy Ar- rivals of Watermelons. The daily market report of fruits and vegetables compiled by the Mar- ket 2 Bureau of Agricul- tural Economics follows: Cantaloupes—Supplies moderate; de- mand moderate, market steady: Cali- fornia and Arizona, salmon tints standards, 45 . mostly 3.50; jumbos, 455, 3.7524.00; flats, 12s and 108, 1.25a1.40; Honey Dews, standard crates, 1.75a2.25; Arizona, pink meats, standard flats, 12s and 15s, 1.25; North Carolina, green meats, standards, 458 ordinary qualit Peaches—Supplies moderate; de- mand moderate, market weak. Georgia and North Carolina, Hileys, 6s, small size, 1.00a1.25 lium sizes, 1.25a1.50 large siz 1.75; bushel ba kets, Hileys, medium size, smail size, 1.00al Germans, small size, 75a1.00; some green, as 50c; medium and larg 1.50; North S large eiz a2.00; California style boxes, Hileys, few sales, 1.00. Potato Market Weak. _Potato upplies liberal; demand light, market weak. Virginia, Nor- folk section and North Carolina. cloth- top stave 2 Irish Cob- blers, U. 75; mostly 2.25a2.50. Watermelons-—Supplies heavy: de- mand moderate; market weak. Carlot sales—Georgia 'and South Carolina. bulk per car Tom Watson's, 53 teirs, 18-20-1b. ave. 100-1 1b. avg., 150 34-1b. avg., Cabbage—Supp moderate: de- mand mederate; market slightly stronger. Homegrown, uncovered ews Service low’ barrels, pointed and round type, 1.00- 1.25; mostly 1.00. Corn—Supplie moderate: demand moderate; market firm. North Caro- lina, crates best, 75-3.00; fair qual- ity, '2.25-2.50. Lettuce—Supplies light; moderate; market stea New York, big Boston type, 1.25- few 1.75. Tomatoes Cheaper Today. Tomatoes — Homegrown supplies liberal and supplying the market; demand moderate market slightly weaker; _homegrown, half bushel bampers N 1, 3.00a3.50; few 4.00. Beets — Supplies liber: demand moderate, market steady; homegrown, 2.50a3.50; per 100 bunches, few higher. Carrots — Supplies oderate; de- mand moderate, market steady; homegrown. 3.00 a 4.00, per 100 bunches. String demand demand beans — Supplies moderate: moderate, market fairly steady: homgrown, uncovered slat barrels, green, 5.00a6.50. Squash—Homegrown supplies mod- moderate, market stead grown, half hampers, white, 1.00. Pears—Supplies light; demand mod- erate, market steady; California, boxes Bartletts. ALL BUTTER MARKETS | UNSETTLED DURING WEEK ! Demand Less Active and Trend Toward Lower Prices Reported. CHICAGO, Ju view of the b er market published | today by th, reau of Agricult 1 Economics, United States Department | of Amriculture, says: | “All butter maurkets for the week | ending July 19 were nervious and un- settled with a tendency toward lower prices. Very li idence was ap- parent on the p: er buyers or sellers and trading o whole | was quiet | “Sentiment mixed, but the appeared to has been somewhat ajority of the trade be in favor of lower under were ly all ge of dium and tive and sales registere practic: scores resulting in widening prices.” EVERYMAN’S INVESTMENTS BY GEORGE T. HUGHES FORTY-FIFTH ARTICLE. Accrued Interest. Apparently simple financial terms may be confusing to the inexperi- enced. Most women and not a few men would shy at trying to define “accrued interest.” Yet you see * crued interest” included in the prices of bonds a dozen itmes a day if you read financial news. IUs a very sim- ple thing to get straight and for all To take the strange sound out of “accrued interest” let us consider that you have a 31,000 bond that you wish to gell. We will say that it is a 8 per cent bond and that the inter- est is payable January 1 and July 1 every year. You wish to get par— that 1s the bond's face value of $1,000—and accrued interest for your bond. On May 1 you seli the bond at $1,000 and accrued interest. Now the last interest payment was January 1. From January 1 to May l1-—four months—the interest had been ac- cruing, or accumulating, but had not been paid because the coupons can be cashed only on interest-paying dates, January 1 and July 1. That four months' interest will not be paid unti] July 1, at which time the inter- est for the whole previous six months will be paid Hence, when you sell your bond on May 1 you charge the buyer for the four months' interest, which will be paid him July 1. You charge him $1,000, the par value of the bond, plus $20, the amount of four months’ interest. On July 1, the next inter- est-paying date. the buyer of your bond receives $30—six months' inter- est, although he has owned the bond only two months. Thus he gets back the $20 he paid you for four months’ accrued interest on the bond. Most bonds pay interest semi-annu- ally. January 1 and July 1 are, per- haps, the greatest interest-paying dates. More bonds pay interest on those dates than on any others. Hence July and January are usually important investment months, since 8 great deal of interest paid om those dates is reinvested. That is a natural development from the fact that the fisoal year of the government and of many corporations begins July 1 and the calendar year begins January 1. However, the January 1 and July 1 interest payments are not nearly so large proportionately as they were SOmMe Yyears ago. An increasingly larger number of _bond issues are being made with other months of interest payments. It is practicable now to select bonds with coupons payable in any month desired. By proper diversification in- once BY WILLIAM F. HEFFERNAN, NEW YORK, July 19.—Interest on the Curb Exchange was again de- voted today to the higher priced stocks. In these shares there was further manifestation of public de- mand, although not in the volume that has heretofore prevailed. Not- withstanding some profit-taking, prices were generally firmer, and new high levels either for the period or all time were established. Gain however, were confined to fractions from the preceding close. Soft spots in the market have beun eliminated and the undertone as a result was firm through the two-hour session. Radio shares continued leaders in the matter of interest, activity and strength. New high levels for all time were pronounced in this depart- ment. Hazeltine Corporation, Dubi- lier Radio and Ware Radio all moved NEW YORK, July 19.—Following is an official list of bonds and stocks traded in on the New York Curb Market today Sales ir, thousands. 6 Allied P 5 Allied BONDS Tigh Noon. 831 6 Low. 10 Cit Sery 7 D0 Gas Balt % B Gas Balt 6xA. % By P & B 6lx A wi 3 Drere & Co Gulf Oil Corp 3%s. Hood Rubber s . Inter Match Glgs wi 1 Kennecott Cop 78 26 Lehigh Power 6 Lebizh V1 Hr 2 Libby, MeN hila Blec Glax ... 5 Pub Serv of N J Ts. Pure 0il Co 6145 .. South Calif Kd 33 Tidal Osage ith FIL& 1 Union 0il & 1 King of Neth .. 5 Sol & (o 6s 34x B.. les STANDARD OIL ISSUES. in_units, 200 Anglo Am_0il 10 Rorne Scrsmser 100 Cheseb Mfg new wi 4% Cumberland P L .. DMPL.... 320 Imp Oil of i0Ind P L .. 300 Intl Pet (o Ltd 40 Magnolia Pet 10 N Y Transit .. 100 Ohio Ol new 210 Prairie 0l & Gas. 100 Penn Mex Fuel 110 3814 811 Y new Vacuum Oil new. ingston et M Prod ... Mutual Oil vot cfs. Noble 0il & Gas Penn RBeaver Oil 8 Pennock_Oil Piercs 3 Red B Roral Haptlss Woodley Pet. INDUSTRIALS. Am G & El new wi. 79% Am Hawaiian 88.... 113 % Am L & Tract..... 135% 0%, 1 135 BY STUART P. Special Dispatch to The Star. NEW YORK, July 19.—Wall street's interest in the business and financial situation of the past week has been absorbed by the happenings in the grain and railway security markets. The extraordinary upturn in farm prices, principally wheat and ocorn, has done more to strengthen the con- fidence in the outlook than anything else that has occurred so far in 1924. This has been demonstrated in an impressive advance in railway stocks and bonds, which have reached new high prices, and in the increasing optimism which has been expressed in investment and speculative quar- ters regarding the future. Not only has the purchasing power of the agri- cultural districts undergone a rapid change for the better, thereby im- proving the whole economic struc- ture, but the effect upon sentiment has been striking. L C. C. Rate Ruling Vital. The rise in grain prices was en- couraging enough in itself, but the ruling of the Interstate Commerce Commission against the proposal to reduce western railway rates on grain and grain products served to emphasize the importance of what has taken place in the field of agri- culture. It struck from the public mind the fear of adverse railway legislation which has been overhang- ing business and financial operations, Moreover, it brought out more clearly the significance of the substantial appreciation in the value of crops in this country. This enhancement in crop values, it is estimated, has in- creased the agircultural wealth of the nation by over $1,000,000,000 in scarcely more than a month. Live Stock Industry Improves. Since the first week of June, when the government report on the condi- tion of farm products was made pub- lic, wheat at its high level of the week has risen approximately 30 cents in the bushel, corn had com- pleted an advance of over 35 cents, and in other commodities there were corresponding gains. The live stock industry, too, has shown decided im- provement. A combination of circum- WEST. come from bonds may be spread out over the entire year. K (Qopyright, 1924, by Consolidated Press Aseo- iation.) MBS e R Ask Your Banker. How much real value stands back of the stock you are asked to buy? Are you sure that the nice, honest- looking stranger is telling you the truth? Ask your banker to look iato ‘what he claims. stances, some of them unforeseen as recently as a few weeks ago, has been responsible for these develop- ments. In the case of wheat, for instance, when the defeat of unfavor- able legislation became a certainty, the market was allowed to move under the influence of natural cau: Producers of wheat cut down their acreage and this, together with the bad weather of the late Spring and early Summer, is calculated to result in a yield in this country. of 45,000,000 NEW YORK CURB MARKET Received by Private Wire Direct to The Star Office THE EVENING ‘ into new high ground on the frac- tional gains. Speclalties,"as a whole. failed to attract as much interest in preceding sessions. Utllity share: generally were qulet, but firm. Ol stocks, although quiet, con- tinued firm at near the best levels from the recovery of the low record of the week. Actlon of these stocks since the announcement of further cuts In the price of crude and refined products has been responsible for an improved semtiment with regard to the stocks. Wyoming olls dis- played a firm price tendency under the lead of Mutual Oll. South Amer- ican shares were active and firm with Lage Petroleum continuing in the lead. Low priced shares were quiet, but steady as to price. Metal shares were less active in the gain, but there was improved price tone through the entire group. Copper shares were again in demand. Jib Consolidated was again neglected, but the price was steady. Silver shares were quiet, but prices were firm in expectation of higher prices for the white metal. . 2 Am T & T new w | 12215 Appalac Pow & Lt Atk Ligt & Pow Borden & Co... BritAm Tob cou Bur Adg M new. Bkiyn City R R Bucyrus, Co ... ERTiERG hatterton & Son. . atter & Son ptd Common Pow Cor Con Tob _Inc D&RGW RR new pfd 2 Dubilier C & Radio Duohill _Intl Inc Durant M : Du Pont Motors 122% 122% K k3 -4 ¥ e 108 e iyear Tire nseltine’ Corp wi Hayden Chem ... 5 Hud & Mann R'R Hudson Co pfd Solether . . Omnibus vte Omnibus pfd A W i Rtadio Corp Radio Corp pfd Rad new A pfd w i 3 Reo Mot Kova Radio S0 C & I new nn Elec Pow. Tenn E Pow 2d pfd 63 Thom R C vte w i 12% 2 Tobacco Prod Expt ed Bakeries. .. 5 United G & E new United Prof United Ret o 2 U S Lt & Heat pfd . Wi Ware Rdo Corp. .. 2 Yel Taxi Corp N Y MINING Black Oak Gd Min .86 Canario Copper ... Mines new Harmill : Hawthorne Min Inc 3 Hollinger Hecla Mine Independence Lead. F1bY Couslfsx -5us0 Kay Copper Carp. Ohio_ Copper ~ .l rmac Pore Mo Lt .48 smouth Tead Min .64 mier_Gold Min. ky Mt S & R ky M S & R pf Gold BunnRBnall R J 0 U_S Cont mew w 10 Wett Lor Spver . RAIL VALUES FIXED. The Grand Rapids and Indiana Rail- way Company, a Pennsylvania sub- sidiary, was tentatively valued by the Interstate Commerce Commission today at $22,533,087 as of June 30, 1917, The Interstate Railway Company of Virginia was valued at $1,835,220. M i McCRORY EARNINGS UP. NEW YORK., July 19—McCrory Stores Corporation reports net earn- ings of $647,804 for the first half of 1924, compared with $476,654 in the same period last year. Soaring Grain Prices are Most Vital Financial Factor of 1924 Natior’s Purchasing Power Greatly In- creased and Sentiment Improved; Merger Talk Used to Hoist Stocks. |WEEK SEESRAILS | of the Bethlehem Steel common divi- bushels under the outturn of a vear ago. For the world altogether the yield is expected to be 120,000,000 bushels less. In addition the Cana- dian crop appears to be considerably less than had been anticipated, and in other countries supplies are ex- pected to be reduced by unfavorable weather conditions. Corn require- ments have been permanently in- creased and the corn crop is likely to be the smallest in vears, with an unusually small carry-over from the old harvest. Rallway Securities Benefit. All classes of railway securities have participated in the spirited up- swing on the Stock Exchange, and for this there can be no doubt that the agricultural situation has been largely responsible. Numerous high- grade issues got to their best prices for the year. It is true that the ex- tremely easy money conditions have been a factor. However, another fao- tor has come into play. Wall Street looks for an era of railway consoli- dations. On this ground the specula- tion in the rails has taken in a large number of the non-dividend-paying issues, the stocks of companies which have shown either mediocre earning power or have in the past year done well to earn interest charges. Speculative imagination has been fired by the possibilities of mergers, but at present these have reached only the rumor stage. The approval of the Interstate Commerce Commis- sion in each case would be necessary. In the meantime railway earnings have been below the average of a year ago and there are no indications, that the traffic of the carriers will un- dergo any quick change until busi- ness generally has shown more of an imptovement than recently noted. Trading Heavy on Stock Exchange. The available supply of money for investment and speculative purposes has been favorable to the bullish dem- onstration in the railway shares and in groups of industrial stocks which have been bid up on reports of better business in the lines of trade they represent. The volume of transac- tions on the Stock Exchange has been | heavy all through the week, exceed- ing a million shares daily on the av- erage. ‘ In the foreign exchanges the nota- ble occurrence was the strength in sterling exchange early in the week. But interest in this quarter dwiddled, 80 far as the price changes could be taken a8 a guide. The exchange mar- STUDEBAKER Just Drive It; That's All D. O, SATURDAY, JULY 19, 1924. Money to Loan Becured by first deed of trust on real estate. Prevailing interest and commission. Joseph I. Weller §, West.©; & Trest | FEDERAL-AMERICAN NATIONAL BANK RESOURCES $13.000.000 1315 F ST Jonn PooLe Paeseew STA When Buying Our 7% First Mortgage Notes Can Be Assured COME T0 FRONT Coppers Also Improve—Price Cuts on Gasoline Send 0il Shares Down. You and con- has been First.—A very eful servative appraisal made. Second.—The loan we recommend is less than 50% of the market pricy : Third.—After you have purchased one of our notes you get a serv- ice that assures you interest the day due. Notes on ha: $100 Chas. D. Sager Main By the Associated Press. NEW YORK, July 19.—Railroad shares resum>d the leadership of the upward movement of stock prices this week after an early perlod of irreg- ularity which apparently marked the correction of a weakened technical posi- tion. Buying of the rails was influ- enced by talk of mergers and the de- cision of the Interstate Commerce Commission denying farmers a re- duction In freight rates on grain. Ralls at New High Marks. More than twoscore railroad shares established new peak prices for the year during the week, Including Southern Pacific, Rock Island, “Katy,” Missourl Pacific and Wheeling and Lake Erle prefer- red issues; New Haven, Great North- ern preferred, Pere Marquette and Chicago and North Western. First officlal confirmation of reports that a merger of the Erie, Pere Marquette and “Nickel Plate” properties was un- der consideration came after @ con- ference of O. P. Van Sweringen with the Pere Marquette officials, in which plans for a consolidation, through an ange of stock, were outlined. teel shares lost &round on the publication of a relatively poor Quarterly earnings report by Repub- llc and rumors questioning the safety The Offer ' To Pay Too Much Interest To the Investor Is Generally The Evidence Of Doubtful Security— When We Sell You Our 6%% Real Estate First Mortgage Notes No Such Risk Is Run— NEVER A LOSS NO DEPRECIATION PROMPT SERVICE We Solicit Full Investigation Mortgage Investment Dept. SO & Luchy) 713 & 715 14th St. NW. | 924 14th St. N.W. Loan Department Co-Operative Building Association Organized 1879. 44th YEAR COMPLETED Annetn .. $4,755,170.52 -$1,248,320.98 Save Now —While you have a steady income ix the time to wave. The systematic sfving plan of the Equitable is & most effective method accumulatiog ‘money. Subscription for the * 87th Issue of Stock Being Received Shares, $2.50 Per Month EQUITABLE BUILDING 915 F ST. N.W. JOHN JOY EDSON, President FRANK P. REESIDE, Sec’y. of dend. Extension of gasoline and crude price cuts and the omission of divi- dend on Sinclair common brought a flood of selling orders into the oil shares, but they steadied later in the week on reports that pro-rating in the midcontinent fleld would be abol- ished about August 15. Copper Shares Wake Up. Revival of speculative interest in the copper shares was based on ex- pectation that the reparations con- ference now in session in London probably would stimulate European consumption of the red metal, and the increased demand for silver, which has steadily appreciated in value in recent trading. Unfavorable dividend rumors also accounted for the weakness of Stew- art-Warner and some of the other motor accessories issues. Sugars were inclined to heaviness on unfavorable trade reports. Trading Very Heavy. Pool operations were in evidence throughout the list, being aided by a continuance of easy money. One of the most significant developments during the week was the placing of seven-month loans at 3% per cent. no maturities beyond six months previously having been offered at that figure. Total sales in the last few sessions of the week were at the rate of more than 1,000,000 shares daily. EASY LOANS EXPLAINED. Increase in Gold Reserves and Note Payments Among Factors. NEW YORK, July 19.—Explanation of the fact that brokers are obtain- ing seven-month loans on prime col- lateral at 3% per cent for the first «dme in years was furnished in the weekly statement of condition of the feaeral reserve banks, showing an increase of $17,000,000 in gold re- serves, a further decrease in bill hold ings and the large shrinkage of more than $42,000,000 in note circulation. Every reserve bank In the system ex- cept Kansas City reported smaller note circuiation. It is assumed that western banks are benefiting by liquidation of old loans, some of which had been in a frozen condition for years. At pres- ent_ little indication is seen of any stiffening of money rates normally ex- perienced in the early fall. POTATOES BIT LOWER. CHICAGO, July19.—Potatoes—Trad ing rather slow; market rather weak receipts, 37 cars, 174 on track; total nited States shipments, 866 cars Kansas and Missouri sacked Irish cobblers, 1.40a1.65; a few fancy, 1.75; sacked early Ohios, 1.35a1.50; North Carolina barrel cobblers, 2.00a2.65, ac- cording to condition; Virginia barrel Irish cobblers, 2.75a3.10. WE FINANCE Apartment Houses Business Property Residence Property Hotels, Ete. Higbie & Richardson, Inc, 816 15tk St. N.W. FIRST MORTGAGE INVESTMENTS Adequate Earning Power is your rightful inheritance from the funds you have saved and laid aside to guard your future. Leading men in the financial and business world today agree that the greatest assured return consistent with absolute safety of invested principal is found in reliable First Mortgage Notes sponsored by an organization of standing and repute. Denominations as low as $100 = WA MAN i Constructio mpany - 1430 K Street e Main 3§30 i e i - AND THEN— The Interest Rate Declined! O not be one of those who wait- ed so long to make up his mind about investing his surplus funds that when he finally decided to do so it was too late to receive the present rate of return of 7%. Make up your mind now and reserve your investment while you can. While indications point to a decline in the interest rate in the near future, we still have on hand some attractive First Mortgages in denominations as low as $100 which will return the in- vestor 7%, and we will be glad to reserve yours for you, if your money is not now available, but will be avail- able in the near future. Consult us before yoix go away on your vacation! Swartzell, Rheem & Hensey Co. 727, 15th Street N. W. 55 Years Without Loss to. An Investor, FINANCIAL. First Mortgage Loans- Lowest Rates of Interest and Commissioh.:’ Prompt Action, Thomas J. Fisher & Com, 735 15tn Stroet P l.,c' FOR SALE FIRST MORTGAGE NOTES Consult Us 1t you have fu investment. THOS. E. JARRELL Member Washington Real Estate Board Woodward Bldg. Main 766-3370. tor Wanted Second Trust Notes We have cHents with funds to purchase good SECOND TRUST NOTES in denomina tions of from $500 to $10,000. Low rates if security is good Apply at Once to Qur MORTGAGE DEPARTMENT Money on Hand To Loan on First Deed of Trust Improved Property Only JAMES F. SHEA 643 Louisiana Ave. N.W. First and Second TRUST NOTES WANTED Also Collateral Notes Secured By Improved Real Estate CONSTRUCTION LOANS made at mod- erate rates. Ample funds; prompt action upon approval. Real Estate Mortgage & Guaranty Corp. (Resources Over One and a Half Million Dollars) L. E. BREUNINGER, Pres. 26 Jackson Place MONEY TO LOAN ON FIRST MORTGAGES AT GCURRENT RATES OF INTEREST Rendall H Hignen ¥ G 7207 Connesticat Snenue INCOME RETURN Helps to fix the value of an in- vestment—but only after the complete safety of the principal has been assured. OUR FIRST MORTGAGES pay 6% interest, and their safety is assured. based upon Washington real estate which has been con- servatively appraised. They are B. F. SAUL CO. Main 2100 1412 Eye St. N.W. Welcome Members of The American Institute of Banking ASRCR SECTY 15th & Penna. Avenue Capital, Surplus and Undivided Profits Over $6,000,000.00 FIVE CONVENIENT BANKING OFFICES